Market Overview:

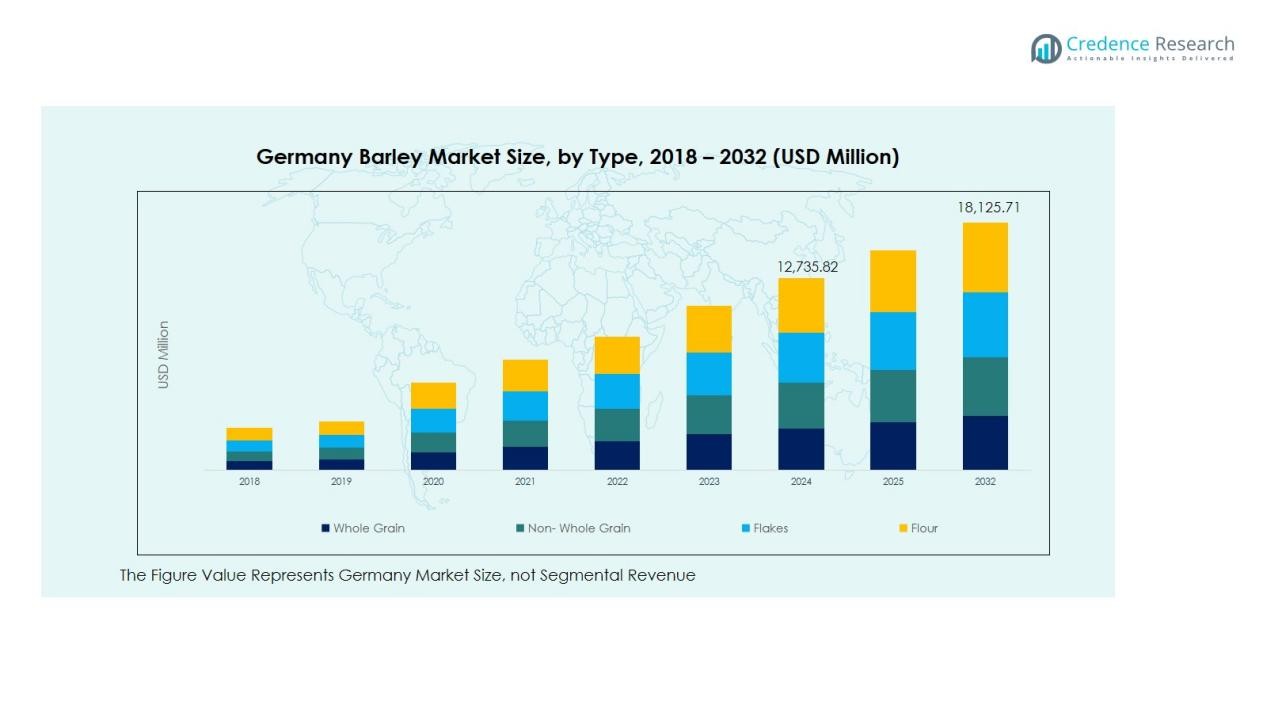

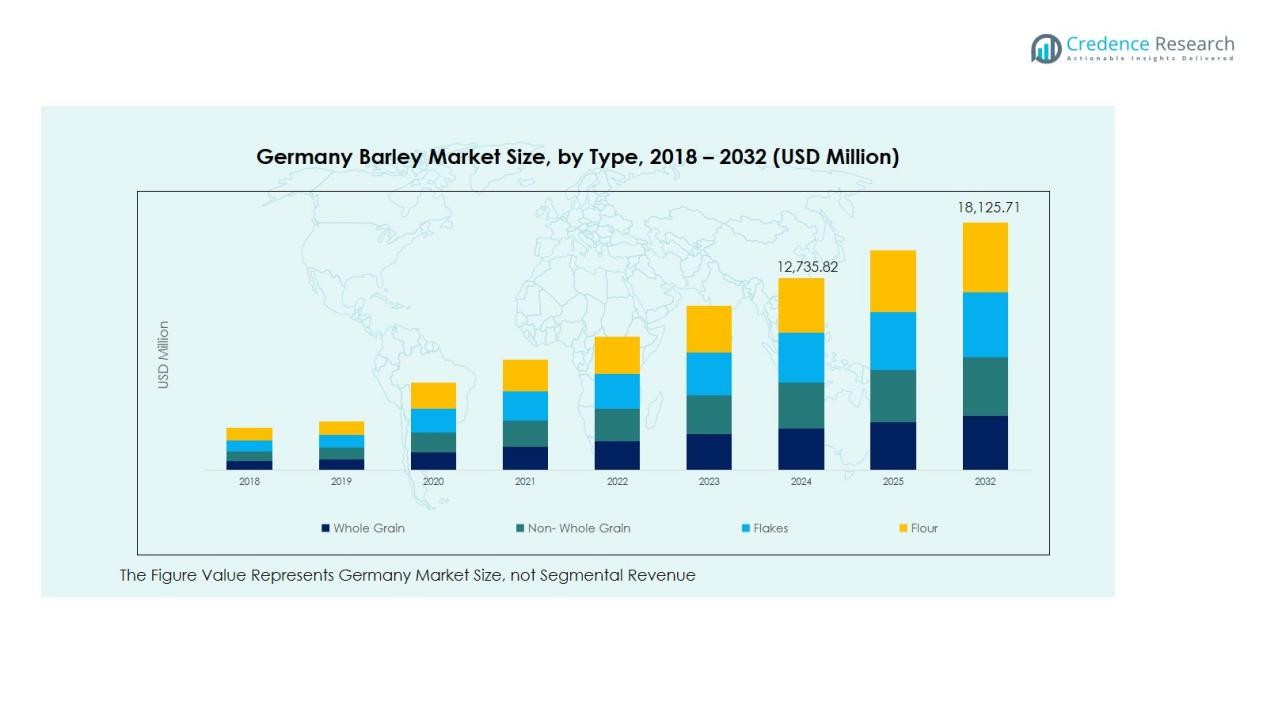

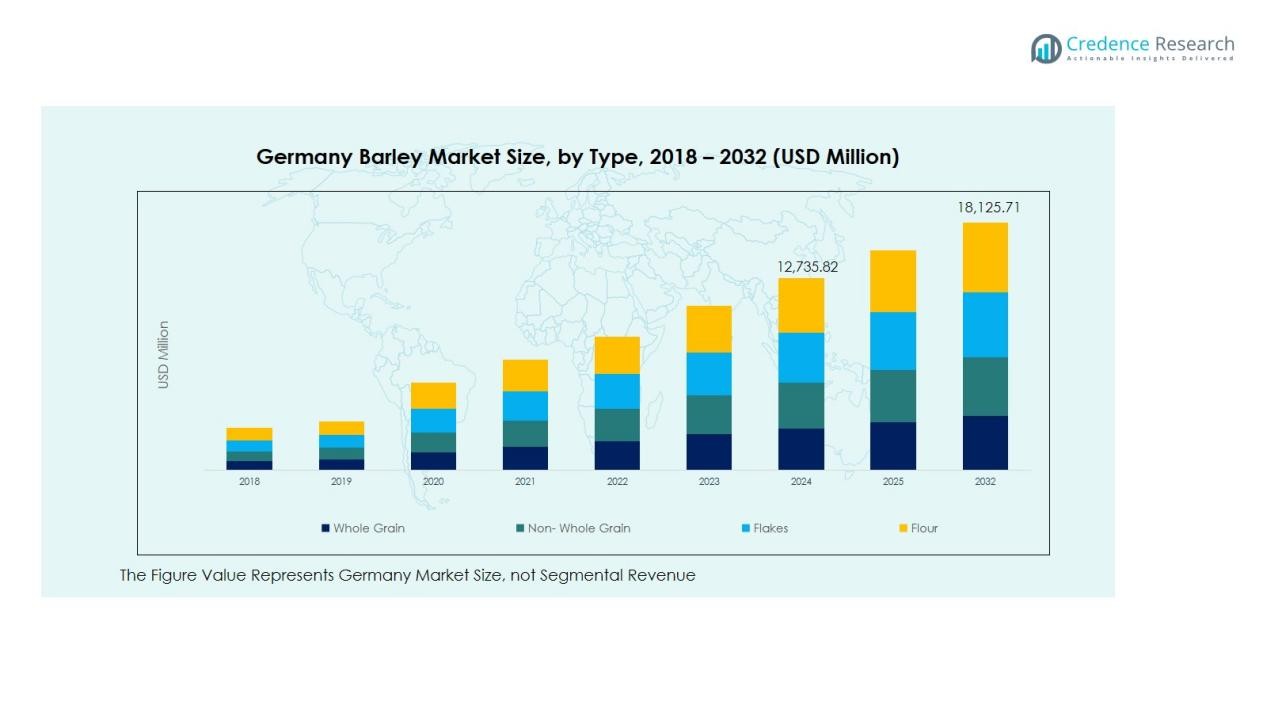

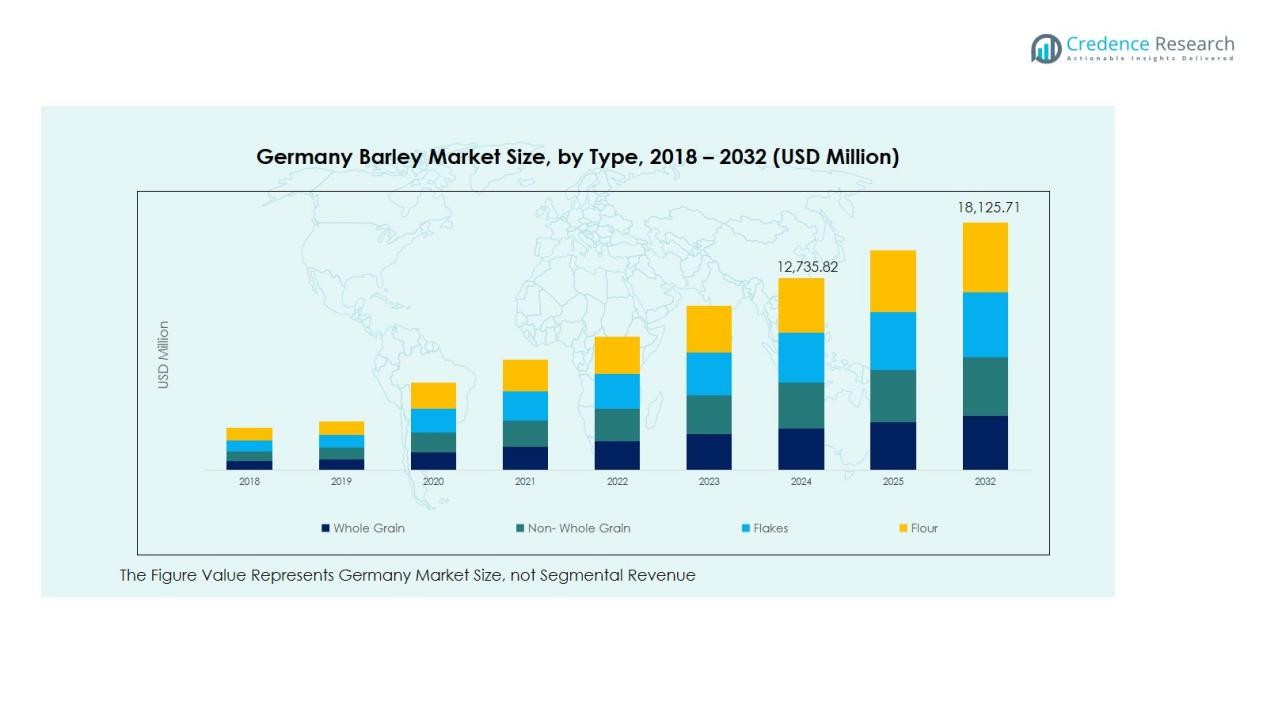

The Germany Barley Market size was valued at USD 12,077.06 million in 2018 to USD 12,735.82 million in 2024 and is anticipated to reach USD 18,125.71 million by 2032, at a CAGR of 4.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Barley Market Size 2024 |

USD 12,735.82 Million |

| Germany Barley Market, CAGR |

4.51% |

| Germany Barley Market Size 2032 |

USD 18,125.71 Million |

Market drivers are anchored in the country’s robust beer and distilling sector, which demands high-quality malting barley for premium and craft beverage production. Rising consumer interest in whole-grain, fiber-rich foods further boosts barley usage in bakery, cereal, and health-focused product formulations. Advances in sustainable agriculture, including precision farming, improved seed varieties, and environmentally conscious cultivation practices, continue to enhance yield performance and product quality. Increased demand for feed barley from Germany’s well-developed livestock and dairy industries adds additional momentum to market expansion.

Regionally, barley cultivation is concentrated in northern and eastern Germany, including states such as Bavaria, Lower Saxony, Saxony-Anhalt, and Mecklenburg-Vorpommern. These regions benefit from favorable agro-climatic conditions, fertile soils, and efficient logistics networks. Proximity to major malting facilities and export hubs strengthens regional competitiveness, ensuring Germany remains a key barley supplier to both domestic processors and European markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Germany Barley Market reached USD 12,735.82 million in 2024 and is projected to hit USD 18,125.71 million by 2032, growing at a CAGR of 4.51%, driven by strong malting demand, rising whole-grain consumption, and stable feed usage.

- Northern Germany holds the largest regional share at 34%, supported by fertile soils, high-yield farms, and proximity to major logistics corridors; Eastern Germany follows with 29% due to large-scale cultivation and efficient crop rotation systems; Bavaria in Southern Germany accounts for 18%, anchored by premium malt varieties and integration with major breweries.

- Northern Germany dominates because of extensive barley acreage and consistent agro-climatic performance, while Eastern regions benefit from large commercial farms and stable output supporting both malting and feed industries.

- The fastest-growing region is Southern Germany, holding 18% share, expanding rapidly due to rising demand for specialty malt varieties, strong craft brewing growth, and adoption of high-quality seed varieties tailored for premium beverage production.

- Demand distribution is led by malting barley at 52% share, driven by Germany’s strong brewing and distilling ecosystem, while feed barley accounts for 35%, supported by high consumption from cattle, swine, and dairy operations.

Market Drivers:

Market Drivers:

Strong Demand from Germany’s Brewing and Distilling Ecosystem

The Germany Barley Market benefits from its globally recognized brewing culture, which requires consistent volumes of high-quality malting barley. Breweries continue to prioritize grain quality, pushing producers to adopt improved varieties with better enzyme performance and flavor characteristics. Premium beer, craft labels, and specialty malt products sustain firm demand for malting barley throughout the year. It strengthens integration between farmers, maltsters, and processors, creating a stable supply chain for the domestic beverage industry.

- For instance, some breweries and agricultural partners explore modern farming technologies, such as precision agriculture, as a method to optimize barley cultivation and potentially enhance efficiency in resource management.

Rising Emphasis on Health-Focused Grain Consumption

Demand for nutritious and fiber-rich foods supports long-term growth in the Germany Barley Market. Food manufacturers increase the use of barley in bakery mixes, breakfast cereals, plant-based beverages, and functional food formulations. Consumers show strong interest in whole-grain products linked to digestive health and balanced diets. It encourages processors to expand barley-based product portfolios, reinforcing steady market expansion in the food segment.

- For instance, the cereal manufacturer Kölln offers various high-fiber products, such as their Kölln Organic Oat Flakes, which contain approximately 9.2 grams of dietary fiber per 100-gram serving (or about 3.7 grams per 40-gram serving), targeting digestive health-conscious consumers

Advancements in Sustainable and Efficient Farming Practices

Producers in the Germany Barley Market adopt modern agronomic practices to improve yield stability and environmental performance. Precision farming tools, improved crop rotation strategies, and certified sustainable practices gain rapid acceptance. Farmers use resilient seed varieties to improve grain quality and reduce vulnerability to climate variability. It supports consistent production volumes while meeting national sustainability expectations.

Stable Demand from Germany’s Livestock and Feed Industry

The Germany Barley Market records strong feed usage due to the country’s developed livestock and dairy sectors. Feed barley remains a cost-effective source of energy and protein for cattle, swine, and poultry nutrition. Large integrated farming operations rely on it to maintain stable feed formulations across seasons. It strengthens overall market balance by supporting steady off-take beyond the malting and food sectors.

Market Trends:

Market Trends:

Shift Toward Premium Malting Varieties and Quality Optimization

Premiumisation influences grain selection patterns in the Germany Barley Market, with breweries prioritizing high extract levels, uniform kernel size, and superior enzyme profiles. Maltsters invest in advanced cleaning, sorting, and germination systems to meet stricter quality benchmarks from both domestic and export clients. Craft brewers continue to diversify their portfolios, which supports interest in specialty malts and region-specific barley varieties. Farmers respond to market signals by adopting certified seeds that improve consistency and reduce quality losses during harvest. It drives stronger alignment between producers and processors, resulting in a more quality-driven supply chain. Demand for traceable and sustainably sourced barley strengthens this trend. Buyers place higher value on transparency across production and processing stages.

- For instance, Radeberger Gruppe partnered with Saaten-Union to plant over 1,200 hectares of EU-certified Avalon barley in Saxony during 2024, resulting in a kernel uniformity rate above 95% in processed malt.

Growing Focus on Sustainable Cultivation and Climate-Resilient Production

Sustainability influences major decisions in the Germany Barley Market, with producers integrating climate-resilient practices to maintain output stability. Farmers adopt digital crop monitoring tools to optimize water use, nutrient application, and soil health. Seed developers advance drought-tolerant and disease-resistant varieties that reduce production risks linked to weather fluctuations. It supports long-term yield reliability and strengthens national supply security. Processors highlight sustainability performance in procurement frameworks, which encourages consistent environmental standards across regions. Demand for low-carbon agricultural inputs remains strong due to evolving regulatory expectations. The integration of renewable energy solutions in malting facilities reinforces this broader sustainability shift.

- For instance, BayWa promotes the use of digital tools and precision farming techniques, such as the “VariableRain” application, which uses satellite data to help farmers manage water more efficiently and prevent waste, thereby reducing their environmental impact.

Market Challenges Analysis:

Climate Variability and Pressure on Yield Stability

Climate fluctuations create persistent uncertainty for the Germany Barley Market, with producers facing irregular rainfall, higher temperatures, and shifting disease patterns. Farmers must adapt quickly to protect grain quality and avoid losses during critical growth stages. It increases dependence on resilient seed varieties and advanced agronomic practices, which raises production costs. Extreme weather events disrupt planting timelines and affect kernel uniformity, which impacts suitability for malting. Market participants handle tighter quality specifications from maltsters, placing extra pressure on growers. Limited predictability in seasonal conditions continues to influence long-term production planning.

Cost Pressures, Supply Chain Gaps, and Competitive Imports

Rising input costs challenge operational efficiency within the Germany Barley Market, especially in fertilizer, energy, and logistics. Producers face tighter margins when global commodity prices weaken or when transport disruptions increase expenses. It creates strain across the supply chain and reduces flexibility for smaller farms. Competition from imported barley in certain years further complicates pricing stability when domestic output fluctuates. Malting facilities require consistent quality, yet supply variations lead to procurement challenges. Regulatory requirements related to sustainability and environmental performance increase compliance obligations, which adds financial and operational pressure on stakeholders.

Market Opportunities:

Expansion of Premium Malts and Value-Added Food Applications

Demand for specialty malts creates strong opportunities for the Germany Barley Market, supported by the growth of craft breweries and premium beverage producers. Maltsters can diversify portfolios with roasted, caramelized, and region-specific malt types that attract both domestic and export buyers. Food manufacturers expand interest in barley due to its fiber content and health benefits, which opens opportunities in bakery, cereals, and plant-based innovations. It strengthens pathways for value-added processing and new product development. Producers can collaborate with food brands to supply traceable and sustainably grown barley. Investments in quality enhancement technologies further support premium positioning across segments.

Advancement of Sustainable Farming and Climate-Resilient Production Models

Sustainability targets introduce clear opportunities for the Germany Barley Market, especially for farms adopting climate-smart practices. Producers who implement precision agriculture, low-carbon techniques, and certified sustainable methods can secure preferred supplier status with major maltsters and food companies. It improves long-term competitiveness and aligns production with evolving regulatory expectations. Development of drought-tolerant and disease-resistant varieties supports stable yields and expands suitability across more regions. Opportunities grow for digital farm management tools that improve resource efficiency and crop performance. Export potential strengthens when supply chains emphasize transparency and environmental credibility.

Market Segmentation Analysis:

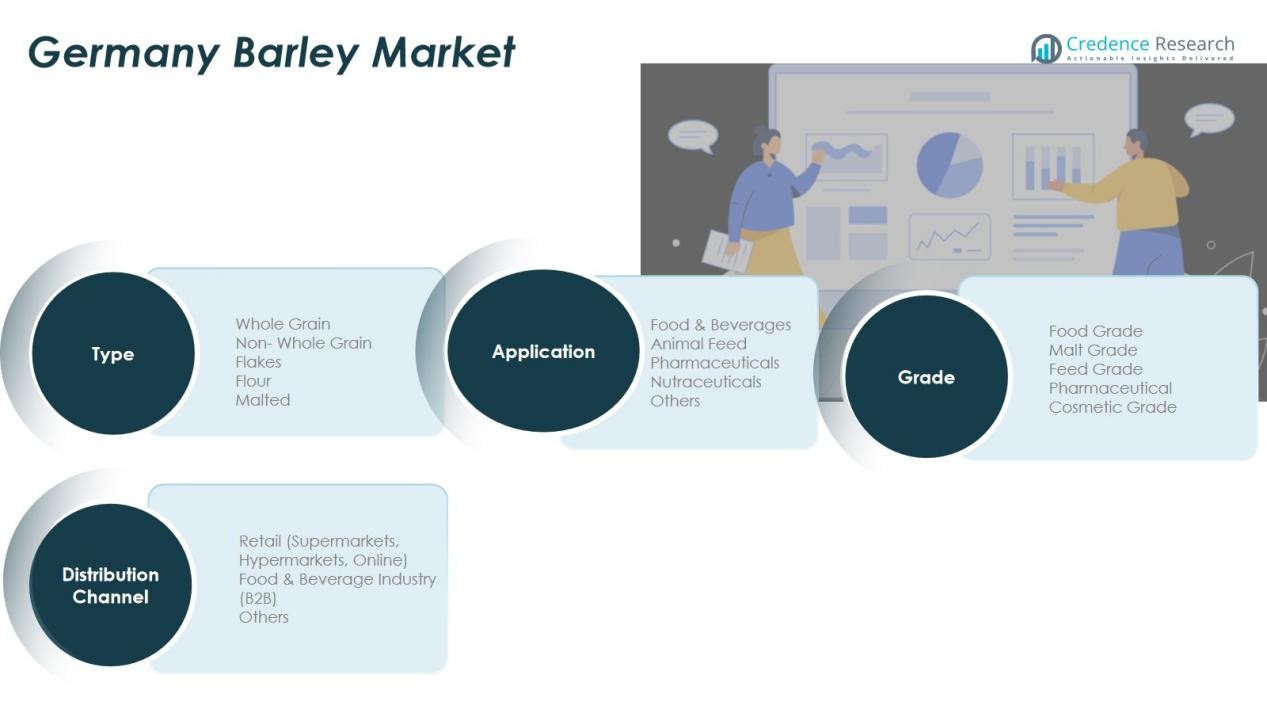

By Type

The Germany Barley Market shows balanced demand across whole grain, non-whole grain, flakes, flour, and malted variants. Whole grain barley secures strong interest from health-focused consumers who prefer high-fiber ingredients. Malted barley dominates value share due to its critical role in beer production and specialty malt applications. Flakes and flour gain traction in bakery, cereals, and plant-based formulations. It supports growth for processors that cater to both industrial buyers and retail-oriented food producers.

- For instance, GoodMills Innovation launched Snow® Prebiotic Fibres, a multi-fiber complex for use in various baked goods, in 2025, driving demand for healthy grain products

By Application

Demand in the Germany Barley Market remains concentrated in food and beverages, driven by the country’s established brewing industry and rising interest in nutrition-oriented grain products. Animal feed represents a stable high-volume segment supported by Germany’s livestock and dairy sectors. Pharmaceuticals and nutraceuticals use barley for its beta-glucan content and clean-label appeal. It encourages producers to explore higher-value applications with stronger margins and long-term consumption potential. Niche uses in specialty foods and wellness categories continue to expand steadily.

- For instance, Bitburger Braugruppe, one of Germany’s largest private breweries, produced over 3.5 million hectoliters of beer in 2024 using domestically sourced barley for its flagship pilsner.

By Grade

Grade-based demand in the Germany Barley Market centers on malt grade, food grade, and feed grade, supported by distinct quality requirements across industries. Malt grade remains the most profitable segment due to stringent specifications from breweries and malt houses. Food grade gains momentum with the growth of whole-grain foods and functional ingredients. Feed grade maintains consistent off-take from animal nutrition companies. It reinforces a stable market structure where producers can target multiple grades to optimize revenue diversification.

Segmentations:

Segmentations:

By Type

- Whole Grain

- Non-Whole Grain

- Flakes

- Flour

- Malted

By Application

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Nutraceuticals

- Others

By Grade

- Food Grade

- Malt Grade

- Feed Grade

- Pharmaceutical

- Cosmetic Grade

By Distribution Channel

- Retail (Supermarkets, Hypermarkets, Online)

- Food & Beverage Industry (B2B)

- Others

Regional Analysis:

Dominance of Northern and Eastern Cultivation Regions Supported by Strong Agronomic Conditions

Northern and eastern regions anchor production in the Germany Barley Market, with states such as Lower Saxony, Mecklenburg-Vorpommern, Saxony-Anhalt, and Brandenburg maintaining high output levels. These areas benefit from fertile soils, stable rainfall, and favorable temperature patterns that support consistent crop performance. Farmers in these regions adopt efficient crop rotation systems that enhance soil health and grain uniformity. It strengthens long-term supply reliability for maltsters and feed producers. Proximity to storage hubs and grain terminals improves logistics efficiency and supports steady domestic distribution.

Southern Production Driven by Specialty Varieties and Strong Brewery Integration

Southern Germany provides a distinct advantage through Bavaria and Baden-Württemberg, where producers focus on premium barley varieties suited for specialty malt applications. Breweries in these states maintain strong relationships with growers to secure traceable, high-quality malting barley. Regional demand for craft beer and traditional brews increases interest in locally sourced grains with defined flavor attributes. Farmers in the south often adopt advanced seed varieties to meet strict brewery specifications. It creates a differentiated production ecosystem where quality-focused outputs hold strategic value for the beverage sector.

Western and Central Regions Strengthening Processing, Distribution, and Value Chain Connectivity

Western and central regions reinforce the Germany Barley Market through their concentration of processing facilities, malting plants, and efficient logistics networks. These areas serve as key corridors for industrial buyers, food manufacturers, and exporters. Strong transportation infrastructure ensures efficient movement of barley from northern and eastern fields to domestic and cross-border markets. It supports a balanced flow of raw material across regions while stabilizing supply for multiple end-use industries. Market participants benefit from proximity to major agribusiness firms and established trade channels.

Key Player Analysis:

- Boortmalt (Axereal Group)

- Malteurop Groupe S.A.

- Soufflet Group

- Cargill Deutschland GmbH

- BayWa AG

- Agravis Raiffeisen AG

- Kulmbacher Brauerei AG

- Bitburger Braugruppe GmbH

- Radeberger Gruppe KG

- Paulaner Brewery Group GmbH & Co. KGaA

Competitive Analysis:

The Germany Barley Market features a concentrated competitive landscape dominated by large maltsters, agribusiness groups, and integrated supply chain operators. Boortmalt (Axereal Group), Malteurop Groupe S.A., Soufflet Group, Cargill Deutschland GmbH, BayWa AG, and Agravis Raiffeisen AG shape market structure through their scale, procurement strength, and processing capabilities. These companies maintain strong relationships with growers to secure consistent volumes of premium-grade barley for malting and food applications. It enhances control over quality standards and supports efficient supply flows across regions. Leading players invest in capacity expansion, sustainability programs, and digital procurement models to improve competitiveness and meet evolving industry requirements. Strategic actions often focus on advanced malting technologies, regional sourcing partnerships, and traceability initiatives that reinforce their position in domestic and export-oriented value chains.

Recent Developments:

- In September 2025, Boortmalt announced the launch of SproutedByNature, a new sugar substitute developed with Paragon Pure, and showcased malt-based coffee innovations at Drinktec 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Grade and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for specialty and premium malts will strengthen long-term opportunities across the brewing and craft beverage sector.

- Expansion of whole-grain and fiber-rich product lines will encourage higher barley use in food manufacturing.

- Sustainability commitments will push producers to adopt low-carbon practices, precision tools, and certified farming systems.

- Climate-resilient seed varieties will gain importance to safeguard yield quality and reduce weather-related risks.

- Digital procurement and traceability platforms will improve supply chain transparency for maltsters and food processors.

- Integration between farmers, cooperatives, and large agribusiness firms will increase to stabilize procurement channels.

- Barley-based ingredients in nutraceuticals and wellness categories will expand due to strong interest in natural health solutions.

- Feed demand will remain steady, supported by Germany’s livestock and dairy sectors that rely on energy-efficient grains.

- Investments in advanced malting technologies will improve efficiency and support value-added product development.

- Export opportunities will grow for high-quality German barley and specialized malts in European and global markets.

Market Drivers:

Market Drivers: Market Trends:

Market Trends: Segmentations:

Segmentations: