Market Overview

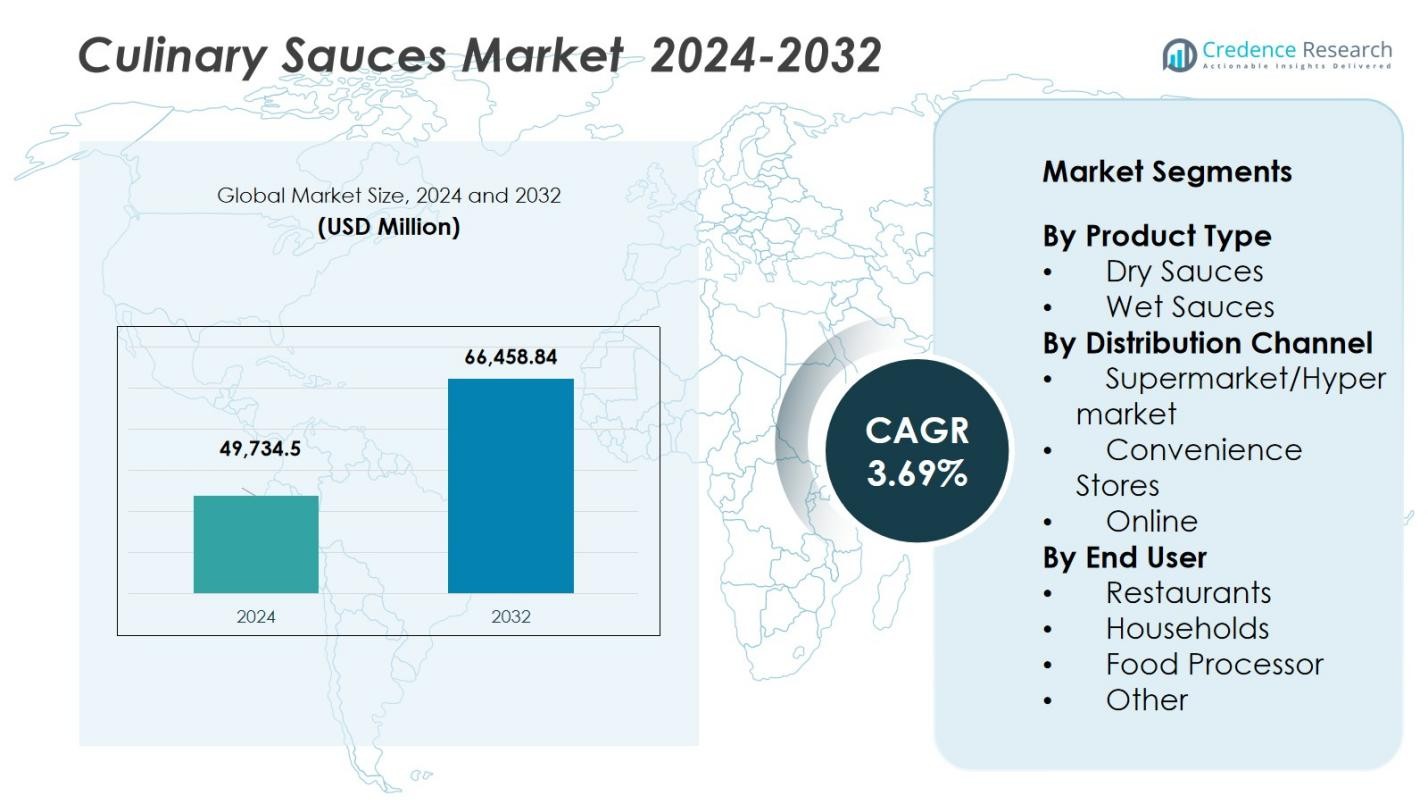

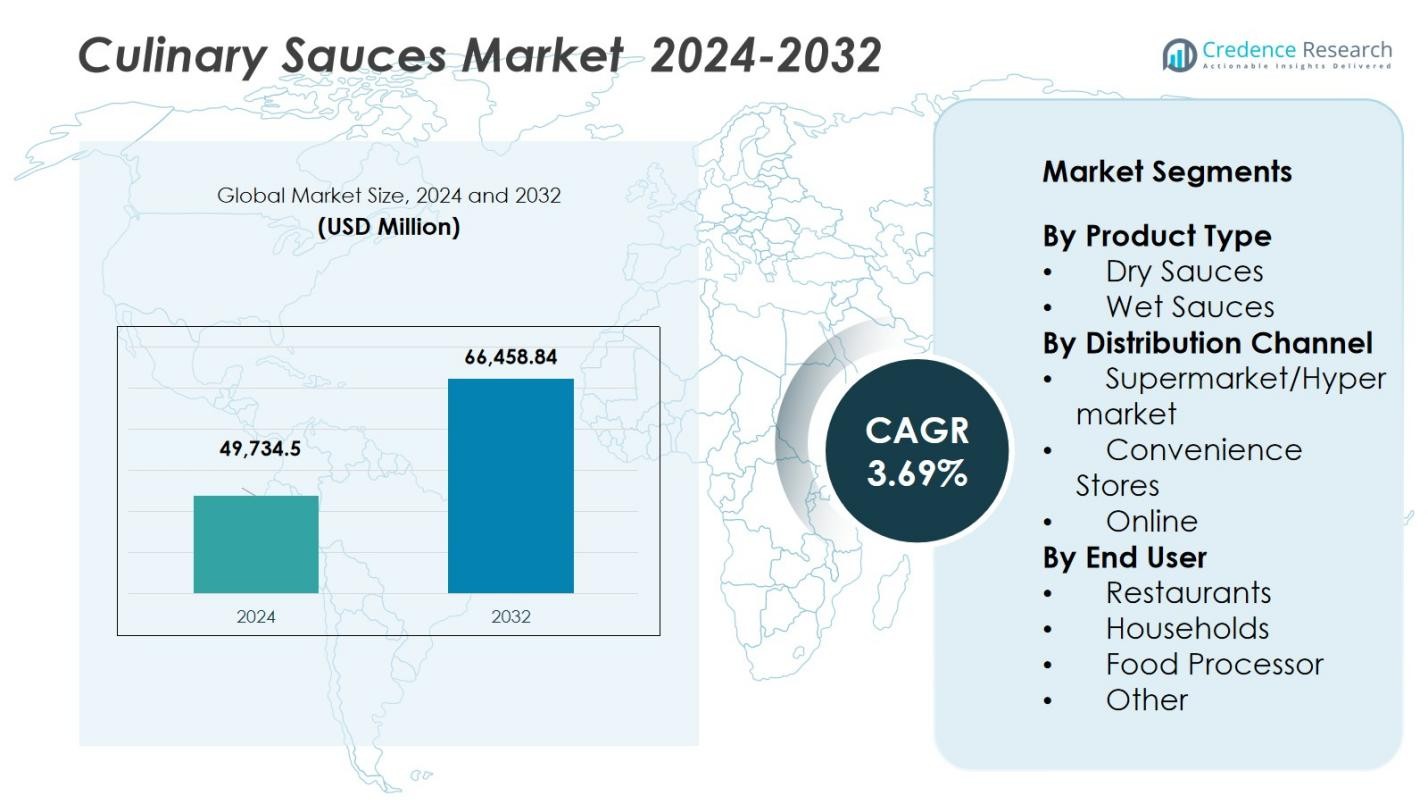

The Culinary Sauces Market size was valued at USD 49,734.5 Million in 2024 and is anticipated to reach USD 66,458.84 Million by 2032, growing at a CAGR of 3.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Culinary Sauces Market Size 2024 |

USD 49,734.5 Million |

| Culinary Sauces Market, CAGR |

3.69% |

| Culinary Sauces Market Size 2032 |

USD 66,458.84 Million |

The Culinary Sauces Market is led by major players such as The Kraft Heinz Company, Unilever PLC, McCormick & Company Inc., Kikkoman Corporation, and Conagra Brands, who leverage extensive product portfolios and global reach. The market is dominated by the Asia Pacific region with a share of 39.8 %, followed by North America at 31.5 %, Europe at 18.3 %, Latin America at 6.2 % and Middle East & Africa at 4.2 %. These companies continue to enhance their market positions through new product innovations tailored to regional tastes, expansion of distribution networks across modern retail and e‑commerce channels, and strategic forays into clean‑label and health‑oriented variants to meet evolving consumer preferences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Culinary Sauces Market size was valued at USD 49,734.5 Million in 2024 and is anticipated to reach USD 66,458.84 Million by 2032, growing at a CAGR of 3.69%.

- The market is driven by increasing consumer preference for ready‑to‑use sauces and busy lifestyles, which is especially boosting wet sauces that hold around 75.2% of the product segment share.

- The trend toward online retailing and e‑commerce is gaining traction, with the online distribution channel holding approximately 24.1% share, while supermarkets/hypermarkets lead at 57.3%.

- Restraints in the market include rising raw‑material costs and intense competition, which make scope for margin pressure and differentiation difficult in mature regional markets.

- Regionally, Asia Pacific commands about 39.8% of market share, North America holds around 31.5%, Europe approximately 18.3%, Latin America 6.2% and Middle East & Africa 4.2%, highlighting where growth and penetration strategies are most crucial.

Market Segmentation Analysis:

By Product Type

The Culinary Sauces Market is segmented into dry sauces and wet sauces. Wet sauces dominate the market with a significant share of 75.2% in 2024. These sauces are preferred due to their convenience and wide range of applications, including ready-to-use pasta sauces, gravies, and dips. The growing demand for ready-to-eat meals and convenience foods is driving the market for wet sauces. Dry sauces, though growing, hold a smaller market share of 24.8%, driven by their long shelf life and ease of storage for food processors and restaurants.

- For instance, Pure Harvest Smart Farms launched a line of 100% natural tomato sauces in UAE retail chains Spinneys and Waitrose, positioned as fresh, convenient wet sauces for everyday cooking occasions.

By Distribution Channel

The market is segmented by distribution channels into supermarkets/hypermarkets, convenience stores, and online platforms. Supermarkets/hypermarkets hold the largest market share of 57.3% in 2024, driven by their widespread availability and consumer preference for purchasing food products in bulk. Online platforms are experiencing rapid growth, with a 24.1% market share, as more consumers turn to e-commerce for convenience and variety. Convenience stores contribute a smaller share of 18.6%, with consumers opting for quick purchases but limited variety compared to larger retail outlets.

- For instance, Albert Heijn in the Netherlands held a market share of 37.7% in 2024, enabling strong store penetration and consumer preference for full‑weekly baskets.

By End User

The Culinary Sauces Market caters to various end users, including restaurants, households, food processors, and others. Restaurants dominate the market with a share of 41.5% in 2024, driven by the increasing popularity of dining out and the diverse use of sauces in food preparation. Households follow closely, holding a 34.8% market share, as consumers continue to experiment with cooking and flavoring at home. Food processors account for 23.7%, with sauces being used in packaged foods and ready-to-eat meals, benefiting from growing consumer demand for convenience foods.

Key Growth Drivers

Rising Consumer Demand for Convenience Foods

The growing preference for convenience foods has been a key driver for the Culinary Sauces Market. Consumers’ busy lifestyles and increasing disposable incomes have led to higher demand for ready-to-use sauces, which simplify meal preparation. This trend is especially prominent in urban areas, where working professionals and families seek quick, easy, and flavorful meal options. As the demand for convenience food continues to rise, the culinary sauces segment will benefit from increased consumption, especially in wet sauces and ready-to-eat meal kits.

- For instance,Nestlé has expanded its offerings in the ready-to-eat sector, launching new lines of frozen and shelf-stable meal kits tailored for busy consumers seeking healthier and flavorful options.

Expansion of Food Service Industry

The expansion of the global food service industry, particularly in quick-service restaurants (QSRs) and fast casual dining, is a significant growth driver for the Culinary Sauces Market. As the number of restaurants, cafes, and fast-food chains continues to increase worldwide, the demand for diverse and flavorful sauces grows. Restaurants rely heavily on sauces to enhance their menu offerings, and this demand is expected to rise in emerging markets where the food service industry is experiencing rapid growth, thus further fueling the market expansion.

- For instance, McCormick & Co. has expanded its food service distribution points significantly, growing volume and presence through innovations in hot sauces and seasonings, which aligns with the rising consumer demand for flavor variety and global cuisines.

Shift Toward Health-Conscious Consumers

Health-conscious consumers are increasingly demanding culinary sauces that cater to their dietary preferences, such as low-sodium, low-sugar, gluten-free, and organic options. This shift has pushed manufacturers to innovate and develop healthier sauce alternatives, contributing to the market’s growth. With rising awareness of health and wellness, consumers are more inclined to choose sauces that are not only convenient but also align with their lifestyle choices. This trend will continue to drive the demand for healthier sauce variants, thereby supporting overall market growth.

Key Trends & Opportunities

Growth of E-commerce Platforms

The increasing popularity of online shopping for food products presents a significant opportunity for the Culinary Sauces Market. E-commerce platforms offer a convenient way for consumers to purchase sauces in bulk or explore niche products that may not be available in local stores. The growth of online retail, combined with personalized recommendations and direct-to-consumer sales, is expected to propel the market further. As consumers become more comfortable with purchasing groceries online, culinary sauces are likely to see a surge in online sales, boosting the market’s overall growth.

- For instance, Campbell’s has expanded its online visibility with enhanced product content and a focus on e-commerce (often through third-party retail channels), encouraging trial of niche and ethnic sauce varieties like Campbell’s Skillet Sauces and Swanson flavor-infused broths.

Innovative Flavors and Customization

One of the emerging trends in the Culinary Sauces Market is the rising demand for innovative and customized flavors. Consumers are increasingly seeking new and exotic taste profiles, such as ethnic, fusion, and plant-based options. Manufacturers are responding by introducing unique sauce varieties to meet this demand. The trend toward flavor innovation provides an opportunity for companies to differentiate their products and cater to specific regional tastes or dietary preferences. This trend is expected to drive the development of a broader product range, including spicy, organic, and ethnic sauces.

- For instance, Unilever Food Solutions launched a premium soy sauce in China with a richer umami profile tailored specifically for professional chefs, blending traditional fermentation with modern science to meet unique culinary needs.

Key Challenges

Rising Raw Material Costs

The Culinary Sauces Market faces a challenge from the increasing costs of raw materials, particularly key ingredients such as tomatoes, oils, spices, and sugar. Fluctuations in the prices of these essential ingredients, driven by factors like weather conditions, supply chain disruptions, and inflation, impact the profitability of manufacturers. Higher production costs can result in increased prices for consumers, potentially limiting demand, especially in price-sensitive markets. Manufacturers need to address these cost fluctuations through efficient sourcing and production strategies to maintain market stability.

Intense Competition and Market Saturation

The Culinary Sauces Market is highly competitive, with numerous established players vying for market share. The presence of multiple local and global brands, along with private-label products, creates a saturated market environment. This intense competition makes it challenging for companies to differentiate themselves, especially in regions where consumer loyalty is low. To stay ahead, manufacturers must innovate with new flavors, packaging, and health-conscious offerings while maintaining quality and affordability, which can be a significant challenge in a crowded marketplace.

Regional Analysis

North America

In North America, the region held a market share of 31.5% in 2024 for the culinary sauces sector. Manufacturers capitalized on the high consumer demand for convenience foods, ethnic cuisine, and retail expansion into online channels. The established infrastructure of supermarkets and hypermarkets continues to support broad distribution, while innovation in premium and bold-flavour sauces boosts growth. The steady adoption of ready-to-use sauces in households and food service settings drives market penetration. North America’s sizable consumer base and sophisticated retail network position it as a key region shaping global market trends.

Asia Pacific

Asia Pacific dominated the global culinary sauces market with a share of 39.8% in 2024. Rapid urbanization, growing middle-class incomes, and strong regional consumption of soy, chili, and fermented sauces underpin this dominance. Major manufacturing hubs in China and Japan offer cost efficiencies and advanced product development. The region’s retail modernization and e-commerce growth further accelerate market adoption. Diverse regional cuisines and increasing exposure to global flavor profiles create a dynamic environment for new sauce variants. Asia Pacific therefore remains both the largest and fastest-growing region within the market.

Europe

Europe accounts for a significant portion of the culinary sauces market, reflecting mature consumption patterns and innovation in product formulations. The region held 18.3% market share in 2024. European consumers demonstrate growing preference for clean-label, organic, and health-oriented sauces, while smaller-format retail and e-commerce channels are gaining traction. Manufacturers are responding with premium and ethnic flavor launches tailored to European tastes. The region’s regulatory environment and high per-capita spending power make it a strategic market for value-added sauce products.

Latin America

Latin America represents a growing market for culinary sauces, driven by increasing urbanization, rising disposable income, and expanding retail networks. The region holds a market share of 6.2% in 2024. Consumers in Latin America are increasingly seeking convenience foods and internationally influenced flavors, while local sauces remain strong. Retail chains and online platforms are improving distribution, and there is heightened interest in premium and authentic ethnic sauces. Latin America thus offers meaningful expansion potential for global sauce manufacturers.

Middle East & Africa

The Middle East & Africa (MEA) region contributes to the global culinary sauces market with a market share of 4.2% in 2024. Growth in MEA is supported by rising food service developments, increasing urban dining, and expanding modern retail chains in countries such as the Gulf states and South Africa. Challenges include fragmented distribution channels and price sensitivity in lower-income markets. Nonetheless, the region offers an opportunity for manufacturers through localized flavor development and adoption of convenience and ready-to-eat formats suited to evolving consumer lifestyles.

Market Segmentations:

By Product Type

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online

By End User

- Restaurants

- Households

- Food Processor

- Other

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the culinary sauces market features major key players such as The Kraft Heinz Company, Unilever PLC, McCormick & Company Inc., Kikkoman Corporation and Conagra Brands who leverage extensive product portfolios and global distribution networks to maintain market leadership. These companies actively engage in strategic initiatives such as acquisitions, geographic expansion, and new product launches to differentiate in a competitive environment. Innovation in flavour profiles, health‑oriented formulations and clean‑label credentials constitutes a key differentiator. Simultaneously, smaller regional and niche players intensify competition by offering tailored local flavours or premium gourmet sauces, pressuring larger firms to continuously adapt. Supply chain optimisation, raw material cost control and evolving consumer preferences further shape the competitive dynamics across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kikkoman Corporation (Japan)

- Hormel Foods Corporation (U.S.)

- McIlhenny Company (U.S.)

- Ken’s Foods (U.S.)

- Del Monte Foods Inc. (U.S.)

- Unilever PLC (U.K.)

- The Kraft Heinz Company (U.S.)

- Conagra Brands (U.S.)

- McCormick & Company Inc. (U.S.)

- YAMASA Corporation (Japan)

Recent Developments

- In March 2025, Adani Wilmar Limited announced the acquisition of GD Foods Manufacturing (India) Pvt Ltd (owner of the “Tops” brand) to expand its sauces & pickles portfolio.

- In January 2025, Reliance Consumer Products Ltd acquired SIL Foods, a legacy brand offering sauces and condiments, to strengthen its consumer foods business in India.

- In October 2024, Paulig Group acquired Panesar Foods Ltd (UK‑based sauces, salsas & condiments manufacturer) to accelerate growth in the World Foods category.

- In June 2024, Lassonde Industries Inc. agreed to acquire Summer Garden Food Manufacturing (U.S. manufacturer of premium sauces and condiments) in a cash transaction of US$235 million (plus up to US$45 million earn‑out) to diversify and bolster its specialty food segment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady expansion as the demand for ready‑to‑use sauce solutions rises hand in hand with evolving lifestyle patterns.

- Increasing global exposure to ethnic and fusion cuisines will drive sales of novel and region‑inspired sauce variants.

- Manufacturers will increasingly invest in clean‑label, low‑sodium, gluten‑free and organic sauces to meet rising health‑conscious consumer demand.

- E-commerce channels will gain a stronger foothold as digital shopping habits shift and direct‑to‑consumer delivery becomes more prevalent.

- The food‑service and quick‑service restaurant sectors will provide growth impetus through expanded menus and global chain proliferation.

- Plant‑based and flexitarian eating trends will propel the development of sauces tailored for vegetarian, vegan and alternative‑protein applications.

- Packaging innovations – such as squeezable pouches, single‑serve portions and environmentally‑friendly materials – will enhance convenience and sustainability appeal.

- Regional market penetration will deepen in emerging markets, where rising urbanisation, disposable income and modern retail infrastructure are fostering growth.

- Supply chain resilience and raw‑material sourcing will become a strategic focus as ingredient cost volatility and climate‑driven disruptions affect production.

- Competitive differentiation will increasingly hinge on flavour innovation, customization and brand storytelling, as traditional formats reach saturation.