Market Overview

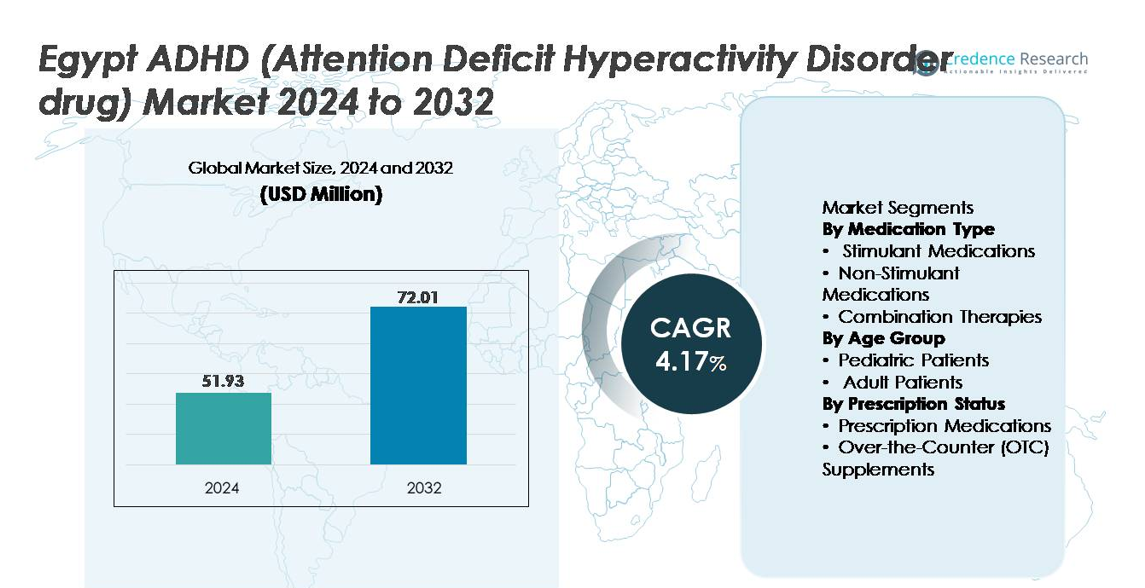

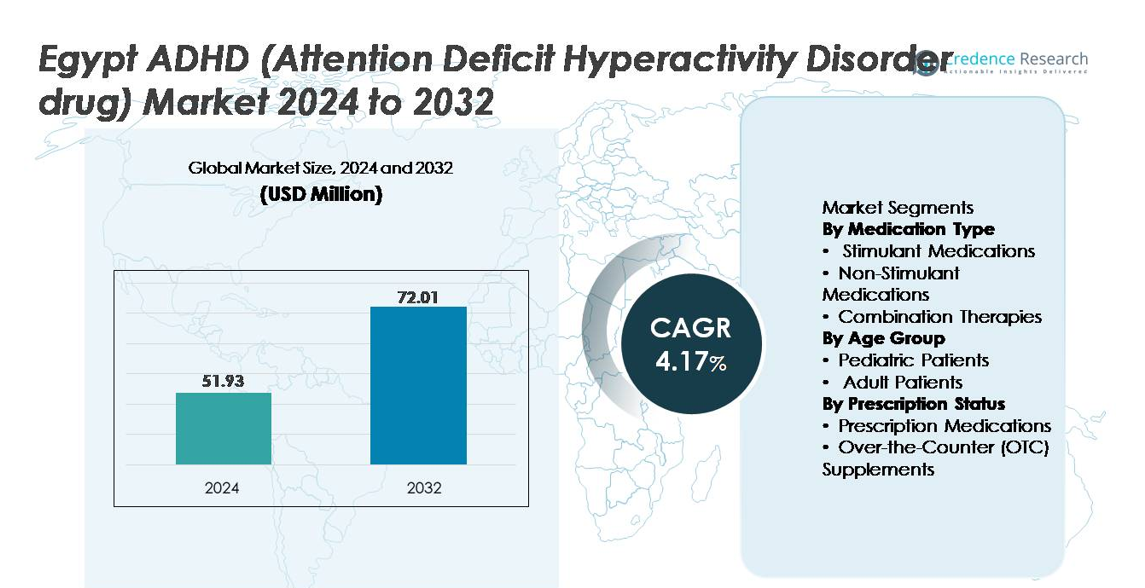

The Egypt ADHD (Attention Deficit Hyperactivity Disorder) drug market was valued at USD 51.93 million in 2024 and is projected to reach approximately USD 72.01 million by 2032, registering a CAGR of 4.17% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Egypt ADHD (Attention Deficit Hyperactivity Disorder Drug) Market Size 2024 |

