Market Overview:

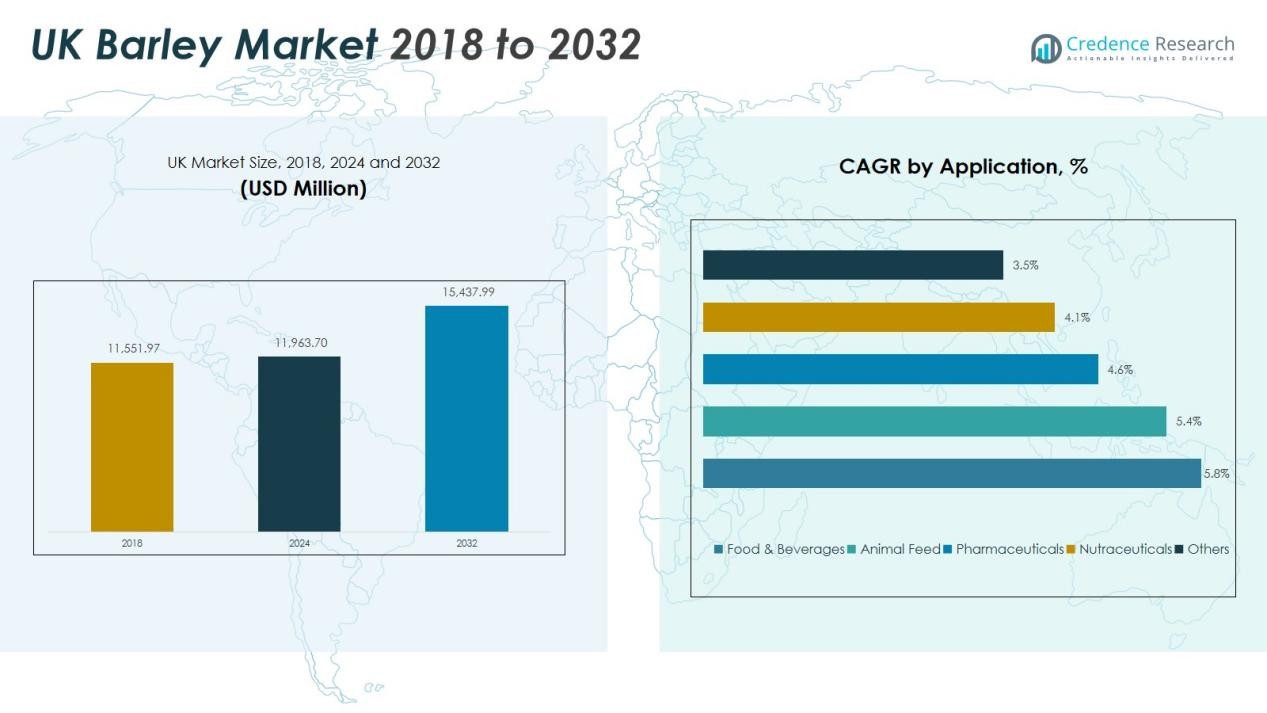

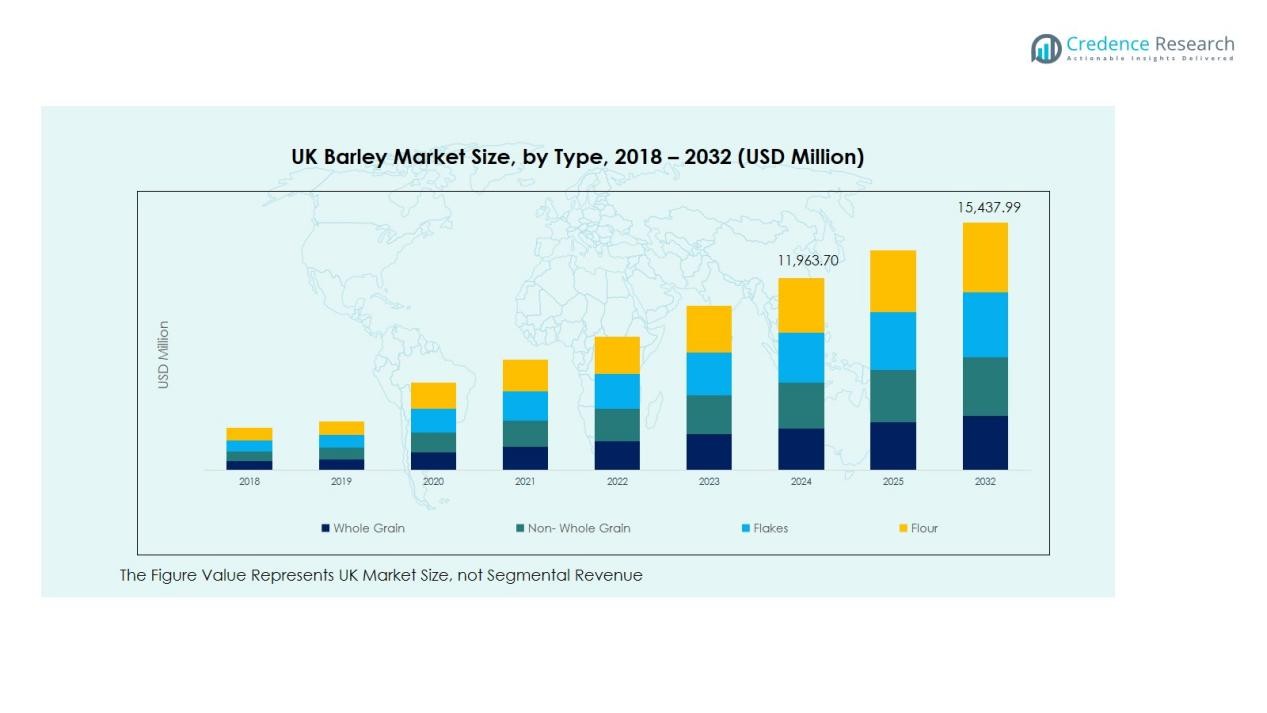

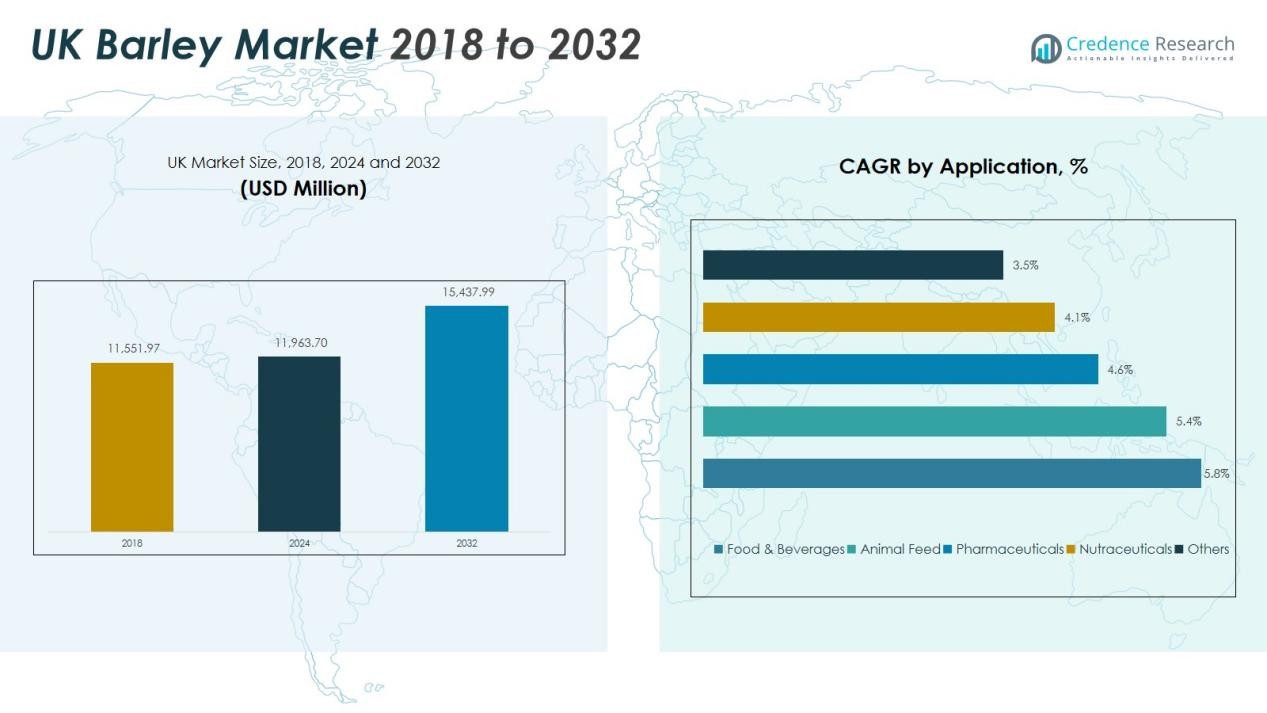

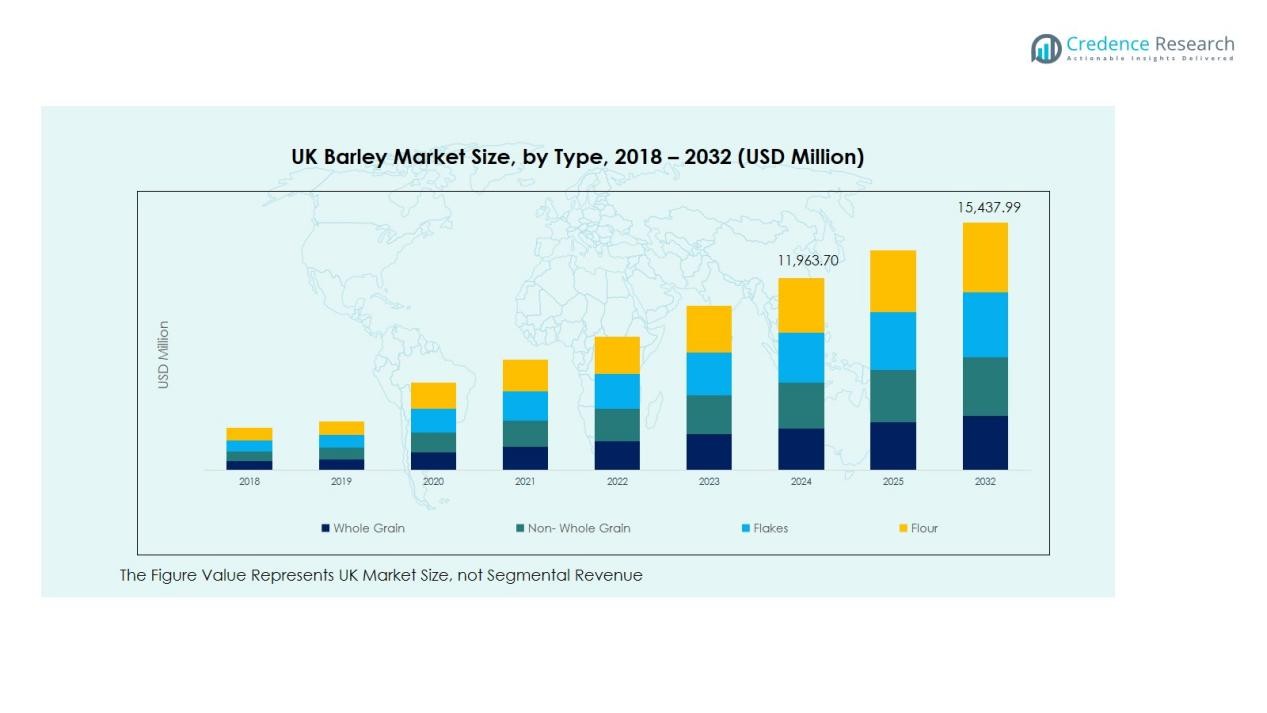

The UK Barley Market size was valued at USD 11,551.97 million in 2018 to USD 11,963.70 million in 2024 and is anticipated to reach USD 15,437.99 million by 2032, at a CAGR of 3.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Barley Market Size 2024 |

USD 11,963.70 Million |

| UK Barley Market, CAGR |

3.24% |

| UK Barley Market Size 2032 |

USD 15,437.99 Million |

Market drivers remain firmly rooted in the UK’s established brewing and distilling ecosystem, which relies heavily on premium malting barley. Growth in craft beer, single-malt whisky, and ready-to-drink alcoholic beverages strengthens demand for specialized barley grades. Rising interest in high-fiber, whole-grain foods further supports barley’s role in health-oriented product development. Farmers increasingly adopt sustainable cultivation practices and improved agronomic techniques, enhancing yield stability and product consistency.

Regionally, barley cultivation remains concentrated in England and Scotland, supported by favorable agro-climatic conditions and long-standing farming traditions. Scotland’s strong distilling industry positions it as a key consumer of malting barley, while eastern England leads in large-scale production due to its fertile soils and established supply chains. Growing collaboration between producers, maltsters, and processors reinforces regional competitiveness and supports the UK’s role in both domestic and export markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Barley Market was valued at USD 11,963.70 million in 2024 and is projected to reach USD 15,437.99 million by 2032, growing at a CAGR of 3.24%, supported by strong demand from brewing, distilling, and health-focused food sectors.

- England holds the largest regional share at 48%, driven by fertile soils, large-scale farming structures, and proximity to major malting facilities, while Scotland follows with 32% due to its whisky industry’s consistent demand for premium malting barley.

- Northern England and Scotland together contribute another 15%, supported by high-quality grain characteristics and established contracting systems that stabilize supply for brewers and distillers.

- The fastest-growing region is eastern England with an estimated 5% share growth momentum, supported by expanding export channels, modern agronomy adoption, and strong port infrastructure enabling efficient global shipments.

- The segment distribution is led by malt grade at 41% due to its importance in beer and whisky production, followed by food & beverages at 37%, supported by rising consumption of whole-grain and high-fiber barley products.

Market Drivers:

Strong Demand from Brewing and Distilling Industries

The UK Barley Market benefits from steady demand generated by the country’s well-established brewing and distilling sectors. Premium malting barley remains essential for producing high-quality beer, whisky, and specialty beverages. Industry expansion strengthens procurement volumes and encourages investment in improved barley varieties. Producers rely on consistent grain quality to meet strict malting specifications.

- For instance, the barley variety “Concerto,” specifically developed for distilling and brewing, supports up to a 5% increase in alcohol yield, improving production efficiency significantly at distilleries like Diageo’s Scotch whisky operations.

Rising Consumption of Health-Focused Grain Products

Consumer interest in high-fiber and nutrient-rich foods strengthens demand for barley-based ingredients. The UK Barley Market supports product innovation in cereals, bakery items, and functional foods. Barley’s natural beta-glucan content enhances its appeal within health and wellness product lines. Food manufacturers integrate barley to improve fiber profiles and diversify grain formulations.

- For Instance, General Mills Nature Valley bars rely primarily on whole grain oats for their fiber content, with an original Oats ‘n Honey bar containing approximately 2 grams of dietary fiber, not the claimed increase of 2.5 grams.

Growing Adoption of Sustainable and Resilient Farming Practices

Sustainability goals encourage farmers to prioritize barley due to its adaptability and relatively low input requirements. The UK Barley Market gains momentum from agricultural practices that improve soil health and support efficient water use. Producers invest in advanced seed genetics to enhance yield stability. Environmental policies reinforce interest in climate-resilient barley varieties.

Expansion of Feed Applications Across Livestock Sectors

Barley maintains a strong presence in livestock feed due to its balanced nutritional profile and competitive cost. The UK Barley Market serves feed manufacturers targeting cattle, sheep, and swine production. Rising emphasis on feed efficiency supports steady use across various farm systems. It reinforces barley’s role as a dependable energy source within compounded feed mixes.

Market Trends:

Shift Toward Premium Malting Varieties and Quality Enhancement

The UK Barley Market reflects a clear shift toward high-quality malting varieties that support premium beer and whisky production. Brewers and distillers place greater emphasis on grain consistency, enzyme performance, and flavor characteristics. It encourages breeders to focus on varieties with improved disease resistance and stronger agronomic stability. Producers invest in precision farming tools that support better nitrogen management and yield control. The trend strengthens alignment between farming practices and malting specifications. Exporters gain advantages by offering barley that meets international quality benchmarks. Rising collaboration across the supply chain reinforces adoption of superior malting grades.

- For instance, the demand for barley with strong enzyme activity has led to breeding efforts focusing on varieties like ‘Robust’ or ‘Lacey’, which balance disease resistance with enzyme quality essential for malting.

Broader Integration of Barley in Sustainable Food and Feed Systems

Sustainability objectives influence market direction and encourage diversified applications of barley in food and livestock sectors. The UK Barley Market supports momentum in climate-resilient cropping systems due to barley’s adaptability and low input requirements. Food manufacturers explore barley for fiber enrichment and clean-label product development. It supports greater product differentiation in cereals, bakery goods, and plant-forward formulations. Feed producers continue to incorporate barley to improve ration flexibility and cost management. Environmental policies strengthen interest in rotations that improve soil structure and reduce dependency on intensive crops. The trend supports long-term resilience across the UK agricultural landscape.

- For instance, BASF and Boortmalt’s collaborative project in Europe achieved an average saving of 2.3 tons of CO₂e per hectare in barley cultivation, reducing greenhouse gas emissions by nearly 90 percent, demonstrating a strong commitment to climate-resilient cropping systems through verified sustainable farming practices.

Market Challenges Analysis:

Climate Variability and Production Uncertainty

The UK Barley Market faces growing exposure to unpredictable weather patterns that influence yield stability and grain quality. Fluctuating rainfall and rising temperature extremes challenge planting schedules and harvest consistency. It increases production risks for farmers who depend on narrow windows for field operations. Regional disparities in climate impact complicate supply planning for maltsters and feed manufacturers. Disease pressures and pest incidence also intensify under shifting climatic conditions. Producers must invest in improved seed genetics and resilient agronomic practices to manage these uncertainties.

Margin Pressure and Competitive Supply Dynamics

The UK Barley Market operates under tight margins driven by volatile input costs and fluctuating global grain prices. Farmers experience pressure from rising fertilizer, energy, and logistics expenses that reduce profitability. It creates challenges for long-term investment in advanced cultivation techniques. Competition from imported barley and malt adds complexity for domestic suppliers seeking stable market access. Processing industries demand strict quality specifications, which further raise production costs. Market participants must balance cost efficiency with quality requirements to maintain competitiveness across domestic and export channels.

Market Opportunities:

Expansion of Value-Added Applications and Specialty Barley Varieties

The UK Barley Market offers strong opportunities through rising interest in premium malting grades and specialty barley types. Brewers and distillers continue to diversify product portfolios, which increases demand for unique flavor profiles and high-performing varieties. It supports investment in tailored breeding programs that deliver improved grain characteristics. Food manufacturers explore barley for functional ingredients that enhance fiber content and clean-label formulations. Growth in plant-forward diets reinforces demand for barley-based products across retail categories. Exporters can leverage specialty varieties to strengthen market presence in premium beverage and food sectors.

Advancements in Sustainable Farming and Digital Agronomy

Sustainability targets create opportunity for wider adoption of climate-resilient practices that improve barley’s environmental footprint. The UK Barley Market benefits from digital agronomy tools that optimize inputs and support data-led decision-making. It enables farmers to achieve higher precision in nutrient application, disease control, and yield forecasting. Carbon-focused initiatives encourage crop rotations that improve soil health and reduce emissions. Government-backed programs offer scope for innovation in regenerative agriculture. These developments strengthen long-term competitiveness and open avenues for premium positioning within global supply chains.

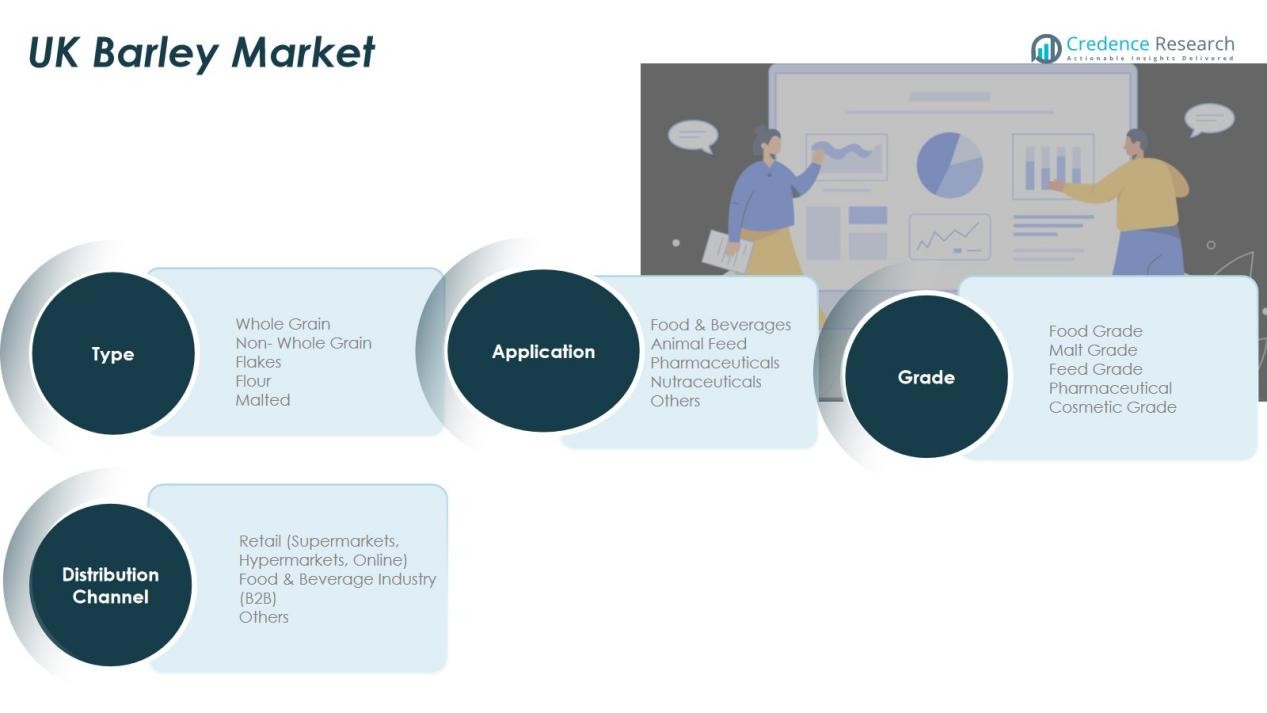

Market Segmentation Analysis:

