Market Overview

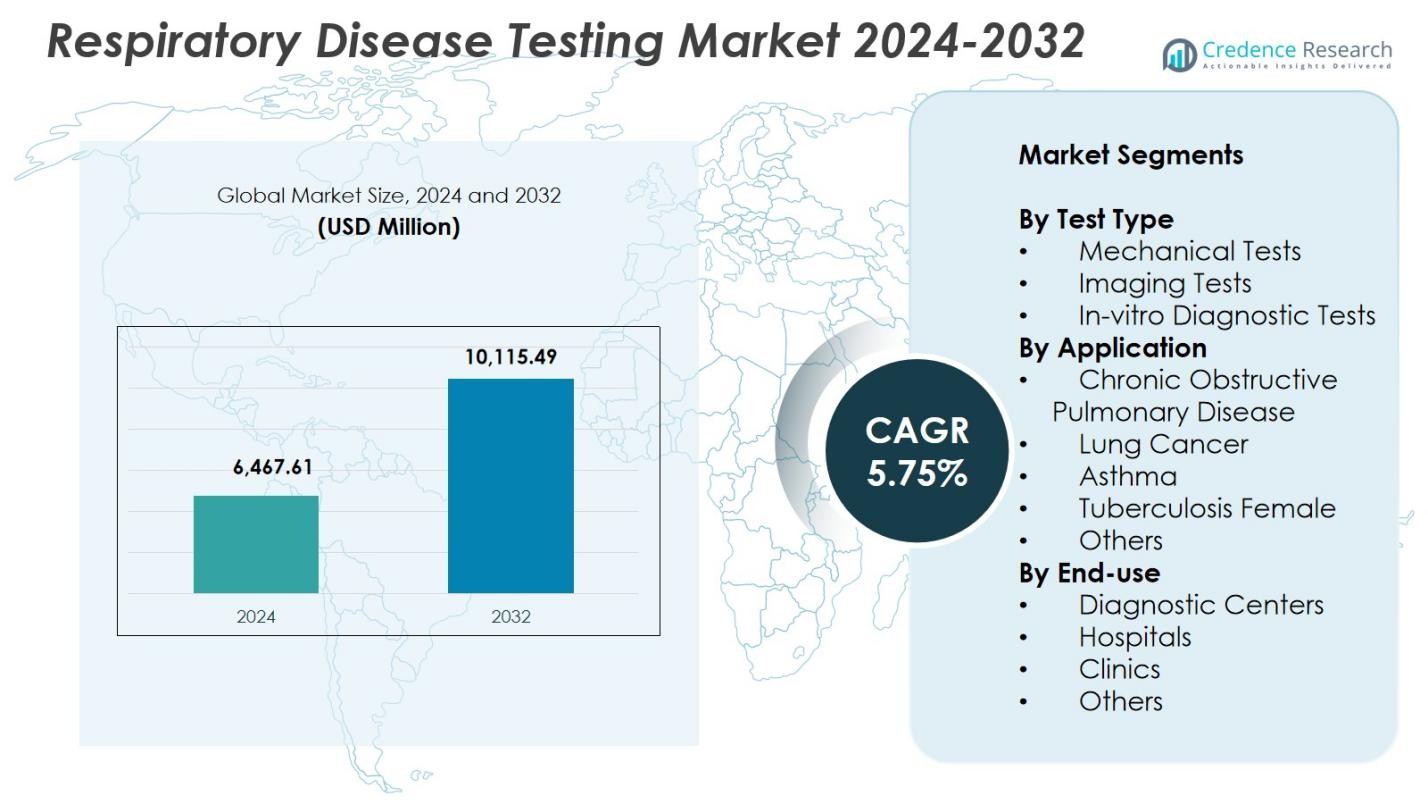

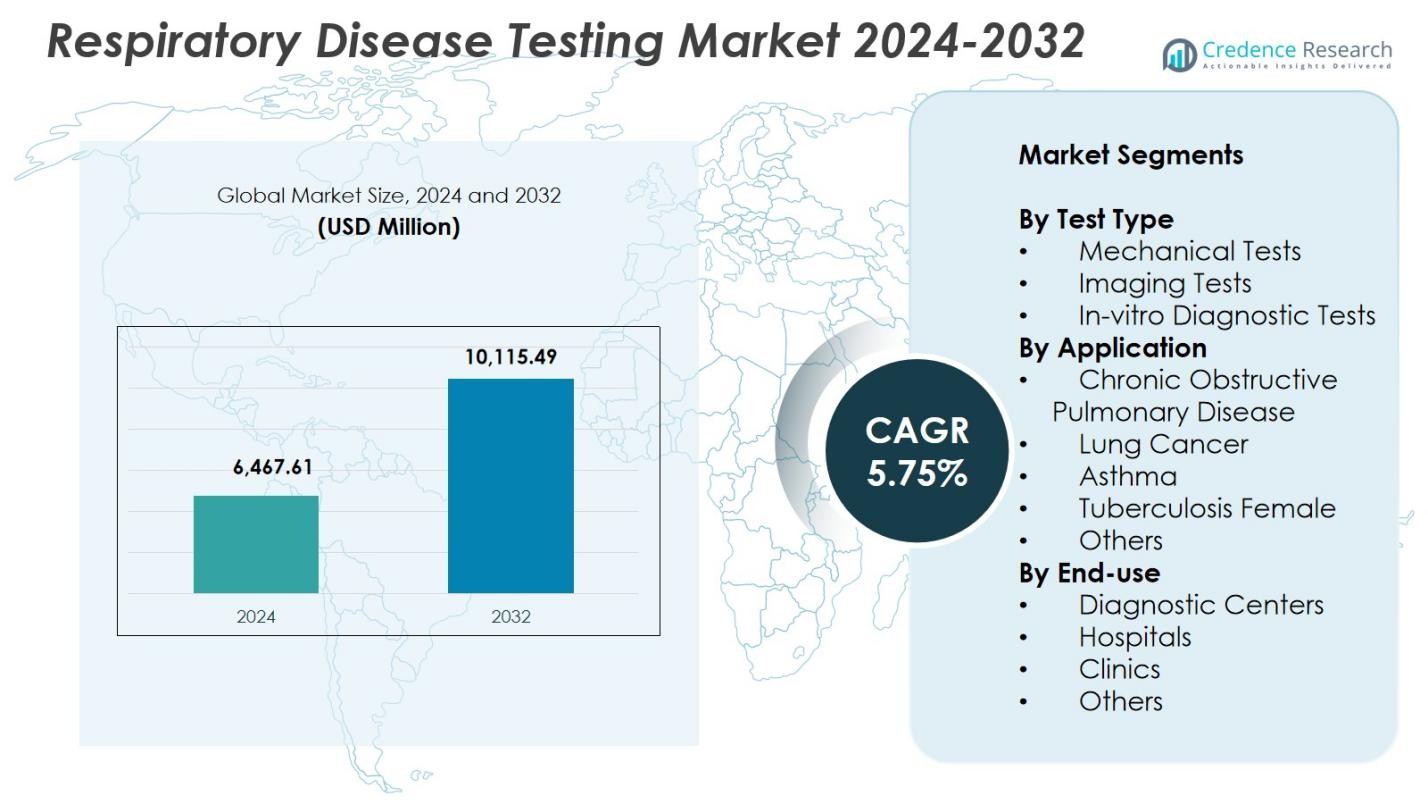

Respiratory Disease Testing Market size was valued at USD 6,467.61 Million in 2024 and is anticipated to reach USD 10,115.49 Million by 2032, at a CAGR of 5.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Respiratory Disease Testing Market Size 2024 |

USD 6,467.61 Million |

| Respiratory Disease Testing Market, CAGR |

5.75% |

| Respiratory Disease Testing Market Size 2032 |

USD 10,115.49 Million |

The Respiratory Disease Testing Market is shaped by the strong presence of leading players such as Medtronic, CAREstream Medical Ltd, VYAIRE MEDICAL INC, ResMed, Thermo Fischer Scientific, Fischer & Paykel, BioMerieux SA, Becton, Dickinson and Company, Abbott, and Koninklijke Philips N.V, who drive advancements in molecular diagnostics, imaging systems, spirometry devices, and point-of-care solutions. These companies focus on enhancing diagnostic accuracy, speed, and accessibility through continuous innovation and technology integration. North America led the market with 41.3% share in 2024, supported by robust healthcare infrastructure, high disease prevalence, and strong adoption of advanced respiratory diagnostic tools.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Respiratory Disease Testing Market reached USD 6,467.61 Million in 2024 and is projected to reach USD 10,115.49 Million by 2032, growing at a CAGR of 5.75%.

- Rising prevalence of COPD, asthma, lung cancer, and tuberculosis continues to drive strong demand for advanced diagnostics, including molecular assays, imaging systems, and spirometry tools.

- Key trends include rapid adoption of AI-powered imaging, digital spirometry, point-of-care PCR platforms, and home-based respiratory monitoring solutions that support early detection and remote care.

- Major players such as Medtronic, ResMed, Abbott, BioMerieux SA, Thermo Fischer Scientific, and VYAIRE MEDICAL INC expand product capabilities through innovation and healthcare partnerships.

- North America led with 41.3% share, Europe followed with 29.6%, and the In-vitro Diagnostic Tests segment dominated with 46.8% share, while high diagnostic equipment costs and workforce shortages remain notable restraints.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Test Type:

The Respiratory Disease Testing Market is dominated by In-vitro Diagnostic (IVD) Tests, which accounted for 46.8% share in 2024, driven by their widespread use for early detection of respiratory infections, high accuracy, and ability to support molecular assays such as PCR and antigen testing. Increasing incidence of COPD, asthma, and infectious diseases accelerates the need for rapid and reliable diagnostic solutions. Mechanical tests and imaging tests continue to grow as complementary modalities, but the scalability, rapid turnaround time, and integration of automation in IVD platforms reinforce their leadership across global healthcare settings.

- For instance, bioMérieux’s BIOFIRE Respiratory 2.1 (RP2.1) Panel serves as a frontline FDA-approved IVD test, identifying upper respiratory tract infections including COVID-19, influenza, and RSV in clinical settings.

By Application:

Chronic Obstructive Pulmonary Disease (COPD) led the Respiratory Disease Testing Market with 38.2% share in 2024, supported by rising global prevalence linked to smoking, pollution, and aging populations. The segment benefits from strong adoption of spirometry, biomarker-based testing, and imaging tools for disease monitoring and progression assessment. Advanced diagnostic systems offering early detection and personalized disease management accelerate growth. Asthma, lung cancer, tuberculosis, and other conditions continue to expand testing demand, but COPD remains the dominant application due to its chronic nature and the need for continuous diagnostic evaluation.

- For instance, ndd Medical Technologies offers the EasyOne Pro, a portable spirometer using TrueFlow ultrasound technology for accurate, calibration-free spirometry measurements in COPD patients.

By End-use:

The Hospitals segment dominated the Respiratory Disease Testing Market with 52.4% share in 2024, driven by their superior diagnostic infrastructure, availability of advanced imaging systems, and integration of molecular laboratories for high-volume testing. Hospitals serve as primary centers for managing acute and chronic respiratory conditions, enabling comprehensive evaluation through multidisciplinary care. Diagnostic centers and clinics continue to gain momentum with point-of-care testing and improved accessibility, yet hospitals remain the preferred end-use setting due to higher patient inflow, specialized respiratory units, and the ability to perform complex diagnostic procedures.

Key Growth Drivers

Rising Prevalence of Chronic and Infectious Respiratory Diseases

The increasing global burden of chronic and infectious respiratory conditions such as COPD, asthma, pneumonia, and tuberculosis continues to drive strong demand for advanced respiratory disease testing. Growing exposure to air pollution, tobacco consumption, occupational hazards, and lifestyle factors significantly elevates disease incidence across both developed and emerging regions. Healthcare providers are prioritizing early diagnosis to reduce complications, mortality rates, and overall treatment costs. As patient volumes rise, hospitals and diagnostic centers accelerate the adoption of modern testing modalities, including spirometry, biomarker assays, molecular diagnostics, and imaging technologies.

- For instance, Abbott’s ID NOW platform delivers rapid molecular results in 13 minutes or less for respiratory pathogens including influenza A/B, RSV, and strep A from nasal swabs. This point-of-care system aids quick differentiation of viral infections to guide therapy in settings with high patient volumes.

Expansion of Molecular and Point-of-Care Testing Capabilities

Advancements in molecular diagnostics and point-of-care (POC) technologies are reshaping the Respiratory Disease Testing Market by enabling rapid, accurate, and decentralized testing. PCR platforms, multiplex assays, and portable analyzers offer improved sensitivity for detecting viral and bacterial respiratory pathogens. Their capability to deliver actionable results within minutes supports timely clinical decisions, particularly during outbreaks and emergency care scenarios. Increased investment in POC innovation and integration with digital reporting tools strengthens accessibility in remote regions. These developments support early intervention, reduce disease transmission, and boost market growth.

- For instance, bioMérieux’s FilmArray system enables multiplex PCR detection of multiple respiratory viruses and bacteria simultaneously from a single sample, supporting comprehensive pathogen identification in minutes. Integration with automation enhances reliability for emergency care.

Increasing Healthcare Expenditure and Infrastructure Modernization

Rising healthcare spending, modernization of diagnostic infrastructure, and enhanced clinical capabilities in hospitals and diagnostic centers contribute significantly to market expansion. Governments and private healthcare investors are strengthening respiratory diagnostic capacities through new laboratory setups, improved imaging facilities, and adoption of automated testing systems. Emerging economies are prioritizing respiratory health due to rising pollution levels and growing patient loads, further accelerating investment. Enhanced reimbursement policies for respiratory testing and greater awareness of preventive healthcare also increase patient screening rates, reinforcing sustained market growth.

Key Trends & Opportunities

Integration of AI and Digital Technologies in Respiratory Diagnostics

Artificial intelligence, machine learning, and digital health tools are transforming respiratory disease diagnostics by improving accuracy, speed, and workflow efficiency. AI-powered imaging systems can detect early-stage abnormalities in lung scans, while algorithm-driven spirometry and predictive analytics enable better disease monitoring and risk assessment. Digital platforms also streamline data sharing between clinicians, supporting coordinated care. These innovations create opportunities for advanced diagnostic ecosystems that integrate automated interpretation, remote monitoring, and decision-support tools, addressing workforce shortages and enhancing diagnostic precision.

- For instance, Aidoc’s AI algorithms analyze chest CT scans and achieve 93% sensitivity in detecting pulmonary embolisms, enabling rapid triage and notification to care teams for faster intervention.

Growing Adoption of Home-Based and Remote Respiratory Testing Solutions

The shift toward home-based diagnostics and telehealth-supported testing presents significant opportunities, particularly for chronic respiratory disease management. Portable spirometers, remote monitoring kits, and digital breath-analysis tools empower patients to track symptoms and lung function from home, reducing hospital visits and improving long-term disease control. Manufacturers are developing user-friendly devices integrated with mobile apps for real-time data transmission. This trend aligns with the rising preference for decentralized care, supporting early intervention and continuous disease surveillance while easing the burden on healthcare facilities.

- For instance, MIR’s Smart One spirometer connects via Bluetooth to a dedicated smartphone app, enabling users to measure Peak Expiratory Flow (PEF) and Forced Expiratory Volume in 1 second (FEV1) in home settings for asthma or COPD monitoring.

Key Challenges

High Cost of Advanced Diagnostic Equipment and Testing Procedures

The elevated cost of respiratory imaging systems, molecular diagnostic platforms, and advanced analyzers remains a major challenge, particularly in low- and middle-income regions. High capital expenditure, recurring maintenance costs, and expensive consumables limit widespread adoption. Smaller clinics and diagnostic centers often struggle to justify investment, reducing access to advanced testing in underserved areas. Limited reimbursement coverage further exacerbates the issue, compelling patients to rely on basic diagnostics. This financial burden slows technology penetration and restricts equitable access to high-quality respiratory testing.

Shortage of Skilled Healthcare Professionals and Operational Barriers

The Respiratory Disease Testing Market faces persistent challenges due to limited availability of trained technicians, pulmonologists, and laboratory professionals capable of performing and interpreting advanced diagnostic tests. Inadequate training, high workload, and operational complexities in busy healthcare environments contribute to inefficient diagnostic workflows and delayed results. Additionally, stringent regulatory requirements and slow approval processes for innovative diagnostic technologies hinder timely market entry. These constraints affect testing accuracy, scalability, and service quality, ultimately limiting the market’s ability to meet growing diagnostic demands.

Regional Analysis

North America

North America dominated the Respiratory Disease Testing Market with 41.3% share in 2024, driven by advanced diagnostic infrastructure, high prevalence of COPD and asthma, and strong adoption of molecular and imaging-based testing. The region benefits from substantial healthcare spending, supportive reimbursement frameworks, and continuous technological innovation led by key manufacturers. Widespread integration of AI-enabled diagnostics, along with an extensive network of hospitals and specialized respiratory centers, enhances testing accuracy and accessibility. Growing awareness of early disease detection and an aging population further strengthen market growth across the United States and Canada.

Europe

Europe accounted for 29.6% share in 2024, supported by well-established healthcare systems, a rising burden of chronic respiratory diseases, and proactive public health initiatives promoting early screening. The region’s strong emphasis on preventive care and regulatory encouragement for advanced diagnostics foster steady adoption of molecular assays, spirometry, and imaging technologies. Countries such as Germany, the U.K., France, and Italy invest heavily in respiratory healthcare modernization. Increasing environmental pollution and occupational exposures further elevate testing demand. Ongoing collaborations between research institutes and diagnostic companies accelerate innovation and market expansion across the region.

Asia Pacific

Asia Pacific captured 21.8% share in 2024, propelled by rapid urbanization, high pollution levels, and increasing incidence of asthma, tuberculosis, and COPD. Expanding healthcare infrastructure in China, India, Japan, and Southeast Asia strengthens access to advanced diagnostic tools. Governments in the region are prioritizing early respiratory screening due to rising disease burdens and heightened public awareness. Growing investments in molecular diagnostics, imaging systems, and point-of-care devices drive significant market growth. The region’s large patient pool and improving affordability of diagnostic services position Asia Pacific as one of the fastest-growing markets through the forecast period.

Latin America

Latin America held 4.2% share in 2024, driven by increasing healthcare modernization, rising cases of chronic respiratory conditions, and improved access to diagnostic services in Brazil, Mexico, and Argentina. Public health initiatives targeting tuberculosis and smoking-related diseases support stronger adoption of diagnostic tests. Growth is further reinforced by expanding private healthcare facilities and gradual integration of molecular and imaging technologies. Despite economic constraints and uneven healthcare distribution, investments in urban medical centers and partnerships with global diagnostic companies help strengthen respiratory testing capabilities across major Latin American countries.

Middle East & Africa

The Middle East & Africa region accounted for 3.1% share in 2024, supported by growing healthcare investments, rising pollution-related respiratory conditions, and increased demand for early diagnostic screening. Gulf countries, including the UAE and Saudi Arabia, are expanding hospital infrastructure and adopting advanced molecular and imaging-based systems. In Africa, tuberculosis prevalence drives significant testing volume, though limited resources and workforce shortages constrain widespread adoption of high-end diagnostics. International health programs and technology partnerships continue to improve accessibility, supporting gradual market growth across the region.

Market Segmentations:

By Test Type

- Mechanical Tests

- Imaging Tests

- In-vitro Diagnostic Tests

By Application

- Chronic Obstructive Pulmonary Disease

- Lung Cancer

- Asthma

- Tuberculosis Female

- Others

By End-use

- Diagnostic Centers

- Hospitals

- Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Respiratory Disease Testing Market features leading players such as Medtronic, CAREstream Medical Ltd, VYAIRE MEDICAL INC, ResMed, Thermo Fischer Scientific, Fischer & Paykel, BioMerieux SA, Becton, Dickinson and Company, Abbott, and Koninklijke Philips N.V. These companies strengthen the market through continuous innovation, portfolio expansion, and strategic collaborations. Major manufacturers focus on advancing molecular diagnostics, spirometry systems, imaging technologies, and point-of-care solutions to support rapid and accurate respiratory disease detection. Increasing investment in AI-enabled diagnostics, remote monitoring tools, and automated laboratory systems further enhances technological leadership. Companies also expand global reach through partnerships with hospitals, diagnostic centers, and research institutes, while targeting emerging markets with cost-effective solutions. Regulatory approvals, product launches, and acquisitions remain key strategies to enhance competitive positioning. Overall, the market is characterized by strong R&D pipelines, expanding digital integration, and rising emphasis on early diagnosis.

Key Player Analysis

- Abbott

- Becton

- Dickinson and Company

- Koninklijke Philips N.V

- ResMed

- VYAIRE MEDICAL INC

- Fischer & Paykel, Medtronic

- BioMerieux SA

- CAREstream Medical Ltd

- Thermo Fischer Scientific

Recent Developments

- In August 2025, Roche announced FDA 510(k) clearance for the cobas Respiratory 4-flex, its first respiratory test using TAGS technology for detecting SARS-CoV-2, influenza A, influenza B, and RSV in a single PCR assay.

- In October 2025, Thermo Fisher Scientific launched its new Molecular Microscope® Diagnostic System for Lung (MMDx® Lung), designed to improve detection of lung transplant rejection and injury.

- In September 2024, Vitalograph acquired Morgan Scientific, a US-based company specializing in software for pulmonary function testing systems like ComPAS2, to strengthen its respiratory diagnostics offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Test Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as early diagnosis becomes a priority across global healthcare systems.

- Adoption of AI-driven diagnostic platforms will improve accuracy and accelerate clinical decision-making.

- Molecular testing and rapid point-of-care devices will gain wider acceptance for respiratory disease screening.

- Remote and home-based testing solutions will grow as chronic disease management shifts toward decentralized care.

- Imaging advancements will enhance detection of early-stage lung disorders and support precision diagnosis.

- Integration of digital health tools will strengthen data connectivity, monitoring, and diagnostic automation.

- Emerging markets will experience faster adoption due to improving healthcare infrastructure and rising patient awareness.

- Product innovation will intensify as manufacturers develop portable, user-friendly, and high-sensitivity testing systems.

- Strategic collaborations between diagnostic companies and healthcare institutions will accelerate technology deployment.

- Increasing focus on preventive respiratory health will support regular screening programs and market expansion.

Market Segmentation Analysis:

Market Segmentation Analysis: