Market Overview

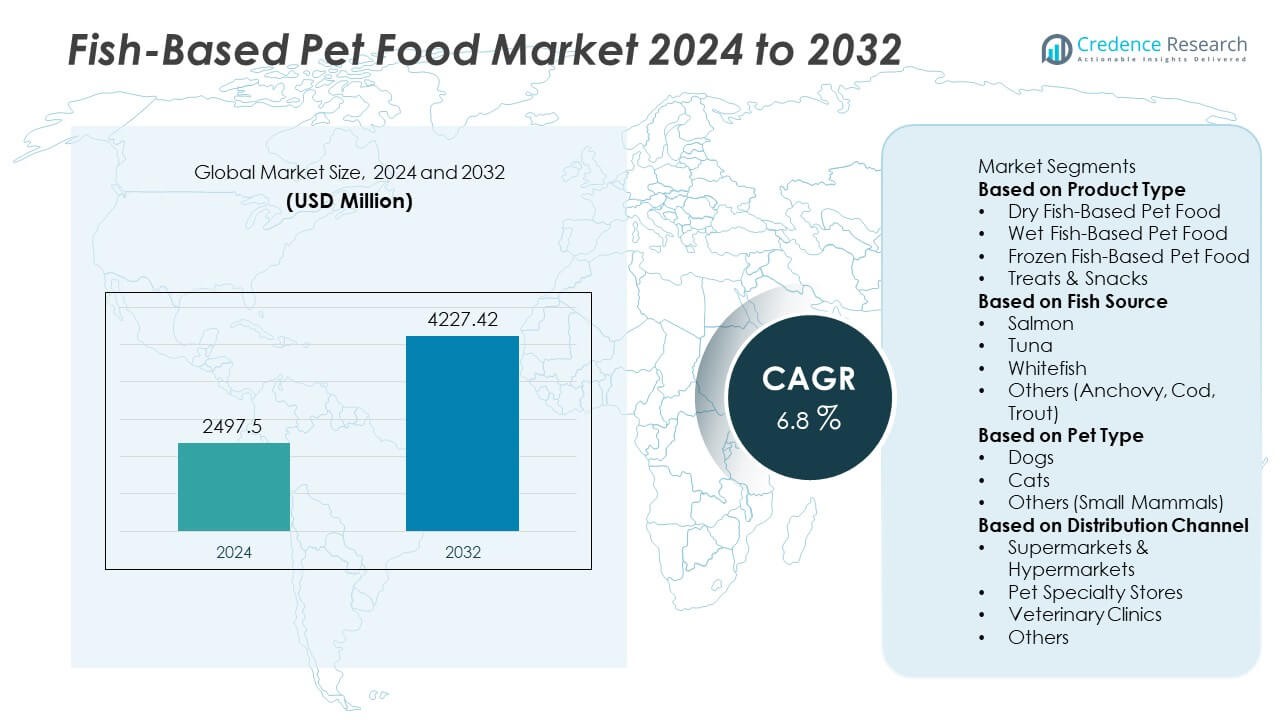

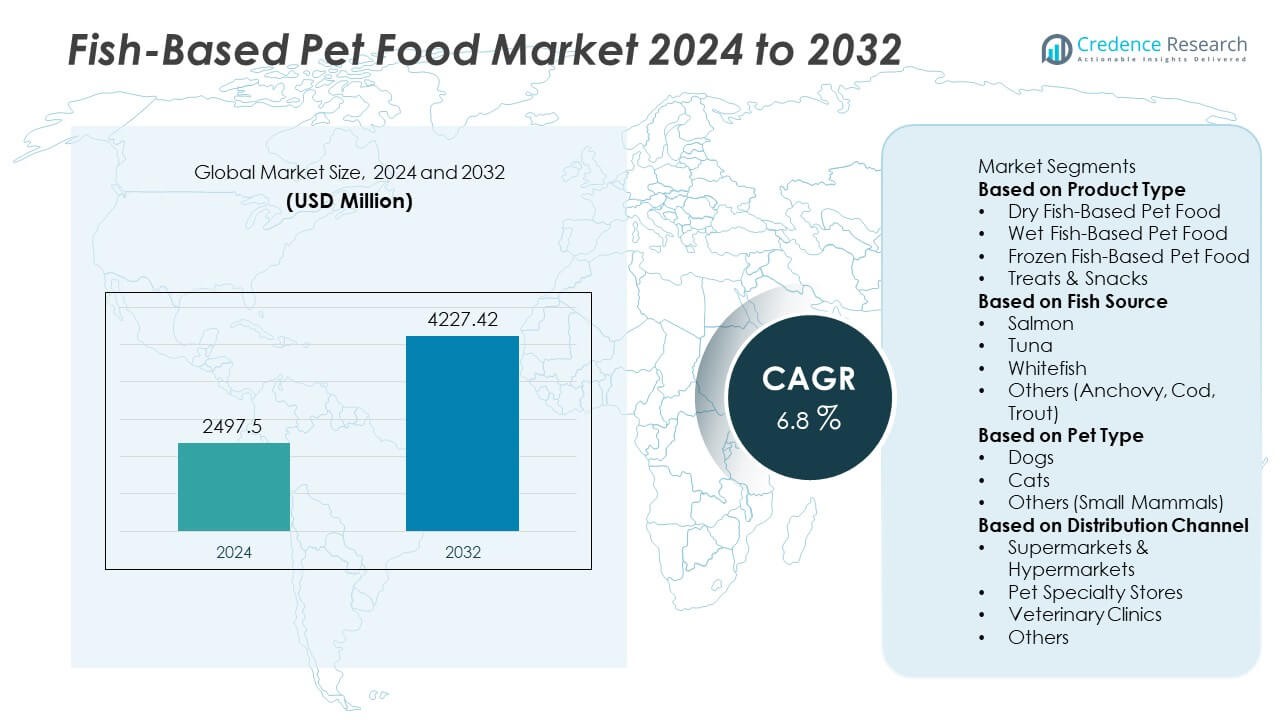

The Fish-Based Pet Food Market reached USD 2,497.5 million in 2024 and is projected to climb to USD 4,227.42 million by 2032, registering a 6.8% CAGR through the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fish-Based Pet Food Market Size 2024 |

USD 2,497.5 Million |

| Fish-Based Pet Food Market, CAGR |

6.8% |

| Fish-Based Pet Food Market Size 2032 |

USD 4,227.42 Million |

Top players in the Fish-based Pet Food market include Mars Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, Blue Buffalo, WellPet LLC, Spectrum Brands, Diamond Pet Foods, Nutro Products, Champion Petfoods, and Farmina Pet Foods. These companies strengthen their portfolios with salmon-, tuna-, and whitefish-based formulations to meet rising demand for premium and functional pet nutrition. North America leads the market with 31% share, driven by strong adoption of grain-free and omega-rich diets, followed closely by Europe with 29% share supported by strict clean-label and sustainability standards. Asia Pacific holds 28% share and remains the fastest-growing region due to expanding pet ownership and strong preference for marine protein diets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 2,497.5 million in 2024 and will grow at a 6.8% CAGR through 2032, supported by rising demand for premium marine protein pet diets.

- Strong protein value and high omega content drive adoption, while dry fish-based products lead the segment with a 41% share due to better storage and cost benefits.

- Sustainable sourcing, freeze-dried formats, and clean-label formulas shape new trends as brands invest in traceable supply chains and functional nutrition to meet owner expectations.

- Major players expand salmon and whitefish ranges, while regional firms add cost-focused lines; raw material volatility and safety concerns limit faster expansion across global markets.

- North America holds 31%, Europe holds 29%, and Asia Pacific holds 28% market share; dogs remain the dominant pet type with 57% share due to higher product consumption.

Market Segmentation Analysis:

By Product Type

Dry fish-based pet food leads this segment with 41% market share, driven by strong demand for long shelf life, easy storage, and cost-effective nutrition. Dry formats support high-protein blends and allow brands to infuse omega-rich fish meals into stable kibble structures. Wet fish-based pet food also gains traction due to rising preference for moisture-rich diets among senior pets. Frozen and semi-moist options expand gradually as owners explore minimally processed choices. Treats and snacks grow through premiumization, but dry formulations remain dominant because they offer convenient feeding, better dental benefits, and strong adoption among both dog and cat owners.

