Market Overview

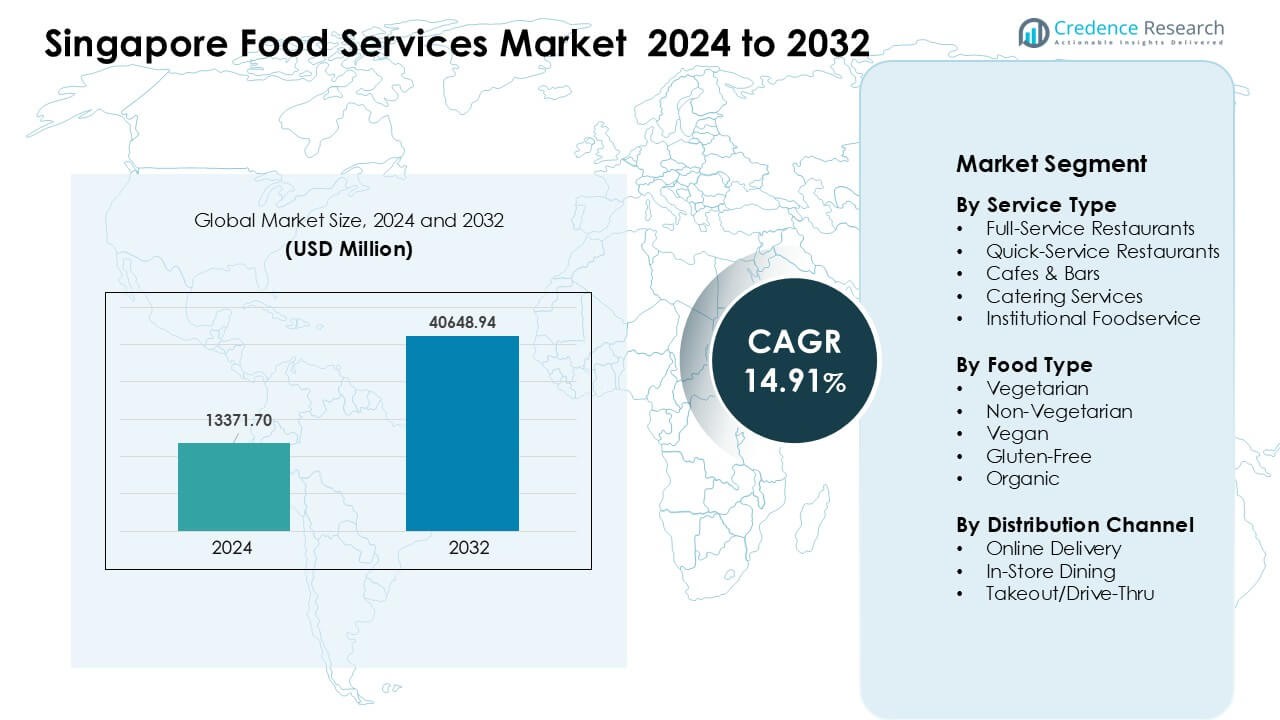

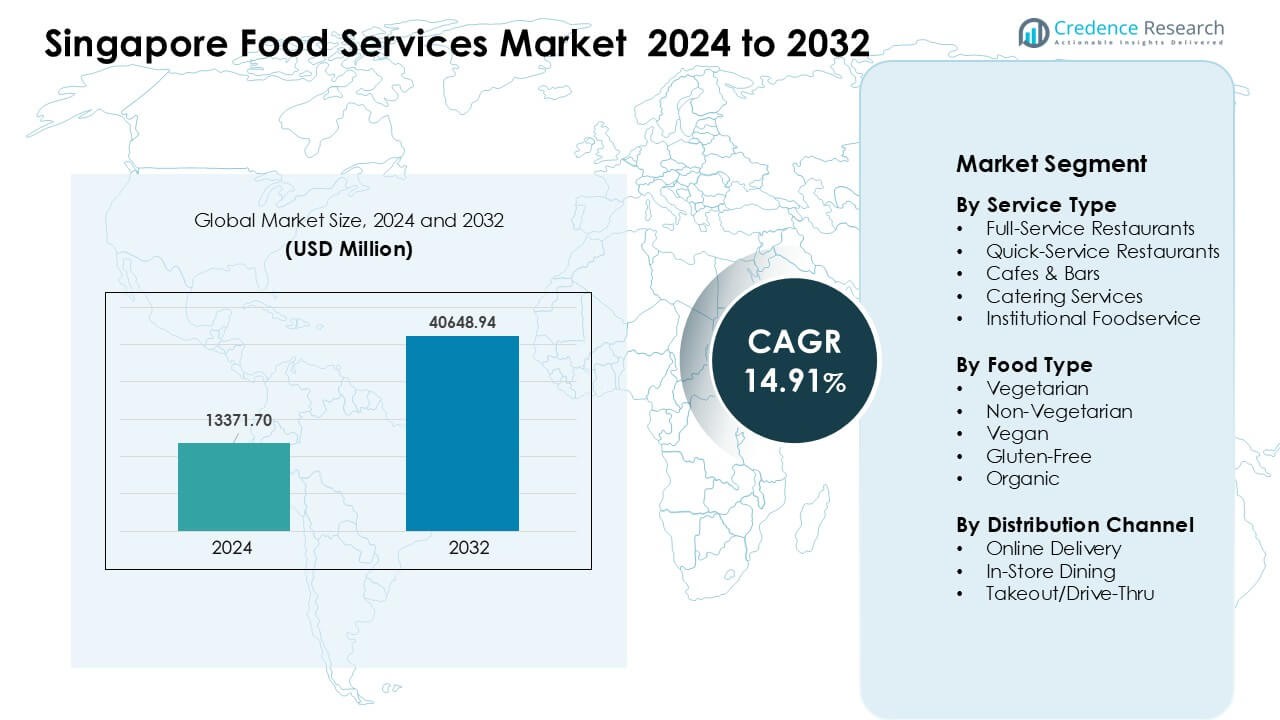

Singapore Food Services Market was valued at USD 13371.70 million in 2024 and is anticipated to reach USD 40648.94 million by 2032, growing at a CAGR of 14.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Singapore Food Services Market Size 2024 |

USD 13371.70Million |

| Singapore Food Services Market, CAGR |

14.91% |

| Singapore Food Services Market Size 2032 |

USD 40648.94 Million |

The Singapore food services market features strong competition from major players such as Starbucks Corporation, Domino’s Pizza Enterprises Ltd., Paradise Group Holdings Pte Ltd, DFI Retail Group Holdings Limited, Jollibee Foods Corporation, Nandos Chickenland Singapore Pte Ltd, Crystal Jade Culinary Concepts Holding, Doctor’s Associates, Inc., Hanbaobao Pte Ltd, and QSR Brands (M) Holdings Sdn. Bhd. These companies expand through digital ordering, menu innovation, and multi-format outlets that target both premium and value-driven consumers. Singapore City-Centre remained the leading region in 2024 with about 39% share, supported by high tourism flow, dense office clusters, and strong demand for premium and experiential dining options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Singapore food services market reached USD 70 million in 2024 and is set to grow at a CAGR of 14.91% through 2032.

- Rising demand for premium dining, diverse cuisines, and digital ordering drives strong growth, with full-service restaurants leading the service type segment at about 42% share.

- Key trends include rapid expansion of online delivery, cloud kitchens, healthier menus, and hybrid dining formats that attract young and urban consumers.

- Competition intensifies as brands like Starbucks, Domino’s, Paradise Group, and DFI Retail Group expand through menu upgrades, loyalty programs, and omnichannel strategies.

