Market Overview:

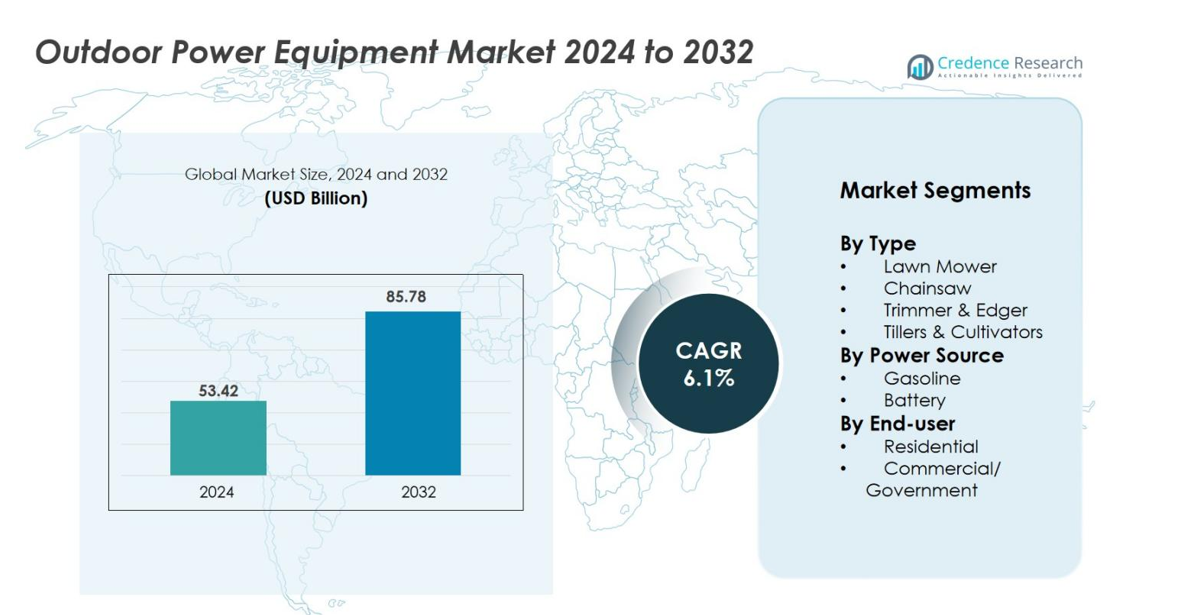

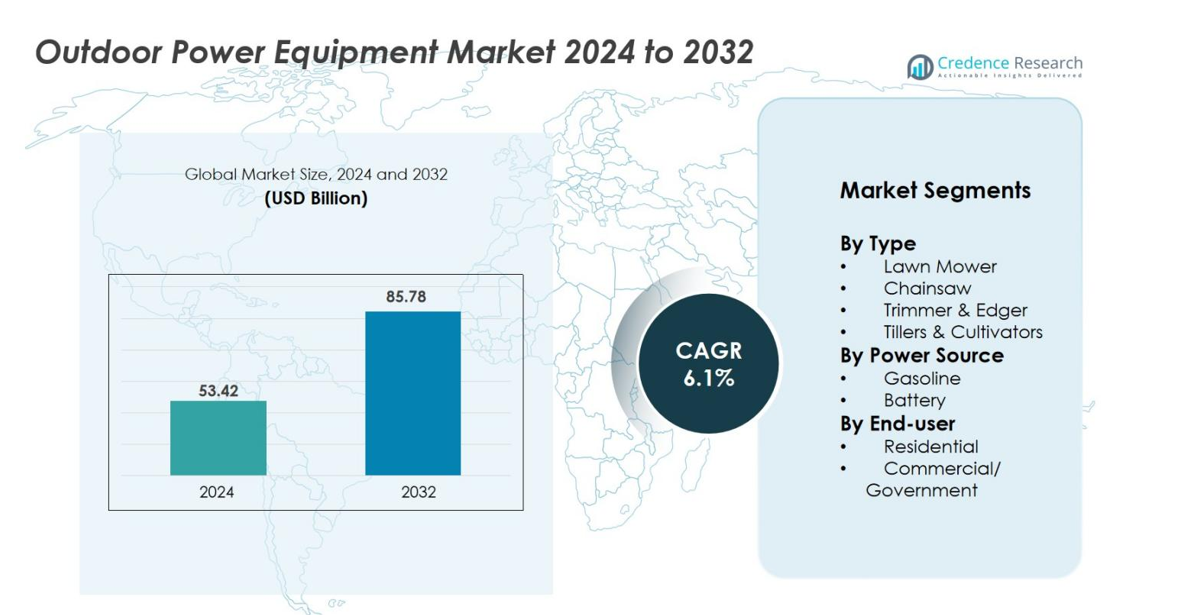

The Outdoor Power Equipment market size was valued at USD 53.42 Billion in 2024 and is anticipated to reach USD 85.78 Billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Outdoor Power Equipment Market Size 2024 |

USD 53.42 Billion |

| Outdoor Power Equipment Market, CAGR |

6.1% |

| Outdoor Power Equipment Market Size 2032 |

USD 85.78 Billion |

The Outdoor Power Equipment market is dominated by key players such as Makita Corporation, Honda Motor Co., Ltd., Briggs & Stratton, MTD Inc, Stanley Black & Decker, Inc., ANDREAS STIHL AG & Co. KG, CHERVON (China) Trading Co., Ltd., Techtronic Industries Co. Ltd., YAMABIKO Corporation and Robert Bosch GmbH. These firms lead through extensive global distribution, strong R&D in cordless and eco‑friendly equipment, and mergers or strategic partnerships that expand product portfolios. Regionally, North America holds the largest share at approximately 35.28% of the global market in 2024, driven by large residential lawn areas and strong landscaping service demand.

Market Insights

- The global Outdoor Power Equipment market was valued at USD 53.42 billion in 2024 and is anticipated to grow at a CAGR of 6.1% through 2032.

- Rising demand for residential landscaping and commercial green‑space management is driving increased purchases of lawn mowers (which held over 36% of the market by type in 2023) and trimmers/edgers, while the gasoline power‑source segment dominated with around 60.5% share in 2024.

- A key trend and opportunity lies in the shift to battery‑powered and electric outdoor equipment, with enhanced smart features and IoT connectivity becoming important, particularly in mature regions such as North America (which held approx. 35.78% share in 2024).

- Competitive dynamics are intensifying as established players expand battery‑and‑smart tool portfolios, but the market’s growth is restrained by the higher upfront cost of advanced equipment and heavy seasonality affecting demand.

- Regionally, North America leads in market share, while Asia‑Pacific is the fastest‑growing region due to rising urbanisation, increasing disposable income and growing landscaping demand in countries such as China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Outdoor Power Equipment market is segmented by type, with lawn mowers dominating the sector. Lawn mowers account for a significant market share due to their widespread use in residential and commercial lawn maintenance. Chainsaws, trimmers & edgers, and tillers & cultivators follow, each serving specific landscaping needs. Lawn mowers lead the market with a share of approximately 40%, driven by increasing demand for residential and commercial lawn care products. Rising interest in aesthetic landscaping and the expansion of commercial lawn care services are key growth drivers in this segment.

- For instance, the cordless electric segment led by companies such as The Toro Company (which features its 60 V Max Recycler® mower leveraging a brushless motor) highlights how manufacturers are diversifying beyond just walk‑behind mowers.

By Power Source

The power source segment is divided into gasoline and battery-powered outdoor equipment. Gasoline-powered equipment holds the majority of the market share, approximately 60%, due to its long operating life and suitability for high-demand, commercial use. Battery-powered equipment is growing rapidly, driven by the shift toward more eco-friendly solutions. It accounts for about 30% of the market, with advancements in battery technology and increasing demand for quieter, emission-free tools in residential areas propelling growth. The demand for sustainable, low-maintenance solutions is a significant driver for the battery-powered segment.