USD 51.93 million |

| Egypt ADHD (Attention Deficit Hyperactivity Disorder Drug) Market, CAGR |

4.17% |

| Egypt ADHD (Attention Deficit Hyperactivity Disorder Drug) Market Size 2032 |

USD 72.01 million |

The Egypt ADHD drug market is influenced by a diverse mix of global and regional pharmaceutical companies, including Takeda Pharmaceutical Company Limited, Novartis International AG, Eli Lilly and Company, Janssen Pharmaceuticals, Inc., Otsuka Pharmaceutical Co., Ltd., Amneal Pharmaceuticals, Inc., Neos Therapeutics, Inc., Noven Pharmaceuticals, Inc., RespireRx Pharmaceuticals Inc., and American Brivision (Holding) Corporation. These players compete through branded formulations, extended-release stimulants, non-stimulant therapies, and emerging digital therapy integration. Greater Cairo remains the leading regional market, accounting for approximately 45% of total demand, supported by specialized psychiatric care, higher diagnosis rates, stronger awareness, and better access to controlled and non-controlled ADHD medications.

Market Insights

- The Egypt ADHD drug market was valued at USD 51.93 million in 2024 and is projected to reach USD 72.01 million by 2032, growing at a CAGR of 4.17% during the forecast period.

- Rising diagnosis rates in pediatric and adult populations, supported by physician awareness, digital consultations, and school-based screening programs, are accelerating treatment adoption and expanding stimulant and non-stimulant medication demand.

- Key trends include increasing preference for extended-release formulations, growth of non-stimulant therapies for stimulant-intolerant patients, and the integration of digital behavioral support tools.

- The competitive landscape is shaped by global brands and regional generic manufacturers, with companies focusing on affordability, differentiated dosing profiles, and telepsychiatry-linked patient retention programs.

- Greater Cairo leads regional demand with nearly 45% share, followed by Alexandria at around 20% and the Nile Delta at approximately 18%, while stimulant medications hold the dominant segment share, driven by proven clinical efficacy and long-term therapeutic adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Medication Type

Stimulant medications represent the dominant segment in the Egypt ADHD drug market, holding the largest share due to their rapid symptom control and extensive clinical evidence supporting use in hyperactivity and impulsivity management. Methylphenidate-based formulations remain the most prescribed, driven by availability in both short and extended-release profiles. Non-stimulant medications are gaining traction among patients with cardiovascular risks or stimulant intolerance, while combination therapies are emerging for cases requiring multi-mechanism control. Rising diagnosis rates, improved physician awareness, and broader inclusion in treatment guidelines continue to support stimulant-led market dominance.

- For instance, Janssen Pharmaceuticals’ OROS-methylphenidate technology delivers controlled release through an osmotic pump mechanism across strengths ranging from 18 mg to 54 mg, enabling once-daily dosing and up to 12 hours of symptom coverage.

By Age Group

The pediatric patient group accounts for the highest market share, as ADHD diagnosis is predominantly established in early school years where behavioral and cognitive impairments become more observable. Increased screening within schools, parental education initiatives, and earlier psychiatric consultations drive prescription volumes in children aged 6–12 years. However, the adult segment is expanding steadily with growing recognition of lifelong ADHD and underdiagnosed cases transitioning from adolescence. Workplace productivity challenges and mental health normalization campaigns are reducing stigma and boosting adult treatment adoption.

- For instance, “Takeda’s lisdexamfetamine (brand name Vyvanse) has received approval for pediatric use beginning at 6 years of age. The efficacy and safety for ADHD treatment were established in several controlled clinical trials, including three short-term controlled trials in children ages 6 to 12 years.