- For instance, Mars Petcare is a leading provider of science-backed nutrition and therapeutic health products across its 50+ global brands, which include fish-based recipes such as those offered by the Whiskas and Purepet brands that contain omega-3 fatty acids.

By Fish Source

Salmon accounts for the largest share with 38% market share, supported by its rich omega-3 content, strong digestibility, and rising use in sensitive-stomach formulas. Brands use salmon in grain-free and hypoallergenic blends, boosting adoption in both premium and functional pet diets. Tuna and whitefish follow due to stable availability and consistent protein levels suited for everyday feeding. Other sources such as cod, trout, and anchovy help diversify product portfolios and reduce sourcing pressure. Salmon maintains leadership because it aligns with consumer preference for high-quality marine protein and supports skin, coat, and joint health benefits across pet categories.

- For instance, Nestlé Purina uses salmon as a main ingredient in its Pro Plan and Beyond pet food ranges, which are formulated with quality ingredients and aim to provide high protein and essential nutrients.

By Pet Type

Dog food dominates this segment with 57% market share, driven by higher consumption volume and broader product availability in both dry and wet formats. Owners prefer fish-based dog diets for improved coat quality, allergy management, and digestive support. Cat products expand steadily due to strong acceptance of marine flavors and higher protein requirements. Small mammals represent a small niche but gain presence through specialty snack products. Dogs hold the largest share because manufacturers prioritize dog-specific formulations, invest in omega-rich recipes, and expand premium fish-based lines that address weight control, gut balance, and skin sensitivities.

Key Growth Drivers

Rising Demand for High-Protein and Omega-Rich Diets

Pet owners increasingly choose fish-based formulas for their superior protein quality and high omega-3 content, which support skin health, joint function, and overall vitality. This demand strengthens premium product adoption across both dog and cat categories. Brands expand formulations using salmon, tuna, and whitefish to meet evolving nutrition standards. Veterinary recommendations for fish-based diets in allergy-prone pets further stimulate market growth. As health-focused feeding becomes mainstream, fish-based pet food secures stronger presence in specialty retail and online platforms.

- For instance, Blue Buffalo formulates its Life Protection fish recipes with real deboned whitefish as the first ingredient to help adult dogs build and maintain healthy muscles. This natural dry dog food is enhanced with a precise blend of vitamins, minerals, and antioxidants in its exclusive LifeSource Bits®, which are cold-formed to help retain the potency of heat-sensitive nutrients.

Expansion of Premium and Functional Pet Nutrition

Premiumization drives strong growth as consumers shift toward natural, grain-free, and digestive-support fish formulations. Manufacturers integrate specialized ingredients such as algae-based DHA, taurine, and antioxidants to enhance functional value. Premium fish-based treats and freeze-dried formats attract attention from owners seeking minimally processed diets. Higher willingness to pay for advanced nutrition accelerates product portfolio expansion. Rising interest in breed-specific and age-specific diets reinforces demand for high-quality marine proteins in customized formulations.

- For instance, Farmina expanded its N&D Ocean line using a vacuum coater system to integrate healthy oils and fatty acids deep within each kibble and packaging the final product in a protective nitrogen atmosphere to ensure nutrient retention and freshness.

Growth of Online Retail and Direct-to-Consumer Channels

Online platforms amplify market reach by offering wider product availability, subscription models, and fast delivery. Consumers prefer digital channels for comparing ingredients, sourcing details, and nutrition claims. Direct-to-consumer brands leverage targeted marketing and transparent labeling to build trust around fish-based products. E-commerce also supports niche offerings such as single-source protein diets and limited-ingredient formulas. Rising adoption of mobile shopping and recurring purchases strengthens repeat buying, supporting steady revenue growth across global markets.

Key Trends & Opportunities

Rise of Sustainable and Traceable Marine Sourcing

Sustainability becomes a major trend as buyers favor fish-based pet food made from responsibly sourced marine ingredients. Companies invest in certified fisheries, byproduct utilization, and traceable supply chains. Technologies such as blockchain and digital tagging enhance ingredient transparency and build trust among eco-conscious consumers. Sustainable fish oils, algae-derived omega supplements, and MSC-certified fish meals gain traction. This shift creates strong opportunities for brands that promote clean labeling and low-impact sourcing practices.

- For instance, Mars Petcare strengthened traceable marine sourcing by integrating a digital verification system across its supply chain that audits 22,000 metric tons of fish raw material per year, using vessel-ID tracking and barcoded batch logs to ensure compliance with certified low-impact fisheries.

Innovation in Freeze-Dried, Air-Dried, and Alternative Fish Formats

Processing innovations expand opportunities in freeze-dried, air-dried, and cold-pressed fish-based products, appealing to owners who prefer nutrient-dense, minimally processed diets. These formats retain higher protein integrity and natural flavor, increasing acceptance among both dogs and cats. Manufacturers explore novel fish species and blend marine proteins with functional additives to enhance digestive health. Premium treat innovations also accelerate growth. As pet owners explore advanced feeding formats, companies offering innovative textures and high-nutrient retention gain competitive advantage.

- For instance, Champion Petfoods uses an advanced vacuum freeze-drying process to remove moisture at low temperatures, which typically involves vacuum pressures below 1 millibar (approximately 0.75 Torr) during the primary drying phase.

Key Challenges

Supply Volatility and Marine Resource Constraints

The market faces challenges due to fluctuating fish availability and rising competition for marine resources. Seasonal variations, quota regulations, and climate-related disruptions impact raw material stability. Price volatility for salmon, tuna, and whitefish affects production planning and margins. Manufacturers face growing pressure to diversify sources and adopt alternative marine proteins. These constraints compel companies to strengthen supply partnerships and invest in long-term sustainability strategies to maintain consistent output.

Rising Concerns Over Contaminants and Product Safety

Concerns regarding mercury levels, microplastics, and environmental toxins in marine ecosystems affect buyer confidence in fish-based diets. Manufacturers must comply with stringent testing protocols and quality-control measures to ensure product safety. Regulatory scrutiny increases for imported fish meals and oils, raising compliance costs. Brands must communicate transparency in sourcing, testing, and processing to maintain trust. These challenges highlight the need for robust safety standards and continuous monitoring across the fish-based pet food supply chain.

Regional Analysis

North America

North America holds 31% market share, supported by strong demand for premium and natural fish-based pet diets. Consumers prefer salmon and whitefish blends for skin and coat support, driving steady growth in both dog and cat categories. Retailers expand shelf space for grain-free and functional marine protein formulas, while online channels boost access to specialty brands. Veterinary endorsements for fish-based diets in allergy-prone pets further strengthen adoption. The region benefits from high spending power, strong brand presence, and rising interest in sustainable fish sourcing across major markets in the United States and Canada.

Europe

Europe accounts for 29% market share, driven by a mature pet nutrition sector and high adoption of clean-label fish-based products. Owners prefer responsibly sourced salmon, cod, and trout, aligning with the region’s strong sustainability focus. Premium wet and dry fish-based diets gain traction as consumers prioritize digestive care and high omega-3 content. Regulatory support for transparent labeling strengthens trust in marine protein formulations. Growth accelerates across Germany, the United Kingdom, France, and Nordic countries, where pet humanization trends and higher spending on functional pet food continue to expand market penetration.

Asia Pacific

Asia Pacific leads growth momentum and holds 28% market share, driven by rising pet ownership in China, Japan, South Korea, and emerging Southeast Asian markets. Fish-based diets gain strong acceptance because marine flavors align with regional feeding habits and preferences. Manufacturers introduce salmon and tuna-rich diets to address skin sensitivities and support higher protein needs in cats, a dominant pet category in several Asian countries. E-commerce expansion accelerates brand visibility and access to premium ranges. Growing urbanization, increased adoption of companion animals, and improving awareness of pet nutrition strengthen the region’s long-term demand.

Latin America

Latin America holds 7% market share, supported by rising pet care spending in Brazil, Mexico, and Chile. Fish-based products gain traction as owners seek healthier protein alternatives for digestive support and allergy management. Brands introduce more cost-effective salmon and tuna formulations to meet regional affordability needs. Growth in specialty retail and online platforms improves availability of premium options. Increasing awareness of omega-rich diets and improved distribution networks contribute to steady adoption. Despite price sensitivity in some markets, rising interest in functional marine protein blends drives expansion across urban pet-owning households.

Middle East & Africa

The Middle East & Africa region accounts for 5% market share, driven by gradual expansion of premium pet nutrition across the UAE, Saudi Arabia, and South Africa. Fish-based products gain attention for their digestibility, high protein value, and suitability for pets with skin and coat issues. International brands dominate due to limited regional manufacturing, supported by growing specialty retail channels. Rising expatriate populations and urban pet adoption strengthen demand for salmon and whitefish formulations. Despite slower penetration in price-sensitive markets, increasing awareness of premium marine-based diets supports steady long-term growth in the region.

Market Segmentations:

By Product Type

- Dry Fish-Based Pet Food

- Wet Fish-Based Pet Food

- Frozen Fish-Based Pet Food

- Treats & Snacks

By Fish Source

- Salmon

- Tuna

- Whitefish

- Others (Anchovy, Cod, Trout)

By Pet Type

- Dogs

- Cats

- Others (Small Mammals)

By Distribution Channel

- Supermarkets & Hypermarkets

- Pet Specialty Stores

- Veterinary Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Fish-based Pet Food market features leading companies such as Mars Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, Blue Buffalo, WellPet LLC, Spectrum Brands, Diamond Pet Foods, Nutro Products, Champion Petfoods, and Farmina Pet Foods. Competitive activity intensifies as brands expand fish-rich formulations using salmon, tuna, and whitefish to strengthen premium and functional product lines. Major players invest in clean-label ingredients, traceable sourcing, and omega-enhanced recipes to differentiate in a crowded market. Sustainability commitments shape new product development as companies adopt certified fisheries, byproduct utilization, and advanced fish meal processing. Growing demand for grain-free, hypoallergenic, and sensitive-stomach diets pushes manufacturers to enhance R&D capabilities and diversify marine protein options. Digital retail growth encourages companies to scale direct-to-consumer strategies, subscription models, and targeted online campaigns. Regional competitors further strengthen market fragmentation by offering cost-effective blends tailored to local preferences and purchasing behavior.

Key Player Analysis

- Mars, Incorporated

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- Blue Buffalo (General Mills)

- WellPet LLC

- Spectrum Brands Holdings

- Diamond Pet Foods

- Nutro Products (Mars Petcare)

- Champion Petfoods

- Farmina Pet Foods

Recent Developments

- In June 2025, Mars Petcare (a division of Mars, Incorporated) committed to full digital traceability of seafood ingredients in its pet-food business by adopting the Global Dialogue on Seafood Traceability (GDST) standard and partnering with Wholechain.

- In July 2023, Hill’s Pet Nutrition did introduce new formulas in its Science Diet Sensitive Stomach & Skin portfolio featuring MSC-certified wild-caught Alaskan pollock.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Fish Source, Pet Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for omega-rich marine protein diets will grow as owners prioritize skin and coat health.

- Premium and grain-free fish-based formulations will expand across both online and offline channels.

- Sustainable and traceable fish sourcing will become a core focus for major brands.

- Freeze-dried, air-dried, and minimally processed fish products will gain stronger market traction.

- Veterinary recommendations for hypoallergenic fish diets will support wider adoption in sensitive pets.

- Direct-to-consumer subscription models will rise as buyers seek convenience and consistent supply.

- Functional blends with DHA, taurine, and antioxidants will shape product innovation.

- Regional players will increase competitiveness by adding cost-effective marine protein options.

- Advanced quality testing and contaminant control will remain essential for building consumer trust.

- Asia Pacific will grow faster due to rising pet ownership and strong preference for marine flavors.