- Singapore City-Centre led the market in 2024 with about 39% share, supported by high tourist activity and strong office demand, while the Eastern Region followed with around 22% share due to airport traffic and dense residential zones.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Service Type

Full-service restaurants led the Singapore food services market in 2024 with about 42% share. Diners preferred full-service formats due to wider menu options, stronger brand presence, and rising demand for premium dining. Growth also came from tourism recovery and higher spending on social dining. Quick-service restaurants grew fast as busy workers sought fast meals and steady prices. Cafes and bars expanded through strong coffee culture and young consumer traffic. Catering and institutional foodservice saw stable orders from schools, offices, and events.

- For instance, one report specifies that full-service restaurants had the largest share of the global foodservice market in 2024, at 46.49%, with quick-service restaurants accounting for a smaller portion.

By Food Type

The non-vegetarian food dominated the food type segment with nearly 58% share. Singapore consumers favored meat and seafood dishes due to strong hawker culture and global cuisine influence. Rising restaurant chains offering Asian fusion and premium meat menus supported this lead. Vegetarian and vegan options grew fast as health awareness increased among young adults. Gluten-free and organic menus expanded in niche urban areas where high-income households showed deeper interest in clean-label meals.

- For instance, a 2023 survey of dietary preferences found that about 51% of Singaporeans identify themselves as “meat eaters,” while only around 5% say they follow a fully plant‑based diet (vegetarian/vegan), indicating that non-vegetarian consumption remains the default among the majority.

By Distribution Channel

In-store dining held the largest share in 2024 with around 49% share. Strong dining culture, busy malls, and widespread hawker centres kept footfall high. Many consumers still preferred on-premise meals for freshness and social experience. Online delivery grew quickly due to platforms like GrabFood and Foodpanda offering wide reach and fast delivery. Takeout and drive-thru also expanded as workers sought quick access to meals during peak hours. Growth across channels came from digital menus, loyalty apps, and easy mobile payments.

Key Growth Drivers

Rising Demand for Diverse and Premium Dining Experiences

Singapore’s food services market grows due to rising demand for diverse and premium dining. Urban consumers seek global cuisines, chef-led menus, and experiential dining formats that offer stronger value. Higher disposable incomes and strong tourism inflows support this shift toward upscale and themed restaurants. Families and young adults also prefer full-service outlets that provide comfort, variety, and social appeal. Premium seafood, fusion menus, and international brands continue to expand across malls and lifestyle districts. This trend strengthens the market as operators invest in menu innovation, interior upgrades, and omnichannel engagement to attract repeat customers.

Expansion of Online Delivery and Digital Ordering

Digital platforms play a major role in market expansion as consumers adopt fast and flexible meal access. Apps like GrabFood, Deliveroo, and Foodpanda drive heavy order volumes through wide restaurant listings and short delivery times. Busy workers choose online delivery for convenience, while families rely on bundled meal deals. Restaurants gain higher reach and improved sales through app-based promotions and subscription models. Digital payments, AI-based recommendations, and loyalty programs increase repeat use. Cloud kitchens further help brands scale without heavy rental costs. This shift improves market efficiency and strengthens overall growth.

- For instance, in 2023 GrabFood held about 63% of the online food delivery GMV share in Singapore, making it the largest delivery app operator in the country.

Rising Health and Sustainability Focus

Health awareness and sustainability interest drive growth in plant-based, organic, low-salt, and allergen-friendly menus. Singapore consumers increasingly value cleaner labels and transparent sourcing. Restaurants respond by adding vegetarian, vegan, and gluten-free options across mainstream menus. Sustainable packaging and reduced food waste practices also gain traction as regulators promote greener standards. Younger customers prefer brands that highlight nutrition data and responsible sourcing. Operators that offer balanced meals, fresh ingredients, and eco-friendly operations attract stronger loyalty. This long-term shift pushes the market toward healthier product development and greener business models.

Key Trends & Opportunities

Growth of Hybrid Dining and Experience-Led Concepts

Hybrid dining formats that mix casual, premium, and themed elements expand as customers seek fresh experiences. Social dining zones, interactive kitchens, and café-bar blends attract younger groups who prefer flexible spaces. Operators use live cooking, seasonal pop-ups, and brand collaborations to drive footfall. Experience-led dining also aligns well with tourism, which strengthens demand for unique local and global cuisine concepts. This creates opportunities for new formats, international brands, and lifestyle-driven restaurant clusters.

- For instance, in 2024 dine‑in outlets many of which include hybrid or experience‑driven restaurants accounted for 65.83% of the total food‑service market share in Singapore, indicating strong consumer preference for on‑premise, experience‑oriented dining.

Expansion of Cloud Kitchens and Menu Innovation

Cloud kitchens continue to rise as brands use low-overhead spaces to scale delivery menus. These kitchens allow faster experimentation with new cuisines, fusion offerings, and seasonal dishes. Multi-brand operators launch virtual restaurants that target niche tastes with minimal risk. Menu innovation increases variety, boosts customer interest, and improves platform visibility. This trend creates opportunities for small and mid-sized operators to grow without high rental pressure.

- For instance, according to a 2024 market analysis, cloud kitchens in Singapore are among the fastest-growing segments their revenue is projected to grow at a 20.55% CAGR from 2025 to 2030, indicating growing confidence and investment in delivery‑only kitchen models.

Key Challenges

High Operating Costs and Labour Shortages

The food services market faces pressure from high rents, rising utility costs, and staffing shortages. Restaurants struggle to maintain margins as wages increase and turnover stays high. Smaller operators face higher financial strain, which limits expansion and innovation. Labour shortages reduce service speed and menu complexity, affecting customer experience. Many operators invest in automation, training, and productivity tools to reduce operating pressure.

Strong Competition and Price Sensitivity

Singapore’s dense food landscape creates intense competition between hawkers, quick-service chains, cafés, and full-service restaurants. Consumers compare prices easily across apps, which increases price sensitivity. Heavy promotions reduce profitability, especially for mid-tier outlets. Brands must differentiate through menu quality, service speed, and digital engagement. Operators that fail to offer clear value struggle to retain customers in this crowded environment.

Regional Analysis

Changi and Eastern Region

Changi and the Eastern Region accounted for about 22% share of the Singapore food services market in 2024. The airport remains the core driver, attracting international travelers, airline staff, and transit passengers who support strong demand for both premium and fast-casual dining. Residential hubs such as Tampines, Bedok, and Pasir Ris add steady daily consumption across cafés, quick-service outlets, and family restaurants. Dense housing clusters boost online delivery volumes, while malls generate strong weekend footfall. Ongoing airport upgrades and rising tourism continue to reinforce long-term growth across diverse food formats.

Singapore City-Centre

The Singapore City-Centre held the largest share in 2024 with nearly 39%. This region covers the CBD, Orchard, Bugis, and surrounding commercial districts, drawing heavy footfall from office workers, tourists, and high-income households. Premium restaurants, international chains, and specialty cafés dominate due to strong spending power and high brand visibility. Retail-driven dining, business lunches, and nightlife activities further boost demand. Frequent menu innovation, concept launches, and experiential dining formats keep the City-Centre the most dynamic and competitive region in the national market.

Southern Islands and Outer Regions

The Southern Islands and outer regions held close to 5% share in 2024, reflecting their smaller population base but steady tourism-led demand. Dining activity is concentrated in resorts, beach clubs, and leisure attractions that attract visitors seeking premium, themed, or nature-focused experiences. Operators rely on curated menus, event-focused dining, and seasonal promotions to maintain traffic. Greater interest in eco-tourism and recreational trips supports gradual expansion. Although footfall remains lower than mainland regions, improved transport links and rising leisure travel continue to strengthen niche market opportunities.

Marina Bay and Sentosa

Marina Bay and Sentosa captured around 18% share in 2024, supported by luxury tourism, integrated resorts, and large-scale entertainment venues. High-end restaurants, celebrity-chef concepts, and waterfront dining attract affluent travelers and business visitors. Convention centers, hotels, and casinos sustain year-round demand for premium dining. The region benefits from strong international cuisine offerings and high event activity. Continued investment in hospitality, attractions, and lifestyle developments supports steady growth, making this area a key hub for upscale and experience-driven food service formats.

