Market Overview:

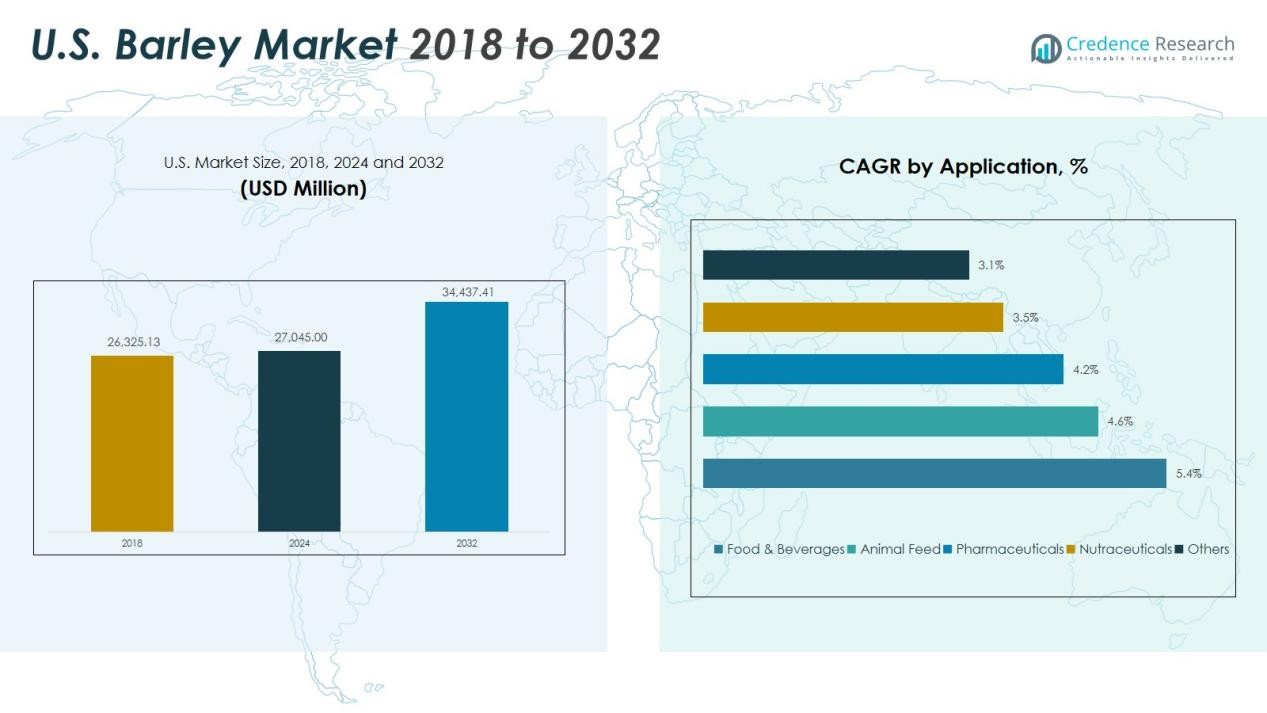

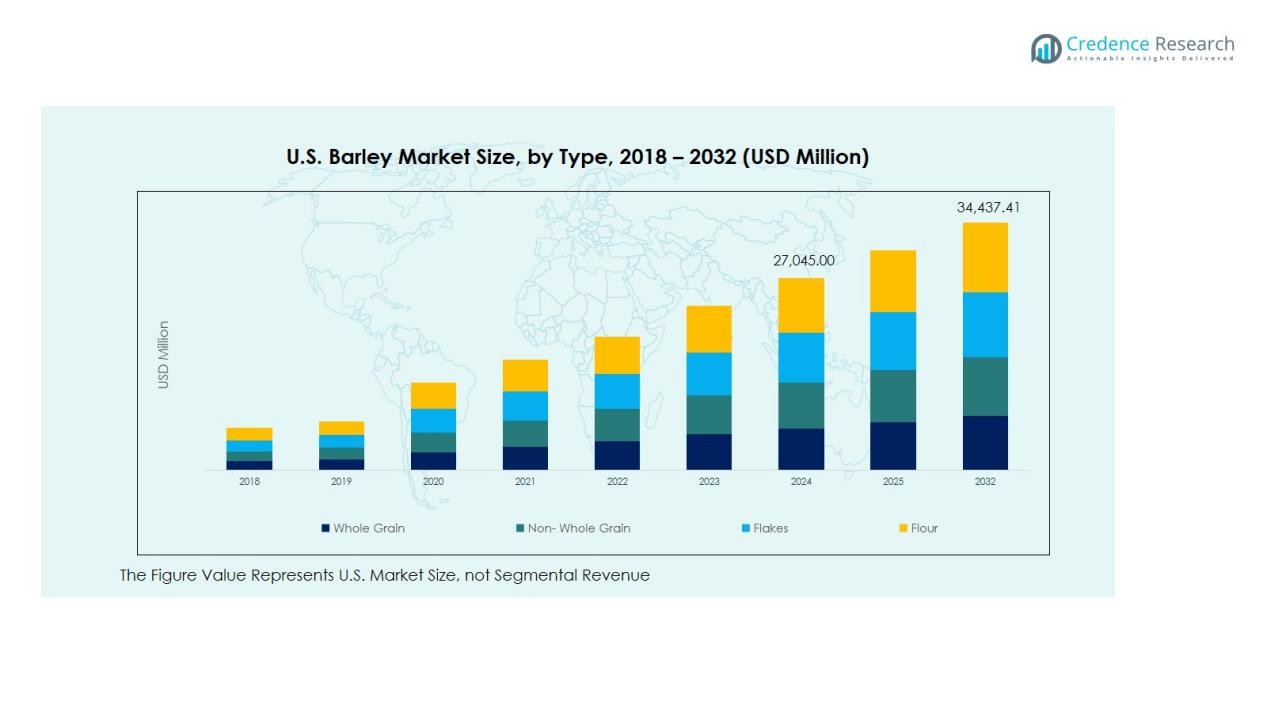

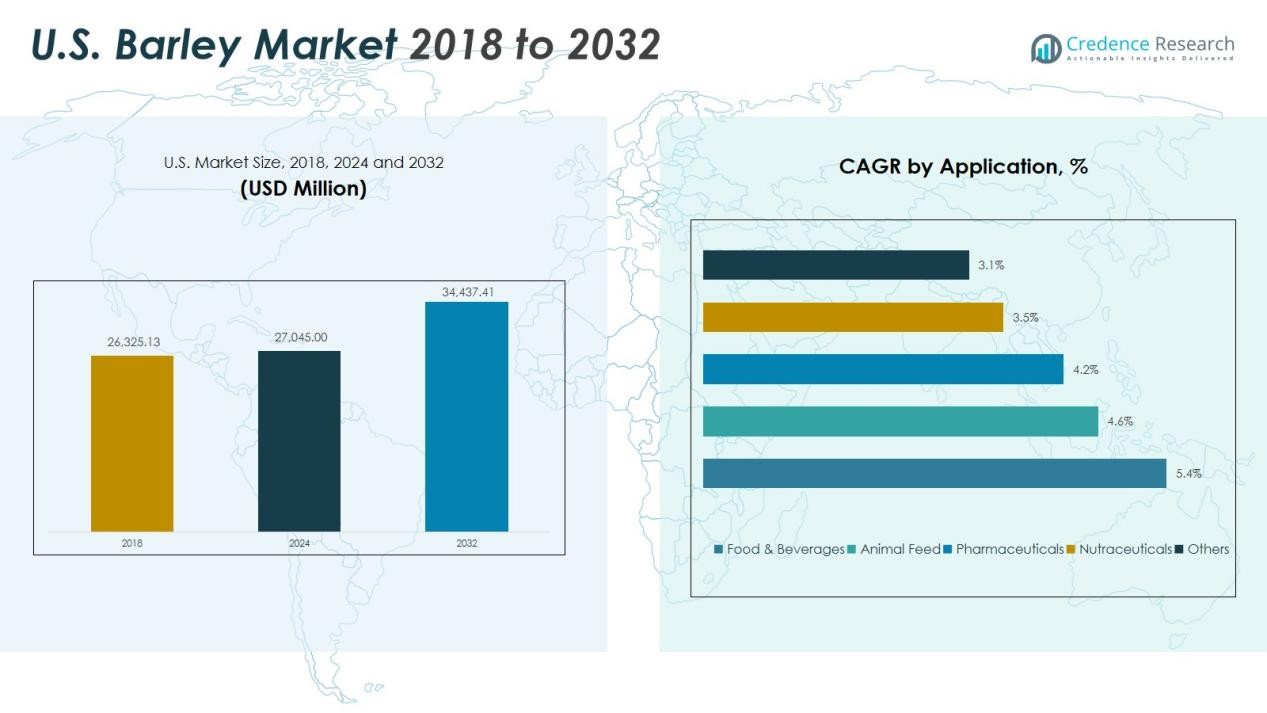

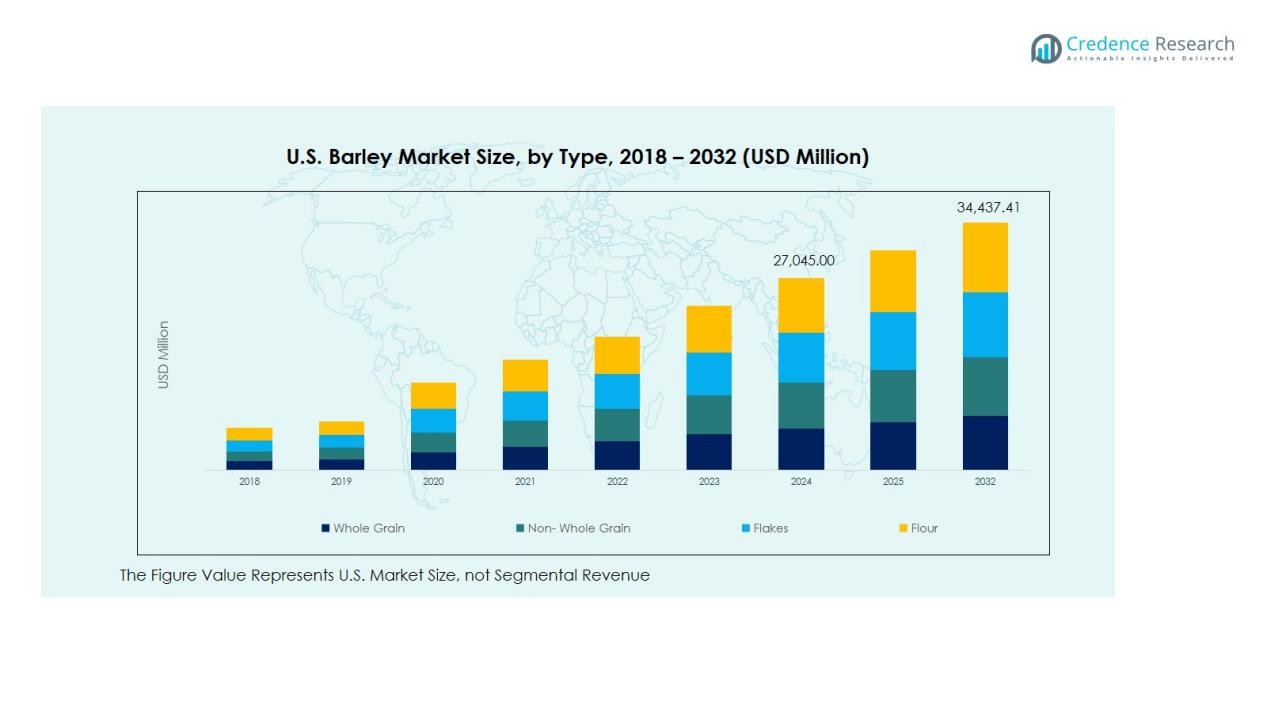

The U.S. Barley Market size was valued at USD 26,325.13 million in 2018 to USD 27,045.00 million in 2024 and is anticipated to reach USD 34,437.41 million by 2032, at a CAGR of 3.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Barley Market Size 2024 |

USD 27,045.00 Million |

| U.S. Barley Market, CAGR |

3.07% |

| U.S. Barley Market Size 2032 |

USD 34,437.41 Million |

Strong market drivers reinforce this upward trajectory. The expanding craft beer and specialty brewing sector significantly boosts demand for premium malting barley. Growing consumer interest in fiber-rich, whole-grain foods enhances barley’s role in health-oriented product formulations. Additionally, barley’s agronomic advantages—such as low input requirements and adaptability to varied climates—support its rising adoption in sustainable farming systems. The livestock industry also remains a key demand generator, relying on feed barley as an economical and nutritious feed component.

