| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Offshore Wind Energy Market Size 2024 |

USD 13,501.6 million |

| Europe Offshore Wind Energy Market, CAGR |

10.13% |

| Europe Offshore Wind Energy Market Size 2032 |

USD 29,267.9 million |

Market Overview

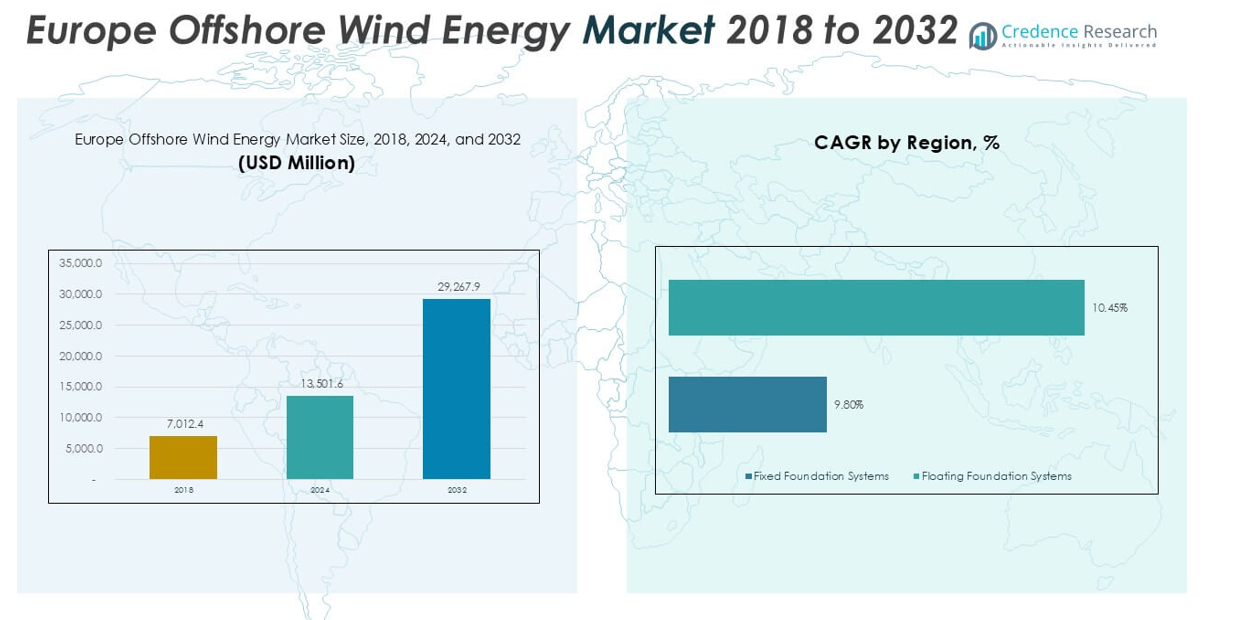

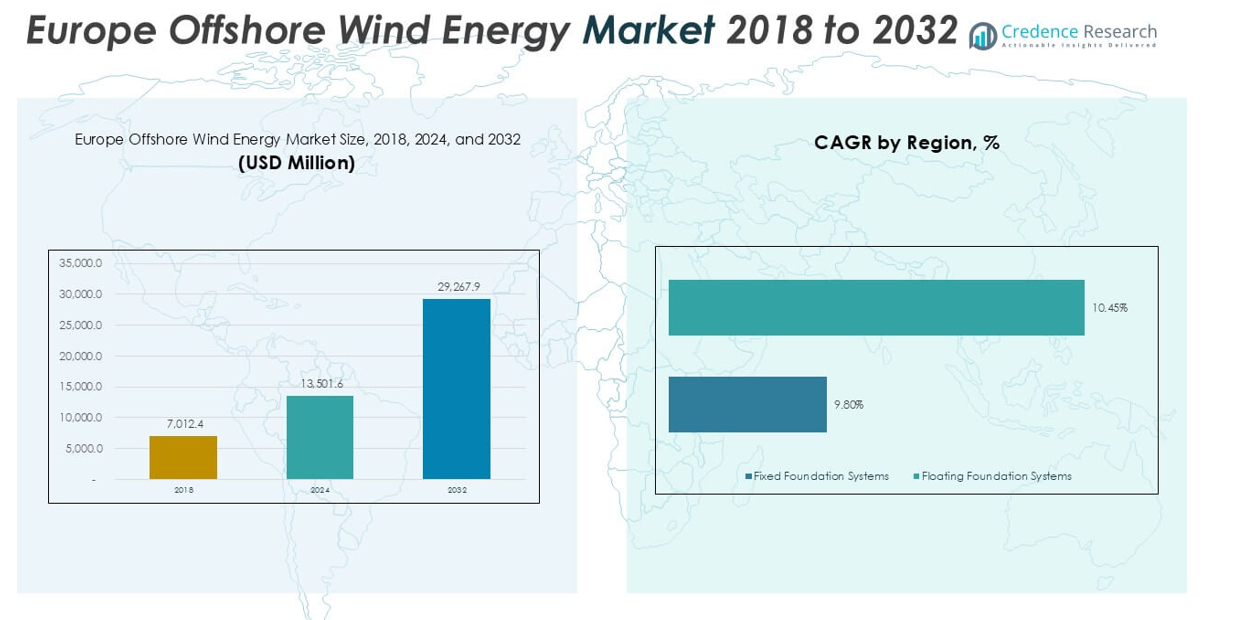

The Europe Offshore Wind Energy market size was valued at USD 7,012.4 million in 2018, increased to USD 13,501.6 million in 2024, and is anticipated to reach USD 29,267.9 million by 2032, at a CAGR of 10.13% during the forecast period.

The Europe offshore wind energy market is shaped by top players such as General Electric, Vestas, Siemens Gamesa, ABB, Nordex SE, EEW, Nexans, Rockwell Automation, and Schneider Electric, each contributing to technological advancement and large-scale project execution across the region. The United Kingdom stands as the leading region, commanding approximately 38% of the market share in 2024, driven by a mature project pipeline, favorable government policies, and robust infrastructure. Germany follows as another key region, supported by advanced supply chains and significant capacity additions. These companies and regions collectively drive market growth, innovation, and Europe’s position as a global offshore wind leader.

Market Insights

- The Europe offshore wind energy market was valued at USD 13,501.6 million in 2024 and is projected to reach USD 29,267.9 million by 2032, registering a CAGR of 10.13%.

- Ambitious renewable energy targets and supportive government policies drive strong investment and rapid capacity expansion across major European economies.

- The market is witnessing trends such as increased adoption of floating foundation systems, digitalization of operations, and integration with energy storage and hydrogen production.

- Competitive dynamics are marked by collaborations, technological innovation, and a focus on cost efficiency among major players, enabling them to lead large-scale project development.

- The UK leads the regional market with a 38% share in 2024, followed by Germany at 26%, while the fixed foundation systems segment dominates with an 85% share, reflecting its technological maturity and suitability for shallow waters.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Installation Type:

Fixed foundation systems represent the dominant installation type in the Europe offshore wind energy market, accounting for approximately 85% of total market share in 2024. This segment leads due to technological maturity, cost-efficiency, and widespread suitability in shallow and transitional waters. Demand for fixed foundation systems continues to grow, supported by favorable seabed conditions across the North Sea and Baltic Sea, streamlined installation processes, and strong project pipelines in the United Kingdom, Germany, and the Netherlands.

- For instance, EEW Group supplied 101 monopiles for the Borssele 1 & 2 wind farms in the Netherlands, each monopile weighing up to 1,200 tons and measuring up to 76 meters in length.

By Component:

Turbines remain the leading component segment, holding over 40% of the Europe offshore wind energy market share in 2024. The turbines segment, particularly advanced nacelle and blade technologies, drives value by enhancing efficiency and capacity factors. Continued innovation in turbine design, larger rotor diameters, and improved reliability fuel market growth. Substructures and electrical infrastructure also see rising demand as project sizes increase, but turbines set the pace in terms of investment and revenue generation.

- For instance, Siemens Gamesa’s SG 14-222 DD turbine features blades that are each 108 meters long and a generator rated at 14 megawatts, supporting some of the world’s largest offshore wind projects.

By Location:

Shallow water installations dominate the Europe offshore wind energy market, capturing nearly 70% of the total market share in 2024. These projects benefit from lower construction costs, established supply chains, and easier access for installation and maintenance. Most existing and planned offshore wind farms across Europe are sited in shallow waters, particularly along the coasts of the United Kingdom, Germany, and Denmark, where favorable wind speeds and government incentives further support this segment’s strong position.

Market Overview

Ambitious Renewable Energy Targets

European governments continue to set ambitious renewable energy targets, which serve as a primary growth driver for the offshore wind energy market. The European Union’s commitment to carbon neutrality and binding climate objectives accelerates the transition from fossil fuels. National energy plans, such as those in the United Kingdom and Germany, promote substantial investments in offshore wind infrastructure, enabling rapid capacity expansion and ensuring long-term demand for new projects.

- For instance, the United Kingdom installed over 2,300 offshore wind turbines by 2023, leading Europe in operational offshore wind units.

Technological Advancements and Cost Reduction

Continuous innovation in turbine technology, foundation engineering, and digital monitoring systems has significantly reduced the levelized cost of offshore wind energy. Larger turbines, floating foundations, and improved installation methods drive efficiency and project viability in deeper waters. These advancements enhance the competitiveness of offshore wind compared to conventional energy sources, attracting both private and public sector investments and facilitating the development of previously inaccessible locations.

- For instance, Vestas’ V236-15.0 MW offshore turbine delivers up to 80 gigawatt-hours of power annually per unit, enough to power more than 20,000 European households per turbine.

Supportive Regulatory Frameworks and Incentives

A supportive regulatory environment and favorable government incentives underpin the expansion of offshore wind in Europe. Feed-in tariffs, contract-for-difference schemes, and streamlined permitting processes encourage investor confidence and project execution. Cross-border cooperation and harmonization of standards across European nations foster an integrated market, while financial support from the European Investment Bank and other institutions catalyzes large-scale offshore wind development.

Key Trends & Opportunities

Growth of Floating Offshore Wind Projects

Floating offshore wind technology emerges as a significant trend, opening new opportunities for deployment in deeper waters where fixed foundations are not feasible. Pilot projects in the North Sea and Mediterranean illustrate growing commercial viability. As costs decline and technology matures, floating wind offers market players access to untapped wind resources and enables geographic diversification beyond traditional shallow water locations.

- For instance, Equinor’s Hywind Scotland has a total installed capacity of 30 megawatts with five floating turbines, each with a tower height of 253 meters from sea surface to blade tip.

Expansion of Offshore Wind Supply Chains

Development and localization of offshore wind supply chains across Europe create opportunities for regional economic growth and job creation. Investments in port infrastructure, blade manufacturing, and assembly facilities enhance project delivery capabilities and reduce logistical costs. This trend also drives greater collaboration between utilities, technology providers, and local governments, strengthening the resilience and competitiveness of the European offshore wind sector.

- For instance, Siemens Gamesa’s blade factory in Hull, UK, produced its 1,000th offshore wind turbine blade by 2021, supporting both domestic and European export projects.

Integration with Hydrogen and Energy Storage

The integration of offshore wind with green hydrogen production and advanced energy storage solutions presents new opportunities for market growth. Several European projects now explore direct coupling of wind farms with electrolysis plants to produce renewable hydrogen. This synergy helps address intermittency challenges, supports grid stability, and positions offshore wind as a cornerstone for Europe’s emerging hydrogen economy.

Key Challenges

Grid Connection and Infrastructure Constraints

Limited grid capacity and bottlenecks in transmission infrastructure pose significant challenges to offshore wind expansion in Europe. Delays in grid upgrades, high connection costs, and cross-border transmission complexities hinder timely project development. Addressing these issues requires coordinated investment, regulatory alignment, and new grid technologies to enable seamless integration of growing offshore wind capacity.

Environmental and Permitting Complexities

Stringent environmental regulations and lengthy permitting procedures can slow project timelines and escalate costs. Developers must navigate concerns over marine biodiversity, fisheries, and coastal impacts, which may lead to project redesigns or delays. Achieving a balance between environmental protection and rapid deployment remains a persistent challenge in several European markets.

Supply Chain Disruptions and Cost Volatility

Volatility in raw material prices, logistical disruptions, and workforce shortages continue to impact the offshore wind supply chain. These challenges can delay project execution and increase overall costs, especially in periods of high demand. Strengthening supply chain resilience and fostering collaboration among stakeholders are essential for mitigating risks and maintaining project momentum.

Regional Analysis

United Kingdom

The United Kingdom leads the Europe offshore wind energy market, holding approximately 38% market share in 2024. The market size grew from USD 2,664.7 million in 2018 to USD 5,130.6 million in 2024, with expectations to reach USD 10,978.8 million by 2032, reflecting a CAGR of 10.2%. Robust government support, ambitious renewable targets, and extensive shallow water resources position the UK as the regional front-runner, with substantial investments in both fixed and floating offshore wind projects driving continuous capacity expansion.

France

France’s offshore wind energy market represents about 7% of the regional share in 2024, with market size growing from USD 491.0 million in 2018 to USD 945.1 million in 2024 and projected to reach USD 2,089.2 million by 2032 at a CAGR of 10.6%. National strategies to expand renewable energy, coupled with new investments in both fixed and floating foundation systems, foster strong market momentum. The country is also advancing large-scale projects along its Atlantic coast, boosting its future market significance.

Germany

Germany holds roughly 26% market share in 2024. The German offshore wind market expanded from USD 1,823.2 million in 2018 to USD 3,510.4 million in 2024 and is forecasted to achieve USD 7,407.7 million by 2032, at a CAGR of 10.1%. Germany’s well-established infrastructure, favorable regulatory frameworks, and extensive North Sea and Baltic Sea installations support market stability and growth, with a focus on scaling both fixed and floating foundation technologies.

Italy

Italy comprises around 3% of the European offshore wind market in 2024, increasing from USD 210.4 million in 2018 to USD 409.5 million in 2024 and expected to reach USD 930.1 million by 2032, reflecting a CAGR of 10.8%. The Italian market is experiencing early-stage growth, driven by pilot projects, especially in the Mediterranean, and strong government commitment to renewable energy. Expansion is expected as floating foundation systems gain traction in deeper coastal waters.

Spain

Spain accounts for approximately 4% of the regional market share in 2024. The market expanded from USD 280.5 million in 2018 to USD 545.1 million in 2024, projected to reach USD 1,189.3 million by 2032, growing at a CAGR of 10.4%. Spain’s offshore wind sector is poised for further development, supported by favorable wind conditions, policy incentives, and growing interest in both fixed and floating foundations along its Atlantic and Mediterranean coastlines.

Russia

Russia captures about 2% of the Europe offshore wind energy market in 2024, with market value rising from USD 140.2 million in 2018 to USD 270.1 million in 2024 and expected to reach USD 589.1 million by 2032, at a CAGR of 10.3%. The Russian market is emerging, with development focused on the Baltic Sea and Arctic regions. Potential remains high as policy frameworks evolve and international partnerships increase investment in the sector.

Rest of Europe

Rest of Europe, including countries such as Belgium, the Netherlands, Denmark, Poland, and others, holds the remaining 20% market share in 2024. This segment saw growth from USD 1,403.4 million in 2018 to USD 2,691.8 million in 2024 and is projected to reach USD 5,984.6 million by 2032, posting a CAGR of 10.4%. Ongoing project pipelines, regional collaborations, and advances in floating foundation systems drive expansion across these diverse markets, contributing to Europe’s overall leadership in offshore wind energy.

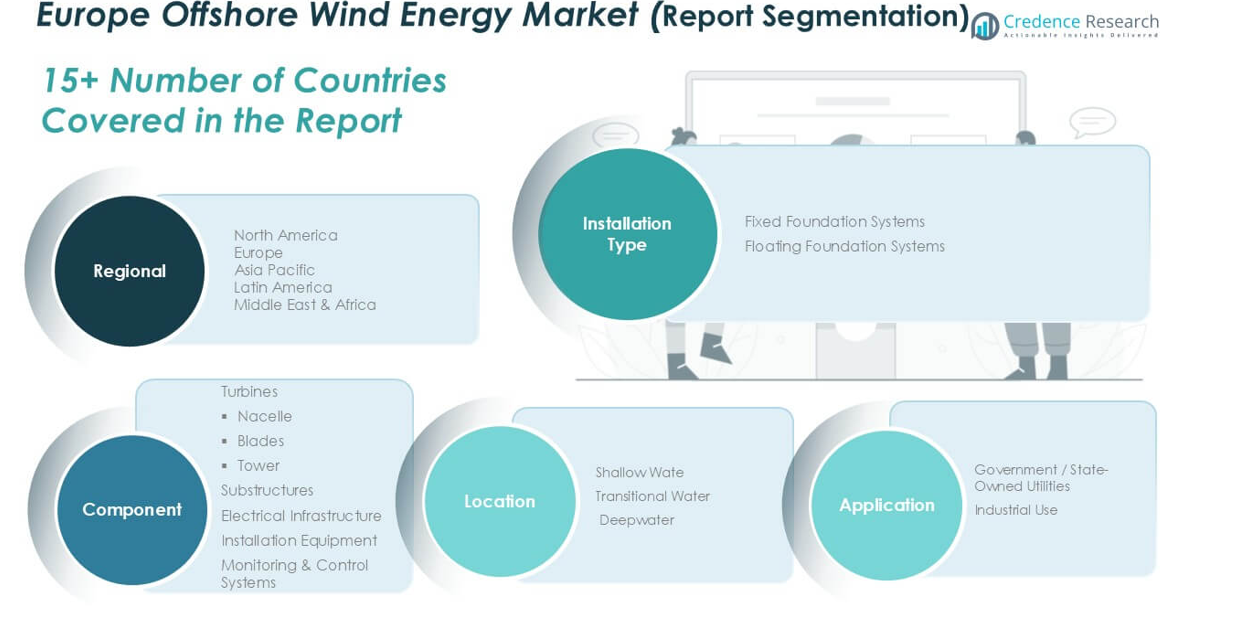

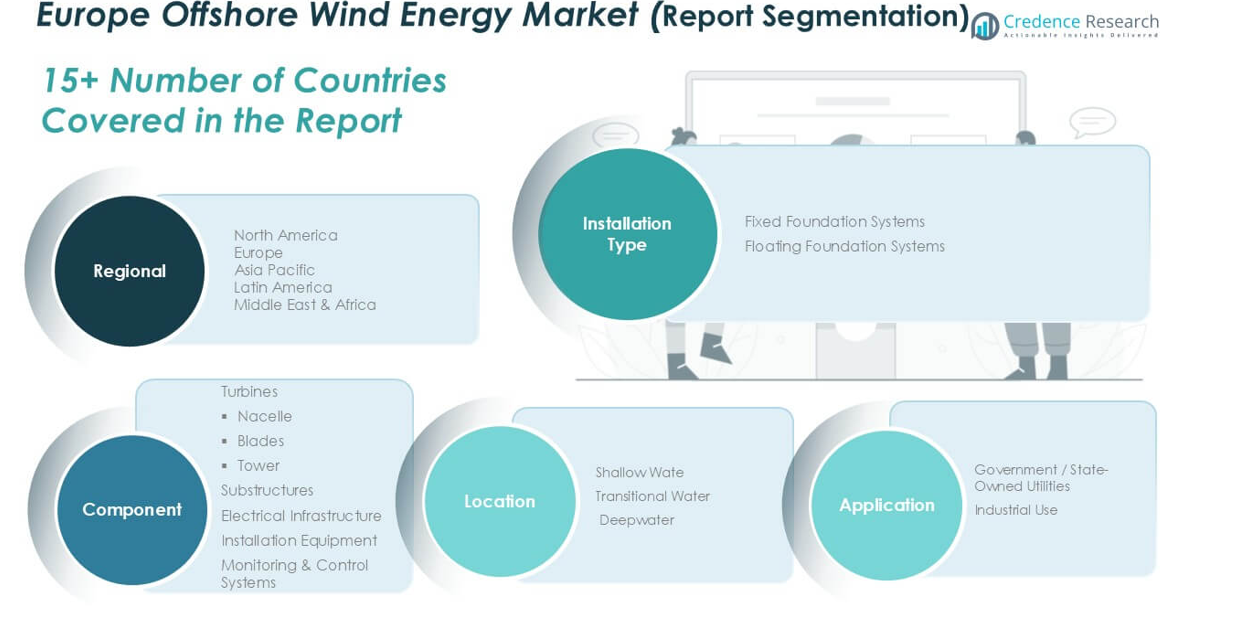

Market Segmentations:

By Installation Type:

- Fixed Foundation Systems

- Floating Foundation Systems

By Component:

- Turbines

- Substructures

- Electrical Infrastructure

- Installation Equipment

- Monitoring & Control Systems

By Location:

- Shallow Water

- Transitional Water

- Deepwater

By Application:

- Government / State-Owned Utilities

- Industrial Use

By Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe offshore wind energy market features a dynamic mix of established multinational corporations and specialized regional players driving innovation and capacity expansion. Leading companies such as General Electric, Vestas, Siemens Gamesa, and Nordex SE dominate the turbine supply segment, leveraging advanced technologies and extensive project portfolios across the continent. Collaboration between manufacturers, service providers, and developers accelerates the deployment of both fixed and floating offshore wind projects, strengthening market presence across various regions. Companies focus on cost reduction, supply chain optimization, and sustainability initiatives to maintain competitiveness. Mergers, acquisitions, and cross-border alliances remain common, supporting market expansion and diversification. The emphasis on operational excellence and scalable solutions ensures that the region retains its leadership in the global offshore wind sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- General Electric

- Vestas

- Siemens Gamesa

- ABB

- Nordex SE

- EEW

- Nexans

- Rockwell Automation

- Schneider Electric

Recent Developments

- In March 2025, Vestas secured a firm order for 68 V236-15.0 MW wind turbines for Vattenfall’s Nordlicht 1 offshore wind project in Germany. This is a significant order totaling 1,020 MW, with installation expected in 2027 and full operation by 2028. This project also emphasizes low-emission steel for towers, reducing the carbon footprint.

- In February 2025, a report predicts Siemens Gamesa will install significantly more offshore wind turbines than Vestas and GE Vernova combined over the next decade (2024-2034) outside of China, nearing 150 GW.

- In December 2024, Nexans was awarded a contract by ScottishPower Renewables for the East Anglia TWO offshore wind farm in the UK’s southern North Sea. Nexans will provide and install 100 km of 275 kV subsea export cables and 55 km of onshore cables. The project, set for completion by the end of 2028, will supply up to 960 MW enough to power nearly one million UK homes

- In December 2024, Vestas won a 1.1 GW order for the Inch Cape offshore wind project in Scotland (1,080 MW).

Market Concentration & Characteristics

The Europe Offshore Wind Energy Market exhibits a moderate to high level of market concentration, with a handful of multinational corporations and regional leaders dominating project development, equipment supply, and installation services. It demonstrates strong barriers to entry due to capital-intensive requirements, complex permitting processes, and the need for specialized technical expertise. The market is characterized by rapid technological advancements, particularly in turbine efficiency, floating foundation systems, and digital asset management. It shows a preference for large-scale, utility-driven projects, with fixed foundation systems capturing the majority share due to their proven reliability and cost-effectiveness in shallow waters. Floating foundation systems are gaining ground, offering new opportunities for deeper water installations. It benefits from robust policy support, ambitious climate targets, and established supply chains, especially in leading regions such as the UK and Germany. Strategic partnerships, supply chain integration, and continual investment in research and development drive market competitiveness and operational excellence.

Report Coverage

The research report offers an in-depth analysis based on Installation Type, Component, Location, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Expansion into deeper waters will accelerate deployment of floating foundation systems.

- Improved turbine technology will increase efficiency and lower costs per megawatt.

- Electrification of offshore platforms will support integration with green hydrogen production.

- Cross-border transmission projects will enhance grid stability and energy trade.

- Digital monitoring and predictive maintenance tools will boost operational uptime.

- Supply chain localization will reduce logistical bottlenecks and shorten project timelines.

- Policy harmonization across European nations will simplify permitting and attract investment.

- Financing models will evolve to support larger, utility-scale offshore wind farms.

- Collaboration between public and private sectors will foster innovation in foundation and installation technologies.

- Workforce development programs will address skill gaps and support long-term sector growth.