Market Overview:

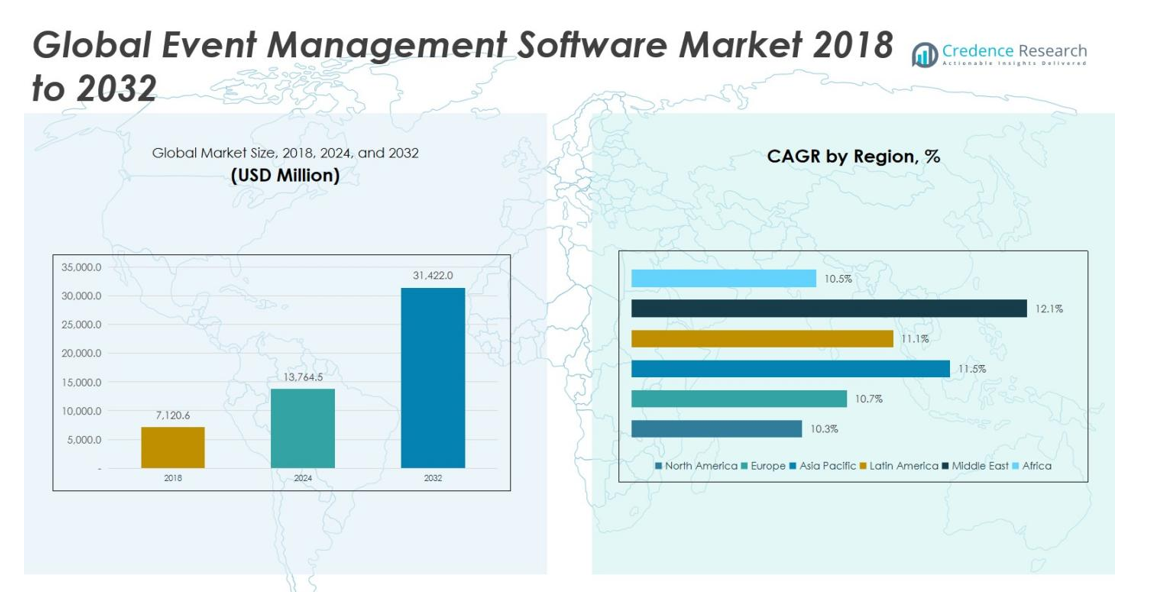

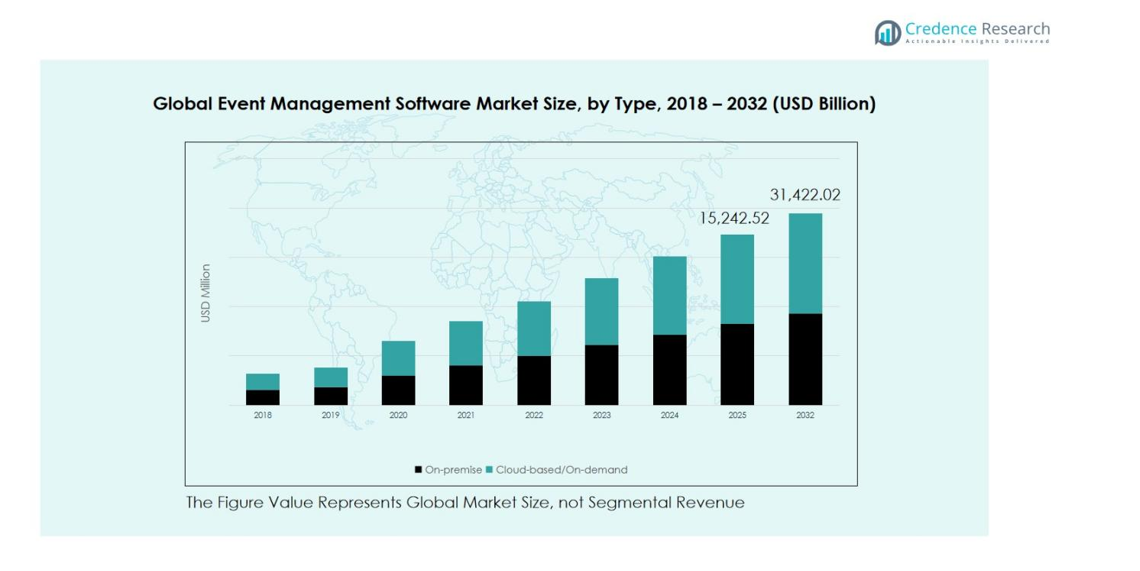

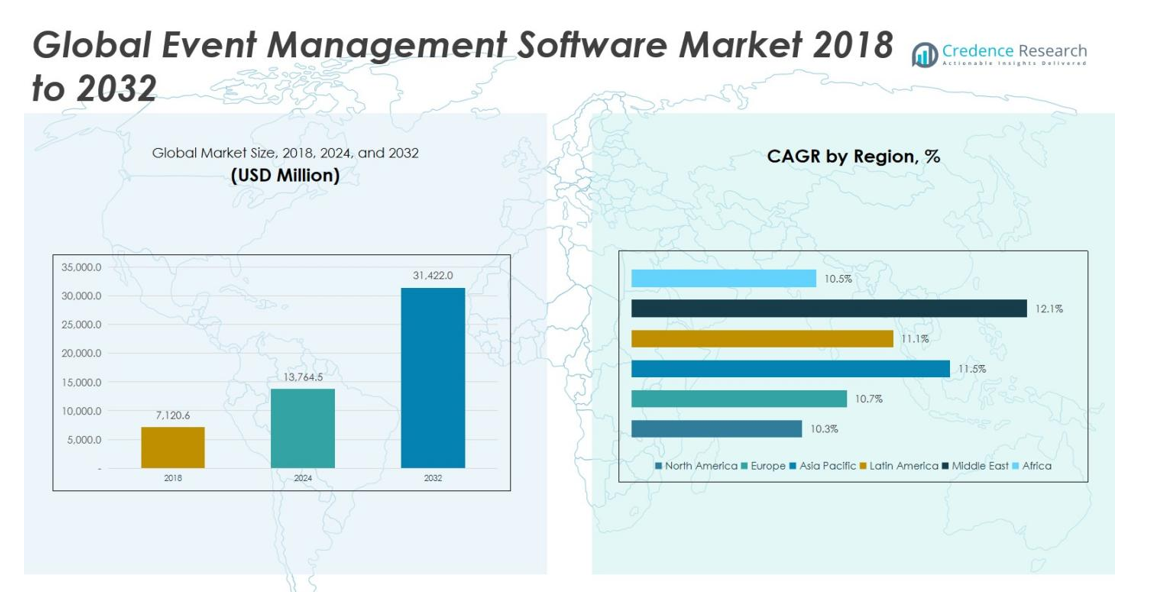

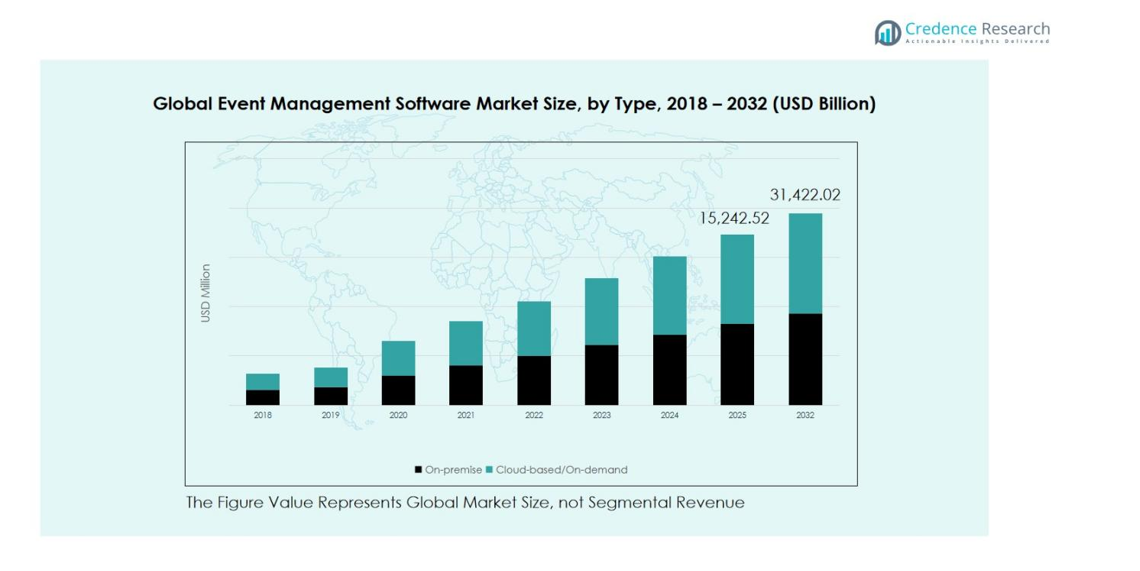

Event Management Software Market size was valued at USD 7,120.6 million in 2018, growing to USD 13,764.5 million in 2024, and is anticipated to reach USD 31,422.0 million by 2032, registering a CAGR of 10.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Event Management Software Market Size 2024 |

USD 13,764.5 million |

| Event Management Software Market, CAGR |

10.89% |

| Event Management Software Market Size 2032 |

USD 31,422.0 million |

The Event Management Software Market is dominated by key players such as Active Network LLC, Eventbrite Inc., Cvent Inc., Social Tables, Eventzilla, Hopin, webMOBI, and Certain, Inc. These companies lead through continuous innovation, cloud-based solutions, AI integration, and mobile-friendly platforms, enabling organizers to efficiently manage virtual, hybrid, and in-person events. Strategic partnerships, product diversification, and expansion into emerging markets further strengthen their competitive positions. Regionally, North America leads the market with a 33.3% share in 2024, driven by high adoption of advanced technologies and a mature event industry, followed by Europe at 26.5% and Asia Pacific at 24.7%, where rapid digitalization and growing MICE activities are fueling growth. Collectively, these top players and leading regions shape the market’s dynamic landscape and drive global expansion in the event management software sector.

Market Insights

- The Event Management Software Market was valued at USD 13,764.5 million in 2024 and is projected to reach USD 31,422.0 million by 2032, growing at a CAGR of 10.89%.

- Growth is driven by rising demand for virtual and hybrid events, increasing adoption of AI and analytics, and expanding usage among SMEs seeking cost-effective, scalable solutions.

- Key trends include the shift toward mobile-compatible solutions, cloud-based platforms, and sustainability-focused features, while event registration and ticketing software holds the largest application share at 38% and cloud-based/on-demand leads type with 67% share.

- The market is highly competitive, dominated by players like Active Network LLC, Eventbrite Inc., Cvent Inc., and Hopin, focusing on innovation, partnerships, and regional expansion to maintain leadership.

- Regionally, North America leads with 33.3% share, followed by Europe at 26.5% and Asia Pacific at 24.7%, while Latin America, Middle East, and Africa collectively account for the remaining share, highlighting strong growth potential in emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The cloud-based/on-demand segment dominates the Event Management Software Market, accounting for 67% of the total share in 2024. This dominance stems from its scalability, real-time data access, and cost-effectiveness compared to traditional on-premise models. The shift toward remote and hybrid event formats has further strengthened demand for cloud-based platforms, enabling seamless coordination and analytics across multiple locations. Meanwhile, the on-premise segment, with around 33% share, continues to attract enterprises prioritizing data security and customized software deployment within internal IT infrastructures.

- For instance, Bizzabo launched its Event Experience OS in 2022, enabling real-time analytics and automated workflows through cloud technology.

By Application:

The event registration and ticketing software segment leads the market, representing 38% of the total share in 2024. This segment’s growth is driven by the rise in online event registrations, contactless payments, and the adoption of integrated ticketing systems by organizers seeking improved attendee experiences. Event marketing software, holding approximately 24% share, is witnessing rapid expansion as companies leverage automated marketing tools and analytics to boost engagement. Event planning, analytics & reporting, and other software solutions collectively capture the remaining market share, reflecting growing demand for comprehensive, data-driven event management ecosystems.

- For instance, Ticketmaster’s integration of NFC and digital wallet payments has streamlined entry management, improving attendee convenience and security.

Key Growth Drivers

Rising Demand for Virtual and Hybrid Events

The growing preference for virtual and hybrid events has become a primary growth driver for the Event Management Software Market. Businesses and organizations increasingly rely on digital platforms to host global conferences, webinars, and trade shows, enabling broader audience reach and cost savings. Event management software solutions offering live streaming, audience analytics, and real-time engagement tools are gaining strong traction. This shift toward digital formats has encouraged continuous innovation in cloud-based event platforms and expanded the market’s adoption across industries.

- For instance, Hopin’s platform supported over 80,000 virtual events globally in 2022, offering integrated networking and analytics tools for real-time audience insights.

Integration of Artificial Intelligence and Analytics

Artificial intelligence (AI) and data analytics are transforming how event organizers plan, manage, and evaluate events. AI-powered tools enhance personalization, automate registration processes, and improve audience targeting. Predictive analytics helps optimize resource allocation and measure engagement more effectively. As companies increasingly seek data-driven insights to refine event strategies, the integration of AI and analytics into event management software has accelerated. This technology integration not only enhances operational efficiency but also delivers measurable ROI for event organizers.

Growing Adoption by Small and Medium Enterprises (SMEs)

The rapid adoption of event management software by SMEs is driving significant market expansion. Affordable subscription-based cloud models have made these tools accessible to small businesses looking to organize professional events with minimal resources. SMEs benefit from features such as online registration, automated email campaigns, and real-time feedback analytics. This democratization of event technology allows smaller organizations to compete with larger players by enhancing attendee engagement and improving operational efficiency, thus boosting market growth.

- For instance, Hopin (now RingCentral Events) positions its platform as an all-in-one, no-code solution with built-in ticketing, networking, chat, and analytics so organizers can assemble virtual/hybrid events quickly without large technical teams.

Key Trends & Opportunities

Shift Toward Mobile Event Management Solutions

Mobile-first solutions are reshaping the event management landscape, offering flexibility and convenience to organizers and attendees. Mobile apps streamline check-ins, enable instant notifications, and support interactive features like polling and Q&A sessions. With the increasing penetration of smartphones and 5G connectivity, event planners are prioritizing mobile compatibility in their digital ecosystems. This trend creates strong opportunities for developers to integrate cross-platform functionality and enhance user experiences through seamless mobile engagement.

- For instance, Cvent’s mobile event app facilitates seamless attendee check-in, real-time push notifications, and interactive Q&A sessions, ensuring a smooth and engaging event experience.

Sustainability and Green Event Practices

Sustainability has emerged as a key opportunity within the Event Management Software Market. Organizers are adopting digital tools to minimize paper usage, track carbon emissions, and manage waste during events. Software solutions that promote eco-friendly practices—such as virtual ticketing and digital agendas—are increasingly favored by corporations committed to environmental goals. As the focus on ESG (Environmental, Social, and Governance) initiatives strengthens, the demand for sustainable event management software continues to rise across global markets.

- For instance, Sweap, a software platform specializing in sustainable event management, enables organizers to manage digital invitations and guest lists, significantly reducing paper waste.

Key Challenges

Data Security and Privacy Concerns

Data protection remains a significant challenge for the Event Management Software Market. These platforms handle sensitive attendee information, including personal details and payment data, which makes them vulnerable to cyberattacks and breaches. Compliance with global data protection regulations such as GDPR and CCPA adds further complexity. Companies must invest in robust encryption, authentication, and access control measures to ensure data integrity and build trust among users while maintaining regulatory compliance across diverse regions.

Integration Complexity with Legacy Systems

Integrating event management software with existing enterprise systems poses ongoing difficulties for many organizations. Legacy infrastructures often lack compatibility with modern cloud-based or AI-driven platforms, leading to workflow disruptions and data silos. Custom integration requires significant technical expertise and financial investment, deterring adoption among traditional enterprises. As a result, vendors are focusing on providing API-based and modular solutions to simplify integration and enhance interoperability across different software ecosystems.

Regional Analysis

North America

North America holds the dominant position in the Event Management Software Market, accounting for 33.3% of the global share in 2024. The regional market expanded from USD 2,437.38 million in 2018 to USD 4,580.06 million in 2024, and it is projected to reach USD 10,055.05 million by 2032, registering a CAGR of 10.3%. Growth is driven by the widespread adoption of cloud-based platforms, a mature event industry, and the presence of leading software providers in the United States. The region’s focus on advanced analytics and virtual event technologies further strengthens its leadership position.

Europe

Europe represents a significant share of the Event Management Software Market, holding 26.5% of the global share in 2024. The market increased from USD 1,903.33 million in 2018 to USD 3,642.10 million in 2024, and is expected to reach USD 8,201.15 million by 2032, at a CAGR of 10.7%. The region benefits from the rapid digitalization of corporate events and the growing emphasis on sustainability in event operations. Demand for automated registration and AI-driven attendee engagement tools continues to rise, particularly across Germany, the UK, and France.

Asia Pacific

Asia Pacific is emerging as the fastest-growing regional market, capturing 24.7% of the global share in 2024. Valued at USD 1,701.11 million in 2018, the market reached USD 3,406.33 million in 2024 and is forecasted to attain USD 8,135.16 million by 2032, expanding at a CAGR of 11.5%. The region’s growth is driven by increasing internet penetration, a booming MICE (Meetings, Incentives, Conferences, and Exhibitions) industry, and strong investments in digital event infrastructure. Countries such as China, India, and Japan are leading the shift toward virtual and hybrid event solutions.

Latin America

Latin America accounts for 8.9% of the global share in 2024, showcasing steady growth across major economies. The market advanced from USD 633.73 million in 2018 to USD 1,236.84 million in 2024, and it is anticipated to reach USD 2,859.40 million by 2032, reflecting a CAGR of 11.1%. The rise of corporate events, entertainment festivals, and educational conferences has spurred adoption of cloud-based event management platforms. Brazil and Mexico are the key contributors, with increasing focus on mobile ticketing, online engagement tools, and localized event marketing technologies.

Middle East

The Middle East represents a smaller yet rapidly expanding market, holding 4.7% of the global share in 2024. The regional market grew from USD 309.03 million in 2018 to USD 642.21 million in 2024, and is projected to reach USD 1,602.52 million by 2032, achieving the highest CAGR of 12.1%. Growth is supported by government investments in tourism, entertainment, and smart city initiatives, particularly in the UAE and Saudi Arabia. The increasing number of international trade fairs and exhibitions is also fueling the demand for efficient digital event management systems.

Africa

Africa contributes 1.9% of the global share in 2024, showing promising growth potential. The market rose from USD 136.00 million in 2018 to USD 257.00 million in 2024, and it is expected to reach USD 568.74 million by 2032, at a CAGR of 10.5%. Expanding internet connectivity and the growing adoption of digital tools in business conferences and educational events are driving market development. South Africa leads the regional landscape, followed by Egypt, where increasing investments in technology infrastructure are fostering broader software adoption for event management.

Market Segmentations:

By Type:

- On-premise

- Cloud-based / On-demand

By Application:

- Event Planning Software

- Event Registration & Ticketing Software

- Event Marketing Software

- Analytics & Reporting Software

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Event Management Software Market is led by key players including Active Network LLC, Eventbrite Inc., Cvent Inc., Social Tables, Eventzilla, Hopin, webMOBI, and Certain, Inc. These companies dominate through product innovation, strategic partnerships, and expansion into emerging markets. Vendors are increasingly focusing on cloud-based solutions, AI integration, and mobile-compatible platforms to enhance user experience and streamline event operations. Competition is also driven by pricing strategies, customization options, and comprehensive service portfolios, enabling companies to address diverse client requirements. Startups and regional players are leveraging niche offerings, such as specialized analytics, hybrid event support, and localized marketing tools, intensifying market rivalry. Continuous technological advancements, coupled with rising adoption of virtual and hybrid events globally, compel established vendors to innovate rapidly. Overall, the market remains highly dynamic, with players investing heavily in R&D, strategic acquisitions, and collaborative solutions to maintain leadership and capture new growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Zoom partnered with Swoogo to integrate Zoom Events’ virtual platform with Swoogo’s in-person event management technology, streamlining hybrid events and enhancing engagement.

- In October 2025, ASB GlassFloor launched AES to globally expand its LED sports floors, with 30 million Euro in equity funding secured to accelerate its global growth.

- In July 2025, Wowza acquired AVA Intellect to accelerate its AI-driven video platform strategy.

- In January 2024, MasterControl launched advanced quality event management software offering customizable processes and enhanced data capture for professional events.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Event Management Software Market is expected to continue strong growth driven by the adoption of cloud-based solutions.

- Increasing demand for virtual and hybrid events will create new opportunities for advanced event management platforms.

- Integration of artificial intelligence and analytics will enhance personalized experiences and improve operational efficiency.

- Mobile-compatible solutions will gain prominence as organizers and attendees seek seamless on-the-go access.

- Small and medium enterprises will increasingly adopt software to streamline event planning and reduce costs.

- Sustainability-focused features will become more important as organizations prioritize eco-friendly event management practices.

- Expansion into emerging markets in Asia Pacific, the Middle East, and Africa will drive regional growth.

- Enhanced cybersecurity measures will be critical to ensure data protection and regulatory compliance.

- Collaboration tools and real-time engagement features will shape software development trends.

- Continuous innovation and strategic partnerships will define competitive positioning in the market.