Market Overview

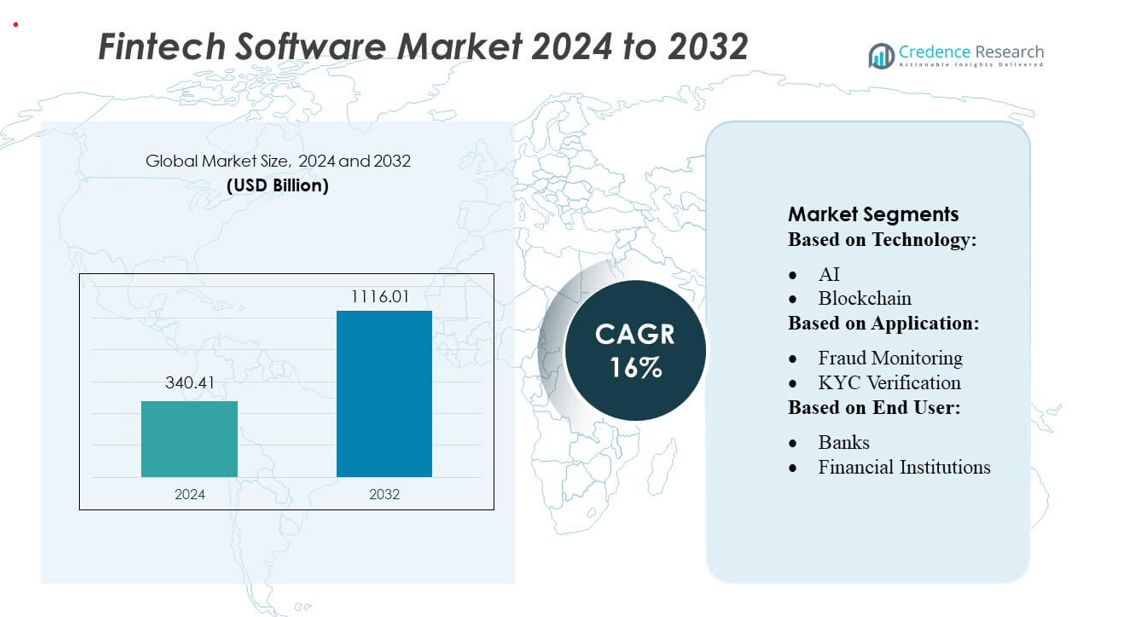

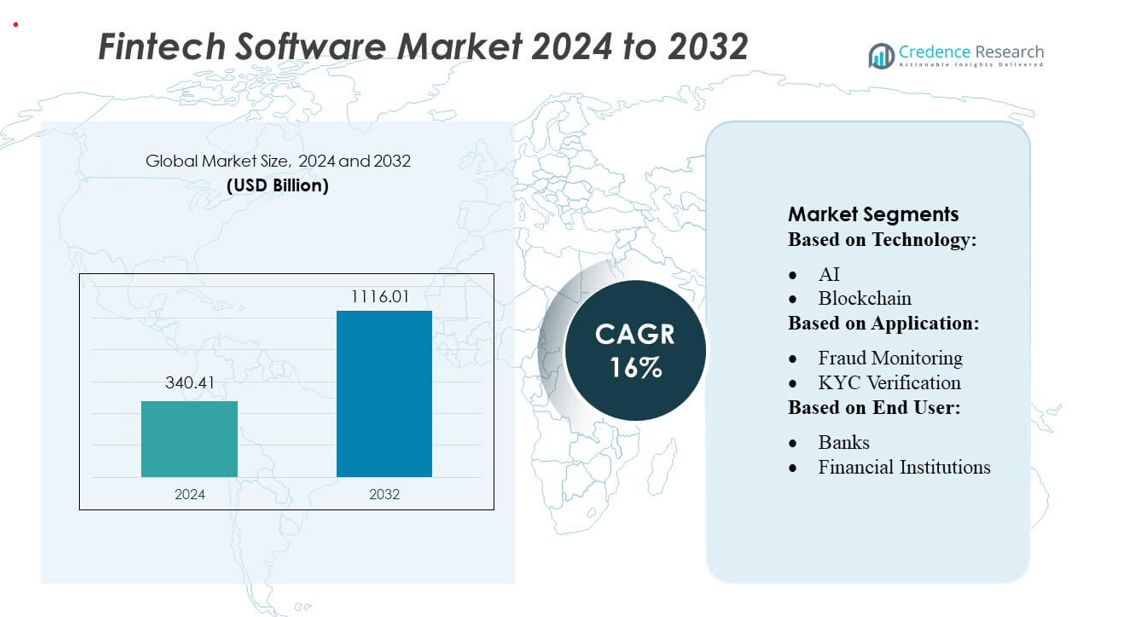

Fintech Software Market size was valued USD 340.41 billion in 2024 and is anticipated to reach USD 1116.01 billion by 2032, at a CAGR of 16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fintech Software Market Size 2024 |

USD 340.41 billion |

| Fintech Software Market, CAGR |

16% |

| Fintech Software Market Size 2032 |

USD 1116.01 billion |

The fintech software market is dominated by leading innovators such as PayPal Holdings, Inc., Mastercard Incorporated, Block, Inc., Upstart Holdings, Inc., Rapyd Financial Network, Railsbank Technology Ltd., Synctera Inc., Braintree, Envestnet, Inc., and Solid Financial Technologies, Inc., which together drive platforms for payments, embedded banking, AI-powered underwriting and infrastructure-as-a-service. These companies continually expand their global footprints through partnerships, API-first architectures, and cloud-native stacks. Regionally, North America leads the market with an estimated 38 % share, leveraging its mature financial ecosystem, strong regulatory support, and advanced technology adoption to sustain dominance.

Market Insights

- The Fintech Software Market, valued at USD 340.41 billion in 2024, is projected to reach USD 1116.01 billion by 2032 at a 16% CAGR, supported by rapid digitization, strong investment flows, and rising enterprise adoption of cloud-based financial solutions.

- Growing demand for real-time payments, embedded finance, and AI-driven credit analytics drives sustained market expansion as organizations prioritize automation, cost efficiency, and integrated financial workflows.

- Market trends highlight the acceleration of open banking, expansion of Banking-as-a-Service models, and increasing deployment of API-first platforms that enhance interoperability across financial ecosystems.

- Competitive intensity remains high as global and emerging players invest in product innovation, cybersecurity, and international partnerships, while regulatory complexities and data-security concerns act as key restraints in several regions.

- North America maintains 38% regional share due to advanced digital infrastructure, while payment software continues to hold the dominant segment share, driven by high transaction volumes and strong merchant adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Artificial Intelligence (AI) dominates the Fintech Software Market technology segment with an estimated over 40% market share, driven by its central role in real-time decision automation, fraud detection, and predictive analytics. AI-powered credit scoring, underwriting automation, and conversational banking significantly enhance operational efficiency and customer engagement. RPA follows with strong adoption in back-office automation, while blockchain gains traction for secure transaction processing and decentralized identity solutions. Overall demand accelerates as financial institutions prioritize intelligent automation, cost reduction, and improved risk management.

- For instance, Solid Financial Technologies’ platform has processed over 11 billion API calls and handled more than 11 billion dollars in transactions, demonstrating the scale and robustness of its AI-powered infrastructure.

By Application

Fraud Monitoring leads the application segment with approximately 45% market share, supported by rising digital transaction volumes and increasingly sophisticated cyber threats. Financial enterprises deploy advanced anomaly-detection engines, AI-driven transaction scoring, and biometric authentication to reduce fraud-related losses. KYC Verification grows rapidly as regulators enforce stricter identity and customer-risk standards, boosting adoption of e-KYC, digital onboarding, and document-verification tools. Compliance & Regulatory Support remains essential as institutions seek automated reporting, AML alert management, and real-time rule-change tracking to maintain regulatory consistency.

- For instance, Rapyd’s Protect solution uses machine-learning models that process risk signals in real time and supports more than 900 payment methods across 100+ countries, allowing it to generate a dynamic risk score that determines automatic approval, manual review, or outright decline.

By End User

Banks hold the dominant position in the end-user segment with more than 50% market share, fueled by large-scale digital transformation initiatives, modernization of core banking systems, and increased adoption of AI and analytics for risk assessment. Financial institutions—including payment providers, lending platforms, and wealth-management firms—expand fintech software usage to enhance customer experience and operational agility. Insurance companies accelerate investment in digital claims handling, automated underwriting, and fraud analytics. The “Others” category, comprising fintech startups and non-bank entities, grows steadily due to rising use of embedded finance solutions.

Key Growth Drivers

Rising Digital Payments and Real-Time Transaction Processing

The rapid expansion of digital payments, fueled by mobile wallets, instant transfers, and contactless transactions, drives strong demand for fintech software. Banks and payment providers deploy real-time processing engines, automated settlement systems, and secure transaction monitoring tools to handle growing volumes. Increasing adoption of ISO 20022 standards and unified payment interfaces further accelerates modernization. As consumers expect seamless, fast, and low-cost payment experiences, enterprises invest heavily in scalable platforms that improve efficiency, minimize downtime, and support cross-border transactions, making payments a major market catalyst.

- For instance, Upstart’s Credit Decision API powers instant, real-time underwriting using more than 2,500 variables per applicant, returning risk-based pricing and term options while estimating probability and timing of default.

Strong Regulatory Push for Compliance Automation

Tightening global regulations in areas such as AML, KYC, data governance, and consumer protection strengthen the need for automated compliance systems. Financial institutions adopt fintech software to streamline identity verification, automate risk scoring, and ensure accurate regulatory reporting. AI-enabled compliance tools reduce manual workloads, minimize false positives, and support real-time rule updates. Regulatory technology (RegTech) integration enables institutions to maintain audit readiness, improve transparency, and prevent financial crime. This ongoing regulatory shift positions compliance automation as a core growth driver for fintech software adoption across markets.

- For instance, Braintree enforces PCI DSS compliance by integrating with SecurityMetrics—its merchants can undergo annual SAQ validation or Level 3/4 assessments via a pre-arranged Qualified Security Assessor.

Growing Integration of AI, Analytics, and Cloud-Native Platforms

Increasing demand for intelligent, data-driven decision-making accelerates deployment of AI, machine learning, and cloud-native fintech solutions. Enterprises leverage predictive analytics for credit scoring, fraud detection, and personalized financial services, enhancing both efficiency and customer experience. Cloud-native architecture reduces operational costs, improves scalability, and enables faster product deployment. The shift toward API-driven ecosystems, open banking frameworks, and microservices further supports innovation. As firms prioritize agility and automation, advanced analytics and cloud integration serve as major enablers of fintech software market growth.

Key Trends & Opportunities

Expansion of Embedded Finance and Banking-as-a-Service (BaaS)

Embedded finance emerges as a major opportunity as non-financial enterprises integrate payment, lending, and insurance capabilities directly into their platforms. Retailers, e-commerce companies, and mobility providers increasingly adopt BaaS solutions to offer seamless financial experiences without building infrastructure from scratch. Fintech software providers benefit from rising demand for API-based onboarding, KYC, and transaction-processing modules. This shift supports new revenue streams for both banks and fintechs, while enabling hyper-personalized financial services. The increasing maturity of open banking accelerates broader adoption of embedded finance models.

- For instance, Railsbank (now Railsr) supports more than 250 B2B customers and has enabled 5.5 million embedded accounts across its platform, allowing brands to deploy financial products such as wallets, cards, and credit using its APIs.

Rapid Growth of Digital Identity, E-KYC, and Authentication Solutions

As digital transactions surge, strong identity verification becomes essential. Fintech software vendors expand capabilities in e-KYC, biometric authentication, document verification, and risk-based scoring. Governments and regulators worldwide promote digital identity frameworks, creating opportunities for compliant verification platforms. Advancements in facial recognition, liveness detection, and AI-driven fraud analytics improve onboarding accuracy and reduce manual review time. This trend supports sectors such as banking, insurance, and digital lending, where fast and secure customer authentication drives competitive differentiation in a high-risk digital environment.

- For instance, Synctera has significantly scaled its BaaS infrastructure in 2024, reconciling 219 billion in transaction volume across more than 80 sources, while automating reconciliation for ~99% of those transactions.

Increasing Adoption of Low-Code/No-Code Fintech Development

Financial institutions embrace low-code and no-code platforms to accelerate product development, reduce IT dependency, and modernize legacy systems. These platforms enable rapid creation of workflows for onboarding, loan processing, and compliance automation. Fintech providers integrate drag-and-drop tools, pre-built templates, and API connectors to support faster innovation. This trend presents an opportunity for software vendors to target mid-size banks and fintech startups seeking cost-efficient digital transformation. As operational agility becomes critical, low-code approaches reshape how financial services design and deploy new digital products.

Key Challenges

Rising Cybersecurity Threats and Data-Privacy Risks

As financial systems become more interconnected, cyberattacks, ransomware incidents, and data breaches pose significant risks. Fintech software must constantly evolve to protect sensitive information across cloud environments, APIs, and digital channels. Institutions face challenges in deploying end-to-end encryption, identity protection, and threat-intelligence systems at scale. Regulatory expectations around data privacy further increase complexity. Balancing innovation with cybersecurity investments remains a major obstacle, particularly for smaller fintech firms with limited resources, making security resilience a core industry challenge.

Integration Issues with Legacy Banking Infrastructure

Many traditional banks continue to operate on outdated core systems, creating major integration barriers for modern fintech software. Legacy architecture often lacks API compatibility, scalability, and real-time processing capabilities, slowing digital transformation efforts. Upgrading or replacing these systems involves high costs, operational risks, and lengthy implementation timelines. As a result, fintech vendors must develop flexible middleware, microservices, and migration tools to bridge old and new environments. Despite growing demand, integration complexity remains a significant challenge that limits rapid adoption of advanced fintech solutions.

Regional Analysis

North America

North America holds the largest share of the Fintech Software Market at around 35%, supported by strong digital adoption, advanced financial infrastructure, and high investment in AI-driven banking platforms. The region benefits from widespread use of mobile banking, real-time payments, and cloud-native financial systems. Regulatory frameworks encouraging open banking and data security also accelerate technological innovation. The presence of major fintech developers, extensive venture capital funding, and rapid integration of API-based services across banks and financial institutions further solidify the region’s leadership in fintech software deployment.

Europe

Europe accounts for approximately 30% of the global market, driven by strong regulatory initiatives such as PSD2 and open banking, which promote interoperability and secure data sharing across financial ecosystems. The region experiences high demand for compliance automation, digital identity verification, and cross-border payments software. Banks and financial institutions increasingly adopt cloud-based platforms and AI-enabled decision systems to enhance operational efficiency. Strong fintech hubs in the UK, Germany, and the Nordics support continuous innovation, while rising digital banking penetration and cybersecurity investments strengthen market expansion.

Asia-Pacific

Asia-Pacific captures around 25% of the fintech software market, supported by rapid digitalization, high mobile-payment adoption, and strong government initiatives promoting cashless economies. Countries such as China, India, and Singapore lead adoption of real-time payments, e-KYC systems, and digital lending platforms. Fintech startups and large technology firms increasingly collaborate with banks to offer embedded finance, AI-powered credit scoring, and blockchain-based transaction tools. Rising financial inclusion efforts and expanding digital infrastructure further accelerate demand, positioning the region as the fastest-growing market for fintech software solutions.

Latin America

Latin America holds roughly 6–7% market share, with growth supported by expanding digital-banking ecosystems, rising smartphone penetration, and a strong shift toward online payments and digital lending. Brazil and Mexico lead regional adoption, driven by fintech-friendly regulations and government-backed instant payment systems. Financial institutions increasingly rely on cloud-based platforms, fraud analytics tools, and digital onboarding software to meet rising consumer expectations. Although infrastructure gaps persist, rapid financial inclusion and growing interest from global fintech investors continue to strengthen opportunities across the region.

Middle East & Africa

The Middle East & Africa region represents around 3–4% of the global market but shows strong growth potential due to accelerating digital transformation and expanding mobile banking usage. Gulf countries lead adoption with investments in blockchain, digital payment platforms, and regulatory technology solutions. African markets experience increasing fintech penetration driven by mobile wallets, digital micro-lending, and identity-verification platforms that support underserved populations. Government initiatives promoting fintech sandboxes and cross-border payment modernization further encourage adoption, positioning the region for steady long-term growth despite infrastructural challenges.

Market Segmentations:

By Technology:

By Application:

- Fraud Monitoring

- KYC Verification

By End User:

- Banks

- Financial Institutions

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Fintech Software Market features a diverse competitive landscape led by Solid Financial Technologies, Inc., Rapyd Financial Network, Upstart Holdings, Inc., Braintree, Railsbank Technology Ltd., Block, Inc., Synctera Inc., Envestnet, Inc., Mastercard Incorporated, and PayPal Holdings, Inc. The Fintech Software Market exhibits a highly dynamic and competitive landscape driven by rapid digitalization, convergence of financial services, and continuous innovation in payments, lending, compliance, and infrastructure solutions. Vendors increasingly differentiate through advanced cloud-native architectures, real-time data analytics, and AI-enabled automation that enhance transaction efficiency and risk management. Competition intensifies as companies expand their product portfolios to include embedded finance, API marketplaces, and modular platforms that enable enterprises to integrate financial capabilities at scale. Strategic partnerships, mergers, and global expansion remain critical as firms aim to strengthen regulatory compliance, improve customer experience, and accelerate time-to-market. Additionally, rising demand for secure digital payment systems, cross-border processing, and personalized financial services encourages providers to invest in cybersecurity, fraud prevention, and open banking frameworks. Overall, the market remains characterized by rapid technological evolution and a shift toward interoperable financial ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Oracle enhanced its supply chain management platform by integrating AI capabilities. This update enables the automation of various tasks for procurement professionals, such as generating standardized product descriptions and providing supplier recommendations, which can significantly streamline procurement processes.

- In January 2025, Block, a technology, announced the launch of Goose, an open-source AI agent designed to empower developers with customizable tools. Goose allows users to leverage various large language models, providing flexibility in its application across different tasks and industries.

- In November 2024, Microsoft unveiled cloud-connected software that enables customers to deploy Azure computing, networking, storage, and application services across various environments, including edge locations, on-premises data centers, and hybrid cloud setups.

- In July 2024, Open Payment Technologies Ltd, a leading provider of fintech solutions, announced the launch of its new digital wallet app, Kuady. Kuady is expected to provide a safe and user-friendly experience to ensure efficient money management.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will adopt more AI-driven automation to enhance credit decisioning, fraud detection, and customer onboarding.

- Open banking frameworks will expand, enabling greater data sharing and fostering new digital financial services.

- Cloud-native fintech platforms will continue to replace legacy systems, improving scalability and operational efficiency.

- Embedded finance will grow as non-financial enterprises integrate payments, lending, and insurance into their offerings.

- Cross-border digital payment solutions will advance, supporting faster, more secure international transactions.

- Regulatory technology adoption will rise as firms strengthen compliance, reporting accuracy, and risk management.

- Blockchain and digital asset infrastructure will gain traction, supporting transparent and secure transaction environments.

- Partnerships between fintechs and traditional financial institutions will increase to accelerate innovation and market reach.

- Cybersecurity investment will intensify to combat sophisticated digital threats and protect customer data.

- Personalized financial services powered by real-time analytics will become more prevalent across consumer and enterprise segments.