Market Overview:

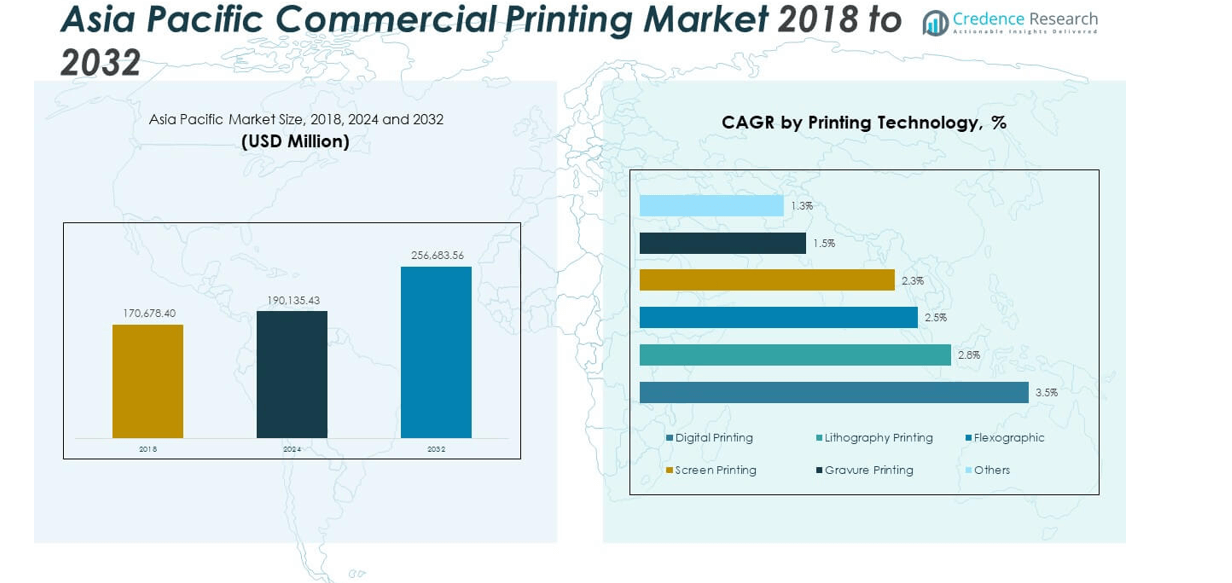

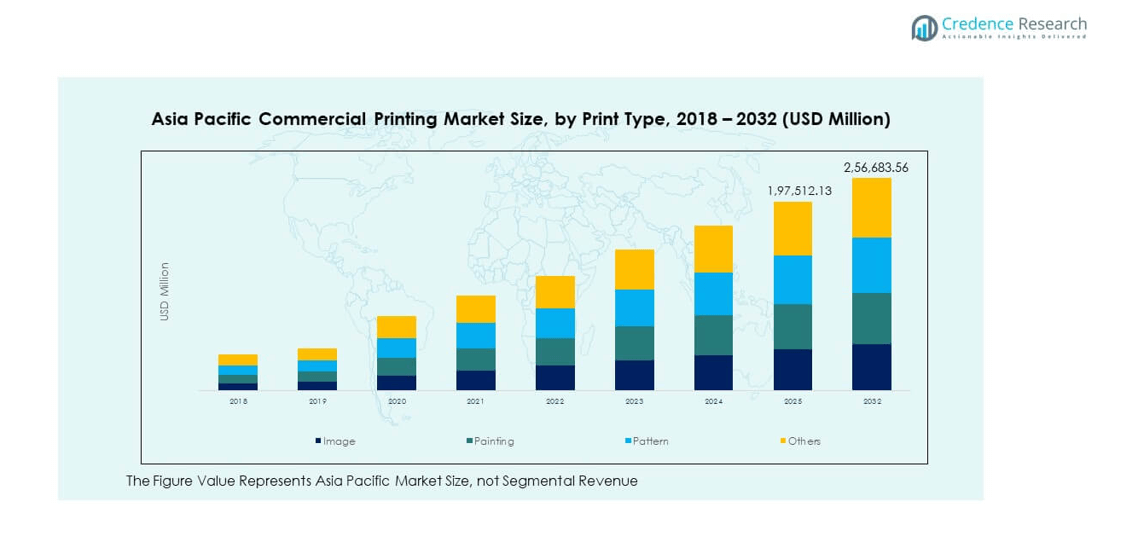

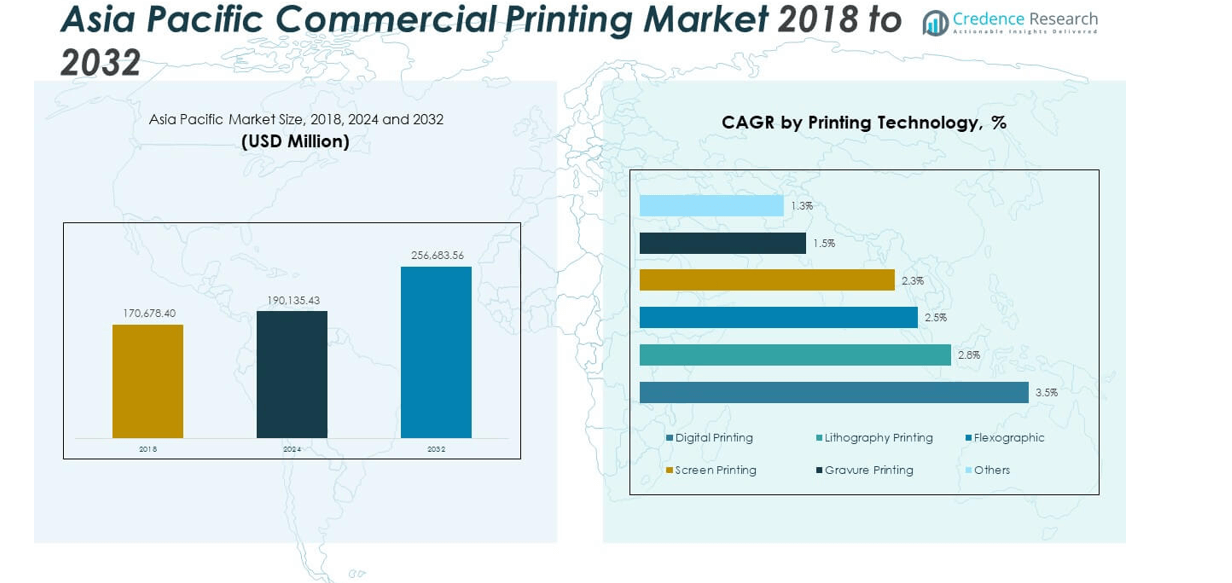

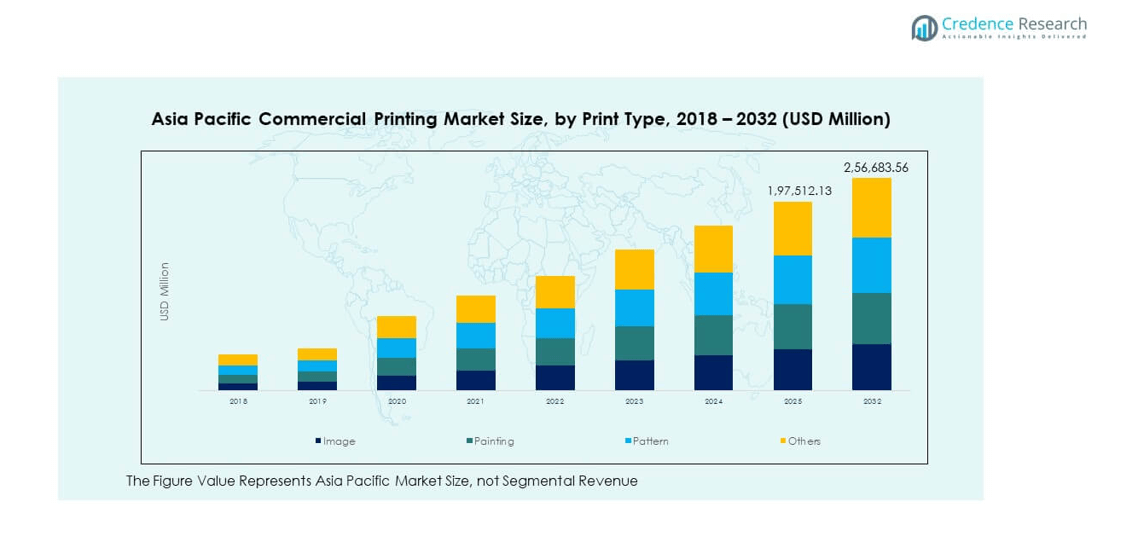

The Asia Pacific Commercial Printing Market size was valued at USD 170,678.40 million in 2018 to USD 190,135.43 million in 2024 and is anticipated to reach USD 256,683.56 million by 2032, at a CAGR of 3.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Commercial Printing Market Size 2024 |

