Market Overview:

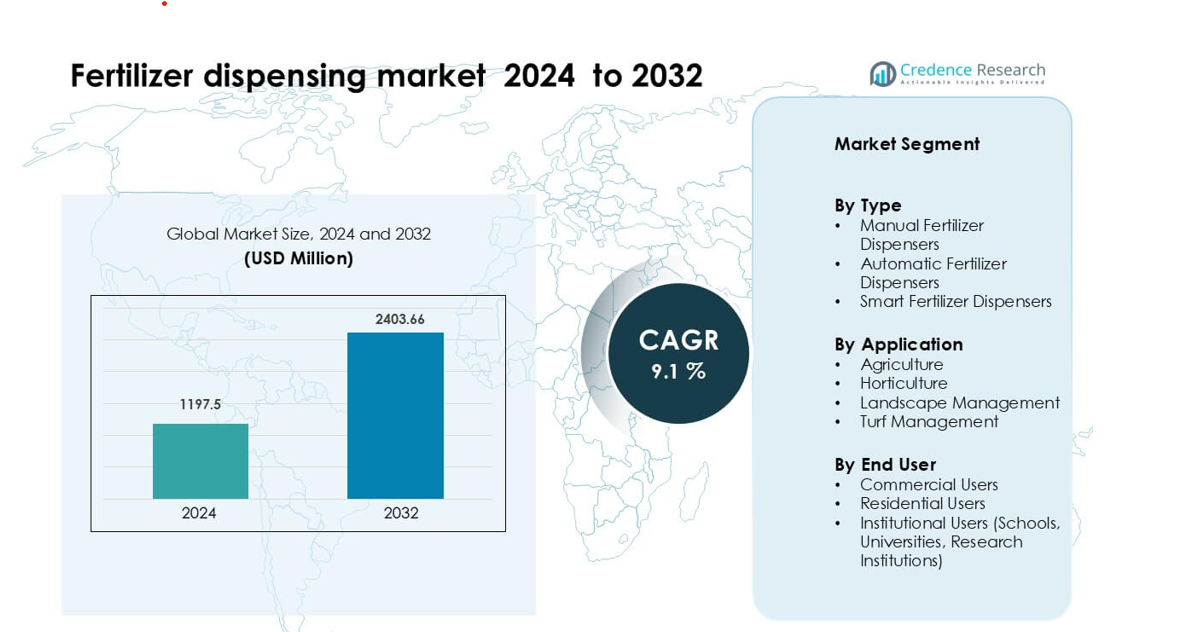

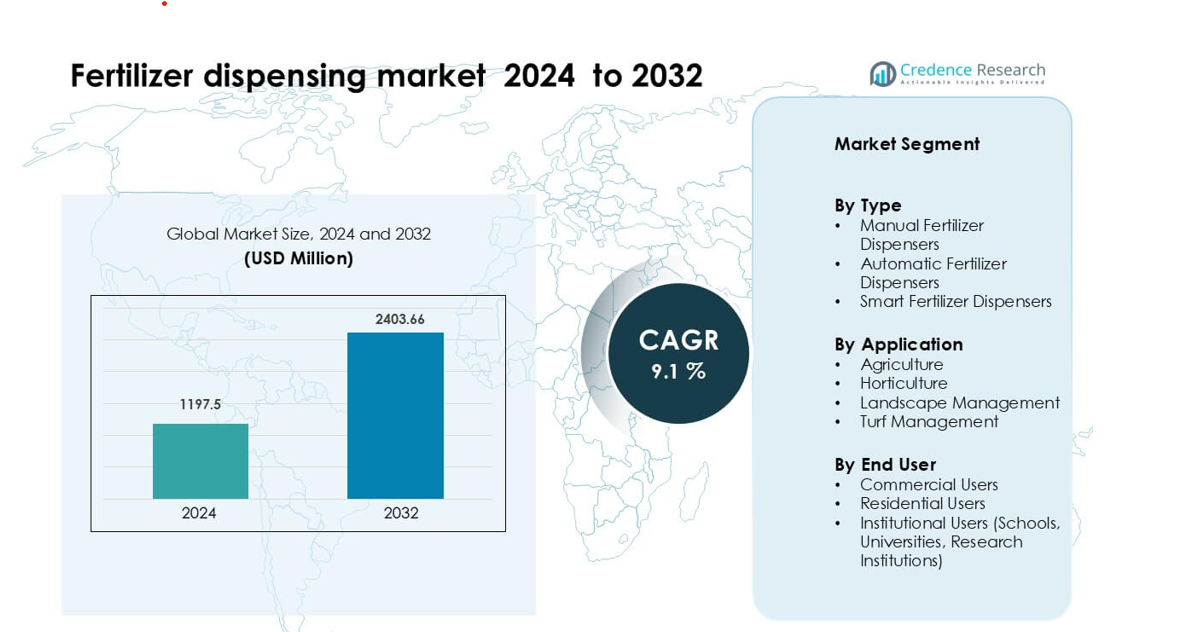

Fertilizer dispensing market was valued at USD 1197.5 million in 2024 and is anticipated to reach USD 2403.66 million by 2032, growing at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fertilizer Dispensing Market Size 2024 |

USD 1197.5 million |

| Fertilizer Dispensing Market, CAGR |

9.1% |

| Fertilizer Dispensing Market Size 2032 |

USD 2403.66 million |

North America leads the fertilizer dispensing market with about 32% share in 2024, supported by high mechanization and rapid adoption of smart nutrient-delivery systems. Key players such as Moirano, Phytotronics Inc, Mayfield, Irritec Spa, Codema, Autogrow, Dosatron, Vogelsang, Agrotop, and Ifeederglobal compete by offering precise, automated, and sensor-enabled dispensers that help growers reduce fertilizer waste and improve yield efficiency. These companies focus on expanding digital capabilities, strengthening distribution networks, and developing durable, low-maintenance designs to meet rising demand from commercial farms, protected cultivation sites, and precision agriculture users.

Market Insights

- The fertilizer dispensing market reached USD 1197.5 million in 2024 and is projected to grow at a 9.1% CAGR through 2032, supported by rising demand for precision nutrient delivery systems.

- Strong drivers include the shift toward automated and smart dispensers that reduce fertilizer waste and improve crop output, with smart dispensers holding about 46% share in 2024 due to high accuracy.

- Key trends involve expansion of IoT-enabled nutrient management, growth in greenhouse automation, and rising adoption of data-driven farming tools across commercial agriculture.

- The market is competitive, with players such as Moirano, Phytotronics Inc, Mayfield, Irritec Spa, Codema, Autogrow, Dosatron, Vogelsang, Agrotop, and Ifeederglobal focusing on automation, durability, and digital integration; restraints include high initial costs and low technical awareness among smallholders.

- North America leads with 32% share, followed by Europe at 28% and Asia Pacific at 26%; agriculture remains the dominant application with 58% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Smart fertilizer dispensers dominate this segment with about 46% share in 2024. Farmers choose smart systems due to accurate dosing, reduced wastage, and support for sensor-based nutrient delivery. Smart units gain demand as growers adopt IoT controls, mobile monitoring, and automated calibration to maintain uniform application. Automatic dispensers follow due to strong use in medium and large farms seeking labor savings. Manual dispensers remain common in smallholdings, but growth is slower because users shift toward precision-based tools that improve yield quality and input efficiency.

- For instance, Precision Planting’s Rate Controller lets farmers retrofit existing dry fertilizer applicators and adjust granular application rate in real time through their cab display, compensating for speed changes down to fine granularity.

By Application

Agriculture leads this segment with nearly 58% share in 2024. Large-scale crop fields adopt fertilizer dispensers to boost nutrient efficiency, lower manual labor, and support precision farming. Demand rises as growers face rising input costs and seek tools that improve root absorption and reduce runoff. Horticulture expands due to controlled environment farming, while landscape and turf management grow through steady adoption in parks, stadiums, and commercial properties. Each sector benefits from improved dosing control, but broad agricultural mechanization continues to keep farming at the top.

- For instance, John Deere’s F4365 High-Capacity Nutrient Applicator can apply up to 1,100 pounds of fertilizer per acre in a single pass, helping large-scale growers reduce input time.

By End User

Commercial users dominate this segment with around 54% share in 2024. Agribusiness firms, commercial growers, estate managers, and large contractors invest in automated and smart dispensers to reduce labor, enhance productivity, and maintain consistent nutrient schedules across large areas. Demand strengthens as commercial operations adopt precision tools to meet sustainability goals and achieve higher yield reliability. Residential users grow steadily due to lawn care popularity, while institutional users—such as schools and research centers—adopt dispensers for teaching, experimental plots, and cost-efficient grounds management.

Key Growth Drivers

Rising Adoption of Precision Agriculture

Precision agriculture drives strong growth in the fertilizer dispensing market as farmers aim to optimize nutrient application and reduce waste. Digital technologies, including GPS-enabled spreaders, soil sensors, and IoT-connected dispensers, help growers deliver accurate fertilizer doses based on field variability. This shift lowers input costs and improves crop yield consistency. Increasing awareness of nutrient-use efficiency encourages farmers to replace manual methods with automated and smart dispensing equipment. Government programs promoting precision farming tools further support adoption, especially in large agricultural economies. As farms scale up and seek data-driven agronomy, demand for accurate and automated fertilizer dispensing systems continues to expand.

- For instance, KUHN’s Axis 40.2 H-EMC-W fertilizer spreader uses sensors to read disc torque every second (i.e. once per second) and adjusts metering gates automatically to maintain the correct application rate between 20 and 500 kg/min as needed.

Labor Shortages and Rising Farm Mechanization

Labor shortages across major agricultural regions push farmers toward mechanical and automated fertilizer dispensers. Many small and mid-sized farms face difficulties in securing skilled workers for manual fertilizer application, which is time-consuming and prone to errors. Automated and smart dispensers offer faster operations, uniform coverage, and reduced dependence on manual labor. Rising wages also encourage growers to adopt mechanized solutions that cut recurring labor costs while improving field productivity. Mechanized dispensing supports timely nutrient delivery, which is critical for improving crop health during peak growing stages. As farms prioritize efficiency and speed, demand for automated dispensers accelerates across emerging and developed markets.

- For instance, Deere states that its autonomous tillage solution can operate 24 hours a day, extending working windows during tight labor periods.

Increasing Focus on Sustainable and Efficient Nutrient Management

Sustainability goals strongly influence the fertilizer dispensing market as growers seek to minimize runoff, reduce environmental impact, and comply with stricter fertilizer-use regulations. Smart dispensers allow precise nutrient placement, improving absorption and reducing excessive application. These systems support climate-friendly practices by limiting nitrogen losses and enhancing soil health over time. Governments and sustainability programs encourage farmers to adopt technologies that ensure responsible nutrient use. Rising global interest in regenerative agriculture and resource-efficient farming increases demand for equipment that enhances fertilizer efficiency. As growers align with environmental standards, precision-based dispensing tools gain significant market momentum.

Key Trends & Opportunities

Integration of IoT and Data Analytics in Dispensing Systems

The market experiences rapid growth in IoT-enabled and sensor-based fertilizer dispensers. Connected systems help farmers monitor nutrient levels in real time, automate dosing decisions, and collect field data for future planning. Data analytics platforms link with dispensers to generate insights on crop response, soil nutrient behavior, and optimal application timing. This trend offers strong opportunities for manufacturers to develop cloud-connected platforms, mobile controls, and AI-based optimization tools. As digital farming technologies mature, demand grows for dispensers that integrate seamlessly with farm management software, drones, and autonomous tractors, creating a broader ecosystem of precision tools.

- For instance, in AGCO’s FendtONE farm management software (part of its Fuse ecosystem), farmers can access real-time diagnostics and field analytics from their mobile devices, enabling immediate adjustments in application rates.

Expansion of Smart Farming Equipment in Emerging Markets

Emerging markets present major opportunities as governments promote mechanization and digital farming tools. Growing farm sizes, rising fertilizer costs, and increased awareness of precision techniques drive interest in smart dispensing solutions. Subsidies on modern equipment, rural digitalization, and the spread of training programs accelerate adoption. Manufacturers can tap into this demand by offering affordable smart dispensers tailored to small and mid-size farms. With climate challenges rising, growers in developing countries increasingly seek tools that improve nutrient efficiency and stabilize yields. This shift positions automated and smart dispensers as high-potential solutions in Asia, Africa, and Latin America.

- For instance, a study from East Africa found that adoption of variable-rate application (VRA) using mobile apps and AI-supported fertilization enabled farmers to monitor soil nutrient conditions remotely and optimize fertilizer use, reducing waste and increasing efficiency.

Key Challenges

High Initial Costs and Limited Affordability for Small Farmers

High upfront costs remain a major barrier, especially for small and marginal farmers who rely on low-cost manual methods. Smart and automated dispensers involve expenses related to sensors, controllers, and maintenance. Limited financing options further restrict adoption in rural regions. Farmers often prioritize short-term savings over long-term efficiency gains, slowing the shift toward advanced technologies. Without accessible credit, subsidies, or rental models, many users cannot justify investing in mechanized dispensers. This affordability gap creates uneven adoption across regions and restrains the overall growth of precision-based fertilizer dispensing solutions.

Low Technical Awareness and Limited Digital Skills in Rural Areas

In many agricultural regions, farmers lack awareness of advanced dispensing technologies and struggle with the digital skills required to operate IoT-enabled systems. Limited training resources, poor connectivity, and inadequate support services restrict effective usage. Smart dispensers require calibration, periodic maintenance, and software updates, which many users find challenging without technical assistance. This gap results in underutilization of equipment potential and discourages repeat investments. Manufacturers must invest in training, field demonstrations, and user-friendly interfaces to overcome this barrier. Until digital literacy improves, adoption of advanced fertilizer dispensers may progress slower than expected in developing markets.

Regional Analysis

North America

North America leads the fertilizer dispensing market with about 32% share in 2024, driven by strong adoption of precision farming and high mechanization levels across the U.S. and Canada. Farmers invest in smart dispensers equipped with IoT and variable-rate technologies to reduce fertilizer waste and improve yield quality. Supportive government programs promoting sustainable nutrient practices further accelerate adoption. Large commercial farms demand automated systems to counter rising labor shortages and improve efficiency. Strong presence of agritech companies and growing interest in data-driven farming continue to reinforce the region’s leading position.

Europe

Europe holds nearly 28% share in 2024, supported by strict environmental rules that push growers toward controlled and efficient fertilizer application. Countries such as Germany, France, and the Netherlands adopt smart and automated dispensers to comply with nutrient limits and reduce nitrate pollution. Demand rises in protected horticulture and high-value crops where precise dosing is essential. Sustainability-focused policies, digital agriculture subsidies, and rapid mechanization strengthen adoption. Growing awareness of nutrient-use efficiency and investments in smart farm technologies continue to support Europe as one of the most established markets for fertilizer dispensing systems.

Asia Pacific

Asia Pacific commands about 26% share in 2024, driven by large agricultural output and rising interest in farm mechanization across China, India, Japan, and Southeast Asia. Small and mid-sized farms increasingly adopt efficient dispensing tools to manage rising fertilizer costs and improve crop productivity. Government initiatives promoting digital farming and subsidies for modern equipment accelerate the shift toward automated and smart dispensers. Expanding horticulture, greenhouse farming, and high-value crop cultivation increase the need for precise nutrient delivery. Rapid population growth and food demand further strengthen long-term market expansion.

Latin America

Latin America accounts for nearly 9% share in 2024, with growth supported by expanding commercial agriculture in Brazil, Argentina, and Mexico. Large crop farms adopt automated dispensers to optimize fertilizer use in soybeans, corn, and sugarcane. Precision farming gains traction as growers face rising input costs and seek tools that improve yield stability. Increasing awareness of sustainable nutrient practices and soil health boosts interest in smart dispensing technologies. However, adoption remains uneven because small farms face affordability challenges, slowing penetration across rural areas.

Middle East & Africa

The Middle East & Africa region holds about 5% share in 2024, driven by rising adoption of controlled irrigation and nutrient management in arid farming zones. Countries like Israel, UAE, and South Africa invest in smart fertilizer dispensers to manage water scarcity and enhance crop efficiency. Government-led agricultural modernization programs support uptake, especially in greenhouse farming and high-value crops. Growth is steady but limited by high upfront costs and low mechanization levels in several African countries. Increasing interest in sustainable farming and improving digital infrastructure offer gradual long-term opportunities.

Market Segmentations:

By Type

- Manual Fertilizer Dispensers

- Automatic Fertilizer Dispensers

- Smart Fertilizer Dispensers

By Application

- Agriculture

- Horticulture

- Landscape Management

- Turf Management

By End User

- Commercial Users

- Residential Users

- Institutional Users (Schools, Universities, Research Institutions)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fertilizer dispensing market features strong competition among manufacturers offering manual, automatic, and smart dispensing technologies. Companies such as Moirano, Phytotronics Inc, Mayfield, Irritec Spa, Codema, Autogrow, Dosatron, Vogelsang, Agrotop, and Ifeederglobal focus on improving dosing accuracy, reliability, and automation to meet rising demand for precision nutrient management. Vendors enhance product portfolios with IoT integration, variable-rate controls, and mobile monitoring systems to support digital farming. Partnerships with distributors, greenhouse operators, and agritech platforms help strengthen market reach. Many players invest in durable materials and modular designs to reduce maintenance and extend equipment life. As sustainability rules tighten and growers seek efficient nutrient solutions, competition intensifies around smart dispensers that reduce fertilizer waste and boost crop performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Vogelsang presented upgraded liquid manure spreading and separation systems at Agritechnica, designed for more uniform nutrient placement and reduced ammonia emissions in slurry-based fertilization.

- In November 2024, Irritec Spa at EIMA 2024, Irritec launched the SFIDA intelligent fertigation system. The IoT-based platform automates irrigation and fertilizer dosing using field, plant, and satellite data to optimize nutrients and reduce waste

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift toward wider use of smart and automated dispensers across large and mid-sized farms.

- IoT-enabled nutrient systems will become standard as growers adopt data-driven farming practices.

- Precision dosing technology will expand as stricter sustainability rules push farmers toward efficient nutrient use.

- Integration with farm management software will increase to support real-time decision-making.

- Demand will rise for dispensers compatible with variable-rate application and autonomous machinery.

- Manufacturers will focus on low-maintenance designs to reduce downtime and operating costs.

- Adoption will grow in emerging markets as governments promote farm mechanization.

- Commercial agriculture will continue to drive advanced dispenser purchases due to scale and efficiency needs.

- Greenhouse and high-value crop segments will adopt more controlled nutrient delivery systems.

- Training, support services, and user-friendly interfaces will expand to overcome skill gaps among rural users.