Market Overview:

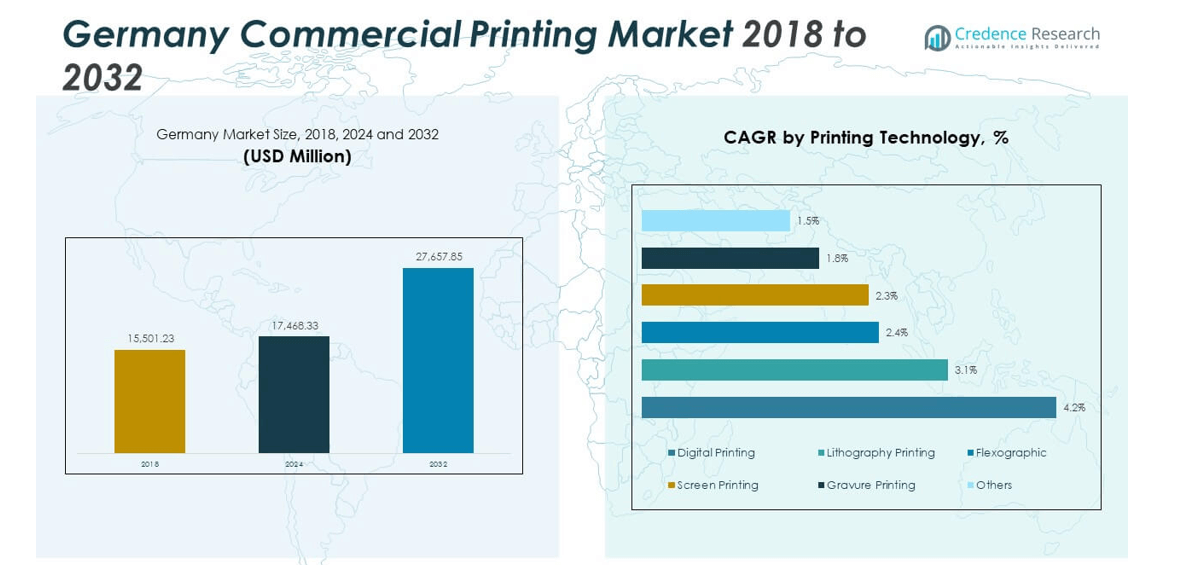

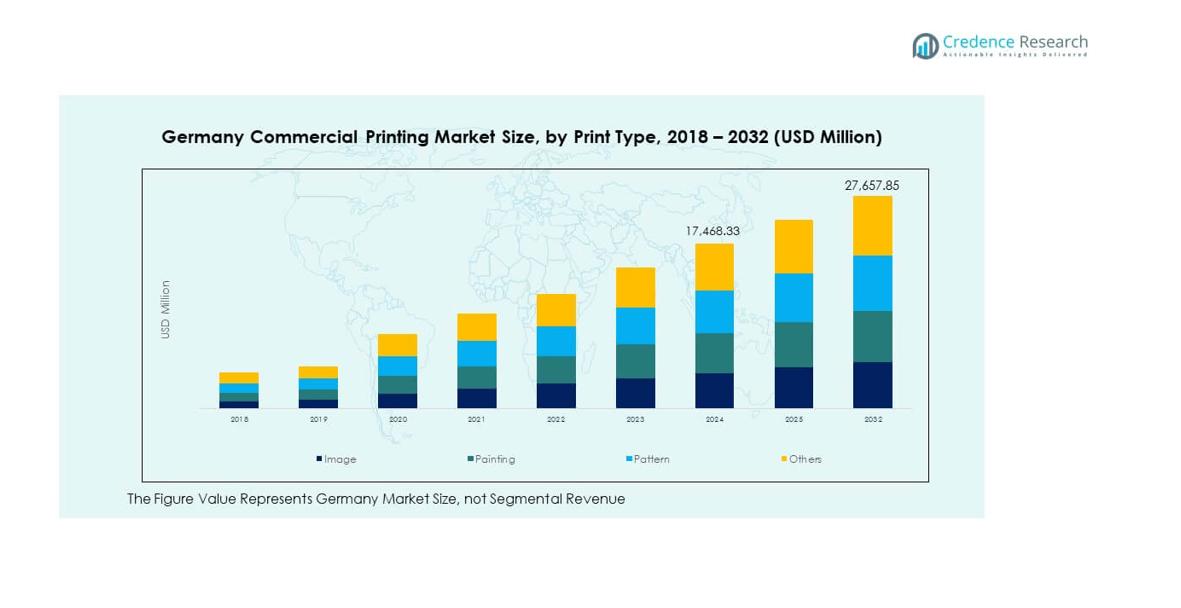

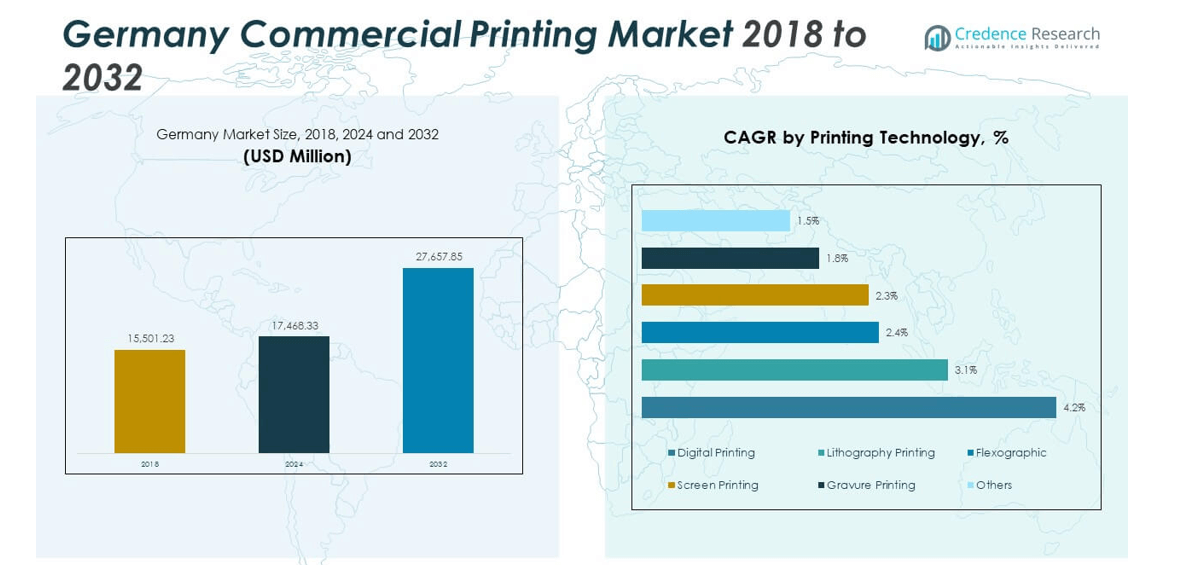

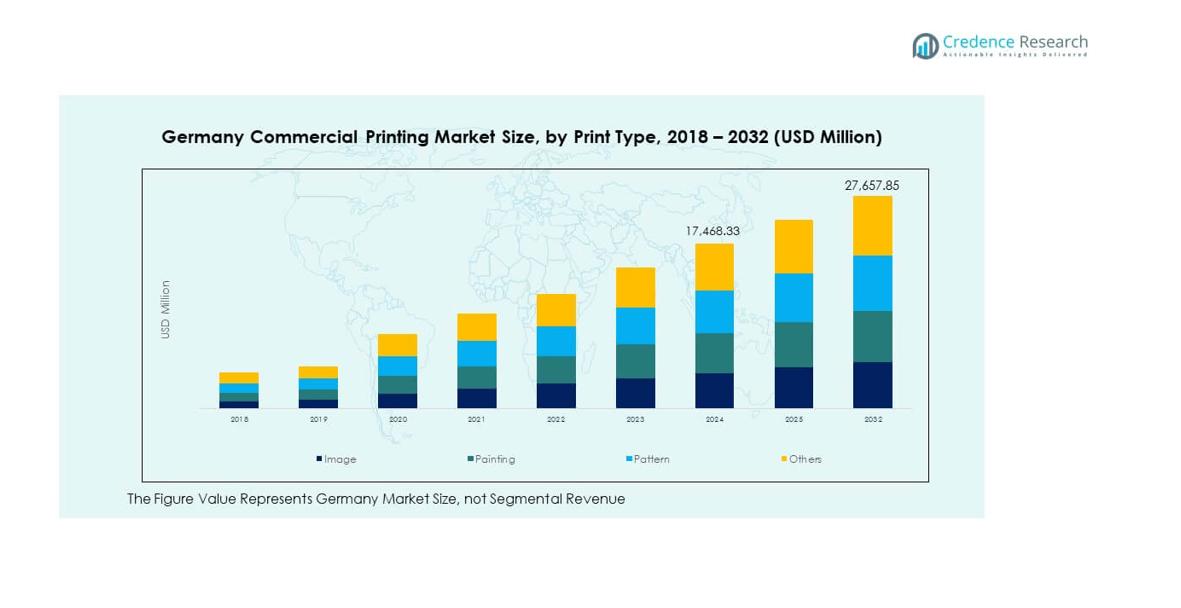

The Germany Commercial Printing Market size was valued at USD 15,501.23 million in 2018, increased to USD 17,468.33 million in 2024, and is anticipated to reach USD 27,657.85 million by 2032, growing at a CAGR of 5.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Commercial Printing Market Size 2024 |

USD 17,468.33 million |

| Germany Commercial Printing Market, CAGR |

5.91% |

| Germany Commercial Printing Market Size 2032 |

USD 27,657.85 million |

Strong demand for packaging, publishing, and marketing materials continues to drive market growth across industrial and commercial sectors. Advancements in digital printing and automation help companies improve speed, precision, and sustainability. Firms invest in smart printing