Market Overview:

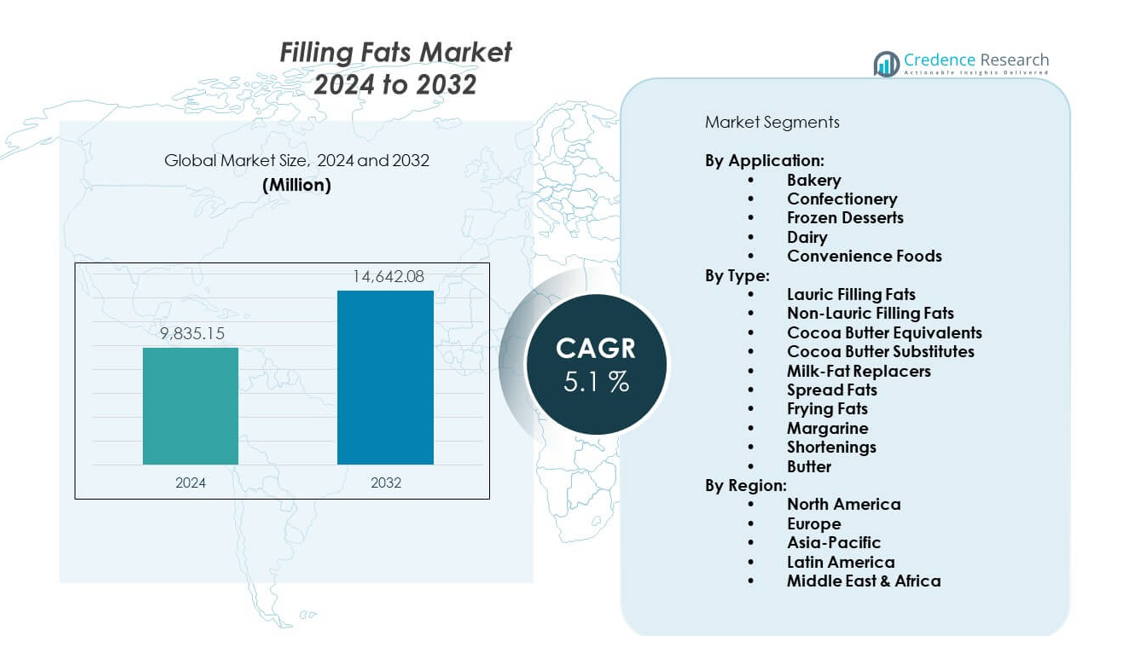

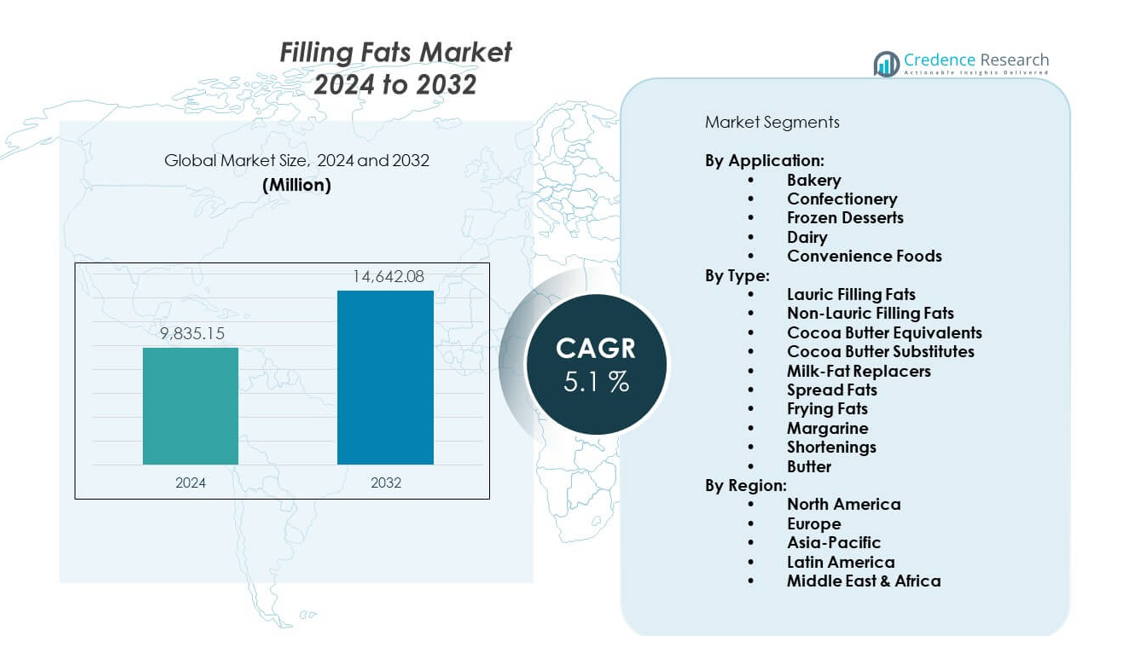

The Filling Fats Market is projected to grow from USD 9,835.15 million in 2024 to an estimated USD 14,642.08 million by 2032, with a compound annual growth rate (CAGR) of 5.1% from 2024 to 2032. Demand rises across confectionery, bakery, and dairy blends as manufacturers seek stable textures and cost-effective fat systems for large-scale production.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Filling Fats Market Size 2024 |

USD 9,835.15 million |

| Filling Fats Market, CAGR |

5.1% |

| Filling Fats Market Size 2032 |

USD 14,642.08 million |

Growing use in chocolates, cream fillings, and layered bakery items drives steady expansion. Food producers adopt specialty filling fats to gain better mouthfeel and heat stability in warm climates. It supports wider product launches in value and premium segments. Brands also shift toward trans-fat-free formulations to match strict nutrition rules. Large confectionery and bakery companies invest in advanced fat modification to maintain consistent performance. Rising demand for longer shelf life also supports deeper use across developing markets.

North America and Europe lead due to mature bakery and confectionery industries with strong demand for premium and specialty filling systems. Asia Pacific emerges as a fast-growing region because bakery chains and chocolate manufacturers expand production capacity. The Middle East and Latin America show rising adoption driven by higher processed food intake and growth in industrial bakery units. Africa sees gradual growth with increasing urbanisation and wider retail distribution. Global producers strengthen supply chains across these regions to meet rising food manufacturing needs.

Market Insights:

- The Filling fats market is valued at USD 9,835.15 million in 2024 and is projected to reach USD 14,642.08 million by 2032, expanding at a 1% CAGR through the forecast period.

- North America holds 32%, Europe holds 29%, and Asia-Pacific holds 28%, driven by strong bakery and confectionery production, advanced processing technology, and high consumer demand in these mature markets.

- Asia-Pacific is the fastest-growing region with a 28% share, supported by rapid industrial bakery expansion, rising packaged food consumption, and stronger manufacturing capacity.

- The bakery application segment leads with an estimated 40% share, driven by high demand for cream-filled and laminated bakery products.

- Lauric and non-lauric filling fats collectively account for about 35% share, supported by their use in confectionery coatings and heat-stable bakery fillings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Heat-Stable and Cost-Efficient Fat Systems in Confectionery Applications

The demand for heat-stable and cost-efficient fat systems supports strong growth in the Filling fats market. Confectionery makers depend on specialty fats to maintain texture under warm storage and transport conditions. It helps brands deliver consistent quality across global retail channels. Manufacturers use advanced fractionation to create fats with reliable melting points. The shift to wider chocolate consumption in tropical regions strengthens adoption. Product developers rely on stable fats to reduce bloom risk in coated items. The market benefits from rising demand for affordable alternatives to cocoa butter. Large producers expand supply chains to support high-volume confectionery production.

- For instance, Barry Callebaut developed heat-resistant chocolate that withstands temperatures up to 38°C, confirmed through global trials and public technical reports.

Rising Use of Tailored Fats to Enhance Texture, Spreadability, and Sensory Performance in Bakery Fillings

Bakeries use tailored fat compositions to improve the spreadability and sensory profile of fillings. The Filling fats market gains steady traction from rising demand for layered pastries and cream-filled items. It supports better aeration and structure in whipped fillings used by industrial bakeries. Producers develop controlled crystal forms to achieve smoother textures. Brands rely on these fats to meet consumer expectations for premium mouthfeel. Large bakery chains invest in stable fat systems to extend shelf life. The need for consistent filling viscosity boosts innovation in formulation. Demand rises across both frozen and ambient bakery formats.

- For instance, AAK reported that its Akopastry™ line improves aeration volume by up to 20% in industrial bakery tests, documented in its published technical performance sheets.

Stronger Shift Toward Trans-Fat-Free and Clean Label Fat Ingredients Across Global Food Lines

The global move away from trans fats drives significant growth in the Filling fats market. Food companies upgrade fat systems to meet evolving nutrition rules. It encourages adoption of interesterified and naturally structured fats. Buyers seek clean label solutions that deliver high stability. Producers reformulate to remove partially hydrogenated oils from major product lines. Retailers promote healthier profiles to match rising consumer concerns. Ingredient suppliers scale up non-hydrogenated options. These changes support stronger penetration across mass-market foods.

Expansion of Industrial Food Processing Capacity and Need for Functionally Superior Fat Blends

Large food processors continue to increase capacity, which boosts adoption in the Filling fats market. It supports the demand for reliable fat systems that work across automated lines. Producers design blends that deliver uniform performance in high-speed equipment. Filling fats help reduce downtime linked to melting instability. Manufacturers in emerging markets expand plants to meet rising snack and dessert consumption. Shelf-life stability requirements also influence product development. Many companies add flexible fat systems that work across multiple product categories. This shift encourages long-term supplier partnerships.

Market Trends:

Growing Formulation of Specialty Filling Fats That Support Premiumization in Bakery and Confectionery Products

Specialty filling fats tailored for premium foods gain strong attention. The Filling fats market benefits from rising interest in high-end pastries and gourmet chocolates. It supports producers aiming for smoother textures and refined sensory profiles. Premium brands invest in fats with narrow melting ranges. Formulators use advanced structuring to achieve richer mouthfeel. Demand rises for high-quality coatings made for luxury confectionery lines. Producers widen their specialty portfolios to target niche segments. Innovation in fat crystallisation helps brands elevate product positioning.

- For instance, Fuji Oil produces specialty fat formulations, such as those used in premium confectionery, which are designed to resist fat bloom and improve functionality.

Rising Preference for Plant-Based and Sustainable Fat Sources Across Filling Applications

Plant-derived filling fats gain momentum in global product lines. The Filling fats market sees rising interest in sustainable sourcing. It encourages manufacturers to use palm alternatives and diversified oil crops. Brands highlight environmental and ethical sourcing on product labels. Producers refine plant-based fats to match performance needed in fillings. Vegan bakery products push demand for clean and natural fat systems. Ingredient suppliers invest in traceable supply chains. These trends shape procurement strategies for major food manufacturers.

- For instance, Unilever reported achieving 97.5% deforestation-free status for its key crops (including palm oil) by the end of 2023, which was independently verified through its global sustainability disclosures. The company also reached 98% traceability of its in-scope palm oil volumes to both the mill and plantation level.

Increasing Adoption of Structured and Interesterified Fats to Improve Functional Flexibility in Industrial Processing

Structured and interesterified fats strengthen industrial flexibility. The Filling fats market gains support from processors needing adaptable fat profiles. It helps brands standardise textures across multiple production sites. Manufacturers apply enzymatic interesterification for precise control. Many food plants need fats that perform well under varying temperature cycles. Adoption rises in automated bakery and confectionery systems. Producers promote stable crystal networks for better output. These improvements enhance consistency in mass-produced items.

Steady Growth in Demand for Low-Fat and Reduced-Calorie Filling Systems for Health-Focused Food Categories

Low-fat and reduced-calorie filling systems attract growing investment. The Filling fats market evolves to match global health awareness. It strengthens interest in fats that mimic indulgence with fewer calories. Manufacturers work on blends that support clean taste and smooth texture. Brands launch reduced-calorie fillings in snacks and bakery goods. Consumer focus on healthier desserts shapes product innovation. Producers refine formulations to avoid waxy mouthfeel. These shifts redefine new product development in many segments.

Market Challenges Analysis:

Stringent Nutrition Rules, Price Volatility in Edible Oils, and Complex Fat Reformulation Constraints

Global producers face rising pressure from strict nutrition rules in the Filling fats market. It pushes companies to remove trans fats while maintaining performance. Producers struggle with reformulation that keeps texture stable. Edible oil price volatility increases procurement risk. It creates margin pressure for large manufacturers. Many producers depend on supply chains that face climate-linked disruptions. Reformulation limits arise when replacing traditional fats. Technical constraints challenge small and mid-size processors.

Limited Access to Sustainable Raw Materials and Operational Barriers in Emerging-Region Food Industries

Sourcing certified and sustainable oils creates long-term challenges. The Filling fats market grows but faces uneven supply quality across regions. It slows expansion in areas with limited industrial infrastructure. Many local bakeries lack machinery that supports advanced fat blends. It reduces adoption of high-performance alternatives. Manufacturers also deal with inconsistent cold-chain conditions. These barriers delay large-scale transition to improved filling systems. Producers work to navigate these hurdles while expanding into new markets.

Market Opportunities:

Rising Demand for Premium, Clean Label, and Plant-Based Filling Systems in Global Food Categories

Premium and plant-based innovations create strong opportunities in the Filling fats market. It supports brands aiming for natural positioning. Clean label lines drive research into minimally processed fats. Vegan bakery and confectionery categories open new supply avenues. Growing demand for palm-alternative fats supports portfolio expansion. Producers also promote transparent sourcing to attract health-focused buyers. Many brands explore niche premium fillings for high-value products.

Expansion of Industrial Bakery, Confectionery, and Ready-to-Eat Food Production in High-Growth Regions

Growth in industrial food plants creates new openings. The Filling fats market benefits from rising capacity in Asia, Africa, and Latin America. It aligns with rising demand for packaged snacks and desserts. Producers invest in flexible fat systems for automated lines. Wider cold-chain improvements support adoption in warm regions. Many global suppliers strengthen distribution partnerships. Brands also introduce diverse filling formats in fast-growing markets.

Market Segmentation Analysis:

By Application

The Filling fats market grows due to wide use across major food categories. Bakery applications lead demand because producers need stable fats for pastries, creams, and laminated products. It supports better texture and longer shelf life across industrial bakery lines. Confectionery follows with strong use in fillings for bars, pralines, and coated items. Frozen desserts rely on structured fats for smooth mouthfeel and controlled melting. Dairy processors adopt tailored blends for flavored creams and value-added products. Convenience foods also expand usage with rising consumption of filled snacks and ready-to-eat items.

- For instance, Mondelēz International news releases have reported that approximately 34 billion to over 60 billion Oreo cookies are sold each year globally, confirming heavy reliance on stable filling systems to manage immense production volumes.

By Type

Type segmentation reflects varied functional needs across food industries. Lauric filling fats and non-lauric variants hold strong demand due to controlled melting behavior and stability in diverse climates. It helps manufacturers maintain quality in high-volume production. Cocoa butter equivalents and substitutes support confectionery makers seeking cost efficiency. Milk-fat replacers gain traction in bakery and dairy applications. Spread fats and frying fats serve broader processing needs. Margarine and shortenings remain essential for aeration, structure, and volume development. Butter retains a niche in premium bakery formulations where flavor drives purchasing decisions.

Segmentation:

By Application:

- Bakery

- Confectionery

- Frozen Desserts

- Dairy

- Convenience Foods

By Type:

- Lauric Filling Fats

- Non-Lauric Filling Fats

- Cocoa Butter Equivalents

- Cocoa Butter Substitutes

- Milk-Fat Replacers

- Spread Fats

- Frying Fats

- Margarine

- Shortenings

- Butter

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a strong position with an estimated 32% share in the Filling fats market. The region benefits from a mature bakery and confectionery industry with high adoption of specialty fat systems. It supports heavy use of non-lauric fats for stable performance across large industrial lines. Food manufacturers focus on reformulation to meet clean-label and trans-fat-free expectations. The region also invests in premium and functional fillings that enhance product differentiation. Growth remains steady due to strong retail demand for packaged bakery snacks. The Filling fats market gains stable volume support from established food brands in the United States and Canada.

Europe

Europe accounts for nearly 29% share, driven by strong demand for bakery fats used across laminated doughs, pastries, and cream-filled items. Producers adopt structured fat systems that meet strict EU nutrition and sustainability rules. It supports increased use of cocoa butter equivalents and milk-fat replacers in chocolate and dairy applications. Many manufacturers focus on high-quality formulations that align with regional premiumisation trends. The region also benefits from advanced processing technology and strong supply chain integration. Demand remains consistent in Germany, France, Italy, and the United Kingdom. Europe sets high standards that influence global formulation trends.

Asia-Pacific

Asia-Pacific leads in growth momentum and holds roughly 28% share, making it the fastest-growing regional contributor. Rapid expansion in industrial bakery and confectionery plants drives strong market uptake. It supports higher consumption of filled biscuits, chocolate products, and frozen desserts across China, India, Japan, and Southeast Asia. Rising urbanisation and wider access to packaged foods boost demand for stable and cost-effective filling fats. Local manufacturers invest in new processing facilities to match rising consumer demand. The region shifts toward both premium and mass-market products supported by diverse fat systems. The Filling fats market gains long-term growth potential from expanding regional supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Filling fats market shows strong competition among global ingredient suppliers focused on premiumisation, stability, and cost-effective fat systems. Large players expand their portfolios through structured fats, interesterified blends, and clean-label alternatives. It drives continuous investment in R&D to enhance melting profiles and sensory performance. Companies strengthen regional supply chains to improve availability for industrial bakeries and confectionery plants. Strategic collaborations support sustainable sourcing and tailored fat solutions. Smaller manufacturers compete through niche offerings in plant-based and specialty fat categories. Leading suppliers work to balance performance, compliance, and pricing stability across global markets.

Recent Developments:

- In March 2025, Cargill introduced a range of innovative ingredient solutions at AAHAR 2025 to meet the growing demand for high-quality foods in India’s specialty fats and oils segment.

- In July 2025, Bunge Limited completed its merger with Viterra Limited, creating a premier agribusiness solutions company that significantly expanded Bunge’s plant-based oils and fats portfolio, positioning it as a key supplier in the global filling fats market. This combination enhances their ability to supply specialty solutions for bakery and confectionery clients, leveraging global origination and distribution capabilities.

Report Coverage:

The research report offers an in-depth analysis based on application and type segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for stable filling fats will rise across bakery and confectionery production lines.

- Plant-based and clean-label fat systems will gain wider adoption.

- Heat-stable and bloom-resistant variants will see strong development focus.

- Regional supply chain expansion will strengthen manufacturer resilience.

- High-growth markets in Asia-Pacific will drive new capacity investments.

- Reformulation pressure will increase due to evolving nutrition rules.

- Speciality fats designed for premium foods will grow in demand.

- Automation in food processing plants will encourage use of consistent fat systems.

- Partnerships for sustainable sourcing will shape procurement strategies.

- Innovation in enzymatic interesterification will shape next-generation formulations.