By Prescription Status

Prescription medications dominate the market, supported by structured treatment protocols and clinical requirement for physician-monitoring when prescribing stimulant or non-stimulant ADHD drugs. Regulatory oversight, dosage precision, and treatment personalization further reinforce the reliance on prescribed therapies. Over-the-counter (OTC) supplements, including omega-3, herbal formulations, and cognitive support blends, are witnessing gradual interest among consumers preferring non-pharmaceutical interventions or adjunct wellness support. Nonetheless, the clinical efficacy and proven outcomes associated with prescribed drugs sustain their leading position, especially for moderate to severe ADHD management.

Key Growth Drivers

Rising ADHD Diagnosis Rates and Expanding Clinical Awareness

Growing awareness of ADHD as a recognized neurodevelopmental disorder is significantly increasing diagnosis rates across Egypt. Pediatric neurologists, psychiatrists, and general practitioners are undergoing continuous education, enhancing their ability to identify varied ADHD presentations such as inattentive, hyperactive, and combined subtypes. School-level assessments and behavioral screening programs are improving early detection in primary grade children, helping parents seek timely medical intervention. Digital health platforms and teleconsultation have also accelerated access to psychiatric evaluations, especially in underserved regions. As families adopt science-backed perception of ADHD, reduced stigma and improved knowledge-sharing through public health campaigns continue to support consistent growth in demand for both stimulant and non-stimulant ADHD medications.

- For instance, Vezeeta has publicly stated that its platform serves over 10 million registered users in Egypt.The service enables online booking for psychiatry and pediatric neurology consultations, including ADHD assessment.

Government and Private Sector Expansion in Mental Healthcare Infrastructure

Egypt’s healthcare sector is undergoing rapid modernization, with expanded investment into neurodevelopmental and behavioral disorder treatment centers. Public and private hospitals are increasing their psychiatric unit capacities, and outpatient facilities specializing in child and adolescent behavioral therapy are becoming more common in Cairo, Giza, and Alexandria. Insurance participation in mental health coverage is slowly improving, encouraging families to pursue long-term ADHD medication and counseling. Pharmaceutical distributors are expanding supply chains for controlled and non-controlled ADHD drugs, improving nationwide accessibility. Workforce training programs aimed at developing psychologists and psychiatric nurses create a sustainable treatment ecosystem. Consequently, improved accessibility, structured diagnosis pathways, and integrated pharmacotherapy-behavioral therapy frameworks are positively influencing market expansion.

- For instance, Otsuka Pharmaceutical introduced Abilify MyCite, the world’s first FDA-approved digital pill system integrating an ingestible sensor only 1 mm in size that tracks medication ingestion events in a time-stamped manner through a wearable patch and mobile interface.

Increasing Preference for Evidence-Based, Long-Term Pharmacological Management

Growing recognition that ADHD persists beyond childhood is driving long-term pharmacological management, particularly among adolescents transitioning into higher education. Physicians are increasingly adopting structured medication regimens tailored to symptom intensity, comorbidities, and lifestyle needs. Extended-release formulations that allow once-daily dosing improve compliance and minimize school-day disruptions. Parents and adult patients are placing greater value on measured improvements in concentration, social functioning, and academic performance resulting from pharmacotherapy. Additionally, behavioral therapy and medication plans are being combined to support comprehensive outcomes, reinforcing recurring demand for medications and sustaining the long-term revenue potential of the ADHD drug market in Egypt.

Key Trends & Opportunities

Growth of Non-Stimulant and Adjunct Therapy Medications

A growing segment of patients unsuitable for stimulant medications due to side-effect concerns, sleep disturbances, or coexisting cardiovascular issues is fueling demand for non-stimulant alternatives. These therapies are expanding opportunity for pharmaceutical companies offering long-acting options that reduce dependency risks and provide consistent symptom control. Adjunct therapies are also emerging, with supplement-based cognitive enhancers and nutritional interventions gaining commercial traction. This diversification allows prescribers to tailor therapies to patient tolerability, providing opportunity for new entrants developing plant-based, peptide-based, or neurochemical modulation therapies targeting ADHD symptom clusters.

- For instance, Otsuka Pharmaceutical’s centanafadine (EB-1020) is a non-stimulant ADHD candidate designed as a triple reuptake inhibitor targeting norepinephrine, dopamine, and serotonin transporters. Preclinical receptor-binding studies report high affinity for the norepinephrine transporter (Ki ≈ 0.03 μM), supporting its differentiated pharmacologic profile compared with single-target non-stimulants.