solutions to meet rising needs for customized, short-run, and high-quality outputs. Growing focus on eco-friendly inks and recyclable materials supports compliance with sustainability regulations. Continuous innovation in hybrid and variable data printing further enhances competitiveness. The market benefits from robust demand across advertising, corporate, and retail applications.

Regionally, South-West Germany leads the market due to its strong industrial base and concentration of printing technology providers. States like Baden-Württemberg and Bavaria account for a large share of high-value printing operations. North Rhine-Westphalia remains a major hub for packaging and advertising printing. Eastern and Northern regions show growing activity with the rise of smaller and specialized print houses. Expansion of e-commerce and manufacturing sectors strengthens the nationwide demand for commercial printing solutions, driving balanced growth across all German regions.

Market Insights

- The Germany Commercial Printing Market was valued at USD 15,501.23 million in 2018, increased to USD 17,468.33 million in 2024, and is projected to reach USD 27,657.85 million by 2032, expanding at a CAGR of 5.91%.

- South-West Germany leads the market with about 40–45% share, supported by advanced manufacturing and packaging clusters in Baden-Württemberg and Bavaria. North Rhine-Westphalia follows with 25–30% share, driven by high corporate printing and logistics demand.

- Eastern and Northern Germany hold around 10–15% share, emerging as the fastest-growing regions due to cost efficiency, industrial diversification, and digital print technology adoption.

- By printing technology, Digital Printing holds the largest growth momentum with 4.2% CAGR, while Flexographic Printing follows at 3.1%, reflecting strong packaging sector adoption.