USD 190,135.43 million |

| Asia Pacific Commercial Printing Market, CAGR |

3.82% |

| Asia Pacific Commercial Printing Market Size 2032 |

USD 256,683.56 million |

Technological upgrades and changing customer expectations drive the Asia Pacific Commercial Printing Market forward. Increased demand for customized and short-run printing supports digital press adoption across regional print houses. Print-on-demand solutions gain popularity among publishers and retailers seeking flexibility and reduced waste. Growing use of eco-friendly inks and recycled substrates enhances compliance with regional environmental standards. Expanding applications in packaging, promotional materials, and corporate branding reinforce the industry’s value. It benefits from digital transformation and innovation in workflow automation that streamline processes and improve turnaround time.

East Asia dominates the Asia Pacific Commercial Printing Market with its well-established manufacturing and packaging sectors. China leads due to high production capacity and strong domestic consumption. Japan and South Korea contribute with premium printing technologies and quality-driven industries. India shows rapid growth in digital and packaging segments supported by expanding retail and education markets. Southeast Asian countries, including Vietnam and Indonesia, emerge as cost-efficient hubs for printing exports. Australia and New Zealand focus on sustainability and high-quality printing for retail and advertising. Each subregion strengthens the market through distinct technological and economic strengths.

Market Insights

- The Asia Pacific Commercial Printing Market was valued at USD 170,678.40 million in 2018, rising to USD 190,135.43 million in 2024, and projected to reach USD 256,683.56 million by 2032, registering a CAGR of 3.82%.

- East Asia leads with nearly 40% share due to advanced packaging, industrial infrastructure, and high manufacturing output across China, Japan, and South Korea.

- South Asia follows with around 25% share, driven by India’s rapid retail growth, digital press adoption, and strong SME participation. Southeast Asia and Oceania together hold close to 35%, reflecting expanding sustainable and specialty printing operations.

- Southeast Asia emerges as the fastest-growing subregion with expanding investments in digital and eco-friendly printing technologies supporting export-driven industries.

- By printing technology, gravure printing holds the highest growth at 3.5%, followed by flexographic printing at 2.8%, while by print type, image and pattern printing collectively account for over 55% of total market output, showing dominance in packaging and advertising applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding E-commerce and Packaging Applications Supporting Print Demand

Rapid growth in e-commerce and packaging activities drives expansion in the Asia Pacific Commercial Printing Market. Retailers invest in customized packaging that supports branding and logistics efficiency. Rising exports across manufacturing economies encourage large-scale production of printed corrugated boxes and flexible packaging. It benefits from increasing consumer preference for visually appealing packaging formats. Companies use printed materials to enhance brand identity and shelf visibility. Digital print technologies enable rapid turnaround for small batch orders. Packaging firms adopt advanced substrates that enhance durability. Strong collaboration between printers and brand owners continues to elevate print quality and innovation levels.

Shift Toward Digital Printing and Variable Data Personalization

Transition from analog to digital presses accelerates across regional printing operations. Businesses adopt variable data printing to support personalized campaigns and targeted communication. The Asia Pacific Commercial Printing Market benefits from lower setup costs and higher print accuracy. Digital platforms offer scalability for both small and large runs with minimal waste. Demand for customized marketing materials strengthens across corporate and consumer-facing industries. Equipment manufacturers expand high-speed inkjet and electrophotographic systems. Printers invest in workflow automation and cloud integration to manage diverse job volumes. It fosters agility and supports stronger alignment with regional marketing strategies.

- For instance, Toshiba Tec Corporation develops advanced multifunction and industrial label printing systems widely used across Asia Pacific. Its latest BX600 series supports high-speed, durable printing for logistics and manufacturing applications, while integrating with cloud-based management tools to improve workflow efficiency and reliability.

Rising Corporate Advertising and Branding Investments

Corporate spending on marketing materials rises steadily across developing economies. Retail chains, FMCG brands, and service firms invest in brochures, flyers, and outdoor banners. The Asia Pacific Commercial Printing Market gains momentum from increased event promotions and trade fairs. High competition across industries boosts demand for printed materials that reinforce visual identity. Large corporations deploy regional print strategies to ensure brand consistency. SMEs adopt cost-effective digital printing for short-run projects. Technological upgrades ensure sharper color reproduction and reduced turnaround time. Growing use of localized campaigns increases the relevance and impact of print advertising.

Sustainability Regulations and Green Printing Initiatives

Governments across Asia Pacific encourage eco-friendly printing practices to reduce environmental impact. Printers switch to water-based and UV-curable inks to meet emission standards. The Asia Pacific Commercial Printing Market witnesses rising adoption of recyclable paper and biodegradable substrates. Sustainable production processes attract eco-conscious clients in retail and publishing. Energy-efficient presses lower operational costs while improving quality consistency. Brands highlight environmental compliance in product packaging and communication. Regional associations promote certifications that validate sustainability performance. It drives innovation in material sourcing and energy management across printing facilities.

- For example, Epson has developed water-based ink solutions that dramatically lower volatile organic compound (VOC) emissions and reduce greenhouse-gas output across its print operations. The Ricoh Group enforces sustainable paper procurement and runs energy-efficient presses designed for reduced waste and improved recyclability of materials.

Market Trends

Adoption of Hybrid Printing Systems Integrating Digital and Offset Capabilities

Printers increasingly adopt hybrid systems that merge digital and offset printing technologies. These platforms provide flexibility for short and long print runs with consistent output. The Asia Pacific Commercial Printing Market experiences rising demand for cost-efficient hybrid production. Manufacturers design presses capable of quick job changes and minimal downtime. Businesses use hybrid systems to balance high-speed production with customization options. Integration of automated color management improves quality control. It reduces waste and supports premium-grade packaging applications. The growing versatility of hybrid presses enhances operational efficiency across commercial print houses.

- For instance, Kao Collins’ X-BAR print module integrates high-speed digital inkjet with offset and flexo systems. It achieves up to 1,000 feet per minute at 1200 × 600 dpi resolution, primarily supporting monochrome and spot-color variable-data printing, making it suitable for transactional, packaging, and labeling applications.

Integration of Artificial Intelligence and Workflow Automation

AI-driven print management tools are transforming job scheduling and production monitoring. Automation reduces human error and enhances consistency across multiple printing processes. The Asia Pacific Commercial Printing Market gains efficiency through predictive maintenance and smart color calibration. AI enables real-time quality inspection and adaptive resource allocation. Cloud-based platforms facilitate remote access and multi-location coordination. Data-driven insights improve order forecasting and client service. Automated workflows accelerate turnaround times for marketing and publishing projects. It strengthens printer competitiveness and ensures higher profitability across dynamic client portfolios.

Growing Use of Specialty Inks and Finishing for Premium Applications

Luxury packaging and marketing materials drive demand for high-quality finishing and specialty inks. Metallic, fluorescent, and tactile finishes elevate consumer engagement through visual appeal. The Asia Pacific Commercial Printing Market expands its footprint in high-end product labeling. Printers deploy advanced coatings that enhance durability and surface feel. UV spot coating, embossing, and foil stamping improve design differentiation. Demand from cosmetics, electronics, and beverage sectors supports premium print services. Equipment upgrades allow faster curing and energy savings. It reinforces the market’s transition toward value-added, design-centric applications.

Expansion of 3D Printing and On-Demand Print Models

Emerging 3D printing applications influence commercial printing strategies in Asia Pacific. Print-on-demand services grow rapidly among publishers and SMEs seeking lower inventory costs. The Asia Pacific Commercial Printing Market adapts to new business models emphasizing customization. Localized production hubs support regional content distribution and fast delivery. 3D printing enables creative design in packaging prototypes and promotional items. Companies explore additive manufacturing for personalized branding solutions. Integration of digital storefronts simplifies ordering and tracking. It enhances market accessibility for both corporate and retail consumers.

- For instance, Stratasys’ J55 Prime 3D printer delivers high-resolution, full-color, multi-material output with layer precision up to 18 microns, enabling detailed packaging prototypes and product mockups. Its compact design and Pantone-validated color capability make it ideal for design studios and localized commercial printing environments focused on rapid prototyping.

Market Challenges Analysis

Rising Raw Material Prices and Supply Chain Disruptions Impacting Margins

Volatility in paper, ink, and substrate costs pressures printer profitability across regional markets. Supply disruptions linked to global trade and logistics constraints affect production schedules. The Asia Pacific Commercial Printing Market faces operational delays from raw material shortages. Printers must balance cost management with client pricing expectations. Currency fluctuations complicate import of high-end equipment and consumables. Limited access to recycled paper grades increases environmental compliance costs. Firms adopt just-in-time sourcing to mitigate inventory risks. It encourages printers to explore local supply partnerships and digital alternatives for cost stability.

Digitalization and Decline in Traditional Print Media Consumption

Growing online content access reduces demand for printed newspapers and magazines. The Asia Pacific Commercial Printing Market witnesses steady transition from offset to digital platforms. Traditional print volumes decline in publishing and advertising sectors. Businesses redirect budgets toward online and social media marketing. Educational institutions adopt e-learning materials, lowering textbook print runs. Printers diversify into packaging and promotional segments to offset revenue loss. Changing consumer habits challenge long-term viability of legacy print formats. It compels the industry to innovate through cross-media integration and digital workflow modernization.

Market Opportunities

Rising Demand for Sustainable and Recyclable Print Solutions

Green transformation offers significant growth potential across regional print operations. The Asia Pacific Commercial Printing Market benefits from client preference for eco-friendly substrates and water-based inks. Printers adopting carbon-neutral production gain competitive advantage. Sustainable certification programs enhance market reputation among global buyers. Public awareness campaigns drive adoption of recyclable packaging formats. Governments incentivize clean technologies through grants and tax benefits. Growing interest in sustainable branding supports investment in renewable materials. It positions printers as key enablers of responsible business communication.

Expansion of Custom Packaging and Digital Labeling Solutions

The surge in consumer personalization reshapes the region’s packaging sector. The Asia Pacific Commercial Printing Market capitalizes on the shift toward on-demand digital labeling. Brands require variable data for limited-edition and promotional runs. Automation and color management improve label consistency across SKUs. SMEs adopt web-to-print portals to streamline customized packaging orders. Growth in online retail supports continuous packaging redesign cycles. Integration of smart labels using QR and NFC enhances traceability. It encourages innovation in compact, high-speed digital presses optimized for regional production.

Market Segmentation Analysis

By Printing Technology

Digital printing leads due to flexibility, speed, and cost advantages in short-run production. The Asia Pacific Commercial Printing Market benefits from fast adoption among SMEs and packaging firms. Lithography remains dominant in high-volume publishing and commercial orders. Flexographic and gravure printing cater to large-scale packaging applications requiring vibrant color and durability. Screen printing continues serving textile and signage industries. Emerging hybrid systems combine digital and offset features for improved workflow. Continuous R&D investments enhance output efficiency. It supports multi-format compatibility across diverse end-use industries.

- For instance, the HP Indigo 100K Digital Press delivers speeds up to 6,000 B2 sheets per hour in Enhanced Productivity Mode with 812 dpi native and up to 2438 × 2438 dpi virtual resolution. It supports seven-color printing, automated quality control, and compatibility with diverse substrates such as synthetics, paperboard, and metalized materials for high-volume commercial printing applications.

By Application

Packaging dominates due to rising demand from food, cosmetics, and consumer goods sectors. Publishing maintains relevance through educational and corporate material printing. Advertising and marketing leverage high-quality visuals for brand outreach. Retail and e-commerce rely on printed materials for promotions and delivery packaging. Corporate communication utilizes brochures, reports, and presentation materials. Government and education sectors maintain steady print requirements for documentation. The Asia Pacific Commercial Printing Market benefits from broad end-user diversification. It ensures stable revenue flow across cyclical demand patterns.

- For instance, Canon’s corrPRESS iB17 digital press prints directly on corrugated boards using water-based inks and 1200-dpi piezo printheads, enabling automated, high-volume output for packaging converters. It supports sustainable production for corrugated packaging used in consumer goods and retail applications.

By Service Type

Printing services remain core, offering design-to-delivery solutions for businesses. Packaging printing grows due to strong e-commerce expansion. Large format printing supports advertising, exhibition, and signage applications. Transactional and direct mail printing serves banks and telecom firms. Promotional printing boosts brand visibility across retail environments. Value-added services such as lamination, binding, and finishing create differentiation. Printers integrate online portals for easy order management. It broadens service reach and client retention across multiple sectors.

By Print Type

Image printing holds significant share due to advertising and marketing needs. Pattern and painting prints gain traction in fashion, décor, and packaging design. The Asia Pacific Commercial Printing Market diversifies across creative applications. Specialty prints such as holographic and textured visuals enhance consumer engagement. Printers experiment with artistic finishes that elevate product appeal. Advancements in ink technology support complex multi-layer outputs. Demand for customized visuals fosters adoption of digital imaging tools. It ensures creative flexibility and consistency in print quality.

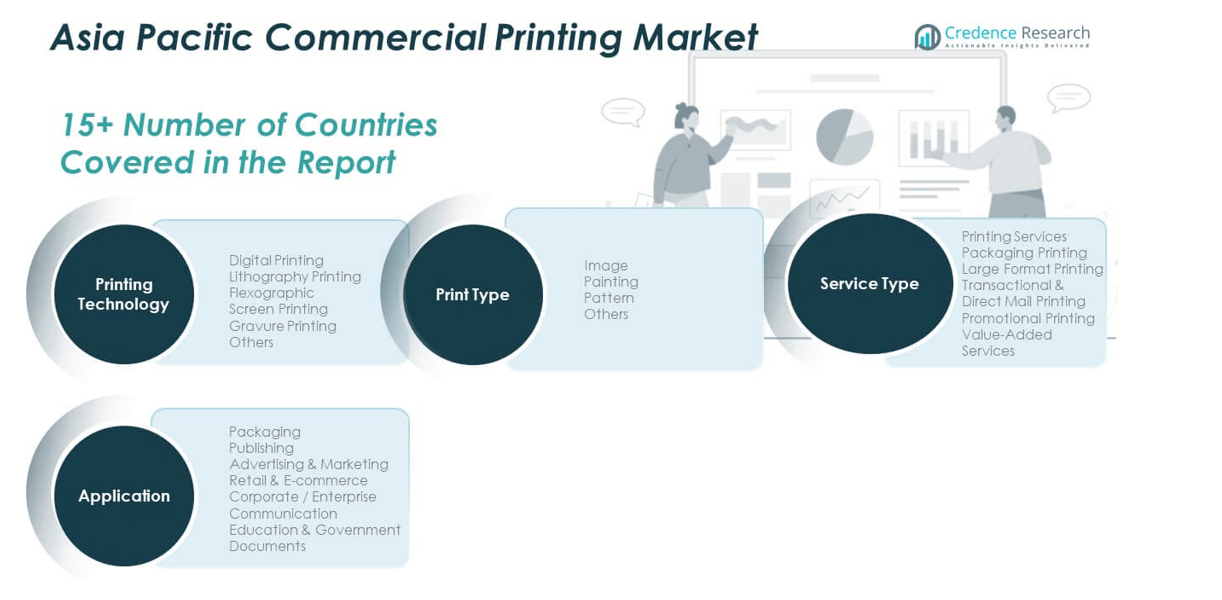

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

East Asia – Leading Market with Strong Industrial and Packaging Infrastructure

East Asia dominates the Asia Pacific Commercial Printing Market, accounting for nearly 40% of the total regional share. China drives this leadership through its large-scale packaging industry and advanced production capacity. Japan follows with high-end printing technology and strong corporate print demand across electronics and publishing sectors. South Korea maintains a strong presence in digital and packaging solutions supported by major technology exporters. The region’s integrated supply chain and focus on sustainable packaging strengthen its print market advantage. It benefits from automation investments and adoption of hybrid printing systems that improve cost efficiency. Strong manufacturing ecosystems continue to secure East Asia’s position as the leading hub for commercial printing output.

South Asia – Rapid Growth Fueled by Expanding Retail and E-Commerce Sectors

South Asia holds around 25% of the regional share, driven by India’s growing retail and digital print transformation. India’s vast SME base relies on affordable digital presses for packaging, labeling, and promotional material. Bangladesh and Sri Lanka show steady demand from textile and apparel printing sectors. Rising internet penetration and online commerce enhance print demand across regional logistics and advertising. The Asia Pacific Commercial Printing Market grows rapidly in this subregion due to cost-effective production and high workforce availability. Domestic manufacturers invest in sustainable ink formulations and recycled substrates. It supports balanced development across both consumer and industrial print applications.

Southeast Asia and Oceania – Emerging Centers for Sustainable and Specialty Printing

Southeast Asia and Oceania collectively capture about 35% of the total regional share. Countries like Indonesia, Vietnam, Thailand, and Malaysia expand commercial printing capacity through new digital installations. Australia and New Zealand contribute through advanced packaging and promotional printing industries focused on eco-friendly solutions. Strong tourism and retail sectors encourage diverse printing applications such as brochures, labels, and displays. The subregion sees rising investment in 3D and on-demand printing capabilities for local businesses. It attracts multinational brands aiming to strengthen regional packaging supply chains. Sustainable practices and export-oriented production support the long-term competitiveness of Southeast Asia and Oceania within the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dai Nippon Printing (DNP)

- Toppan Printing

- Fuji Xerox / Fujifilm Business Innovation

- Yamato Printing

- C&C Joint Printing (HK)

- Horizon Group

- Hucais Printing (China)

- Haimen Huanyu Printing

- Dinglong Group

- Hongbo Co. Ltd.

- Komori

- Konica Minolta

- Ricoh Asia Pacific

- Matsuoka Printing

- Kadam Digital (India)

- Printec Group

- Shanghai PrintYoung

Competitive Analysis

Competition across the Asia Pacific Commercial Printing Market remains intense due to technological innovation and regional diversification. Leading players include Fuji Xerox, Canon Inc., Ricoh Company Ltd., HP Inc., and Konica Minolta, all investing heavily in automation, digital workflow, and sustainable ink solutions. Local firms such as Toppan Printing, Daewoong Printing, and Cosmo Films strengthen their regional influence through specialized printing services and eco-certified substrates. Companies adopt hybrid systems combining digital and offset features to meet varied print volumes. Strategic partnerships and mergers enhance equipment portfolios and expand client reach across packaging, publishing, and advertising sectors. Firms compete on turnaround speed, print accuracy, and integration of smart printing solutions. It experiences consolidation trends where global suppliers collaborate with local printers to capture cost-sensitive markets. Growing demand for sustainability and customization keeps innovation central to regional competitiveness.

Recent Developments

- In April 2025, Konica Minolta introduced a high-speed UV inkjet press AccurioJet 30000 featuring automated quality inspection and remote maintenance, boosting print productivity on varied media and supporting on-demand commercial print services.

- In January 2025, Konica Minolta launched its new AccurioPress 14010S at PrintPack 2025, aiming to cater to the evolving demands of retail and e-commerce sectors with automation and innovative finishing technologies.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rapid digitalization will continue reshaping production models and drive the transition from offset to high-speed digital presses across the region.

- Expanding e-commerce packaging and labeling requirements will create sustained demand for customizable, short-run printing solutions.

- Automation, AI-driven workflows, and predictive maintenance will enhance operational efficiency and reduce job turnaround times.

- Green printing practices will gain momentum, with water-based inks and recyclable substrates becoming industry standards.

- The premium and specialty printing segment will expand, supported by luxury packaging and high-end marketing applications.

- Hybrid printing systems will rise in popularity, merging the flexibility of digital with the efficiency of offset processes.

- Localized print-on-demand platforms will flourish across small and medium enterprises seeking cost-effective customization.

- Technological collaborations between global and regional firms will enhance market competitiveness and expand service offerings.

- Sustainable investments by governments and corporations will encourage eco-certified print production and responsible sourcing.

- Integration of smart labels and data-enabled packaging will open new growth opportunities in connected and traceable printing formats.