Regionally, production is concentrated in states such as Idaho, Montana, North Dakota, Washington, and Colorado, which benefit from favorable agro-climatic conditions and established farming practices. The Pacific Northwest and Northern Plains dominate output and supply notable volumes for both domestic malting operations and export channels. Growing collaboration between farmers, maltsters, and brewers continues to strengthen regional market alignment and competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- S. Barley Market size reached USD 27,045.00 million in 2024 and is projected to hit USD 34,437.41 million by 2032, growing at a CAGR of 3.07%, supported by expanding malt demand, rising whole-grain food usage, and sustained feed consumption.

- Idaho, Montana, and North Dakota collectively hold over 65% regional share, driven by ideal agro-climatic conditions, large-scale cultivation, and long-standing supply partnerships with maltsters and brewers that secure consistent premium-grade output.

- The Pacific Northwest contributes around 20% share, supported by efficient irrigation networks, established malting operations, and strong export orientation, reinforcing its position as a major production corridor.

- Colorado, Washington, and Wyoming—collectively holding nearly 10% share—represent the fastest-growing region, fueled by rising craft brewery demand, preference for specialty malt profiles, and improved agronomy that enhances protein stability and kernel uniformity.

- Malting barley accounts for about 55% of segment share, driven by premium beer and specialty brewing demand, while feed barley represents approximately 30%, supported by cattle, swine, and poultry producers seeking cost-efficient, digestible feed alternatives.

Market Drivers:

Rising Demand from Craft Brewing and Premium Malt Production

The U.S. Barley Market gains strong momentum from the expansion of craft breweries and the shift toward premium malt varieties. Breweries focus on consistent flavor, local sourcing, and quality assurance, which increases the need for high-grade malting barley. It benefits from closer collaboration between growers and maltsters who aim for superior protein levels and grain uniformity. The continuous rise in specialty beer consumption strengthens long-term demand and supports steady acreage allocation.

- For Instance, Anheuser-Busch sources high-quality malting barley with protein levels typically averaging within the industry-standard range of 9.5% to 12.5%.

Growing Preference for Health-Focused Food and Beverage Applications

Health-conscious consumers increase the use of barley in cereals, baked goods, snacks, and functional beverages. The U.S. Barley Market benefits from this shift, as food manufacturers incorporate barley for its fiber, beta-glucan content, and clean-label positioning. It supports product innovation in ready-to-eat categories, targeting digestive wellness and cholesterol management. Strong interest in whole grains encourages consistent demand from major food brands.

- For instance, Graasí, a U.S.-based company, developed an organic barley water beverage powered by barley grass juice powder, infused with essential vitamins like D, C, and Zinc, offering a low-sugar option with just 4 grams of sugar per bottle compared to the 40 grams typical in soft drinks.

Strengthening Role of Barley in Sustainable Farming and Climate-Resilient Agriculture

Barley offers agronomic advantages that align with long-term sustainability goals. The U.S. Barley Market benefits from its lower water needs, shorter growing cycles, and adaptability across diverse soil conditions. Farmers adopt barley to improve crop rotations, reduce input costs, and stabilize yields under shifting weather patterns. It remains an attractive option for growers who prioritize soil health and risk mitigation.

Expanding Use of Feed Barley Across Livestock Sectors

The livestock industry supports steady demand for feed barley due to its protein content, digestibility, and cost efficiency. The U.S. Barley Market sees rising utilization across cattle, swine, and poultry operations seeking reliable feed alternatives. It helps producers manage feed budgets in periods of corn and soybean price volatility. Strong interest in regionally sourced feed inputs sustains market relevance and encourages broader adoption.

Market Trends:

Advancement in Malt Quality, Product Innovation, and Supply Chain Coordination

The U.S. Barley Market experiences a shift toward higher malt quality standards driven by breweries that prioritize flavor consistency and process efficiency. Producers focus on improved seed varieties that support better enzyme activity, uniform kernel size, and superior extract potential. Maltsters refine processing methods to meet tighter brewing specifications and maintain dependable supply. It benefits from data-driven farming tools that improve crop planning and harvest timing. Farmers integrate precision practices to enhance protein balance and reduce variability. Close coordination between growers, maltsters, and brewers strengthens transparency and encourages long-term contracting. This trend elevates overall product value and supports market stability.

- For Instance, Anheuser-Busch InBev (AB InBev) has implemented pilot programs utilizing blockchain technology to improve supply chain transparency and traceability, specifically linking barley growers and maltsters in its European operations.

Expansion of Barley in Food, Health, and Sustainable Agriculture Segments

The U.S. Barley Market sees rising incorporation of barley in functional foods, plant-forward diets, and clean-label product lines. Food manufacturers increase their use of barley to capture demand for high-fiber and heart-health formulations. It gains traction in ready meals, snacks, bakery ranges, and nutrient-focused beverages. Sustainability commitments drive interest in barley for its low-input profile and contribution to soil regeneration. Farmers adopt it more widely to support diversified rotations and climate-resilient production. Feed buyers explore barley as an efficient, cost-managed option that reduces dependence on single-source grains. These trends expand its relevance across consumer, agricultural, and industrial channels.

- For instance, Nestlé offers several multi-grain breakfast options, such as certain variants of Cheerios or Fitness cereals, which incorporate barley and can contribute to a high-fiber diet to promote heart health and digestive benefits in line with consumer demand. A standard 30g serving of most common variants, such as Nestlé Multigrain Cheerios, typically provides around 3 grams of fiber, while some specific regional or ‘fiber-focused’ products, such as Fitness Fiber cereal, can provide over 5 grams per serving.

Market Challenges Analysis:

Volatility in Production, Weather Risk, and Competitive Crop Economics

The U.S. Barley Market faces challenges linked to fluctuating acreage and weather uncertainty across major producing states. Farmers often shift to higher-margin crops such as corn and soybeans, which constrains barley’s long-term supply stability. It remains sensitive to heat, drought, and early frost events that affect yield quality and malting suitability. Malt processors depend on strict protein and moisture thresholds, which increases rejection rates in adverse seasons. Price competition from alternative grains limits incentives for growers who weigh profitability and contract availability. These constraints create periodic supply gaps that influence both domestic and export-focused operations.

Quality Variability, Supply Chain Constraints, and Shifting Consumer Preferences

The U.S. Barley Market encounters challenges tied to maintaining consistent quality from farm to malt house. It requires careful handling, storage, and transport to preserve germination capacity and avoid contamination. Infrastructural limitations in certain regions reduce efficiency and raise logistics costs. Consumer preferences continue to evolve, which places pressure on brewers and food manufacturers to diversify ingredient choices. Demand for new malt profiles increases complexity for suppliers who must meet multiple specifications. Slow expansion of barley-based food categories limits growth potential compared with faster-rising grains. These factors influence investment decisions and restrict rapid market acceleration.

Market Opportunities:

Expansion of High-Value Malt Varieties, Food Applications, and Premium Formulations

The U.S. Barley Market holds strong potential through the rising demand for specialty malts used in craft beer, low-alcohol beverages, and premium brewing lines. Brewers seek unique flavor profiles, which creates room for new malt types and region-specific varieties. It enables producers to target niche segments that offer higher margins and stable contracting opportunities. Food manufacturers widen their use of barley in high-fiber snacks, fortified bakery lines, and functional beverages. Interest in clean-label ingredients strengthens opportunities for barley-based health products. Innovation in processing methods supports the development of refined, consumer-friendly formats.

Growth in Sustainable Farming, Climate-Resilient Crop Strategies, and Feed Optimization

The U.S. Barley Market benefits from the push toward regenerative agriculture, where barley fits well within diversified rotations. Its lower water needs and soil-health advantages align with sustainability programs that attract government incentives and private-sector partnerships. It gives farmers a pathway to improve yield stability under variable climatic conditions. Feed buyers explore barley as a strategic option that reduces cost exposure linked to corn and soybean markets. Expansion of regionally sourced feed programs creates new regional demand pockets. These opportunities support broader market diversification and long-term value creation.

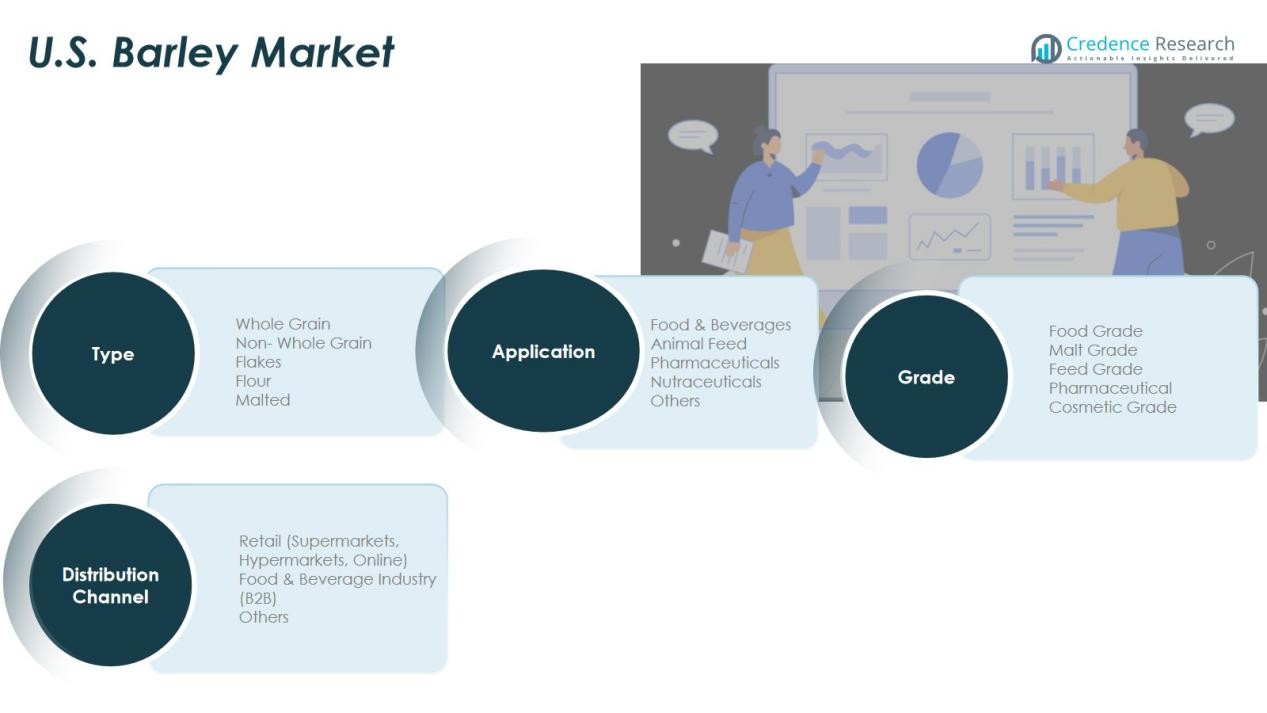

Market Segmentation Analysis:

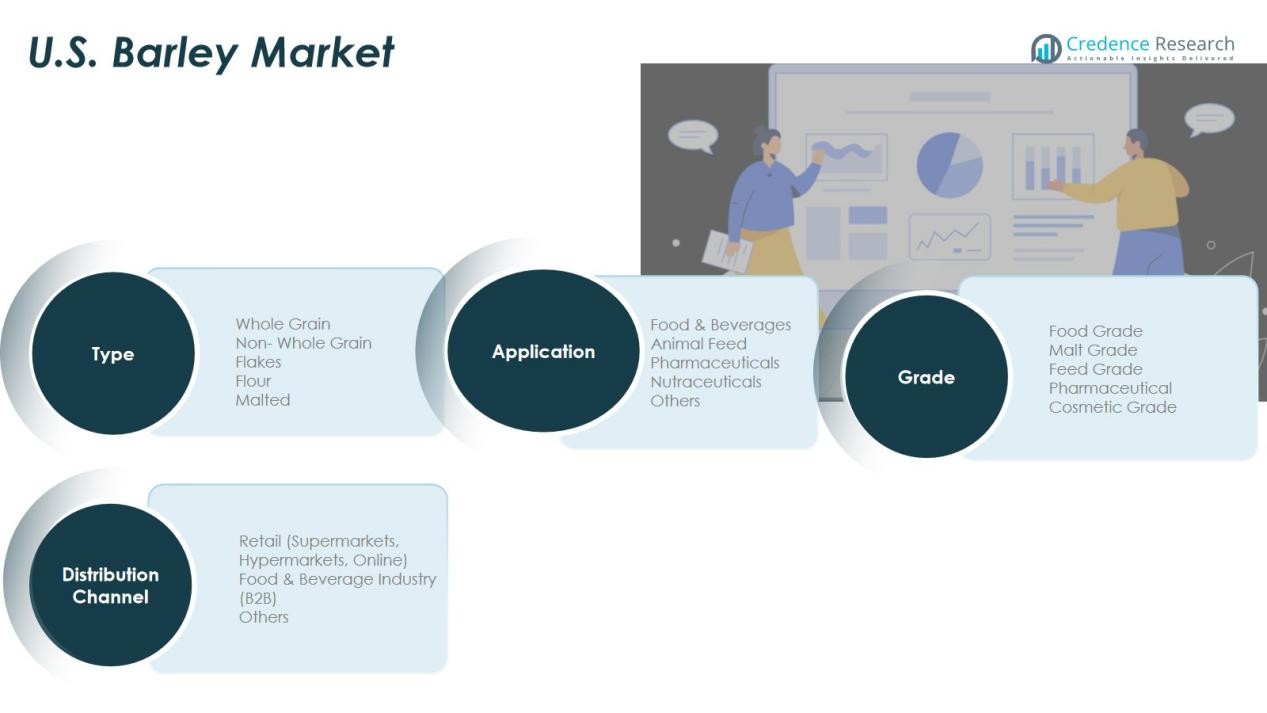

By Type

The U.S. Barley Market shows strong differentiation across whole grain, non-whole grain, flakes, flour, and malted forms. Malted barley holds the largest influence due to its essential role in brewing and distilling. Food processors increase their use of whole grain and flour formats to support high-fiber and clean-label product lines. It gains steady traction in flakes that cater to breakfast cereals and snack applications. Demand for versatile formats strengthens the market’s reach across both industrial and consumer segments.

- For instance, leading malting companies operate advanced production facilities, with the world’s largest single-site malthouse having an annual capacity of approximately 460,000 metric tons of malted barley. This emphasizes the significant scale and technological upgrades in modern malt processing to support brewing innovation and meet global demand.

By Application

The U.S. Barley Market maintains broad application diversity across food and beverages, animal feed, pharmaceuticals, nutraceuticals, and other industrial uses. Food and beverages remain the leading segment, driven by brewing, malting, and the rising use of barley in health-focused foods. Animal feed secures consistent demand due to its protein content and cost efficiency. It supports niche applications in pharmaceuticals and nutraceuticals where beta-glucan and dietary fibers deliver functional benefits. These segments expand opportunities for producers and processors targeting differentiated end uses.

- For instance, the Malteurop Group, a major malt supplier, collects 3 million tons of malting barley annually to produce malt for breweries and health food manufacturers, underscoring their technological capacity in delivering consistent barley malt quality to meet diversified food and beverage demands.

By Grade

The U.S. Barley Market organizes production across food grade, malt grade, feed grade, pharmaceutical, and cosmetic grade categories. Malt grade retains strong dominance due to its stringent quality requirements and close alignment with brewery specifications. Food grade barley gains traction from growth in whole-grain products and wellness-oriented formulations. Feed grade maintains reliable uptake across livestock sectors seeking stable grain alternatives. It sees emerging interest in pharmaceutical and cosmetic grades that use barley derivatives in specialized formulations.

Segmentations:

By Type

- Whole Grain

- Non-Whole Grain

- Flakes

- Flour

- Malted

By Application

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Nutraceuticals

- Others

By Grade

- Food Grade

- Malt Grade

- Feed Grade

- Pharmaceutical

- Cosmetic Grade

By Distribution Channel

- Retail (Supermarkets, Hypermarkets, Online)

- Food & Beverage Industry (B2B)

- Others

Regional Analysis:

Dominance of the Northern Plains and Pacific Northwest in Production

The U.S. Barley Market is heavily concentrated in the Northern Plains and Pacific Northwest, where Idaho, Montana, and North Dakota lead national output. These states benefit from favorable temperatures, reliable irrigation access, and long-standing cultivation expertise. Farmers in these regions maintain strong ties with maltsters and breweries that require consistent grain quality. It supports stable contracting models that encourage growers to prioritize high-grade malting barley. Strategic investments in seed improvement and agronomic practices strengthen the region’s ability to meet strict brewing specifications. This dominance reinforces the role of these states as the primary supply base for domestic malting operations.

Emerging Contributions from Western and Mountain States

States such as Washington, Colorado, and Wyoming expand their role due to rising interest in premium and specialty malt varieties. The U.S. Barley Market benefits from the presence of craft breweries that seek regionally sourced malt with distinctive profiles. Producers in these states focus on tailored cultivation practices that enhance protein stability and kernel uniformity. It allows growers to target niche brewing segments that value quality differentiation over volume. Improved agronomic support and extension services strengthen yields and reduce variability. These regions create new supply pockets that support market diversification.

Growing Importance of Midwest and Localized Supply Chains

The U.S. Barley Market gains incremental support from Midwestern states where food processors and feed manufacturers explore barley for functional foods and cost-effective feed options. Localized value chains help reduce transport costs and improve freshness for malting and food applications. It encourages small and mid-sized farms to incorporate barley into rotation systems that improve soil health and input efficiency. Interest in sustainable crop strategies strengthens regional participation across multiple production zones. Expansion of regional malt houses and craft brewing hubs increases opportunities for contract farming. These developments broaden the geographic footprint of the market and enhance long-term supply flexibility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Bunge / Viterra Inc.

- CHS Inc.

- The Scoular Company

- Rahr Corporation

- Briess Malt & Ingredients Co.

- Malt Products Corporation (MPC)

- GrainCorp Limited

- Muntons plc

- The Andersons, Inc.

- CGB Enterprises, Inc.

Competitive Analysis:

Dominance of the Northern Plains and Pacific Northwest in Production

The U.S. Barley Market is heavily concentrated in the Northern Plains and Pacific Northwest, where Idaho, Montana, and North Dakota lead national output. These states benefit from favorable temperatures, reliable irrigation access, and long-standing cultivation expertise. Farmers in these regions maintain strong ties with maltsters and breweries that require consistent grain quality. It supports stable contracting models that encourage growers to prioritize high-grade malting barley. Strategic investments in seed improvement and agronomic practices strengthen the region’s ability to meet strict brewing specifications. This dominance reinforces the role of these states as the primary supply base for domestic malting operations.

Emerging Contributions from Western and Mountain States

States such as Washington, Colorado, and Wyoming expand their role due to rising interest in premium and specialty malt varieties. The U.S. Barley Market benefits from the presence of craft breweries that seek regionally sourced malt with distinctive profiles. Producers in these states focus on tailored cultivation practices that enhance protein stability and kernel uniformity. It allows growers to target niche brewing segments that value quality differentiation over volume. Improved agronomic support and extension services strengthen yields and reduce variability. These regions create new supply pockets that support market diversification.

Growing Importance of Midwest and Localized Supply Chains

The U.S. Barley Market gains incremental support from Midwestern states where food processors and feed manufacturers explore barley for functional foods and cost-effective feed options. Localized value chains help reduce transport costs and improve freshness for malting and food applications. It encourages small and mid-sized farms to incorporate barley into rotation systems that improve soil health and input efficiency. Interest in sustainable crop strategies strengthens regional participation across multiple production zones. Expansion of regional malt houses and craft brewing hubs increases opportunities for contract farming. These developments broaden the geographic footprint of the market and enhance long-term supply flexibility.

Recent Developments:

- In July 2025, Cargill announced an agreement to acquire Mig-Plus, a Brazilian animal nutrition company, to expand its animal feed business in Brazil, subject to regulatory approval.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Grade and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for premium malting barley will rise as craft breweries expand product portfolios and refine quality requirements.

- Health-focused food manufacturers will increase the use of barley in high-fiber, clean-label, and functional product lines.

- Barley-based ingredients will gain traction in nutraceuticals and specialty formulations driven by interest in beta-glucan and whole-grain benefits.

- Producers will adopt advanced agronomic practices and improved seed varieties to achieve better yield stability and grain uniformity.

- Climate-resilient farming strategies will strengthen barley’s role in diversified crop rotations across key producing states.

- Feed buyers will expand the use of barley to manage cost volatility linked to corn and soybean markets.

- Investments in regional malt houses and craft supply chains will support localized sourcing and premium product development.

- Digital tools and precision farming platforms will enhance crop monitoring, harvest timing, and quality management.

- Sustainability programs and regenerative agriculture initiatives will encourage wider adoption of barley on mid-sized farms.

- Expansion of export opportunities will support market diversification and strengthen the long-term competitiveness of the U.S. supply base.