- By print type, Image Printing dominates the overall volume share, followed by Pattern Printing, which gains traction through packaging, textile, and decorative product applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Quality Packaging Across Industries

Demand for premium and customized packaging continues to drive expansion in the Germany Commercial Printing Market. Manufacturers and consumer goods brands invest in visually rich and durable packaging that supports shelf appeal and compliance. Digital printing enables short-run packaging with variable data and fast turnaround times. Flexible packaging formats gain traction in food, cosmetics, and healthcare sectors. Many converters integrate advanced presses to handle multi-material substrates. Automation in labeling and folding cartons enhances output consistency. Sustainability goals push firms to adopt recyclable inks and substrates. Growing exports of packaged products sustain domestic printing demand across various industries.

Shift Toward Digitally Enabled and Automated Print Solutions

Digital transformation encourages printers to adopt advanced workflow systems and intelligent presses. Firms upgrade production lines with software-controlled setups that improve efficiency and reduce downtime. It enables real-time print quality monitoring and predictive maintenance. Cloud-based management tools help operators coordinate large-scale print runs with fewer manual steps. Automation reduces waste and increases uptime across high-volume segments. Print-on-demand models also reduce inventory cost for clients. AI-driven inspection systems ensure color accuracy and layout precision. The Germany Commercial Printing Market benefits from such digital innovations in both commercial and industrial domains.

Expanding Role of Personalization and Variable Data Printing

Personalization drives a new phase of value creation for advertising, retail, and direct mail services. Brands invest in variable data printing to enhance customer engagement and brand loyalty. It allows customized labels, brochures, and marketing materials that match audience profiles. Data-driven printing supports individualized QR codes and serialized packaging formats. The approach enhances campaign impact while minimizing print waste. Marketing agencies increasingly rely on digital presses for micro-segmentation projects. Integration with CRM platforms ensures message relevance and timing precision. E-commerce growth further accelerates adoption of personalized printing applications across regional markets.

- For instance, Coca-Cola’s “Share a Coke” campaign used HP Indigo presses and digital printing technologies to print individual names on bottles, showcasing precise, scalable personalization with individual label differentiation on millions of units, thus enhancing customer loyalty through targeted messaging.

Growing Focus on Sustainable and Environmentally Friendly Print Practices

Sustainability shapes every aspect of commercial printing operations in Germany. Printers adopt biodegradable substrates, soy-based inks, and energy-efficient presses. Green certifications become essential for large corporate print contracts. Many printing houses install waterless offset and UV-curable systems to reduce emissions. It aligns with strict EU environmental standards and client sustainability policies. Waste reduction programs cut paper usage through optimized layouts. Recycled paper demand grows steadily among publishing and corporate clients. The shift toward eco-label printing strengthens the position of printers committed to circular economy goals.

- For instance, Karl Knauer KG, a German packaging manufacturer, emphasizes sustainability by using recyclable materials and resource-efficient production methods, aligning its operations with EU environmental standards and client demand for eco-friendly packaging solutions.

Market Trends

Adoption of Hybrid Printing Systems for Greater Flexibility

Hybrid printing integrates digital precision with analog speed, creating competitive versatility for printers. It supports variable data runs and bulk production in one workflow. German firms install hybrid presses to meet diverse job requirements efficiently. The combination allows flexible switching between packaging, advertising, and transactional formats. Automated ink systems improve color management across hybrid lines. Clients benefit from reduced lead times and lower material costs. Integration with digital finishing adds premium effects like embossing and metallic layers. The Germany Commercial Printing Market sees increased investment in such hybrid infrastructure for long-term scalability.

- For instance, Heidelberg has installed over 3,000 Versafire toner-based digital presses and completed more than 1,500 Prinect hybrid workflow integrations worldwide, demonstrating its strong role in advancing digital and hybrid printing technologies across global markets.

Integration of Cloud-Based Workflow and Automation Software

Workflow automation becomes a central trend for operational optimization. Printers adopt software that links design, scheduling, and post-press stages through one platform. Cloud systems provide real-time data for print monitoring and resource planning. They also support remote proofing and order approvals from clients. Automation tools minimize manual intervention and error risk. The trend improves machine utilization rates across high-volume plants. Many German firms integrate ERP modules for full production visibility. The growing digital ecosystem transforms traditional printing into a connected industrial service model.

Rising Penetration of On-Demand and Short-Run Printing Models

On-demand printing gains strength with the shift toward faster marketing cycles. Businesses require smaller but more frequent print batches tailored to campaigns. It helps avoid inventory waste and ensures design flexibility. Printers invest in advanced digital presses that support variable formats. E-commerce drives growth in customized print-on-demand packaging. The model suits retail, publishing, and promotional sectors with dynamic design needs. It also fits sustainability goals by reducing unsold printed stock. The Germany Commercial Printing Market expands under these agile production methods that match digital-age consumer habits.

- For instance, Limego, a German commercial printer, became the first beta customer to install the HP Indigo 120K Digital Press, a high-volume digital system designed to deliver offset-quality printing with advanced automation for short-run and on-demand production.

Increasing Use of Smart and Interactive Print Technologies

Interactive print merges physical and digital engagement for marketing innovation. Brands embed QR codes, AR tags, and NFC elements in printed materials. These tools enhance customer experience through mobile connectivity and real-time product information. Smart packaging helps trace origin, verify authenticity, and enable feedback. Printers upgrade presses to integrate such smart elements efficiently. The approach supports digital marketing synchronization for brands and retailers. Demand for traceable and secure print solutions rises among regulated industries. The use of embedded digital identifiers modernizes commercial print output in Germany’s advanced market ecosystem.

Market Challenges Analysis

Rising Operational Costs and Pressure on Profit Margins

Printers face rising energy, labor, and raw material expenses that strain profitability. Paper and ink costs fluctuate with global supply constraints. Smaller print shops struggle to manage high input costs while maintaining quality. Competitive pricing from online print platforms adds market pressure. It compels firms to adopt cost control through automation and process optimization. Large players invest in energy-efficient equipment to offset expenses. Maintaining skilled labor remains difficult due to demographic shifts. The Germany Commercial Printing Market must balance cost containment with investments in innovation to sustain competitiveness.

Accelerating Digitalization Reducing Traditional Print Demand

Digital media adoption continues to reduce print volumes in publishing and advertising. Brands redirect budgets toward online marketing, affecting commercial print runs. Newspapers and magazines see continued circulation decline. Educational institutions adopt digital resources over printed textbooks. Printers must reposition services toward packaging, industrial, and promotional niches. The transition requires capital investment in new technologies and retraining of staff. It also demands creative diversification into digital-physical integration. Print firms that adapt early gain resilience in Germany’s changing communication landscape.

Market Opportunities

Expansion of Value-Added Services and Digital Finishing

Demand grows for premium finishing and personalization features in printed materials. Firms offering embossing, holographic effects, and texture coatings gain higher client retention. Automation supports precision in digital embellishment and UV spot coating. The trend encourages new investments in finishing units compatible with hybrid presses. It also opens opportunities for collaborations with luxury packaging and brand merchandising sectors. The Germany Commercial Printing Market can capture value by aligning advanced finishing with design innovation.

Growth Potential in Sustainable and Circular Printing Solutions

Eco-friendly printing creates strong opportunities in packaging and corporate communication. Clients prefer printers certified under EU Ecolabel and FSC programs. Use of recycled paper, non-toxic inks, and solvent-free processes expands customer loyalty. Printers adopting renewable energy and waste recovery gain procurement advantages. Green marketing initiatives boost preference for eco-conscious vendors. The transition to sustainable print practices creates long-term differentiation and regulatory compliance benefits.

Market Segmentation Analysis

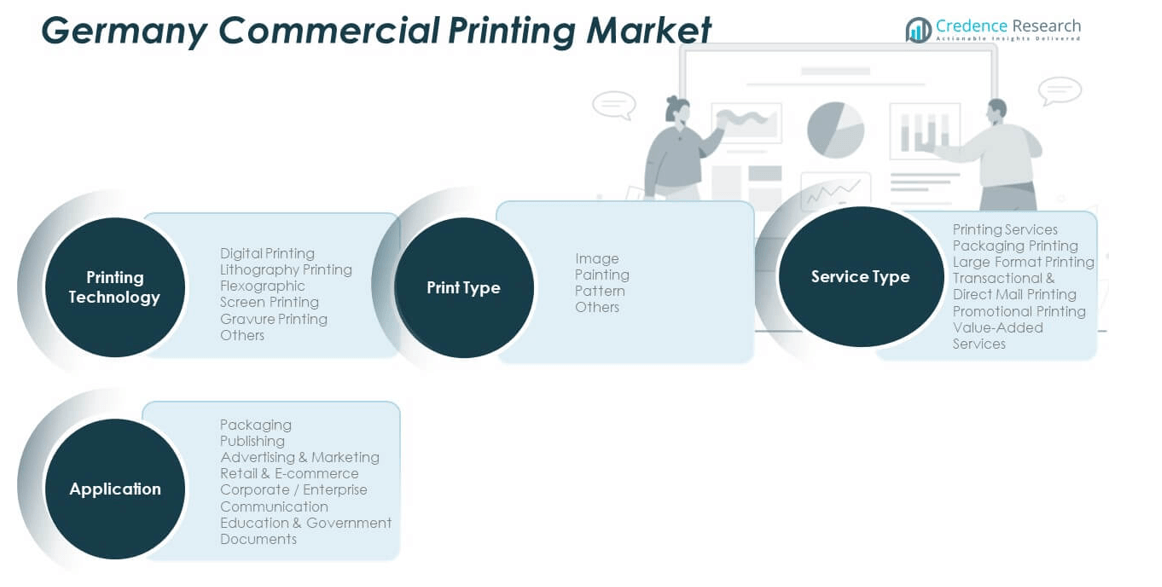

By Printing Technology

Digital printing dominates due to flexibility and minimal setup cost. It supports short-run, personalized, and variable data printing with faster turnaround. Lithography retains demand for high-volume publishing and commercial applications. Flexographic printing expands in packaging for labeling and flexible substrates. Screen printing continues to serve textile and industrial applications requiring strong color depth. Gravure printing holds niche use in premium magazines and décor printing. Others include UV and 3D printing gaining traction in specialty design and prototyping fields within the Germany Commercial Printing Market.

- For instance, Heidelberg’s Jetfire 50 inkjet press represents a major step in industrial digital printing, delivering up to 9,120 SRA3 sheets per hour (around 18,000 A4 pages/hour) with 1,200 × 1,200 dpi resolution, fully integrated into Heidelberg’s Prinect hybrid workflow system.

By Application

Packaging remains the leading application with growing use in food, beverages, and cosmetics. Publishing continues to sustain moderate demand through educational and professional print materials. Advertising and marketing segments leverage digital printing for customized campaigns. Retail and e-commerce sectors require creative promotional materials and labels. Corporate communication emphasizes brand-aligned documents and catalogs. Education and government printing maintains steady output across institutional documentation and identity cards.

- For instance, BOBST develops advanced digital and hybrid printing presses for labels and flexible packaging, enabling short-run, variable-data production that improves efficiency and meets the growing demand for customized packaging across diverse industries.

By Service Type

Printing services form the core offering for standard commercial jobs. Packaging printing rises rapidly due to sustainability and branding needs. Large-format printing serves retail signage and event graphics. Transactional and direct mail printing gains importance in financial and telecom sectors. Promotional printing includes brochures, posters, and customized gift materials. Value-added services include digital proofing, finishing, and color management solutions that enhance customer retention and quality assurance.

By Print Type

Image printing leads across advertising, publishing, and corporate uses. Painting formats appeal to creative and decorative projects. Pattern printing supports textile, packaging, and interior industries. Others cover specialized designs and industrial prints tailored for niche business needs. Each category offers opportunities for printers to diversify output through innovative substrates and smart printing techniques.

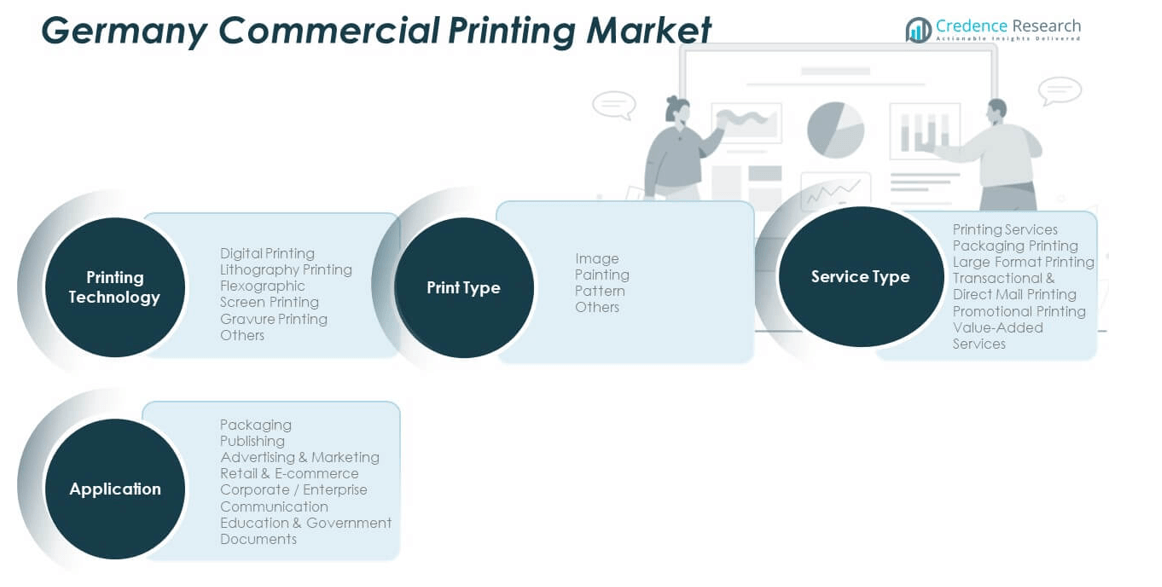

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

South-West Germany Leads Market Share (≈ 40–45 %)

South-West Germany holds the largest share of the Germany Commercial Printing Market, accounting for roughly 40–45 %. The region includes states such as Baden-Württemberg and Bavaria, which benefit from strong industrial infrastructure and skilled workforce. It hosts many high-tech printers and research-driven firms, boosting printing quality and innovation. Firms here serve both domestic and export clients, supported by efficient logistics networks. The region’s concentration of manufacturing, automotive, chemical and packaging industries sustains demand for printed packaging, labels, and marketing materials. Technology adoption remains high, encouraging digital and hybrid print solutions. Printers in this region often lead in sustainable practices and advanced finishing. This dominance positions the region as the heartland of Germany’s commercial printing capacities.

North Rhine-Westphalia as Key Industrial and Commercial Hub (≈ 25–30 %)

The western state of North Rhine-Westphalia (NRW) contributes about 25–30 % of the national commercial printing output. NRW combines high population density, industrial activities, and a diverse economy, driving steady demand for printing services. Major urban centres such as Düsseldorf and Cologne concentrate businesses, retailers, and media houses requiring packaging, advertising, and corporate print. The region’s strong manufacturing base also fuels demand for technical documentation, labels, and industrial printing. Wide range of clients—from SMEs to large enterprises—supports varied printing services including transactional, promotional, and packaging print. Printers leverage regional logistics to deliver to clients across Germany and beyond. The robust economic activity sustains consistent printing volumes and market stability.

Emerging Eastern And Northern States Filling Niche Segments (≈ 10–15 %)

Eastern and northern German states contribute around 10–15 % to the commercial printing market. Regions formerly part of East Germany, along with states like those in the North and Baltic coast, attract cost-sensitive printing orders. Many small and medium printing firms establish operations there due to lower labour and property costs. These firms handle niche segments such as regional publication, local advertising, labels, and small-batch printing. Growth emerges around digital and flexographic printing where setup costs stay modest. Some firms also support larger national clients with overflow demand or special-purpose print jobs. Though share remains smaller, gradual modernization and better connectivity promise incremental growth in these regions over time.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- WKS Druckholding

- Berliner Druck

- Druckerei C.H. Beck

- Prinovis (Bertelsmann Printing Group)

- Schwarz Druck

- Hubert & Co.

- Koehler Paper Group (Print & Specialty Papers)

- Elanders Germany

- Druckhaus Mainfranken

- Saxoprint (CEWE Group)

- Gutenberg Druck

- Mohn Media (Bertelsmann Group)

- Weppert Druck

Competitive Analysis

The Germany Commercial Printing Market features a mixture of traditional printing houses and modern, technology-driven firms. Some established players focus on offset lithography and high-volume jobs. Others pursue digital and hybrid printing solutions. Firms based in industrial regions like Baden-Württemberg and Bavaria leverage proximity to manufacturing clients. They deliver packaging, labels, and corporate materials with tight lead-times and quality standards. Smaller firms in North Rhine-Westphalia and emerging regions compete by offering quick turnaround, flexible print runs, and lower cost structures. Many adopt digital presses and workflow automation to deliver short-run, variable-data print. Competitive advantage shifts toward providers offering value-added services finishing, customization, and eco-friendly printing. Export-oriented firms benefit from Germany’s strong logistics and supply-chain integration. They serve both domestic and European clients, supplying packaging and promotional print. Pricing pressure remains intense due to fragmented supply and online print platforms. Firms with scalable operations, diversified service portfolios, and efficient processes tend to occupy leading positions. Printers that ignore investment in digital and sustainable solutions risk losing share. The market rewards those that combine quality, flexibility, sustainability, and cost-efficiency within one offering.

Recent Developments

- In September 2025, Gallus and Heidelberg unveiled new digital and hybrid printing solutions designed to meet rising demand across the label market in Germany, reflecting significant advancement in commercial printing technologies. This launch was showcased at Labelexpo 2025 Europe, emphasizing innovation tailored to the specialized needs of the commercial printing sector.

- In August 2025, WKS Druckholding invested in two new highly automated Speedmaster XL 106 presses from Heidelberger Druckmaschinen AG at its Felsberg site, transforming it into a center of excellence for sheetfed offset printing in the Germany commercial printing market.

- In April 2025, ColorGATE, a notable player in digital printing and color management, presented major innovations at the FESPA trade show in Hanover, Germany, including the launch of Version 25 and new product families, reinforcing their commitment to advancing digital printing solutions for commercial applications.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Germany Commercial Printing Market will experience steady expansion through the adoption of digital and hybrid presses that boost efficiency and customization.

- Automation and AI integration will streamline workflows, reducing downtime and improving output quality for both small and large print providers.

- Growing environmental awareness will drive investments in sustainable inks, recyclable substrates, and carbon-neutral production facilities.

- Packaging printing will continue to dominate demand, supported by rapid developments in smart labeling, folding cartons, and eco-pack materials.

- The shift toward short-run and on-demand printing will redefine production models, aligning with changing retail and e-commerce requirements.

- Cross-industry collaborations will emerge between printing firms and tech developers to strengthen data integration and color management.

- Value-added services such as embellishment, textured coatings, and augmented reality prints will create new revenue channels for printers.

- Market consolidation will intensify, with regional players forming strategic alliances to enhance competitiveness and operational scale.

- Export opportunities will expand as Germany’s printing technology gains recognition for quality and sustainability across Europe.

- Continuous innovation, backed by investments in R&D and digital transformation, will sustain the market’s long-term resilience and growth trajectory.