- For instance, ECHO (Incorporated) expanded its 56 V battery system and launched nine new tools in its X Series in 2024.

By End-User

The end-user segment of the Outdoor Power Equipment market is divided into residential and commercial/government sectors. The residential segment leads with a market share of around 55%, driven by increasing homeowner investments in yard maintenance and landscaping. The commercial/government sector holds a 45% share, with significant growth in urbanization, government landscaping projects, and the expansion of commercial services like golf courses and parks. The residential sector is driven by a rising focus on home aesthetics and DIY projects, while the commercial sector benefits from growing demand for large-scale landscaping services.

Key Growth Drivers

Increasing Demand for Lawn Care Services

The growing trend of outsourcing lawn and garden care has significantly boosted the demand for outdoor power equipment in the commercial and residential sectors. Lawn care services, including landscaping and maintenance, are expanding as people increasingly prioritize the aesthetic value of their homes and businesses. As disposable income rises, both residential and commercial property owners are investing in professional landscaping services that rely heavily on outdoor power equipment. Additionally, the rise in commercial landscaping projects such as golf courses, parks, and corporate campuses drives demand for high-performance machinery. This growth in demand for lawn care services is expected to remain a key growth driver for the outdoor power equipment market over the forecast period.

- For instance, The Toro Company reported full‑year fiscal 2024 professional‑segment net sales of USD 3,560 million, reflecting strong uptake of commercial landscaping equipment used by lawn‑care service firms.

Technological Advancements in Battery-Powered Equipment

Advancements in battery technology are transforming the outdoor power equipment market, with consumers and businesses alike embracing more environmentally friendly alternatives. Battery-powered equipment, particularly lawn mowers, trimmers, and chainsaws, has gained popularity due to its quiet operation, reduced emissions, and minimal maintenance compared to gasoline-powered options. Manufacturers are investing heavily in improving battery life, charging times, and energy efficiency, thus addressing previous limitations. As urbanization increases and governments enforce stricter emissions regulations, the demand for battery-powered outdoor power equipment is expected to surge. Technological innovations such as lithium-ion batteries and smart connectivity are also contributing to market growth, enhancing the appeal of battery-powered equipment for both residential and commercial users.

- For example, Ryobi’s One+ 18 V lithium‑ion battery can be used to power over 200 different tools—including lawn‑mowers, string‑trimmers and brush‑cutters—illustrating the shift toward battery ecosystems.

Government Regulations and Environmental Policies

As environmental concerns continue to rise, government regulations promoting the reduction of greenhouse gas emissions are becoming a significant growth driver for the outdoor power equipment market. Policies such as stricter emission standards for gasoline-powered equipment are encouraging manufacturers and consumers to adopt more sustainable, energy-efficient solutions. In many regions, local governments are offering incentives and subsidies for purchasing eco-friendly equipment, further stimulating market growth. Additionally, many commercial and government entities are increasingly adopting sustainable practices, which includes transitioning to battery-powered outdoor power equipment to comply with environmental regulations. As a result, the shift toward eco-friendly solutions is expected to be a major driver in the market, particularly in urban areas with stringent emissions laws.

Key Trends & Opportunities

Shift Toward Smart Outdoor Power Equipment

The adoption of smart technology is one of the key trends in the outdoor power equipment market. Manufacturers are increasingly integrating Internet of Things (IoT) and smart features into their products, offering users enhanced control and efficiency. For instance, smart lawn mowers can be programmed remotely and equipped with sensors to navigate obstacles. This trend toward connectivity allows users to optimize power usage, schedule maintenance, and improve the performance of their equipment through mobile apps or cloud-based services. As consumers become more tech-savvy and demand more convenience, there is a growing opportunity for outdoor power equipment brands to innovate and capture market share by offering smart, connected solutions. These technologies enhance operational efficiency and appeal to both residential and commercial users who prioritize ease of use and time savings.

- For instance, Husqvarna reports that “over three million homeowners and professionals around the world” already use its robotic lawn mowers that feature GPS‑assisted navigation and smartphone connectivity.

Expansion of the DIY Market

The DIY (Do-It-Yourself) movement continues to grow, particularly in the residential sector, which presents a significant opportunity for the outdoor power equipment market. More homeowners are taking on landscaping and outdoor maintenance projects themselves, driven by the desire to save money and increase the value of their properties. This trend is supported by increased availability of consumer-friendly outdoor power equipment that is easy to operate and maintain. With a growing interest in home improvement, gardening, and sustainability, the DIY market for outdoor power equipment is poised for further expansion. Companies can capitalize on this opportunity by offering compact, affordable, and efficient equipment that meets the needs of hobbyists and homeowners looking to enhance their outdoor spaces without professional help.

- For instance, WORX (a brand of Positec Tool Corporation) sold approximately 313,000 units of its GT electric trimmers by the end of 2007, demonstrating early traction in the DIY homeowner tool segment

Key Challenges

High Initial Cost of Battery-Powered Equipment

Although battery-powered outdoor power equipment is gaining traction due to its environmental benefits, the high initial cost remains a significant challenge for widespread adoption. Despite advances in battery technology, the upfront cost of battery-powered tools, such as lawn mowers and chainsaws, is typically higher than their gasoline-powered counterparts. This price disparity can deter cost-conscious consumers, especially in the residential market, where affordability is a key consideration. Additionally, the need for periodic battery replacements and limited battery life compared to gasoline engines may further hinder the growth of this segment. As manufacturers work to reduce costs through technological improvements and economies of scale, it will be critical for them to overcome this financial barrier to expand the battery-powered equipment market.

Seasonality and Weather Dependency

The outdoor power equipment market is heavily dependent on seasonal demand, with the highest sales typically occurring during the spring and summer months. This seasonality can create challenges in maintaining consistent revenue streams for manufacturers and distributors throughout the year. In regions with harsh winter conditions, outdoor power equipment usage is limited to a few months, causing demand fluctuations. Furthermore, unpredictable weather patterns due to climate change can further complicate the market by altering typical seasonal patterns. Manufacturers need to adopt strategies that address these seasonal fluctuations, such as offering equipment for year-round use or diversifying their product range to include equipment that is relevant for off-season activities like snow removal.

Regional Analysis

North America

The North America market for outdoor power equipment captured 35.3% of global revenue in 2024. The region benefits from abundant suburban gardens, high lawn‑care spend per household, and robust commercial landscaping activity. Growth is driven by rising consumer demand for efficient yard tools, stringent emissions standards prompting uptake of battery‑powered models, and large-scale public infrastructure landscaping projects. As manufacturers introduce advanced cordless mowers and connected devices, the region remains the largest single market while continuing to adopt innovative, climate‑friendly solutions.

Europe

In Europe, the outdoor power equipment market holds an estimated share of 30% of global sales. Demand is bolstered by strict environmental regulations, high adoption rates of electric‐and battery‑powered tools, and mature landscaping and garden‑maintenance services across residential and commercial segments. Growth is supported by green initiatives, urban‑renewal projects and investment in public parks and golf facilities. However, currency fluctuations, regulatory compliance costs, and preference for rental over ownership in some countries moderate growth. The region remains a strategic market for premium and eco‑friendly outdoor equipment.

Asia Pacific

Asia Pacific is emerging as a high‑growth region for outdoor power equipment, with forecasts suggesting it will outpace other regions in CAGR over the coming years. While the region currently accounts for 25% of the market, stronger disposable incomes, urbanisation, expanding landscaping infrastructure and growth in residential home‑improvement activity are driving rapid demand. Countries such as China and India are notable for rising garden‑care interest and domestic manufacturing of outdoor tools. Manufacturers are leveraging local production and tailored battery‑powered solutions to capitalise on this dynamic region.

Latin America

Latin America accounts for 10% of the global outdoor power equipment market. Growth is rooted in increasing residential landscaping investments, redevelopment of public green spaces and rental‑model expansion for commercial equipment. The market faces challenges such as import tariffs, currency volatility and inconsistent infrastructure spend, which temper growth. Nonetheless, improved distribution networks, entry of global players and the gradual shift to cordless and battery‑based tools present opportunities for market expansion in Brazil, Mexico and Argentina.

Middle East & Africa

The Middle East & Africa (MEA) region contributes 7% of the global outdoor power equipment market. Growth drivers include government‑led landscaping of urban developments, hospitality and golf‑resort projects, and rising interest in home‑garden care among affluent consumers. Harsh climate conditions and limited infrastructure in some areas constrain penetration of residential tools, but commercial and rental segments remain promising. Adoption of battery‑powered and low‑emission machines is gaining traction as part of sustainability initiatives in key markets such as UAE, Saudi Arabia and South Africa.

Market Segmentations

By Type

- Lawn Mower

- Chainsaw

- Trimmer & Edger

- Tillers & Cultivators

By Power Source

By End-user

- Residential

- Commercial/ Government

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global outdoor power equipment market is characterised by robust activity among well‑established manufacturers and emerging disruptors. Leading companies such as Makita Corporation, Honda Motor Co., Ltd., Briggs & Stratton, MTD Inc, Stanley Black & Decker, Inc., ANDREAS STIHL AG & Co. KG, CHERVON (China) Trading Co., Ltd., Techtronic Industries Co. Ltd., YAMABIKO Corporation and Robert Bosch GmbH repeatedly vie for market share by expanding product portfolios, enhancing battery‑powered offerings and investing in digital connectivity. For example, Makita and Bosch emphasise R&D in cordless and smart equipment, while Honda and Briggs & Stratton continue to leverage their strong engine‑heritage for gasoline models. Strategic acquisitions—such as Stanley Black & Decker’s move to strengthen its cordless equipment portfolio—are also reshaping the competitive environment. Overall, the competitive dynamics centre on balancing reliable traditional machines with next‑generation eco‑friendly solutions, enabling key players to maintain leadership while new entrants push innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Oso Electric Equipment acquired Electric Sheep Robotics to combine electric power‑trains with AI‑driven autonomous landscaping robotics, paving the way for zero‑emission, autonomous outdoor power equipment.

- In September 2025, Greenworks® launched 35 new hand and power tools across its outdoor power equipment portfolio, including the POWERALL™ 24 V collection, available nationwide at Target.

- In February 2025, Husqvarna Group and Flex Ltd. announced a strategic manufacturing‑partnership, whereby Husqvarna will leverage Flex’s supply‑chain and manufacturing capabilities for its North American outdoor power equipment operations

Report Coverage

The research report offers an in-depth analysis based on Type, Power Source, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The outdoor power equipment market will see sustained demand growth as more homeowners and commercial landscapers invest in modern lawn‑care tools.

- Battery‑powered and electric equipment will continue to gain share, supported by advancements in battery technology, lighter devices and broader regulatory pressure on emissions.

- Smart and connected features including IoT‑enabled diagnostics, remote control and automated scheduling will become standard in higher‑end tools, boosting value‑add and brand differentiation.

- Urbanisation and rising landscaping services in emerging regions will open growth opportunities, especially in Asia‑Pacific, even as North America retains its lead.

- Manufacturers will increasingly adopt modular platforms and shared battery systems to reduce cost and improve cross‑tool compatibility, enhancing customer loyalty and aftermarket sales.

- The residential segment will remain dominant, but growth from commercial/government landscaping, park infrastructure and rental fleets will accelerate.

- Gasoline‑powered equipment will gradually be phased out in certain segments, but heavy‑duty commercial applications will still rely on traditional engines for some time.

- Seasonality and weather patterns will continue to pose challenges, making diversification (into rental, accessories, service) a strategic consideration for vendors.

- Supply‑chain constraints and rising raw‑material costs (for batteries, motors, electronics) will pressure margins and drive consolidation among smaller players.

- Sustainability and regulatory compliance (noise, emissions, waste‑battery recycling) will increasingly shape product design, certification requirements and marketing narratives across regions.