| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Electric Commercial Vehicle Battery Market Size 2024 |

USD 3,118.54 Million |

| Europe Electric Commercial Vehicle Battery Market, CAGR |

10.0% |

| Europe Electric Commercial Vehicle Battery Market Size 2032 |

USD 7,091.03 Million |

Market Overview

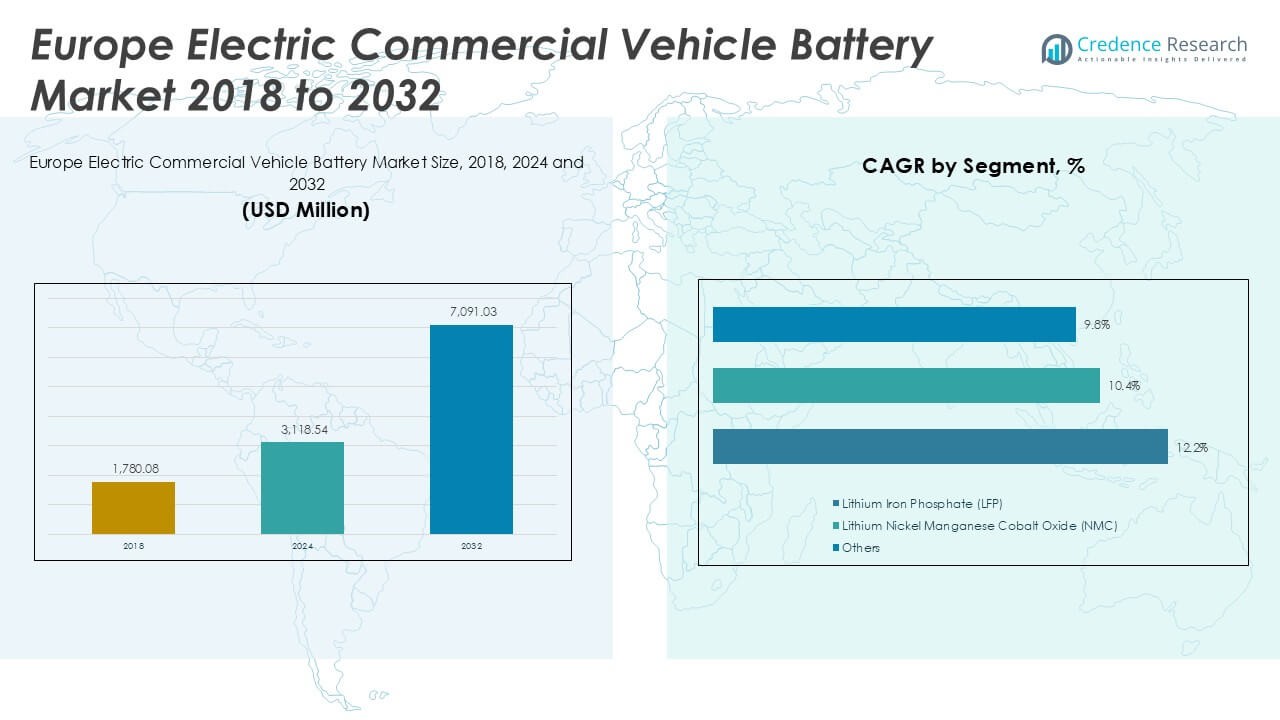

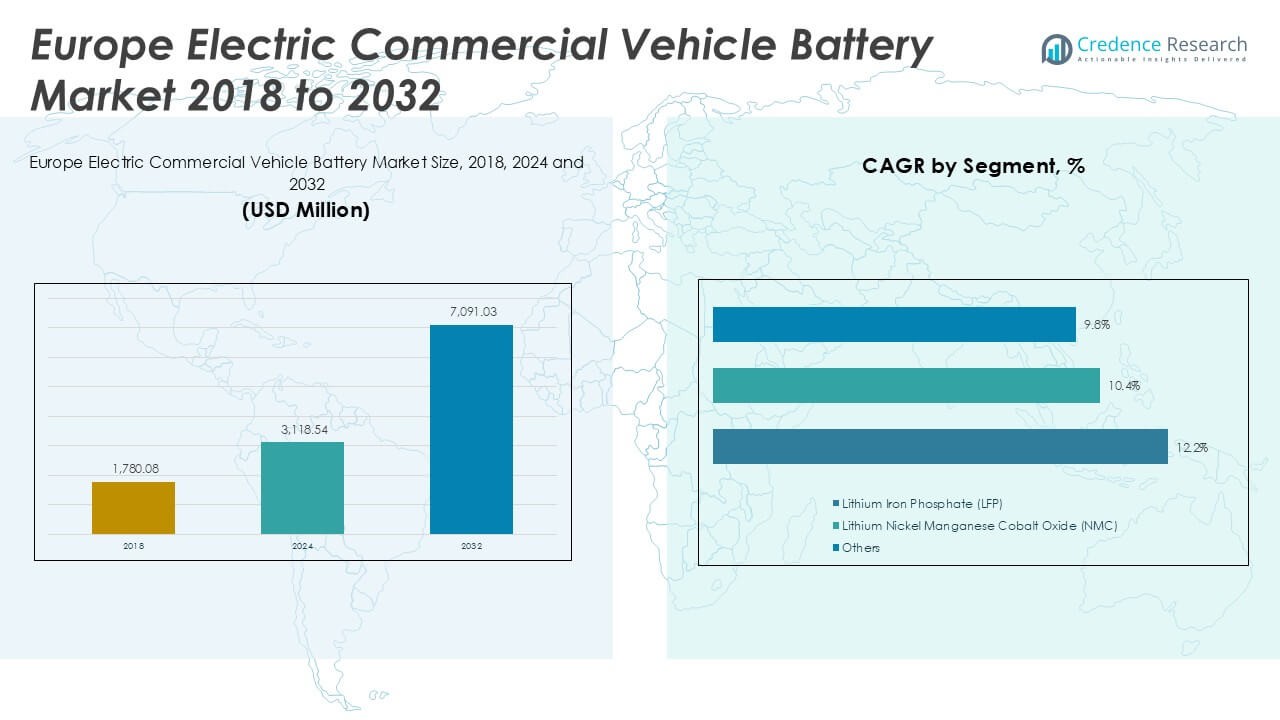

The Europe Electric Commercial Vehicle Battery Market was valued at USD 1,780.08 million in 2018, reached USD 3,118.54 million in 2024, and is anticipated to reach USD 7,091.03 million by 2032, at a CAGR of 10.0% during the forecast period.

The Europe Electric Commercial Vehicle Battery Market is experiencing robust growth driven by the region’s stringent emissions regulations, substantial government incentives for fleet electrification, and growing consumer demand for sustainable transportation solutions. Key automotive manufacturers are accelerating investments in battery technology to enhance vehicle range, performance, and charging speed, supporting the transition of commercial fleets toward electrification. Advancements in battery chemistry, such as the adoption of lithium-ion and emerging solid-state batteries, are further improving energy density and reducing overall costs. Increasing urbanization, expansion of low-emission zones, and rising e-commerce activities are boosting demand for electric delivery vans, trucks, and buses. Industry trends indicate a growing collaboration between battery suppliers and OEMs to localize production, strengthen supply chains, and ensure regulatory compliance. As the market evolves, continuous innovation and supportive policy frameworks are expected to sustain momentum and solidify Europe’s leadership in commercial electric mobility.

The geographical landscape of the Europe Electric Commercial Vehicle Battery Market features strong growth across leading economies such as the UK, France, and Germany, supported by advanced infrastructure, progressive policy frameworks, and active investment in clean mobility solutions. Southern and Eastern European nations are also accelerating adoption, driven by urbanization and EU-backed sustainability initiatives. Key players shaping this dynamic market include Leclanché S.A., a major innovator in battery technology and energy storage solutions, and Johnson Matthey Battery Systems, renowned for its expertise in advanced battery management and sustainable materials. Automotive Cells Company (ACC) has emerged as a strategic joint venture focused on localizing battery cell manufacturing for Europe’s automotive sector. These companies, along with others like FIAMM Energy Technology, continue to advance product innovation, expand regional partnerships, and strengthen Europe’s position as a global leader in commercial vehicle electrification.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Electric Commercial Vehicle Battery Market reached USD 3,118.54 million in 2024 and is projected to grow to USD 7,091.03 million by 2032, reflecting a CAGR of 10.0% during the forecast period.

- Stringent emission regulations, ambitious national climate targets, and increasing adoption of low-emission zones are driving demand for electric commercial vehicles and advanced battery solutions across the region.

- Rapid advancements in battery technologies, such as higher energy density, improved safety features, and cost reductions, support large-scale fleet electrification and attract new investments from global and regional manufacturers.

- The market displays a trend towards localized production, with new gigafactories and supply chain partnerships emerging to reduce import dependency and strengthen regional supply resilience.

- Leading companies such as Leclanché S.A., Johnson Matthey Battery Systems, and Automotive Cells Company (ACC) are enhancing their product portfolios through technological innovation and collaborations with automotive OEMs.

- Challenges persist due to high upfront costs, critical raw material supply constraints, and infrastructure gaps in some countries, which may limit the pace of adoption among smaller fleets and in emerging markets.

- Regional analysis indicates the strongest market momentum in Western, Northern, and Central Europe, supported by established infrastructure, government incentives, and a high concentration of commercial fleet operators.

Market Drivers

Stringent Environmental Regulations and Government Incentives Fuel Adoption

Governments across Europe have introduced aggressive emission reduction targets and stringent environmental regulations, compelling commercial fleet operators to shift toward electric vehicles. The introduction of low-emission and zero-emission zones in major cities has accelerated this transition, while strict regulatory frameworks for vehicle emissions make compliance with traditional diesel and petrol options increasingly challenging. Policymakers have offered substantial incentives, including tax credits, purchase subsidies, and grants, which have reduced the upfront cost of electric commercial vehicles and batteries. These incentives have not only stimulated market demand but also encouraged manufacturers to ramp up production and invest in battery research and development. The Europe Electric Commercial Vehicle Battery Market benefits directly from this supportive policy landscape, which sustains both consumer and manufacturer confidence.

- For instance, in the UK, Arrival announced the deployment of 300 electric vans for UPS as part of a pilot project to comply with zero-emission delivery requirements.

Rapid Advancements in Battery Technology Enhance Performance and Cost Efficiency

Continuous improvements in battery chemistry and manufacturing processes are transforming the commercial vehicle sector. Innovations in lithium-ion and emerging solid-state battery technologies have enabled higher energy density, longer vehicle range, and shorter charging times. These advancements address key operational concerns for fleet owners, such as total cost of ownership and route optimization. Falling battery prices due to technological progress and economies of scale have further improved the cost competitiveness of electric commercial vehicles. The market sees increasing collaboration between battery manufacturers and automakers to deliver tailored energy solutions for varying commercial applications. It remains crucial for suppliers to focus on reliability, longevity, and recyclability to support the expanding electric fleet ecosystem.

- For instance, Leclanché S.A. delivered battery packs with 60 kWh capacity for electric buses in Belgium, enabling routes of up to 100 kilometers on a single charge.

Rising E-commerce and Urbanization Drive Fleet Electrification

E-commerce growth and rapid urbanization are reshaping delivery and logistics networks across Europe. The surge in online shopping requires faster, more frequent deliveries, intensifying the demand for electric vans and trucks capable of operating within city centers. Electric vehicles offer a compelling solution by meeting regulatory requirements and addressing noise and air quality concerns in urban areas. Fleet operators recognize the operational and reputational benefits of transitioning to electric, including lower maintenance costs and improved sustainability credentials. The Europe Electric Commercial Vehicle Battery Market continues to expand in response to changing logistics patterns, reflecting the evolving needs of urban mobility and last-mile delivery.

Strategic Partnerships and Localization Strengthen Market Competitiveness

Automotive manufacturers and battery suppliers are forming strategic alliances to streamline supply chains, improve local production capabilities, and meet regional content requirements. These partnerships facilitate knowledge sharing, investment in advanced manufacturing infrastructure, and joint development of next-generation battery solutions. Localizing production mitigates risks associated with global supply disruptions and helps companies align with EU industrial policy. The market remains highly dynamic, with industry players prioritizing investments in research, development, and sustainable sourcing practices. It consistently adapts to shifting regulatory standards, market demands, and technological opportunities, cementing its role as a leading force in the global transition to electric commercial transportation.

Market Trends

Rising Integration of Advanced Battery Technologies Across Commercial Fleets

The adoption of next-generation battery technologies stands out as a central trend in the Europe Electric Commercial Vehicle Battery Market. Manufacturers are incorporating lithium-iron-phosphate and solid-state batteries into new commercial vehicle models to boost energy density, safety, and lifecycle performance. It reflects a shift from traditional lithium-ion cells toward more durable, high-capacity alternatives that align with demanding fleet requirements. Enhanced battery management systems support better monitoring, predictive maintenance, and overall efficiency for operators. These advancements not only extend the range of electric vehicles but also improve total cost of ownership, making large-scale fleet electrification more practical. The market continues to emphasize product innovation, which remains a key differentiator for leading OEMs.

- For instance, BYD’s commercial vehicles utilize LFP batteries that achieve a rated cycle life of 4,000 charge-discharge cycles, supporting intensive daily operations for transit fleets.

Expansion of Localized Manufacturing and Supply Chain Resilience Initiatives

OEMs and battery suppliers are investing in localized manufacturing facilities across Europe to strengthen regional supply chains and meet local content requirements. This trend reduces reliance on imported battery cells and critical raw materials, addressing geopolitical risks and potential supply shortages. It supports job creation, encourages regional economic development, and aligns with EU ambitions for technological sovereignty. The Europe Electric Commercial Vehicle Battery Market benefits from these initiatives, which ensure steady component availability and facilitate timely product rollouts. Manufacturers are also prioritizing circular economy practices, including battery recycling and reuse, to minimize environmental impact. It drives the adoption of closed-loop supply systems, reinforcing the market’s commitment to sustainability.

- For instance, Automotive Cells Company (ACC) commissioned a gigafactory in Billy-Berclau, France, with a 13 GWh annual production capacity dedicated to electric vehicle batteries.

Accelerated Deployment of Fast-Charging Infrastructure and Smart Energy Solutions

The rapid expansion of public and private fast-charging networks has become a transformative trend supporting commercial fleet electrification. Companies are collaborating with utilities and infrastructure providers to install high-capacity chargers at depots, distribution centers, and urban delivery hubs. Smart charging solutions optimize energy use, reduce peak demand charges, and ensure vehicle readiness for daily operations. The Europe Electric Commercial Vehicle Battery Market is witnessing strong interest in vehicle-to-grid integration, enabling fleets to participate in grid balancing and energy trading. These developments help reduce operational downtime and enhance the economic viability of electric commercial transport.

Greater Emphasis on Sustainability, Recycling, and Circular Business Models

Sustainability considerations now play a pivotal role in procurement decisions and corporate strategies within the sector. Stakeholders are investing in battery recycling technologies and second-life applications, seeking to close the loop and lower the environmental footprint of battery production. It drives industry-wide adoption of circular business models, where end-of-life batteries serve new functions in stationary storage or return to the supply chain as raw materials. Manufacturers and fleet operators are setting ambitious targets for emissions reduction and resource efficiency. The Europe Electric Commercial Vehicle Battery Market demonstrates ongoing commitment to responsible sourcing, eco-friendly design, and full lifecycle management of energy storage solutions.

Market Challenges Analysis

High Upfront Costs and Uncertain Return on Investment Limit Adoption

The Europe Electric Commercial Vehicle Battery Market faces significant challenges due to the high initial costs of battery systems and electric vehicles, which remain a barrier for many fleet operators. Despite falling battery prices, the total upfront investment required to transition from internal combustion engine fleets often exceeds the budgets of small and medium-sized enterprises. Uncertainty about battery lifespan, residual value, and long-term maintenance expenses further complicates purchasing decisions. It limits widespread adoption, particularly among operators with tight margins or unpredictable service requirements. Financial constraints may slow market growth until broader cost parity is achieved or financing options become more accessible. The market continues to seek innovative business models, such as leasing and battery-as-a-service, to address affordability concerns.

Supply Chain Constraints and Critical Raw Material Dependency Persist

Persistent supply chain bottlenecks and reliance on imported raw materials, such as lithium, cobalt, and nickel, present ongoing risks for the Europe Electric Commercial Vehicle Battery Market. Volatility in raw material prices, coupled with geopolitical uncertainties, can disrupt production schedules and drive up manufacturing costs. It challenges OEMs and battery suppliers to secure stable, ethical sources of key minerals while adhering to EU sustainability standards. Regulatory complexity across different European markets further complicates sourcing strategies and compliance efforts. The industry must invest in local refining, recycling, and alternative chemistries to mitigate vulnerability and support long-term growth. Supply chain resilience will remain a top priority for stakeholders aiming to sustain competitive advantage.

Market Opportunities

Expansion of Green Public Transport and Last-Mile Delivery Solutions

Growing investments in green public transport and the rapid evolution of last-mile delivery networks create promising opportunities for the Europe Electric Commercial Vehicle Battery Market. Cities are adopting ambitious electrification targets for bus and municipal fleets, which drive sustained demand for advanced battery systems tailored to diverse operational profiles. The expansion of e-commerce accelerates the need for electric delivery vans and trucks, providing a broad customer base for battery manufacturers. It encourages OEMs to innovate with modular, high-performance battery packs suited for intensive urban use. Public and private partnerships are supporting large-scale fleet conversions, creating long-term growth prospects for suppliers. The market stands to benefit from ongoing policy support for clean transportation infrastructure across the region.

Technological Advancements and Circular Economy Initiatives Unlock Growth

Breakthroughs in battery technology and the adoption of circular economy models present further avenues for expansion within the sector. Advances in solid-state batteries, ultra-fast charging, and energy-dense chemistries are set to enhance vehicle performance and operational flexibility. It enables commercial fleets to achieve longer ranges, faster turnaround times, and lower lifecycle costs. Increasing investment in recycling facilities and second-life battery applications supports both sustainability and resource security. The Europe Electric Commercial Vehicle Battery Market can leverage these innovations to meet stringent environmental goals while creating new business models and revenue streams. The convergence of technology and sustainability positions the sector for resilient and dynamic growth.

Market Segmentation Analysis:

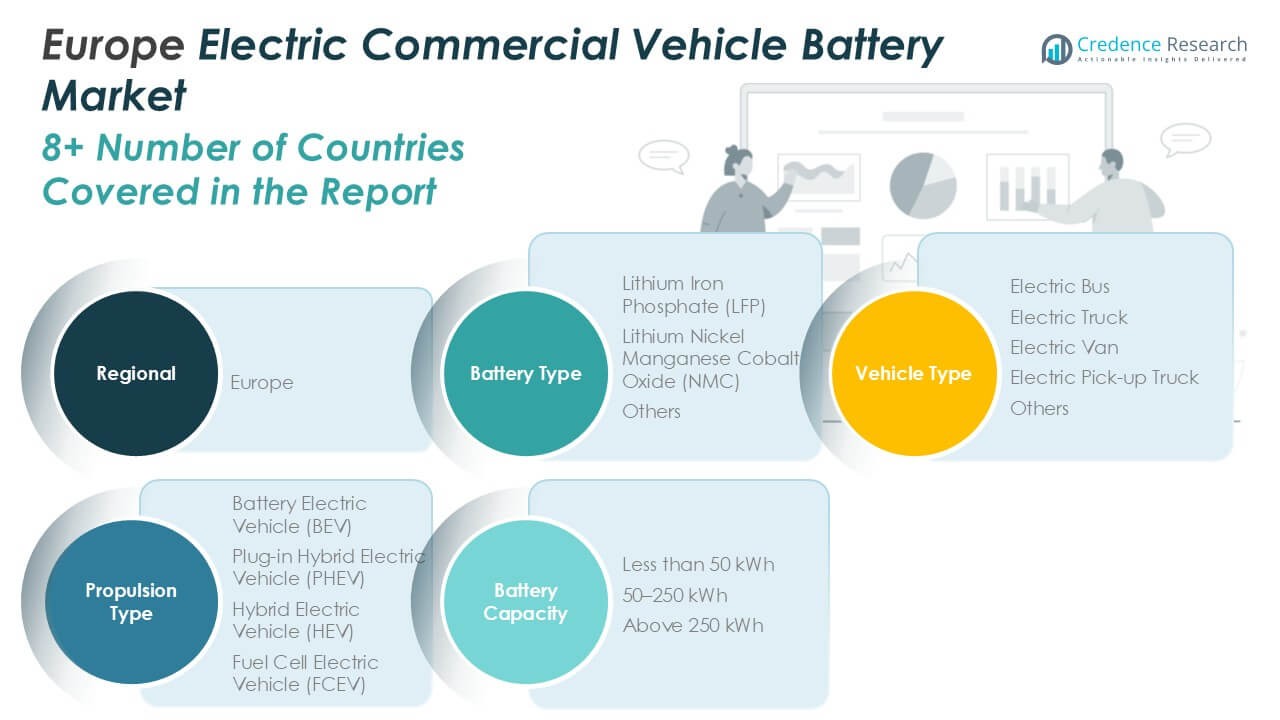

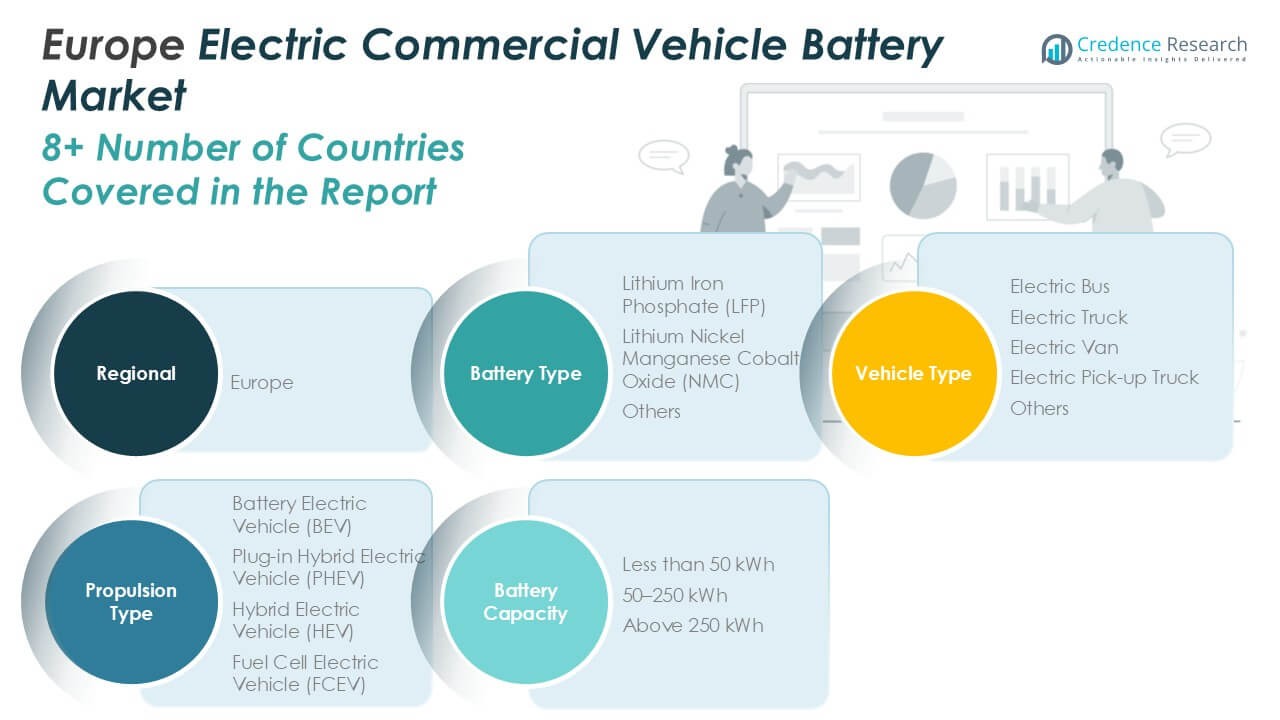

By Battery Type:

Lithium Iron Phosphate (LFP) and Lithium Nickel Manganese Cobalt Oxide (NMC) dominate the landscape. LFP batteries stand out for their thermal stability, safety, and long cycle life, making them a preferred choice for public transport applications such as electric buses. NMC batteries offer higher energy density, supporting extended vehicle range and meeting the performance demands of electric trucks and vans engaged in intercity logistics and heavy-duty operations. The “Others” segment, including emerging chemistries and hybrid solutions, remains niche but demonstrates potential for specialized applications.

- For instance, Johnson Matthey Battery Systems supplied NMC battery modules with an energy density of 160 Wh/kg for Daimler’s electric trucks, supporting operational ranges up to 200 kilometers per charge.

By Vehicle Type:

The electric bus segment leads due to strong government investment in sustainable public transport and urban air quality improvement initiatives. Electric trucks are gaining significant market share as logistics companies modernize their fleets to comply with emission regulations and capitalize on lower operating costs. Electric vans cater to the booming e-commerce and last-mile delivery sector, where reliability and frequent urban operation are essential. Electric pick-up trucks, while still in early adoption, show promise in utility and commercial services. The “Others” category covers specialized vehicles such as minibuses and construction vehicles, contributing incremental volume to the overall market.

- For instance, FIAMM Energy Technology supplied battery systems powering over 2,000 Solaris electric buses in active service across more than 30 European cities.

By Propulsion Type:

Battery Electric Vehicles (BEVs) maintain a dominant position, driven by their zero-emission profile and alignment with EU climate goals. BEVs are widely adopted across bus, truck, and van segments, supported by expanding charging infrastructure and favorable total cost of ownership. Plug-in Hybrid Electric Vehicles (PHEVs) appeal to operators seeking flexibility for longer routes without full reliance on public charging networks. Hybrid Electric Vehicles (HEVs) provide a transitional option for fleets in regions with limited charging access. Fuel Cell Electric Vehicles (FCEVs) represent an emerging niche, particularly in segments requiring long-range capability and fast refueling, such as heavy-duty trucks and select bus routes. The Europe Electric Commercial Vehicle Battery Market continues to evolve, driven by technology choices that align with operational needs and sustainability targets.

Segments:

Based on Battery Type:

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Others

Based on Vehicle Type:

- Electric Bus

- Electric Truck

- Electric Van

- Electric Pick-up Truck

- Others

Based on Propulsion Type:

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

Based on Battery Capacity:

- Less than 50 kWh

- 50–250 kWh

- Above 250 kWh

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis

UK

The United Kingdom stands as the leading market for electric commercial vehicle batteries in Europe, commanding a 24% share of total regional revenue. The UK’s rapid adoption is driven by strong policy support, ambitious emission reduction targets, and aggressive investment in charging infrastructure. Major cities such as London and Manchester are advancing low-emission zones and municipal fleet electrification programs. The UK government’s funding for gigafactories and research hubs, coupled with incentives for fleet operators, has attracted major OEMs and battery suppliers to localize operations. British logistics and e-commerce sectors increasingly deploy electric vans and delivery trucks, fueling demand for high-capacity and reliable battery solutions. Local production capability, innovative financing models, and collaboration between public and private sectors contribute to the UK’s dominance in the Europe Electric Commercial Vehicle Battery Market. The UK’s ongoing commitment to net zero and sustainable urban mobility ensures continued market leadership.

France

France accounts for 19% of the Europe Electric Commercial Vehicle Battery Market, driven by robust industrial policy and well-established automotive manufacturing. Paris, Lyon, and Marseille have emerged as early adopters of electric buses, leveraging EU and national funding to modernize municipal transport fleets. French OEMs collaborate with global battery producers to enhance the domestic supply chain, while the government’s “France 2030” strategy supports R&D in battery chemistry and recycling technologies. The commercial logistics sector is responding to national clean air regulations by transitioning urban delivery fleets to electric powertrains. France benefits from extensive public charging infrastructure and tax incentives that reduce the total cost of ownership for fleet operators. Investments in domestic gigafactories and recycling initiatives position France as a major supplier of next-generation battery solutions in Europe.

Germany

Germany captures an 18% share in the Europe Electric Commercial Vehicle Battery Market, underscored by its status as a European automotive powerhouse. German manufacturers lead technological innovation in both battery systems and electric commercial vehicles, fostering close collaboration between OEMs, Tier-1 suppliers, and research institutions. The government supports large-scale deployment of electric buses and trucks through incentives and pilot programs. German cities such as Berlin, Munich, and Hamburg implement progressive transport policies and invest in charging infrastructure, accelerating fleet electrification. Germany’s strong focus on battery research, coupled with significant investment in local production capacity, ensures long-term competitiveness and supply chain security. Its export-oriented industry leverages new battery technologies to serve both domestic and wider European demand.

Italy

Italy holds a 13% share of the Europe Electric Commercial Vehicle Battery Market, benefiting from targeted policy initiatives aimed at urban air quality and fleet modernization. Italian cities such as Milan, Rome, and Turin have begun adopting electric buses and vans for municipal and commercial transport. Government grants and incentives are encouraging fleet operators to invest in electric vehicles, while local manufacturing capabilities support the growth of battery pack assembly and integration. The logistics and tourism industries are increasing their uptake of electric commercial vehicles, particularly for last-mile and city-center deliveries. Italy’s market is characterized by growing infrastructure investments and efforts to bridge regional disparities in EV adoption. Public-private partnerships and EU support programs help Italy strengthen its position in the evolving European battery market.

Spain

Spain accounts for 11% of the Europe Electric Commercial Vehicle Battery Market, propelled by a focus on sustainable urban mobility and regional investment in electrification. Spanish cities such as Madrid and Barcelona have prioritized the replacement of aging public transport fleets with zero-emission vehicles. The government’s national strategy for industrial modernization and green recovery has attracted foreign direct investment in battery manufacturing and assembly plants. Spanish logistics and retail sectors are accelerating the deployment of electric vans and light trucks, spurred by e-commerce growth and environmental regulations. Spain’s climate favors battery efficiency and longevity, supporting the performance of commercial fleets. Continued expansion of charging infrastructure and targeted funding for innovation contribute to Spain’s growing market share.

Russia

Russia represents 7% of the regional market, reflecting gradual progress in electric commercial vehicle adoption amid a traditionally fossil fuel-driven economy. Russian cities such as Moscow and Saint Petersburg are piloting electric buses and trucks in select urban corridors, supported by local manufacturing and government incentives. The focus remains on building domestic capacity for battery cells and powertrains, often in partnership with foreign technology suppliers. Harsh climatic conditions necessitate robust battery performance and thermal management solutions. Russia’s market growth is influenced by policy developments, infrastructure rollout, and cross-border trade in battery materials and components. Strategic investments in R&D and localization are expected to accelerate adoption over the forecast period.

Rest of Europe

The “Rest of Europe” segment, accounting for 9% of total regional share, includes smaller and emerging markets such as Austria, Switzerland, Belgium, Netherlands, Greece, and Eastern European nations. These countries display varying adoption rates based on local regulatory environments, infrastructure readiness, and industrial base. Some, like the Netherlands and Belgium, are noted for their advanced charging networks and early electric bus deployments. Others are catching up through EU-supported projects and targeted national initiatives. Regional collaboration, technology transfer, and shared investment in battery recycling and production are helping these markets close the gap with Western Europe. The Rest of Europe remains a critical growth area, contributing to overall market resilience and innovation in electric commercial vehicle battery adoption.

Key Player Analysis

- Leclanché S.A.

- Johnson Matthey Battery Systems

- FIAMM Energy Technology

- Automotive Cells Company (ACC)

- Verkor

- PowerCo

- Envision AESC

- Integrals Power

- PULSETRAIN GmbH

Competitive Analysis

The competitive landscape of the Europe Electric Commercial Vehicle Battery Market is defined by technological innovation, strategic alliances, and regional manufacturing expansion. Leading players such as Leclanché S.A., Johnson Matthey Battery Systems, Automotive Cells Company (ACC), Verkor, PowerCo, and Envision AESC are actively investing in research and development to deliver batteries with higher energy density, longer lifespans, and enhanced safety features. These companies partner with commercial vehicle manufacturers to tailor battery systems for buses, trucks, vans, and specialty vehicles, ensuring compatibility with evolving fleet requirements. Market leaders are also prioritizing localized production, with new gigafactories and supply chain investments across the UK, Germany, and France. This focus helps reduce dependency on imported cells and critical raw materials, while strengthening supply resilience and supporting local employment. Collaboration is a common theme, with joint ventures and technology-sharing agreements fostering rapid product development and faster time to market. The competitive environment remains dynamic, with new entrants and established firms competing to set industry benchmarks for performance, sustainability, and cost efficiency.

Recent Developments

- In January 2024, SGL Carbon entered into a technology partnership with E-Works Mobility, a German company specializing in electric vans. Under this collaboration, SGL Carbon is expected to supply the first battery cases made from glass fiber-reinforced plastic (GFRP) for E-Works’ HEERO e-transporter. The newly developed GFRP battery cases provide various advantages, such as weight reduction, battery insulation, and fire protection. With this partnership, SGL Carbon aims to leverage this partnership to enhance its product offerings, improve operational efficiency, and solidify its competitive edge in the rapidly growing electric vehicle sector.

- In August 2023, Linamar Corporation announced the completion of its acquisition of three battery enclosure manufacturing facilities from Dura-Shiloh. This acquisition, initially disclosed on May 30, 2023, involved an all-cash transaction valued at USD 325 million and was subject to customary regulatory approvals and closing conditions, all of which have now been satisfied.

- In February 2023, Magna secured a contract with General Motors (GM) to supply battery enclosures for the upcoming 2024 Chevrolet Silverado EV, which will be assembled at GM’s Factory ZERO. Production of these enclosures is set to begin in late 2023 at Magna’s Electric Vehicle Structures facility in St. Clair, Michigan, where they currently manufacture battery enclosures for the GMC HUMMER EV. To support this expansion, Magna is adding a 740,000-square-foot extension to its existing 345,000-square-foot facility, which opened in 2021. This significant investment underscores Magna’s commitment to meeting the growing demand for electric vehicle components while enhancing its production capabilities.

- In February 2023, LG Energy Solution will invest 10 trillion won this year, up 50 percent from 6.3 trillion won a year ago, and expand its global production capacity by 50 percent to 300 gigawatt hours (GWh).

Market Concentration & Characteristics

The Europe Electric Commercial Vehicle Battery Market displays a moderate to high level of market concentration, with a select group of established players holding significant influence over technological development, supply capacity, and regional expansion. It is characterized by strong collaboration between battery manufacturers and automotive OEMs, driving rapid innovation in battery chemistry, energy density, and modular design to meet diverse fleet requirements. Leading companies benefit from robust R&D capabilities and early investment in local manufacturing facilities, which strengthens their position amid evolving regulatory and sustainability demands. The market features high barriers to entry due to the complexity of battery technology, the need for advanced quality controls, and capital-intensive production processes. It remains sensitive to changes in raw material supply and policy shifts, but continues to advance through targeted public and private investments. Flexibility in production scale, a focus on recycling, and the development of high-performance batteries distinguish the Europe Electric Commercial Vehicle Battery Market, positioning it for sustained growth and leadership in commercial fleet electrification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Vehicle Type, Propulsion Type, Battery Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for electric commercial vehicle batteries in Europe is expected to rise steadily due to stricter emission regulations and clean energy policies.

- Governments across Europe are increasing investments in EV infrastructure, boosting battery adoption in commercial fleets.

- Fleet operators are shifting toward electric vehicles to reduce operating costs and meet carbon neutrality goals.

- Advancements in battery technologies are improving energy density, leading to longer driving ranges and greater efficiency.

- Partnerships between OEMs and battery manufacturers are likely to strengthen to ensure a steady battery supply chain.

- The growth of last-mile delivery services is accelerating the adoption of electric light commercial vehicles with high-performance batteries.

- Expansion of charging networks across key transport corridors will support the deployment of electric heavy-duty trucks.

- Battery recycling and second-life applications are gaining importance to meet sustainability and circular economy targets.

- EU incentives and subsidies continue to make electric commercial vehicles more cost-competitive with traditional models.

- Urban low-emission zones and diesel bans are driving a faster transition to battery-powered commercial transport in major cities.