Market Overview

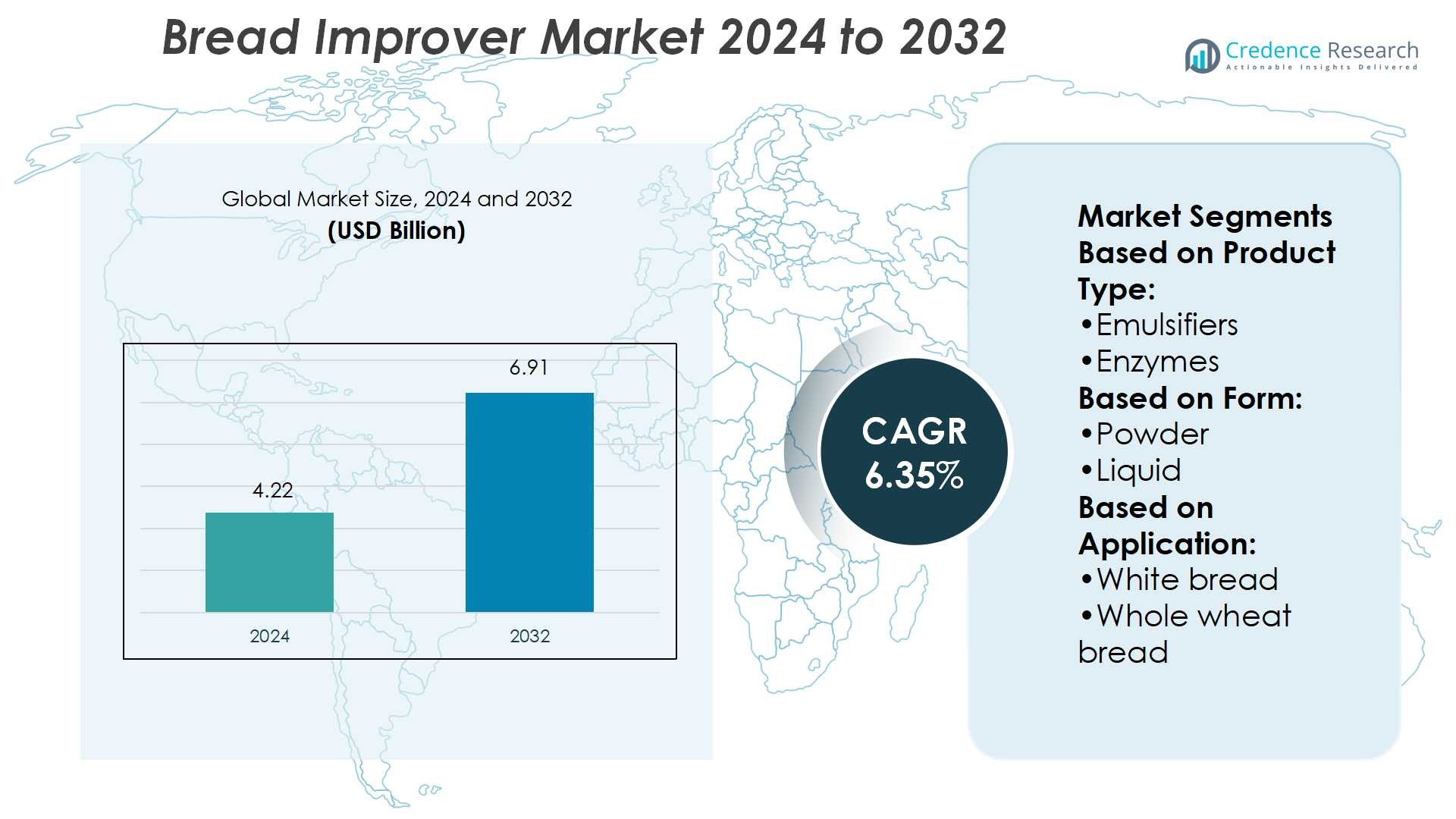

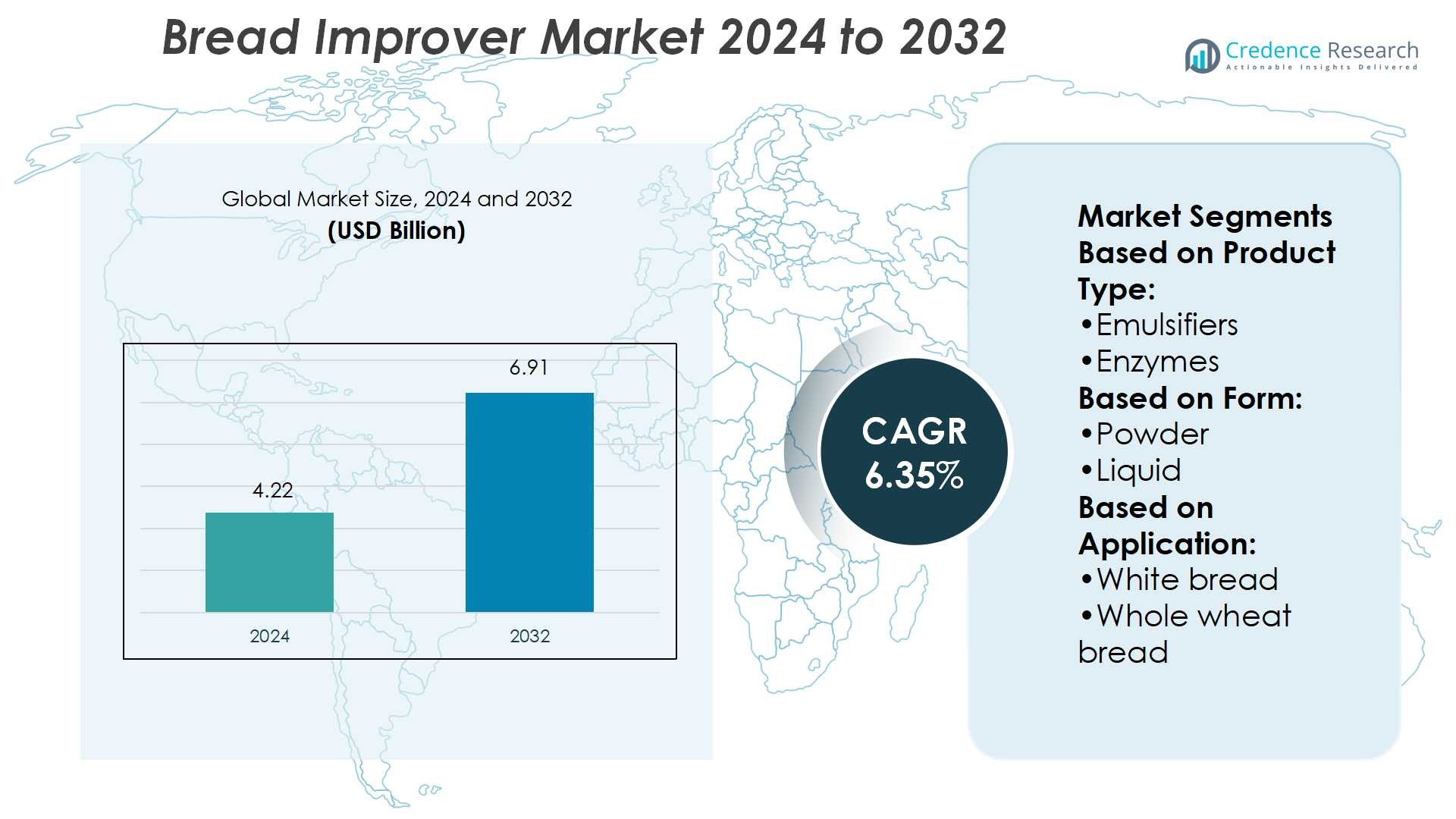

Bread Improver Market size was valued at USD 4.22 billion in 2024 and is anticipated to reach USD 6.91 billion by 2032, at a CAGR of 6.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bread Improver Market Size 2024 |

USD 4.22 Billion |

| Bread Improver Market, CAGR |

6.35% |

| Bread Improver Market Size 2032 |

USD 6.91 Billion |

The Bread Improver Market grows with rising demand for consistent, high-quality bread across commercial and retail bakeries. Drivers include increasing consumer preference for convenience foods, expanding urbanization, and health-focused diets that encourage fortified and whole grain bread adoption. Manufacturers invest in enzyme-based and clean-label improvers to meet regulatory compliance and shifting consumer expectations. Trends highlight the move toward natural ingredients, nutrient-enriched bread, and solutions that extend shelf life while maintaining freshness. Growth in industrial automation and large-scale production further strengthens market adoption, while the expansion of foodservice and retail channels reinforces innovation in tailored improver formulations.

The Bread Improver Market shows strong geographical presence, with Europe leading on strict sustainability standards, North America driving demand through commercial bakeries, and Asia Pacific emerging as the fastest-growing region due to urbanization and evolving diets. Latin America and the Middle East & Africa present steady opportunities through expanding retail and foodservice sectors. Key players strengthen competitiveness with innovation and global distribution, including Kerry Group, Corbion NV, AB Mauri, ADM, Associated British Foods plc, Bakels Worldwide, BreadPartners, Calpro Foods, Cain Food Industries, and Fazer Group.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Bread Improver Market size was valued at USD 4.22 billion in 2024 and is anticipated to reach USD 6.91 billion by 2032, at a CAGR of 6.35%.

- Demand grows with rising preference for consistent, high-quality bread across commercial and retail bakeries.

- Trends highlight clean-label, enzyme-based, and nutrient-enriched improvers that extend shelf life and freshness.

- Competitive landscape features global and regional players investing in innovation, technical expertise, and distribution strength.

- Restraints include raw material cost fluctuations and strict regulatory frameworks on additives and labeling.

- Europe leads the market with sustainability standards, North America grows through commercial bakery adoption, and Asia Pacific emerges as the fastest-growing region.

- Latin America and the Middle East & Africa show steady growth supported by expanding retail formats and foodservice channels.

Market Drivers

Rising Demand for Convenient and Consistent Baking Solutions

The Bread Improver Market benefits from the rising preference for consistent baking outcomes in both household and commercial sectors. Consumers seek reliable texture, volume, and shelf life in bread products, which drives the adoption of improvers. Bakeries prioritize solutions that reduce production errors and ensure uniform quality across batches. The industry values products that help standardize performance under varied flour quality. Demand from quick-service restaurants and large-scale bakery chains further accelerates usage. It creates a solid foundation for continued growth and broader market penetration.

- For instance, AB Mauri’s Softase Palladium 2300 improves resilience of white pan loaves, maintaining a resilience value around 0.45 on day 3 and about 0.30 on day 14 (with 0.25% usage rate on cereal weight basis), while delivering up to 5% reduction in added sugar.

Growing Health-Conscious Consumer Base and Functional Ingredients

The Bread Improver Market expands due to consumer preference for healthier, fortified, and cleaner-label bread. Health-focused customers demand reduced additives, improved nutritional profiles, and natural alternatives in bakery products. Manufacturers respond by introducing improvers with enzymes, emulsifiers, and natural fibers that maintain performance while meeting expectations. It encourages reformulation strategies across bakery brands to align with shifting diets. Functional benefits such as improved digestion and extended freshness strengthen the appeal of advanced bread improvers. This trend influences both retail bakery operations and packaged bread manufacturers globally.

- For instance, The product is marketed to keep products fresh and resilient for up to 21 days in ambient conditions. The recommended usage level is 0.50% based on flour weight.The recommended usage level is 1.00%.

Expanding Industrial and Commercial Bakery Production

The Bread Improver Market experiences strong demand from industrial-scale production lines that require high-efficiency solutions. Large bakeries rely on improvers to optimize fermentation, enhance dough handling, and improve shelf stability. These products allow companies to cut waste and speed up production without sacrificing quality. It creates competitive advantages for manufacturers operating in high-volume environments. Urbanization and rising bread consumption in emerging economies amplify demand from commercial bakeries. The consistent need for scalable, cost-effective solutions ensures sustained market reliance on improvers.

Influence of Evolving Foodservice and Retail Distribution Channels

The Bread Improver Market grows as modern retail and foodservice sectors expand worldwide. Supermarkets, convenience stores, and bakery cafés drive product diversity and push for extended shelf life solutions. Food delivery platforms and online grocery services require bread products that maintain quality during transit. It raises the importance of improvers that enhance resilience and reduce spoilage. Retailers also encourage suppliers to deliver innovative bread formats tailored for convenience-driven lifestyles. This evolving distribution ecosystem reinforces steady growth and continuous innovation in bread improver technologies.

Market Trends

Rising Preference for Clean Label and Natural Ingredient Formulations

The Bread Improver Market witnesses a strong shift toward clean-label solutions that rely on natural ingredients. Consumers demand transparency and healthier bread options free from artificial additives. Manufacturers invest in enzyme-based improvers and natural emulsifiers to meet these expectations. It encourages innovation in product development that balances functionality with consumer trust. Bakeries adopting clean-label improvers gain a competitive edge in retail and foodservice channels. This trend creates opportunities for long-term growth and product differentiation.

- For instance, Fazer, the recommended dosage is 1–3% of the flour weight. With a 1% dosage, fructan content is reduced by more than 50%, and with a 3% dosage, it is reduced by 85%.

Increasing Adoption of Enzyme-Based and Specialty Improvers

The Bread Improver Market expands with the rising adoption of enzyme-driven solutions that improve dough strength, volume, and texture. Enzymes deliver consistent performance and align with regulatory pressure to reduce chemical use. Specialty improvers tailored for whole grain and gluten-free bread also gain traction. It supports bakeries in addressing niche consumer needs without sacrificing quality. Manufacturers develop targeted solutions that enhance fermentation stability and extend shelf life. This trend reshapes product portfolios to support diverse baking applications.

- For instance, Bakels is a global supplier of bakery ingredients, and “Excel 600” is one of its established products. The product is available from various Bakels subsidiaries, including South Bakels and British Bakels.

Growing Demand for Functional and Nutrient-Enhanced Bread Products

The Bread Improver Market benefits from rising interest in functional bread fortified with fibers, proteins, and vitamins. Health-conscious consumers drive bakeries to integrate improvers that support enriched formulations. It allows manufacturers to create bread that offers nutritional value alongside taste and convenience. Demand for low-sodium, high-fiber, and digestive-health products strengthens the role of advanced improvers. Retail and commercial bakeries adapt recipes to serve wellness-oriented markets. This trend reinforces innovation toward multifunctional bread improvers.

Expansion of Automation and Large-Scale Production Technologies

The Bread Improver Market evolves with the growth of automated bakery lines and industrial-scale production. Manufacturers design improvers that perform reliably under fast, high-volume baking conditions. It ensures consistent dough handling, uniform output, and reduced processing variability. Industrial bakeries adopt these solutions to cut waste and optimize efficiency. Growing urbanization and expanding consumption in emerging economies accelerate this trend. The focus on efficiency and consistency strengthens the adoption of technologically advanced improvers.

Market Challenges Analysis

Stringent Regulatory Standards and Concerns Over Additives

The Bread Improver Market faces challenges from strict regulatory frameworks governing food safety and labeling. Governments enforce tighter rules on chemical additives, preservatives, and emulsifiers used in bakery products. Manufacturers must continuously reformulate products to comply with evolving standards, which increases production costs. It raises concerns over maintaining performance while meeting health and safety requirements. Negative consumer perception of artificial additives further complicates product positioning. Companies struggle to balance regulatory compliance with the demand for consistent bread quality.

Fluctuating Raw Material Costs and High Competition Among Producers

The Bread Improver Market experiences volatility due to fluctuating costs of key raw materials such as enzymes, emulsifiers, and specialty ingredients. Rising prices put pressure on margins for both manufacturers and bakeries. It creates difficulty in maintaining affordability, particularly in price-sensitive markets. Intense competition among producers also leads to limited differentiation, reducing profitability. Smaller bakeries face challenges adopting advanced improvers due to cost constraints. These issues hinder steady growth and force companies to explore new strategies for cost efficiency and innovation.

Market Opportunities

Rising Demand for Premium and Health-Oriented Bread Products

The Bread Improver Market offers strong opportunities through the increasing demand for premium and health-focused bakery products. Consumers prefer bread with natural ingredients, enhanced nutrition, and longer freshness. Manufacturers can capture this trend by developing improvers that support whole grain, gluten-free, and fortified bread varieties. It creates pathways for innovation in enzyme-based and fiber-rich formulations that meet wellness expectations. The growing popularity of artisanal and specialty bread further expands opportunities for tailored improver solutions. Companies that align with these preferences strengthen their presence in both retail and foodservice channels.

Expanding Growth Potential in Emerging Economies and Industrial Bakeries

The Bread Improver Market benefits from rapid urbanization and rising disposable incomes in emerging regions. Growing consumption of packaged bread in Asia Pacific, Latin America, and the Middle East drives adoption of improvers. It allows large bakeries to scale production efficiently while ensuring consistent quality. Industrial bakeries seeking automation-friendly improvers create fresh opportunities for suppliers. Partnerships with expanding foodservice chains and supermarket bakeries add to market growth potential. This demand landscape enables manufacturers to broaden global reach and establish stronger distribution networks.

Market Segmentation Analysis:

By Product Type

The Bread Improver Market segments by product type into emulsifiers, enzymes, and stabilizers. Emulsifiers dominate due to their ability to enhance dough strength, improve texture, and extend shelf life. Enzymes gain strong traction because they deliver natural solutions that align with clean-label demands. Stabilizers support consistent product quality by balancing moisture and structure across bread varieties. It encourages manufacturers to invest in advanced formulations that combine performance with health-conscious benefits. This diversity ensures product adaptability across both large-scale and artisanal baking operations.

- For instance, ADM’s dried deoiled lecithin emulsifiers (Ultralec P/F) feature ≥ 50 % higher phospholipid strength than their fluid lecithin, available in powder/granular form for cleaner handling and better flowability in bakery mixes.

By Form

The Bread Improver Market divides into powder and liquid forms, each serving distinct industry needs. Powdered improvers remain popular for their long shelf life, ease of storage, and precise dosing in industrial production. Liquid improvers find rising adoption in automated and high-speed bakery lines where uniform blending improves efficiency. It provides manufacturers with flexible options to support both small bakeries and large-scale producers. The shift toward industrial automation boosts the demand for liquid formats, while powder continues to serve traditional bakeries effectively. This balance highlights the adaptability of improver solutions across the baking spectrum.

- For instance, Liquid improver systems are developed via solid improvers (≥ 80 % dry matter) that can be dispersed in water, forming a stable liquid with pH between 3.8 to 7.0 when 10 parts improver are in 100 parts water.

By Application

The Bread Improver Market covers diverse applications such as white bread, whole wheat bread, baguettes, buns and rolls, multigrain bread, artisan bread, and flatbreads. White bread leads demand due to its high global consumption and reliance on improvers for consistent softness and volume. Whole wheat and multigrain bread segments grow rapidly, driven by rising health awareness and consumer preference for nutrient-rich products. Artisan bread and flatbreads benefit from improvers that support texture, crust quality, and extended freshness without altering traditional recipes. Buns and rolls attract strong demand from quick-service restaurants and foodservice chains requiring durability and uniformity. It positions improvers as essential across both staple and specialty bread categories, fueling continuous market growth.

Segments:

Based on Product Type:

Based on Form:

Based on Application:

- White bread

- Whole wheat bread

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 28% share of the Bread Improver Market, driven by strong demand from commercial bakeries, retail chains, and quick-service restaurants. The region benefits from a well-established bakery industry, with consistent demand for white bread, buns, rolls, and artisanal products. Consumers increasingly prefer clean-label and health-focused bakery goods, which pushes manufacturers to adopt enzyme-based and natural improvers. The market also sees growth from convenience-focused formats such as packaged bread, frozen dough, and ready-to-bake items. It creates opportunities for suppliers to deliver specialized improvers that enhance shelf life, maintain freshness, and optimize texture. Regulatory compliance in food labeling reinforces innovation in natural and enzyme-based solutions. Continuous product development by key industry players strengthens the region’s competitive edge and ensures stable growth.

Europe

Europe accounts for a 32% share of the Bread Improver Market, making it the largest regional contributor. Strict food safety regulations and strong consumer demand for sustainable and natural products drive widespread adoption of clean-label improvers. The region also emphasizes premium bakery formats, with artisan bread and specialty recipes gaining traction. Industrial bakeries in countries such as Germany, France, and the UK heavily rely on improvers to ensure efficiency and consistent product quality. It supports the region’s leadership in both traditional bread consumption and innovative product development. Multigrain and whole wheat bread segments show faster growth as consumers shift toward healthier dietary options. The presence of global leaders and strong distribution networks enhances the availability of advanced improver solutions across retail and commercial channels.

Asia Pacific

Asia Pacific captures a 24% share of the Bread Improver Market and stands as the fastest-growing regional segment. Rising urbanization, income growth, and changing dietary habits are fueling bread consumption across China, India, Japan, and Southeast Asia. Local bakeries and large-scale industrial producers expand capacity to meet demand from retail, convenience stores, and foodservice outlets. It accelerates the adoption of improvers that support large production volumes while ensuring consistent quality. Growing awareness of nutrition also drives interest in multigrain, fortified, and functional bread categories. International companies collaborate with local players to expand distribution and customize improver solutions for regional tastes. This combination of rising demand, industrialization, and evolving consumer preferences positions Asia Pacific as a long-term growth hub.

Latin America

Latin America represents a 9% share of the Bread Improver Market, supported by expanding urban centers and rising bakery culture in Brazil, Mexico, and Argentina. Bread remains a dietary staple, and demand spans from affordable white bread to specialty and artisan formats. It creates opportunities for improver suppliers to serve both cost-sensitive and premium segments. Growing influence of supermarket chains and foodservice outlets accelerates the need for extended shelf life solutions. Health-driven trends also encourage adoption of improvers designed for multigrain and fortified products. Regional players invest in localized product development to balance affordability with performance. The market continues to expand steadily, aided by economic growth and increasing bakery innovation.

Middle East & Africa

The Middle East & Africa account for a 7% share of the Bread Improver Market, with demand centered around flatbreads, buns, and rolls. Bread remains a dietary essential across both urban and rural households. Rising disposable incomes and expansion of modern retail formats stimulate consumption of packaged and branded bread products. It increases reliance on improvers that maintain freshness in challenging climates and extend shelf life during distribution. Countries such as Saudi Arabia, UAE, and South Africa lead adoption, while other nations gradually increase bakery industry investments. Cultural preferences for fresh, soft bread support continuous demand for effective improvers. With rising urbanization and foodservice expansion, the region shows promising growth potential despite its smaller current share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Bread Improver Market players such as Kerry Group; BreadPartners; AB Mauri; Cain Food Industries; Fazer Group; Corbion NV; Calpro Foods; Associated British Foods plc; Bakels Worldwide; ADM. The Bread Improver Market demonstrates intense competition driven by innovation, regional expansion, and shifting consumer demands. Companies focus on developing enzyme-based and clean-label solutions that enhance dough stability, extend shelf life, and improve nutritional value. Industrial bakeries seek large-scale, cost-effective improvers, while artisan and specialty producers demand customized blends that preserve traditional qualities. It creates a market dynamic where differentiation depends on technical expertise, product performance, and regulatory compliance. Competitive strategies include investments in R&D, partnerships with bakeries, and expansion into emerging regions with rising bread consumption. The emphasis on sustainability and health-focused formulations further shapes competition, pushing suppliers to balance affordability with advanced product development.

Recent Developments

- In July 2025, Lotte India debuted its biscuit snack range, Pepero, offering both original and crunchy flavors. This launch marked the company’s entry into the premium biscuit snack segment, aiming to cater to evolving consumer preferences for innovative and indulgent snack options.

- In June 2025, Aditya Birla Group, through its subsidiary Aditya Birla Chemicals (USA) Inc., strategically entered the United States chemicals market by acquiring Cargill’s specialty chemical manufacturing facility in Dalton, Georgia. This acquisition aligns with the group’s objective to strengthen its presence in the US manufacturing landscape.

- In February 2024, Base Culture, one of the well-known frozen bakery goods manufacturers, announced the launch of its new simply bread line to expand its gluten-free product range. The new product line is said to be a clean label and gluten-free product range.

- In June 2023, Arva Flour Mills, one of North America’s prominent commercial bakery mills, announced the acquisition of the Full of Beans gluten-free products brand. The company aims to launch a gluten-free product range under the Arva Flour Mills to expand its consumer base further.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean-label improvers will expand with stronger consumer preference for natural ingredients.

- Enzyme-based solutions will dominate due to efficiency, sustainability, and regulatory compliance.

- Industrial bakeries will drive innovation in improvers that support automation and high-volume production.

- Growth in functional bread will create opportunities for nutrient-enriched improver formulations.

- Retail and foodservice expansion will increase reliance on improvers with extended shelf life.

- Emerging economies will witness rising adoption supported by urbanization and shifting dietary habits.

- Artisan and specialty bread segments will benefit from improvers tailored for texture and crust quality.

- Climate and supply chain pressures will encourage investment in cost-effective and stable raw materials.

- Digital tools and technical support services will enhance customer engagement and product development.

- Sustainability-focused formulations will shape future portfolios, aligning with global environmental goals.