Market overview

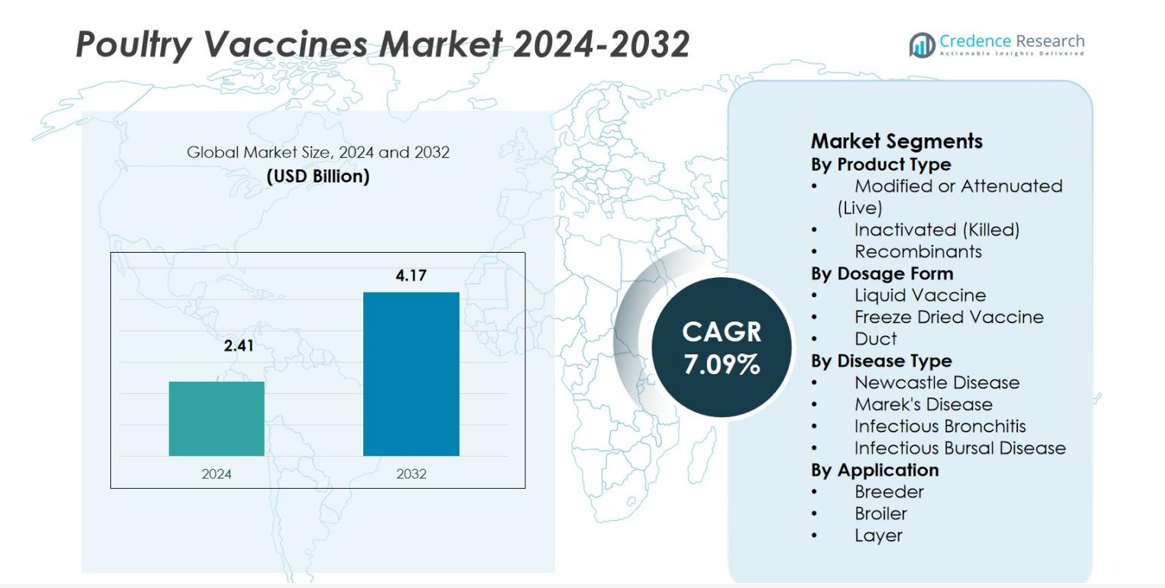

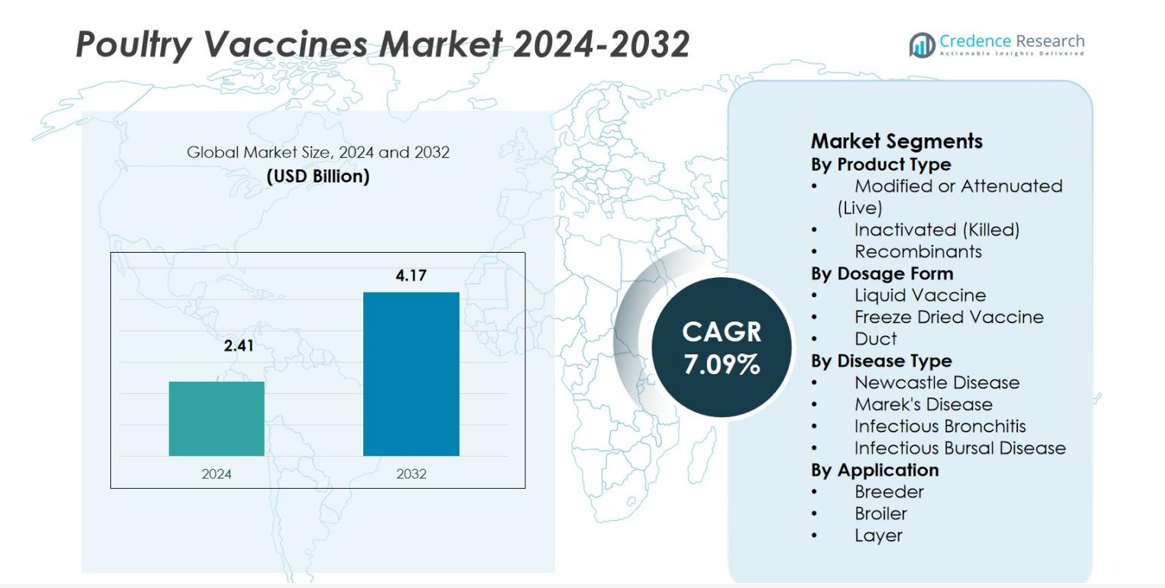

Poultry Vaccines Market size was valued at USD 2.41 billion in 2024 and is anticipated to reach USD 4.17 billion by 2032, at a CAGR of 7.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Poultry Vaccines Market Size 2024 |

USD 2.41 billion |

| Poultry Vaccines Market, CAGR |

7.09% |

| Poultry Vaccines Market Size 2032 |

USD 4.17 billion |

Poultry Vaccines Market is driven by strong participation from leading companies such as Merck & Co., Inc., Boehringer Ingelheim, Ceva Santé Animale, Elanco Animal Health, HIPRA, Phibro Animal Health Corporation, Dechra Pharmaceuticals, Hester Biosciences, Biovac, and Vaxxinova. These players focus on expanding advanced live, inactivated, and recombinant vaccine portfolios to address major poultry diseases and enhance flock immunity. Asia-Pacific leads the Poultry Vaccines Market with a 36.2% share, supported by large-scale poultry production and high vaccination adoption, followed by North America and Europe, which benefit from robust animal health systems and stringent biosecurity standards.

Market Insights

- Poultry Vaccines Market stands at USD 2.41 billion in 2024 and will reach USD 4.17 billion by 2032, expanding at a 09% CAGR during the forecast period.

- The market grows rapidly as rising outbreaks of Newcastle Disease, Marek’s Disease, and Infectious Bronchitis drive producers to adopt structured immunization programs, supported by expanding commercial poultry farming and stronger animal health regulations.

- Key trends include increasing adoption of hatchery-based vaccination systems, rising demand for recombinant and vector-based vaccines, and growing preference for thermostable formulations to improve efficiency and reduce losses.

- Major players such as Merck, Boehringer Ingelheim, Ceva, Elanco, HIPRA, and Phibro actively develop advanced live and recombinant vaccines, focusing on R&D, partnerships, and automated vaccination solutions; however, high costs and cold-chain challenges restrict access for small-scale producers.

- Asia-Pacific leads the market with a 2% share, followed by North America at 29.8%, while Modified or Attenuated (Live) vaccines dominate product segments with a 51.4% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Poultry Vaccines Market by product type is dominated by Modified or Attenuated (Live) vaccines, accounting for 51.4% of the total share in 2024. Their strong adoption stems from their ability to provide rapid, long-lasting immunity and reduce disease severity across large flocks, making them highly efficient for intensive poultry farming. Inactivated (killed) vaccines follow due to their safety profile, particularly for layers and breeders, while recombinant vaccines gain traction as producers adopt advanced genetic technologies that enhance targeted disease prevention and reduce post-vaccination reactions.

By Dosage Form

Within dosage forms, Liquid Vaccines lead the Poultry Vaccines Market with a 57.2% share in 2024. Their dominance is driven by ease of administration through drinking water, spray, or injection, enabling rapid mass immunization in commercial poultry operations. Freeze-dried vaccines continue to grow as they provide better stability and longer shelf life, especially in regions with cold-chain challenges. Duct vaccines serve niche applications but see rising adoption alongside automated hatchery-based immunization, which supports early-life protection and reduces manual handling on farms.

- For instance, live attenuated vaccines like those produced by Ceva are widely applied via drinking water or spray, facilitating rapid delivery across large flocks without manual handling.

By Disease Type

By disease type, Newcastle Disease vaccines hold the largest share at 38.6% in 2024, driven by the persistent global threat of virulent ND virus strains and mandatory vaccination policies in many poultry-producing countries. Marek’s Disease vaccines follow due to increasing prevalence in broilers and the need for early-life protection at hatcheries. Vaccines for Infectious Bronchitis and Infectious Bursal Disease also maintain strong demand, supported by high disease incidence and the requirement for multi-strain immunization to minimize flock mortality, performance losses, and economic impact.

- For instance, thermostable Newcastle Disease vaccines are increasingly used in regions with limited cold chain infrastructure, providing effective protection with reduced dependency on refrigeration.

Key Growth Drivers

Rising Prevalence of Poultry Diseases

The Poultry Vaccines Market experiences strong growth due to the rising prevalence of highly contagious diseases such as Newcastle Disease, Infectious Bronchitis, and Marek’s Disease. Increasing disease outbreaks across commercial farms create substantial economic losses, prompting producers to rely on routine vaccination programs. Regulatory bodies in major poultry-producing regions have also strengthened mandatory vaccination protocols, further boosting demand. Continuous viral mutations and evolving pathogenic strains drive the need for updated and combination vaccines, ensuring sustained market expansion across broilers, layers, and breeders.

- For instance, Merck Animal Health launched Innovax®-ND-IBD in the U.S., a recombinant vaccine that protects poultry against Marek’s Disease, Newcastle Disease, and Infectious Bursal Disease, supporting broader disease control strategies in commercial operations.

Expansion of Commercial Poultry Farming

Rapid industrialization of poultry farming significantly drives vaccine adoption as producers shift toward high-density operations that require strict disease prevention strategies. Rising global consumption of poultry meat and eggs encourages farmers to maintain flock health and productivity through comprehensive immunization schedules. Growing investments in modern hatcheries, improved biosecurity systems, and automated vaccination technologies further contribute to higher vaccine usage. Emerging markets in Asia-Pacific, Africa, and Latin America show accelerated adoption as countries scale production to meet rising domestic and export demand.

- For instance, Automated systems, such as the in-ovo vaccination technology used by hatcheries like Ceva’s Egginject®, inject vaccines into eggs on day 18 of incubation, providing immunity before chicks hatch and reducing handling stress while ensuring uniform protection.

Advancements in Vaccine Technology

Technological advancements play a crucial role, with innovations such as recombinant vaccines, vector-based platforms, and improved thermostability enhancing vaccine safety and effectiveness. These advancements help overcome limitations associated with traditional vaccines, including reduced sensitivity to cold-chain disruptions and improved cross-protection against multiple viral strains. R&D efforts by major manufacturers focus on developing combination vaccines that reduce handling stress and streamline immunization protocols. The integration of biotechnology and genomics accelerates the introduction of precision vaccines tailored to emerging pathogens and regional disease profiles.

Key Trends & Opportunities

Growing Adoption of Hatchery Vaccination Systems

A major trend reshaping the market is the widespread adoption of hatchery-based vaccination systems that enable uniform, early-life protection. In-ovo and day-old chick vaccination technologies ensure consistent dosing and reduce labor-intensive field administration. This shift enhances vaccine efficacy and minimizes stress on flocks, supporting better productivity outcomes. Manufacturers are increasingly partnering with hatchery automation providers to introduce integrated solutions, creating strong opportunities for premium vaccine sales and boosting long-term adoption in large-scale commercial poultry operations.

- For instance, PREVENT’s project in sub-Saharan Africa enabled 37 hatcheries to produce over 200 million vaccinated day-old chicks, administering almost 500 million doses, which transformed poultry health management and fostered vaccine accessibility among small-scale producers.

Rising Demand for Recombinant and Vector-Based Vaccines

Growing preference for recombinant and vector-based vaccines presents notable opportunities, driven by their superior safety profiles, reduced risk of reversion to virulence, and ability to deliver multivalent protection. These advanced vaccines support improved immune responses and offer flexibility to target emerging strains, making them highly attractive for high-performance poultry operations. As producers prioritize lower antibiotic usage and enhanced flock immunity, demand for genetically engineered vaccines increases. Investing in novel recombinant platforms offers manufacturers a competitive edge and aligns with evolving regulatory and sustainability standards.

- For instance, Boehringer Ingelheim’s VAXXITEK® HVT+IBD is a single-shot recombinant vaccine that provides life-long protection across broiler, layer, and breeder chickens by building a strong immune foundation, resulting in better flock health and performance.

Key Challenges

Cold-Chain Dependency and Storage Limitations

One of the major challenges in the Poultry Vaccines Market is the high dependency on cold-chain infrastructure to maintain vaccine potency. Many regions, particularly in developing countries, struggle with inconsistent refrigeration facilities and supply-chain gaps, resulting in reduced vaccine efficacy. Breaks in the cold chain increase wastage, raise operational costs, and limit access in rural areas. Expanding reliable storage networks and developing thermostable formulations remain essential to overcoming distribution barriers and ensuring broad immunization coverage across global poultry farms.

High Cost Burden on Small-Scale Producers

Despite strong market growth, vaccine affordability remains a significant hurdle for small and backyard poultry producers. Limited financial resources restrict their ability to adopt comprehensive vaccination programs, increasing susceptibility to disease outbreaks that affect overall market health. Rising prices of advanced vaccines and associated administration costs further widen the gap between commercial farms and smallholder operations. Addressing this challenge requires government subsidies, awareness programs, and cost-effective vaccine alternatives to support wider adoption and reduce disease prevalence across the broader poultry ecosystem.

Regional Analysis

North America

North America holds a 29.8% share of the Poultry Vaccines Market, driven by strong commercial poultry production across the U.S. and Canada. The region benefits from advanced veterinary infrastructure, stringent biosecurity regulations, and high adoption of hatchery-based vaccination systems. Producers prioritize live attenuated and recombinant vaccines to combat persistent threats such as Marek’s Disease and Infectious Bronchitis. Growing consumer demand for antibiotic-free poultry further accelerates vaccine uptake. Continuous R&D investments by key manufacturers and robust regulatory oversight strengthen North America’s market leadership in technologically advanced poultry immunization solutions.

Europe

Europe accounts for a 24.7% share of the Poultry Vaccines Market, supported by strict animal health standards and widespread implementation of disease prevention programs across major poultry-producing countries such as France, Germany, and the Netherlands. The region shows strong preference for inactivated and recombinant vaccines due to high regulatory emphasis on safety and traceability. Increasing outbreaks of avian influenza and Newcastle Disease have heightened demand for effective immunization protocols. Moreover, ongoing sustainability initiatives and reduced antibiotic usage across European farms promote broader adoption of innovative vaccines that enhance flock immunity and overall productivity.

Asia-Pacific

Asia-Pacific dominates the global Poultry Vaccines Market with a 36.2% share, driven by expanding poultry farming operations in China, India, Indonesia, and Vietnam. Rapid urbanization, rising meat and egg consumption, and large-scale broiler production strongly contribute to vaccine demand. The region faces recurrent outbreaks of infectious diseases, prompting governments and producers to invest in comprehensive vaccination programs. Growth in commercial hatcheries and adoption of cost-effective vaccines further fuel market expansion. Increasing collaborations between global vaccine manufacturers and regional distributors also enhance access to advanced poultry immunization technologies across emerging markets.

Latin America

Latin America holds an 8.1% share of the Poultry Vaccines Market, supported by growing poultry production in Brazil, Mexico, and Argentina. The region’s increasing export activities necessitate strict disease control measures and compliance with international health standards. Producers rely heavily on live attenuated vaccines due to their cost-effectiveness and strong immunity benefits for large flocks. However, rising incidences of Infectious Bursal Disease and Newcastle Disease continue to drive demand for improved recombinant and multivalent vaccines. Investments in modern hatchery automation and expanding commercial farming operations further strengthen market growth across Latin America.

Middle East & Africa

The Middle East & Africa region represents a 7.2% share of the Poultry Vaccines Market, driven by rising poultry consumption and growing reliance on imported day-old chicks across Gulf and African nations. Frequent disease outbreaks, particularly Newcastle Disease and Infectious Bronchitis, increase the need for effective vaccination programs. Limited cold-chain infrastructure poses challenges, but government-led animal health initiatives are improving access to quality vaccines. Expanding commercial farms in Saudi Arabia, South Africa, and Egypt support steady market growth. Increasing partnerships with global vaccine manufacturers further enhance availability of advanced poultry immunization solutions.

Market Segmentations:

By Product Type

- Modified or Attenuated (Live)

- Inactivated (Killed)

- Recombinants

By Dosage Form

- Liquid Vaccine

- Freeze Dried Vaccine

- Duct

By Disease Type

- Newcastle Disease

- Marek’s Disease

- Infectious Bronchitis

- Infectious Bursal Disease

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Poultry Vaccines Market reflects strong participation from leading companies including Merck & Co., Inc., Boehringer Ingelheim, Ceva Santé Animale, Elanco Animal Health, HIPRA, Phibro Animal Health Corporation, Dechra Pharmaceuticals, Hester Biosciences, Biovac, and Vaxxinova. These players actively expand their portfolios through advanced live attenuated, inactivated, and recombinant vaccines addressing major poultry diseases such as Newcastle Disease, Marek’s Disease, and Infectious Bronchitis. The market is characterized by continuous R&D investments, strategic partnerships with hatcheries, and growing emphasis on innovative vector-based and thermostable formulations. Companies focus on integrating automated hatchery vaccination systems and developing multivalent vaccines to improve immunity and reduce handling stress. Expansions into emerging markets, enhanced manufacturing capacities, and compliance with evolving regulatory standards further strengthen their global positioning while fostering technological leadership in high-performance poultry immunization solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merck & Co., Inc.

- Hester Biosciences Limited

- Dechra Pharmaceuticals PLC

- Vaxxinova International BV

- Biovac

- HIPRA

- Elanco Animal Health Incorporated

- Ceva Sante Animale

- Phibro Animal Health Corporation

- Boehringer Ingelheim International GmbH

Recent Developments

- In March 2025, Merck Animal Health secured European approval for its NOBILIS MULTRIVA™ REOm vaccine, formulated for chickens from seven weeks of age to protect against avian reovirus-related disease.

- In May 2024, Merck & Co., Inc. received marketing authorization from the European Commission for its INNOVAX-ND-H5 vaccine for chickens, expanding its product portfolio and strengthening revenue potential.

- In January 2024, Boehringer Ingelheim introduced Vaxxilive Cocci 3, a rebranded version of Hatchpak Cocci III, enhancing its coccidiosis vaccine lineup and reinforcing its market position.

- In June 2025, VaxThera entered a partnership with Quantoom Biosciences to develop a vaccine targeting highly pathogenic avian influenza in poultry, utilizing Quantoom’s advanced N-Force technology platform

Report Coverage

The research report offers an in-depth analysis based on Product Type, Dosage Form, Disease Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as poultry producers increase vaccination coverage to reduce disease-related losses.

- Adoption of recombinant and vector-based vaccines will accelerate due to their strong safety profiles and multivalent protection.

- Hatchery-based vaccination systems will gain wider acceptance for ensuring consistent early-life immunity.

- Demand for thermostable vaccines will rise as producers seek solutions that overcome cold-chain challenges.

- Integration of automation and digital monitoring in vaccination processes will enhance accuracy and flock health outcomes.

- Governments will strengthen disease control regulations, driving higher compliance in commercial farms.

- Emerging markets will experience rapid growth as poultry meat and egg consumption continues to climb.

- Manufacturers will intensify R&D efforts to develop vaccines targeting evolving and emerging viral strains.

- Partnerships between global vaccine companies and regional distributors will improve accessibility across developing regions.

- Increased focus on antibiotic-free poultry production will further boost vaccination adoption as a core biosecurity measure.