Market Overview

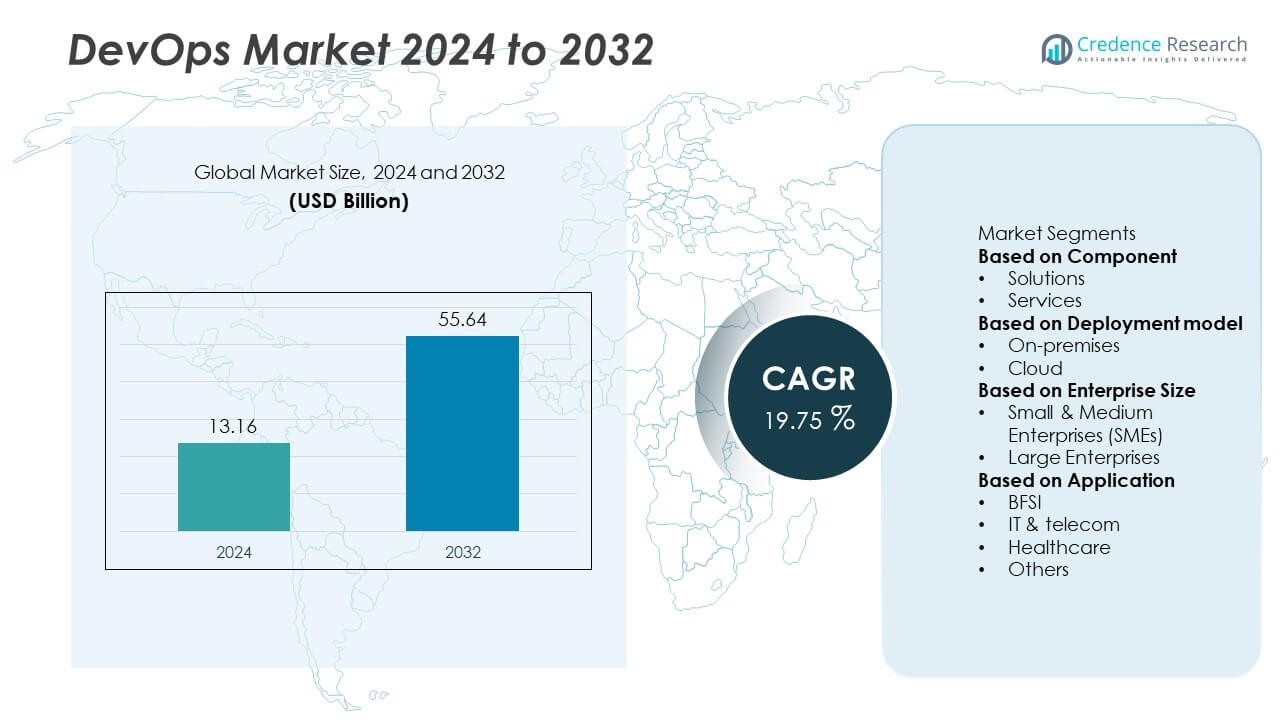

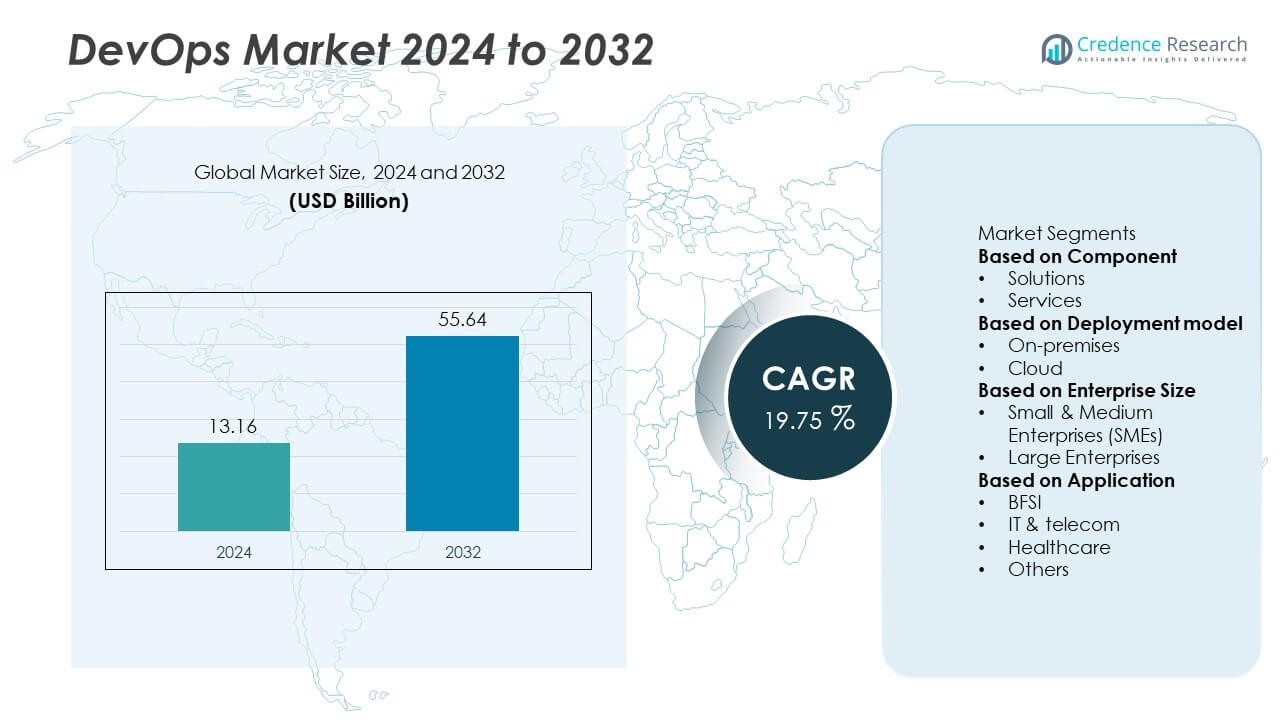

The DevOps market reached USD 13.16 billion in 2024 and is projected to reach USD 55.64 billion by 2032. The market is expected to grow at a CAGR of 19.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DevOps Market Size 2024 |

USD 13.16 Billion |

| DevOps Market, CAGR |

19.75% |

| DevOps Market Size 2032 |

USD 55.64 Billion |

The DevOps market is driven by leading players such as Microsoft Corporation, IBM Corporation, Amazon Web Services, Google LLC, Atlassian Corporation, GitLab Inc., Docker Inc., Red Hat Inc., Puppet Inc., and Broadcom Inc. These companies strengthen market growth through advanced automation tools, cloud-native platforms, and integrated CI/CD solutions that enhance development speed and operational efficiency. North America leads the global DevOps market with a 41% share, supported by strong cloud adoption and mature digital infrastructure. Europe follows with 28%, while Asia Pacific holds 23%, driven by rapid digitalization, expanding enterprise IT spending, and growing cloud migration across emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The DevOps market reached USD 13.16 billion in 2024 and will grow to USD 55.64 billion by 2032 at a 19.75% CAGR, driven by rapid enterprise digitalization.

- Strong growth is supported by rising automation adoption, with solutions leading the component segment with a 62% share, as enterprises enhance CI/CD pipelines and streamline deployment cycles.

- Key trends include increasing integration of AI-driven monitoring, security automation, and cloud-native development, with Asia Pacific expanding rapidly due to strong digital transformation and cloud migration.

- The competitive landscape is shaped by major players such as Microsoft, IBM, AWS, Google, Atlassian, GitLab, Docker, Red Hat, Puppet, and Broadcom, who invest in advanced automation, orchestration, and multi-cloud tools.

- North America leads with a 41% share, followed by Europe at 28%, while Asia Pacific holds 23%, supported by rising DevOps adoption across SMEs and large enterprises seeking faster, more reliable software delivery.

Market Segmentation Analysis:

By Component

Solutions hold the dominant position in the component segment with a 62% market share, supported by strong adoption of CI/CD platforms, automation tools, and monitoring solutions that streamline software delivery. Organizations prioritize integrated toolchains that enhance deployment speed, improve workflow transparency, and reduce manual errors. Demand rises as enterprises adopt microservices and container-based architectures that require continuous updates. Services also expand due to growing needs for consulting, training, and managed DevOps environments. As enterprises scale digital transformation, demand for unified, automation-driven solutions continues to strengthen.

- For instance, one GitLab customer is able to complete 1.5 million builds every month using the platform’s CI/CD capabilities. GitLab offers a unified DevOps platform that enables large development teams to manage code delivery, security scans, and testing within a single automated environment.

By Deployment Model

Cloud deployment leads the segment with a 68% market share, driven by rapid adoption of scalable, flexible, and cost-efficient DevOps environments. Organizations rely on cloud-based toolchains for faster provisioning, automated updates, and seamless integration with AI-driven monitoring systems. Cloud platforms support distributed development teams and accelerate software release cycles, making them preferred for modern application architectures. On-premises adoption remains steady in regulated sectors that require strict data control. Overall growth favors cloud deployment as companies modernize infrastructure and enhance resilience across development and operations.

- For instance, the internal Microsoft .NET infrastructure team relies on Azure Pipelines to run millions of automated tests a day for their open-source projects, enabling automated build, test, and release workflows for distributed development teams.

By Enterprise Size

Large enterprises dominate the enterprise-size segment with a 57% market share, supported by extensive investments in automation, advanced pipeline orchestration, and enterprise-grade security. These organizations integrate DevOps to reduce release bottlenecks, improve collaboration across teams, and support complex application portfolios. SMEs also show strong adoption as cloud-native tools lower implementation costs and simplify scaling. Growing startup ecosystems further boost SME participation. Market expansion continues as both large enterprises and SMEs prioritize faster deployment cycles, reduced downtime, and greater operational efficiency through structured DevOps practices.

Key Growth Drivers

Rising Adoption of Automation and Continuous Delivery Pipelines

Organizations expand their use of automated workflows, CI/CD pipelines, and integrated toolchains to accelerate software development. Automation improves release frequency, reduces manual errors, and enhances collaboration between development and operations teams. Companies prioritize efficiency as digital transformation accelerates across industries. The need for faster product updates, seamless integration, and real-time monitoring strengthens the demand for DevOps solutions. Enterprises also adopt AI-assisted automation to streamline code testing and deployment, supporting scalable and resilient development environments.

- For instance, GitHub advanced its Actions platform by offering robust performance metrics for users to track data like job failure rates, average run times, and success percentages.

Growth of Cloud-Native Applications and Microservices

Enterprises shift toward cloud-native architectures, containerized applications, and microservices to improve scalability and agility. This transition increases the need for DevOps platforms that support orchestration, automated provisioning, and continuous deployment. Cloud providers offer integrated toolsets that simplify development and operations workflows. DevOps becomes essential as distributed systems require consistent monitoring and rapid updates. Growing adoption of Kubernetes, serverless computing, and API-based applications further strengthens market demand. These advances help enterprises build adaptable, high-performance systems suited for rapid innovation.

- For instance, IBM enhanced its Cloud Code Engine with features such as Serverless Fleets for compute-intensive workloads (including AI and machine learning tasks on CPUs and GPUs), enabling microservice-driven applications and batch jobs to run without manual resource management.

Increasing Demand for Faster and Reliable Software Delivery

Businesses prioritize reduced downtime, shorter release cycles, and enhanced product stability to meet rising customer expectations. DevOps practices improve collaboration, transparency, and workflow standardization, allowing teams to release reliable software at scale. Industries such as BFSI, healthcare, and retail rely on DevOps to maintain continuous service availability. The growing use of real-time analytics, automated testing, and performance monitoring boosts overall efficiency. This increasing focus on speed and reliability positions DevOps as a core strategy for digital competitiveness.

Key Trends & Opportunities

Growing Integration of AI and Machine Learning in DevOps

AI-driven analytics, predictive monitoring, and intelligent automation redefine DevOps workflows by improving fault detection, optimizing pipelines, and enhancing resource allocation. Organizations adopt AIOps platforms to gain deeper insights into system behavior and reduce incident response times. Machine learning models help teams predict failures before they impact production, raising system reliability. This integration creates opportunities for vendors offering advanced automation capabilities. As AI adoption rises, DevOps evolves into a more autonomous, insight-driven approach to software development and operations.

- For instance, Splunk integrated ML algorithms capable of analyzing massive volumes of machine data per day to predict system anomalies with high accuracy for large financial institutions.

Expanding Demand for DevSecOps and Security Automation

Security integration across development pipelines becomes a major trend as organizations aim to detect vulnerabilities early and comply with stringent regulations. DevSecOps practices embed automated security checks, code scanning, and policy enforcement into CI/CD workflows. This trend opens opportunities for solutions that provide real-time threat detection and compliance reporting. Rising cyber risks and complex application environments push enterprises to adopt unified development-security frameworks. As security automation improves, DevOps environments become more resilient and aligned with global security standards.

- For instance, Palo Alto Networks Prisma Cloud scans Infrastructure as Code (IaC) files for misconfigurations, vulnerabilities, and exposed secrets, providing immediate detection and inline code fixes.

Key Challenges

Skill Shortages and Limited Expertise in DevOps Practices

Many organizations struggle to adopt DevOps due to limited availability of skilled professionals capable of managing automation pipelines, cloud orchestration, and integrated toolchains. Cross-functional expertise in development, operations, and security remains difficult to source. This talent gap slows implementation and increases dependency on external consultants. Companies face challenges in scaling DevOps across teams without proper training and cultural alignment. Skill shortages continue to hinder widespread adoption, especially in small and medium enterprises.

Complexity in Integrating Legacy Systems and New Technologies

Enterprises with large legacy infrastructures face difficulties merging outdated systems with modern DevOps tools and cloud-native architectures. Integration challenges delay automation efforts and increase operational risks. Older systems often lack the compatibility needed for seamless CI/CD workflows. This complexity raises implementation costs and impacts deployment efficiency. Organizations must invest in modernization, containerization, and API development to support DevOps adoption. The difficulty of transitioning from traditional IT environments remains a major barrier to full-scale DevOps transformation.

Regional Analysis

North America

North America leads the DevOps market with a 41% share, driven by strong cloud adoption, advanced IT infrastructure, and early integration of automation across enterprises. Large technology companies and financial institutions invest heavily in CI/CD platforms, security automation, and AI-driven monitoring tools. The region benefits from a mature ecosystem of DevOps vendors and widespread use of microservices and containerized applications. Growing demand for faster software delivery and strong presence of hyperscale cloud providers support continued growth. Expansion of DevSecOps and AIOps further strengthens market adoption across both large enterprises and SMEs.

Europe

Europe holds a 28% market share, supported by rising digital transformation across BFSI, healthcare, and manufacturing sectors. Organizations adopt DevOps to modernize legacy systems, improve deployment cycles, and enhance collaboration across technical teams. The region emphasizes regulatory compliance, which boosts demand for secure, traceable, and automated DevOps pipelines. Strong cloud migration in Germany, the U.K., France, and the Netherlands continues driving adoption. Increasing investment in container orchestration, Kubernetes platforms, and security automation supports steady market expansion across mid-sized and enterprise-level companies in Europe.

Asia Pacific

Asia Pacific accounts for a 23% market share, driven by rapid cloud expansion, fast-growing digital ecosystems, and rising investments in enterprise automation. Countries such as China, India, Japan, and South Korea accelerate adoption of DevOps to support large-scale application development and expanding e-commerce and telecommunications sectors. SMEs and startups adopt cloud-native tools that offer low-cost implementation and easy scalability. Growing IT outsourcing, strong presence of global service providers, and rising focus on agile development accelerate the region’s growth. Asia Pacific remains the highest-growth region as enterprises modernize infrastructure and prioritize continuous delivery.

Latin America

Latin America holds a 5% market share, supported by increasing cloud adoption and modernization efforts among enterprises in Brazil, Mexico, and Argentina. Organizations implement DevOps to reduce development bottlenecks and improve system reliability across banking, telecommunications, and retail sectors. Growth is supported by expanding investment in automation, analytics, and cloud-native platforms. Regional enterprises strengthen digital capabilities through partnerships with global cloud providers and IT service firms. While adoption is still developing, rising demand for real-time services and improved customer experiences drives steady DevOps integration across key industries.

Middle East & Africa

Middle East & Africa represent a 3% market share, driven by the rise of smart city initiatives, digital government programs, and expanding enterprise cloud usage. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption as organizations invest in agile development, automation, and secure cloud environments. Enterprises adopt DevOps to enhance application performance and support modernization of IT operations. Growing interest in AI, cybersecurity, and infrastructure automation strengthens market momentum. Although adoption is at an early stage, increasing digital transformation projects create long-term opportunities for DevOps growth.

Market Segmentations:

By Component

By Deployment model

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Application

- BFSI

- IT & telecom

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Microsoft Corporation, IBM Corporation, Amazon Web Services, Google LLC, Atlassian Corporation, GitLab Inc., Docker Inc., Red Hat Inc., Puppet Inc., and Broadcom Inc. These companies compete by offering integrated DevOps platforms, advanced automation tools, and cloud-native solutions that support continuous delivery and streamlined software development. Leading vendors invest in AI-driven monitoring, security automation, and orchestration capabilities to enhance performance and reduce operational complexity. Strategic partnerships with cloud providers, managed service firms, and enterprise clients strengthen market reach. Companies also focus on expanding CI/CD toolsets, improving pipeline efficiency, and supporting hybrid and multi-cloud environments. Continuous upgrades, strong developer ecosystems, and open-source contributions reinforce competitive positioning and help vendors meet rising demand for scalable, secure, and high-speed DevOps workflows.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Atlassian made its AI coding agent Rovo Dev generally available, bundling it with Bitbucket, Compass and the DX engineering metrics platform for CI/CD, planning and code review tasks.

- In September 2025, GitLab Inc. announced release version 18.4, expanding AI-native capabilities: teams can build/share custom agents, navigate codebases with a Knowledge Graph and optimize feature performance via model selection.

- In June 2025, IBM launched IBM DevOps Deploy 8.1.2, which introduced an AI assistant called “Deployment Genie” to help identify deployment failure causes and provide remediation recommendations.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment model, Enterprise Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of cloud-native DevOps tools will accelerate as enterprises scale digital initiatives.

- AI-driven automation and predictive monitoring will strengthen pipeline performance and reliability.

- DevSecOps integration will rise as companies prioritize security throughout development cycles.

- Large enterprises will expand multi-cloud and hybrid DevOps environments to improve flexibility.

- SMEs will adopt low-cost, scalable DevOps platforms to support faster application delivery.

- Demand for Kubernetes and container orchestration will continue to grow across industries.

- Automation of testing, deployment, and configuration will streamline software release cycles.

- Outsourcing to managed DevOps services will increase as organizations address skill gaps.

- Collaboration tools and integrated CI/CD suites will gain wider adoption across distributed teams.

- DevOps adoption in emerging regions will rise as cloud infrastructure and digital investments grow.