Market Overview

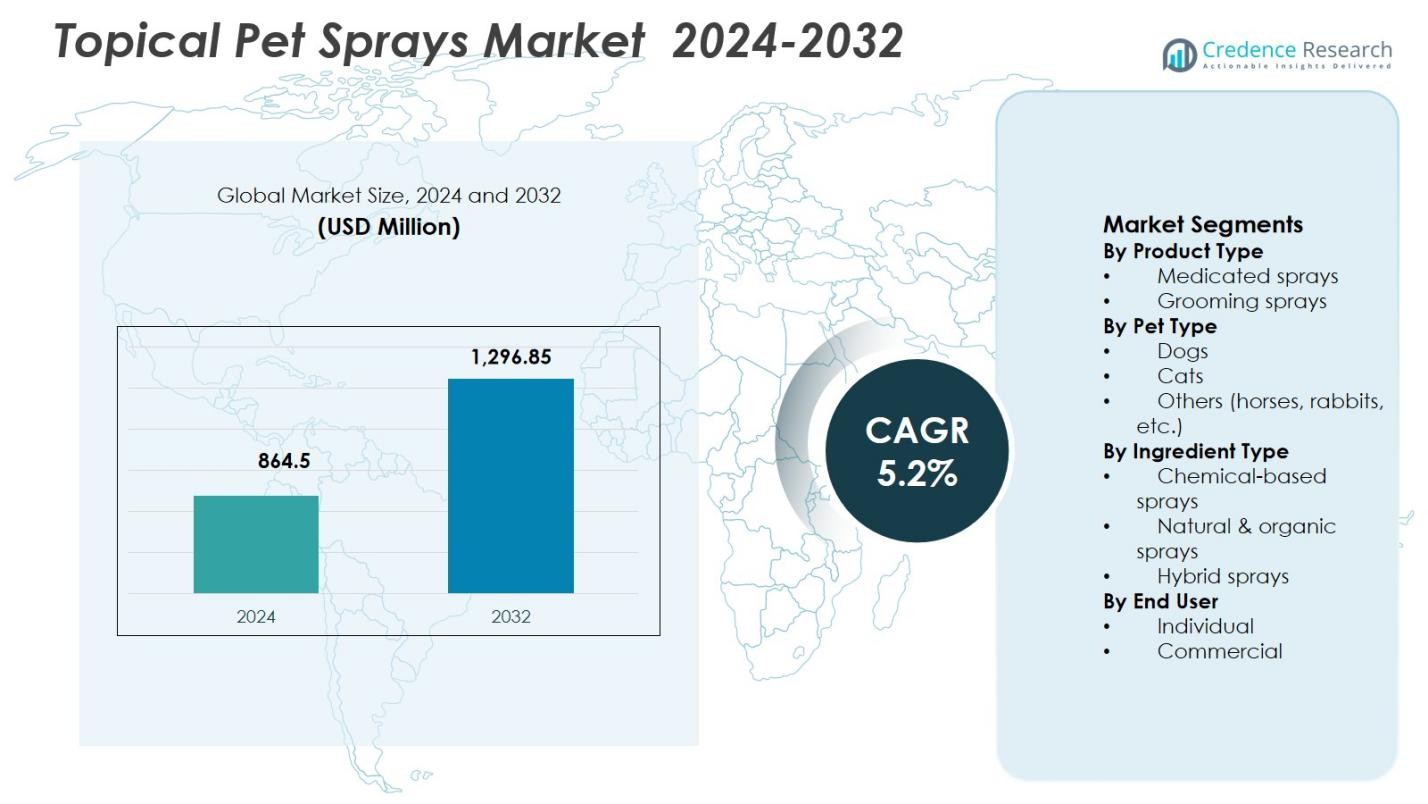

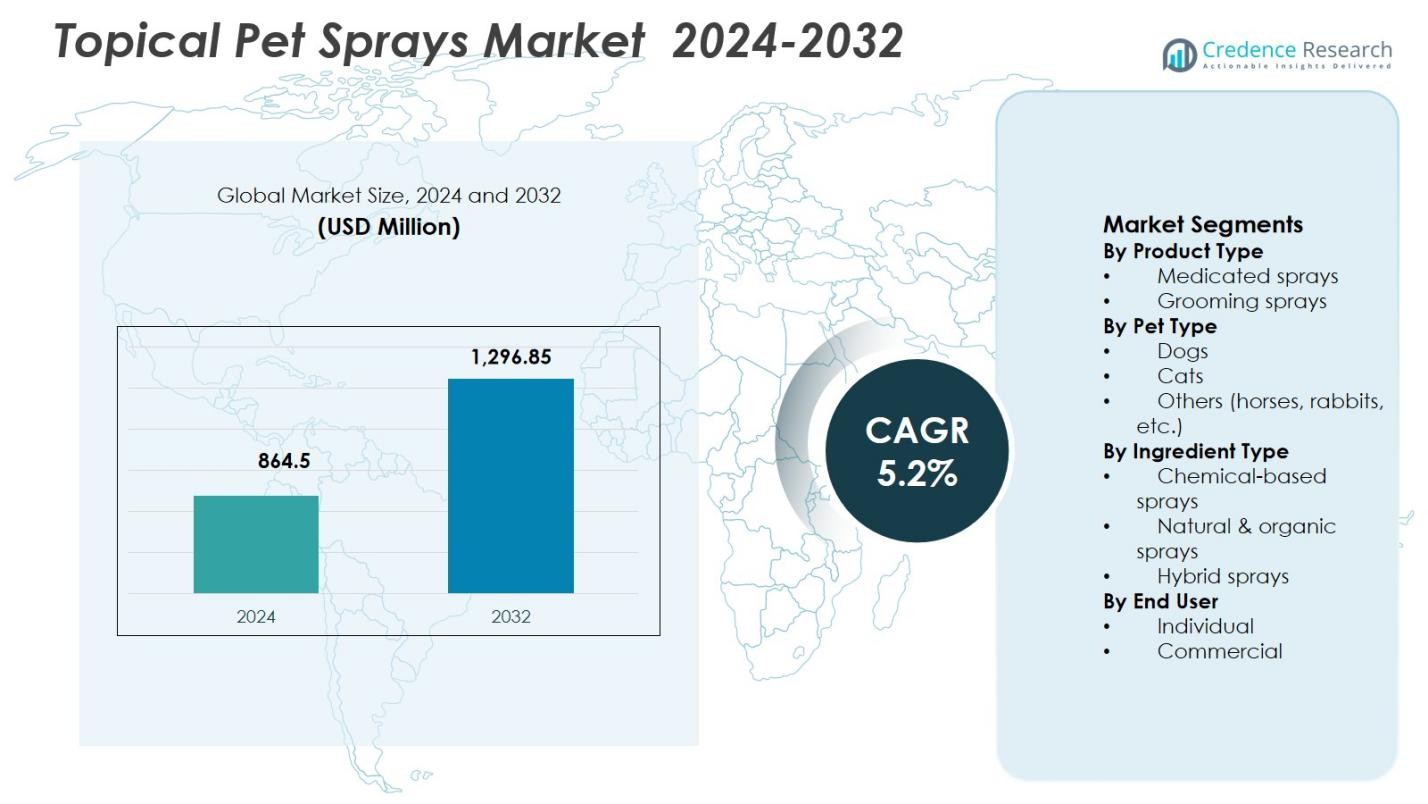

Topical Pet Sprays Market size was valued at USD 864.5 million in 2024 and is anticipated to reach USD 1,296.85 million by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Topical Pet Sprays Market Size 2024 |

USD 864.5 Million |

| Topical Pet Sprays Market, CAGR |

5.2% |

| Topical Pet Sprays Market Size 2032 |

USD 1,296.85 Million |

Topical Pet Sprays Market is shaped by the strong presence of established pet care and animal health companies such as Bayer, Elanco Animal Health, Mars, Nestlé Purina PetCare, Hill’s Pet Nutrition, Cardinal Pet Care, Davis Manufacturing, Earthbath, Pet King, and PetArmor. These players focus on diversified product portfolios covering medicated, grooming, and preventive spray solutions, supported by veterinary endorsements and expanding omnichannel distribution networks. Continuous innovation in natural, hypoallergenic, and multi-functional formulations strengthens brand positioning and consumer trust. North America led the market with a 38.2% share in 2024, driven by high pet ownership, advanced veterinary infrastructure, and strong spending on premium pet healthcare products, followed by Europe and Asia Pacific, which benefit from rising preventive care awareness and expanding pet care ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Topical Pet Sprays Market was valued at USD 864.5 million in 2024 and is projected to grow at a CAGR of 5.2% through the forecast period, supported by steady demand across medicated and grooming applications.

