Market Overview

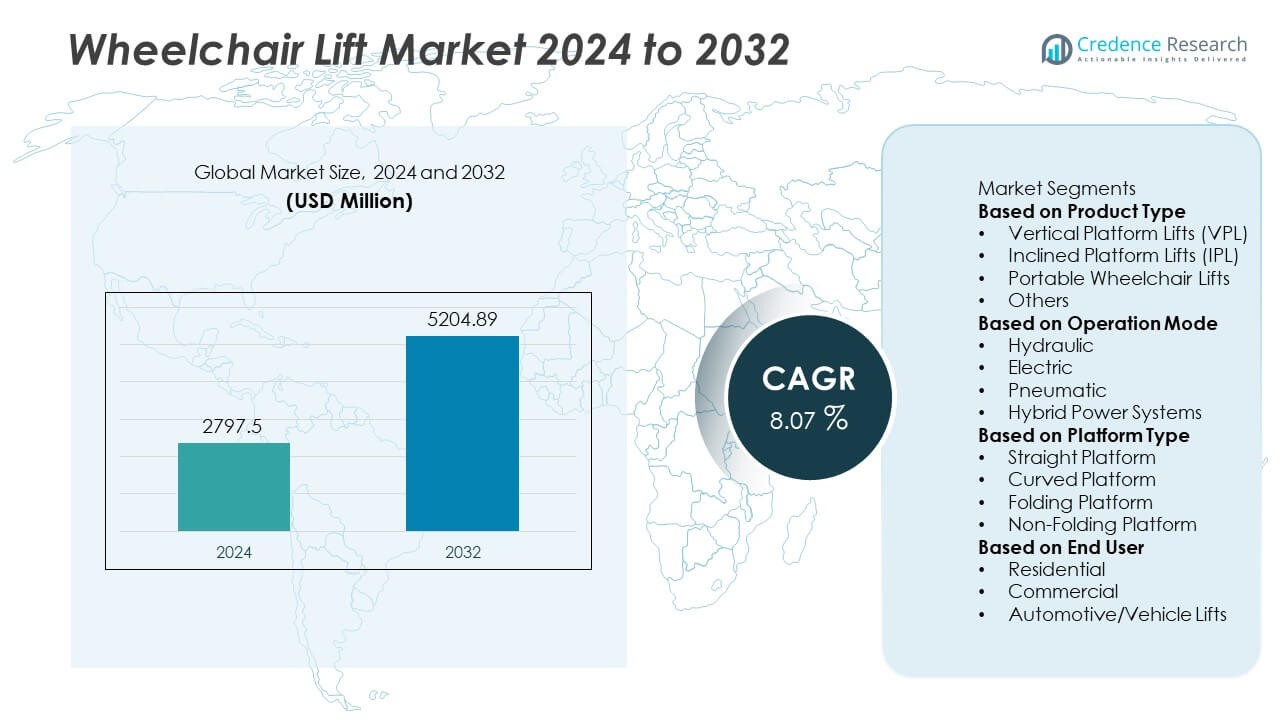

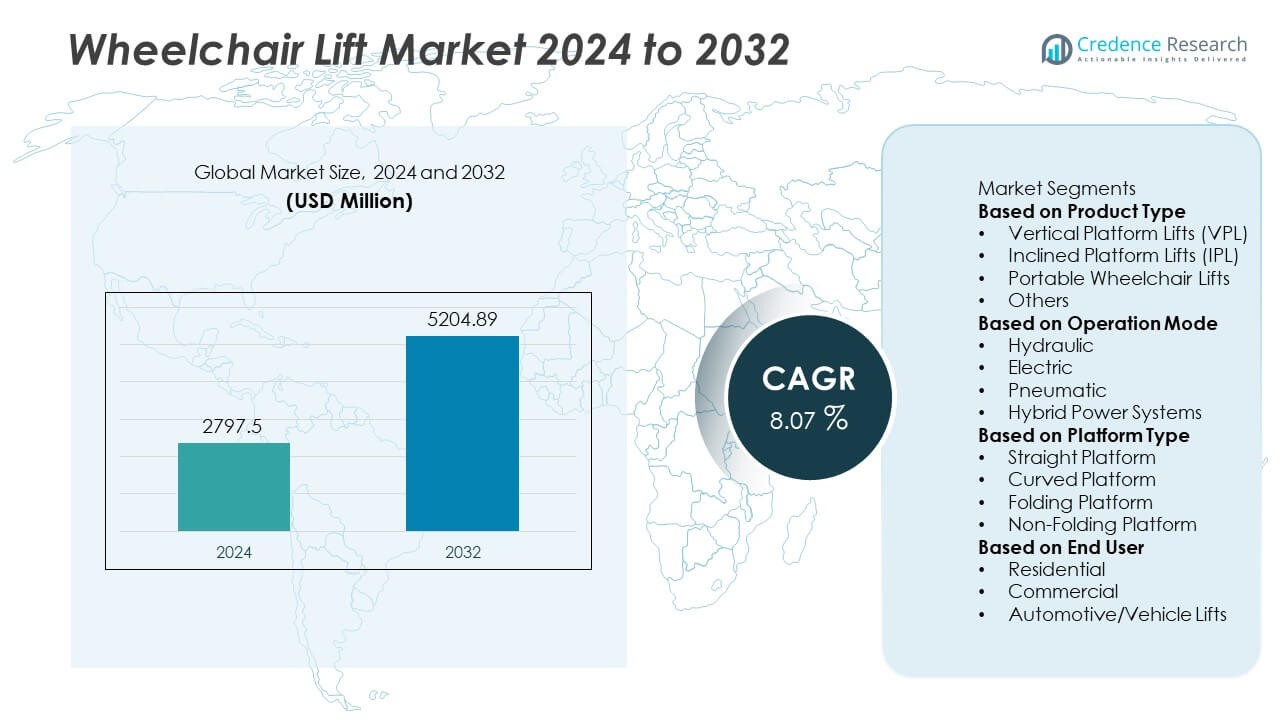

The Wheelchair Lift Market reached USD 2,797.5 million in 2024 and is projected to grow to USD 5,204.89 million by 2032, reflecting a CAGR of 8.07% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wheelchair Lift Market Size 2024 |

USD 2,797.5 Million |

| Wheelchair Lift Market, CAGR |

8.07% |

| Wheelchair Lift Market Size 2032 |

USD 5,204.89 Million |

The Wheelchair Lift market is driven by major companies such as Savaria Corporation, Garaventa Lift, Thyssenkrupp Access Solutions, Bruno Independent Living Aids, Harmar Mobility LLC, Stannah Lifts Holdings Ltd., Hybrid Elevator Inc., Mobility Lifts Systems Inc., American Elevator Inc., and Ascendor Lifttechnik GmbH. These manufacturers focus on advanced hydraulic and electric platform lift technologies to support accessible mobility in homes, commercial facilities, and public transport systems. North America leads the market with a 34% share, supported by strong ADA compliance requirements and extensive accessibility integration across healthcare and public infrastructure. Europe and Asia-Pacific follow, driven by elderly population growth, inclusive mobility policies, and increasing installations in residential and transportation projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Wheelchair Lift market reached USD 2,797.5 million in 2024 and is projected to reach USD 5,204.89 million by 2032 at an 8.07% CAGR, supported by expanding accessibility requirements in public and private infrastructure.

