Market Overview

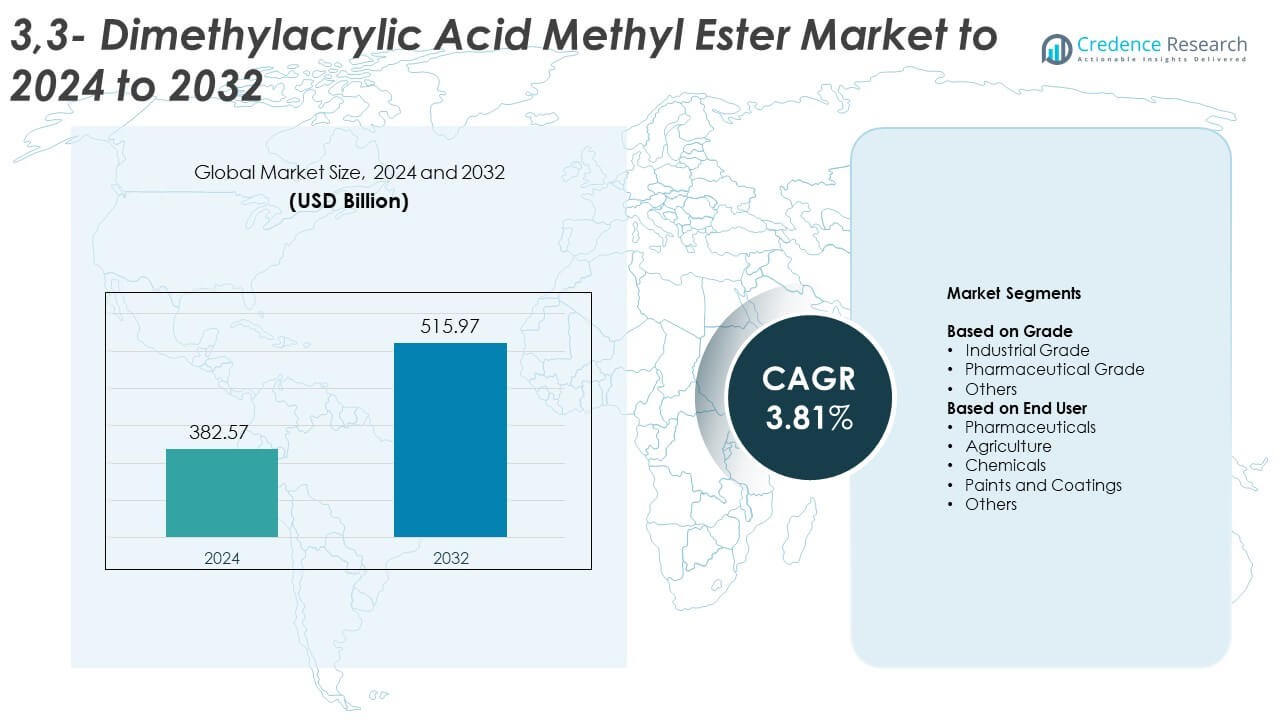

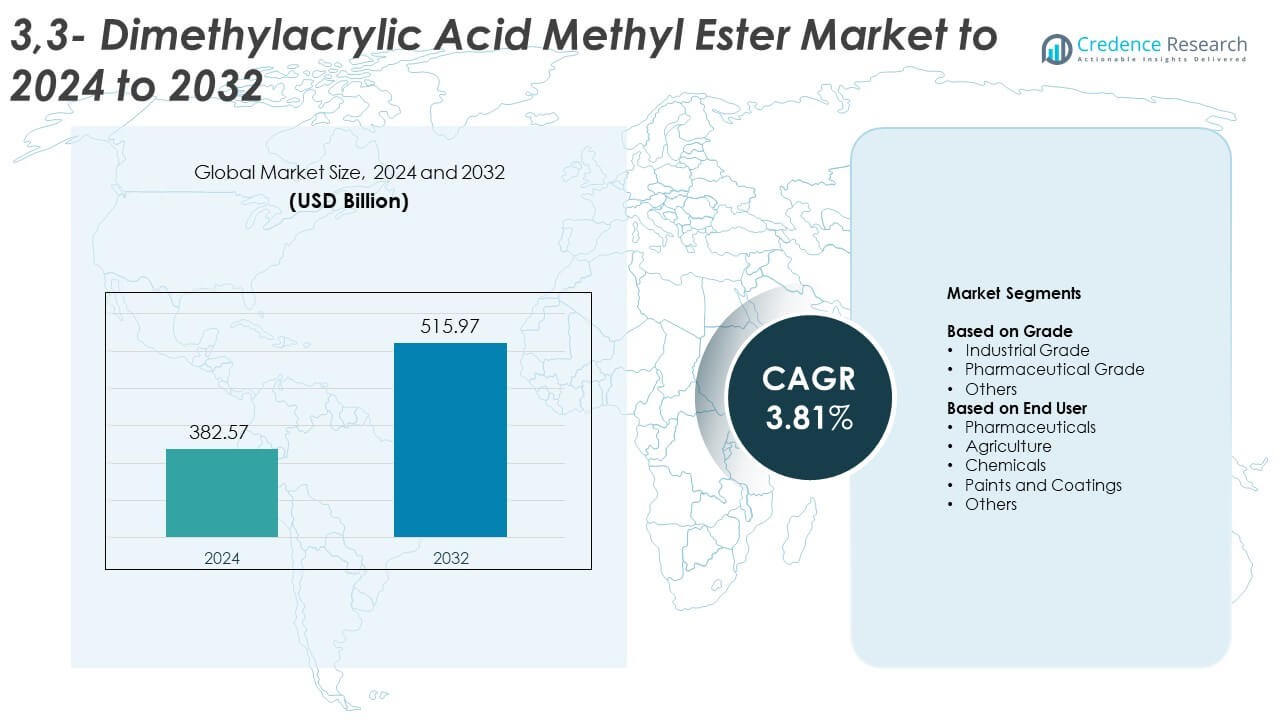

3, 3- dimethylacrylic acid methyl ester market size was valued at USD 382.57 billion in 2024 and is anticipated to reach USD 515.97 billion by 2032, at a CAGR of 3.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3,3-Dimethylacrylic Acid Methyl Ester Market Size 2024 |

USD 382.57 Billion |

| 3,3-Dimethylacrylic Acid Methyl Ester Market, CAGR |

3.81% |

| 3,3-Dimethylacrylic Acid Methyl Ester Market Size 2032 |

USD 515.97 Billion |

The 3,3-dimethylacrylic acid methyl ester market is shaped by leading companies including Sigma-Aldrich, Aurora Fine Chemicals, Spectrum Chemical Mfg. Corp., Evonik Oxeno, TCI Chemicals India Pvt. Ltd., Shandong Xinhua Pharmaceutical Co. Ltd., Hangzhou Longshine Bio-Tech Co., Ltd., Innopharm Chem, Gansu Zeyou New Materials Co., Ltd., and WeylChem International GmbH. These producers strengthen the market through high-purity grades, expanded distribution networks, and consistent supply for pharmaceutical, coatings, and specialty chemical applications. Asia Pacific emerged as the leading region with nearly 30% share, driven by strong manufacturing activity in China and India. North America followed with about 34% share, supported by advanced pharmaceutical and specialty chemical production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 382.57 billion in 2024 and is projected to reach USD 515.97 billion by 2032, growing at a CAGR of 3.81%.

• Demand increased as industrial grade held about 62% share, driven by its wide use in polymers, coatings, and intermediate chemicals.

• Growth trends reflect rising adoption of UV-curable systems and performance polymers across electronics, packaging, and advanced coatings.

• Competition strengthened as key producers expanded high-purity output and improved synthesis efficiency to meet pharmaceutical and specialty chemical standards.

• North America held nearly 34% share, Europe captured around 27%, and Asia Pacific accounted for close to 30%, with the chemicals segment leading regional consumption.

Market Segmentation Analysis:

By Grade

Industrial grade dominated the grade segment in 2024 with about 62% share due to its broad use in polymer synthesis, resin modifiers, and large-volume chemical processes. Manufacturers preferred industrial grade because it supports high-temperature stability and reliable reactivity needed in bulk production. Demand rose as coatings, adhesives, and specialty chemical plants increased capacity across Asia and Europe. Pharmaceutical grade grew at a steady pace, supported by rising demand for high-purity intermediates in drug synthesis, yet industrial grade remained the clear leader due to wider applicability and lower processing costs.

- For instance, SABIC’s own production capacity for propylene oxide is actually cited as approximately 500 kilotons per year (equivalent to 0.5 million metric tons) across its various assets, including the Petro Rabigh and Sadara joint ventures.

By End User

Chemicals led the end-user segment in 2024 with nearly 41% share, backed by strong consumption in resin modification, performance polymers, and UV-curable materials. Chemical producers increased adoption as industries expanded high-performance coatings and advanced composites. Pharmaceuticals showed stable growth as the compound gained use in active ingredient intermediates. Agriculture and paints and coatings segments also advanced due to rising demand for efficient additives and durable film-forming agents. The chemicals segment maintained dominance because it drives the largest volume of methyl ester-based intermediates in global industrial supply chains.

- For instance, Covestro’s Shanghai mechanical recycling line can deliver more than 25,000 tons of polycarbonate compounds annually.

Key Growth Drivers

Rising Adoption in Performance Polymers

Growing use of performance polymers boosted demand as manufacturers sought intermediates that offer strong reactivity and stability. The compound supported high-grade coatings, adhesives, and sealants that meet stricter durability needs in automotive and construction. Expansion of resin plants in Asia increased bulk consumption and strengthened supply chains. Producers also used the ester in UV-curable systems, which grew with rising electronics and packaging activity. This trend positioned polymer applications as a major force driving market expansion.

- For instance, BASF’s expanded Schwarzheide compounding plant can produce up to 70,000 additional tons of Ultramid and Ultradur each year. This brings its worldwide engineering plastics compounding capacity to over 700,000 tons annually.

Expansion of Pharmaceutical Intermediates

Pharmaceutical companies increased dependence on high-purity intermediates to support complex drug synthesis. The compound met key purity and consistency requirements, enabling safer and more predictable formulation stages. Rising chronic disease cases pushed higher production of advanced therapeutics, which raised intermediate demand in large markets. Global investment in manufacturing upgrades also expanded opportunities. Pharmaceutical R&D pipelines continued to widen, making this segment a strong driver for long-term market growth.

- For instance, Solvay’s rare earth processing expansion in La Rochelle is planned for eventual output between 2,000 and 5,000 metric tons of rare earth oxides each year.

Growth in Specialty Chemicals Production

Specialty chemical producers relied on the ester for tailored formulations used across coatings, catalysts, and fine chemicals. Growing demand for enhanced surface performance and chemical resistance increased interest in customized polymer modifiers. Industrial expansion across India and China boosted consumption as plants invested in versatile intermediates. Sustainability programs also encouraged new formulations with better efficiency per batch. These shifts strengthened specialty chemicals as a core driver shaping market momentum.

Key Trends & Opportunities

Shift Toward High-Performance Coatings

High-performance coatings gained traction due to rising infrastructure upgrades and demand for longer-lasting industrial finishes. Producers used the ester to improve film integrity, UV resistance, and drying efficiency. The trend accelerated with growth in automotive refinishing, marine coatings, and protective solutions for heavy equipment. Innovations in water-based formulations opened new market potential as regulations tightened. This shift created strong opportunities for suppliers offering advanced coating intermediates.

- For instance, PPG expanded its Brazil, Indiana powder coatings plant by 20,000 square feet. The project added two new lines for bonded metallic powder and automated packaging capabilities.

Growing Focus on UV-Curable Technologies

UV-curable systems expanded rapidly as manufacturers sought faster curing, lower emissions, and energy savings. The compound’s strong compatibility with acrylate networks made it valuable in electronics, printing inks, and packaging. Demand rose as companies replaced traditional thermal systems with cleaner and more efficient processes. Investments in automated curing lines across consumer goods and industrial sectors created further openings. This trend strengthened the role of advanced intermediates in next-generation curing technologies.

- For instance, Arkema has doubled UV/LED curing resin capacity at its Sartomer facility in Nansha, China, to support fast-growing electronics and renewable energy applications.

Rising Demand for Agriculture and Fine-Chemical Applications

Agriculture and fine-chemical producers explored new uses for the ester in controlled-release formulations and advanced additives. Growing focus on crop efficiency and specialty intermediates created room for product diversification. Expansion of agrochemical manufacturing in emerging economies supported this shift. Producers used the ester to improve reaction control and optimize molecular structure in fine-chemical synthesis. This broadened application landscape offered promising opportunities for long-term market penetration.

Key Challenges

High Production and Purification Costs

Manufacturers faced cost pressure due to strict purity needs and complex synthesis routes. Advanced distillation and controlled reaction environments raised operating expenses, especially for pharmaceutical-grade output. Rising energy prices intensified cost challenges for large-scale plants. Smaller producers struggled to match the consistency demanded by high-value sectors. These economic constraints limited broader adoption in price-sensitive industries.

Regulatory and Environmental Compliance Pressure

Tightening global regulations on chemical handling and emissions created compliance burdens for producers. Facilities needed upgraded systems to manage waste streams and meet evolving safety norms. Environmental audits increased operational delays and required additional certification. Markets with strict chemical registration rules slowed product entry for smaller suppliers. These factors collectively challenged expansion plans and added risk to long-term investments.

Regional Analysis

North America

North America held nearly 34% share in 2024 due to strong demand from pharmaceutical, specialty chemical, and high-performance coating producers. The region benefited from advanced manufacturing lines and strict quality standards that increased consumption of high-purity intermediates. Expanding investments in drug formulation and resin technologies supported steady market growth. The United States led regional demand as companies increased adoption in UV-curable systems and precision polymers. Canada contributed through rising specialty chemical output and stable regulatory frameworks that encouraged production upgrades, keeping North America a major consumer of methyl ester derivatives.

Europe

Europe accounted for about 27% share in 2024, supported by its large specialty chemical base and strong presence of high-value coatings manufacturers. Germany, France, and the Netherlands drove most consumption through advanced polymer applications and strict product-quality norms. The region saw higher adoption in automotive refinishing, electronic materials, and industrial adhesives. Regulatory focus on cleaner formulations boosted demand for intermediates suitable for low-emission systems. Investment in modern chemical synthesis units across Central Europe also strengthened supply capabilities, helping the region maintain a stable share of global demand.

Asia Pacific

Asia Pacific dominated globally with nearly 30% share in 2024, driven by strong production activity in China, India, Japan, and South Korea. Rapid industrial expansion increased demand for intermediates used in performance polymers, coatings, and pharmaceutical ingredients. China led consumption due to large-scale resin manufacturing and a growing pharmaceuticals sector. India showed rising adoption in specialty chemicals as local producers expanded capacity for fine-chemical applications. Supportive government policies and a growing export base further boosted market presence, making Asia Pacific the fastest-expanding regional contributor.

Latin America

Latin America captured roughly 6% share in 2024, supported by moderate growth in chemical processing and agricultural formulations. Brazil led regional demand with rising consumption in coatings, adhesives, and fine-chemical intermediates. Mexico contributed through growing pharmaceutical production and expanding manufacturing networks. The region benefited from increasing investment in industrial modernization, though growth remained slower compared to Asia. Expanding agrochemical needs and improved trade activity created new opportunities for methyl ester suppliers. Despite economic constraints, Latin America maintained a stable position in the global market.

Middle East and Africa

The Middle East and Africa held around 3% share in 2024, driven by expanding industrial development in the Gulf and emerging chemical clusters in North Africa. Rising investment in specialty chemicals and growing interest in high-performance coatings supported demand for advanced intermediates. The UAE and Saudi Arabia led adoption due to new manufacturing projects and increased diversification beyond traditional petrochemicals. South Africa contributed with steady consumption in industrial adhesives and fine-chemical synthesis. Limited local production kept import dependence high, but infrastructure upgrades offered long-term market potential.

Market Segmentations:

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Others

By End User

- Pharmaceuticals

- Agriculture

- Chemicals

- Paints and Coatings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The 3,3-dimethylacrylic acid methyl ester market is shaped by key players such as Sigma-Aldrich, Aurora Fine Chemicals, Spectrum Chemical Mfg. Corp., Evonik Oxeno, TCI Chemicals India Pvt. Ltd., Shandong Xinhua Pharmaceutical Co. Ltd., Hangzhou Longshine Bio-Tech Co., Ltd., Innopharm Chem, Gansu Zeyou New Materials Co., Ltd., and WeylChem International GmbH. The competitive landscape reflects strong focus on purity enhancement, consistent batch performance, and stable global distribution. Companies expand production capacity to meet rising demand from pharmaceutical, coatings, and specialty chemical applications. Manufacturers invest in advanced synthesis routes that improve yield and reduce impurities, supporting high-value sectors that rely on strict quality standards. Several players strengthen their supply chains through regional warehouse networks and long-term contracts with industrial buyers. The market also shows increasing emphasis on regulatory compliance and sustainable processing, prompting producers to adopt safer solvents and efficient waste-management systems. Innovation in resin intermediates and UV-curable materials continues to create new competitive advantages.

Key Player Analysis

Recent Developments

- In November 2025, Sigma-Aldrich continued to list and offer research quantities of the related compound ethyl 3,3-dimethylacrylate for immediate purchase, confirming ongoing supply for R&D.

- In 2025, Tokyo Chemical Industry (TCI Chemicals) continues to list methyl 3,3-dimethylacrylate as a building block chemical for organic synthesis, facilitating its use in ongoing research.

- In 2025, Evonik Oxeno, in collaboration with the Leibniz Institute for Catalysis (LIKAT) and Ruhr University Bochum, developed an innovative bimetallic catalyst system that enables the direct use of carbon dioxide (CO?) as a raw material in chemical manufacturing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Grade, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as demand rises in performance polymers.

- Pharmaceutical use will expand due to higher need for high-purity intermediates.

- UV-curable technologies will gain more adoption across electronics and packaging.

- Specialty chemical producers will increase reliance on customized acrylate derivatives.

- Asia Pacific will strengthen its position with new resin and chemical capacity.

- Water-based and low-emission coating systems will create fresh application scope.

- Advances in synthetic routes will reduce production costs and improve efficiency.

- Regulatory pressure will push companies toward cleaner and safer formulations.

- Industrial automation will support consistent large-volume manufacturing.

- Product diversification across agriculture and fine chemicals will open new growth paths.