Market Overview:

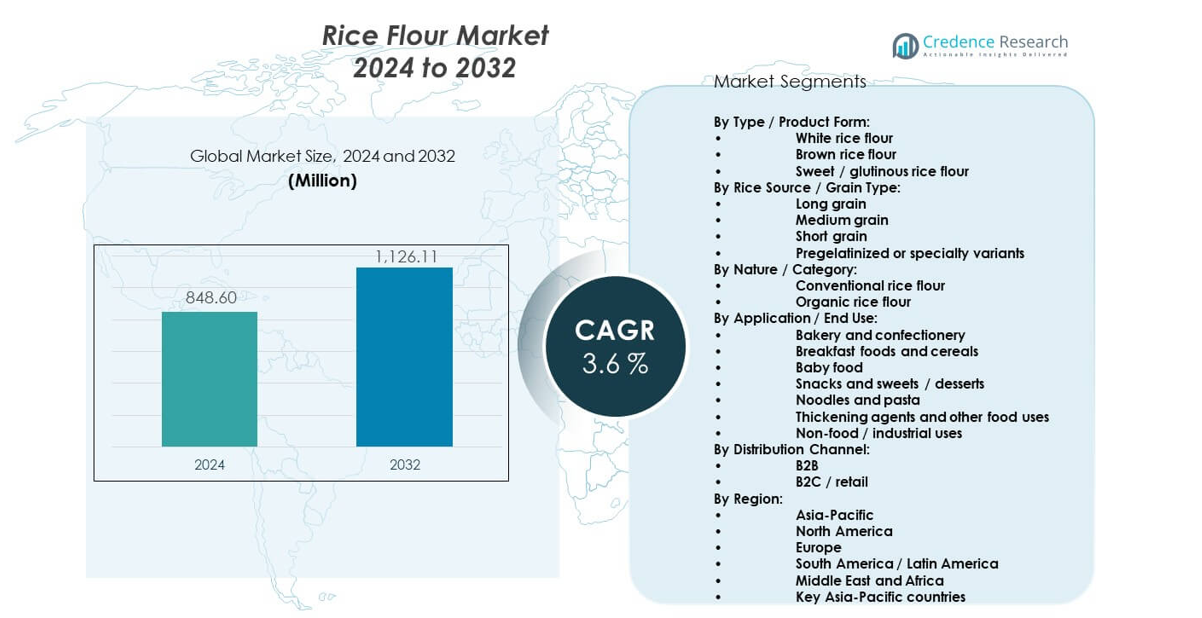

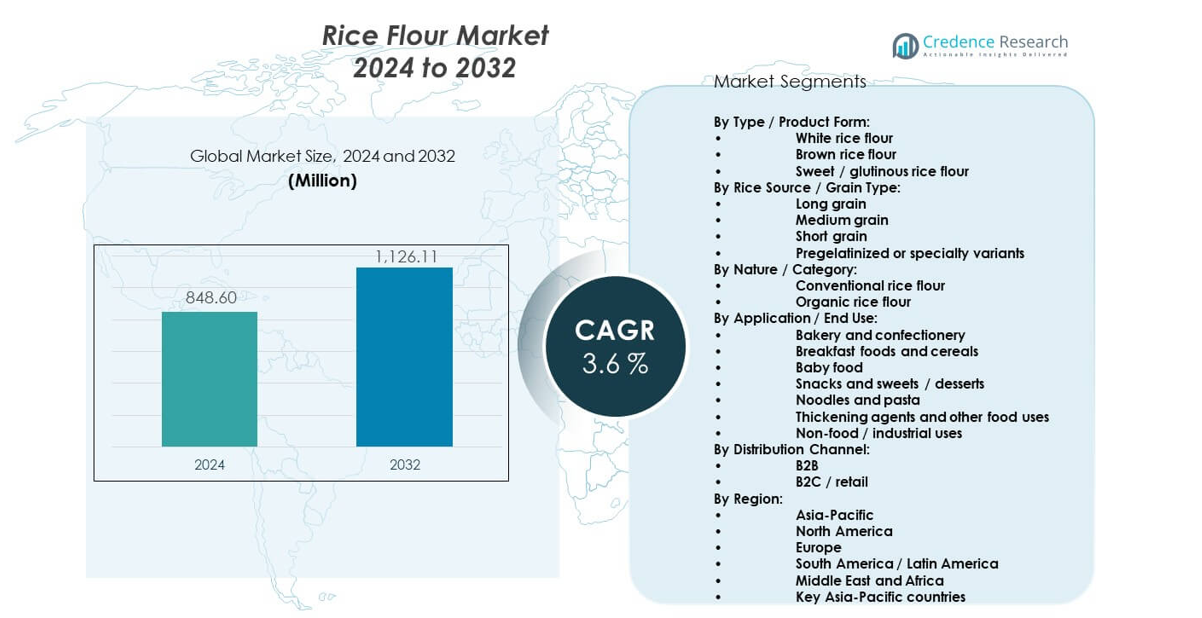

The Rice Flour Market is projected to grow from USD 848.6 million in 2024 to an estimated USD 1,126.11 million by 2032, with a compound annual growth rate (CAGR) of 3.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rice Flour Market Size 2024 |

USD 848.6 million |

| Rice Flour Market, CAGR |

3.6% |

| RRice Flour Market Size 2032 |

USD 1,126.11 million |

Growing demand comes from consumers who want allergen-free products that support healthy eating habits. Brands use rice flour to replace wheat in breads, batter mixes, and noodles due to rising gluten sensitivity. Processors increase output with better milling systems that improve uniformity and stability. Clean-label claims push wider use in packaged goods. Rising interest in plant-based diets lifts usage across ready meals and snack foods. Strong retail presence helps the market reach new consumers across urban areas.

Regional growth shows strong activity across Asia Pacific due to large rice production and deep culinary use. China, India, Japan, and Southeast Asian countries lead due to wide food applications and stable supply chains. North America grows fast due to strong gluten-free adoption and product innovation across bakery and snacks. Europe expands usage through rising demand for clean-label and allergen-free foods. Latin America and the Middle East & Africa emerge as processors strengthen food diversification and introduce rice-based blends across retail formats.

Market Insights:

- The Rice Flour Market is valued at USD 848.6 million in 2024 and is projected to reach USD 1,126.11 million by 2032, advancing at a 3.6% CAGR as gluten-free adoption and clean-label demand increase across food sectors.

- Asia-Pacific leads with ~48% share due to strong rice production and deep culinary use; North America holds ~23% driven by gluten-free preference; Europe follows with ~19% backed by clean-label and organic product growth.

- North America is the fastest-growing region with its rising gluten-free innovation, strong retail penetration, and expanding bakery and snack reformulation efforts.

- By product type, white rice flour accounts for ~52%, supported by its versatility across bakery, snacks, and cereals, while brown rice flour holds ~28% due to its higher fiber and health appeal.

- By application, bakery and confectionery represent ~34%, and noodles and pasta capture ~22%, reflecting strong demand in both Western and Asian food categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Gluten-Free and Allergen-Free Food Products Across Global Consumer Groups

Growing shifts toward gluten-free diets fuel new interest in clean-label choices. Consumers seek flour options that support better digestion and lower allergen exposure. Food makers use rice flour to reformulate bakery and snack items without wheat. It supports texture improvement and stable shelf performance in major packaged goods. Health-focused buyers prefer mild flavors that blend well with many recipes. Brands push new launches to meet the steady rise in gluten sensitivity. The Rice Flour Market grows through wider adoption across retail and foodservice. Rising consumer awareness strengthens steady product movement across many regions.

- For instance, Ingredion’s HOMECRAFT® Create GF 10 rice flour is used to provide texture and structure in gluten-free bakery applications.

Expanding Use of Rice Flour in Baby Foods, Instant Mixes, and Nutritional Products

Parents choose rice flour for infant foods due to easy digestibility and mild taste. Producers include fortified blends to support balanced nutrition for early-age groups. It enhances smooth texture in purees, cereals, and instant mixes. Brands reformulate products to meet growing safety and purity standards. Food developers extend usage in ready breakfast items to serve busy users. Health campaigns push cleaner ingredient profiles in packaged goods. The Rice Flour Market grows with rising focus on controlled processing and quality checks. Broader awareness among parents drives higher demand across many channels.

- For instance, Nestlé’s CERELAC rice-based infant cereals use hydrolyzed rice flour with controlled particle sizing below 250 microns to ensure smooth consistency and demonstrated digestibility in pediatric feeding studies.

Rising Adoption Across Bakery, Confectionery, and Specialty Culinary Applications Worldwide

Food producers test new formulations that use rice flour to improve crumb structure. Bakers use fine-milled variants to craft soft breads and stable pastries. It allows product developers to maintain taste while replacing wheat in key recipes. Chefs rely on rice flour to support crisp texture in frying and coating mixes. Confectionery makers prefer it for smooth mouthfeel and allergen-free appeal. Product launches support growing interest in diverse flour alternatives. The Rice Flour Market moves forward with strong adoption in multiple food formats. Rising innovation drives steady use in modern kitchen and industrial systems.

Growing Industrial-Scale Milling Efficiency and Improved Supply Chain Integration

Milling units upgrade systems to deliver finer particle sizes and consistent quality. Better screening tools help processors reduce waste and improve throughput. It enables producers to control moisture levels and enhance storage stability. Supply chains strengthen with faster movement across mills and distributors. Producers invest in temperature-controlled storage for longer shelf life. Food firms use stable supply to support frequent product launches. The Rice Flour Market benefits from more reliable sourcing across major growing nations. Rising collaborations help streamline production cycles for global buyers.

Market Trends:

Rising Popularity of Clean-Label, Minimal-Ingredient, and Plant-Based Flour Formulations

Consumers prefer simple ingredient lists that match natural food habits. Clean-label promises push reformulation across bakery and snack divisions. It encourages brands to reduce additives and enhance transparency. Plant-based diets support the shift toward rice flour in blended mixes. Shoppers want flour alternatives that support controlled nutrition. It supports wide use in organic and specialty food outlets. The Rice Flour Market gains traction through stronger retail messaging. Brands highlight purity to attract health-focused buyers.

- For instance, Bob’s Red Mill markets organic stone-ground rice flours produced using single-ingredient processing, with batch testing confirming gluten levels below 20 ppm under their stringent in-house testing protocols, and some products are also available with a separate GFCO certification (which guarantees below 10 ppm).

Growing Innovation in Specialty Rice Flour Grades for Texture, Crispiness, and Culinary Performance

Producers offer variants tailored for crisp coatings, instant thickening, and soft crumb profiles. Fine-grain flours help bakers shape uniform dough textures. It improves performance in noodles, dumplings, and batter mixes. Foodservice brands test blends to raise stability under heat. Specialty grades support chefs who want predictable cooking behavior. Product developers explore new blends for global recipes. The Rice Flour Market adapts to rising interest in advanced flour functionality. Texture-driven trends shape new product adoption across key markets.

- For instance, Koda Farms’ Sho-Chiku-Bai sweet rice flour provides amylopectin-rich composition above 98%, enabling superior binding and crispness, validated in commercial tempura coating tests.

Widening Use of Rice Flour in Ready Meals, Frozen Foods, and Quick-Serve Culinary Categories

Busy consumers prefer convenient foods that rely on stable flour bases. Ready meals use rice flour for binding, thickening, and flavor balance. It improves product hold during freezing and reheating. Food brands design flexible formats that support fast preparation. Restaurant chains add rice-flour-based coatings to raise crispiness. Frozen snack makers expand menus with new formulations. The Rice Flour Market responds to higher demand for convenience-focused foods. Rising urban lifestyles support this trend in many regions.

Rising Integration of Rice Flour in Premium, Organic, and Functional Food Products

Organic processors use rice flour to meet strict certification goals. Functional food makers add it to support fiber variation and clean taste. It blends well with botanical ingredients in modern wellness products. Premium brands reformulate flour mixes to target niche users. Shoppers respond well to natural textures in gourmet items. Retail expansion supports steady placement of high-end flour lines. The Rice Flour Market grows as premium health categories gain attention. Wellness trends guide long-term product planning across many producers.

Market Challenges Analysis:

Limited Protein Structure, Variable Texture, and Functional Constraints in Complex Food Formulations

Food developers face challenges when replacing wheat with rice flour across advanced recipes. Protein structure remains weaker, affecting dough elasticity and crumb strength. It creates hurdles in bread-making, confectionery shaping, and pasta development. Bakers test enzymes and stabilizers to manage these gaps. Texture inconsistency can rise due to raw material variation across regions. Moisture control also requires strict processing steps. The Rice Flour Market sees slower progress in certain premium categories due to these limits. Firms continue to adjust blends to match target performance levels.

Supply Fluctuations, Seasonal Yield Variation, and Higher Processing Costs for Fine-Milled Grades

Rice cultivation depends on weather stability and regional water availability. Season-driven swings influence output and raw material pricing. It affects millers who need stable grain quality for consistent flour grades. Fine milling demands higher energy use and strict screening controls. Supply chains face delays when transport networks strain during peak seasons. Retailers adjust stocking plans to manage unpredictable inflows. The Rice Flour Market manages rising cost pressure across major producing zones. Producers work toward better forecasting tools to steady long-term supply.

Market Opportunities:

Growing Demand for Specialty Functional Blends and Gluten-Free Innovations Across Processed Foods

Food brands expand rice-flour-based innovation to serve rising gluten-free needs. Specialty blends attract consumers who want clean taste and better digestibility. It supports product development in bakery, noodles, snacks, and mixes. Health-driven buyers shift toward flour options with minimal allergens. The Rice Flour Market benefits from wider interest in safer and simpler ingredients. Brands design new blends to reach premium health segments. Rising clean-label focus supports long-term opportunity creation across many regions.

Rising Use of Rice Flour in Plant-Based, Organic, and Premium Culinary Products Globally

Plant-based categories integrate rice flour to enhance stability and improve texture. Organic processors prefer it due to clean sourcing and lower allergen risk. It blends smoothly in sauces, desserts, and gourmet mixes. Premium brands highlight its mild flavor to meet niche cooking needs. Demand rises in global cuisines that prefer neutral flour profiles. The Rice Flour Market gains opportunity through expanding wellness-focused habits. Producers scale capacity to support steady growth across multiple food sectors.

Market Segmentation Analysis:

By Type / Product Form

The Rice Flour Market expands through steady use of white, brown, and sweet or glutinous variants. White rice flour leads due to broad application in bakery, snacks, and cereals. Brown rice flour gains attention for higher fiber and clean-label appeal. Sweet or glutinous flour supports strong demand in Asian recipes, desserts, and specialty coating mixes. It helps food makers design diverse product lines for global users. Growth follows rising interest in allergen-free options and wider culinary adoption.

- For instance, Kröner-Stärke produces pregelatinized functional rice flour variants, such as the Organic Pregelatinized Rice Flour R90, which are designed for applications in industrial bakery systems, providing properties like long-lasting water binding and retaining freshness.

By Rice Source / Grain Type

Long-grain, medium-grain, and short-grain categories support broad supply diversity across regions. Long-grain variants offer mild flavor for bakery and snack blends. Medium-grain supports balanced viscosity in sauces and instant mixes. Short-grain delivers higher stickiness for noodles and ethnic dishes. Pregelatinized or specialty grades provide better thickening and stability for processed foods. The Rice Flour Market benefits from strong functional flexibility across these grain types. It drives wider use across industrial and culinary sectors.

- For instance, Thai Flour Industry Co., Ltd. supplies a pregelatinized rice flour ingredient that functions as a highly effective thickening and binding agent in instant food applications, such as soups and ready-mix formulations, by absorbing water rapidly without requiring heat.

By Nature / Category

Conventional rice flour holds strong volume share due to wide availability and stable pricing. Organic rice flour grows faster with rising clean-label demand and higher consumer trust. It supports premium product launches in cereals, baby food, and snacks. Producers invest in certified sourcing to meet strict organic standards. Growth rises across online retail and specialty stores.

By Application / End Use

Bakery, cereals, baby food, snacks, noodles, pasta, and thickening uses shape core demand. It helps manufacturers design gluten-free and allergen-friendly recipes. Non-food uses appear in cosmetics, pharmaceuticals, and industrial blends. Wider product innovation keeps application diversity strong across markets.

By Distribution Channel

B2B channels dominate through food manufacturers and industrial users. B2C retail grows through supermarkets, specialty stores, and strong online expansion. It supports broad consumer access across many regions.

Segmentation:

By Type / Product Form:

- White rice flour

- Brown rice flour

- Sweet / glutinous rice flour

By Rice Source / Grain Type:

- Long grain

- Medium grain

- Short grain

- Pregelatinized or specialty variants

By Nature / Category:

- Conventional rice flour

- Organic rice flour

By Application / End Use:

- Bakery and confectionery

- Breakfast foods and cereals

- Baby food

- Snacks and sweets / desserts

- Noodles and pasta

- Thickening agents and other food uses

- Non-food / industrial uses

By Distribution Channel:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leads with Strong Production Capacity and Deep Culinary Integration

Asia-Pacific holds the largest share of the Rice Flour Market with nearly 48% of global demand. Strong rice cultivation in China, India, Thailand, and Vietnam supports stable raw material supply. It benefits from deep use of rice-based foods in daily culinary habits across the region. Japan and South Korea push premium-grade demand through bakery, confectionery, and specialty products. It strengthens export activity with strong industrial-scale milling facilities. The Rice Flour Market grows through expanding retail presence and rising gluten-free awareness across major APAC economies.

North America and Europe Gain Steady Momentum with Rising Gluten-Free Adoption

North America accounts for nearly 23% of global share due to strong interest in allergen-free diets. Consumers choose rice flour for bakery mixes, cereals, snacks, and expanding plant-based recipes. It supports product reformulation across major food brands that target clean-label buyers. Europe holds nearly 19% share with high adoption of organic and specialty flour variants. Strong regulations push food makers to use simple ingredient profiles that build trust. The Rice Flour Market gains sustained traction in both regions through premium and fortified product categories.

Latin America and Middle East & Africa Show Emerging Growth through Diversifying Food Processing

Latin America captures nearly 6% share with increasing demand in snacks, baby food, and bakery items. It supports regional processors who diversify raw materials beyond wheat and corn. Middle East & Africa hold close to 4% share with rising interest in rice-based blends for cereals and processed foods. It benefits from expanding retail channels that introduce gluten-free and clean-label alternatives. Growth rises as urban buyers show stronger preference for mild-flavor and versatile flour types. The Rice Flour Market gains long-term opportunity as both regions scale food manufacturing capacity and improve import networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Ebro Foods S.A.

- General Mills Inc.

- Associated British Foods PLC

- Bob’s Red Mill Natural Foods Inc.

- Bay State Milling Company

- Koda Farms Inc.

- Kroner-Stärke GmbH

- Shipton Mill Ltd.

- Whitworth Bros. Ltd.

- Thai Flour Industry Co., Ltd.

- Naturis SpA

Competitive Analysis:

The Rice Flour Market features strong competition among global milling companies, ingredient suppliers, and regional producers. Firms invest in advanced milling systems to improve texture, purity, and consistency. It supports product launches targeting bakery, cereals, snacks, and gluten-free segments. Major players strengthen distribution networks to expand B2B and retail reach. Brands highlight organic and clean-label variants to attract health-focused users. Strategic partnerships help companies secure stable grain sourcing and expand processing capacity. The Rice Flour Market continues to shift toward higher-value specialty grades that improve performance across food applications.

Recent Developments:

- Ebro Foods’ business strategy during the first half of 2025 involved strengthening its aromatic and microwave rice varieties, while planning the launch of refrigerated rice-based products for the second half of the year. For H1 2025, the company’s rice division posted a turnover of €1,187.2 million and an adjusted EBITDA of €169.9 million. The overall group recorded a consolidated net turnover of €1,533.4 million and an adjusted EBITDA of €212.9 million.

- In September 2024, Bay State Milling Company announced the assumption of full ownership of Bay State Milling Montana, a facility previously operated in partnership with Montana Gluten Free since 2016. The acquisition, announced on September 17, 2024, marked the completion of a strategic realignment that expanded Bay State Milling’s operations to 13 milling, processing, and lab facilities across the United States and Canada. However, this acquisition primarily focuses on gluten-free oats (SowNaked Mindfully Farmed Oats) rather than rice flour.

Report Coverage:

The research report offers an in-depth analysis based on Type, Rice Source, Nature, Application, Distribution Channel, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage]

Future Outlook:

- Demand for gluten-free foods will elevate global consumption patterns.

- Clean-label and organic trends will increase adoption across premium products.

- Innovation in milling technology will enhance texture and stability.

- Specialty flour grades will gain traction for functional food applications.

- Retail expansion will strengthen household consumption across new regions.

- B2B demand will grow due to reformulation in bakery and snack segments.

- Plant-based foods will integrate rice flour for smoother texture profiles.

- Online channels will widen market access for small and mid-size brands.

- Regional suppliers will scale output to support export growth.

- Sustainability initiatives will push producers toward eco-friendly sourcing.