- Rising demand for mobility assistance acts as a key growth driver, with Vertical Platform Lifts holding a 46% segment share as hospitals, senior living centers, and residential buildings integrate safe vertical transfer systems for wheelchair users.

- Smart safety features, remote diagnostics, and electric drive systems represent key trends, while manufacturers introduce compact and folding platforms to support installations in narrow residential hallways, commercial spaces, and transport vehicles.

- Competitive activity increases as Savaria, Garaventa Lift, Thyssenkrupp Access Solutions, Bruno, and Harmar Mobility focus on cost-efficient lift engineering, regulatory compliance, and service networks to strengthen their global presence.

- North America leads the market with a 34% regional share, followed by Europe at 29% and Asia-Pacific at 30%, while Latin America and Middle East & Africa account for 4% and 3%, supported by transport accessibility upgrades and healthcare facility expansions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type:

Vertical Platform Lifts (VPL) hold a 46% share and lead the product type segment. These systems support safe vertical mobility for wheelchair users in residential and commercial buildings, improving accessibility compliance. Inclined Platform Lifts (IPL) gain adoption in stairways and heritage structures where elevator installation is not feasible. Portable wheelchair lifts serve temporary needs in events, schools, and public transport. Other lift types, including enclosed and hybrid systems, expand due to increasing use in hospitals and senior care facilities. Growth in mobility assistance programs and building accessibility requirements supports strong demand for VPL systems.

- For instance, Savaria introduced the M2lift platform with a 340 kg (750 lb) load rating. The system uses a reliable chain drive system housed in a slim-profile twin tower design for smooth, quiet operation.

By Operation Mode:

Hydraulic wheelchair lifts account for a 39% share of the operation mode segment. The system offers strong load capacity, smooth lifting, and reliable performance across residential and vehicle applications. Electric lifts observe rising installation due to quieter operation and lower energy consumption, particularly in public facilities and transport vehicles. Pneumatic and hybrid power lifts support specialized medical and emergency mobility use cases. Advancements in power-efficient motors and electronic control systems strengthen the shift toward electric-driven lifts. Government incentives for public infrastructure accessibility also reinforce adoption across the market.

- For instance, Harmar Mobility offers various lifts, with popular models like the AL100HD featuring a 181 kg (400 lbs) lifting capacity. Other high-capacity models, such as certain versions of the AL425 hoist lift, can also lift up to 450 lbs. These lifts are typically fully powered for effortless operation.

By Platform Type:

Folding platform lifts represent the dominant platform category with a 42% share. The folding mechanism reduces space requirements and supports narrow corridors, buses, and private mobility vans. Straight platforms continue to serve residential and commercial buildings with standard staircase and entry layouts. Curved platform lifts are preferred for customized architectural designs and multi-turn staircases, especially in schools, airports, and historical properties. Non-folding platforms support high-capacity and continuous-use environments such as hospitals and rehabilitation centers. Growth in transportation accessibility programs and specialized mobility vehicles drives stronger use of folding platform lift solutions.

Key Growth Drivers

Growing Aging Population and Mobility Disabilities

The global rise in aging populations increases the demand for wheelchair lifts across residential, healthcare, and public infrastructure. Mobility impairments linked to chronic diseases and post-surgical rehabilitation further create a need for safe vertical transport solutions. Wheelchair lifts offer accessibility in multi-level homes, senior living facilities, and hospitals, improving user independence and caregiver support. Government funding for home accessibility modification programs accelerates adoption. As disability inclusion policies strengthen, demand is expected to increase across both developed and emerging economies, driving long-term growth in the wheelchair lift market.

- For instance, the Savaria V-1504 vertical platform lift has a standard load rating of 340 kg (750 lb). The company’s V-1504 model has a verified noise output of 72.9 decibels (dBA) in the up direction and 50.0 dBA in the down direction during typical operation.

Expansion of Accessible Public Transportation Systems

Governments and transport agencies deploy wheelchair lifts in buses, vans, rail stations, and airports to comply with accessibility regulations. Public transport fleets integrate electric and hydraulic lift systems to ensure safe boarding and reduce operator strain. Increased investment in inclusive urban mobility and smart transit infrastructure supports market expansion. Lift installations improve service efficiency for passengers using wheelchairs, mobility scooters, and walkers. Rising demand for accessible ride-sharing and paratransit services further enhances adoption across commercial vehicle fleets, reinforcing strong growth in the transport application segment.

- For instance, BraunAbility is a major supplier of public-fleet wheelchair lifts to U.S. transit agencies, offering models with various capacities (commonly 800 pounds or up to 400 kg) that meet and exceed rigorous federal safety and durability standards, including mandatory cyclic testing.

Rising Construction of Inclusive Residential and Commercial Buildings

Demand for wheelchair lifts increases as building codes mandate barrier-free access in new and renovated structures. Real estate developers integrate vertical and inclined lift systems in multi-family housing, hotels, educational facilities, and corporate buildings. Users seek compact, quiet, and folding platform options that support narrow layouts and limited installation space. Advances in design flexibility, lightweight materials, and safety automation improve lift installation in both indoor and outdoor environments. The trend aligns with universal design initiatives, boosting market adoption in both private and public infrastructure projects.

Key Trends & Opportunities

Integration of Smart, Electric, and IoT-Enabled Lift Controls

Manufacturers introduce connected monitoring systems, remote diagnostic capabilities, and safety sensors for predictive maintenance. Smart lifts enable real-time usage tracking, automated platform locking, and battery condition monitoring. Electric drive mechanisms reduce noise, energy use, and maintenance requirements, supporting installations in hospitals, offices, and high-traffic transit hubs. Digital connectivity creates opportunities for service subscription models and improved device uptime. These advancements enhance user experience and align with broader smart building and smart transportation investments.

- For instance, TK Elevator (formerly Thyssenkrupp Elevator) integrated an IoT module in its MAX platform that continuously collects data on elevator performance, components, and systems.

Growth of Portable and Modular Lift Solutions

Portable wheelchair lifts create opportunities in schools, event venues, community centers, and temporary accessibility setups. Modular platforms allow rapid assembly and relocation, serving short-term construction and maintenance needs. Lightweight aluminum structures and efficient lifting motors improve safety and ease of handling. These products support disaster relief, field medical units, and emergency transport vehicles. Increased demand for flexible accessibility solutions expands commercial rental markets and enables manufacturers to target new service-driven revenue streams.

- For instance, Harmar Mobility offers various residential and commercial vertical platform lifts (VPLs) designed to provide reliable access, with some models offering a lift height of up to 14 feet (approximately 4267 millimeters).

Key Challenges

High Installation and Maintenance Costs

Wheelchair lifts require specialized design, site preparation, and professional installation, resulting in high initial investment. Ongoing maintenance, inspection, and part replacements add to lifecycle cost concerns, particularly for households with limited affordability. Public institutions may face budget constraints when upgrading accessibility infrastructure. Manufacturers are pressured to improve cost-efficiency, offer financing options, and provide longer service intervals. Price sensitivity may limit adoption across low-income regions, slowing market penetration.

Technical Integration and Space Constraints in Existing Buildings

Retrofitting wheelchair lifts into older structures can be difficult due to limited shaft space, structural restrictions, and non-standard stair layouts. Architectural modifications increase installation time and cost, especially in narrow indoor corridors and heritage properties. Vehicle lift integration may require reinforced flooring and custom mounting. These constraints drive demand for compact, folding, and curved-platform solutions, but may delay adoption where modifications are not feasible. Improved modular engineering and flexible platform designs are essential to overcoming this challenge.

Regional Analysis

North America

North America holds a 34% share of the Wheelchair Lift market. The United States leads adoption due to strong accessibility laws, including ADA building requirements. Public transportation agencies invest in lifts for buses, trains, and airport mobility services. Healthcare facilities and senior living centers expand lift installations to support safe patient movement. Canada strengthens adoption through government funding for home accessibility modifications. Rising mobility disabilities linked to aging populations further support demand. Manufacturers focus on electric and hydraulic platform lifts with enhanced safety controls and remote diagnostics, supporting modernization of public and private infrastructure.

Europe

Europe accounts for a 29% share of the market, driven by strict accessibility regulations across commercial and municipal buildings. Countries such as Germany, France, the United Kingdom, and Italy integrate wheelchair lifts in schools, hospitals, and railway stations to meet EU mobility standards. Growth in elderly care facilities and rehabilitation centers increases demand for vertical and inclined lifts. Investments in barrier-free public transport networks strengthen adoption of lifts in buses and metro systems. European manufacturers emphasize energy-efficient electric lifts, compact folding platforms, and design integration for historic and space-limited buildings, supporting wider implementation.

Asia-Pacific

Asia-Pacific leads with a 30% share, supported by rapid urbanization and improving disability inclusion policies. China and India expand public infrastructure and transportation projects, creating demand for lifts in metro systems, airports, and government buildings. Japan and South Korea show strong adoption in residential care facilities and accessible housing programs due to aging demographics. Growing awareness of mobility rights and rising healthcare infrastructure investments support long-term growth. Manufacturers introduce cost-effective electric and hydraulic platform lifts for hospitals, malls, and educational institutions. Digital retail channels and government subsidies improve access to home mobility solutions.

Latin America

Latin America holds a 4% share of the market. Brazil and Mexico lead regional demand as cities upgrade public transit and hospital infrastructure. Adoption increases in airports, sports venues, and community buildings to support accessibility compliance. Growth in private rehabilitation clinics and elderly care homes drives demand for safe lifting platforms. Cost sensitivity encourages use of compact and portable lifts for short-term or shared applications. Market expansion improves through distribution partnerships and government-supported mobility programs, although slower economic development limits broader infrastructure upgrades in some countries.

Middle East & Africa

The Middle East & Africa represent a 3% share of the Wheelchair Lift market. Gulf countries invest in accessible airports, hotels, and healthcare centers, driving installations of advanced vertical and inclined lifts. Public transport modernization supports lift adoption in metro and bus stations. South Africa and Kenya observe growth in rehabilitation centers and nonprofit mobility projects. Hot climates increase interest in durable, weather-resistant lift materials. Limited budget capacity and uneven regulatory enforcement slow large-scale deployment, but expanding medical tourism and inclusive construction policies create long-term opportunities for manufacturers and service providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type

- Vertical Platform Lifts (VPL)

- Inclined Platform Lifts (IPL)

- Portable Wheelchair Lifts

- Others

By Operation Mode

- Hydraulic

- Electric

- Pneumatic

- Hybrid Power Systems

By Platform Type

- Straight Platform

- Curved Platform

- Folding Platform

- Non-Folding Platform

By End User

- Residential

- Commercial

- Automotive/Vehicle Lifts

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Wheelchair Lift market includes key players such as Savaria Corporation, Garaventa Lift, Thyssenkrupp Access Solutions, Bruno Independent Living Aids, Harmar Mobility LLC, Stannah Lifts Holdings Ltd., Hybrid Elevator Inc., Mobility Lifts Systems Inc., American Elevator Inc., and Ascendor Lifttechnik GmbH. Competition focuses on safety-certified lifting technology, compact platform engineering, and reliable hydraulic and electric mechanisms. Companies expand portfolios with vertical, inclined, and portable lift models designed for residential, commercial, and transportation applications. Smart monitoring systems, remote diagnostics, and battery backup controls enhance operational continuity. Partnerships with healthcare institutions, construction firms, and public transport authorities strengthen distribution channels. Manufacturers invest in modular designs and low-maintenance components to reduce installation time and lifecycle cost. Pricing strategies and regulatory compliance, particularly with ADA and EN standards, play a crucial role in product differentiation. As demand rises for aging-in-place solutions and accessible infrastructure, companies continue advancing user comfort, lift load capacity, and energy-efficient drive systems.

Key Player Analysis

- Savaria Corporation

- Garaventa Lift

- Thyssenkrupp Access Solutions

- Bruno Independent Living Aids

- Harmar Mobility LLC

- Stannah Lifts Holdings Ltd.

- Hybrid Elevator Inc.

- Mobility Lifts Systems Inc.

- American Elevator Inc.

- Ascendor Lifttechnik GmbH

Recent Developments

- In November 2025, Bruno Independent Living Aids acquired Terry Group Ltd, a UK-based lift/elevator manufacturer, extending Bruno’s platform-lift and accessibility product scope.

- In May 2025, Savaria Corporation announced the acquisition of Western Elevator Ltd., reinforcing its accessibility-equipment portfolio.

- In September 2024, Harmar Mobility LLC acquired Pollock Lifts (Northern Ireland). This acquisition was strategic, allowing Harmar to expand its product offerings into new categories, including residential elevators, homelifts, and steplifts, beyond its existing stairlift and vehicle-lift product lines.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Operation Mode, Platform Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for wheelchair lifts will rise as aging populations and mobility impairments increase.

- Electric and smart-controlled lift systems will gain preference over traditional designs.

- Compact and folding lift platforms will support installations in smaller residential spaces.

- Public transport fleets will expand lift adoption to meet inclusive mobility standards.

- Hospitals and rehabilitation centers will upgrade to higher-capacity, low-maintenance lift systems.

- Remote diagnostics and predictive maintenance will improve lift safety and uptime.

- Manufacturers will increase focus on energy-efficient motors and quieter operation.

- Modular and portable lift solutions will expand use in temporary and emergency facilities.

- Government accessibility incentives and construction regulations will drive infrastructure-based deployments.

- Emerging markets will invest more in accessibility solutions across healthcare, education, and public buildings.

Market Segmentation Analysis:

Market Segmentation Analysis: