Market Overview:

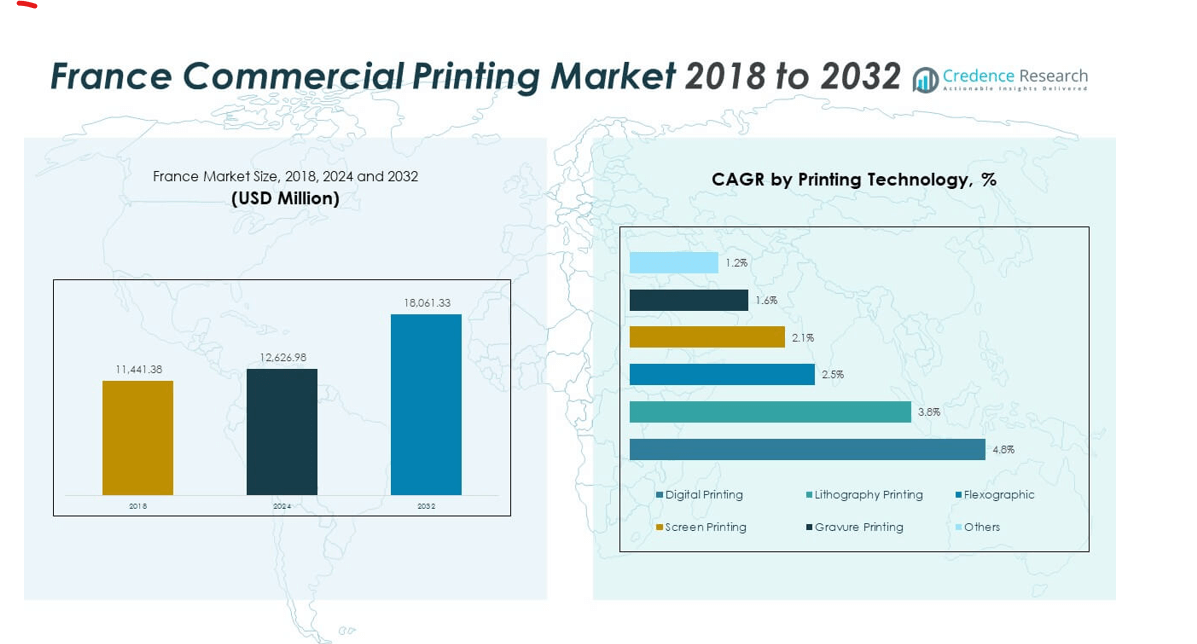

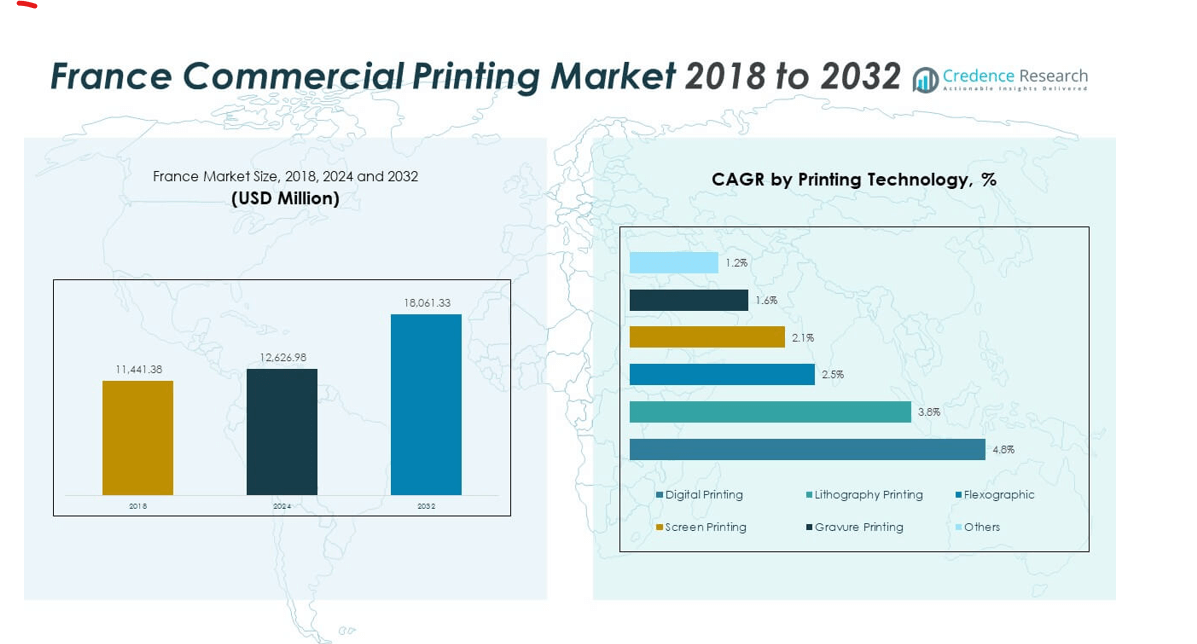

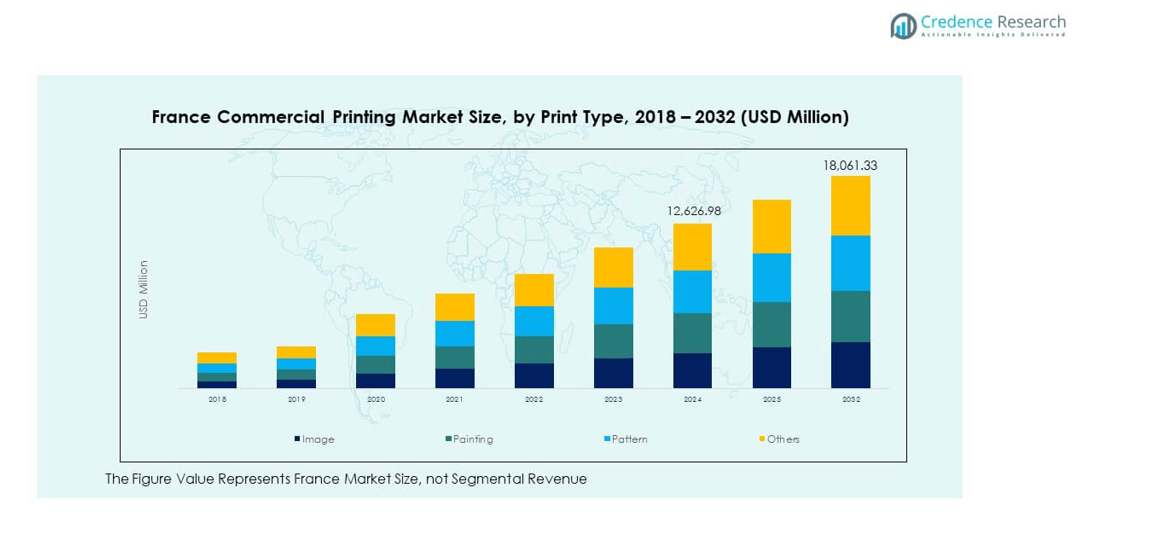

The France Commercial Printing Market size was valued at USD 11,441.38 million in 2018, rising to USD 12,626.98 million in 2024, and is anticipated to reach USD 18,061.33 million by 2032, at a CAGR of 4.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Commercial Printing Market Size 2024 |

USD 12,626.98 million |

| France Commercial Printing Market, CAGR |

4.58% |

| France Commercial Printing Market Size 2032 |

USD 18,061.33 million |

Strong demand from packaging, advertising, and publishing industries drives market expansion. Businesses adopt digital and hybrid presses for faster delivery, cost control, and high-quality results. Sustainability goals promote the use of water-based inks and recyclable substrates. The rise of short-run, customized printing for marketing and e-commerce packaging enhances profitability. Automation and smart workflow integration improve productivity across commercial print operations. Continuous investment in technology modernizes legacy facilities and supports competitiveness among local and global players.

