Market Overview:

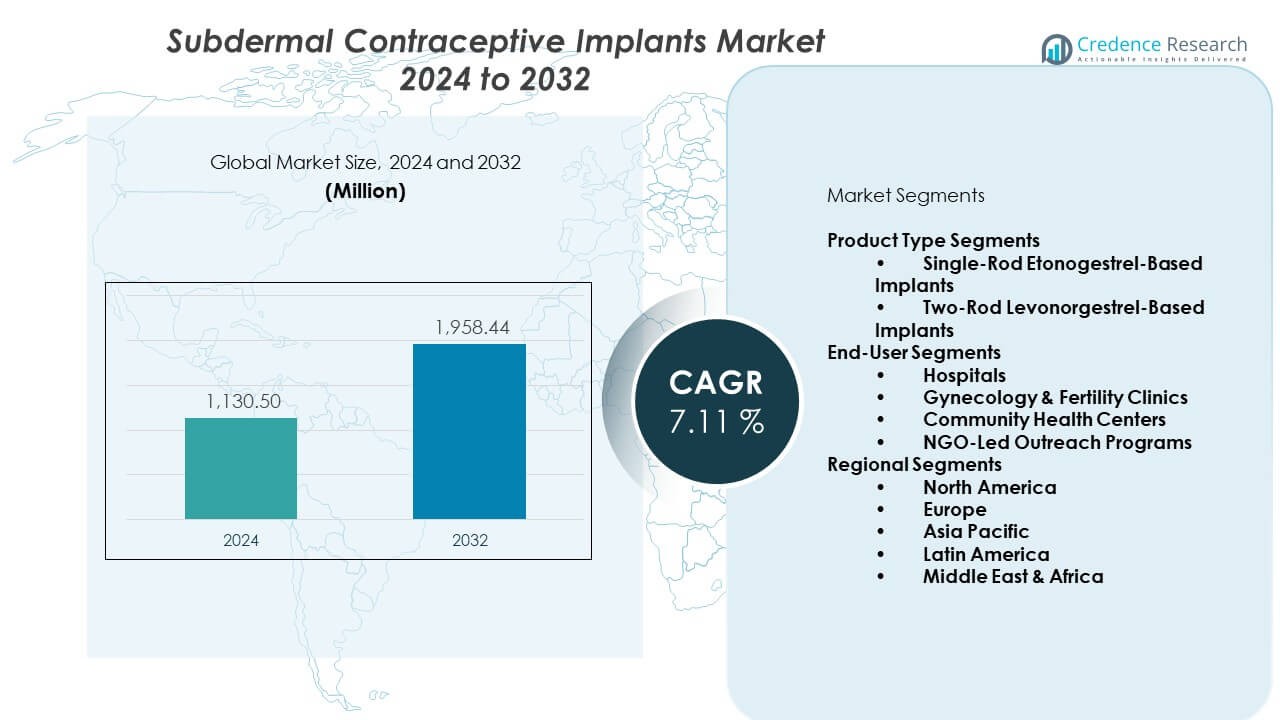

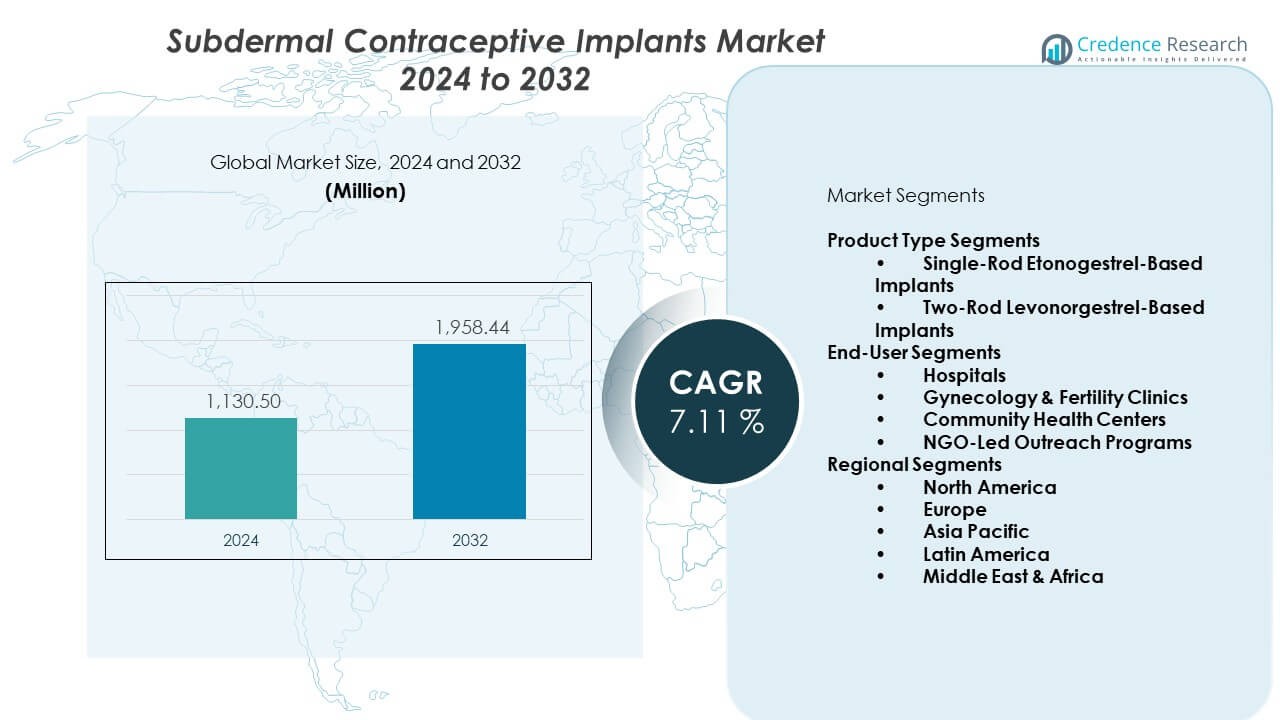

The Subdermal Contraceptive Implants Market is projected to grow from USD 1,130.5 million in 2024 to an estimated USD 1,958.44 million by 2032, with a CAGR of 7.11% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Subdermal Contraceptive Implants Market Size 2024 |

USD 1,130.5 Million |

| Subdermal Contraceptive Implants Market, CAGR |

7.11% |

| Subdermal Contraceptive Implants Market Size 2032 |

USD 1,958.44 Million |

Strong demand rises due to wider acceptance of long-acting reversible contraception. Healthcare providers promote these implants for dependable hormone delivery and fewer user-related failures. The market expands as public programs scale contraceptive access across urban and rural zones. Manufacturers improve implant designs to lower insertion time and reduce side-effects. Growing awareness campaigns help young women adopt longer protection cycles. Better clinical guidance encourages users to shift from short-term contraceptives to longer solutions.

Geographic growth remains strong in North America due to established reproductive health systems and broad insurance support. Europe follows with rising adoption driven by structured family planning programs. Asia Pacific emerges as a high-potential region as large populations gain better access to women’s health services. Countries such as India, Indonesia, and the Philippines show fast uptake with government-led outreach. Latin America gains traction through expanding clinic networks and improved product availability. Sub-Saharan Africa records strong momentum through NGO-supported contraceptive initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Subdermal contraceptive implants market stands at USD 1,130.5 million in 2024 and is projected to reach USD 1,958.44 million by 2032, growing at a CAGR of 7.11%.

- North America (~35%), Europe (~28%), and Asia Pacific (~24%) hold the largest shares due to strong family-planning programs, trained clinical networks, and high awareness.

- Asia Pacific (~24%) remains the fastest-growing region driven by expanding public health investment, rising reproductive health awareness, and NGO-supported access in high-density nations.

- Single-rod etonogestrel implants lead with an estimated ~60% share, supported by easier insertion and wider clinical preference.

- Hospitals dominate end-user adoption with ~40% share, followed by gynecology and fertility clinics due to structured counseling and higher procedural capacity.

Market Drivers:

Growing Shift Toward Long-Acting Reversible Contraceptive Choices

Demand increases as more women seek low-maintenance birth control that offers long protection. Clinics promote longer-acting devices to reduce frequent follow-up visits. The Subdermal contraceptive implants market gains traction as providers highlight strong reliability. Governments support wider access to long-term contraceptives through funded programs. Healthcare workers recommend implants to reduce unintended pregnancy rates. Awareness drives encourage adoption among younger age groups. Users prefer predictable outcomes without daily or weekly schedules. Expanding education campaigns strengthen long-term user confidence.

- For instance, DKT WomanCare’s WHO-prequalified Levoplant implant offers up to three years of protection with fewer than one pregnancy per 100 users each year, demonstrating the high effectiveness of modern implant systems.

Rising Support From Public Health Agencies and Family Planning Programs

Public health bodies launch campaigns to expand contraceptive choices across different regions. Programs focus on outreach in underserved communities to increase awareness. Policy makers integrate implants into national reproductive health frameworks. Training programs improve clinician capability for insertion and removal. The market benefits when agencies promote modern contraceptive methods. Partnerships with NGOs help extend free or subsidized implant supply. Governments encourage reliable contraception to reduce maternal health risks. Wider program coverage creates consistent market momentum.

- For instance, the UNFPA Supplies Partnership supported 48 programme countries in 2022 and delivered 39.6 million couple-years of contraceptive protection, showcasing the scale at which public procurement can expand access to long-acting methods, including implants.

Improved Clinical Safety Profiles Strengthening User Confidence

Modern implants offer more stable hormone delivery with lower complication risks. Manufacturers refine materials to reduce discomfort during insertion and removal. Healthcare providers highlight safer outcomes to build user trust. New clinical guidelines promote implants among women seeking long-acting protection. The technology supports fewer compliance issues due to its fixed dosage delivery. The Subdermal contraceptive implants market advances as better safety outcomes gain attention. Providers counsel patients on longer life cycles to support adoption. Clear communication strengthens acceptance across demographic groups.

Expanding Adoption Across Urban and Rural Healthcare Networks

Hospitals integrate implants into routine contraceptive services. Rural clinics gain better access through mobile health units and outreach camps. Training workshops help more clinicians handle implant procedures safely. Governments aim to reduce gaps in reproductive health access across regions. Better supply chains ensure dependable product availability at local centers. Providers promote implants to reduce strain on overloaded outpatient services. Continuous awareness programs boost acceptance among first-time users. Growing healthcare networks create strong expansion opportunities.

Market Trends:

Increasing Preference for Hormonal Methods With Predictable Outcomes

Women select implant-based contraception to achieve stable hormonal control. Predictability appeals to users seeking consistent monthly cycles. Providers recommend hormonal solutions for users with irregular patterns. The Subdermal contraceptive implants market reflects a steady transition toward regulated hormone systems. Manufacturers highlight smoother hormonal release in updated models. Better clinical counseling supports awareness of predictable outcomes. Demand rises for convenience-driven choices that align with changing lifestyles. Broader acceptance strengthens the shift to modern hormonal methods.

- For instance, Shanghai Dahua Pharmaceutical and DKT WomanCare market Levoplant, a two-rod implant containing 75 mg of levonorgestrel per rod that releases hormone continuously over three years, providing steady endocrine profiles in routine use.

Rising Integration of Digital Health Tools in Contraceptive Management

Digital tools support users with guidance for follow-up, side-effect logging, and provider access. Mobile apps help schedule periodic check-ins with clinics. Telehealth services extend counseling opportunities in remote locations. Providers use digital reminders to track implant longevity. The trend aligns with broader digital transformation in healthcare. It improves adherence by maintaining communication between users and clinicians. Healthcare systems adopt digital records to monitor contraceptive outcomes. Consumers respond positively to technology that simplifies contraceptive tracking.

- For instance, Bayer has expanded digital family-planning initiatives, including chatbots and online platforms, within programs that now support reproductive health and contraception in more than 130 countries, showing how global companies use digital channels to scale information access.

Growing Role of Public–Private Partnerships in Contraceptive Expansion

Governments partner with manufacturers to widen supply of modern contraceptives. Public procurement strategies expand access in low-income regions. Private distributors support efficient logistics across rural clinics. NGOs collaborate with health agencies to improve uptake. The Subdermal contraceptive implants market benefits from coordinated multisector initiatives. Partnerships aim to reduce supply gaps in fast-growing regions. Providers receive better training through shared programs. Sustained cooperation strengthens market consistency.

Shift Toward Simplified Insertion Techniques and User-Friendly Designs

Manufacturers develop slimmer and more flexible implants to ease insertion. Enhanced applicators reduce procedural complexity for trained staff. Clinics promote streamlined designs to reduce procedure time. Users feel more comfortable with small-profile products. The shift encourages adoption among first-time contraceptive users. The trend supports stronger patient satisfaction with minimal discomfort. Providers adopt updated tools that lower training requirements. Market growth aligns with better design efficiency.

Market Challenges Analysis:

Limited Access in Low-Resource Regions Restricting Wider Adoption

Several low-income areas struggle with limited healthcare infrastructure. Clinics face shortages of trained professionals who can insert or remove implants. Supply chain gaps lead to inconsistent availability across remote zones. Cultural resistance in certain communities slows adoption of modern contraception. The Subdermal contraceptive implants market faces hurdles when awareness levels remain low. Health systems work to overcome myths surrounding hormonal methods. Budget constraints limit procurement in public health settings. Outreach programs require long-term funding to sustain momentum.

Concerns Around Side-Effects and Removal Complexity Influencing User Decisions

Some users express concern about hormonal side-effects that vary from person to person. Providers must spend more time explaining expected outcomes to ease anxiety. Removal challenges occur when users visit untrained staff at smaller clinics. Misconceptions about implant safety spread faster than verified information. The market requires strong counseling frameworks to support informed decisions. Providers train extensively to handle complications that may arise during removal. Limited follow-up care discourages some users from choosing long-acting methods. Clinicians continue to address these concerns through detailed patient education.

Market Opportunities:

Expansion Through Government-Led Family Planning Programs in High-Growth Regions

Governments invest in reproductive health reforms that favor long-term contraceptive adoption. Public programs introduce subsidized or free implants to increase coverage. The Subdermal contraceptive implants market gains momentum when agencies prioritize long-acting solutions. Outreach programs reach rural zones where awareness remains low. Clinics receive program-based training to handle implant procedures. High-growth regions display stronger interest due to expanding public health budgets. International funding bodies support scaling initiatives. The opportunity strengthens when countries modernize women’s health policies.

Growing Potential From Product Innovation and User-Friendly Implant Designs

Manufacturers develop improved implants with longer active life cycles. Slimmer formats create more comfort during insertion and daily use. Providers highlight updated features to attract new users. Technological refinement supports safer procedures with improved applicators. The market benefits from rising acceptance of smaller medical devices. Innovation aligns with global demand for low-maintenance reproductive solutions. Better design features help win trust among younger women. The opportunity accelerates as companies compete on ease of use.

Market Segmentation Analysis:

Product Type Segments

Single-rod etonogestrel-based implants hold strong demand due to easier insertion and predictable hormone release. Providers recommend these implants for users seeking long-lasting protection with minimal follow-up. Two-rod levonorgestrel-based implants maintain steady use in regions where trained clinicians prefer familiar multi-rod formats. Hospitals and clinics select product types based on procedure proficiency, supply access, and patient preferences. The Subdermal contraceptive implants market benefits from strong acceptance of both categories due to stable safety profiles. Manufacturers refine materials to improve comfort and durability. Healthcare programs promote both formats to expand contraceptive choice. Product diversity supports broader adoption across age groups.

- For instance, the Levoplant two-rod system from Shanghai Dahua Pharmaceutical and DKT WomanCare delivers a total of 150 mg levonorgestrel and offers up to three years of reversible contraception, giving providers a proven long-acting option in multiple low- and middle-income markets.

End-User Segments

Hospitals lead uptake by offering trained specialists for implant procedures. Gynecology and fertility clinics support growing demand through routine contraceptive counseling and personalized care. Community health centers extend access to rural and underserved populations. NGO-led outreach programs drive awareness and distribute implants in low-resource areas. Market expansion strengthens when end users coordinate with public health authorities. Clinics emphasize proper training to ensure safe insertion and removal. Programs support continuous supply availability to maintain service quality. Each end-user group contributes to consistent growth by improving accessibility and informed decision-making across regions.

- For instance, DKT International reported that its mobile outreach teams inserted more than 23,000 contraceptive implants by August 2025 in Mozambique alone, highlighting how NGO-led and clinic-based services together scale implant access in challenging settings.

Segmentation:

Product Type Segments

- Single-Rod Etonogestrel-Based Implants

- Two-Rod Levonorgestrel-Based Implants

End-User Segments

- Hospitals

- Gynecology & Fertility Clinics

- Community Health Centers

- NGO-Led Outreach Programs

Regional Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the global landscape with a strong contribution driven by advanced healthcare systems and structured family planning programs. The Subdermal contraceptive implants market benefits from high awareness among women seeking long-term contraception. Providers offer specialized services that support safe insertion and removal across hospitals and clinics. Insurance coverage improves access for various demographic groups. Public health initiatives encourage adoption in underserved areas. Manufacturers maintain strong distribution networks that ensure consistent product availability.

Europe

Europe secures a significant share supported by its robust reproductive health policies and widespread clinical adoption. Clinics across Western and Northern Europe integrate implants into standard contraceptive counseling. It gains momentum from strong government-backed awareness campaigns. Training programs help clinicians maintain high service standards. Eastern Europe increases uptake with expanding women’s health investments. Stable regulatory frameworks sustain product availability across diverse healthcare settings.

Asia Pacific, Latin America, and Middle East & Africa

Asia Pacific emerges as the fastest-growing region, supported by expanding public health programs and rising awareness in densely populated nations. Latin America contributes a moderate share with strong adoption in countries that promote modern contraceptive methods through primary care networks. Middle East & Africa records a smaller share yet shows strong improvement through NGO-led outreach and donor-funded programs. It expands with rising focus on maternal health safety. Regional clinics adopt scalable models to provide implants in both urban and rural zones. Overall demand strengthens as healthcare infrastructure improves across developing markets.

Key Player Analysis:

- Bayer AG

- Merck & Co., Inc.

- Shanghai Dahua Pharmaceutical Co., Ltd.

- Organon & Co.

- Pfizer Inc.

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- DKT WomanCare Global

- Celanese

- Gerresheimer AG

Competitive Analysis:

The Subdermal contraceptive implants market shows steady competition driven by strong portfolios from global pharmaceutical and medical device manufacturers. Bayer AG and Organon lead with well-established implant brands supported by broad distribution. It gains further strength from Merck & Co., Inc. and Shanghai Dahua Pharmaceutical Co., Ltd., which supply hormonal implants across high-demand regions. Gerresheimer AG and Celanese support the ecosystem by supplying medical-grade materials for implant components. DKT WomanCare Global expands reach through partnerships in low-resource markets. Competitors focus on product safety, clinical training, and public health collaborations to secure stronger positioning. Ongoing investments in material science and delivery systems further intensify rivalry across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments:

- Organon’s Implanon NXT was expanded to 16 Indian states under the national family-planning program through a phased rollout that began in 2023 and was completed in 2024. News coverage in August 2025 highlighted the implant’s successful adoption and its availability across these states.

- In March 2023, Organon & Co. launched its “Her Plan is Her Power” initiative, committing USD 30 million to reduce unplanned pregnancies via global partnerships and expanded access to long-acting contraception.

Report Coverage:

The research report offers an in-depth analysis based on Product Type Segments and End-User Segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will expand through stronger public health initiatives supporting long-acting choices.

- Product innovation will focus on slimmer and more ergonomic implant designs.

- Healthcare programs will increase adoption through structured clinical training.

- Emerging regions will strengthen uptake with better outreach infrastructure.

- Digital tools will support counseling, monitoring, and user engagement.

- Manufacturers will prioritize improved hormone release stability.

- Partnerships between NGOs and governments will widen access in low-resource zones.

- Supply chains will advance through standardized procurement systems.

- Clinical safety enhancements will reinforce patient trust and acceptance.

- Competitive activity will rise as companies invest in reproductive health portfolios.