Market Overview

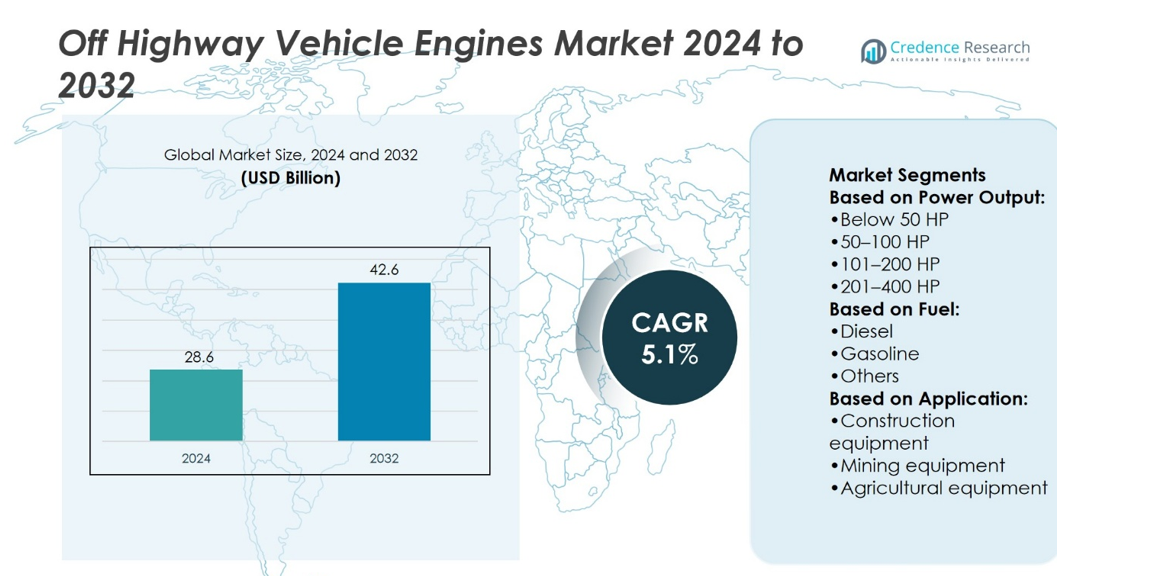

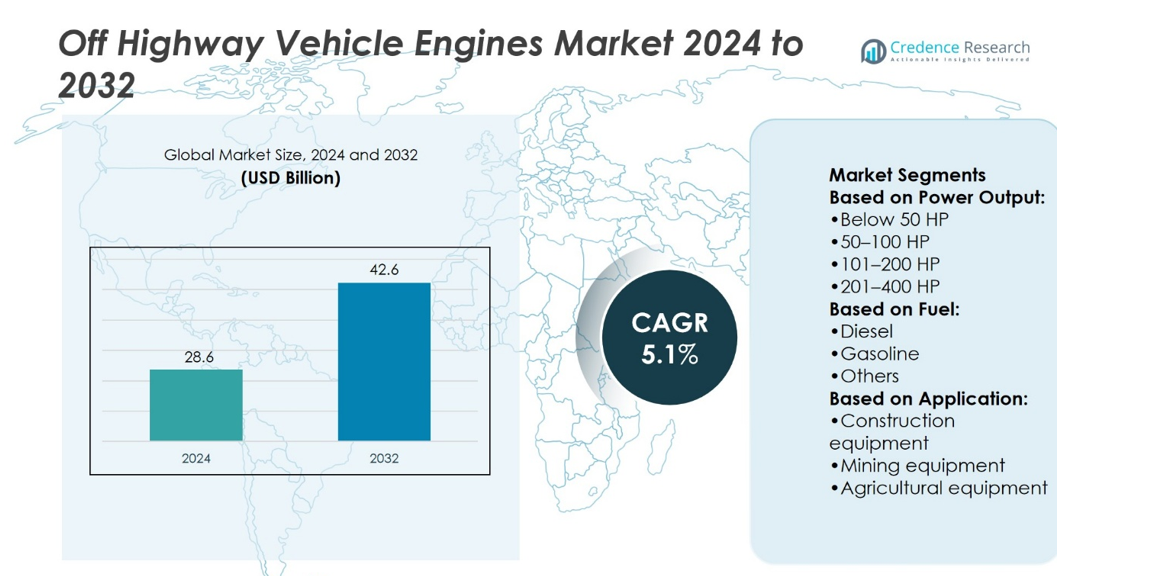

Off Highway Vehicle Engines Market size was valued at USD 28.6 billion in 2024 and is anticipated to reach USD 42.6 billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off Highway Vehicle Engines Market Size 2024 |

USD 28.6 billion |

| Off Highway Vehicle Engines Market, CAGR |

5.1% |

| Off Highway Vehicle Engines Market Size 2032 |

USD 42.6 billion |

The Off Highway Vehicle Engines Market is driven by rising demand from construction, agriculture, and mining industries, supported by infrastructure expansion and mechanization. Strict emission standards accelerate innovation in cleaner combustion technologies, hybrid systems, and alternative fuels. It gains momentum from technological advancements in electronic control units, telematics, and predictive maintenance that enhance efficiency and reduce downtime. Trends highlight a growing shift toward compact, high-performance engines capable of meeting diverse operational needs. Sustainability initiatives and digital integration continue to reshape market dynamics, positioning manufacturers to balance environmental compliance, fuel efficiency, and long-term reliability in heavy-duty applications.

The Off Highway Vehicle Engines Market shows strong regional presence, with Asia-Pacific leading due to large-scale construction, agriculture, and mining activities, followed by North America and Europe with advanced technology adoption and strict emission regulations. Latin America and the Middle East & Africa contribute steadily through agriculture, forestry, and infrastructure projects. Key players such as Caterpillar, Cummins, Komatsu, Deere & Company, CNH Industrial, and Volvo strengthen competitiveness by offering diverse power outputs, fuel-efficient designs, and robust service networks across global markets.

Market Insights

- Off Highway Vehicle Engines Market size was valued at USD 28.6 billion in 2024 and is projected to reach USD 42.6 billion by 2032, at a CAGR of 5.1%.

- Rising demand from construction, agriculture, and mining sectors drives steady growth worldwide.

- Strict emission regulations encourage adoption of hybrid systems, alternative fuels, and advanced combustion technologies.

- Compact, high-performance engines and digital integration emerge as key market trends.

- Competition remains strong, with leading players focusing on product innovation and robust service networks.

- High compliance costs and supply chain disruptions act as restraints for smaller manufacturers.

- Asia-Pacific dominates regional demand, followed by North America and Europe, while Latin America and the Middle East & Africa show steady growth through agriculture, forestry, and infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Construction and Mining Sectors

The Off Highway Vehicle Engines Market benefits from strong demand in construction and mining industries. Growth in large-scale infrastructure projects drives need for durable and fuel-efficient engines. It supports heavy-duty vehicles used for earthmoving, excavation, and material transport. Rising urbanization and industrial expansion increase equipment fleets across developing economies. Manufacturers respond with engines built for high torque and extended durability. The focus remains on productivity, uptime, and reduced total cost of ownership.

- For instance, a version of Caterpillar’s C13B engine has a maximum power output of 430 kW. It produces its peak torque of 2,634 Nm at 1,400 rpm. This engine core has been leveraged and proven across designs that have logged over 109 million field hours in off-highway applications.

Advancements in Engine Technology and Emission Compliance

The Off Highway Vehicle Engines Market advances through adoption of next-generation technologies and strict emission standards. Global regulations push for engines with lower nitrogen oxides and particulate matter. It leads to development of cleaner combustion, turbocharging, and after-treatment systems. Hybrid and alternative fuel options gain momentum as industries target sustainability goals. Manufacturers invest in electronic control systems to optimize fuel efficiency. High-performance designs improve reliability under extreme operating conditions.

- For instance, BAE Systems Hägglunds, the vehicle’s manufacturer, awarded a €42 million contract to Tatra Defense Vehicle for work on 250 BvS10 all-terrain vehicles. The contract covers hull welding, painting, and insulation for vehicles in the Collaborative All-Terrain Vehicle (CATV-3N) program, which involves Germany, Sweden, and the United Kingdom. These vehicles are designed for challenging terrains and are integral to military operations.

Expansion of Agriculture and Forestry Mechanization

The Off Highway Vehicle Engines Market grows with the expansion of modern agriculture and forestry operations. Farms adopt high-horsepower tractors and harvesters to increase efficiency and output. Forestry vehicles rely on robust engines for logging and timber processing in challenging terrain. It enables mechanized solutions that reduce labor costs and improve productivity. Demand rises in emerging markets with strong focus on food security. Suppliers provide engines tailored for seasonal, high-load operations. This expansion ensures steady consumption of advanced off-highway engines.

Increasing Adoption of Digital Integration and Telematics

The Off Highway Vehicle Engines Market gains momentum from digital integration and telematics. Engines now connect with fleet management systems to monitor performance in real time. It allows predictive maintenance, reducing downtime and operational costs. Telematics optimize fuel usage, engine health, and operator efficiency. Connectivity supports compliance tracking for emissions and machine safety. Manufacturers offer data-driven services that extend beyond engine supply. This digital shift strengthens long-term customer relationships and operational reliability.

Market Trends

Growing Shift Toward Electrification and Hybrid Engines

The Off Highway Vehicle Engines Market observes a clear trend toward electrification and hybrid models. Rising pressure to lower emissions drives investment in battery-electric and hybrid powertrains. It enables reduced fuel costs and compliance with evolving global standards. Hybrid solutions balance power demands with efficiency for heavy equipment in mining and agriculture. Manufacturers introduce scalable platforms that allow gradual transition from diesel to hybrid systems. This shift aligns with sustainability targets set by governments and operators.

- For instance, Perkins introduced the 2600 Series, a 13-liter diesel engine platform designed for demanding off-highway applications. The engine offers power ratings from 456 to 690 horsepower and up to 3,200 Nm of peak torque.

Integration of Advanced Connectivity and Smart Control Systems

The Off Highway Vehicle Engines Market advances through integration of smart control technologies. Electronic control units improve engine mapping, diagnostics, and adaptive performance. It strengthens efficiency while reducing wear and unplanned downtime. Telematics platforms provide operators with real-time data on load cycles and fuel usage. Predictive maintenance reduces failures, extending engine lifespan in demanding applications. Connectivity also supports fleet-wide optimization for construction and agricultural operators.

- For instance, FPT Industrial F28 Power Unit—designed for off-road use—weighs in the class yet delivers 416 Nm of torque with a 75 kW (101 hp) peak output. It includes a compact after-treatment system and allows single-side servicing, enabling fast maintenance and tight packaging.

Rising Preference for Alternative Fuels and Low-Carbon Solutions

The Off Highway Vehicle Engines Market evolves with rising use of alternative fuels. Operators explore biofuels, natural gas, and hydrogen-powered solutions to cut carbon footprint. It reflects the need for sustainable options in construction and forestry industries. Governments encourage adoption through incentives and stricter regulatory frameworks. Engine makers invest in dual-fuel and flexible-fuel systems for diverse markets. Demand for renewable energy integration further accelerates this trend globally.

Growing Emphasis on High-Performance and Compact Engine Designs

The Off Highway Vehicle Engines Market sees stronger demand for compact yet high-output engines. Equipment manufacturers prioritize space-saving designs without compromising durability. It supports lightweight vehicles while maintaining high torque delivery for rugged conditions. Compact engines also lower installation costs for OEMs across segments. Customers favor engines with modular platforms for easier customization and serviceability. Performance-driven designs ensure reliability under heavy-duty operations while keeping efficiency at the forefront.

Market Challenges Analysis

Rising Regulatory Pressure and Compliance Costs

The Off Highway Vehicle Engines Market faces mounting challenges from strict global emission norms. Governments enforce Tier 4 and Stage V standards that demand costly after-treatment technologies. It raises development expenses for manufacturers who must redesign engines to meet limits on nitrogen oxides and particulate matter. Smaller players struggle to absorb compliance costs, which affects their competitiveness. High research investment also lengthens product development cycles. Regulatory uncertainty across different regions complicates long-term planning for global suppliers.

Volatility in Raw Material Prices and Supply Chain Constraints

The Off Highway Vehicle Engines Market encounters risks from fluctuating raw material prices and unstable supply chains. Steel, aluminum, and rare earth metals remain vulnerable to global price swings. It disrupts production schedules and increases engine manufacturing costs. Semiconductor shortages further strain availability of advanced control systems. Logistics delays create downtime for OEMs and operators, reducing reliability of supply. Dependence on imports in key markets heightens vulnerability during trade restrictions or geopolitical tensions. This challenge limits profitability and operational stability for market participants.

Market Opportunities

Expansion of Electrification and Hybrid Powertrain Solutions

The Off Highway Vehicle Engines Market presents strong opportunities through adoption of electrified and hybrid systems. Growing demand for sustainable construction, agriculture, and mining equipment drives this shift. It enables manufacturers to offer solutions that balance efficiency with environmental compliance. Hybrid powertrains reduce fuel consumption while delivering the high torque required for heavy-duty tasks. Advances in battery density and charging infrastructure create space for broader market penetration. Companies that expand their hybrid portfolios position themselves as leaders in low-emission equipment solutions.

Rising Demand in Emerging Markets and Infrastructure Growth

The Off Highway Vehicle Engines Market benefits from expanding opportunities in emerging economies. Rapid urbanization and infrastructure development in Asia-Pacific, Latin America, and Africa increase demand for heavy machinery. It creates a strong market for engines capable of handling large-scale construction and agricultural projects. Growth in mining activities also requires reliable, high-performance powertrains. Local governments invest in transport, energy, and industrial sectors, fueling equipment deployment. Engine makers that establish localized production and service networks strengthen their global reach and customer base.

Market Segmentation Analysis:

By Power Output

The Off Highway Vehicle Engines Market covers a broad range of power outputs, serving diverse equipment needs. Engines below 50 HP remain prominent in compact agricultural and forestry machinery where mobility and fuel economy matter most. Units in the 50–100 HP range support mid-sized tractors, loaders, and light construction vehicles, balancing efficiency with reliable performance. The 101–200 HP segment dominates in agricultural harvesters and medium-scale construction machines, offering higher torque and durability. Engines in the 201–400 HP range find strong use in heavy-duty mining trucks and large-scale construction equipment. Above 400 HP engines play a critical role in high-capacity mining and earthmoving operations, where continuous performance under extreme loads is essential. It highlights the importance of scalable designs that address varied industrial requirements.

- For instance, CNH Industrial’s New Holland T4 Electric Power tractor features an electric motor with a maximum torque of 440 Nm and a peak power of 120 hp. With a top speed of 40 km/h, it is a powerful alternative to diesel for light utility applications.

By Fuel

The Off Highway Vehicle Engines Market demonstrates strong reliance on diesel as the leading fuel type. Diesel engines deliver high torque output, fuel efficiency, and durability, making them the preferred choice for construction, mining, and agricultural operations. Gasoline engines retain niche use in lighter equipment segments, where affordability and ease of maintenance drive adoption. The “others” category, including hybrid and alternative fuels, gains attention as industries pursue sustainability targets. It creates pathways for innovation in biofuel compatibility and natural gas-based systems. Manufacturers are aligning strategies with regulations favoring cleaner and more flexible fuel technologies.

- For instance, Isuzu’s 6SD1 straight-six engine displaces approximately 9.8 liters (9,839 cc) and is used in the heavy-duty Giga truck series. Depending on the specific version and application, its power output can range from 320 to 480 horsepower, making it capable of handling heavy-duty tasks effectively. One variant, the 6SD1 (Model TQW), is specifically rated at 302 kW (405 hp).

By Application

The Off Highway Vehicle Engines Market sees construction equipment as the largest application segment, supported by infrastructure development worldwide. Engines in this category power excavators, loaders, and bulldozers, enabling continuous performance across projects. Mining equipment also accounts for significant demand, requiring engines with high horsepower and advanced cooling systems to sustain heavy-duty cycles. Agricultural equipment continues to expand, with tractors, harvesters, and tillers depending on versatile power outputs for efficiency and productivity. Forestry equipment forms a specialized segment, where engines must withstand rugged environments and deliver consistent power for logging activities. It reinforces the need for engines designed for endurance and adaptability across challenging terrains.

Segments:

Based on Power Output:

- Below 50 HP

- 50–100 HP

- 101–200 HP

- 201–400 HP

Based on Fuel:

Based on Application:

- Construction equipment

- Mining equipment

- Agricultural equipment

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of around 28% in the Off Highway Vehicle Engines Market, supported by its strong presence in construction, agriculture, and mining sectors. The United States drives most of the demand, with heavy investment in infrastructure renewal and modernization of agricultural equipment. It is also influenced by strict emission standards from the Environmental Protection Agency (EPA), pushing manufacturers to adopt cleaner technologies and advanced after-treatment systems. Canada contributes steadily with forestry and mining applications that require high-performance engines for rugged terrains and heavy-duty operations. The presence of global OEMs such as Caterpillar, John Deere, and Cummins further strengthens the regional dominance. Investment in digital integration, telematics, and hybrid solutions continues to grow, creating new opportunities for engine suppliers.

Europe

Europe accounts for nearly 22% of the Off Highway Vehicle Engines Market, driven by a mix of advanced agricultural mechanization and ongoing urban infrastructure projects. Germany, France, and the UK serve as major hubs for construction and agricultural equipment, supported by strong policies promoting fuel efficiency and emission reduction. It reflects the influence of stringent European Union Stage V regulations that require advanced emission-control systems. The adoption of hybrid and alternative fuel-powered engines is also more pronounced in this region due to sustainability initiatives. Eastern Europe demonstrates rising demand as construction projects expand, while Western Europe remains a leader in technological adoption. Key manufacturers such as Deutz AG, Volvo Penta, and MAN Engines maintain strong positions in the region.

Asia-Pacific

Asia-Pacific leads the Off Highway Vehicle Engines Market with a dominant share of about 36%. China and India account for the largest contribution, fueled by extensive construction activities, rapid urbanization, and growth in agriculture. Japan and South Korea provide advanced technological expertise, supplying efficient and durable engines to global markets. It reflects a mix of high-volume demand in emerging economies and innovation-led growth in developed countries. Government-backed infrastructure programs and mechanization initiatives in agriculture sustain demand across the region. The mining sector in Australia also contributes heavily, with engines above 400 HP supporting large-scale operations. This region shows the fastest growth potential, combining high consumption with expanding manufacturing capacity for both local and export markets.

Latin America

Latin America represents nearly 8% of the Off Highway Vehicle Engines Market, supported mainly by agriculture and mining. Brazil dominates the regional demand with large-scale mechanization of soybean, sugarcane, and maize farming. Argentina and Chile contribute through mining activities that require durable engines for trucks and loaders. It reflects the region’s reliance on resource-based industries that depend on efficient and high-performance off-highway machinery. Economic challenges and inconsistent infrastructure funding remain barriers, but steady demand from agriculture continues to support the market. Global players establish localized service networks to ensure equipment reliability and maintain long-term customer engagement.

Middle East & Africa

The Middle East & Africa accounts for approximately 6% of the Off Highway Vehicle Engines Market, supported by construction and mining sectors. The Gulf countries, including Saudi Arabia and the UAE, invest heavily in large-scale infrastructure projects, driving demand for construction engines across multiple horsepower categories. Africa shows strong reliance on engines for mining and agricultural applications, with South Africa being a key contributor. It also experiences growing demand for forestry machinery in Central and East Africa. While political instability and regulatory inconsistencies hinder uniform growth, the availability of untapped resource projects ensures steady opportunities. Engine suppliers focus on expanding distribution and service networks to strengthen their foothold in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Komatsu

- Caterpillar

- Isuzu Motors

- Volvo

- Cummins

- Mitsubishi Heavy Industries

- CNH Industrial

- Doosan Infracore

- Deere & Company

- FPT Industrial

Competitive Analysis

The Off Highway Vehicle Engines Market players including Caterpillar, CNH Industrial, Cummins, Deere & Company, Doosan Infracore, FPT Industrial, Isuzu Motors, Komatsu, Mitsubishi Heavy Industries, and Volvo. The Off Highway Vehicle Engines Market features strong competition shaped by innovation, regulatory compliance, and global distribution strength. Companies compete by offering engines that balance durability, fuel efficiency, and low emissions across construction, agriculture, mining, and forestry equipment. It emphasizes continuous investment in advanced technologies such as hybrid systems, electronic control units, and telematics integration to improve engine performance and operational efficiency. Sustainability goals and stricter emission regulations further push market participants toward cleaner combustion solutions and alternative fuel adoption. Competitive advantage often relies on expanding localized manufacturing and service networks to strengthen customer trust and reduce downtime. The market continues to evolve with players focusing on long-term partnerships, aftermarket services, and digital solutions that enhance overall value delivery.

Recent Developments

- In February 2025, CNH commenced production of its 2.8-litre TREM V-compliant F28 engine at its Greater Noida facility. Initially designed for construction equipment adhering to CEV V norms, the engine will later power agricultural machinery once TREM V emission standards are implemented.

- In February 2025, Komatsu commenced proof-of-concept testing of its HD785 dump truck, now equipped with a 12-cylinder hydrogen combustion engine developed in collaboration with German firm KEYOU. Conducted at Komatsu’s Ibaraki Plant, the trials aim to evaluate performance, fuel efficiency, and safety.

- In January 2024, Bosch Rexroth partnered with Modine, a thermal management manufacturer. The partnership aimed to develop Modine EVantage thermal management systems to be added to the Bosch Rexroth portfolio of eLION products for electrified off-highway machinery globally.

- In June 2023, Zero Nox Inc., which specializes in sustainable, off-highway vehicle electrification, signed a product development agreement with Kubota Corporation. The agreement is based on electrifying products for off-highway applications.

Report Coverage

The research report offers an in-depth analysis based on Power Output, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hybrid and electric engines will expand across construction and mining sectors.

- Regulatory compliance will push manufacturers to adopt cleaner combustion and after-treatment technologies.

- Alternative fuels such as biofuels, hydrogen, and natural gas will gain stronger adoption.

- Digital integration and telematics will improve fleet management and predictive maintenance.

- Compact, high-performance engines will see higher demand in agriculture and forestry equipment.

- Investment in R&D will focus on emission reduction and fuel efficiency improvements.

- Emerging markets will drive growth with infrastructure expansion and agricultural mechanization.

- Global supply chains will adapt to reduce risks from raw material and semiconductor shortages.

- Aftermarket services and localized support will become key to retaining customer loyalty.

- Sustainability commitments will shape product development and long-term competitive strategies.