Île-de-France leads the market, driven by its high concentration of businesses, retail hubs, and creative agencies. Auvergne-Rhône-Alpes follows, supported by strong industrial and packaging demand. Provence-Alpes-Côte d’Azur emerges as a growing region due to tourism, luxury branding, and retail growth. Secondary regions such as Grand Est and Nouvelle-Aquitaine show steady adoption of digital printing and packaging innovation. The geographic distribution highlights France’s balanced industrial base and regional diversification in print production.

Market Insights

- The France Commercial Printing Market was valued at USD 11,441.38 million in 2018, reached USD 12,626.98 million in 2024, and is projected to hit USD 18,061.33 million by 2032, registering a CAGR of 4.58%.

- Île-de-France (≈35%), Auvergne-Rhône-Alpes (≈20%), and Provence-Alpes-Côte d’Azur (≈15%) dominate the market due to high industrial activity, dense corporate presence, and luxury brand operations.

- Grand Est and Nouvelle-Aquitaine (≈30% combined) represent the fastest-growing regions, driven by expanding e-commerce and regional manufacturing networks.

- By printing technology, digital printing leads with 4.8% CAGR, followed by flexographic printing at 3.8%, reflecting the shift toward short-run, customizable, and sustainable solutions.

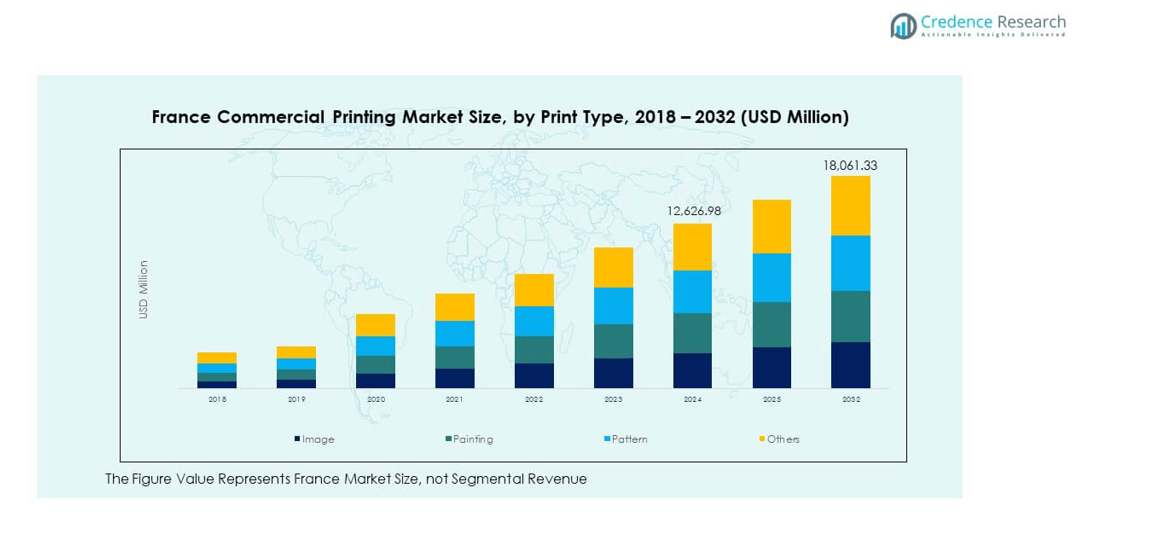

- By print type, image and pattern printing collectively account for over 55% of the market, supported by demand from packaging, publishing, and promotional segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Adoption of Digital Printing Technology Across Commercial Sectors

The France Commercial Printing Market benefits from the rising use of digital printing solutions across industries. Businesses demand faster turnaround and shorter print runs to meet promotional timelines. Digital presses allow variable data printing for personalized marketing materials. Companies deploy inkjet and toner-based systems that deliver consistent quality at high speed. The shift toward on-demand printing reduces inventory waste and supports eco-friendly operations. Digital platforms also simplify workflow automation and proofing cycles. The technology helps printers handle frequent design changes efficiently. Growing e-commerce and retail sectors accelerate the demand for flexible print applications. The market experiences consistent investment in high-resolution printing systems from domestic and global suppliers.

