| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Industrial Roller Chain Drives Market Size 2024 |

USD 743.0 million |

| Europe Industrial Roller Chain Drives Market, CAGR |

4.10% |

| Europe Industrial Roller Chain Drives Market Size 2032 |

USD 1,024.7 million |

Market Overview

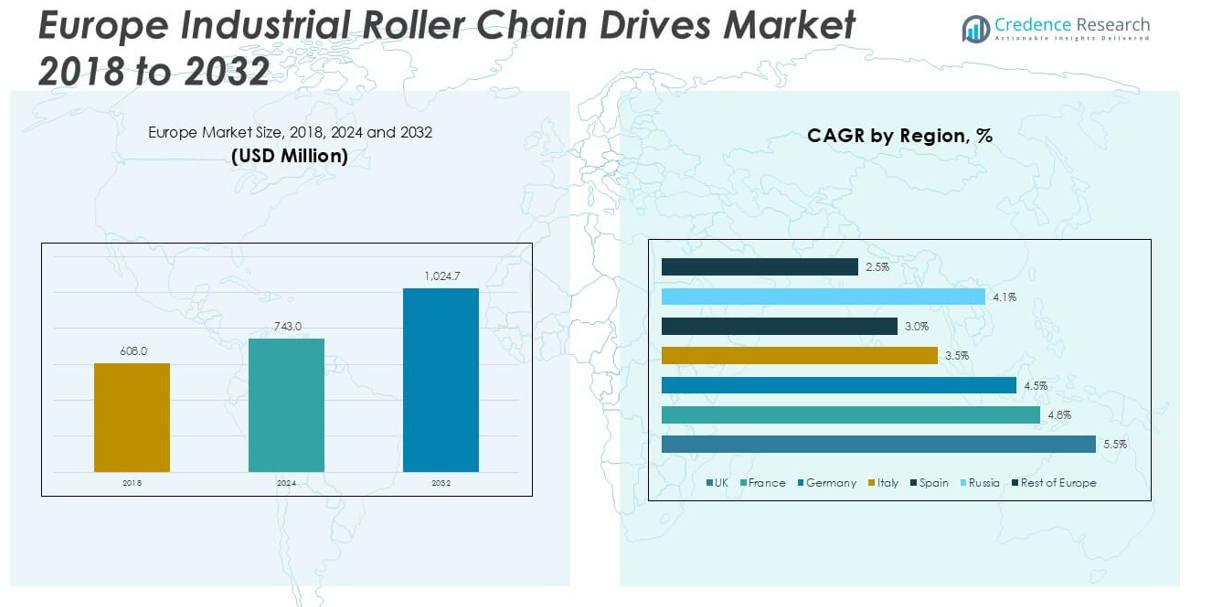

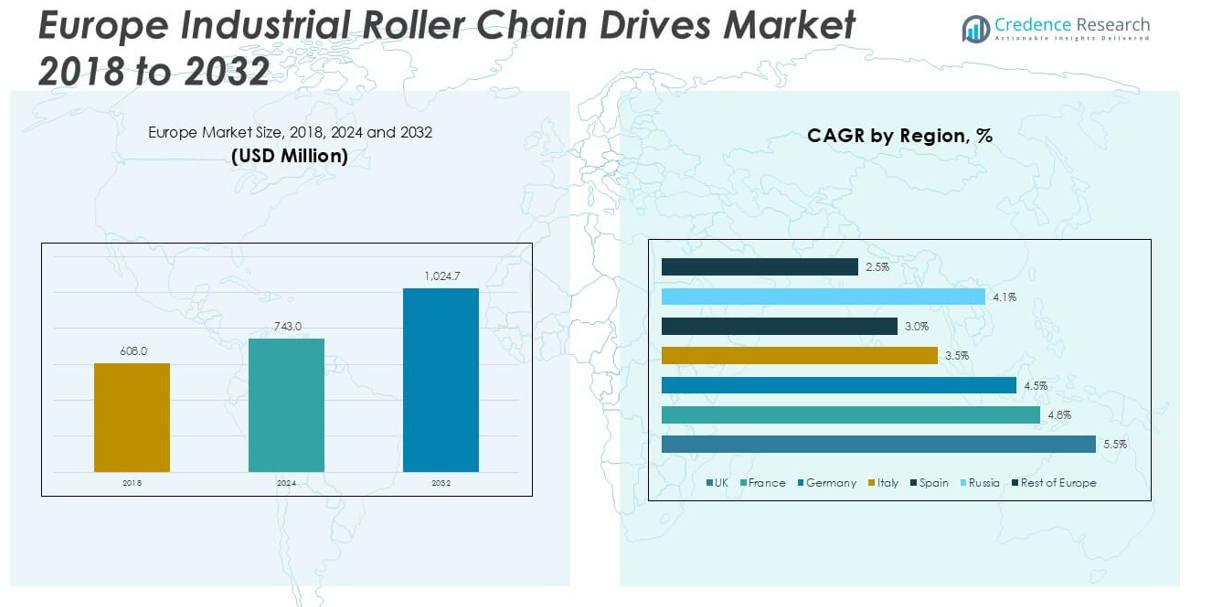

The Europe Industrial Roller Chain Drives market size was valued at USD 608.0 million in 2018, increased to USD 743.0 million in 2024, and is anticipated to reach USD 1,024.7 million by 2032, at a CAGR of 4.10% during the forecast period.

The Europe Industrial Roller Chain Drives market is led by prominent players such as Renold Plc, iwis antriebssysteme GmbH & Co. KG, Tsubakimoto Europe B.V. (Tsubaki), KettenWulf Betriebs GmbH, Regina Catene Calibrate SpA, Sedis (Part of Murugappa Group), and Diamond Chain Company (a Timken brand). These companies hold strong positions through extensive product portfolios, continuous innovation, and established distribution networks. Germany emerges as the leading region, commanding approximately 27.5% of the market share in 2024, driven by its advanced industrial base and strong presence of automotive and heavy machinery sectors. The UK and France follow as significant markets, supported by rising automation and expanding logistics infrastructure. Leading companies actively invest in developing maintenance-free, self-lubricating chains and smart monitoring systems to meet evolving industry demands and strict European safety standards.

Market Insights

- The Europe Industrial Roller Chain Drives market was valued at USD 743.0 million in 2024 and is projected to reach USD 1,024.7 million by 2032, growing at a CAGR of 4.10% during the forecast period.

- Rising industrial automation and increasing demand from manufacturing and logistics sectors are major drivers supporting the market growth across Europe.

- A key market trend includes the growing adoption of self-lubricating and maintenance-free chains, especially in food processing and automated production environments.

- Germany holds the largest regional share of around 27.5% in 2024, while the single-strand chain segment dominates the market with over 50% share due to its wide industrial applications.

- Market growth may face restraints from rising competition with alternative power transmission solutions like belt drives and compliance challenges with strict European safety and environmental regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Lubrication Type

In the Europe Industrial Roller Chain Drives market, the external lubricating chain segment dominates, holding a market share of over 65% in 2024. This segment leads due to its ability to handle heavy loads and high-speed applications efficiently across diverse industries. External lubricating chains are widely preferred for their ease of maintenance and enhanced durability, which significantly reduce wear and prolong service life. The growing need for reliable power transmission in sectors like material handling and manufacturing continues to drive the adoption of external lubricating chains, despite the rising interest in self-lubricating alternatives for cleaner operations.

- For instance, Renold’s HV-Series external-lubricated chains deliver tensile strength up to 41,004 lb (≈182 kN) providing dependable performance in demanding environments.

By Chain Type

The single-strand chain segment holds the largest share, exceeding 50% in 2024 in the Europe Industrial Roller Chain Drives market. This dominance is primarily driven by its broad application in industrial machinery, conveyor systems, and material handling equipment. Single-strand chains offer a cost-effective solution with reliable performance, making them the preferred choice for moderate load conditions. Increasing industrial automation and demand for efficient mechanical power transmission systems further boost the use of single-strand chains. In contrast, multi-strand and double-pitch chains serve niche high-load or long-distance applications, maintaining steady but smaller market shares.

- For instance, Renold’s stainless-steel single-strand 120SS chain supports a tensile strength of 20,906 lb (≈93 kN) underscoring its suitability for robust industrial use.

By End-Use Industry

The industrial manufacturing and material handling segment leads the market, capturing more than 40% share in 2024. This dominance is attributed to the increasing use of roller chain drives in conveyor systems, assembly lines, and automated manufacturing units where precision and durability are critical. Rapid advancements in factory automation and the expansion of industrial infrastructure across Europe fuel demand in this segment. Transportation & logistics and food processing follow as significant contributors, driven by the need for reliable and efficient mechanical power systems. The agriculture and construction sectors also show steady demand, supporting market diversification.

Market Overview

Expanding Industrial Automation Across Europe

The increasing adoption of industrial automation significantly drives the Europe Industrial Roller Chain Drives market. Automated manufacturing plants require efficient, durable, and high-speed power transmission systems, boosting demand for roller chain drives. European countries are heavily investing in advanced production technologies to enhance productivity and reduce operational costs, which directly increases the application of roller chains in conveyors, assembly lines, and material handling systems. This trend is expected to continue as industries prioritize efficiency and precision in production environments.

- For instance, iwis reports their standard roller chains achieve up to 15,000 operating hours before reaching 3% wear elongation, according to internal test rigs illustrating their longevity in high-use scenarios.

Rising Demand from Food Processing and Logistics Sectors

Growth in the food processing and logistics sectors strongly contributes to the expansion of the Europe Industrial Roller Chain Drives market. Roller chains offer hygienic, efficient, and robust solutions for conveyor and handling equipment, essential in large-scale food production and distribution operations. The region’s well-established food industry and increasing investments in cold storage and automated warehouses create sustained demand for roller chain drives. These sectors require high operational reliability, making roller chain drives a preferred component for consistent material flow.

- For instance, iwis’ VP8 FoodPlus spray, certified NSF H1, offers a viscosity of 110 mm²/s at 40 °C, enabling consistent food-grade lubrication across operational ranges of –35 °C to 135 °C making it a reliable choice in cold storage and automated warehousing.

Infrastructure Development and Agricultural Mechanization

Infrastructure growth and agricultural modernization across Europe are key drivers for the roller chain drives market. The increasing use of construction machinery and modern agricultural equipment that rely on roller chain drives enhances market growth. Countries focusing on improving transportation, urban infrastructure, and adopting mechanized farming practices contribute to rising demand. Roller chain drives are essential in these machines for efficient power transmission under varying loads and environmental conditions, making them indispensable in both sectors.

Key Trends and Opportunities

Shift Towards Self-Lubricating and Maintenance-Free Chains

A notable trend in the Europe Industrial Roller Chain Drives market is the increasing preference for self-lubricating and maintenance-free chain designs. These chains help reduce downtime, lower operational costs, and meet stringent hygiene standards, especially in food processing and pharmaceutical industries. Manufacturers are focusing on developing advanced chain technologies with longer service life and reduced lubrication needs. This trend presents growth opportunities as industries seek solutions that improve operational efficiency while addressing sustainability and safety concerns.

- For instance, iwis’ MEGAlife I chain operates without relubrication at speeds up to 3 m/s and functions reliably in temperatures from –40 °C to 160 °C, showcasing extended service life in harsh environments.

Integration of Smart Monitoring and Predictive Maintenance

The integration of smart technologies, including sensors and predictive maintenance systems, is emerging as a significant opportunity in the Europe Industrial Roller Chain Drives market. Real-time performance monitoring allows operators to track wear, tension, and lubrication needs, minimizing unexpected breakdowns. This digital advancement aligns with the broader Industry 4.0 transformation across Europe, encouraging the adoption of intelligent chain drive solutions. Companies investing in smart chain systems can gain a competitive edge by offering enhanced reliability and reduced lifecycle costs.

- For instance, the iwis CCM‑S system offers contactless chain elongation measurement across speeds up to 15 m/s, with wear readings available in 0.5% increments via USB or IO‑Link, enabling precise replacement scheduling.

Key Challenges

Rising Competition from Alternative Drive Technologies

One of the major challenges for the Europe Industrial Roller Chain Drives market is the growing competition from alternative drive technologies such as belt drives and gear drives. These systems often provide quieter operation, lower maintenance, and smoother motion, making them attractive in certain industrial applications. As manufacturers seek to reduce noise and improve energy efficiency, the shift towards alternative solutions could limit market expansion for traditional roller chain drives.

Compliance with Strict Environmental and Safety Regulations

European industries face stringent environmental and workplace safety regulations that directly impact the design and application of roller chain drives. Chains requiring external lubrication can pose contamination risks, especially in sensitive sectors like food and pharmaceuticals. Ensuring compliance with evolving safety and environmental standards can increase production costs and lead to redesign requirements. Companies must innovate to provide safer, cleaner, and regulation-compliant chain solutions to maintain competitiveness.

Volatility in Raw Material Prices

Fluctuations in the prices of raw materials, particularly steel, present an ongoing challenge for the Europe Industrial Roller Chain Drives market. Price instability affects manufacturing costs and can squeeze profit margins for both suppliers and end-users. Supply chain disruptions and geopolitical factors can further exacerbate these price fluctuations, making cost management a critical issue for manufacturers. Companies must explore material optimization and alternative sourcing strategies to mitigate these risks.

Regional Analysis

UK

The UK holds a significant position in the Europe Industrial Roller Chain Drives market, accounting for approximately 14.5% market share in 2024 with a market size of USD 107.7 million, up from USD 83.9 million in 2018. The market is projected to reach USD 155.8 million by 2032, expanding at a CAGR of 5.5%, the highest among European countries. This growth is driven by the increasing automation in manufacturing and strong demand from the logistics sector. The UK market is also supported by continuous investments in industrial modernization and a growing focus on operational efficiency.

France

France captures around 16.0% market share in 2024 in the Europe Industrial Roller Chain Drives market, with its size rising from USD 100.3 million in 2018 to USD 118.9 million in 2024. It is anticipated to reach USD 157.8 million by 2032, reflecting a CAGR of 4.8%. The market in France benefits from the country’s well-established food processing, automotive, and logistics sectors, which consistently demand reliable roller chain solutions. The rise of advanced manufacturing technologies and increasing focus on energy-efficient power transmission further support the market’s steady expansion in France.

Germany

Germany leads the Europe Industrial Roller Chain Drives market, holding the largest market share of approximately 27.5% in 2024. The market was valued at USD 175.1 million in 2018 and reached USD 204.3 million in 2024, with projections to attain USD 266.4 million by 2032, growing at a CAGR of 4.5%. Germany’s dominance is driven by its strong industrial base, particularly in automotive manufacturing, engineering, and heavy machinery. The country’s focus on Industry 4.0, advanced automation, and smart factory initiatives continues to fuel the demand for durable and efficient roller chain drives.

Italy

Italy holds a notable 13.0% market share in 2024 within the Europe Industrial Roller Chain Drives market. The market has grown from USD 74.2 million in 2018 to USD 96.6 million in 2024, with an expected size of USD 140.4 million by 2032, advancing at a CAGR of 3.5%. The Italian market benefits from the increasing adoption of automation in food processing, packaging, and material handling industries. Additionally, the expansion of the country’s logistics infrastructure and modernization of manufacturing facilities contribute to sustained growth in Italy’s industrial roller chain drives sector.

Spain

Spain accounts for approximately 7.0% of the Europe Industrial Roller Chain Drives market in 2024, with its market size rising from USD 38.3 million in 2018 to USD 52.0 million in 2024. It is projected to reach USD 79.9 million by 2032, growing at a CAGR of 3.0%. The Spanish market is driven by increasing investments in the food, construction, and logistics sectors. As industries focus on enhancing efficiency and reducing operational downtime, demand for reliable power transmission solutions, including roller chain drives, continues to grow across key Spanish industrial hubs.

Russia

Russia holds a modest 6.5% market share in 2024 in the Europe Industrial Roller Chain Drives market. The market increased from USD 43.2 million in 2018 to USD 48.3 million in 2024, and is expected to reach USD 60.5 million by 2032, at a CAGR of 4.1%. The Russian market is supported by the development of industrial and construction equipment sectors, as well as the growing agricultural machinery industry. Continued investment in modernization and the increasing need for durable mechanical systems in challenging environments sustain market growth in the region.

Rest of Europe

The Rest of Europe segment, which includes smaller but significant markets, collectively holds around 15.5% market share in 2024. The market size grew from USD 93.0 million in 2018 to USD 115.2 million in 2024, with projections to reach USD 164.0 million by 2032, advancing at a CAGR of 2.5%. Growth in this segment is supported by the expanding manufacturing sectors in countries such as Poland, the Netherlands, and Scandinavian nations. Increasing focus on industrial automation, along with growing investments in infrastructure and logistics, continues to create steady demand for roller chain drives across these markets.

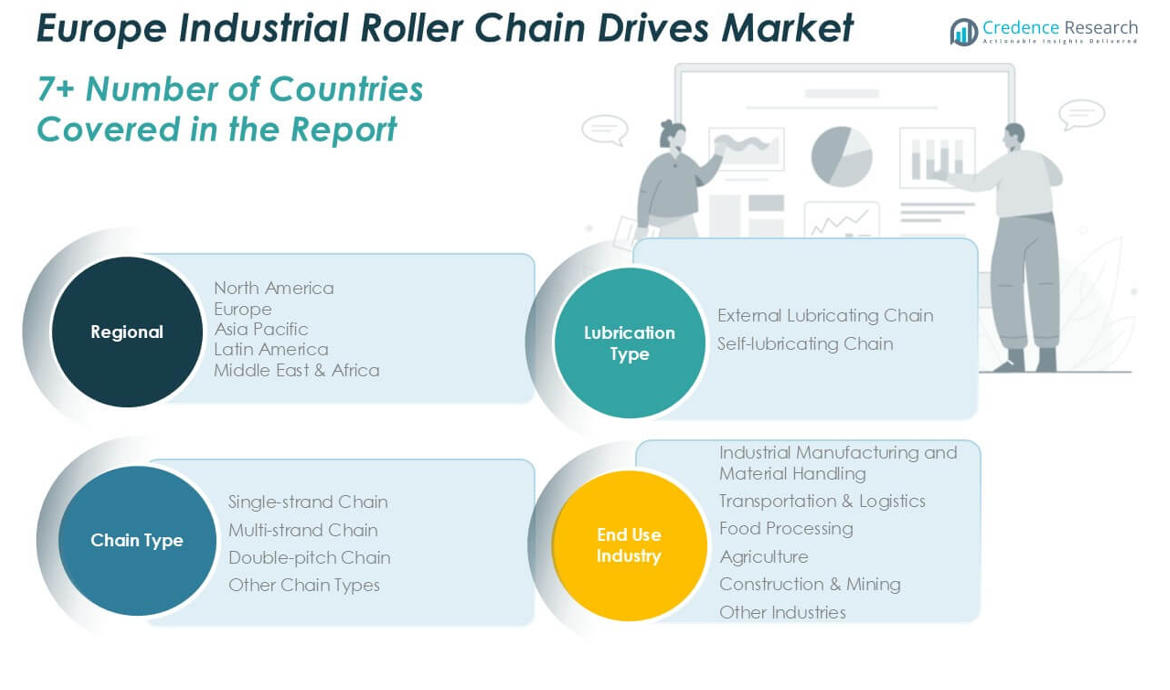

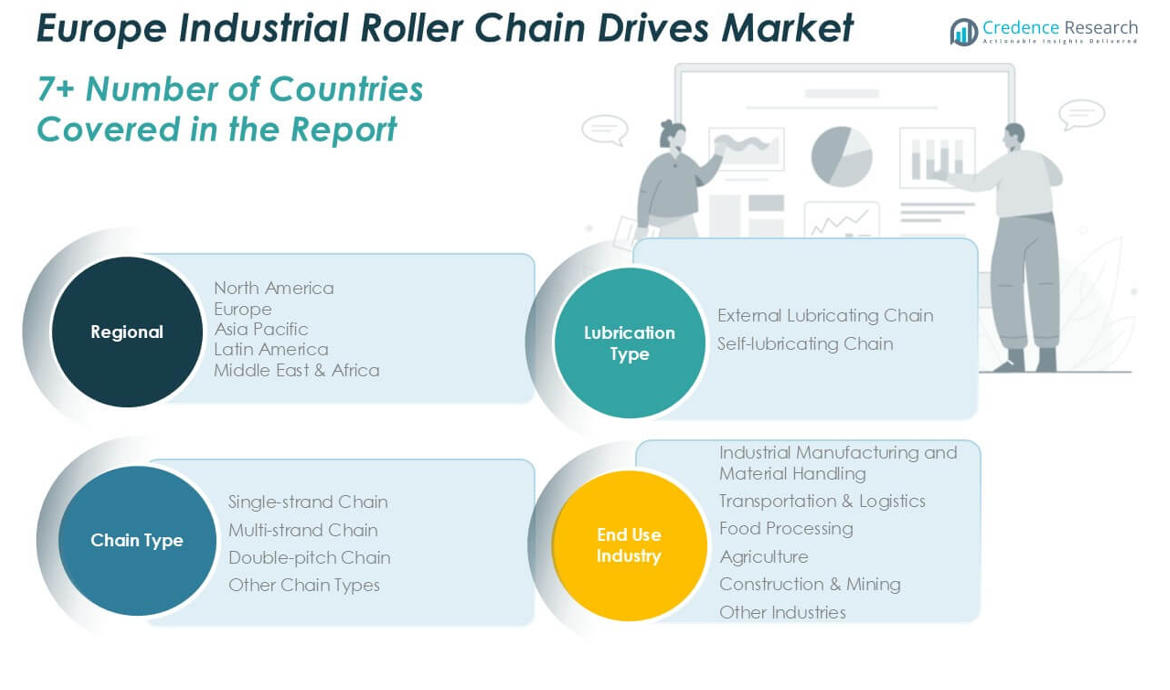

Market Segmentations:

By Lubrication Type

- External Lubricating Chain

- Self-lubricating Chain

By Chain Type

- Single-strand Chain

- Multi-strand Chain

- Double-pitch Chain

- Other Chain Types

By End-Use Industry

- Industrial Manufacturing and Material Handling

- Transportation & Logistics

- Food Processing

- Agriculture

- Construction & Mining

- Other Industries

By Geography

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Industrial Roller Chain Drives market is moderately fragmented, with several well-established international and regional players competing on product quality, technological innovation, and distribution networks. Key companies such as Renold Plc, iwis antriebssysteme GmbH & Co. KG, Tsubakimoto Europe B.V., and KettenWulf Betriebs GmbH hold significant market shares due to their extensive product portfolios and strong industry presence. These players focus on expanding their footprints through strategic partnerships, acquisitions, and new product launches, particularly self-lubricating and maintenance-free chain solutions. The market also sees active participation from specialized manufacturers like Sedis, Regina Catene Calibrate SpA, and Donghua Limited (Europe), which target niche applications and customized solutions. Continuous investments in advanced manufacturing technologies and smart monitoring capabilities are shaping the competitive strategies in the market. Companies are increasingly emphasizing sustainability and compliance with stringent European safety and environmental regulations to strengthen their market positioning and gain a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Renold Plc

- iwis antriebssysteme GmbH & Co. KG

- Tsubakimoto Europe B.V. (Tsubaki)

- KettenWulf Betriebs GmbH

- Regina Catene Calibrate SpA

- Sedis (Part of Murugappa Group)

- Diamond Chain Company (a Timken brand)

- Donghua Limited (Europe)

- Rexnord Corporation

- Senqcia Corporation

- Ramsey Products Corporation

- Allied Locke Industries

- Renqiu City Chain Factory

- Zhejiang Gidi Industrial Chain Co., Ltd.

Recent Developments

- In June 2024, Regal Rexnord Corporation successfully completed the strategic acquisition of Smith Bearing Company. This move expanded its portfolio of specialized chain drive solutions for heavy industrial applications and reinforced its market position in the mining and construction sectors.

- In March 2024, Tsubakimoto Chain Co. formed a joint venture with Indian manufacturer Precision Engineered Products. The collaboration led to the establishment of a new manufacturing hub in Pune, enhancing the company’s ability to serve the rapidly expanding industrial market across South Asia.

- In August 2024, Renold plc entered into a technology partnership with German automation leader Bosch Rexroth. This alliance aims to develop integrated smart chain systems equipped with predictive maintenance capabilities tailored for Industry 4.0 applications.

- In April 2024, Timken, the parent company of Diamond Chain Company, acquired Netherlands-based VanderGraaf Industries. This acquisition extended Timken’s European presence and brought in advanced expertise in corrosion-resistant chain solutions.

- In October 2024, IWIS Group announced a strategic alliance with Brazilian manufacturer Corrente Ipiranga. The partnership provided IWIS with strengthened distribution networks across Latin America and access to regional manufacturing infrastructure.

- In July 2024, Regina and its parent company, Tsubaki Group, inaugurated a new manufacturing facility in Vietnam. This initiative supports the ongoing shift of global manufacturing to Southeast Asia and boosts regional supply chain resilience.

- In September 2024, Sweden’s SKF Group acquired Challenge Power Transmission. This acquisition integrated Challenge’s specialized chain drive products into SKF’s broader power transmission offerings, enhancing its global portfolio.

- In October 2023, Rubix retains EcoVadis gold. EcoVadis ratings are used widely by European manufacturers when assessing suppliers for new contracts and renewals.

Market Concentration & Characteristics

The Europe Industrial Roller Chain Drives Market is moderately fragmented, with the presence of both international and regional players offering diverse product portfolios. It is characterized by steady competition, where key companies focus on product innovation, durability, and efficiency to secure market share. The market shows a strong concentration in Germany, the UK, and France, supported by their advanced manufacturing sectors and expanding logistics networks. Companies actively pursue the development of self-lubricating and maintenance-free chains to meet growing demands for reduced maintenance and improved operational efficiency. The market emphasizes compliance with strict European environmental and safety standards, which shapes product development and material selection. It also exhibits a strong preference for reliable and cost-effective solutions, making single-strand chains the dominant product type. Technological advancements such as smart monitoring and predictive maintenance features are gradually reshaping competitive dynamics. Despite competition from alternative power transmission systems like belt and gear drives, roller chains remain widely used for their high load capacity and operational reliability.

Report Coverage

The research report offers an in-depth analysis based on Lubrication Type, Chain Type, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily driven by increasing industrial automation across Europe.

- Demand for self-lubricating and maintenance-free chains will continue to rise in key industries.

- Germany will remain the leading regional market supported by its strong industrial base.

- The food processing and logistics sectors will create sustained demand for roller chain drives.

- Companies will focus on developing smart monitoring and predictive maintenance capabilities.

- Compliance with strict environmental and safety regulations will shape future product innovations.

- Single-strand chains will continue to dominate due to their broad industrial applications.

- Competition from belt drives and other alternatives may slightly impact the market expansion.

- Manufacturers will invest in lightweight, durable materials to enhance performance and efficiency.

- Strategic partnerships and regional expansions will remain key growth strategies for major players.