Western and North-Eastern Region

The Western and North-Eastern Region recorded nearly 16% share in 2024, driven by expanding residential districts and rising mall development. Jurong’s commercial and transit hubs boost demand for quick-service outlets, cafés, and multicultural restaurants. In the North-East, towns like Punggol and Sengkang attract young families who drive strong café culture and high online delivery usage. Growing educational and commercial facilities enhance weekday traffic, while lifestyle malls support weekend dining. As new housing projects and transport upgrades progress, both areas continue to strengthen their position in Singapore’s food services market.

Market Segmentations:

By Service Type

- Full-Service Restaurants

- Quick-Service Restaurants

- Cafes & Bars

- Catering Services

- Institutional Foodservice

By Food Type

- Vegetarian

- Non-Vegetarian

- Vegan

- Gluten-Free

- Organic

By Distribution Channel

- Online Delivery

- In-Store Dining

- Takeout/Drive-Thru

By Geography

- Changi and Eastern Region

- Singapore City-Centre

- Southern Islands and Outer Regions

- Marina Bay and Sentosa

- Western and North-Eastern Region

Competitive Landscape

The competitive landscape of the Singapore food services market remains intense, driven by a mix of global chains, regional operators, and strong local brands. Players such as Starbucks Corporation, Domino’s Pizza Enterprises Ltd., Paradise Group Holdings Pte Ltd, DFI Retail Group Holdings Limited, and Jollibee Foods Corporation expand through menu innovation, digital ordering, and multi-format outlets. Growing interest in healthier meals, premium dining, and delivery-focused concepts pushes operators to refresh product lines and enhance customer experience. New entrants use niche cuisines and lifestyle concepts to win younger consumers, while established brands strengthen loyalty through mobile apps and membership programs. Rising labour and rental costs encourage investment in automation, supply chain optimization, and cloud kitchens. Competitive pressure intensifies as brands compete on value, convenience, and brand differentiation across both physical and online channels, shaping a dynamic and fast-evolving market.

Key Player Analysis

- Starbucks Corporation

- Domino’s Pizza Enterprises Ltd.

- Paradise Group Holdings Pte Ltd

- DFI Retail Group Holdings Limited

- Jollibee Foods Corporation

- Nandos Chickenland Singapore Pte Ltd

- Crystal Jade Culinary Concepts Holding

- Doctor’s Associates, Inc.

- Hanbaobao Pte Ltd

- QSR Brands (M) Holdings Sdn. Bhd.

Recent Developments

- In April 2025, Starbucks Corporation Opened a landmark heritage / concept store at 37 Smith Street (Chinatown, Singapore) featuring local-design elements, exclusive Singapore-inspired drinks and food (collab with Old Seng Choong) and limited-run merchandise. The outlet launched a Singapore-exclusive menu and drew local press attention on opening.

- In May 2024, Paradise Group Holdings (Singapore) Announced further US expansion plans (aiming to reach multiple outlets in California and first Texas outlet; part of Paradise Group’s overseas growth push).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Food type, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as consumers seek diverse global cuisines and premium dining.

- Digital ordering and delivery platforms will gain stronger adoption across age groups.

- Cloud kitchens will grow as operators reduce rental costs and scale faster.

- Health-focused menus will rise as demand for vegan, organic, and allergen-free meals increases.

- Automation will improve speed, reduce labour pressure, and enhance service consistency.

- Experiential dining formats will attract tourists and young urban consumers.

- Sustainability practices will strengthen, with greener packaging and reduced food waste.

- Competition will intensify as international and local brands broaden menu offerings.

- Retail and transit hubs will drive higher food traffic with new lifestyle developments.

- Hybrid dining models will expand as brands blend dine-in, takeaway, and delivery for flexible consumption.

Market Segmentation Analysis:

Market Segmentation Analysis: