Market Overview

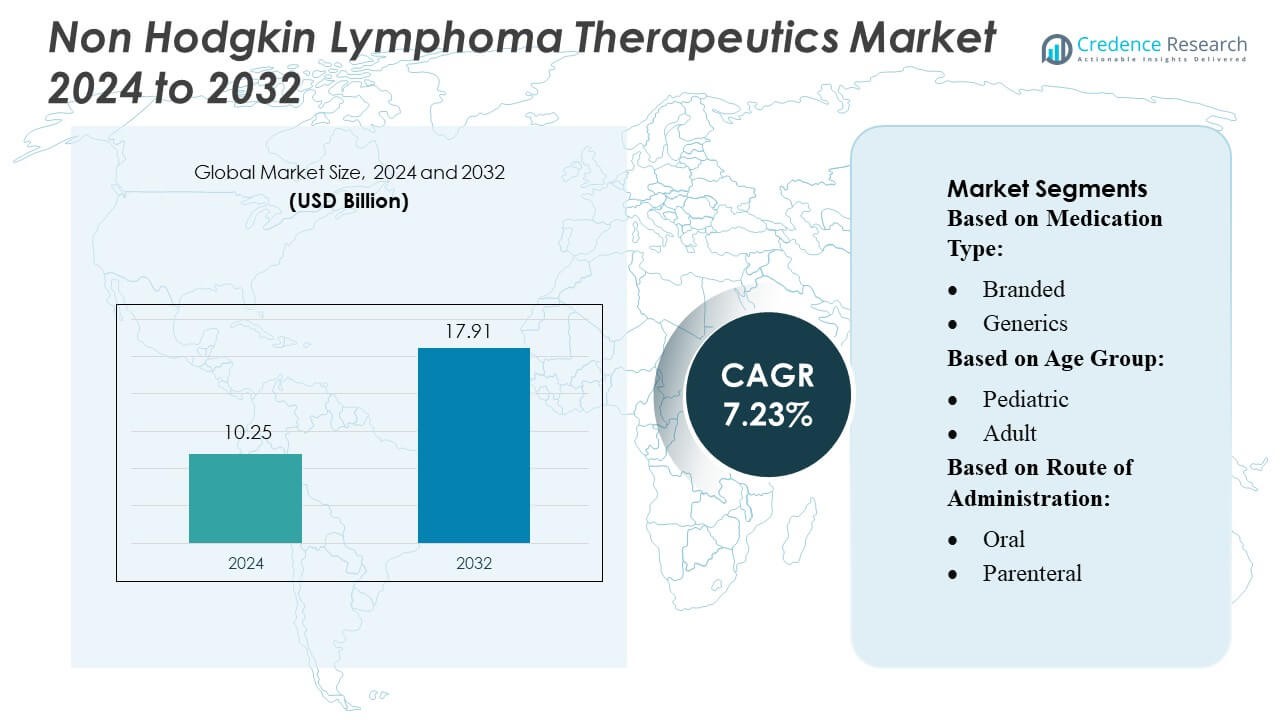

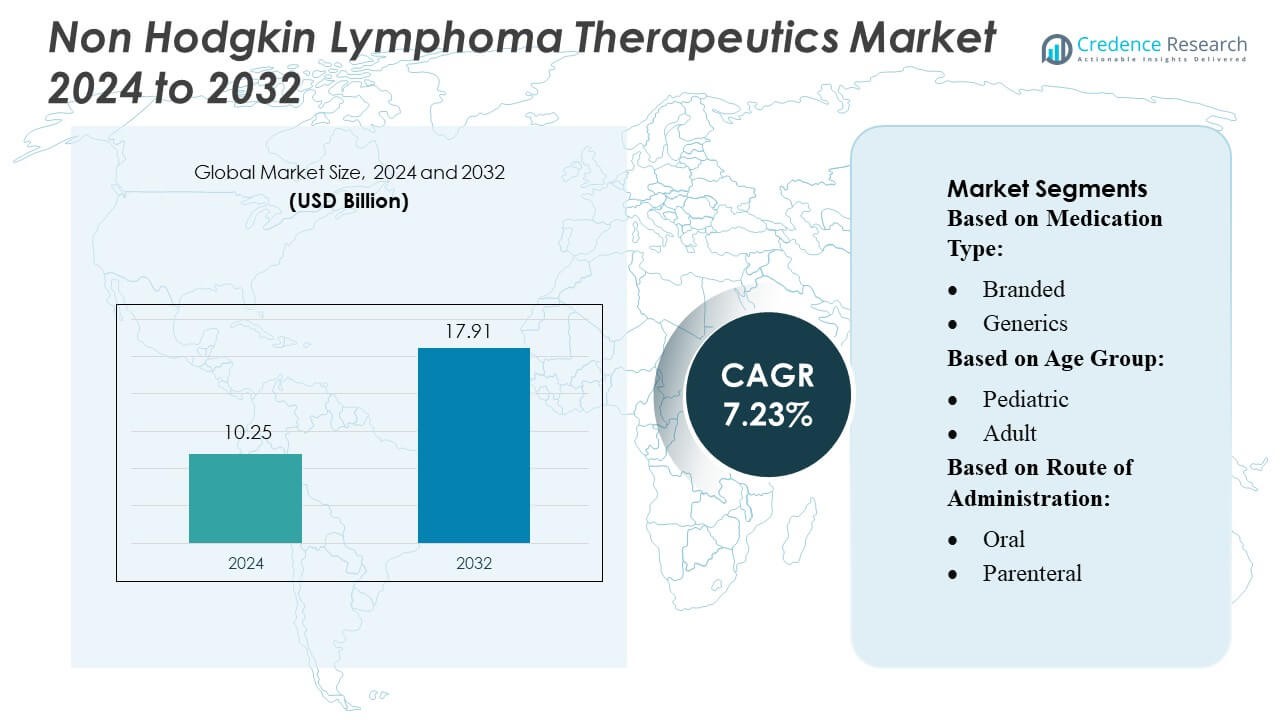

Non Hodgkin Lymphoma Therapeutics Market size was valued USD 10.25 billion in 2024 and is anticipated to reach USD 17.91 billion by 2032, at a CAGR of 7.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non Hodgkin Lymphoma Therapeutics Market Size 2024 |

USD 10.25 Billion |

| Non Hodgkin Lymphoma Therapeutics Market, CAGR |

7.23% |

| Non Hodgkin Lymphoma Therapeutics Market Size 2032 |

USD 17.91 Billion |

The Non-Hodgkin Lymphoma therapeutics market remains highly competitive, with leadership driven by companies that maintain strong portfolios in targeted therapies, immunotherapies, and cell-based treatments. Major players such as F. Hoffmann-La Roche Ltd., Novartis AG, Gilead Sciences, Bristol Myers Squibb, Merck & Co., and AstraZeneca strengthen their positions through continuous innovation in monoclonal antibodies, CAR-T therapies, and bispecific antibodies. These companies benefit from extensive clinical pipelines, broad regulatory experience, and global commercialization capabilities. North America remains the leading region, accounting for approximately 40–45% of the global market, supported by advanced oncology infrastructure, high adoption of novel therapies, and strong reimbursement frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Non-Hodgkin Lymphoma (NHL) Therapeutics Market reached USD 10.25 billion in 2024 and is projected to hit USD 17.91 billion by 2032, expanding at a 7.23% CAGR, driven by rising adoption of targeted and immunotherapy-based treatments.

- Market growth is supported by strong demand for monoclonal antibodies and CAR-T therapies, which together capture a significant share of the therapeutic segment, as patients and clinicians shift toward precision and cell-based interventions with improved survival outcomes.

- Competitive activity remains intense, with key players like Roche, Novartis, Gilead, BMS, Merck, and AstraZeneca advancing bispecific antibodies and next-generation CAR-T platforms to strengthen pipelines and accelerate global commercialization.

- Restraints include high treatment costs, limited accessibility in developing regions, and complex manufacturing requirements for advanced therapies, which constrain widespread adoption despite strong clinical effectiveness.

- Regionally, North America accounts for 40–45% of total market share, supported by robust oncology infrastructure, while targeted therapies dominate the largest treatment segment globally.

Market Segmentation Analysis:

By Medication Type

Branded medications hold the dominant share in the non-Hodgkin lymphoma (NHL) therapeutics market, accounting for most of the revenue due to the strong use of biologics and advanced immunotherapies. Their leadership is driven by higher efficacy, established clinical outcomes, and continuous innovation in targeted and cell-based therapies. Generic drugs are growing steadily as patent expiries increase availability and affordability, especially in cost-sensitive regions. This shift supports wider treatment access, but generics still lag in share because complex biologics remain difficult and costly to replicate.

- For instance, Novartis’s Kymriah (a CAR-T therapy) is dosed at 0.6 to 6.0 × 10⁸ CAR-positive viable T cells per infusion in adult DLBCL or follicular lymphoma patients.

By Age Group

The adult segment represents the largest share of the NHL therapeutics market, driven by the high prevalence of the disease in middle-aged and older adults. Strong treatment adoption, availability of multiple drug classes, and broader eligibility for biologics and combination therapies support this dominance. The geriatric segment is growing due to an aging population and improved tolerability of newer therapies, though comorbidities remain a challenge. The pediatric segment holds the smallest share but benefits from specialized high-intensity regimens and strong survival outcomes in aggressive subtypes.

- For instance, Canary Health’s peer-led “Building Better Caregivers®” program has enrolled more than 19,000 veteran caregivers through its six-week online workshop.

By Route of Administration

Parenteral administration dominates the market, largely due to the extensive use of injectable monoclonal antibodies, immunotherapies, and chemotherapy agents that require controlled dosing and monitored delivery. This route remains essential for treating aggressive or advanced cases. The oral segment is expanding quickly as targeted small-molecule drugs gain adoption, offering greater convenience, home-based treatment possibilities, and suitability for long-term therapy. Despite its rapid growth, oral treatments still hold a smaller share because many frontline and advanced therapies remain infusion-based.

Key Growth Drivers

- Rising Adoption of Targeted and Immunotherapy Agents

The market grows steadily as healthcare systems adopt targeted therapies and immunotherapies that demonstrate superior efficacy and safety over chemotherapy. Agents such as anti-CD20 monoclonal antibodies, CAR-T cell therapies, and novel bispecific antibodies continue to expand their indication base, supporting higher treatment uptake. Clinical success with precision-based approaches improves patient survival outcomes, encouraging broader clinical use. Their ability to modulate tumor-specific immune responses also increases long-term remission prospects, positioning targeted therapies as critical growth accelerators across developed and emerging regions.

- For instance, Propeller Health (a ResMed company) has conducted over 60 clinical studies involving 5,000+ patients, and its inhaler-sensor platform (paired with a smartphone app) has shown a 58% improvement in medication adherence, a 78% reduction in rescue inhaler use, and a 63% increase in asthma control, according to its product profile.

- Increasing Prevalence of B-Cell Lymphomas Globally

The expanding incidence of B-cell NHL subtypes, including diffuse large B-cell lymphoma (DLBCL) and follicular lymphoma, drives sustained therapeutic demand. Population aging and improved diagnostic capabilities contribute to early identification, accelerating treatment initiation rates. Growing awareness among clinicians and patients supports wider adoption of evidence-backed treatment guidelines. The rising patient pool also encourages companies to invest in next-generation therapeutics with enhanced durability of response, strengthening market expansion. Additionally, prevalence growth in Asia-Pacific and Latin America underpins opportunities for treatment penetration in underserved markets.

- For instance, Teladoc Health (which acquired Livongo) had 1.203 million members enrolled in its chronic care programs as of December 31, 2024, according to its full-year 2024 results.

- Robust R&D Investment and Clinical Trial Advancements

Global pharmaceutical companies continue to increase R&D spending to develop innovative therapeutic modalities, including next-generation CAR-T therapies, antibody-drug conjugates (ADCs), and small-molecule inhibitors. Advancements in translational research accelerate identification of novel biomarkers and resistance pathways, enabling more targeted drug development. Expanding clinical trials across multiple NHL subtypes enhances therapeutic diversity while fostering faster regulatory approvals. Collaboration between academic centers, biotech companies, and manufacturing partners further shortens development cycles, boosting the pipeline of effective and commercially viable NHL treatment options.

Key Trends & Opportunities

1. Expansion of Combination Therapies and Personalized Medicine Approaches

Combination regimens integrating immunotherapies, targeted agents, and chemotherapy continue to gain prominence due to their ability to improve response rates and overcome resistance. Advances in genomic profiling and liquid biopsy technologies enable personalized treatment selection based on tumor biology. Precision-guided approaches improve patient stratification, enhance clinical outcomes, and reduce adverse effects. This trend creates substantial opportunities for companies to develop proprietary combination protocols and companion diagnostics that address heterogeneity across NHL subtypes.

- For instance, Pear Therapeutics’ FDA-authorized PDT reSET demonstrated a clinically verified abstinence rate of 40% compared with 17% in the control group across a 12-week randomized trial, while its opioid-use PDT reSET-O achieved a treatment retention rate of 82% versus 68% with standard care—showing the measurable impact of personalized, software-driven interventions.

2. Growing Opportunity in Cell-Based and Next-Gen Gene Therapies

Commercial adoption of CAR-T therapies accelerates rapidly as manufacturing becomes more scalable, allowing broader patient access. Continued innovation in allogeneic (“off-the-shelf”) CAR-T platforms, gene-edited T-cells, and NK-cell therapies offers significant market potential. These therapies aim to reduce production time, improve safety, and expand applicability across relapsed or refractory NHL cases. With increasing investment in advanced biomanufacturing and regulatory support for expedited approvals, next-generation cell therapies present one of the most transformative opportunities in the NHL therapeutics landscape.

- For instance, Omada Health reported 831,000 total members in Q3 2025, up 53% over Q3 2024, and disclosed that its AI-agent OmadaSpark (launched in May 2025) delivers real-time nutritional education and motivational interviewing at scale.

3. Digital Health Integration to Support Treatment Monitoring

Digital platforms that enable real-time symptom tracking, remote monitoring, and AI-assisted decision support are gaining traction across oncology. These tools improve treatment adherence and allow early identification of complications, enhancing overall care efficiency. Pharmaceutical companies and healthcare providers increasingly collaborate to integrate digital solutions alongside therapies, particularly for immunotherapy-associated toxicities. This creates new revenue streams and strengthens patient-centric care models, positioning digital enablement as a strategic market opportunity.

Key Challenges

1. High Cost of Advanced Therapies and Limited Access in Emerging Regions

The elevated cost of targeted agents, biologics, and CAR-T therapies remains a major barrier to adoption, especially in low- and middle-income countries. Reimbursement complexities and limited insurance coverage further restrict patient access to innovative treatments. Manufacturing constraints for advanced therapies increase production expenses and reduce pricing flexibility. As healthcare budgets remain tight, cost containment pressures challenge companies to demonstrate strong real-world value and cost-effectiveness to achieve broader market penetration.

2. Treatment Resistance and Clinical Complexity Across NHL Subtypes

Heterogeneity within NHL subtypes creates significant complexity in treatment planning and outcome prediction. Many patients with aggressive or relapsed disease develop resistance to existing therapies, limiting long-term effectiveness. The need for precise biomarker identification and subtype-specific strategies complicates clinical decision-making. Moreover, immunotherapy-related toxicities require specialized management, adding further strain on healthcare infrastructure. These clinical hurdles slow therapeutic adoption and highlight the need for continuous innovation in resistance-targeted drug development.

Regional Analysis

North America

North America holds the largest share of the Non-Hodgkin Lymphoma therapeutics market at 40–45%. Strong adoption of advanced treatments, including targeted therapies and CAR-T cell products, drives market leadership. The region benefits from high healthcare spending, strong insurance coverage, and well-developed cancer centers that support early diagnosis and rapid treatment initiation. The U.S. leads regional growth due to fast regulatory approvals and broad availability of innovative therapies. Continuous R&D investments and active clinical trial networks further strengthen North America’s dominant position in the global market.

Europe

Europe accounts for about 28–30% of the global NHL therapeutics market. The region benefits from well-established healthcare systems, strong oncology networks, and broad access to immunotherapies and targeted agents. Countries such as Germany, the UK, and France drive adoption through favorable reimbursement frameworks and standardized treatment guidelines. Growing use of personalized medicine and increasing participation in clinical trials support sustained demand. Although regulatory processes can be slower than in North America, Europe continues to expand access to next-generation therapies, maintaining solid market growth.

Asia-Pacific

Asia-Pacific holds approximately 15–20% of global market share and remains the fastest-growing region. Rising cancer awareness, improving diagnostic capabilities, and expanding healthcare infrastructure support market expansion. China, Japan, India, and South Korea lead regional growth as access to immunotherapies and targeted treatments steadily improves. Increasing government investment, rising private insurance coverage, and growth in local manufacturing of biologics and cell-based therapies strengthen uptake. As clinical trial activity increases across major countries, Asia-Pacific continues to emerge as a key growth engine in the NHL therapeutics market.

Latin America

Latin America contributes roughly 5–8% of the global NHL therapeutics market. Growth is driven by improving oncology care in Brazil, Mexico, and Argentina, where access to targeted therapies is gradually expanding. However, high treatment costs and limited reimbursement restrict adoption across several countries. Efforts to upgrade cancer care infrastructure and expand public–private partnerships support gradual improvement in treatment availability. Despite regional disparities, increasing awareness and the introduction of more affordable biosimilars are helping expand access to NHL therapies, supporting moderate but steady market growth.

Middle East & Africa

The Middle East & Africa region accounts for around 5–10% of the global NHL therapeutics market. GCC nations, including the UAE and Saudi Arabia, drive most growth due to their advanced healthcare systems and rising investment in oncology services. Access to innovative therapies is improving, though affordability and limited infrastructure remain challenges in several African countries. Government-led healthcare modernization, growing medical tourism, and partnerships with global pharmaceutical companies are gradually expanding treatment availability, supporting slow but consistent regional market development.

Market Segmentations:

By Medication Type:

By Age Group:

By Route of Administration:

Market, By Distribution

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Non-Hodgkin Lymphoma (NHL) therapeutics market includes a wide spectrum of stakeholders, and digital health–focused companies such as Fitbit LLC, Canary Health, Propeller Health (ResMed), Livongo Health, Inc. (Teladoc Health, Inc.), Pear Therapeutics, Inc., Omada Health, Inc., Welldoc, Inc., 2Morrow, Inc., Noom, Inc., and Mango Health. The Non-Hodgkin Lymphoma (NHL) therapeutics market is defined by rapid innovation, strong R&D intensity, and continuous advancement in targeted and immunotherapy-based treatment options. Companies compete by expanding portfolios that include monoclonal antibodies, CAR-T therapies, bispecific antibodies, antibody-drug conjugates, and precision medicines addressing specific genetic markers. Market participants focus heavily on clinical differentiation, demonstrating improved response rates, reduced toxicity, and longer progression-free survival to secure competitive advantage. Strategic alliances, licensing agreements, and co-development partnerships remain central to accelerating late-stage pipelines and accessing advanced technologies. Competition also expands around manufacturing capabilities, particularly for cell and gene therapies, where scalability and turnaround time strongly influence market success. As payers increasingly emphasize value-based models, firms differentiate through real-world evidence generation and health-economic data to strengthen reimbursement positioning. The accelerating shift toward personalized regimens and combination therapies continues to heighten competition across all major NHL treatment categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fitbit LLC

- Canary Health

- Propeller Health (ResMed)

- Livongo Health, Inc. (Teladoc Health, Inc.)

- Pear Therapeutics, Inc.

- Omada Health, Inc.

- Welldoc, Inc.

- 2Morrow, Inc.

- Noom, Inc.

- Mango Health

Recent Developments

- In March 2025, ATA Action acquired the Digital Therapeutics Alliance (DTA), a global provider promoting digital therapeutics access. This merger strengthens advocacy efforts to support innovative technologies reshaping healthcare and enhancing patient outcomes.

- In October 2024, Click Therapeutics, Inc. launched Software-Enhanced Drug therapies under its new Click SE offering, introducing a novel category of prescription digital therapeutics aligned with growing FDA interest in Prescription Drug-Use Related Software (PDURS) guidance.

- In May 2024, Otsuka announced the launch of a subsidiary focused on data and technology. This entity, named Otsuka Precision Health, will commercialize Rejoyn, a digital therapeutic specifically designed for individuals suffering from major depressive disorder.

- In January 2024, Eli Lilly and Company announced the launch of LillyDirect, a digital healthcare platform for U.S. patients managing obesity, migraine, and diabetes. LillyDirect provides a suite of disease management tools, enabling personalized support, access to independent healthcare providers, and the convenience of direct delivery of certain Lilly medications to homes through third-party pharmacy services.

Report Coverage

The research report offers an in-depth analysis based on Medication Type, Age Group, Route of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue shifting toward targeted therapies and precision-based treatment strategies.

- Adoption of CAR-T and next-generation cell therapies will expand across more lymphoma subtypes.

- Bispecific antibodies will gain wider clinical use due to strong efficacy in relapsed and refractory cases.

- Combination therapy regimens will become standard to overcome resistance and improve long-term outcomes.

- Diagnostic advances will enhance early detection and support personalized treatment planning.

- More biosimilars will enter the market, increasing affordability and broadening patient access.

- Digital health tools will increasingly support treatment monitoring and patient management.

- Global clinical trial activity will accelerate development of novel and mutation-specific therapies.

- Emerging markets will strengthen their share as access to advanced oncology treatments improves.

- Real-world evidence will play a larger role in guiding reimbursement and approving next-generation therapies.