Market Overview

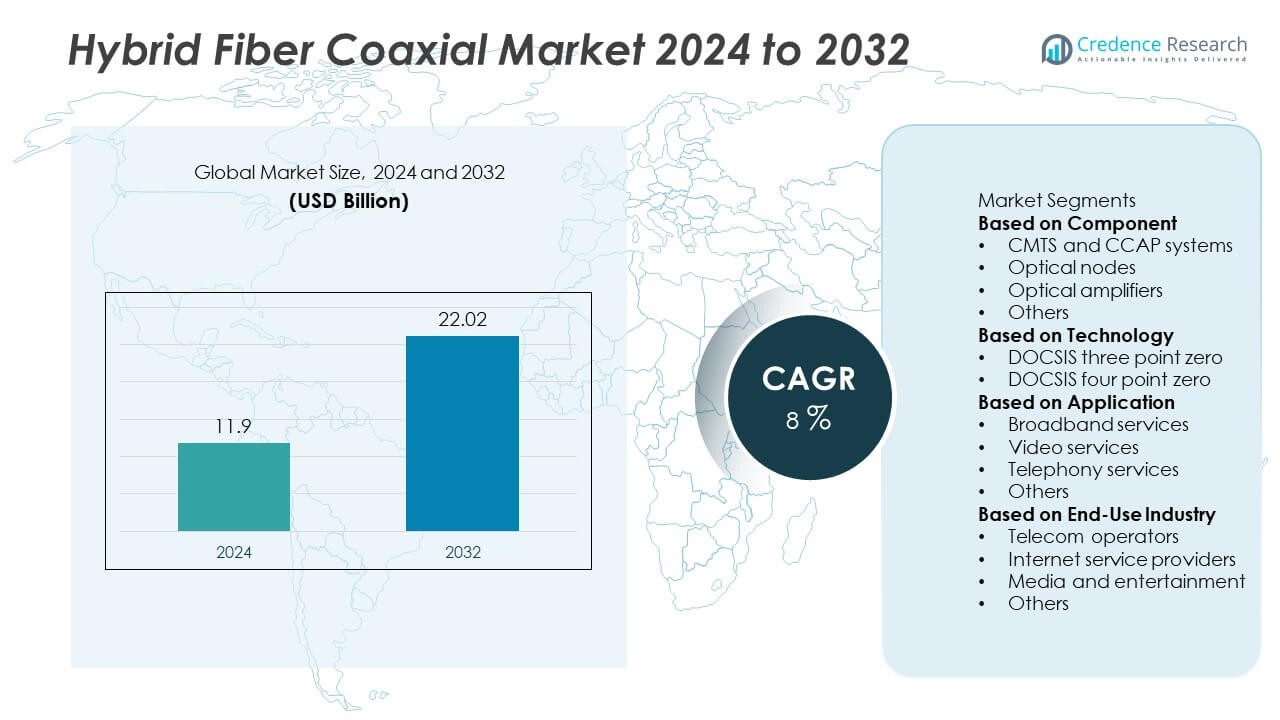

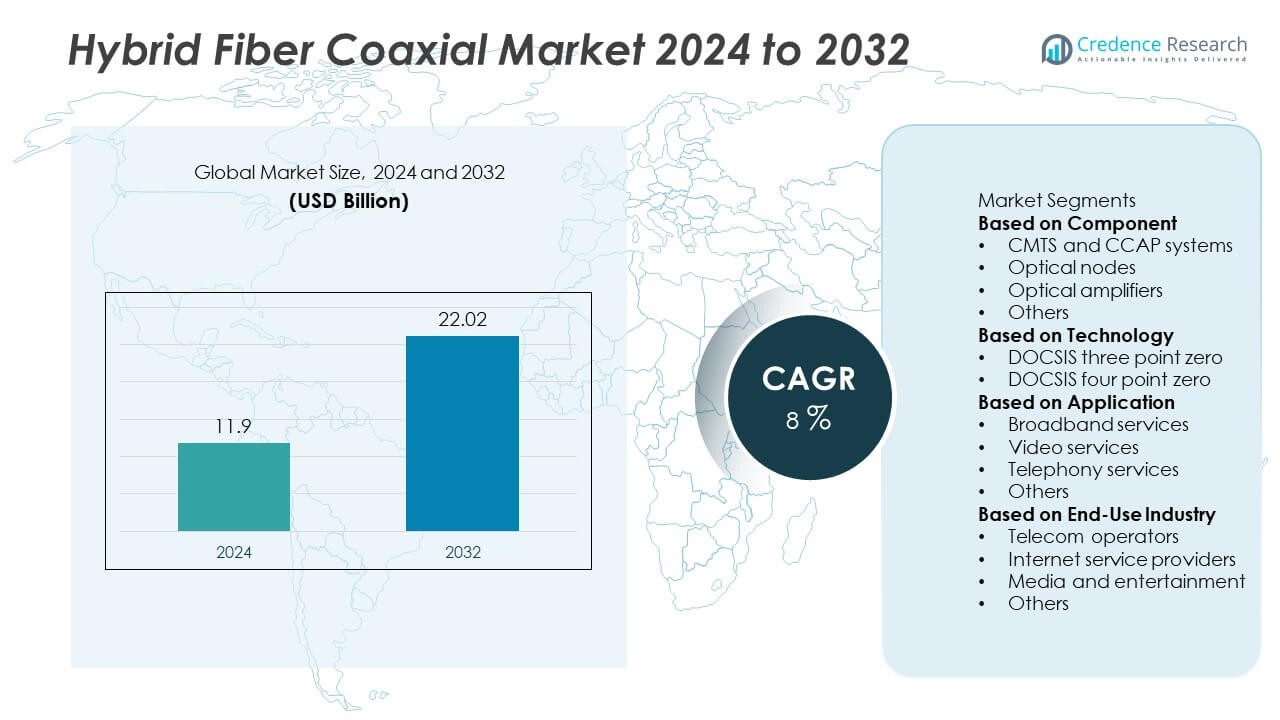

Hybrid Fiber Coaxial market size reached USD 11.9 billion in 2024 and is expected to rise to USD 22.02 billion by 2032. The market is set to grow at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hybrid Fiber Coaxial market Size 2024 |

USD 11.9 Billion |

| Hybrid Fiber Coaxial market , CAGR |

8% |

| Hybrid Fiber Coaxial market Size 2032 |

USD 22.02 Billion |

Top players in the Hybrid Fiber Coaxial market include Arris International, Cisco Systems, CommScope, Teleste Corporation, Huawei Technologies, Casa Systems, Nokia, Ciena Corporation, Harmonic Inc., and Technicolor SA. These companies strengthen their position through continuous DOCSIS advancements, enhanced CMTS platforms, and scalable optical components that support multi-gigabit broadband delivery. Their focus on virtualization, automation, and improved network efficiency helps operators upgrade hybrid networks with lower deployment costs. North America leads the market with a 38% share, driven by strong broadband adoption and extensive modernization of legacy coaxial networks. Europe and Asia Pacific follow, supported by growing digital services and steady operator investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 11.9 billion in 2024 and will grow at a CAGR of 8%. Growth strengthens as operators expand hybrid networks to meet rising digital demand.

- Strong demand for high-speed broadband drives adoption of CMTS and CCAP systems, which hold a 45% share. DOCSIS four point zero leads technology use with a 52% share as operators push for higher upstream capacity.

- Multi-gigabit service expansion and network virtualization shape key trends, supporting faster upgrades and flexible operations. Streaming growth, remote work, and cloud use increase pressure for stable hybrid networks.

- Competition intensifies as major players enhance DOCSIS platforms and optical components. Fiber rollouts create restraints by raising performance expectations, while hybrid networks face heavy maintenance needs across ageing coaxial lines.

- North America leads with a 38% share, followed by Europe at 27% and Asia Pacific at 24%. Broadband services hold a 58% share, driven by strong data consumption across residential and enterprise users.

Market Segmentation Analysis:

By Component

CMTS and CCAP systems lead the component segment with a 45% market share. These platforms support unified bandwidth control and help operators manage dense subscriber loads. Optical nodes hold 28% share as service providers enhance last-mile delivery for stronger signal quality. Optical amplifiers secure 18% share due to their role in long-distance transmission stability. Other components make up 9% share through improved reliability and reduced maintenance needs. CMTS and CCAP systems stay dominant because operators demand real-time network optimization. Continued DOCSIS upgrades also reinforce their leadership across hybrid fiber coaxial networks.

- For instance, CommScope’s E6000 Converged Edge Router (CER) is the industry’s leading and most widely-deployed Converged Cable Access Platform (CCAP), used by operators across North America and globally. The platform is designed to provide high channel density and power efficiency.

By Technology

DOCSIS four point zero dominates the technology segment with a 52% market share. This version improves spectral efficiency and supports multi-gigabit performance for advanced digital applications. DOCSIS three point zero holds 48% share as many legacy systems still rely on it for stable speeds. Adoption of DOCSIS four point zero rises as competition from fiber networks increases. Operators prefer this upgrade because it delivers higher upstream capacity. The technology also offers a flexible migration path without complete infrastructure replacement. Strong performance and future-ready design maintain its leadership in hybrid deployments.

- For instance, Harmonic enables multi-gigabit upstream and downstream speeds through its CableOS Cloud-Native Core platform, which powers over 33 million cable modems globally, including deployments with major operators in Europe.

By Application

Broadband services lead the application segment with a 58% market share due to rising demand for fast internet. Video services capture 24% share, driven by growth in streaming and cloud-based entertainment. Telephony services hold 12% share through integrated voice offerings delivered over hybrid networks. Other applications secure 6% share, supported by IoT expansion and connected device adoption. Broadband services remain dominant because operators focus on high-speed access and low-latency performance. Digital lifestyles push continuous upgrades across hybrid networks. This demand strengthens broadband’s long-term leadership in the application landscape.

Key Growth Drivers

Rising Demand for High-Speed Broadband

Demand for high-speed broadband grows as homes and businesses rely on data-heavy tasks. Hybrid fiber coaxial networks offer strong downstream capacity, which helps operators deliver fast services without major infrastructure changes. Continuous expansion of streaming, gaming, and cloud-based tools drives upgrades across hybrid systems. Operators focus on low latency and consistent performance to meet user expectations. The flexible design of hybrid networks supports scalable improvements through DOCSIS enhancements. Growing digital adoption strengthens investment in hybrid deployments. This rising need for stable high-speed access positions hybrid fiber coaxial networks as a key broadband solution.

- For instance, Comcast upgraded more than 100,000 nodes with mid-split configurations delivering up to 85 MHz of upstream spectrum to support low-latency applications and lay the foundation for DOCSIS 4.0.

Cost-Efficient Network Expansion

Hybrid fiber coaxial networks support cost-efficient expansion because they reuse existing coaxial infrastructure. This approach reduces upgrade costs and shortens deployment timelines compared with full fiber rollouts. Operators boost capacity using advanced DOCSIS standards and software-based improvements. Lower capital needs help providers extend services to new regions. Cost efficiency also supports competitive pricing and rapid launch of upgraded broadband plans. Providers benefit from reduced construction work and simpler upgrade paths. This model helps operators balance performance goals with budget limits. Demand for affordable network expansion keeps this driver strong.

- For instance, Charter Communications is upgrading its network using DOCSIS 3.1 and 4.0 high-split enhancements, which raise upstream capacity, typically without requiring new fiber builds to every home.

Increasing Adoption of DOCSIS Upgrades

DOCSIS upgrades remain a major growth driver as operators enhance hybrid network capability. DOCSIS four point zero supports higher upstream capacity and improved latency for modern digital activities. The upgrade path enables multi-gigabit speeds without full infrastructure replacement. Strong demand for real-time applications encourages operators to improve spectral efficiency and signal processing. These upgrades support long-term scalability and better energy use. Providers gain stronger competitive positioning against fiber services. Continuous DOCSIS evolution reinforces hybrid network relevance. This shift improves performance across residential and enterprise markets.

Key Trends and Opportunities

Expansion of Multi-Gigabit Services

The expansion of multi-gigabit broadband creates strong opportunities for hybrid fiber coaxial systems. Operators use advanced DOCSIS standards to increase bandwidth and meet rising data needs. Growth in remote work, cloud gaming, and high-resolution content drives demand for faster speeds. Hybrid networks allow providers to offer premium service tiers at lower upgrade cost. Enterprises adopt higher-speed plans for cloud platforms and analytics tools. This trend pushes operators to optimize spectral capacity and support future-ready performance. Multi-gigabit service adoption strengthens the value of hybrid deployments.

- For instance, Nokia tested its 25G PON coexistence modules over HFC backbones, enabling operators to deliver multi-gigabit services across combined infrastructures.

Network Modernization Through Virtualization

Virtualization becomes a major trend as operators adopt software-driven systems for greater flexibility. Virtual CMTS and cloud-based control platforms enable faster service delivery and better traffic management. Automation improves operational efficiency and helps providers reduce hardware dependence. Real-time analytics enhance performance and support proactive maintenance. Virtualized hybrid networks scale faster and handle rising user demand more effectively. Providers gain opportunities to modernize networks without extensive physical upgrades. This shift strengthens hybrid network capability in competitive environments.

- For instance, Cisco deployed its virtualized cBR-8 platform supporting up to 256,000 L2TP sessions in operator-grade environments. It also offers up to 1.6 Tbps of capacity in a single chassis and supports up to 256 service groups with Remote PHY, enabling maximum speeds approaching 10 Gbps per subscriber.

Key Challenges

Rising Competition From Fiber Networks

Hybrid fiber coaxial networks face growing competition from expanding fiber deployments. Fiber-to-the-home projects attract users with higher speeds and long-term reliability. This shift pressures hybrid networks to deliver improved performance through frequent upgrades. Customers often view fiber as a premium service option. Operators must balance investment needs while improving hybrid capabilities. Competitive pressure forces providers to enhance pricing and service quality. Fiber expansion creates long-term market hurdles for hybrid systems. Operators respond with targeted upgrades and advanced DOCSIS adoption.

Increasing Infrastructure Maintenance Requirements

Hybrid fiber coaxial networks require ongoing maintenance due to faster wear of coaxial components. Ageing cables and amplifiers affect signal strength and reliability. Providers invest in inspections and replacements to maintain performance. These activities raise operational costs and slow expansion efforts. Environmental factors such as heat, moisture, and physical stress increase maintenance needs. Operators rely on advanced monitoring to detect issues early. High maintenance demands reduce long-term scalability. This challenge pushes providers to modernize systems and optimize operational practices.

Regional Analysis

North America

North America holds a market share of 38%, driven by strong broadband adoption and continuous DOCSIS upgrades across major operators. Service providers invest in multi-gigabit rollouts and network automation to support rising demand from streaming, cloud gaming, and remote work. The region benefits from extensive legacy coaxial networks that enable cost-effective modernization. Growth stays steady as operators enhance upstream capacity and improve latency to compete with expanding fiber deployments. Government programs supporting rural broadband expansion also boost hybrid network investments. Strong digital consumption patterns reinforce North America’s leading position in the market.

Europe

Europe accounts for a market share of 27%, supported by ongoing modernization of hybrid broadband infrastructure across key countries. Operators focus on improving service quality through DOCSIS enhancements and targeted coaxial upgrades. The region sees rising demand for high-speed connectivity due to cloud adoption and digital media growth. Regulatory support for network improvement and fair-competition frameworks encourages operators to expand hybrid services. Competition from fiber networks drives hybrid systems to deliver higher performance and stability. The shift toward digital public services and connected homes strengthens the region’s reliance on hybrid deployment models.

Asia Pacific

Asia Pacific captures a market share of 24%, driven by rising internet penetration and rapid expansion of digital services across developing economies. Operators invest in hybrid fiber coaxial networks to deliver affordable high-speed broadband in dense urban regions. Growth accelerates as streaming, online education, and mobile-first ecosystems expand. Countries with large populations support strong demand for hybrid upgrades to manage traffic loads efficiently. Hybrid networks provide a practical solution where fiber rollout remains slow or costly. Continuous DOCSIS adoption and rising multi-device usage reinforce Asia Pacific’s growing importance in the global market.

Latin America

Latin America holds a market share of 7%, supported by growing investments in broadband infrastructure and gradual modernization of cable networks. Operators use hybrid fiber coaxial systems to expand coverage in urban and semi-urban areas at lower cost. Rising digital entertainment consumption and small-business connectivity needs strengthen market demand. Economic constraints make hybrid networks a cost-effective alternative to full fiber deployment. Service providers adopt DOCSIS improvements to enhance speed and reliability. The region continues to develop through targeted upgrades and government-led connectivity programs that improve digital inclusion.

Middle East and Africa

The Middle East and Africa represent a market share of 4%, with growth driven by increasing broadband adoption and gradual expansion of hybrid network infrastructure. Operators invest in hybrid systems to offer competitive internet services while managing deployment costs in diverse geographic areas. Urban regions see stronger adoption as demand rises for streaming, cloud services, and digital banking. Hybrid networks help bridge gaps where fiber expansion remains limited or slow. Government initiatives promoting digital transformation encourage further investment. Steady enhancements in network capacity and reliability support the region’s emerging presence in the market.

Market Segmentations:

By Component

- CMTS and CCAP systems

- Optical nodes

- Optical amplifiers

- Others

By Technology

- DOCSIS three point zero

- DOCSIS four point zero

By Application

- Broadband services

- Video services

- Telephony services

- Others

By End-Use Industry

- Telecom operators

- Internet service providers

- Media and entertainment

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Arris International, Cisco Systems, CommScope, Teleste Corporation, Huawei Technologies, Casa Systems, Nokia, Ciena Corporation, Harmonic Inc., and Technicolor SA. These companies focus on strengthening hybrid fiber coaxial infrastructure through continuous DOCSIS upgrades, advanced CMTS platforms, and enhanced optical components. Vendors invest in multi-gigabit solutions and network virtualization to improve flexibility and reduce operational complexity. Strategic partnerships with telecom operators help accelerate regional deployments and support faster service rollouts. Companies also expand R&D activities to deliver higher upstream capacity and better latency performance. Competitive pressure intensifies as firms integrate AI-driven monitoring and cloud-based network control to support scalable modernization. Operators prefer suppliers offering end-to-end hybrid solutions that combine performance, cost efficiency, and long-term upgrade paths.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arris International

- Cisco Systems

- CommScope

- Teleste Corporation

- Huawei Technologies

- Casa Systems

- Nokia

- Ciena Corporation

- Harmonic Inc.

- Technicolor SA

Recent Developments

- In August 2025, CommScope achieved record-breaking downstream speeds of over 16 Gbps at a CableLabs interoperability event, demonstrating the technology’s readiness.

- In June 2025, CommScope announced that Liberty Global had chosen it to support its DOCSIS 4.0 Distributed Access Architecture (DAA) deployment.

- In September 2024, Harmonic and Mediacom Communications Corporation announced the production deployment of Unified DOCSIS 4.0 on a live HFC network in Moline, Illinois.

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Operators will expand multi-gigabit broadband plans to meet rising data usage.

- DOCSIS four point zero adoption will accelerate as providers seek higher upstream capacity.

- Hybrid networks will integrate more automation to improve service reliability.

- Virtual CMTS platforms will gain traction as operators shift toward software-driven control.

- Network upgrades will focus on reducing latency for cloud gaming and real-time applications.

- Hybrid systems will remain a cost-effective alternative in regions where fiber rollout is slow.

- Demand for enhanced optical components will increase to support long-distance transmission.

- Maintenance optimization tools will grow as operators monitor ageing coaxial lines more closely.

- Integration of AI-driven traffic management will support better bandwidth allocation.

- Regional investments will rise as governments push for broader digital access and connectivity.