Market Overview:

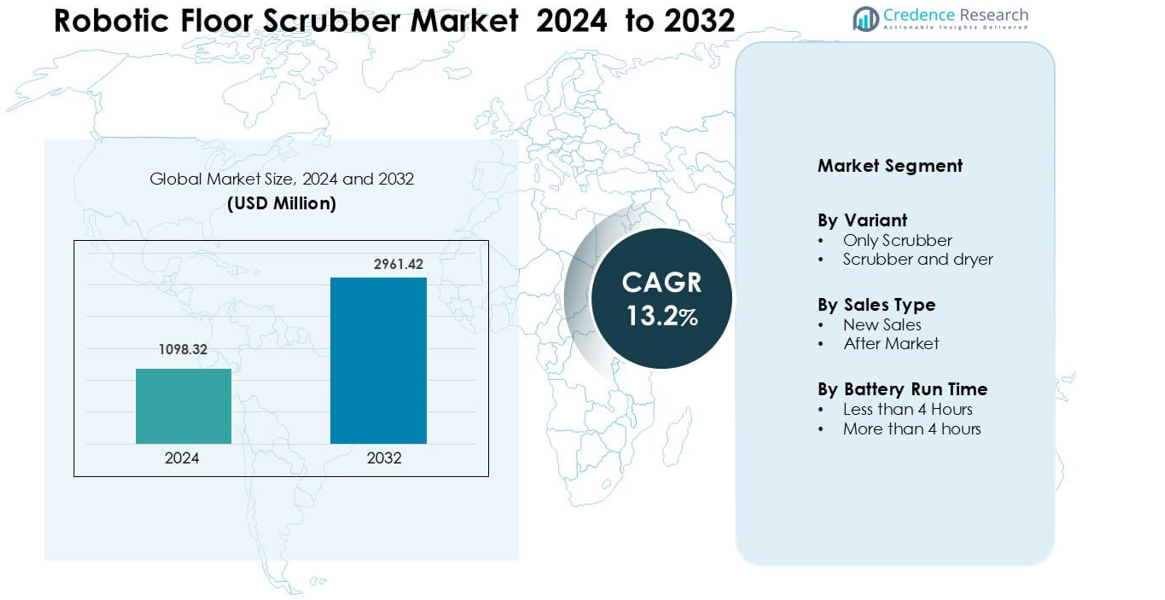

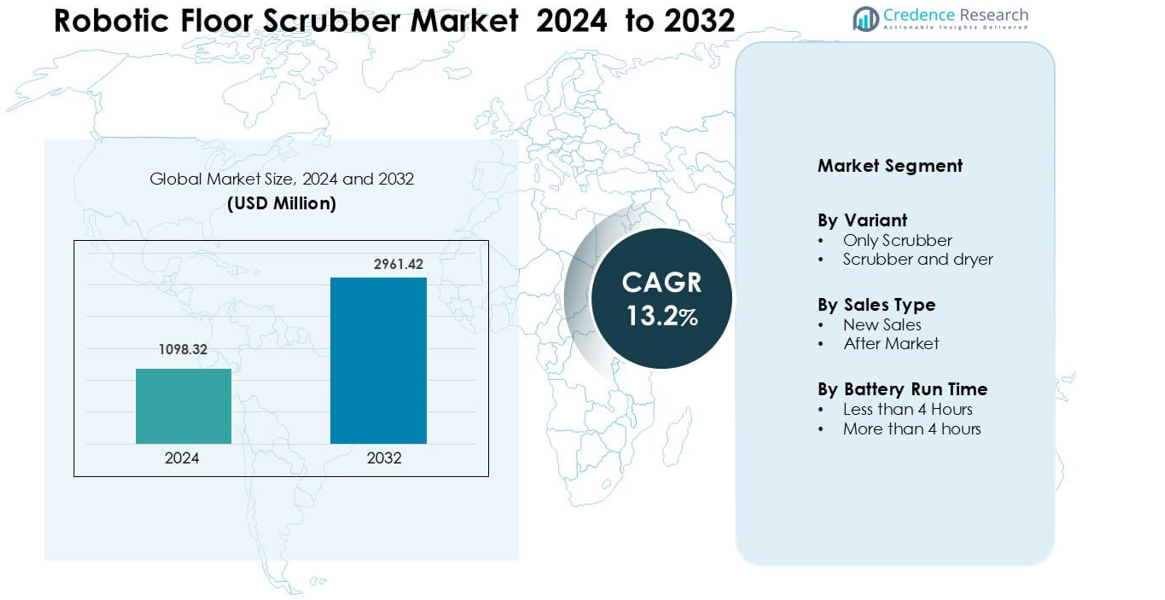

Robotic Floor Scrubber Market was valued at USD 1098.32 million in 2024 and is anticipated to reach USD 2961.42 million by 2032, growing at a CAGR of 13.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic Floor Scrubber Market Size 2024 |

USD 1098.32 million |

| Robotic Floor Scrubber Market, CAGR |

13.2% |

| Robotic Floor Scrubber Market Size 2032 |

USD 2961.42 million |

The Robotic Floor Scrubber Market is shaped by strong competition among Numatic International Ltd., Amano Corporation, Dulevo International S.p.A., Polivac International Pty Ltd., Alfred Kärcher SE & Co. KG, Truvox International, Hako GmbH, Nilfisk A/S, Hefei Gaomei Cleaning Equipment Co., Ltd, and Diversey, Inc. These companies focus on autonomous navigation, longer battery life, and multi-function cleaning to strengthen adoption across commercial and industrial sites. North America remains the leading region with about 34% share in 2024, supported by rapid automation in airports, retail, healthcare, and logistics facilities seeking consistent hygiene and lower labor dependence.

Market Insights

- The Robotic Floor Scrubber market was valued at USD 1098.32 million in 2022 and is projected to reach USD 2961.42 million by 2032, at a CAGR of 13.2%.

- Rising labour costs, growing demand for automated cleaning in high-traffic areas, and stricter hygiene standards are increasing uptake of robotic scrubbers compared to manual cleaning.

- The “Only Scrubber” variant segment held the largest share in 2023, and battery runtime of “More than 4 hours” is gaining traction as facilities prefer longer-duration operations.

- Leading suppliers focus on advanced navigation, IoT integration and service models, yet high upfront costs and infrastructure compatibility issues restrict adoption among smaller facilities.

- North America dominates with a share of over 34% in 2023, supported by high automation readiness, infrastructure investment and demand in airports, retail and healthcare.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Variant

Scrubber and dryer units lead this segment with about 61% share in 2024 due to rising adoption in hospitals, airports, malls, and large commercial sites where fast drying lowers slip risk and reduces downtime. Facility managers prefer combined systems because the integrated squeegee and suction modules deliver cleaner surfaces in a single cycle, allowing crews to cover more area with fewer passes. Demand grows as enterprises replace manual mopping with automated units that provide consistent results, stronger hygiene control, and better water-usage efficiency across daily cleaning routines.

- For instance, Tennant’s T12 Compact Battery Ride‑On Scrubber‑Dryer offers a 1,040 mm cleaning path (with side brush), a 132 L solution tank, and a 166 L recovery tank enabling it to cover up to 6,660 m² per charge.

By Sales Type

New sales dominate this segment with nearly 68% share in 2024, supported by rapid adoption of autonomous scrubbers across retail, logistics, and corporate facilities. Buyers focus on new units because advanced navigation, low-noise motors, and improved obstacle-avoidance sensors boost productivity and reduce labor dependence. Enterprises invest in fresh fleets as part of long-term automation strategies, while the aftermarket grows steadily through consumables, replacement parts, and service contracts that keep existing fleets operational. Rising cleaning standards in high-traffic environments continues to push new-unit demand.

- For instance, Tennant Company sold its 10,000th autonomous mobile robot (AMR) scrubber in 2025, highlighting continued enterprise investment in new units.

By Battery Run Time

Models with more than 4 hours of battery life hold the dominant 57% share in 2024, as longer runtime supports uninterrupted cleaning in warehouses, airports, and large retail stores. Buyers prefer extended-runtime units because high-capacity lithium-ion packs reduce charging breaks, lower downtime, and improve area coverage per shift. Facilities with multi-floor operations rely on long-duration models to maintain continuous cleaning schedules. Systems with less than 4 hours runtime remain relevant in small offices and hospitality spaces, but large enterprises drive growth toward long-lasting, autonomous scrubbers.

Key Growth Drivers

Rising Demand for Automated Cleaning Across High-Traffic Facilities

High-traffic environments such as airports, malls, hospitals, and logistics hubs continue to adopt robotic floor scrubbers to reduce manual labor and maintain consistent cleanliness throughout long operating hours. Facility managers choose robotic systems because autonomous navigation and real-time obstacle sensing improve cleaning accuracy while lowering worker fatigue. The shift toward automated maintenance schedules also helps organizations reduce operational bottlenecks, especially during peak hours. Growing reliance on robotics supports stronger hygiene compliance, which remains a priority in healthcare and food-grade facilities. As building footprints expand and labor shortages persist, enterprises accelerate adoption to maintain large areas with predictable cycle times.

- For instance, Denver Public Schools (DPS) deployed 20 Tennant T380AMR machines after initially deploying 14, a decision driven by positive initial results. The district added six more machines in the summer of 2022, increasing their total to 20 robotic scrubbers.

Advancements in Battery Technology and Autonomous Navigation

Improved lithium-ion batteries, longer runtime, and fast-charging capabilities make robotic floor scrubbers more practical for long cleaning shifts across large commercial settings. Modern units cover wider surface areas without frequent charging, reducing downtime and increasing overall workflow efficiency. Developers integrate LiDAR, SLAM navigation, and multi-sensor fusion to enhance path accuracy and reduce human intervention. These upgrades allow robots to adapt to dynamic spaces such as retail aisles or warehouse corridors with high object movement. As companies prioritize energy-efficient devices with stronger automation, advanced navigation and battery innovations become key adoption accelerators.

- For instance, the X6 ROVR supports up to six hours of continuous cleaning on its lithium-ion battery (typically 180 Ah), minimizing manual interventions with its optional docking station for automated recharging.

Rising Labor Costs and Growing Shortage of Skilled Cleaning Staff

Increasing labor expenses and recurring staff shortages push facilities to adopt robotic scrubbers to sustain daily cleaning operations with fewer workers. Enterprises face difficulty hiring and retaining cleaning staff for repetitive, physically demanding tasks, making automation a practical productivity solution. Robotic platforms reduce reliance on large cleaning teams by handling repetitive floor-care cycles while staff focus on manual detailing. This structural shift helps organizations manage costs, improve consistency, and meet strict service-level expectations. Governments and large corporations also promote automation incentives, strengthening demand for solutions that lower dependence on human labor.

Key Trend & Opportunity

Integration of IoT-Enabled Fleet Management Platforms

Manufacturers expand value offerings by equipping robotic scrubbers with IoT dashboards, remote monitoring, and data-driven performance analytics. Facility managers track cleaning routes, battery health, coverage time, and machine status through cloud portals that support predictive maintenance. This reduces unexpected downtime and improves fleet planning across multi-site operations such as retail chains and airports. Growing use of interconnected cleaning ecosystems opens opportunities for subscription-based software layers, enabling vendors to generate recurring revenue. As enterprises standardize digital facility management, demand rises for scrubbers that integrate with building management systems and enterprise IoT platforms.

- For instance, Brain Corp s BrainOS® FleetOps cloud portal provides real‑time dashboards with drill‑down reporting on Auto Usage (time spent in autonomous mode) and Area Covered (sq ft/hour) for each robot, enabling remote performance optimization.

Expansion of Muti-Function Robotic Cleaning Systems

The market moves toward multipurpose robots that combine scrubbing, drying, vacuuming, sweeping, and sanitizing functions in a single platform. Combined systems help organizations reduce device counts, lower maintenance costs, and optimize storage space. Vendors add modular accessories, UV-C disinfection attachments, and automatic water-refill stations to support a wider range of cleaning workflows. This shift creates strong growth opportunities as buyers prefer machines that deliver higher return on investment and reduce operational complexity. As hybrid cleaning robots enter manufacturing floors, airports, and institutional facilities, multifunctional automation becomes a key market trend.

- For instance, Avidbots’ Neo 2W, built for industrial settings, can clean up to 42,000 ft²/hour, uses swappable batteries with up to 6 hours of runtime, and navigates with advanced obstacle detection tailored for warehouse environments.

Growing Adoption in Industrial Warehouses and E-Commerce Fulfillment Centers

E-commerce expansion drives rapid growth in large warehouses that must maintain spotless floors for safety and compliance. Robotic scrubbers help warehouses reduce slip hazards, support 24/7 operation, and maintain consistent cleaning without slowing logistics flow. Adoption increases as facilities integrate robots into broader automation ecosystems that include AMRs and AS/RS systems. Companies also use robots to maintain hygiene in cold-chain and food-grade storage areas. The rise of mega-fulfillment centers and dark stores creates strong opportunities for heavy-duty scrubbers designed for long aisles, high dust levels, and large operational footprints.

Key Challenge

High Initial Purchase Cost and Limited Budget Flexibility

Robotic scrubbers require a high upfront investment due to embedded sensors, advanced motors, lithium-ion batteries, and autonomous software. Many small and mid-sized facilities struggle to justify the purchase cost compared to traditional manual equipment. Budget constraints restrict adoption, especially in cost-sensitive markets where cleaning operations run with small teams. Although long-term savings exist, decision makers hesitate when capital expenditure competes with other operational priorities. Vendors attempt to address this through leasing models, subscription services, and performance-based contracts, but the initial price remains a major barrier for widespread adoption.

Navigation Limitations in Highly Dynamic or Cluttered Environments

Robotic scrubbers struggle in spaces with unpredictable foot traffic, frequent layout changes, or dense shelf arrangements. While navigation technologies improve, robots still require consistent floor visibility and stable mapping for optimal performance. Retail stores, busy hospitals, and dynamic warehouse aisles often disrupt route planning, forcing staff intervention. This reduces the perceived value of fully autonomous cleaning and slows adoption in challenging sites. Vendors work to enhance AI-based obstacle recognition, adaptive path planning, and environment learning, but navigation reliability remains a key challenge in real-world conditions.

Regional Analysis

North America

North America leads the Robotic Floor Scrubber Market with about 34% share in 2024, driven by strong adoption across airports, retail chains, and healthcare facilities that prioritize automated cleaning. Large enterprises invest in autonomous units to reduce labor dependence and maintain consistent hygiene standards. The region benefits from high purchasing power, rapid technology acceptance, and availability of advanced models from leading manufacturers. Growth accelerates as commercial real-estate operators integrate robotic scrubbers into digital facility-management platforms. The expansion of warehouses and fulfillment centers further strengthens demand for long-runtime, heavy-duty robotic systems.

Europe

Europe holds roughly 29% share in 2024, supported by strict hygiene regulations, high labor costs, and strong environmental standards that favor energy-efficient robotic scrubbers. Airports, hospitality chains, and public institutions drive adoption as they shift from manual cleaning to automated operations. The region also benefits from advanced robotics manufacturing ecosystems in Germany, Italy, and the Nordic countries. Facilities adopt smart cleaning equipment to meet sustainability goals and reduce water usage. Expanding commercial spaces and growing interest in fleet-management software continue to push the market toward fully autonomous cleaning solutions.

Asia Pacific

Asia Pacific accounts for about 28% share in 2024, driven by rapid urban growth, rising commercial construction, and strong uptake of automation in China, Japan, South Korea, and Southeast Asia. Large malls, metro stations, airports, and hospitality chains invest in robotic scrubbers to maintain high cleanliness levels across dense, high-traffic environments. Local manufacturers introduce cost-competitive autonomous units, boosting regional penetration. Demand increases in industrial facilities and logistics hubs, where extended-runtime scrubbers support long operational hours. Government-led smart-city programs further accelerate deployment across public infrastructure.

Latin America

Latin America holds around 5% share in 2024, with growth led by expanding retail chains, airports, and corporate facilities in Brazil, Mexico, and Chile. Adoption remains moderate due to budget limitations, but demand rises as companies seek to reduce labor costs and improve cleaning efficiency. Growing interest in automation across hospitality and healthcare boosts uptake of mid-range robotic scrubbers. Improvements in commercial infrastructure and partnerships with global vendors help strengthen the regional presence of autonomous cleaning technologies. As awareness increases, the market gradually shifts toward energy-efficient and low-maintenance robotic models.

Middle East & Africa

The Middle East & Africa region captures nearly 4% share in 2024, supported by strong investments in luxury hotels, airports, and commercial complexes across the UAE, Saudi Arabia, and Qatar. Large public facilities adopt robotic scrubbers to maintain high hygiene levels and support 24/7 operations. The region favors advanced long-runtime units capable of handling large floor areas typical of malls and transport hubs. Africa shows slower adoption due to cost barriers, though interest grows in corporate offices and institutional facilities. Upcoming mega-projects and smart-city developments continue to create new deployment opportunities.

Market Segmentations:

By Variant

- Only Scrubber

- Scrubber and dryer

By Sales Type

By Battery Run Time

- Less than 4 Hours

- More than 4 hours

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Robotic Floor Scrubber Market features strong participation from major cleaning equipment manufacturers such as Numatic International Ltd., Amano Corporation, Dulevo International S.p.A., Polivac International Pty Ltd., Alfred Kärcher SE & Co. KG, Truvox International, Hako GmbH, Nilfisk A/S, Hefei Gaomei Cleaning Equipment Co., Ltd, and Diversey, Inc. These companies focus on advanced navigation, energy-efficient motors, and high-capacity lithium-ion batteries to strengthen product performance across commercial and industrial facilities. Many invest in IoT-enabled fleet management, automated docking stations, and multi-function cleaning systems to increase operational value. Partnerships with facility-management firms and large commercial chains help expand regional footprints. Companies also enhance service networks and subscription-based maintenance plans to support long-term use of autonomous fleets. Competition intensifies as new entrants introduce cost-efficient models while established brands innovate premium systems for airports, malls, warehouses, and healthcare buildings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, Hako GmbH Hako’s Minuteman brand promoted the RoboScrub 20 autonomous floor scrubber at ISSA 2023 Melbourne, emphasizing safe operation in complex environments. The robot uses 3D and 2D cameras plus multiple sensors for route learning, obstacle avoidance, and consistent autonomous scrubbing performance in industrial and commercial spaces.

- In September 2023, Amano Corporation Amano showcased its AI-equipped compact floor cleaning robot HAPiiBOT at RoboDEX Autumn 2023 in Makuhari Messe. The robot uses autonomous navigation, detects people and obstacles, supports cloud-based fleet management, and can clean continuously for about two hours, targeting facilities facing cleaning labor shortages.

Report Coverage

The research report offers an in-depth analysis based on Variant, Sales Type, Battery Run Time and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift toward fully autonomous models with improved mapping accuracy.

- Long-runtime lithium-ion systems will become standard across commercial and industrial facilities.

- IoT-enabled fleet management platforms will drive stronger adoption in multi-site operations.

- Multi-function robots combining scrubbing, drying, and sweeping will gain wider demand.

- Manufacturers will integrate AI-based obstacle recognition to improve real-world navigation.

- Leasing and subscription models will expand as buyers seek lower upfront costs.

- Adoption will rise in warehouses and fulfillment centres due to safety and productivity needs.

- Smart-city projects will accelerate deployment across airports, metros, and public buildings.

- Energy-efficient and water-saving designs will gain preference in sustainability-focused regions.

- Local manufacturing in Asia Pacific will intensify competition and lower product prices.