Market Overview

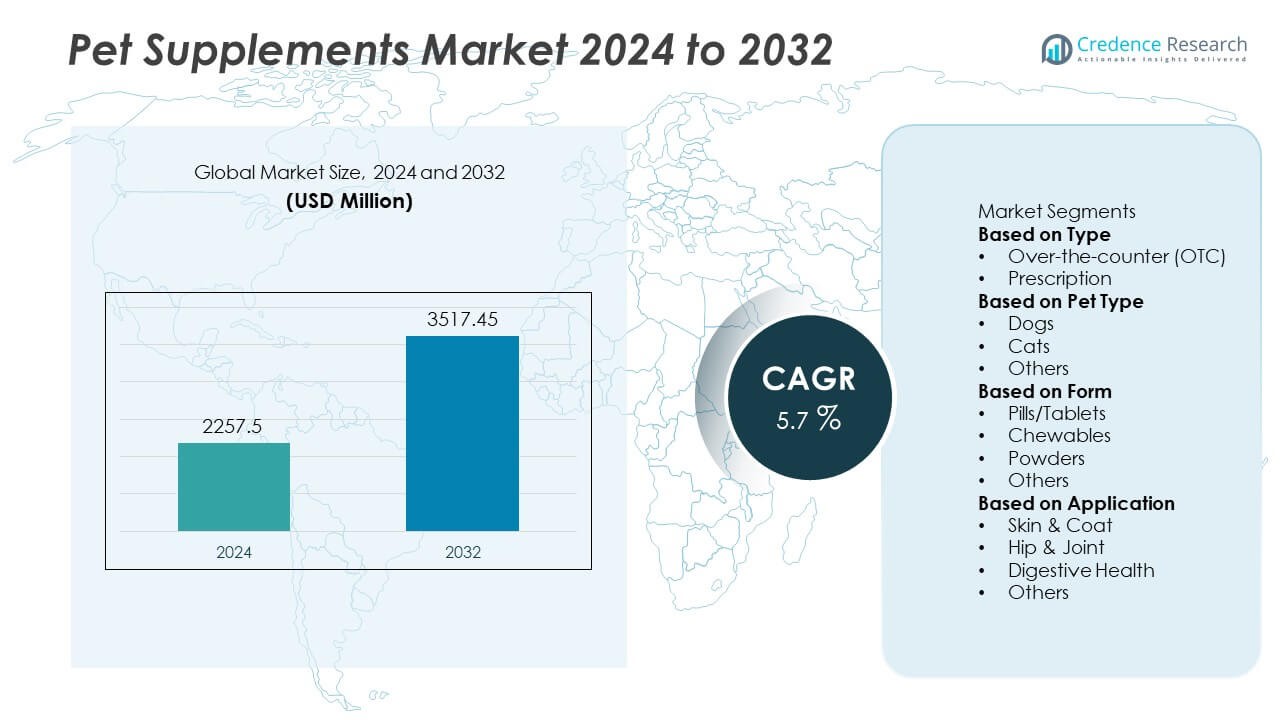

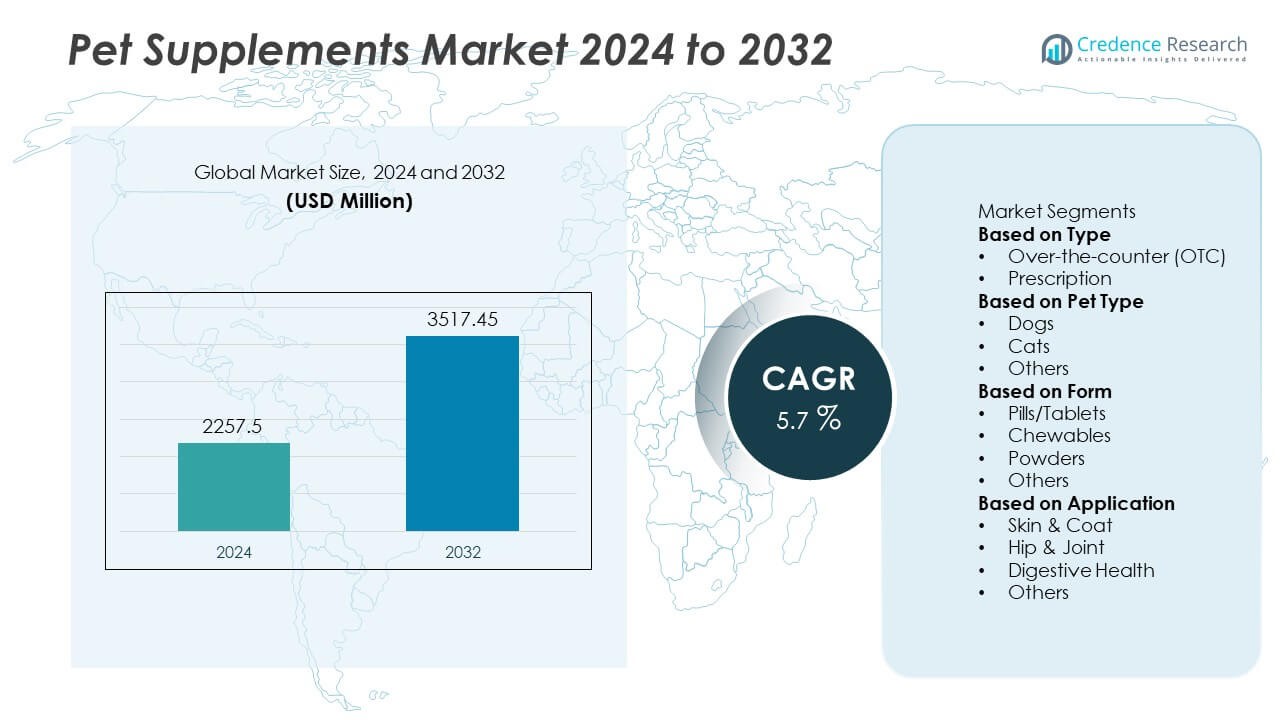

The Pet Supplements market reached USD 2,257.5 million in 2024 and is projected to hit USD 3,517.45 million by 2032. The market is expanding at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pet Supplements Market Size 2024 |

USD 2,257.5 Million |

| Pet Supplements Market, CAGR |

5.7% |

| Pet Supplements Market Size 2032 |

USD 3,517.45 Million |

The Pet Supplements market features leading players such as Nestlé Purina PetCare, Mars Petcare (Greenies), Hill’s Pet Nutrition, Zesty Paws, Nutramax Laboratories, Virbac, Ark Naturals, VetriScience Laboratories, NaturVet, and PetHonesty. These companies strengthen their positions through innovation in functional blends, clean-label ingredients, and improved delivery formats that increase acceptance among pets. North America leads the global market with a 38% share, supported by high pet ownership, strong preventive healthcare adoption, and advanced retail and online distribution networks. Europe follows with a solid presence driven by strict quality standards and rising demand for natural formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pet Supplements market reached USD 2,257.5 million in 2024 and will rise to USD 3,517.45 million by 2032 at a CAGR of 5.7%.

- Key drivers include rising preventive pet healthcare adoption and strong demand for functional supplements that support joint health, immunity, and digestion, especially in dogs which hold a 74% segment share.

- Major trends include growing preference for natural, clean-label ingredients and wider acceptance of chewable formats, which lead the form segment with a 45% share.

- Competitive pressure increases as companies expand premium formulations, invest in clinical validation, and enhance online distribution supported by subscription models and personalized nutrition plans.

- North America leads with a 38% regional share, followed by Europe at 27% and Asia Pacific at 22%, while OTC products dominate the type category with a 67% share, shaping growth opportunities across global markets.

Market Segmentation Analysis:

By Type

Over-the-counter (OTC) supplements lead the market with a 67% share, driven by rising preference for easily accessible health products and broader retail availability across supermarkets, pharmacies, and online channels. Consumers choose OTC options for routine nutrition support, joint care, skin health, and immunity enhancement without the need for a veterinarian’s prescription. The segment grows further due to cost-effective formulations and frequent product innovation, including multivitamin blends and functional supplements. Prescription supplements hold the remaining share and serve targeted needs such as chronic joint diseases or digestive disorders, but demand grows slower due to mandatory clinical oversight.

- For instance, Nestlé Purina PetCare’s FortiFlora probiotic line is a number one veterinarian-recommended brand that contains a guaranteed minimum of 100 million (1×10⁸) viable CFU of Enterococcus faecium SF68 per sachet to support intestinal health and immune function in dogs.

By Pet Type

Dogs dominate the segment with a 74% share, supported by higher adoption rates and stronger spending patterns among dog owners on nutrition, mobility, and overall wellness. The dog category benefits from increasing use of preventive health supplements and heightened awareness of breed-specific needs such as bone development and joint support. Cats follow with a moderate share as feline owners increasingly adopt supplements for urinary health, skin issues, and digestive support. The “Others” segment, including birds, small mammals, and reptiles, grows steadily due to expanding exotic pet ownership and tailored nutritional products.

- For instance, Hill’s Prescription Diet J/D Joint Care dog food is formulated with a specific blend of ingredients, including high levels of omega-3 fatty acids and L-carnitine, which has been clinically proven to improve mobility in arthritic dogs in as little as 21 days.

By Form

Chewables hold the largest share at 45%, boosted by strong owner preference for easy dosing, palatability, and better acceptance among pets. The segment sees high adoption in multivitamins, joint care, and probiotic formulations due to improved flavoring technologies. Pills and tablets follow, serving pets that require precise dosing for specific conditions, although acceptance issues limit faster growth. Powders gain traction as owners mix supplements with meals to improve digestion and nutrient absorption. Other forms, including liquids and gels, expand gradually and cater to pets with swallowing difficulties or special dietary needs.

Key Growth Drivers

Rising Focus on Preventive Pet Healthcare

Pet owners increasingly adopt preventive healthcare practices to support long-term wellness, driving strong demand for supplements that enhance immunity, joint mobility, skin health, and digestion. Preventive usage reduces veterinary visits and supports healthier aging in pets, especially dogs and cats. The rising influence of veterinarians recommending nutritional support fuels consistent product uptake across retail and online platforms. Growing awareness of nutrient deficiencies in commercial pet diets further encourages routine supplement use. This shift toward preventive care strengthens market expansion and supports higher adoption of multivitamins and functional formulations.

- For instance, Nutramax Laboratories’ Cosequin Maximum Strength tablets contain 600 milligrams of glucosamine per chewable tablet to support joint health outcomes in dogs. Zesty Paws Probiotic Bites feature a six-strain gut health blend for a total of 3 billion CFU (Colony Forming Units) per chew to support a stronger digestive and immune response.

Growth of Premiumization and Functional Formulations

Premium supplements gain traction as owners seek advanced, high-quality ingredients that support targeted health benefits. Functional formulations designed for mobility, coat health, gut balance, and cognitive support attract buyers willing to spend more on improved efficacy. Brands invest in clean-label, natural, and science-backed ingredients to build trust and differentiate their portfolios. Rising demand for transparency, clinical validation, and allergen-free compositions boosts innovation in tailored solutions for specific breeds and age groups. This premiumization trend supports higher product margins and drives sustained market growth.

- For instance, PetHonesty utilizes wild Alaskan salmon oil in its coat-health treats to support Omega-3 absorption. NaturVet offers products within its digestive range that integrate plant-based digestive enzymes to promote higher bioavailability.

Increased Online Purchasing and Subscription Adoption

E-commerce platforms accelerate market expansion by making supplements widely accessible through convenient delivery models. Subscription services grow rapidly as owners adopt automated monthly refills for multivitamins, probiotics, and joint formulations. Digital marketplaces allow buyers to compare ingredients, reviews, and dosages, improving confidence in product selection. Direct-to-consumer brands gain strong traction by offering personalized pet nutrition plans supported by online consultation tools. This shift toward digital channels reshapes market distribution and enhances repeat purchase rates.

Key Trends & Opportunities

Rising Demand for Natural and Clean-Label Ingredients

Pet owners increasingly prefer natural, plant-based, and chemical-free supplements to support safer and more holistic nutrition. Clean-label formulations free from artificial additives and fillers align with broader human wellness trends and appeal to health-conscious buyers. The use of turmeric, omega-rich oils, probiotics, and botanical extracts expands rapidly across major product lines. This trend creates strong opportunities for brands investing in organic certification, sustainable sourcing, and transparent ingredient lists that support premium positioning and customer trust.

- For instance, Zesty Paws enhanced its natural supplement line by formulating plant-based chews using 400 milligrams of organic turmeric root per serving to support antioxidant activity.

Product Innovation Through Functional Blends and Advanced Delivery Formats

Manufacturers introduce multi-benefit blends that address joint health, immunity, digestion, and skin wellness in a single formulation. Improved delivery formats such as flavored chewables, soft chews, liquid droppers, and meal-mix powders enhance acceptance among picky eaters. Brands experiment with microencapsulation and slow-release technologies to boost nutrient absorption and product stability. These innovations open opportunities for premium pricing, breed-specific solutions, and age-specific nutrient profiles targeted at puppies, senior dogs, and multi-pet households.

- For instance, VetriScience Laboratories introduced soft chews containing 21 milligrams of L-theanine for calming support.

Key Challenges

Regulatory Inconsistencies and Quality Control Gaps

The pet supplement market faces complex regulatory variations across regions, creating hurdles for standardization and compliance. Limited oversight in certain markets leads to inconsistent labeling, variable ingredient purity, and quality discrepancies across brands. These issues reduce consumer confidence and increase the risk of product recalls. Companies must invest in rigorous testing, certification, and transparent documentation to build trust. Regulatory tightening is expected, which may increase operational costs for smaller manufacturers.

Difficulty Ensuring Palatability and Dosage Compliance

A key challenge arises from pets rejecting supplements due to taste, smell, or texture, which affects consistent dosing and product effectiveness. Pills and tablets often face low acceptance, forcing owners to mix them with food or switch formats. Ensuring correct dosage becomes difficult when pets refuse or partially consume supplements. Manufacturers must focus on flavor optimization, soft chew formats, and alternative delivery systems to improve compliance. This challenge remains significant, especially in products targeting chronic conditions requiring long-term use.

Regional Analysis

North America

North America holds a 38% share, supported by high pet ownership and strong spending on preventive health products. Consumers prefer premium supplements targeting joint care, immunity, and digestive balance, driving consistent adoption across dogs and cats. Veterinarian recommendations strengthen product credibility, while expanding online sales boost convenience and repeat purchases. The region benefits from well-established brands and strict quality standards that ensure product safety. Rising demand for natural and clean-label formulations further accelerates growth. The U.S. leads the market due to advanced retail networks and strong penetration of subscription-based supplement services.

Europe

Europe accounts for a 27% share, driven by rising focus on pet wellness and increased use of specialized supplements. Owners seek natural, plant-based, and allergen-free products to support healthier lifestyles for pets. Regulatory frameworks promoting high-quality ingredients strengthen trust and support sustained adoption across major countries. Growth is supported by expanding veterinary clinics and strong demand for targeted solutions such as mobility, skin health, and digestion support. Online platforms contribute to rising supplement purchases as consumers explore personalized nutrition options. Germany, the U.K., and France remain leading contributors to regional market expansion.

Asia Pacific

Asia Pacific captures a 22% share, supported by rapid growth in pet adoption and rising spending on pet nutrition in urban households. Consumers increasingly choose supplements for immunity, coat health, and digestive comfort, driven by higher awareness of preventive care. The region shows strong momentum in premium and functional formulations due to growing influence of Western pet care practices. Expanding e-commerce platforms enable broad access to domestic and international brands. China, Japan, and India contribute significantly as pet humanization trends accelerate. The region remains a key growth hotspot with rising demand for natural and customized products.

Latin America

Latin America holds a 7% share, with growth supported by expanding pet ownership and rising interest in basic nutritional supplements among urban consumers. Demand increases for affordable multivitamins, skin health products, and digestive aids, especially for dogs. Brazil and Mexico drive market expansion due to stronger retail penetration and rising awareness of preventive healthcare. Limited regulatory enforcement creates product variety but also raises concerns regarding quality consistency. Online sales channels and pet specialty stores play a growing role in distribution. Gradual adoption of premium and natural formulations is expected as consumer income levels improve.

Middle East & Africa

The Middle East & Africa region accounts for a 6% share, driven by steady growth in pet ownership in urban centers and rising preference for imported supplements. Consumers seek solutions for immunity, coat health, and digestive wellness, particularly for dogs and cats. The market benefits from expanding veterinary clinics and increasing awareness of routine nutritional support. However, limited local manufacturing and higher product costs slow broader adoption. The UAE and South Africa lead regional demand due to stronger retail presence and growing acceptance of premium supplements. E-commerce platforms continue to enhance accessibility and market penetration.

Market Segmentations:

By Type

- Over-the-counter (OTC)

- Prescription

By Pet Type

By Form

- Pills/Tablets

- Chewables

- Powders

- Others

By Application

- Skin & Coat

- Hip & Joint

- Digestive Health

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape or analysis features major companies including Nestlé Purina PetCare, Mars Petcare (Greenies), Hill’s Pet Nutrition, Zesty Paws, Nutramax Laboratories, Virbac, Ark Naturals, VetriScience Laboratories, NaturVet, and PetHonesty. These companies compete through innovation in functional formulations, clean-label ingredients, and advanced delivery formats that improve palatability and nutrient absorption. Leaders focus on expanding product portfolios targeting joint care, immunity, digestion, and skin health. Strategic investments in research, veterinarian partnerships, and clinical validation strengthen credibility and support premium positioning. E-commerce growth drives stronger engagement, with brands leveraging subscription models and personalized nutrition plans. Several players expand presence across emerging markets through online distribution, retail partnerships, and region-specific formulations. Sustainability-focused packaging and natural ingredient sourcing further differentiate offerings, while strong marketing and brand loyalty enable market leaders to maintain competitive advantage in a rapidly evolving pet wellness sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestlé Purina PetCare

- Mars Petcare (Greenies)

- Hill’s Pet Nutrition

- Zesty Paws

- Nutramax Laboratories

- Virbac

- Ark Naturals

- VetriScience Laboratories

- NaturVet

- PetHonesty

Recent Developments

- In May 2025, Nestlé Purina PetCare announced it would expand its R&D in biotechnology and clinical research to advance precision nutrition and pet therapeutics globally.

- In 2025, Mars Petcare (holder of the GREENIES brand) introduced AI-powered digital pet health tools including a smartphone-based canine dental health check, supporting its supplement & wellness ecosystem.

- In August 2023, GREENIES launched a “Digestive Probiotic Supplement Powder for Dogs” targeted at gut health and microbiome support, marking a specific supplement innovation under Mars Petcare.

Report Coverage

The research report offers an in-depth analysis based on Type, Pet Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for preventive healthcare supplements will rise as owners prioritize long-term pet wellness.

- Clean-label and natural formulations will gain stronger traction across major retail channels.

- Functional blends targeting joint care, immunity, and digestion will see higher adoption.

- Subscription-based models will expand as digital platforms increase repeat purchases.

- Personalized nutrition plans will grow due to rising use of data-driven pet health insights.

- Veterinary recommendations will shape stronger brand trust and product credibility.

- Innovation in chewables, liquids, and soft gels will improve acceptance among pets.

- Premium supplement lines will expand as consumers shift toward higher-quality ingredients.

- Emerging markets will show faster growth as pet ownership and spending continue to rise.

- Regulatory tightening will push companies toward higher transparency and improved product testing.