Market Overview

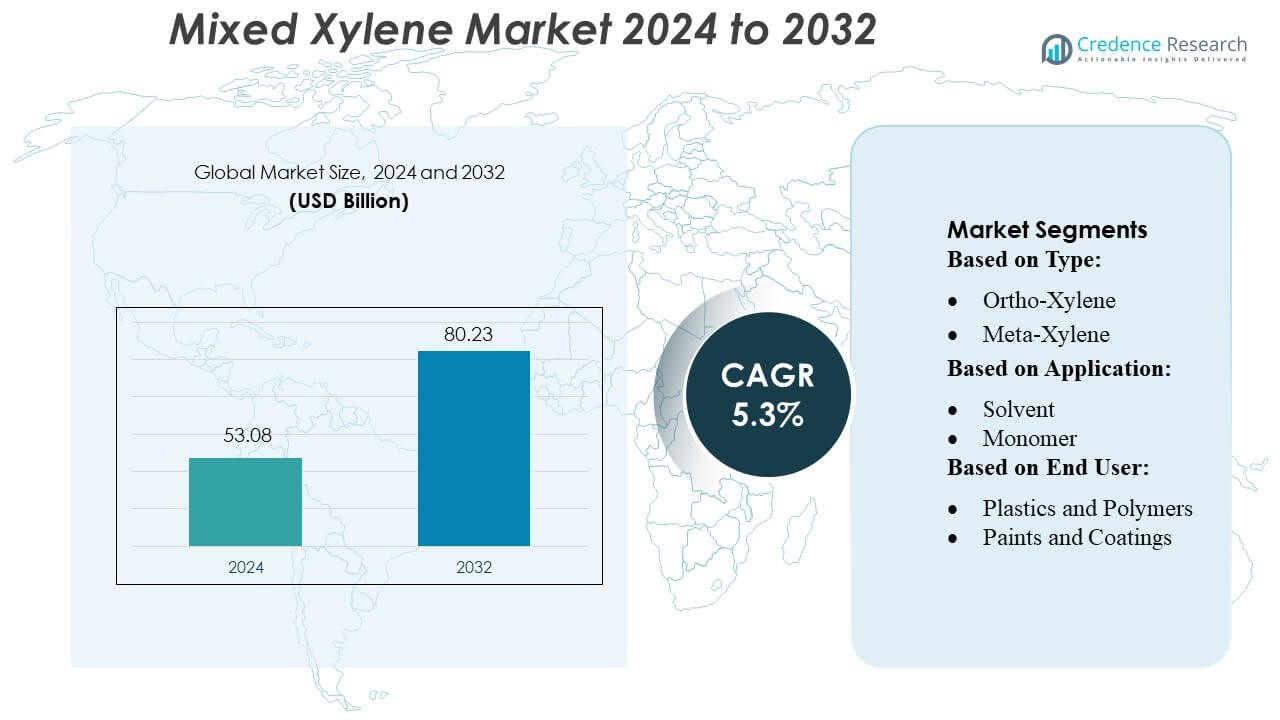

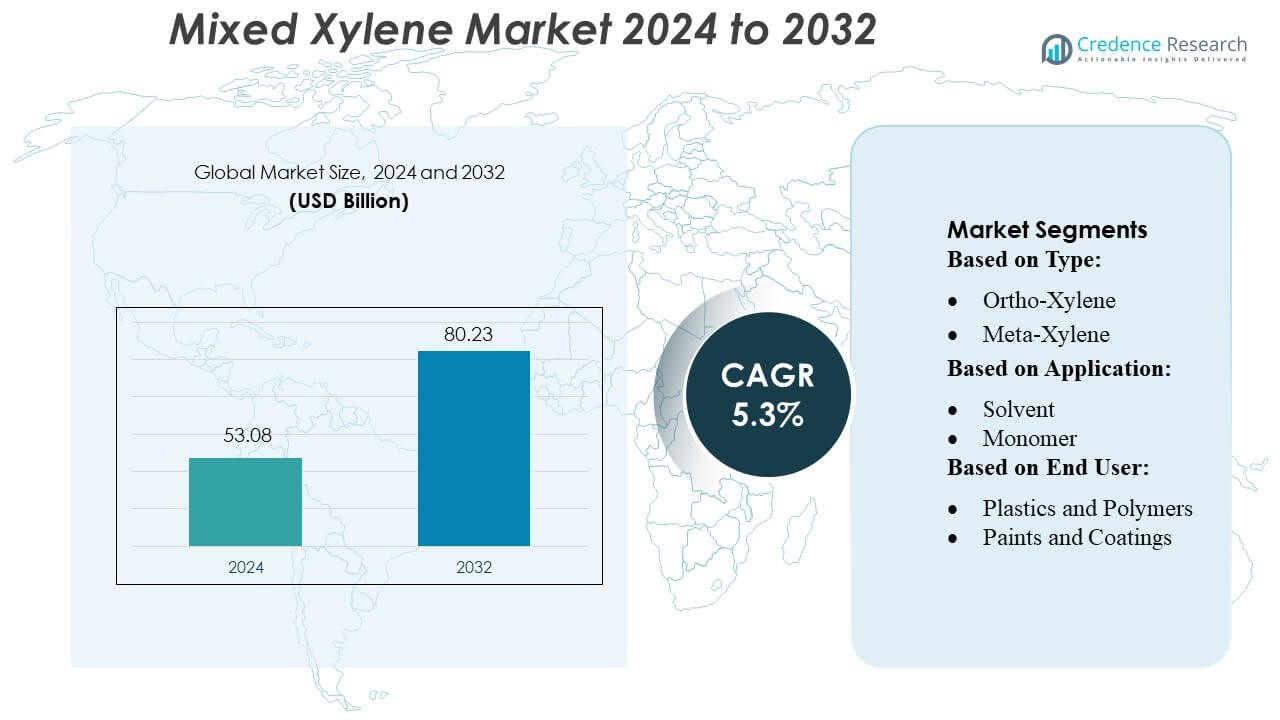

Mixed Xylene Market size was valued USD 53.08 billion in 2024 and is anticipated to reach USD 80.23 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mixed Xylene Market Size 2024 |

USD 53.08 Billion |

| Mixed Xylene Market, CAGR |

5.3% |

| Mixed Xylene Market Size 2032 |

USD 80.23 Billion |

The mixed xylene market remains competitive, with major integrated refiners and chemical manufacturers strengthening their positions through capacity expansions, improved aromatics extraction technologies, and diversification into high-purity solvent grades. Leading producers focus on operational efficiency, long-term supply agreements, and investments in advanced reforming units to support rising demand from coatings, plastics, and chemical intermediates. Asia-Pacific emerges as the dominant regional market, accounting for over 50% of global share, driven by extensive petrochemical capacity, strong polyester production, and sustained industrial growth across China, India, South Korea, and Japan. This regional leadership continues to shape global supply and demand dynamics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mixed Xylene Market reached USD 53.08 billion in 2024 and is projected to hit USD 80.23 billion by 2032 at a 5.3% CAGR, supported by rising demand from petrochemicals, coatings, and solvent applications.

- Strong market drivers include expanding polyester and plastic production, increased use of solvents in industrial processes, and continuous capacity additions in refinery–petrochemical complexes.

- Key trends highlight the shift toward high-purity grades, adoption of advanced aromatics extraction technologies, and growing investments in energy-efficient and low-emission production systems.

- Competitive dynamics intensify as major refiners enhance operational efficiency, secure long-term supply agreements, and focus on process optimization to maintain stronger positions.

- Asia-Pacific leads with over 50% regional share, driven by its large petrochemical base, while the solvents segment holds the largest application share, reinforcing the region’s influence on global demand patterns.

Market Segmentation Analysis:

By Type

The type segment in the Mixed Xylene Market is led by para-xylene, which secures the largest share due to its extensive use in PET and polyester production. Para-xylene’s dominance strengthens as packaging and textile manufacturers expand output. Ortho-xylene and meta-xylene maintain steady demand in phthalic anhydride and specialty chemicals, while mixed xylene grades support fuel blending. Growth across all types aligns with rising petrochemical capacity additions and expanding consumer goods production. The segment benefits from stable feedstock availability and increasing downstream investments that reinforce the long-term relevance of aromatic derivatives.

- For instance, Honeywell International Inc. reports that its UOP Parex™ technology enables para-xylene recovery systems capable of producing over 200,000 metric tons per year with product purity reaching 99.9, supporting higher-efficiency PX separation in large-scale complexes.

By Application

The application segment is dominated by solvents, capturing the highest market share owing to consistent use in coatings, industrial cleaning agents, and chemical formulations. Its leadership is driven by strong demand from manufacturing hubs and formulation-intensive industries. Monomers, including para-xylene for polyester chains, sustain notable growth as synthetic fibers and PET packaging consumption rises. Other applications gain traction in agrochemicals and intermediates. The segment expands with increasing construction activity, stronger manufacturing output, and adoption of high-purity aromatic solvents across diverse processing environments.

- For instance, INEOS Aromatics recently upgraded its para-xylene and PTA production assets—its Zhuhai 3 line operates with a PTA capacity of 2.2 million tons per year, supported by optimized PX feed systems designed to reduce energy consumption by 15 gigajoules per ton compared to earlier-generation units, enhancing output stability for downstream solvent and monomer applications.

By End-User

The end-user segment is led by plastics and polymers, which hold the dominant share due to high consumption of para-xylene-derived PET and polyester resins. This leadership is reinforced by rapid growth in packaging, textiles, and consumer goods. Paints and coatings follow with strong reliance on xylene solvents for formulation consistency and application performance. Adhesives also contribute to demand through rising use in automotive and construction assemblies. Overall segment growth aligns with urban development initiatives, expansion of packaged goods markets, and steady adoption of petrochemical-based materials across industrial value chains.

Key Growth Drivers

Rising Demand from the Petrochemical Sector

The mixed xylene market grows steadily as petrochemical producers increase consumption for downstream derivatives such as phthalic anhydride, isophthalic acid, and terephthalic acid. These derivatives support expanding industries including plastics, packaging, and polyester fibers, which sustain large-scale production cycles. Refiners also raise reformate processing volumes to meet the feedstock needs of aromatic units. The steady expansion of polyester manufacturing hubs, particularly in Asia-Pacific, strengthens demand. This consistent requirement for high-purity aromatics reinforces the market’s long-term growth.

- For instance, Saudi Aramco Total Energies Refining and Petrochemical Company (SATORP) refinery has a significant crude oil processing capacity of 460,000 bpd, which feeds an integrated aromatics plant capable of producing 700,000 tons of paraxylene annually.

Expanding Use in Paints, Coatings, and Adhesives

Growth accelerates as mixed xylene remains a key solvent for paints, coatings, varnishes, and adhesive formulations. The construction and automotive sectors generate substantial consumption, driven by long-term infrastructure investments and rising vehicle output. Manufacturers adopt solvent-based systems for durability and performance, sustaining xylene demand despite increasing regulatory scrutiny. Rapid industrialization in emerging markets adds new application volumes, particularly across metalworking and protective coating segments. The widespread availability of mixed xylene through global refining networks further supports market expansion.

- For instance, Shell operates eight refineries globally with a combined crude processing capacity of approximately 1.6 million barrels per day, supplying feedstock to its chemical plants.

Growth in Energy and Chemical Refining Capacities

The market benefits from continuous refining capacity additions and modernization projects that boost aromatics output. Integrated refinery–petrochemical complexes across Asia and the Middle East adopt advanced catalytic reforming and extraction technologies to improve mixed xylene yields. Operators aim for higher efficiency and product value recovery, which strengthens overall supply stability. Increased investments in downstream chemical plants stimulate long-term feedstock requirements. This strategic shift toward high-margin aromatics production supports the robust availability and commercial attractiveness of mixed xylene.

Key Trends & Opportunities

Shift Toward High-Purity and Customized Grades

A notable trend emerges as end users increasingly demand high-purity and customized grades of mixed xylene for specialized chemical synthesis, coatings, and industrial solvents. Producers invest in enhanced fractionation and extraction units to deliver consistent product quality. This shift creates opportunities for refineries offering tailored aromatic profiles, especially for high-performance polymers and value-added intermediates. Regulatory requirements and performance-driven applications push suppliers to optimize purity levels, supporting a premium product segment with strong growth potential.

- For instance, RIL commissioned a new para-xylene (PX) plant with an output capacity of 2.2 million metric tons per annum (MMTPA), raising its total PX capacity from 2.0 MMTPA to 4.2 MMTPA.

Technological Advancements in Aromatics Production

Technology-driven improvements in catalytic reforming, adsorption, and extraction systems create opportunities for higher yields and lower operating costs. Refineries deploy energy-efficient units and advanced catalysts to increase aromatics recovery without significant capital expansion. Digital monitoring systems and process integration further enhance reliability and product consistency. These developments help operators meet rising downstream demand and compete effectively in a margin-sensitive market. Technology-driven optimization also opens opportunities to expand sustainable and low-emission production pathways.

- For instance, CPChem committed to installing a Low-Emission Cracking Furnace at its Sweeny, Texas olefins site, a design project that reduces fuel consumption and CO₂ emissions by roughly 30%, thanks to a novel heat-recovery system and electrified compressor drive.

Expanding Opportunities in Emerging Economies

Emerging economies across Asia-Pacific, Latin America, and the Middle East present strong opportunities as industrial growth boosts demand for solvents, plastics, coatings, and chemical intermediates. Governments prioritize construction, manufacturing, and automotive sector expansion, creating a broad market for mixed xylene applications. New refinery and petrochemical investments strengthen regional self-sufficiency and raise consumption of aromatics feedstocks. Suppliers benefit from developing trade networks and cost-competitive production bases, supporting long-term growth in these high-potential regions.

Key Challenges

Stringent Environmental and Safety Regulations

Environmental regulations present a major challenge as authorities enforce stricter controls on VOC emissions, solvent usage, and refinery operations. Mixed xylene’s classification as a hazardous air pollutant requires compliance with advanced emission-control systems, increasing operational costs. Coating and adhesive manufacturers shift toward low-VOC and water-based technologies, limiting solvent-based product growth. These regulatory pressures force producers to adopt costly upgrades and process modifications, influencing competitiveness and future investment strategies.

Feedstock Price Volatility and Supply Constraints

Volatile crude oil and naphtha prices create uncertainty in mixed xylene production costs, influencing margins for refiners and downstream manufacturers. Fluctuations in reformate availability and aromatics extraction economics affect market supply stability. Geopolitical disruptions, refinery maintenance cycles, and trade restrictions add supply risks that complicate long-term planning. Producers and consumers face challenges in managing procurement and pricing strategies, especially in markets reliant on imports. This volatility remains a persistent constraint on consistent market expansion.

Regional Analysis

North America

North America accounts for roughly 15–18% of the mixed xylene market share, supported by its advanced refining infrastructure and steady demand from chemical and industrial coatings segments. The United States leads regional consumption through strong production of phthalic anhydride, isophthalic acid, and other downstream intermediates. Growth across construction coatings, automotive refinishing, and packaging applications maintains stable demand. Producers invest in efficiency upgrades and process integration to improve aromatics yields. Regulatory pressures on VOC emissions and a shift toward low-VOC formulations temper consumption growth yet maintain the region’s role as a technologically advanced and supply-stable market.

Asia-Pacific

Asia-Pacific holds the dominant position in the mixed xylene market, capturing more than 50% of global share due to its extensive petrochemical, polyester, and coatings manufacturing base. China, India, South Korea, and Japan anchor consumption through large integrated refinery–petrochemical complexes and high downstream demand from plastics, packaging, and automotive industries. Capacity expansions in catalytic reforming and aromatics extraction strengthen regional self-sufficiency and boost supply reliability. Strong industrial growth, expanding construction activity, and rising demand for solvents across emerging economies further reinforce Asia-Pacific’s leadership and long-term growth momentum in the mixed xylene landscape.

Europe

Europe represents about 13–15% of global mixed xylene demand, driven by established chemical, automotive, and industrial coatings sectors. Germany, France, Italy, and the UK sustain consumption through specialty chemicals and polymer intermediates. Refiners maintain moderate aromatics output, supported by integrated petrochemical complexes and efficiency-driven technology upgrades. However, stringent environmental regulations and the growing adoption of waterborne and low-VOC coatings soften demand for traditional solvent-based formulations. Despite regulatory constraints, Europe retains relevance through innovation-driven manufacturing, consistent industrial activity, and stable procurement networks that support medium-term market engagement.

Latin America

Latin America captures around 6–8% of the mixed xylene market share, driven by demand from Brazil, Mexico, and Argentina. The region relies partly on imported aromatics but maintains moderate domestic production through established refining networks. Mixed xylene supports applications in paints, coatings, adhesives, and chemical intermediates for construction, automotive, and packaging industries. Economic recovery cycles influence consumption patterns, while infrastructure development projects stimulate demand for solvent-based products. Competitive pricing, growing manufacturing activity, and the expansion of coatings and plastics sectors contribute to Latin America’s steady participation in the global mixed xylene market.

Middle East & Africa

The Middle East & Africa region holds approximately 10–12% market share, strengthened by expanding refining and petrochemical capacities in Saudi Arabia, the UAE, and Kuwait. These countries leverage large-scale integrated complexes to supply mixed xylene for regional and export markets. Rising investments in construction, automotive components, and packaging industries support downstream consumption. Africa shows gradual uptake as industrialization increases, though dependence on imports remains high. MEA’s growing aromatics footprint, cost-competitive feedstock availability, and strategic trade positioning reinforce its emerging yet steadily expanding role in the global mixed xylene market.

Market Segmentations:

By Type:

By Application:

By End User:

- Plastics and Polymers

- Paints and Coatings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mixed Xylene Market includes leading global refiners and chemical producers such as Honeywell International Inc., INEOS, Saudi Arabian Oil Co., Eastman Chemical Company, Mitsubishi Gas Chemical Company, Inc., Royal Dutch Shell plc, Reliance Industries Limited, Chevron Phillips Chemical Company, CNPC, and Exxon Mobil Corporation. The mixed xylene market features a competitive environment driven by large integrated refiners, diversified chemical manufacturers, and regional producers that optimize aromatics output to meet rising downstream demand. Companies strengthen their positions by expanding catalytic reforming capacity, improving solvent-grade purity, and deploying advanced extraction technologies that enhance yield efficiency. Competitive strategies often center on securing long-term supply agreements, investing in high-growth regions, and improving operational reliability through digital monitoring and energy-efficient systems. Sustainability initiatives, including emission-control upgrades and reduced-VOC product development, increasingly influence competitive differentiation. Continuous innovation in processing capabilities and portfolio expansion supports sustained market competitiveness.

Key Player Analysis

- Honeywell International Inc.

- INEOS

- Saudi Arabian Oil Co.

- Eastman Chemical Company

- Mitsubishi Gas Chemical Company, Inc.

- Royal Dutch Shell plc

- Reliance Industries Limited

- Chevron Phillips Chemical Company

- CNPC (China National Petroleum Corporation)

- Exxon Mobil Corporation

Recent Developments

- In February 2025, Osaka University, Kawasaki Heavy Industries, and Mitsui Chemicals announced the successful demonstration of a technology to synthesize methanol and para-xylene from carbon dioxide. This project, which is part of a Japanese government initiative to develop carbon recycling technologies, is a significant step toward reducing CO2 emissions and achieving a carbon-neutral society.

- In February 2024, INEOS Aromatics permanently shut one of two Para-xylene (PX) is a key industrial chemical used primarily as a feedstock for the production of polyesters, which are then used in a wide range of products including plastic bottles and synthetic fibers for clothing.

- In January 2023, Reliance Industries Limited (RIL) decided to keep its prices for Mixed Xylene (MX) unchanged in the Indian domestic market. With a prevailing basic price of INR 78/kg for mixed xylene, it is expected that demand in the Indian market will remain on the upswing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market maintains steady growth as petrochemical producers expand capacity for downstream derivatives.

- Demand increases across paints, coatings, and adhesive applications supported by construction and automotive activity.

- Refining and aromatics production upgrades improve yield efficiency and strengthen long-term supply stability.

- High-purity mixed xylene gains traction as specialty chemical manufacturers require consistent solvent performance.

- Emerging economies create strong consumption potential with rising industrialization and infrastructure development.

- Sustainability initiatives encourage producers to adopt energy-efficient technologies and emission-control systems.

- Capacity additions in Asia-Pacific and the Middle East reinforce regional leadership in aromatics production.

- Volatility in crude oil prices prompts producers to optimize feedstock sourcing and improve cost management.

- Regulatory pressure on VOC emissions influences the shift toward compliant formulations across coatings applications.

- Strategic alliances and long-term contracts support supply security and enhance the competitive positioning of major suppliers.