Market Overview

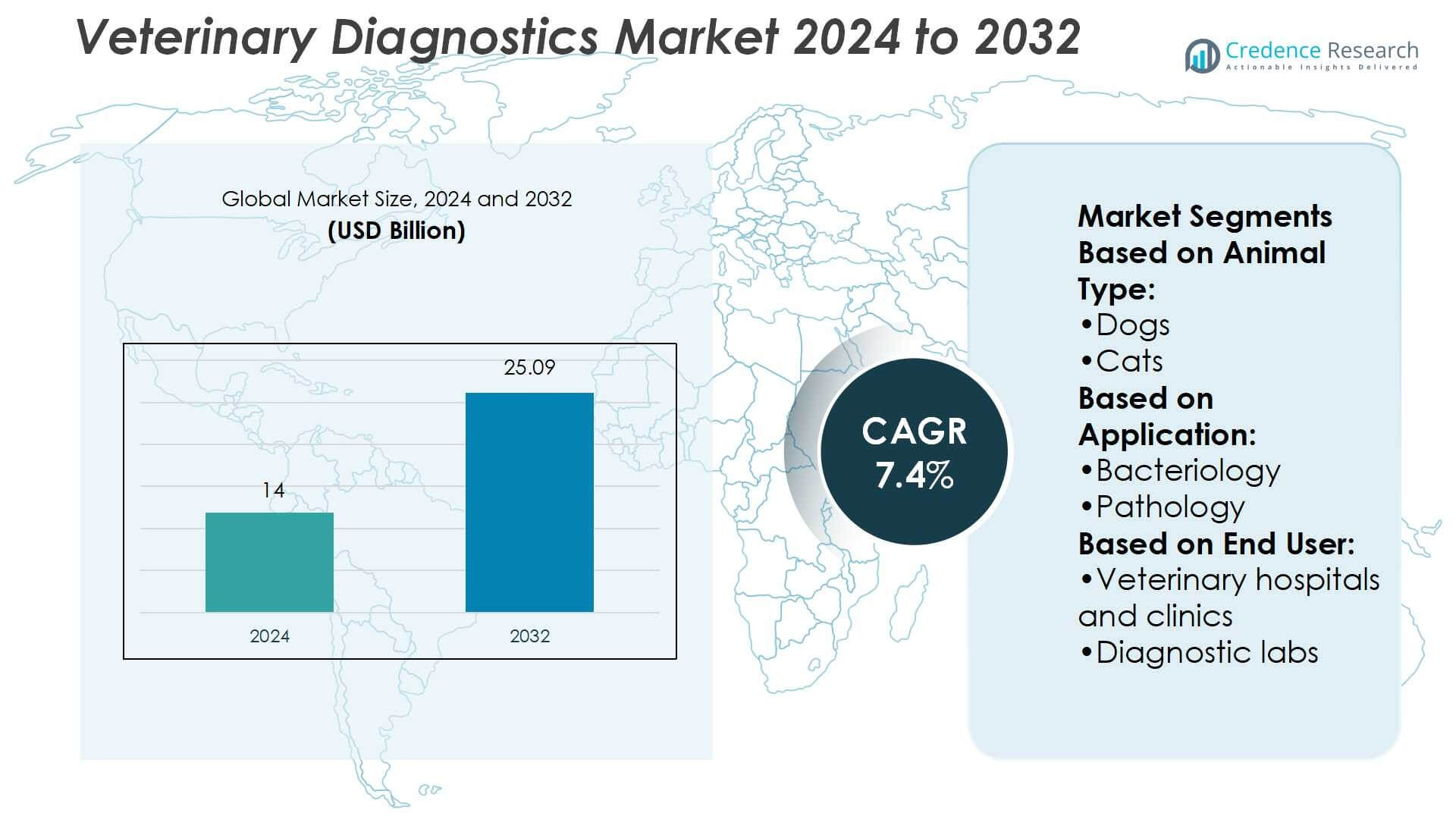

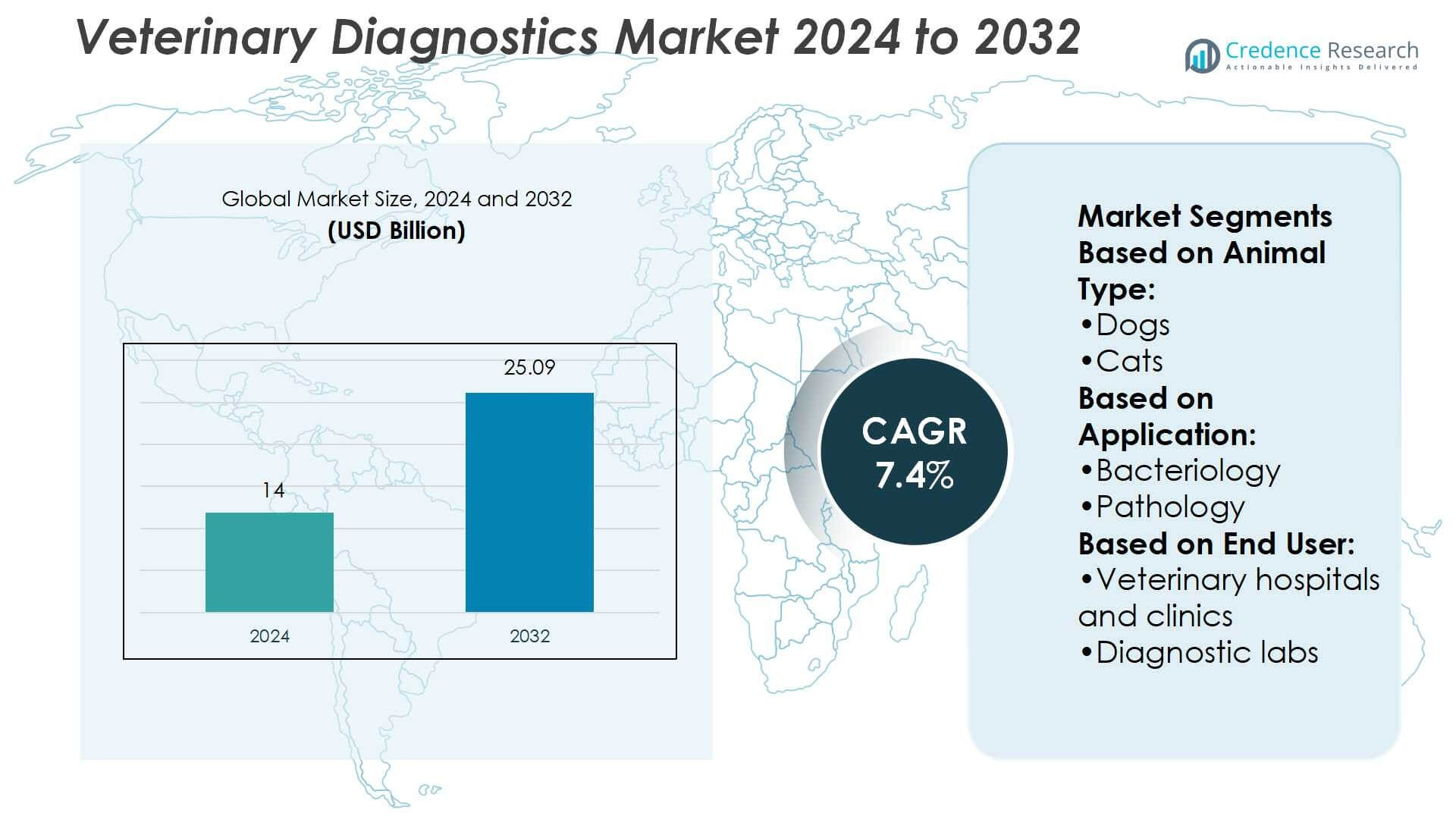

Veterinary Diagnostics Market size was valued USD 14 billion in 2024 and is anticipated to reach USD 25.09 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Diagnostics Market Size 2024 |

USD 14 Billion |

| Veterinary Diagnostics Market, CAGR |

7.4% |

| Veterinary Diagnostics Market Size 2032 |

USD 25.09 Billion |

The veterinary diagnostics market is shaped by leading players such as Zoetis, Ceva Santé Animale, Vetoquinol S.A., Dechra Pharmaceuticals PLC, Neogen Corp., Phibro Animal Health, Biogénesis Bagó, and Hester Biosciences, each focusing on innovation, product diversification, and strategic collaborations. These companies strengthen their positions through advanced molecular diagnostics, point-of-care testing devices, and AI-driven platforms to meet rising demand for preventive animal healthcare. North America leads the global veterinary diagnostics market with a 35% share, supported by strong veterinary infrastructure, high pet ownership, and substantial healthcare expenditure. This regional dominance highlights the integration of advanced technologies and widespread adoption across veterinary hospitals and diagnostic labs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The veterinary diagnostics market was valued at USD 14 billion in 2024 and is projected to reach USD 25.09 billion by 2032, registering a CAGR of 7.4% during the forecast period.

- Rising pet ownership, increasing prevalence of animal diseases, and growing awareness of preventive healthcare are key drivers boosting the adoption of advanced diagnostic tools and services.

- Trends such as molecular diagnostics, point-of-care testing, and AI-driven platforms are reshaping the market, enabling faster, more accurate results and supporting the shift toward personalized veterinary care.

- The market faces restraints including high costs of advanced diagnostic technologies and limited awareness in emerging economies, which challenge wider adoption and accessibility.

- North America leads the market with a 35% share, driven by robust veterinary infrastructure and healthcare spending, while companion animals, particularly dogs, dominate the animal type segment, reflecting the highest demand for diagnostics.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Animal Type

The companion animals segment dominates the veterinary diagnostics market with the largest share, led by dogs. Rising pet ownership, preventive healthcare awareness, and the growing demand for advanced diagnostic services contribute to this leadership. Dogs account for a substantial portion due to their higher prevalence of chronic and infectious diseases, which require routine testing and monitoring. Cats follow closely, supported by increasing adoption in urban households. Horses and other companion animals remain smaller contributors, driven mainly by niche demand. Growth is fueled by technological advancements, such as point-of-care testing and molecular diagnostics tailored for companion species.

- For instance, Zoetis introduced its Vetscan Imagyst platform, which integrates artificial intelligence to analyze fecal samples and can detect intestinal parasites with an accuracy rate exceeding 95%, processing each test in under 10 minutes, significantly improving turnaround time in veterinary clinics.

By Application

The clinical pathology segment holds the largest market share in the veterinary diagnostics market by application. Its dominance is driven by routine blood tests, urinalysis, and fecal examinations that support early disease detection and monitoring. Rising cases of chronic illnesses, such as diabetes and kidney disorders in companion animals, strengthen demand. Imaging diagnostics, including X-rays and ultrasounds, follow closely due to their role in diagnosing orthopedic and internal conditions. Molecular diagnostics and immunodiagnostics are gaining traction with technological progress and higher adoption of advanced testing. The strong emphasis on preventive healthcare continues to drive growth in clinical pathology.

- For instance, Dechra’s ACTH stimulation test monitoring shows that post-ACTH serum cortisol concentrations between 1.45 and 9.1 µg/dL (4-6 hours after VETORYL administration) correlate with positive improvements in clinical signs.

By End User

Veterinary hospitals and clinics hold the largest market share in the end-user segment. Their dominance comes from high patient inflow, availability of advanced diagnostic tools, and a wide range of services. These facilities are primary access points for pet owners seeking routine checkups and disease management, making them critical users of diagnostic kits and instruments. Diagnostic labs follow, benefiting from specialized testing and outsourcing trends. Home care settings are gaining traction due to portable diagnostic devices, while other end users contribute modestly. The rising demand for preventive screening and timely disease detection strengthens hospital and clinic leadership.

Key Growth Drivers

Rising Pet Ownership and Expenditure

Increasing pet ownership worldwide and higher spending on animal healthcare strongly drive the veterinary diagnostics market. Pet owners are prioritizing preventive care, routine checkups, and advanced testing, fueling demand for diagnostic services. Dogs and cats, in particular, account for the majority of diagnostic procedures due to higher disease incidence. The shift toward treating pets as family members further boosts expenditure on sophisticated diagnostic tools. This trend creates sustained growth, as more households invest in comprehensive veterinary healthcare solutions.

- For instance, Biogenesis Bago opened a new vaccine production plant in Campo Largo, Brazil, with capacity to produce over 10 million doses per year of live attenuated virus vaccines for pets and farm animals, using a 4,000 square meter facility equipped with high-throughput filling lines and state-of-art R&D labs across species.

Advancements in Diagnostic Technologies

Rapid innovation in diagnostic methods, such as molecular diagnostics, immunoassays, and point-of-care testing, supports market expansion. These technologies offer improved accuracy, faster results, and early disease detection, strengthening adoption among veterinary hospitals and clinics. Portable and user-friendly devices also enable home-based diagnostic support, enhancing accessibility for pet owners. Integration of digital platforms and AI-powered tools further refines diagnostic capabilities. The growing adoption of these advanced technologies accelerates the ability to manage chronic diseases and infectious conditions effectively, fueling sustained growth.

- For instance, Phibro offers a diagnostics lab capable of precise bacterial isolation, serotyping and PCR assays that detect specific virulence genes, with turnaround time for PCR tests at their lab sometimes under 48 hours, and their autogenous vaccine service using those isolates to develop customized vaccines via the Tailor-Made® platform.

Rising Prevalence of Animal Diseases

The increasing occurrence of zoonotic and chronic animal diseases remains a major driver for veterinary diagnostics. Outbreaks of infectious conditions, such as parvovirus and feline leukemia, highlight the need for timely testing and monitoring. Chronic conditions like diabetes, kidney disorders, and cancers in companion animals also demand frequent diagnostics. This surge in disease prevalence compels veterinarians to rely on advanced diagnostic solutions to ensure accurate treatment. The demand for disease surveillance and monitoring continues to expand the use of diagnostic kits and equipment.

Key Trends & Opportunities

Adoption of Point-of-Care Testing

Point-of-care testing is emerging as a key trend, offering rapid and reliable results within veterinary practices. These portable solutions improve decision-making speed, enabling same-day diagnosis and treatment. Growing demand for convenience and early disease detection supports the adoption of handheld and in-clinic testing devices. This trend opens opportunities for manufacturers to design cost-effective and user-friendly diagnostic solutions, further expanding market penetration across both urban and rural areas.

- For instance, Vetoquinol has a Biosecurity & Diagnostics division that supports diagnostic product lines alongside its R&D of over 150 employees, working globally to develop formats like single-dose injectables and formulations that are easy for pet owners to administer accurately.

Integration of Digital and AI Tools

The use of digital platforms and AI-driven analytics in veterinary diagnostics is expanding rapidly. AI assists in interpreting diagnostic images, identifying patterns, and reducing human error, while cloud-based platforms support remote access to test results. This integration improves efficiency in veterinary practices and facilitates better collaboration among professionals. The trend creates opportunities for innovation in telemedicine and remote diagnostics, aligning with the rising preference for digital healthcare services in animal health.

- For instance, Neogen’s Petrifilm® system can count up to 900 plates per hour with a reader, while using up to 85% less space compared to agar methods, and delivers results in about half the time, helping labs accelerate throughput.

Key Challenges

High Cost of Advanced Diagnostics

The high cost of advanced diagnostic technologies, including molecular and imaging tools, poses a significant challenge. Many veterinary practices, particularly in developing markets, face budget constraints, limiting adoption. Pet owners in cost-sensitive regions may also avoid expensive diagnostic tests, impacting market penetration. Manufacturers must address affordability by offering flexible pricing models and developing lower-cost alternatives to ensure wider accessibility and uptake.

Limited Awareness in Developing Regions

In several emerging markets, limited awareness about the importance of veterinary diagnostics hampers growth. Many pet owners prioritize basic treatment over preventive testing, reducing demand for advanced diagnostics. Lack of adequate infrastructure and trained professionals further restricts adoption in rural areas. This challenge creates a need for awareness programs, educational campaigns, and investment in veterinary infrastructure to enhance diagnostic utilization and market expansion globally.

Regional Analysis

North America

North America holds the largest share of the veterinary diagnostics market, accounting for more than 35%. The region benefits from advanced veterinary healthcare infrastructure, high pet ownership rates, and strong expenditure on companion animal health. The U.S. dominates with a robust network of veterinary hospitals and diagnostic labs supported by technological adoption, including molecular assays and point-of-care devices. Rising prevalence of chronic diseases in pets and favorable insurance coverage also drive growth. Canada contributes significantly, with increasing demand for preventive diagnostics and advanced care, strengthening North America’s leadership position in the global market.

Europe

Europe captures nearly 28% of the veterinary diagnostics market share, making it the second-largest region. Countries such as Germany, the UK, and France drive growth through well-established veterinary practices, high awareness of preventive healthcare, and supportive government initiatives. Rising adoption of pets, particularly cats and dogs, strengthens demand for routine testing. Diagnostic advancements, including imaging and molecular tools, are widely implemented across clinics and labs. Additionally, the European market benefits from strict regulations on animal health and zoonotic disease monitoring. Growing investment in research and collaborations further reinforces Europe’s position in the veterinary diagnostics market.

Asia Pacific

Asia Pacific represents about 22% of the veterinary diagnostics market share and is the fastest-growing region. Expanding middle-class populations in China, India, and Southeast Asia drive higher pet ownership and healthcare spending. Rising prevalence of zoonotic diseases and growing awareness of preventive diagnostics fuel demand across both companion and livestock segments. Japan and Australia remain advanced markets, adopting cutting-edge molecular and imaging diagnostics. Meanwhile, China and India see rapid infrastructure development in veterinary clinics and diagnostic labs. Increasing investment from international companies and government programs to improve animal health boost Asia Pacific’s growth trajectory.

Latin America

Latin America holds nearly 8% of the veterinary diagnostics market share, supported by rising urbanization and increasing adoption of companion animals. Brazil and Mexico lead the regional market, benefiting from expanding veterinary hospital networks and growing demand for preventive care. Despite challenges such as limited infrastructure and price sensitivity, adoption of portable and point-of-care devices is increasing. Rising awareness of zoonotic disease risks further drives the need for reliable diagnostic testing. International players are expanding partnerships in the region to improve accessibility, making Latin America an emerging market with promising long-term growth opportunities.

Middle East & Africa

The Middle East & Africa accounts for about 7% of the veterinary diagnostics market share, reflecting gradual adoption. The Gulf countries, led by Saudi Arabia and the UAE, drive growth through investments in advanced veterinary care and rising pet adoption trends. In Africa, demand for livestock diagnostics is increasing due to disease management and food security concerns, though infrastructure limitations remain. Growing awareness of zoonotic diseases and government initiatives to enhance veterinary services are supporting market expansion. Despite slower adoption compared to other regions, MEA shows strong potential for steady growth in the coming years.

Market Segmentations:

By Animal Type:

By Application:

By End User:

- Veterinary hospitals and clinics

- Diagnostic labs

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The veterinary diagnostics market include Zoetis, Ceva Santé Animale, Dechra Pharmaceuticals PLC, Biogénesis Bagó, Phibro Animal Health, Vetoquinol S.A., Neogen Corp., and Hester Biosciences, alongside repeated mentions of Ceva Santé Animale and Vetoquinol S.A. The veterinary diagnostics market is characterized by intense competition, driven by rapid technological advancements and rising demand for accurate, timely animal healthcare solutions. Companies are heavily investing in molecular diagnostics, immunoassays, and point-of-care testing devices to meet the growing need for preventive and routine testing. The competitive environment is further shaped by digital innovations, including AI-based platforms and cloud-enabled diagnostic systems that enhance accuracy and accessibility. Strategic collaborations with veterinary hospitals, clinics, and diagnostic laboratories are common approaches to strengthen market reach. Continuous research and development, coupled with expansion into emerging regions, remains central to sustaining competitiveness and long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zoetis

- Ceva Sante Animale

- Dechra Pharmaceuticals PLC

- Biogenesis Bago

- Phibro Animal Health

- Vetoquinol S.A.

- Neogen Corp.

- Hester Biosciences

- Ceva Sante Animale

- Vetoquinol S.A.

Recent Developments

- In April 2025, Transcend Biologics introduced TropoVet™ PRP, a regenerative medicine product designed for the veterinary market. The company, founded from Eclipse MedCorp, brings decades of experience in medical devices to support advancements in pet health care.

- In April 2025, Cordyceps Sunshine Biotech Holdings (C.S Group) unveiled its Antcin A-based veterinary drug initiative for Taiwan and China. The announcement was made during a major conference on the applications of Taiwanofungus camphoratus in the pet industry.

- In March 2025, Privo Technologies Inc. launched BeneVet Oncology, a new subsidiary focused on veterinary health. The company aims to use its innovative drug delivery systems to treat cancer and other conditions in companion animals.

- In September 2024, Zoetis Inc. introduced Vetscan OptiCell, a new cartridge-based hematology analyzer that employs AI-powered technology to deliver precise Complete Blood Count (CBC) analysis at the point of care, offering lab-quality results with time, cost, and space efficiencies for veterinary clinics.

- In July 2024, EKF Diagnostics launched the Biosen C-Line, an advanced glucose and lactate analyzer designed for enhanced usability. It features a touch screen and advanced connectivity options to integrate seamlessly with hospital and lab IT systems via EKF Link.

Report Coverage

The research report offers an in-depth analysis based on Animal Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with rising pet ownership worldwide.

- Preventive healthcare adoption will strengthen demand for routine diagnostics.

- Point-of-care testing devices will see higher integration in veterinary practices.

- Molecular and genetic testing will expand applications in early disease detection.

- Digital platforms and AI tools will enhance diagnostic accuracy and speed.

- Emerging markets will offer growth opportunities through improved veterinary infrastructure.

- Partnerships with clinics and labs will drive wider accessibility of advanced diagnostics.

- Increasing prevalence of zoonotic diseases will boost surveillance and testing needs.

- Portable and home-based diagnostic solutions will gain traction among pet owners.

- Investment in R&D will remain critical for innovation and competitive advantage.

Market Segmentation Analysis:

Market Segmentation Analysis: