Market Overview:

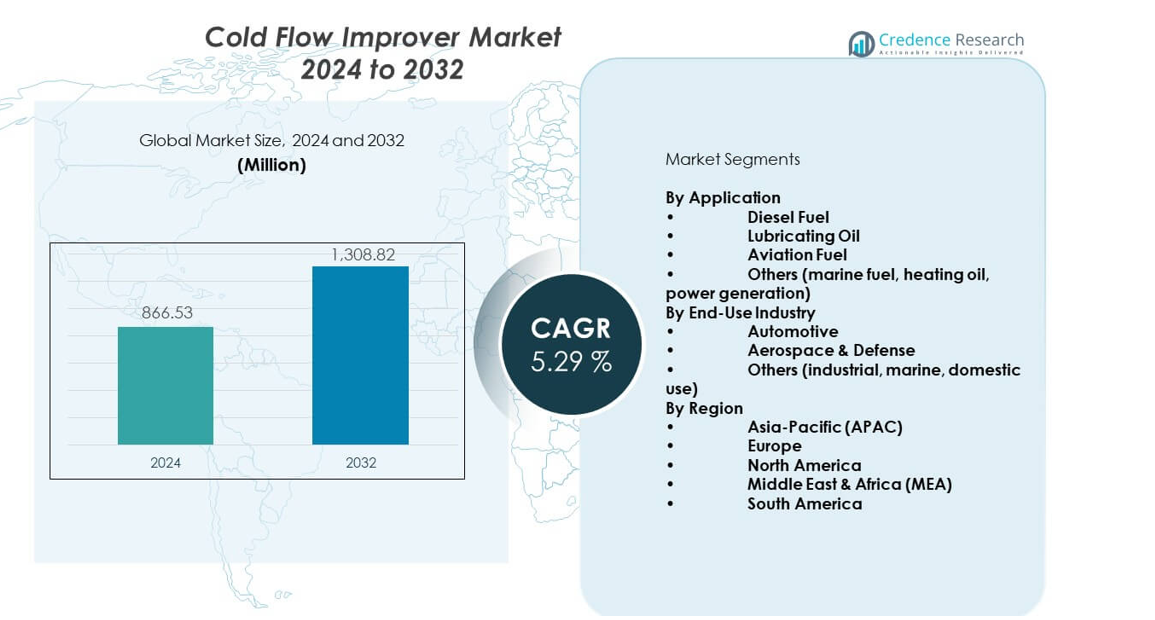

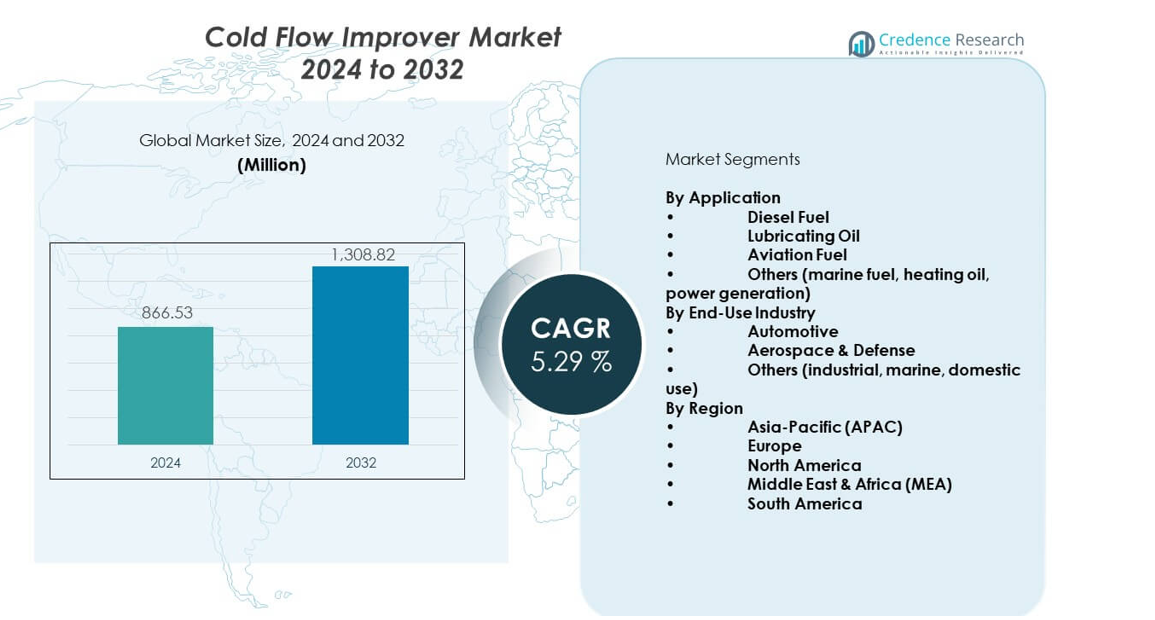

The Cold flow improver market is projected to grow from USD 866.53 million in 2024 to an estimated USD 1308.82 million by 2032, with a compound annual growth rate (CAGR) of 5.29% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cold Flow Improver Market Size 2024 |

USD 866.53 million |

| Cold Flow Improver Market, CAGR |

5.29% |

| Cold Flow Improver Market Size 2032 |

SD 1308.82 million |

Growing use of diesel engines in transport and industry drives steady adoption across global supply chains. Fuel suppliers seek additives that lower pour points and improve flow during cold spells. Aviation and marine operators adopt advanced cold flow improvers to reduce risks linked to fuel thickening. Chemical innovators launch formulations that offer better compatibility with modern low-sulfur fuels. Emission regulations push refiners to upgrade additive packages. The push for cleaner and smoother engine performance shapes new product development. Rising awareness among fleet owners boosts product uptake across severe-weather zones.

Regional demand stays strong in North America and Europe due to harsh winters and large diesel fleets. Countries with advanced refining infrastructure lead adoption because they face strict efficiency and compliance norms. Asia Pacific emerges as a key growth region due to expanding transport networks and rising diesel consumption in commercial sectors. South America shows growing traction as agriculture and mining expand their diesel-based machinery base. The Middle East & Africa witness gradual uptake where colder high-altitude zones support higher usage.

Market Insights:

- The Cold flow improver market is valued at USD 866.53 million in 2024 and is projected to reach USD 1308.82 million by 2032, growing at a 29% CAGR during the forecast period.

- North America (34%), Europe (30%), and Asia Pacific (26%) lead global share due to cold-weather demand, strict fuel-quality norms, and large diesel-dependent fleets.

- Asia Pacific, holding 26%, remains the fastest-growing region, driven by expanding transport networks, industrial activity, and rising adoption of winter-grade diesel.

- The diesel fuel segment accounts for the largest share at an estimated 60%, supported by heavy use in commercial fleets and off-road machinery.

- The automotive end-use segment holds roughly 55%, driven by high diesel vehicle density and growing need for winter operability across key markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Reliable Low-Temperature Fuel Performance

Growing winter disruptions push fuel suppliers to adopt additives that support smoother diesel flow. The Cold flow improver market gains momentum as fleets operate in colder zones. Refiners use solutions that stop wax crystal formation and protect engine parts. Transport operators want additives that maintain steady performance during severe cold spells. Aviation and marine users choose advanced agents for stable low-temperature handling. Policymakers encourage safe winter transport practices across regions. Chemical firms create new blends that work well with low-sulfur diesel. It strengthens overall usage across logistics and industrial segments.

- For instance, Infineum reports that tailored cold flow additives for hydrotreated vegetable oil can improve cold filter plugging point performance by more than 5 °C, allowing use of less isomerised HVO in colder conditions.

Expansion of Diesel-Based Transport and Industrial Operations

Global transport networks expand fast, driving the need for additives that protect fuel performance. The Cold flow improver market benefits from heavy reliance on diesel trucks, tractors, and machinery. Cold climates increase risks that operators avoid by adopting dependable additive packages. Refineries adjust blending choices to meet emission rules and maintain winter stability. Mining and construction fleets show high interest due to long hours in remote zones. Developing countries grow diesel fleets, raising demand for improved winter operability. Industrial users value strong ignition during extreme cold cycles. It supports broad adoption in commercial sectors.

- For instance, Infineum highlights that its cold flow additive technology can raise the operability specification to CFPP and enable refineries to direct up to 10% more of the heavy fuel stream into the diesel pool while maintaining low-temperature performance.

Shift Toward High-Performance Low-Sulfur Diesel Formulations

Emission rules push refiners toward low-sulfur diesel that needs stronger additive support. The Cold flow improver market progresses due to advanced chemistry that stabilizes low-temperature flow. Low-sulfur fuels face waxing risks that motivate wider additive use. Engine makers suggest enhanced packages that improve cold-start reliability. Regulatory bodies encourage cleaner blends that still maintain fuel mobility. Buyers want additives that show stable results across varied climates. Producers launch agents that support long storage without thickening. It drives interest in optimized formulations.

Rising Adoption Across Aviation, Marine, and Off-Grid Systems

Aviation and marine operators seek additives that maintain smooth operations in cold routes. The Cold flow improver market grows as airports and ports handle winter traffic. Remote generators in cold zones require stronger flow agents to avoid shutdowns. Defense fleets adopt high-grade formulations for mission stability. Fuel distributors use advanced blends that reduce freezing risks in extreme latitudes. Energy firms deploy additives to protect diesel-powered backup units. Research groups develop new polymers that enhance wax control. It expands usage across specialized fuel systems.

Market Trends:

Growth of Precision-Engineered Polymer Additives

Manufacturers design polymers that target specific wax crystal behavior. The Cold flow improver market reflects strong interest in engineered molecules that support uniform flow. Refiners look for additives that work across varied crude sources. Buyers request solutions that match new blending practices. Engine makers test additives for compatibility with updated systems. Chemical firms release variants that improve dispersant efficiency. Fuel labs run cold chamber tests to validate performance. It encourages constant refinement of additive design.

- For instance, Evonik’s VISCOPLEX 10-310 pour point depressant for biodegradable lubricants stabilizes the pour point of rapeseed oil at -25 °C with typical treat rates of 0.5–1.0% by weight.

Rising Integration of Digital Blending and Real-Time Monitoring

Refineries invest in digital tools that guide additive dosing with high accuracy. The Cold flow improver market benefits from automated control that improves winter fuel reliability. Sensors offer real-time feedback on blend behavior. Operators reduce waste by applying precise treatment levels. Digital platforms help track performance across supply chains. Industrial users analyze field data to optimize dosage. Automation boosts consistency across multiple sites. It supports smarter production cycles.

- For instance, Premix Technologies describes additive injection packages that meter fuel additives at 0.01–0.5% v/v with ±0.5% accuracy using API 675-compliant pumps and real-time flow-meter control to keep fuel quality within target limits.

Sustainability Shift Toward Bio-Based Additive Chemistry

Producers explore bio-based polymers that reduce environmental impact. The Cold flow improver market sees a rise in eco-focused product lines. Buyers prefer cleaner solutions that align with sustainability targets. Research teams test natural compounds for flow improvement. Regulators encourage greener chemical choices. Industries seek additives with lower toxicity profiles. Supply chains show interest in renewable inputs. It strengthens development of sustainable formulations.

Expansion of Cold-Resistant Fuels for Harsh-Climate Regions

Fuel suppliers develop blends for extreme cold regions with long winter seasons. The Cold flow improver market expands as Arctic and high-altitude zones face severe waxing issues. Heavy trucks in sub-zero routes need stronger flow agents. Aviation hubs near polar corridors demand premium-grade packages. Marine operators choose solutions that protect fuel in icy seas. Governments fund winter resilience programs for transport. Energy firms deploy cold-ready fuels for remote operations. It increases consumption in harsh-climate territories.

Market Challenges Analysis:

Complex Compatibility Issues with Evolving Fuel Standards

Low-sulfur regulations change fuel chemistry in ways that complicate additive behavior. The Cold flow improver market faces challenges when refiners adjust blending formulas. Some additives struggle to perform uniformly across crude variations. Engine makers demand strict compatibility that many older formulations fail to meet. Fuel supply chains show inconsistent winter quality in developing regions. Testing costs rise due to changing regulatory expectations. Operators face risk when poor dosing reduces engine protection. It creates barriers for seamless adoption.

High Production Costs and Limited Awareness in Emerging Markets

Advanced polymer additives require complex processing that pushes production expenses upward. The Cold flow improver market sees limited adoption in regions where buyers avoid premium grades. Fleet operators in developing countries often lack awareness of winter flow risks. Price-sensitive sectors choose low-cost blends that offer weak cold protection. Import duties create cost burdens for distributors. Knowledge gaps slow adoption among small transport firms. Energy users avoid high-grade agents due to budget pressure. It restricts growth across emerging economies.

Market Opportunities:

Faster Growth in Cold-Prone Transport and Industrial Zones

Harsh winter regions create strong demand for additives that improve diesel flow reliability. The Cold flow improver market gains openings in logistics, mining, agriculture, and marine sectors facing freezing concerns. Fleet modernization in cold climates strengthens interest in premium agents. Governments support winter-ready transport infrastructure. Oil firms expand supply networks in remote cold areas. Strong uptake across industrial units boosts long-term potential. Buyers prefer high-performance formulations that reduce downtime. It enables broader penetration in winter-heavy markets.

Advancements in Bio-Based and Multifunctional Additive Technologies

Producers explore bio-derived polymers that match performance goals while reducing environmental impact. The Cold flow improver market benefits from technology that blends flow improvement with cleaning and stabilizing effects. Research teams create additives that support multiple fuel properties at once. Buyers seek eco-friendly solutions for long-term sustainability targets. Chemical firms invest in modular designs that fit diverse fuels. Regulatory shifts favor greener additive choices. Improved scalability raises market readiness. It widens opportunities for innovative product portfolios.

Market Segmentation Analysis:

By Application

The Cold flow improver market shows strong demand across diesel fuel applications due to rising usage in transport and off-road machinery. Diesel blends in cold regions need reliable additives that prevent wax formation and support smooth ignition. Aviation fuel grades use tailored improvers that protect flow performance on long cold routes. Lubricating oil users adopt specialty agents that support viscosity control under low temperatures. Marine fuel operators deploy improvers to avoid thickening risks during long voyages. Heating oil suppliers integrate flow agents to support reliable winter supply. Power generation units in remote zones depend on cold flow additives to maintain operational stability. It supports wide adoption across multiple fuel types.

- For instance, Clariant’s DODIFLOW 6087 improves both the pour point and cold filter plugging point of marine gas oil across fuel grades that have pour point specifications ranging from +6 °C to -6 °C, helping correct off-spec fuels and safeguard bunkering in cold weather.

By End-Use Industry

The Cold flow improver market serves automotive fleets that rely on winter-grade diesel to maintain engine efficiency. Heavy trucks in cold climates adopt stronger additive packages to prevent filter plugging. Aerospace and defense segments use premium agents that support mission reliability under harsh conditions. Industrial units demand stable low-temperature performance for generators and machinery. Marine operators apply additives to protect fuel behavior during cold sea operations. Domestic users depend on improved heating oil performance during winter months. Remote sites with diesel-driven systems show strong traction for advanced improvers. It strengthens demand across diverse industries.

- For instance, Evonik documents that its VISCOPLEX 10-310 pour point depressant for biodegradable lubricants keeps flow stable at -25 °C in rapeseed oil, supporting low-temperature performance when dosed at 0.5–1.0% by weight.

Segmentation:

By Application

- Diesel Fuel

- Lubricating Oil

- Aviation Fuel

- Others (marine fuel, heating oil, power generation)

By End-Use Industry

- Automotive

- Aerospace & Defense

- Others (industrial, marine, domestic use)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe

The Cold flow improver market holds strong presence in North America, capturing close to 32–34% of the global share due to harsh winter conditions and high diesel consumption. Refineries in the United States and Canada use advanced additive packages to maintain seasonal fuel stability. Fleets across logistics, mining, and agriculture show steady demand for winter-ready blends. Europe follows with about 28–30% share supported by strict emission norms and widespread adoption of low-sulfur diesel. Nordic countries drive higher per-capita usage due to longer cold seasons. Chemical producers in Germany and the U.K. promote specialized formulations for transport and heating oil. It secures a firm position across regulated and cold-intense markets.

Asia Pacific

The Cold flow improver market records the fastest growth in Asia Pacific with a share of 24–26%, driven by expanding transport networks and rising diesel demand. Cold regions in China, Japan, and South Korea adopt premium additives for winter operations. Growing mining and construction projects in high-altitude areas push further interest. Regional refineries invest in performance additives that support cleaner diesel adoption. Automotive fleets in northern states of India increase usage during seasonal drops in temperature. Marine and industrial sectors also adopt improvers to protect fuel during storage and transit. It strengthens Asia Pacific’s role as an emerging high-volume consumer.

Middle East & Africa and South America

The Cold flow improver market shows moderate uptake in the Middle East & Africa, holding around 8–10% share due to limited cold areas but growing use in high-altitude and winter-prone zones. Mining and remote industrial operations increased reliance on stable winter-grade diesel. South America maintains roughly 6–8% share supported by adoption in southern regions and expanding agricultural machinery use. Countries with cooler climates such as Chile and Argentina show stronger demand. Marine and industrial fuel consumption supports gradual uptake across coastal and remote regions. Refineries adopt improvers to support winter compliance and reduce risks linked to diesel thickening. It drives consistent, need-based application across emerging regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Afton Chemical Corporation

- Evonik Industries AG

- Clariant AG

- The Lubrizol Corporation

- Chevron Oronite Company LLC

- Infineum International Limited

- Baker Hughes Company

- Bell Performance, Inc.

- Innospec Inc.

- Dorf Ketal Chemicals

- Akzo Nobel N.V.

Competitive Analysis:

The Cold flow improver market features a balanced mix of large multinationals and specialized additive producers. BASF SE, Afton Chemical, Evonik, Clariant, Lubrizol, Chevron Oronite, Infineum, Baker Hughes, Innospec, Dorf Ketal, Akzo Nobel, and Bell Performance compete on performance, treat rate efficiency, and compatibility with low-sulfur and biofuels. Product portfolios focus on diesel, aviation, marine fuels, and lubricating oils for harsh climates. Players invest in R&D to optimize CFPP and pour point reduction while meeting tight emission norms. Strategic moves include bio-based formulations, multi-functional additives, and capacity expansions in Asia Pacific and North America. It remains moderately competitive with technology, technical support, and long-term supply contracts shaping differentiation.

Recent Developments:

- In April 2023, BASF SE launched a new bio-based cold flow improver aimed at enhancing the low-temperature performance of biodiesel, supporting sustainability goals and regulatory compliance.

- In January 2024, Evonik Industries AG introduced its VISCOPLEX series cold flow improvers designed for biodiesel and fossil fuel blends (B5–B20), enhancing fuel performance in cold climates.

Report Coverage:

The research report offers an in-depth analysis based on By Application and By End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing diesel and biodiesel consumption in cold regions will sustain demand for cold flow additives.

- Adoption of ultra-low sulfur diesel and renewable fuels will create complex formulation needs for suppliers.

- Asia Pacific will remain a key volume growth engine, supported by transport and industrial expansion.

- Automotive fleets will continue to dominate consumption as operators seek higher winter reliability.

- Bio-based and lower-toxicity chemistries will gain traction under tightening environmental rules.

- Multi-functional additives that blend cold flow, detergency, and lubricity benefits will see rising preference. Digital dosing and real-time fuel quality monitoring will improve blending efficiency at refineries and terminals.

- Investments in aviation and marine fuels will open higher-value niches for specialized improvers.

- Strategic alliances between additive suppliers and fuel producers will deepen to secure long-term offtake.

- It is expected to benefit from infrastructure growth in colder geographies where winter fuel reliability is critical.