Market Overview:

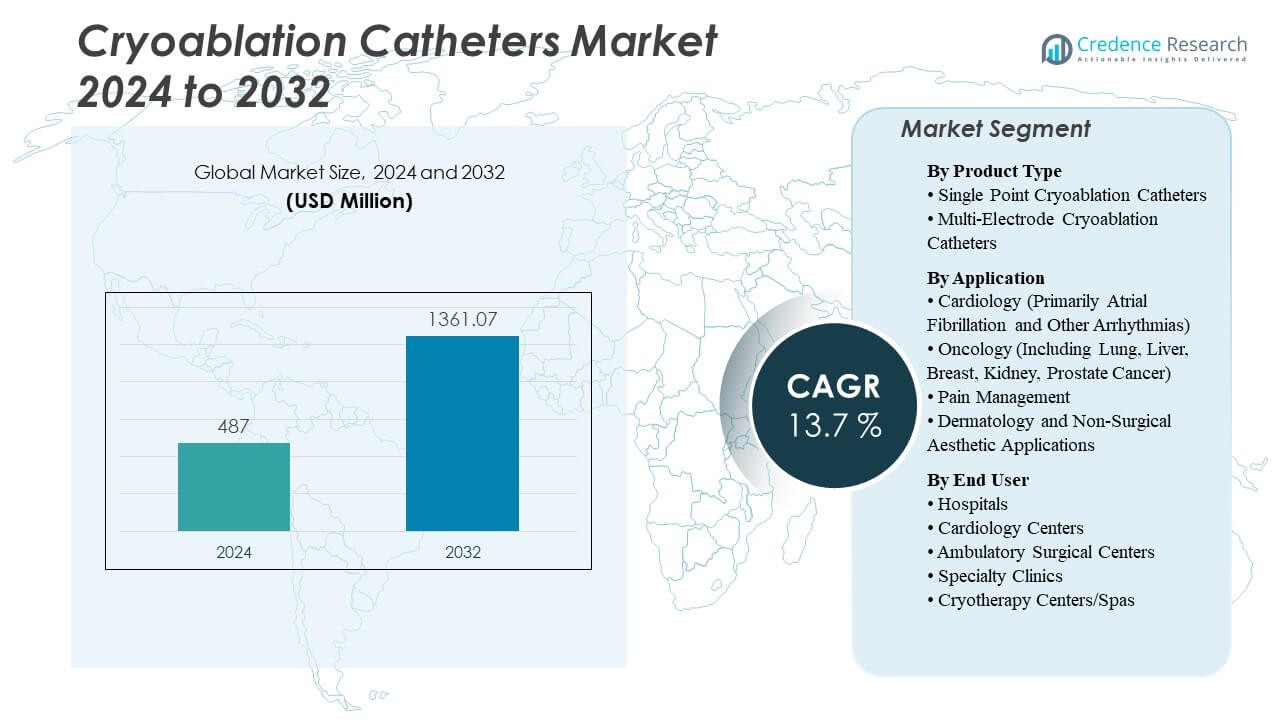

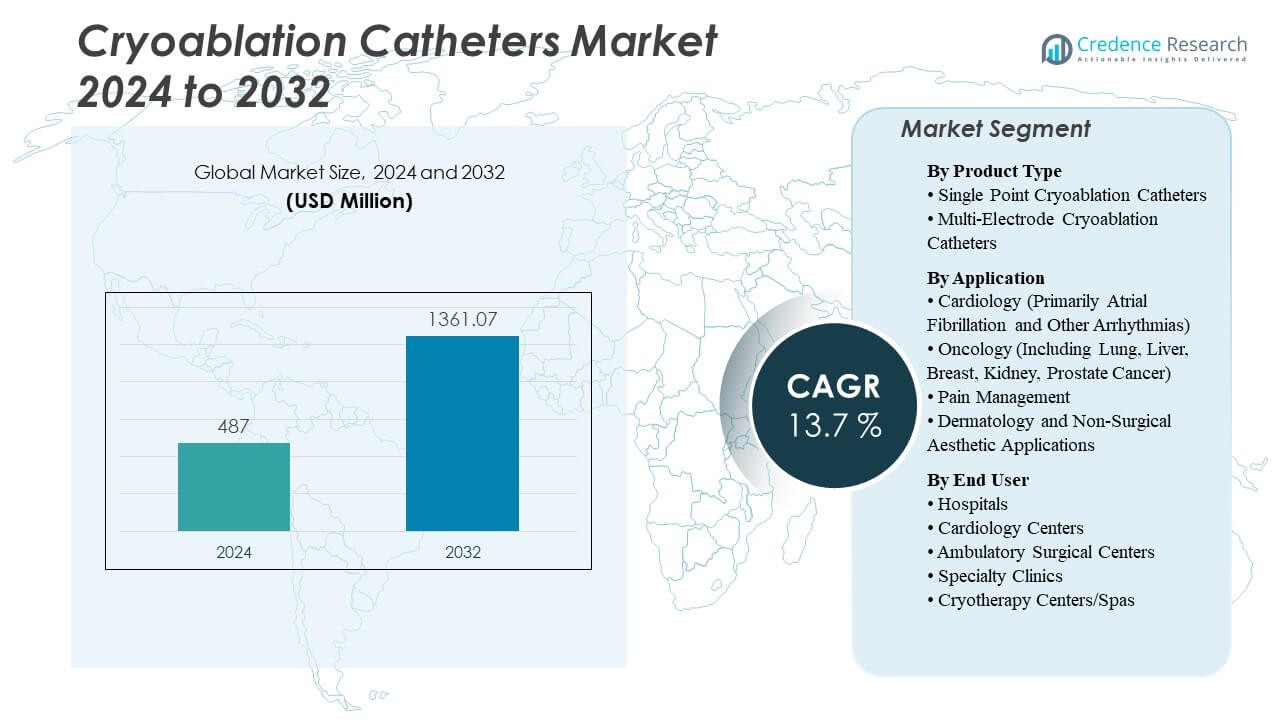

The Cryoablation Catheters Market is projected to grow from USD 487 million in 2024 to an estimated USD 1,361.07 million by 2032, with a compound annual growth rate (CAGR) of 13.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cryoablation Catheters Market Size 2024 |

USD 487 Million |

| Cryoablation Catheters Market, CAGR |

13.7% |

| Cryoablation Catheters Market Size 2032 |

USD 1,361.07 Million |

Rising prevalence of cardiac rhythm disorders and strong preference for cryothermal procedures drive market growth. Healthcare professionals favor cryoablation over traditional methods due to its precision, reduced collateral tissue damage, and faster recovery time. Growing clinical validation and favorable regulatory approvals further strengthen adoption rates. Technological innovation by major players focusing on catheter performance, temperature control, and improved lesion durability also supports long-term market sustainability across both developed and emerging economies.

North America leads the Cryoablation Catheters Market owing to advanced healthcare infrastructure, strong reimbursement support, and higher awareness of cardiac arrhythmia treatments. Europe follows with strong adoption in cardiac centers backed by ongoing clinical research and regulatory support. The Asia-Pacific region is emerging rapidly due to growing healthcare investments, expanding patient awareness, and rising cardiovascular disease prevalence in countries like China, Japan, and India. Latin America and the Middle East & Africa show steady growth with improving access to modern cardiac treatment facilities and skilled practitioners.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Cryoablation Catheters Market is projected to grow from USD 487 million in 2024 to USD 1,361.07 million by 2032, at a CAGR of 13.7%.

- Rising cases of atrial fibrillation and increasing adoption of minimally invasive cardiac procedures are major growth drivers.

- Advancements in cryothermal technology improve safety, lesion precision, and overall treatment outcomes.

- High equipment costs and limited access in low-income regions act as key market restraints.

- North America dominates due to advanced healthcare systems and strong reimbursement structures.

- Europe shows steady growth driven by clinical validation and adoption across cardiac care centers.

- Asia-Pacific is the fastest-growing region, supported by healthcare investments and expanding cardiac facilities.

Market Drivers

Rising Prevalence of Atrial Fibrillation and Growing Need for Minimally Invasive Treatments

The Cryoablation Catheters Market benefits from a sharp rise in atrial fibrillation cases globally. Hospitals and cardiac centers prefer cryoablation procedures for their precision and minimal tissue damage. The growing elderly population increases the number of cardiac rhythm disorders needing advanced intervention. Surgeons favor cryothermal technology due to its predictable lesion formation and safety profile. It allows shorter procedure durations and faster recovery for patients. Strong clinical success rates drive greater physician adoption. Governments and health insurers support these therapies due to lower long-term care costs. This creates consistent demand for advanced cryoablation catheters worldwide.

- For example, Medtronic’s Arctic Front Advance cryoballoon catheter system has demonstrated pulmonary vein isolation success rates above 99% in multicenter studies involving over 1,600 patients. Data from the STOP AF Post-Approval Study and European registry confirmed consistent performance across diverse clinical settings, reinforcing its global adoption in cardiac ablation practice.

Technological Innovation and Integration of Advanced Imaging and Mapping Systems

Continuous innovation strengthens product capabilities and supports the efficiency of cardiac ablations. Modern systems now integrate three-dimensional mapping, enhanced visualization, and precise temperature control. The combination of cryo-energy with navigation tools ensures accurate lesion targeting. It enables electrophysiologists to treat complex arrhythmias safely and reproducibly. Medical device companies invest heavily in R&D to improve catheter flexibility and energy delivery. Upgraded hardware enhances patient safety while improving procedural consistency. Hospitals adopt systems that merge cryoablation with digital guidance for higher precision. These innovations support a strong competitive edge among leading manufacturers.

- For example, a 2025 multicenter study (N=80) comparing Boston Scientific’s POLARx FIT Cryoablation System with Medtronic’s Arctic Front Advance Pro showed that POLARx FIT achieved a shorter skin-to-skin procedure time of 62.7 ± 8.9 minutes versus 72.7 ± 21.6 minutes (p = 0.008). The study also reported significantly reduced fluoroscopy and left atrial dwell times, while the POLARx balloon’s 31 mm adaptive diameter improved tissue contact and visualization.

Increasing Clinical Validation and Favorable Regulatory Support for New Catheter Technologies

Rising clinical evidence supports the safety and long-term outcomes of cryoablation therapy. Several large-scale trials confirm its effectiveness in managing atrial fibrillation and other rhythm disorders. It has gained rapid FDA and CE mark approvals, encouraging healthcare providers to expand usage. Regulatory bodies recognize the technology’s potential to reduce complications and recurrence rates. Hospitals rely on documented outcomes to improve patient confidence and procedural adoption. Growing acceptance in clinical guidelines strengthens the market outlook. Companies with proven clinical performance see faster product approvals. These factors collectively ensure steady market expansion across developed economies.

Expanding Healthcare Infrastructure and Access to Electrophysiology Services in Emerging Markets

Developing regions invest heavily in advanced cardiac care facilities and training programs. Hospitals in Asia-Pacific, Latin America, and the Middle East expand electrophysiology units. It allows broader access to cryoablation therapies and supports early arrhythmia intervention. Growing health awareness increases patient willingness to adopt modern treatment solutions. Governments prioritize cardiac disease management through funding and insurance coverage. Training programs by device manufacturers improve procedural expertise among physicians. Local distributors form alliances to ensure product availability in secondary cities. The growing reach of cardiac treatment centers continues to open new commercial opportunities.

Market Trends

Integration of Artificial Intelligence and Digital Mapping Tools in Cryoablation Procedures

Artificial intelligence is transforming ablation workflows through predictive analytics and smart mapping systems. AI-enabled tools analyze patient-specific data to plan optimal lesion paths. It supports faster diagnosis and better intra-procedural decision-making. Digital mapping ensures complete lesion coverage with minimal radiation exposure. Hospitals use connected software for real-time monitoring and documentation. The integration reduces human error while improving procedural reproducibility. Medical device manufacturers partner with software firms to refine these systems. The trend is accelerating clinical adoption of AI-driven cryoablation solutions worldwide.

- For example, Boston Scientific’s POLARx™ Cryoablation System achieved an acute pulmonary vein isolation rate of 99.5% compared to 100% with Medtronic’s Arctic Front Advance Pro in a multicenter study. The system also demonstrated higher pulmonary vein potential visualization at 96.3% versus 88.6% (p < 0.001), supporting its precision and procedural efficiency.

Growing Shift Toward Outpatient and Ambulatory Cryoablation Procedures

Healthcare providers favor outpatient ablations due to reduced hospitalization costs and higher patient turnover. Shorter recovery times and lower complication risks make the technology ideal for same-day discharge. It supports hospital efficiency and patient convenience simultaneously. Many centers now adopt compact cryoablation systems designed for ambulatory settings. It also reduces the overall burden on tertiary cardiac hospitals. Insurers expand reimbursement for outpatient arrhythmia care, improving accessibility. Technological refinements enhance safety for shorter stay treatments. This shift drives higher utilization rates in both developed and emerging markets.

Product Miniaturization and Focus on Single-Use Catheter Development

Manufacturers increasingly design smaller and more flexible catheters for easier navigation. The miniaturization trend enhances comfort and reduces vascular complications during procedures. It supports treatment of complex arrhythmias in smaller cardiac chambers. Single-use catheter models eliminate cross-contamination risks and meet stringent hospital hygiene norms. It also simplifies inventory management and ensures device consistency. Companies invest in new materials that withstand extreme cryothermal stress. Hospitals prefer disposable devices for operational efficiency and compliance. This trend reshapes procurement strategies across high-volume cardiac centers globally.

Increased Collaboration Between Device Makers and Healthcare Providers for Clinical Training

Collaborations between manufacturers and hospitals improve clinical expertise and procedural outcomes. Structured training programs and simulation workshops boost confidence among new electrophysiologists. It leads to better procedural success rates and patient satisfaction. Companies sponsor fellowships and educational courses in major cardiac institutes. The partnerships ensure proper equipment usage and feedback-driven product enhancement. It also supports regional adoption where specialized expertise is still developing. By building skilled user networks, firms strengthen their brand trust. These collaborations play a vital role in long-term technology acceptance.

- For example, Major academic hospitals in the U.S. and Europe have participated in multicenter clinical studies evaluating Boston Scientific’s POLARx™ and Medtronic’s Arctic Front Advance Pro systems. Their involvement supports evidence-based training programs and standardized protocols for cardiac cryoablation procedures.

Market Challenges Analysis

High Cost of Cryoablation Systems and Limited Accessibility in Low-Income Regions

The Cryoablation Catheters Market faces major cost-related barriers that restrict its widespread use. Advanced cryoablation systems demand heavy investment in equipment, installation, and maintenance. It limits adoption in low- and middle-income economies with budget constraints. Hospitals often rely on public funding or grants to procure these systems. Limited insurance coverage in developing regions further deters patient uptake. Import duties and lack of local manufacturing increase device pricing. The situation reduces affordability for both private and public health institutions. Overcoming these challenges requires cost optimization and scalable technology models.

Shortage of Trained Electrophysiologists and Lack of Procedural Awareness Among Clinicians

A growing skill gap in electrophysiology affects treatment quality and procedural consistency. Many hospitals struggle to recruit adequately trained specialists. It slows the diffusion of cryoablation technology beyond major cardiac centers. Limited awareness among general cardiologists delays timely referrals for advanced care. Training costs and certification requirements also deter smaller hospitals. The absence of standardized global protocols affects procedural uniformity. Medical device firms invest in capacity-building programs to bridge this gap. Addressing this shortage is critical for ensuring sustainable market expansion and patient access.

Market Opportunities

Growing Investments in Healthcare Modernization and Expansion of Cardiac Care Facilities

The Cryoablation Catheters Market benefits from major healthcare modernization programs across developing economies. Governments are allocating funds to upgrade cardiac hospitals and diagnostic labs. It creates a favorable environment for integrating cryoablation technology into routine practice. The expanding private hospital sector accelerates adoption through equipment upgrades. Multinational firms partner with local distributors to meet regional demands. Continuous expansion of telemedicine networks supports faster referrals and follow-ups. The focus on improving procedural safety encourages wider technology penetration. These dynamics provide long-term opportunities for global and regional manufacturers.

Emergence of Next-Generation Cryothermal Platforms and Hybrid Ablation Techniques

Ongoing R&D is introducing advanced cryothermal systems that improve precision and procedural safety. Manufacturers focus on hybrid ablation combining cryo and radiofrequency energy for enhanced outcomes. It offers greater lesion control and reduces recurrence in complex arrhythmia cases. Integration with robotic and digital systems increases procedural consistency. Device miniaturization supports use in pediatric and low-volume cardiac structures. Hospitals seek new systems that minimize procedure time and improve recovery. These innovations create strong opportunities for technology differentiation. Early adopters gain competitive advantage in both developed and emerging markets.

Market Segmentation Analysis:

By Product Type

The Cryoablation Catheters Market is divided into single point and multi-electrode cryoablation catheters. Single point catheters hold a major share due to their accuracy in targeted tissue ablation and proven safety profile. They are widely used in cardiac procedures requiring localized lesion creation. Multi-electrode catheters are gaining traction for their ability to treat multiple areas simultaneously, improving procedural efficiency. It supports shorter operation times and reduced patient recovery periods. Manufacturers focus on integrating advanced temperature sensors and control systems to improve procedural outcomes. The segment continues to evolve with higher precision and reliability in clinical applications.

- For instance, in the STOP AF clinical trial for Medtronic’s Arctic Front cryoablation catheter, nearly 70% of patients were free from atrial fibrillation at 12 months post-procedure, a result that led to FDA approval and broad clinical adoption.

By Application

Cardiology leads the market due to increasing atrial fibrillation cases and rising demand for minimally invasive treatments. Cryoablation provides long-term rhythm control with lower recurrence rates. Oncology applications are expanding, with cryoablation used for localized tumors in the lung, liver, and kidney. Pain management procedures employ cryothermal therapy to block sensory nerves with minimal side effects. It also finds growing acceptance in dermatology for removing benign lesions and supporting aesthetic treatments. The wide therapeutic scope ensures stable demand across multiple clinical areas.

- For instance, the Medtronic Arctic Front Cryoballoon showed superior effectiveness over antiarrhythmic drugs in the STOP AF First randomized multicenter trial, achieving 74.6% treatment success at 12 months, accompanied by improved quality of life and low complication rates.

By End User

Hospitals dominate the market due to extensive infrastructure, skilled professionals, and access to advanced imaging systems. Cardiology centers follow closely, offering specialized procedures for arrhythmia management. Ambulatory surgical centers are expanding adoption to deliver cost-effective outpatient care. Specialty clinics incorporate cryoablation for oncology and pain therapy applications. It shows rising acceptance in cryotherapy centers and wellness spas for non-surgical skin treatments. The broad end-user diversity strengthens overall market penetration across clinical and wellness segments.

Segmentation:

By Product Type

- Single Point Cryoablation Catheters

- Multi-Electrode Cryoablation Catheters

By Application

- Cardiology (Primarily Atrial Fibrillation and Other Arrhythmias)

- Oncology (Including Lung, Liver, Breast, Kidney, Prostate Cancer)

- Pain Management

- Dermatology and Non-Surgical Aesthetic Applications

By End User

- Hospitals

- Cardiology Centers

- Ambulatory Surgical Centers

- Specialty Clinics

- Cryotherapy Centers/Spas

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America dominates the Cryoablation Catheters Market with a 41% share, driven by the high prevalence of atrial fibrillation and well-established healthcare infrastructure. The U.S. leads due to advanced electrophysiology labs, skilled professionals, and strong reimbursement policies. Canada supports market growth through rising investments in cardiac care and government funding for advanced ablation devices. It benefits from a high adoption rate of minimally invasive cardiac procedures. The presence of leading medical device manufacturers strengthens regional innovation and clinical adoption. Continuous product launches and regulatory approvals further consolidate North America’s market leadership.

Europe holds a 31% share, supported by extensive use of cryoablation in arrhythmia management and a growing geriatric population. Germany, France, and the U.K. lead the region with robust healthcare systems and early adoption of advanced ablation technology. It benefits from favorable reimbursement schemes and clinical research collaborations across major hospitals. Regulatory alignment within the European Union accelerates new device introductions. Rising cardiac awareness and increased screening programs contribute to expanding procedural volumes. Training programs by manufacturers enhance physician proficiency, ensuring consistent procedural outcomes. The regional market continues to benefit from partnerships promoting technology-driven cardiac care.

The Asia-Pacific region accounts for a 20% share and is emerging as the fastest-growing regional market. Countries such as China, Japan, and India show strong demand for advanced electrophysiology treatments. It benefits from growing investments in healthcare modernization and expansion of specialized cardiac centers. Rising awareness about arrhythmia management and improving diagnostic infrastructure support adoption. Local partnerships and government initiatives to enhance cardiac care accessibility create new growth avenues. The region attracts multinational firms establishing manufacturing and training hubs to strengthen supply capabilities. Latin America and the Middle East & Africa collectively contribute 8% share, supported by improving hospital infrastructure and expanding patient access.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Medtronic plc

- Boston Scientific Corporation

- Johnson & Johnson (Biosense Webster)

- Abbott Laboratories

- AtriCure, Inc.

- MicroPort Scientific Corporation

- IceCure Medical

- BVM Medical Limited

- METRUM CRYOFLEX

Competitive Analysis:

The Cryoablation Catheters Market is characterized by strong competition among global medical device manufacturers focusing on innovation and procedural efficiency. Key players include Medtronic plc, Boston Scientific Corporation, Johnson & Johnson’s Biosense Webster, Abbott Laboratories, and Japan Lifeline Co., Ltd. It features constant product upgrades targeting precision, safety, and compatibility with digital navigation systems. Companies emphasize clinical validation to secure regulatory approvals and physician confidence. Strategic acquisitions and distribution partnerships help expand product reach across emerging markets. Leading players invest in R&D to enhance energy control, catheter flexibility, and patient outcomes. New entrants focus on affordable cryoablation systems to capture cost-sensitive segments. Continuous collaboration with hospitals and academic institutions enables ongoing procedural training and feedback-driven product refinement. The competition remains innovation-led, with companies leveraging clinical expertise and global distribution networks to maintain their market position.

Recent Developments:

- In February 2025, Shanghai Antec Medical Technology Co., Ltd. received approval from the China NMPA for its innovative balloon cryoablation catheter and Cryoablation Console. This device features a 32 mm large balloon and an 8 mm short tip, designed for the treatment of paroxysmal atrial fibrillation. The product aims to enhance temperature management, flow control, and proximity to the pulmonary vein ostium, supporting better clinical outcomes for atrial fibrillation patients in China.

- In November 2024, IceCure Medical was granted a Notice of Allowance by Japan’s Patent Office for its Cryogenic System with Multiple Submerged Pumps. This innovation offers the capability to independently control multiple cryoprobes, enhancing the treatment of larger tumors and strengthening the company’s intellectual property portfolio in cryoablation technology.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising atrial fibrillation cases will continue to expand procedural demand in hospitals and specialty clinics.

- Growing healthcare investment in emerging economies will increase access to advanced ablation technologies.

- Integration of digital mapping, AI-assisted imaging, and data analytics will improve procedural precision and success rates.

- Ongoing innovation in catheter flexibility and temperature control will enhance safety and shorten recovery time.

- Increasing preference for minimally invasive surgeries will accelerate adoption across cardiology and oncology applications.

- Expanding use of cryoablation in oncology and dermatology will diversify clinical applications beyond cardiac care.

- Collaboration between manufacturers and healthcare institutions will strengthen clinical training and device optimization.

- Regulatory approvals and reimbursement support will encourage faster product launches across major regions.

- Development of compact, cost-effective systems will improve adoption in mid-sized and outpatient facilities.

- Sustained R&D investments will drive next-generation cryothermal systems and hybrid ablation platforms.