- Rising incidence of pet skin disorders and increasing pet humanization are driving higher adoption, with medicated sprays leading the market at 48.6% segment share due to strong veterinary recommendation.

- Growing preference for natural and organic formulations represents a key trend, with this segment holding 37.5% share as consumers seek safer, hypoallergenic pet care solutions.

- Product differentiation and brand strength define market dynamics, while regulatory compliance requirements and price sensitivity in emerging economies act as key restraints.

- North America dominated with 38.2% regional share, followed by Europe at 27.4% and Asia Pacific at 22.6%, reflecting advanced veterinary infrastructure and rising pet care awareness across regions.

Market Segmentation Analysis:

By Product Type:

The Topical Pet Sprays Market by product type shows clear dominance of medicated sprays, which accounted for 48.6% market share in 2024, driven by rising incidence of skin infections, allergies, flea infestations, and dermatitis among companion animals. Veterinarians widely recommend medicated sprays for targeted treatment, quick relief, and ease of topical application, supporting higher adoption. Grooming sprays followed with 34.1% share, supported by growing pet hygiene awareness and premium grooming trends, while functional grooming products addressing odor control and coat conditioning sustained demand across urban pet owners.

- For instance, Vetoquinol’s Dermichlor Spray treats bacterial skin infections and fungal issues like ringworm in dogs and cats through targeted application, reducing itching and promoting healing.

By Pet Type:

By pet type, dogs dominated the market with a 62.4% share in 2024, reflecting higher global dog ownership, frequent outdoor exposure, and greater susceptibility to ticks, fleas, and skin disorders. Regular grooming routines and preventive care practices among dog owners significantly supported spray usage. Cats accounted for 28.7% share, driven by increasing indoor pet adoption and demand for stress-free, non-invasive care solutions. Other pets, including horses and rabbits, represented 8.9% share, supported by niche veterinary applications and expanding awareness of topical care in specialty animal segments.

- For instance, Zoetis’s Revolution, approved for rabbits, treats fleas across life stages plus mites and lice in a monthly top-spot application that’s waterproof after two hours.

By Ingredient Type:

In terms of ingredient type, chemical-based sprays led with a 44.8% market share in 2024, supported by their proven efficacy, fast action, and strong veterinary acceptance for therapeutic treatments. However, natural & organic sprays captured 37.5% share, driven by rising consumer preference for plant-based, toxin-free, and hypoallergenic formulations aligned with premium pet care trends. Hybrid sprays held 17.7% share, benefiting from balanced formulations that combine clinical effectiveness with perceived safety, appealing to pet owners seeking both performance and reduced chemical exposure in routine applications.

Key Growth Drivers

Rising Incidence of Pet Skin Disorders

The growing prevalence of skin-related conditions such as allergies, flea infestations, dermatitis, and fungal infections among companion animals is a primary growth driver for the Topical Pet Sprays Market. Environmental allergens, climate changes, and increased outdoor exposure have heightened dermatological issues, particularly in dogs and cats. Pet owners increasingly prefer topical sprays for their targeted application, fast relief, and non-invasive nature. Strong veterinary recommendations further support routine use of medicated and preventive sprays, reinforcing consistent demand across therapeutic and grooming applications.

- For instance, Zoetis Pet Derm Spray treats seborrheic dermatitis, dermatophyte infections, and ringworm in dogs and cats with miconazole nitrate and chlorhexidine gluconate.

Increasing Pet Humanization and Preventive Care Focus

Pet humanization continues to influence purchasing behavior, with owners prioritizing comfort, hygiene, and long-term wellness. This shift has elevated spending on advanced grooming and healthcare products, including topical pet sprays. Preventive care awareness has increased the adoption of anti-itch, deodorizing, and coat-conditioning sprays as part of regular pet care routines. Educational campaigns by veterinarians and pet care brands have strengthened understanding of skin health maintenance, encouraging proactive use of sprays to prevent infections and improve overall pet well-being.

- For instance, Petvit’s Anti-Itch Oil Spray delivers fast relief from itching and redness via pH-balanced, lick-safe elements including Vitamin E, Lavender Oil, and Castor Oil for all dog and cat breeds. Its vegan, toxin-free blend soothes irritation on contact, enabling safe repeated use.

Expansion of Veterinary and Specialty Pet Care Infrastructure

The expanding network of veterinary clinics, pet hospitals, and specialty pet care retail outlets significantly supports market growth. These professional channels actively recommend clinically validated topical sprays as part of standard treatment and grooming protocols. Improved access to veterinary guidance has increased consumer trust in branded products. Additionally, the growth of organized pet retail chains has enhanced product visibility and availability, supporting higher adoption rates in urban and semi-urban regions.

Key Trends & Opportunities

Shift Toward Natural and Organic Pet Care Solutions

Rising concerns over chemical exposure have accelerated the shift toward natural and organic topical pet sprays. Consumers increasingly favor formulations free from harsh chemicals, parabens, and synthetic fragrances. Manufacturers are responding with plant-based, essential-oil-infused, and hypoallergenic products that align with wellness-oriented pet care trends. This shift creates opportunities for premium product positioning, brand differentiation, and expansion into high-margin segments driven by safety-conscious and environmentally aware pet owners.

- For instance, Coco Crush provides a natural Flea & Tick Repellent Spray using neem oil, lemongrass oil, and tea tree oil as key ingredients. This 100% natural, vegan formula creates a gentle barrier against pests without artificial colors or flavors.

Rapid Growth of E-commerce and Direct-to-Consumer Channels

- commerce platforms are transforming product accessibility and purchasing behavior in the topical pet sprays market. Online channels enable wider reach, subscription-based sales, and personalized product recommendations. Digital platforms also support consumer education through reviews, tutorials, and condition-specific guidance. This trend presents strong opportunities for manufacturers to engage directly with customers, improve brand loyalty, and penetrate underserved regions with lower distribution costs.

- For instance, VetBox offers monthly subscriptions for flea and tick spot-on treatments containing Fipronil and S-Methoprene, delivered automatically with treats included.

Key Challenges

Stringent Regulatory and Compliance Requirements

The topical pet sprays market faces challenges related to strict regulatory standards governing animal health products. Compliance with ingredient safety, efficacy testing, and labeling regulations increases development timelines and costs. Heightened scrutiny of chemical formulations further complicates product innovation. Manufacturers must continuously adapt formulations to meet evolving regulations, which can delay product launches and limit flexibility, particularly for smaller or emerging players.

Price Sensitivity and Limited Adoption in Emerging Economies

Price sensitivity among pet owners in emerging markets restricts the adoption of premium topical pet sprays. While awareness of pet healthcare is improving, cost remains a key purchasing factor. Branded medicated and natural sprays often face competition from low-cost alternatives and home remedies. This challenge requires manufacturers to balance affordability with quality, optimize pricing strategies, and develop value-oriented offerings to expand market penetration.

Regional Analysis

North America

North America held 38.2% market share in 2024, driven by high pet ownership rates, advanced veterinary infrastructure, and strong spending on premium pet healthcare products. The region benefits from widespread adoption of preventive grooming and medicated sprays, supported by strong veterinarian recommendations. Rising awareness of skin health, allergies, and parasite control has increased routine usage among dog and cat owners. Well-established pet specialty retail chains and e-commerce platforms further enhance product accessibility. The growing preference for natural and organic formulations also supports premium product penetration across the United States and Canada.

Europe

Europe accounted for 27.4% market share in 2024, supported by strict animal welfare standards and growing emphasis on preventive pet healthcare. Increasing demand for dermatologically tested and regulated topical sprays has driven adoption across key markets such as Germany, the United Kingdom, and France. High awareness of pet hygiene, along with rising preference for natural and eco-friendly formulations, supports market growth. Strong veterinary networks and expanding specialty pet stores enhance product availability. Regulatory compliance and ingredient transparency remain key factors influencing product development and purchasing decisions across the region.

Asia Pacific

Asia Pacific captured 22.6% market share in 2024, driven by rapidly increasing pet adoption, urbanization, and rising disposable income in countries such as China, Japan, and India. Growing awareness of pet grooming and skin care has accelerated demand for topical sprays, particularly for dogs. Expansion of organized pet retail, veterinary clinics, and online platforms has improved product accessibility. The region shows strong growth potential due to rising pet humanization trends and increasing demand for affordable yet effective grooming and medicated spray solutions across emerging markets.

Latin America

Latin America held 7.1% market share in 2024, supported by growing pet ownership and increasing focus on basic pet hygiene and healthcare. Countries such as Brazil and Mexico are witnessing higher adoption of topical pet sprays, driven by expanding veterinary services and improved awareness of flea and tick control. The market favors cost-effective and multifunctional products, with medicated and grooming sprays gaining steady traction. Growth of pet specialty retail stores and gradual expansion of e-commerce channels further support market development across urban centers.

Middle East & Africa

The Middle East & Africa region accounted for 4.7% market share in 2024, driven by rising pet adoption in urban areas and increasing awareness of pet grooming and skin health. Demand is primarily concentrated in countries such as the UAE and South Africa, where veterinary services and specialty pet retail infrastructure are expanding. Topical sprays are increasingly adopted for parasite control and basic grooming needs. Limited access to premium products and price sensitivity remain challenges, though growing investment in pet care services supports gradual market expansion.

Market Segmentations:

By Product Type

- Medicated sprays

- Grooming sprays

By Pet Type

- Dogs

- Cats

- Others (horses, rabbits, etc.)

By Ingredient Type

- Chemical-based sprays

- Natural & organic sprays

- Hybrid sprays

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive Landscape Analysis: The Topical Pet Sprays Market features the presence of key players including Bayer, Elanco Animal Health, Mars, Nestlé Purina PetCare, Hill’s Pet Nutrition, Cardinal Pet Care, Davis Manufacturing, Earthbath, Pet King, and PetArmor. The market is characterized by strong brand positioning, broad product portfolios, and a focus on differentiated formulations addressing medicated, grooming, and preventive care needs. Leading companies leverage veterinary endorsements, clinical validation, and established distribution networks across pet specialty stores, veterinary clinics, and online channels. Strategic emphasis on natural and organic ingredients, hypoallergenic formulations, and multi-functional sprays enhances product appeal among health-conscious pet owners. Companies actively pursue product line extensions, packaging innovations, and region-specific offerings to strengthen market presence. Competitive intensity remains moderate to high, driven by brand loyalty, regulatory compliance capabilities, and continuous investment in research, marketing, and omnichannel distribution strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PetArmor

- Hill’s Pet Nutrition

- Earthbath

- Mars

- Davis Manufacturing

- Nestlé Purina PetCare

- Pet King

- Elanco Animal Health

- Cardinal Pet Care

- Bayer

Recent Developments

- In September 2025, Nutravet launched Nutramed®, a hypochlorous gel and spray for animal skin care, targeting irritation and infections in pets.

- In May 2025, FurLife introduced FurLife™ Flea & Tick Spray, a plant-based topical solution safe for dogs and cats over 8 weeks old, forming a protective barrier against pests.

- In February 2025, Elanco Animal Health launched its new line of veterinarian-formulated pet supplements under the Pet Protect brand, enhancing its overall pet health portfolio.

- In October 2025, Mars Petcare, in collaboration with Big Idea Ventures, selected three startups for the 2025 Next Generation Pet Food Program, signaling broader innovation engagement in pet health.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pet Type, Ingredient Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to benefit from rising global pet ownership and increasing focus on companion animal skin health.

- Preventive care adoption will strengthen demand for daily-use grooming and protective topical sprays.

- Natural and organic formulations will gain stronger traction as safety and ingredient transparency influence purchasing decisions.

- Medicated sprays will remain essential for managing allergies, infections, and parasite-related skin conditions.

- Veterinary recommendation and clinical validation will play a critical role in shaping brand preference.

- E-commerce and direct-to-consumer channels will expand product reach and improve consumer engagement.

- Product innovation will focus on multi-functional sprays offering treatment, grooming, and odor control benefits.

- Emerging markets will experience faster adoption as awareness of pet hygiene and healthcare improves.

- Manufacturers will invest in sustainable packaging and eco-friendly formulations to align with evolving consumer expectations.

- Strategic partnerships and product line extensions will support long-term market expansion and competitiveness.