- For instance, the Canon imagePRESS V1000, a color sheetfed digital press, delivers production speeds up to 101 images per minute (ipm) with a print resolution of 2400 x 2400 dpi, supporting media weights up to 150 lb. cover stock and consistent color across long runs through advanced imaging technology.

Expanding Demand from Packaging and Label Applications

Growth stays strong in packaging and labeling segments driven by consumer goods and food industries. Brands seek attractive and durable print designs that support shelf visibility. Flexographic and lithographic presses produce detailed packaging that enhances brand image. Label converters integrate security features such as QR codes and holograms for authenticity. Increasing export activities push manufacturers to meet multi-language labeling needs. Recyclable and bio-based packaging trends raise the use of eco-safe inks and substrates. Printing firms invest in finishing techniques like UV coating and embossing to add visual appeal. Retail packaging now combines branding with information delivery for better consumer engagement. It continues to expand with stronger packaging innovation across regional industries.

- For instance, Avery Dennison’s label printing technologies integrate secure QR code applications and holograms with precision digital print capabilities, meeting multi-language export labeling demands.

Growing Investments in Automation and Smart Workflow Integration

Automation transforms how printers manage their production environments in France. Companies deploy software tools that streamline prepress, color management, and scheduling. Smart workflows reduce human errors and support continuous operation cycles. Printers integrate AI-driven predictive maintenance to prevent costly downtime. The automation trend strengthens operational efficiency and lowers material waste. Real-time analytics enable better capacity utilization across multiple print lines. Firms implement hybrid systems combining offset and digital setups to balance cost and flexibility. These integrated workflows enhance delivery accuracy for corporate and advertising clients. It benefits printing companies that handle multi-format and high-frequency jobs.

Sustainability and Eco-Friendly Printing Initiatives Strengthening Market Transition

Growing environmental awareness drives printers toward greener production methods. Water-based inks and recycled paper gain popularity among French print providers. Government policies encourage low-emission equipment and resource-efficient facilities. Brands prioritize suppliers with verified environmental certifications such as FSC and PEFC. The market shifts toward chemical-free plate processing in lithography and flexography. Companies develop solvent-free lamination and reduced VOC formulations. Sustainable packaging trends push printers to adopt renewable substrates. Eco-efficient production practices build a positive brand image among buyers. It reinforces the France Commercial Printing Market as an environmentally responsible industry segment.

Market Trends

Rise of Hybrid Printing Solutions Merging Offset and Digital Capabilities

Hybrid systems combining digital and offset methods gain traction across the commercial segment. These platforms support faster job switching and reduce setup times for short-run tasks. Printers use them to balance cost efficiency with high color accuracy. The trend helps firms manage both large-scale and personalized orders without workflow disruption. Packaging and advertising clients value this hybrid capability for consistent output. Manufacturers expand product lines that combine automation, color calibration, and remote monitoring. This mix improves turnaround speed and lowers waste. It enables seamless integration between digital prepress tools and offset hardware. The hybrid model becomes central to strategic growth in France.

- For example, Heidelberg’s Speedmaster CX 104 offset press combines innovation with automation features like Intellistart 3 and Intelliline that enable navigated or autonomous production. It processes substrates from lightweight paper up to carton stock at speeds up to 16,500 sheets per hour.

Increased Demand for Short-Run and On-Demand Print Services

Corporate and retail clients prefer smaller, customized batches over bulk printing. Short-run print production enables rapid updates in campaigns and promotions. On-demand models lower warehousing costs for marketing materials. Printers install cloud-based portals for clients to place and track print jobs instantly. This flexibility supports regional offices and distributed marketing teams. The trend reflects changing business needs for real-time content delivery. Automation enhances job scheduling to accommodate varying batch volumes. Firms gain better capital efficiency by optimizing print queues. It aligns the France Commercial Printing Market with evolving customer behavior and marketing agility.

Integration of Artificial Intelligence and Predictive Analytics

AI tools support data-driven color control, maintenance prediction, and process optimization. Predictive analytics prevent system failures by identifying print inconsistencies early. Machine learning improves registration accuracy and ink application precision. Smart presses self-adjust based on substrate type and humidity conditions. AI-assisted quality inspection systems detect flaws before finishing. This technology raises overall productivity and waste reduction. It allows better insights into operational costs and energy usage. The France Commercial Printing Market adopts these tools to enhance competitiveness. The adoption of intelligent print ecosystems defines a new era of industrial efficiency.

- For example, Xerox’s iGen 5 digital press incorporates AI-based predictive maintenance to reduce unplanned downtime and enhance print quality through automated registration and ink control systems.

Growth of 3D Printing and Specialty Print Applications

3D printing enters the commercial landscape through prototyping, packaging molds, and promotional materials. Specialty printing extends to textile, signage, and decorative applications. Firms explore UV-curable and metallic inks to produce high-value outputs. New substrate compatibility widens the design possibilities for creative industries. Demand for tactile finishes and raised textures expands. Printers diversify into augmented reality-enabled prints that engage consumers interactively. 3D and specialty print formats drive higher margins in niche markets. This diversification reduces dependency on traditional print volumes. It marks a technological evolution within France’s commercial printing ecosystem.

Market Challenges Analysis

High Operating Costs and Competitive Pricing Pressure

Printers face rising costs for raw materials, inks, and energy. The competitive nature of the sector limits room for price adjustments. Small firms struggle to maintain profitability while matching service standards. Large corporations leverage automation to offset cost pressures, widening the performance gap. The France Commercial Printing Market endures strong competition from digital marketing alternatives. Print volumes in advertising continue to fluctuate due to online media preference. Businesses focus on optimizing production without compromising print quality. Balancing innovation investment with margin sustainability remains a challenge. It forces operators to prioritize efficiency-driven modernization strategies.

Skilled Labor Shortage and Technological Transition Gap

Recruiting skilled technicians for modern print systems remains difficult across France. Experienced operators retire faster than new professionals enter the trade. Training programs often lag behind rapid technological upgrades in printing machines. Small firms face financial strain when retraining existing staff for new tools. Automation requires software expertise rather than traditional print craft knowledge. The shortage slows technology adoption across regional printing plants. Industry associations invest in vocational initiatives to bridge the gap. The transition phase causes uneven productivity across facilities. It limits the full potential of advanced printing technologies within the sector.

Market Opportunities

Emerging Scope for Personalized and Data-Driven Print Campaigns

Personalization gains strong relevance in corporate and retail promotion strategies. Variable data printing supports tailored designs and targeted marketing. Businesses integrate consumer insights with creative layouts to improve response rates. The France Commercial Printing Market leverages automation to deliver faster, customized outputs. Demand rises for personalized packaging and limited-edition merchandise. These offerings enhance customer engagement across luxury and FMCG sectors. Smart software integration allows seamless data exchange between clients and printers. It positions print media as an interactive marketing channel with measurable impact.

Expansion into Sustainable and Smart Packaging Solutions

Eco-conscious product packaging opens new revenue opportunities for printing firms. Printers innovate recyclable and compostable material solutions with minimal carbon impact. Brands partner with certified suppliers to strengthen sustainability claims. Digital watermarks and QR labels enhance traceability and compliance. Investments in green inks and energy-efficient presses improve environmental credentials. The trend aligns with EU sustainability goals promoting circular economy models. It strengthens market differentiation for firms adopting low-impact production systems. The opportunity reinforces France’s position as a responsible and innovative printing hub.

Market Segmentation Analysis

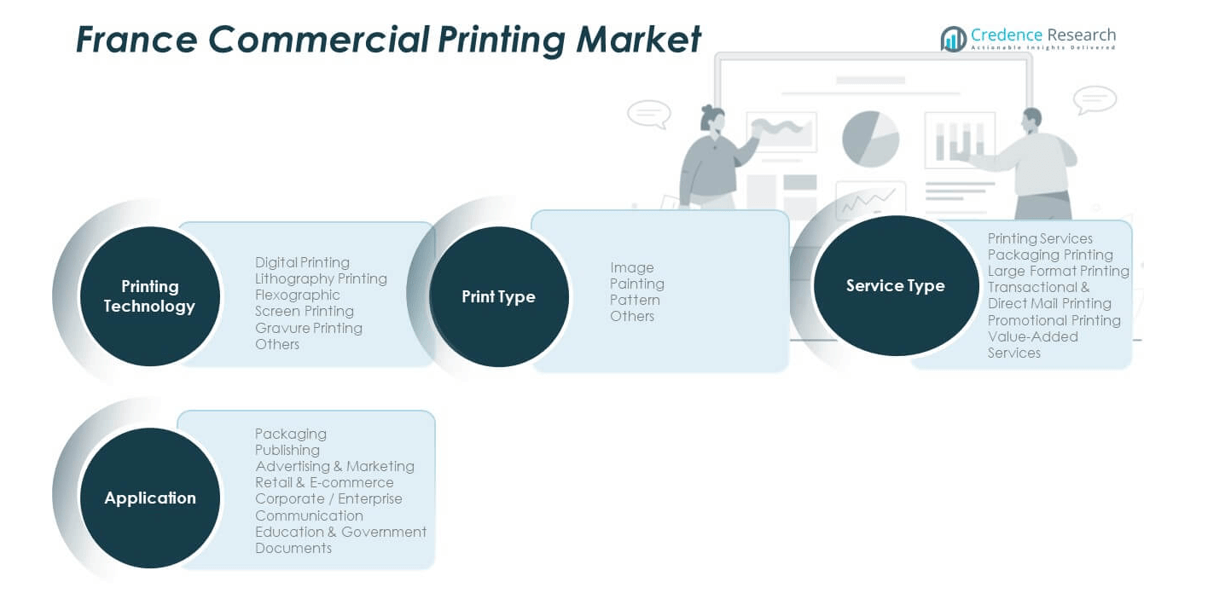

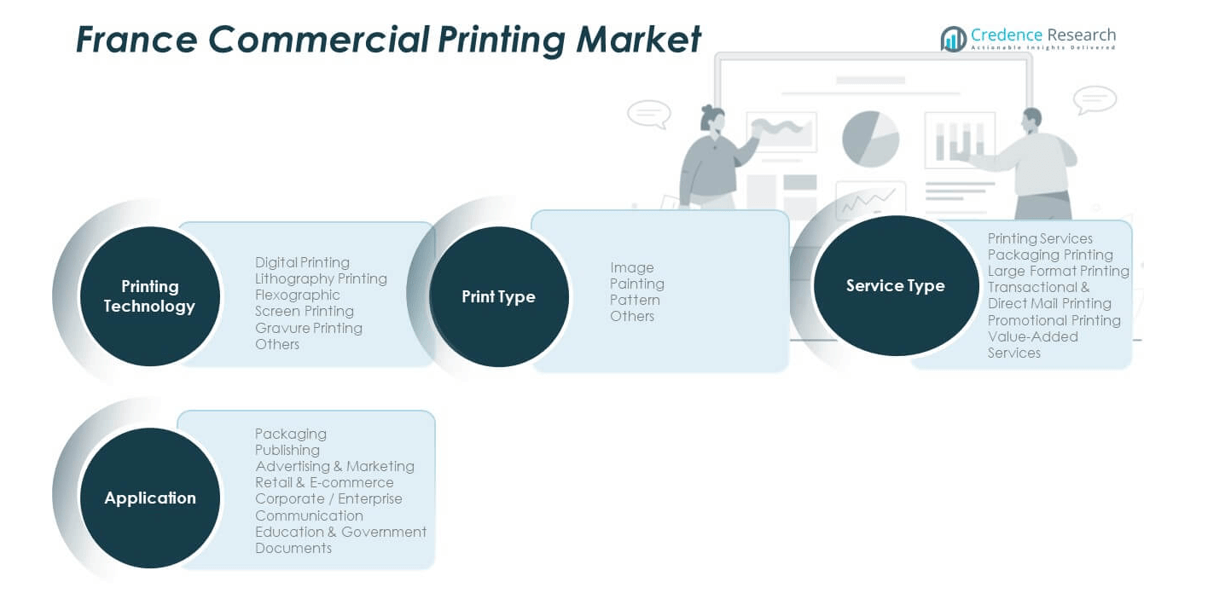

By Printing Technology

Digital printing leads due to rising demand for customization and fast production cycles. Lithography printing holds strong adoption in high-volume publishing and commercial catalogs. Flexographic printing grows with packaging expansion across food and FMCG sectors. Screen printing maintains use in textiles and promotional signage. Gravure printing serves long-run packaging with superior image quality. Other niche methods target décor and specialty design applications. The France Commercial Printing Market benefits from a balanced mix of digital and traditional platforms supporting diverse output formats.

- For instance, the HP Indigo 6K digital press prints up to 130 feet per minute (40 meters per minute) in enhanced productivity mode, delivering 812 dpi resolution with 175 lpi screen ruling suitable for high-quality labels and packaging production. It supports substrates up to 18 points thick, making it versatile for various materials.

By Application

Packaging dominates the application segment due to continuous innovation in design and sustainability. Publishing remains significant across education and corporate communication sectors. Advertising and marketing print materials sustain demand for product promotion. Retail and e-commerce segments seek branded labels and promotional displays. Corporate communication drives secure and branded internal print usage. Government and educational institutions maintain consistent document printing needs. Each application area supports long-term demand diversification across service portfolios.

By Service Type

Printing services account for a major share, covering transactional and promotional categories. Packaging printing gains traction with enhanced finishing options and eco-friendly substrates. Large format printing caters to retail displays, events, and outdoor campaigns. Transactional and direct mail printing provide personalized customer interaction tools. Promotional printing remains strong for brand merchandise. Value-added services include digital proofing, design, and logistics support. It broadens the service landscape, enabling printers to deliver complete solutions under one platform.

- For example, FedEx Office manages one of the world’s largest transactional printing networks, delivering high-volume customized print jobs with quick turnaround. WestRock employs advanced UV coating lines that enhance durability and finish quality across millions of packaging units annually.

By Print Type

Image-based prints dominate due to corporate and media requirements for branding. Pattern printing gains traction in textile and interior design industries. Painting reproductions sustain niche demand within art and décor sectors. Other print types cater to industrial and creative prototypes. The diversity in print type supports product differentiation and innovation flexibility. It enables print firms to capture wider client segments through tailored solutions. The France Commercial Printing Market continues evolving toward high-quality and value-driven print production.

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

Île-de-France Remains The Leading Hub (≈ 35 % Market Share)

Île-de-France holds the highest share of the national commercial printing demand. The concentration of businesses, advertising agencies, and corporate headquarters drives heavy demand for varied printed materials. Many major printers establish their base in this region to serve corporate and retail clients swiftly. It features high population density and strong economic activity. Printers invest in advanced digital and offset equipment here to meet diverse needs. The demand for packaging, promotional materials, and corporate print jobs stays consistently high. This region shapes trends and sets quality standards for the entire country.

Auvergne-Rhône-Alpes and Provence-Alpes-Côte d’Azur Grow Fast (≈ 20 % and 15 % Shares Respectively)

Auvergne-Rhône-Alpes shows strong growth owing to expanding industrial sectors and rising packaging needs. Many manufacturing firms locate their plants in this region, triggering demand for labels, packaging, and operational printing. Printers there adopt newer technologies to support variable packaging volumes and diverse output formats. Production hubs for food, pharmaceuticals, and consumer goods spur further printing demand. Provence-Alpes-Côte d’Azur sees growth driven by tourism, retail expansion, and luxury brand packaging. Printers cater to travel brochures, seasonal promotions, and branded packaging for premium goods. These regions transform into emerging printing centres offering regional clients quicker turnaround.

Emerging Regions Outside Core Clusters Contribute Steadily (≈ 30 % Combined Share)

Regions such as Hauts-de-France, Grand Est, Occitanie and Nouvelle-Aquitaine collectively represent about 30 % of demand. Manufacturers and SMEs in these regions increasingly adopt printing services for packaging and advertising needs. Local retail growth and expanding e-commerce support demand for printed packaging, labels, and marketing material. Printers deploy flexible digital presses to serve small and mid-sized orders efficiently. This trend spreads printing capacity beyond traditional hubs. It supports balanced national development of commercial printing services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Imprimerie Nationale

- Groupe CPI France

- Groupe Jouve

- Groupe Firmin-Didot

- Groupe Laballery

- Grafoprint

- Imprimerie Chirat

- Groupe Autajon

- Groupe Techniphoto

- MPO Group

Competitive Analysis

The France Commercial Printing Market shows strong competition among national and regional players. Leading printing houses invest heavily in digital and hybrid presses to reduce costs and speed up delivery. Many firms offer integrated services from design to finishing. They focus on packaging, corporate printing, and retail solutions to diversify revenue streams. Smaller printers emphasize niche offerings like specialty packaging or short-run jobs. They maintain competitiveness through flexible pricing and quick response time. Large players leverage economies of scale and broader service portfolios. They invest in automation, quality control, and large-format equipment to serve high-volume clients. Mid-sized firms concentrate on regional clients and personalized services. New entrants challenge incumbents by adopting cloud-based ordering platforms and on-demand printing. Established firms respond by improving operational efficiency and expanding service lines. Market competition drives innovation, cost control, and expanded service coverage across regions.

Recent Developments

- In November 2024, Daddy Kate Group acquired Imprimerie Moutier in Ronchin, enhancing its packaging capabilities with the addition of 10 employees and €2.5 million in annual sales, as its third French acquisition that year.

- In June 2025, Screen Europe appointed TechPack SAS as its official sales and service partner for Truepress Label 350UV SAI digital inkjet label presses across France.

- In April 2024, Bobst partnered with French software specialist Packitoo to advance digitalization in the packaging value chain through tools like Packitoo HIPE for automating quotations and managing projects.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital transformation will remain the key focus, with printers investing in automation and hybrid workflows to enhance efficiency.

- Sustainable practices will shape long-term competitiveness as eco-certified substrates and water-based inks gain broader acceptance.

- Packaging printing will evolve as the most dynamic segment driven by rising demand from FMCG, cosmetics, and e-commerce brands.

- AI and predictive analytics will improve production accuracy, machine uptime, and color consistency across large-scale operations.

- Short-run and personalized print orders will dominate, catering to brand-specific campaigns and limited-edition packaging.

- Regional expansion will strengthen, with medium-sized firms extending service networks into emerging industrial zones.

- Print-on-demand portals and online ordering platforms will redefine customer engagement and operational responsiveness.

- Integration between print houses and digital marketing agencies will rise to provide omnichannel brand solutions.

- Workforce upskilling will become essential to bridge the gap between traditional craftsmanship and digital technology expertise.

- The France Commercial Printing Market will continue its transition toward a high-value, technology-led, and sustainability-driven ecosystem.