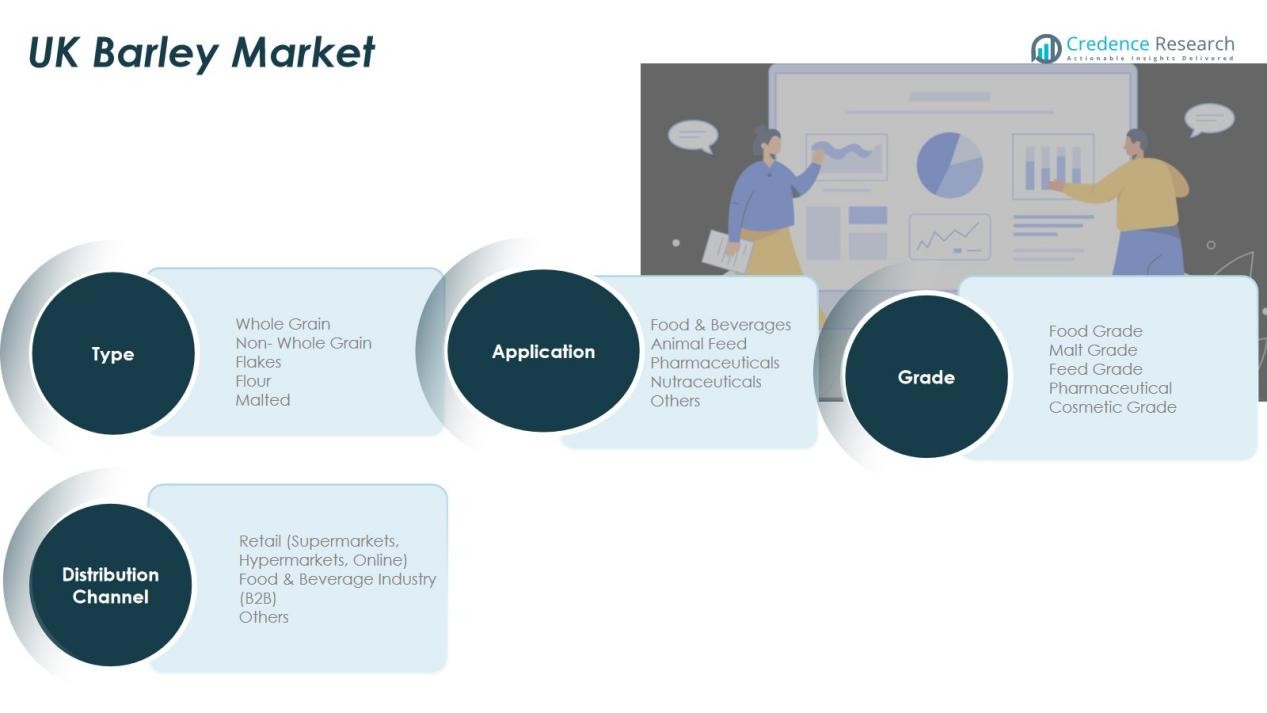

By Type

The UK Barley Market presents a diversified type portfolio that supports both food and industrial applications. Whole grain barley secures strong demand driven by its use in health-focused foods and traditional recipes. Non-whole grain formats and flakes hold steady consumption within cereals and ready-to-eat categories. Malted barley remains the dominant type due to its critical role in beer, whisky, and craft beverage production. Flour-based barley products expand with rising interest in fiber-rich bakery formulations. It supports flexible product innovation across retail and B2B channels.

- For example, Wildfarmed, a UK regenerative supply brand, supplies various regeneratively grown crops, including wheat and some barley, sourced from a network of over 100 farmers across the UK and France.

By Application

Application trends highlight robust use across food and beverages, animal feed, pharmaceuticals, nutraceuticals, and broader industrial segments. The UK Barley Market maintains strong momentum in beverages, backed by the country’s brewing and distilling heritage. Feed applications benefit from barley’s balanced nutritional profile and cost efficiency. Pharmaceutical and nutraceutical categories gain traction through demand for beta-glucan and functional ingredients. It strengthens barley’s role in health-oriented formulations.

- For Instance, Health authorities like the FDA and EFSA recognize that a daily intake of 3 grams of beta-glucan from oats or barley (or a similar amount from specific, highly concentrated barley sources like BARLEYmax®) can help lower blood cholesterol levels, a key risk factor for heart disease.

By Grade

Grade segmentation reflects clear specialization across food, malt, feed, pharmaceutical, and cosmetic categories. Food-grade barley grows steadily with rising consumer interest in clean-label grains. Malt grade dominates due to its essential role in premium beverage production. Feed grade supports consistent livestock sector demand. Pharmaceutical and cosmetic grades expand through innovation in natural extracts and functional compounds. It enables suppliers to target diverse high-value market segments.

Segmentations:

By Type

- Whole Grain

- Non-Whole Grain

- Flakes

- Flour

- Malted

By Application

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Nutraceuticals

- Others

By Grade

- Food Grade

- Malt Grade

- Feed Grade

- Pharmaceutical

- Cosmetic Grade

By Distribution Channel

- Retail (Supermarkets, Hypermarkets, Online)

- Food & Beverage Industry (B2B)

- Others

Regional Analysis:

Strong Production Base in England and Scotland

The UK Barley Market benefits from a well-established production base concentrated in England and Scotland. Eastern England leads cultivation due to fertile soils, efficient farm structures, and strong access to malting and processing facilities. Scotland secures significant demand through its globally recognised whisky industry, which relies heavily on premium malting barley. It maintains consistent procurement volumes and supports long-term contracting between farmers and distillers. Both regions demonstrate resilience through modern agronomy and adoption of high-yield varieties.

Regional Variations in Grain Quality and Supply Dynamics

Distinct climatic and soil conditions shape regional differences in yield performance and grain characteristics. Northern regions experience shorter growing seasons yet deliver high-quality malting barley with desirable protein levels. Southern and central areas support more diverse barley types suited for food and feed applications. The UK Barley Market reflects these regional strengths through tailored supply chains that serve brewers, distillers, food manufacturers, and feed mills. It enables the industry to balance domestic requirements with export commitments.

Evolving Role of Regional Infrastructure and Export Channels

Investment in storage, logistics, and port facilities strengthens regional competitiveness and improves market access for both domestic and international buyers. Ports in eastern England play a central role in exporting malting and feed barley to Europe and global markets. Regional cooperatives and grain merchants contribute to efficient consolidation and quality assurance. The UK Barley Market benefits from integrated networks that link farms to processors with high traceability standards. It positions the UK as a dependable supplier within global barley trade flows.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Muntons plc

- Simpsons Malt Ltd.

- Crisp Malting Group

- Bairds Malt Ltd.

- Boortmalt (Axereal Group – UK operations)

- Soufflet Group (UK operations)

- Diageo plc

- Heineken UK Ltd.

- AB InBev UK Ltd.

- Carlsberg Marston’s Brewing Company

Competitive Analysis:

The UK Barley Market reflects a concentrated competitive landscape shaped by leading maltsters, grain processors, and beverage manufacturers. Muntons plc, Simpsons Malt Ltd., Crisp Malting Group, Bairds Malt Ltd., Boortmalt, Soufflet Group, and Diageo plc anchor the market through strong production capacity, integrated supply chains, and long-standing partnerships with farmers and brewers. These companies compete on product quality, malting expertise, and consistency in meeting strict specifications required by the brewing and distilling sectors. It strengthens competition around innovation in barley varieties, sustainability initiatives, and processing efficiency. Market players focus on traceability, carbon reduction, and contract farming models to secure reliable, high-quality supply. Strategic expansions, facility upgrades, and premium malt product development continue to shape competitive positioning across domestic and export channels.

Recent Developments:

- In April 2025, Muntons launched its Climate Positive Malt, a new sustainable malt product with up to 30% lower carbon emissions per tonne compared to the UK malt average, introduced at BeerX 2025.

- In April 2025, Simpsons Malt commissioned a new peated malt production plant with a capacity of 25,000 tonnes per year and advanced emission-reducing technology at its Tweed Valley Maltings site.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Grade and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Barley Market is set to advance with stronger integration across food, beverage, and feed value chains, reflecting rising demand for high-quality and sustainably produced grains.

- Premium malting barley will gain further traction as brewers and distillers expand product portfolios and target higher-value segments.

- Producers will adopt precision agriculture tools that improve yield consistency, nitrogen efficiency, and grain uniformity.

- Climate-resilient seed varieties will see wider adoption to support production stability under variable weather conditions.

- Barley’s role in health-focused foods will expand as manufacturers increase use of fiber-rich and clean-label ingredients.

- Feed applications will remain stable, supported by interest in cost-effective and energy-rich ingredients for livestock systems.

- Export opportunities will strengthen for specialty and high-spec malting barley as global breweries seek reliable suppliers.

- Sustainability programs will influence farming decisions, with greater focus on soil health, carbon reduction, and regenerative practices.

- Digital traceability systems will become more common to support quality assurance and supply-chain transparency.

- The overall outlook points to stronger collaboration between growers, maltsters, and processors to enhance competitiveness and long-term value creation.