Digital Behavioral Therapy, Remote Monitoring, and AI-Driven Management Tools

Integration of digital therapeutics, symptom tracking apps, and remote behavioral support platforms presents a strong opportunity for patient engagement and treatment optimization. AI-based analytics can deliver personalized monitoring, helping clinicians adjust dosages and manage medication adherence without frequent in-person visits. Schools and parents benefit from real-time progress tracking tools that measure focus, mood variations, and classroom behavior. These technology-enabled models align with global adoption trends and appeal to private-sector mental health providers in Egypt seeking differentiated service offerings. The partnership potential between pharmaceutical firms and digital therapy platforms creates complementary revenue pathways.

- For instance, Akili Interactive’s EndeavorRx is the first FDA-cleared digital therapeutic for ADHD, delivered as a video game that improved attention function in children aged 8–12 after 25 minutes per day, five days per week, for four weeks in controlled trials

Key Challenges

Diagnostic Gaps, Stigma, and Misconceptions Affecting Treatment Adoption

Despite progress, stigma associated with psychiatric disorders continues to slow treatment adoption in many Egyptian communities. Misinterpretation of ADHD symptoms as behavioral disobedience, poor parenting, or temporary childhood phase leads to delayed diagnosis. Limited specialist availability in rural and semi-urban areas restricts timely evaluation and creates disparities in care. Social hesitation toward long-term use of psychiatric drugs further impacts compliance, particularly among adolescents. Awareness campaigns and caregiver education remain essential to overcoming cultural barriers. Without sustained efforts to normalize ADHD treatment as a clinical necessity—not a behavioral label—market penetration may remain below true prevalence levels.

Regulatory Complexity and Controlled Substance Oversight

Stimulant-based ADHD medications fall under controlled substance regulations in Egypt, presenting challenges related to distribution logistics, prescription management, and inventory tracking. Strict oversight prevents misuse but can limit availability in outpatient clinics and retail pharmacies. Import regulation constraints, procurement delays, and fluctuating supplier lead times may disrupt consistent supply for patients requiring continuous therapy. Non-stimulant growth presents an alternative, but affordability and reimbursement gaps hinder broad uptake. Balancing compliance with accessibility will remain a critical challenge as market growth intersects with evolving policies related to mental health pharmaceutical governance.

Regional Analysis

Greater Cairo

Greater Cairo holds the dominant share of the Egypt ADHD drug market, accounting for approximately 45% of total demand, driven by the highest concentration of psychiatrists, neurologists, private hospitals, and specialty behavioral clinics. Urban families demonstrate greater awareness of ADHD symptoms and seek earlier clinical intervention for pediatric and adolescent cases. Better access to prescription medications and diagnostic pathways further supports market penetration. The presence of international pharmaceutical distributors and digital mental health service providers strengthens supply-chain efficiency and treatment continuity. As telepsychiatry adoption rises, Greater Cairo continues to lead in both stimulants and non-stimulant therapy utilization.

Alexandria

Alexandria represents nearly 20% of the market share, supported by expanding healthcare infrastructure and increasing adoption of child development and behavioral therapy services. The city benefits from a growing private sector that actively promotes mental health screening and structured ADHD treatment programs. Pharmaceutical distribution networks ensure consistent availability of controlled and non-controlled medications. Awareness initiatives led by pediatric clinics and school counseling programs contribute to early detection, while a rising adult diagnosis rate presents new growth potential. Although smaller than Cairo, Alexandria remains a high-value, rapidly progressing regional market.

Nile Delta Region

The Nile Delta accounts for an estimated 18% of the market, driven by expanding semi-urban access to psychiatric consultation and referral-based treatment pathways. Tier-2 cities within the region are witnessing gradual adoption of pharmacological ADHD management as families gain clinical knowledge and trust in prescribed therapies. However, diagnosis often remains delayed compared to major metropolitan areas. Growing private clinic networks, teleconsultation services, and pharmacy-led education are improving uptake. Market expansion is supported by increased acceptance of long-term medication plans, especially among school-aged children requiring academic performance support.

Upper Egypt

Upper Egypt holds approximately 12% of the ADHD drug market, characterized by lower diagnosis rates and limited specialist availability. Cultural stigma, affordability concerns, and travel distances to psychiatric facilities continue to restrict treatment penetration. Patients often rely on general practitioners, leading to underdiagnosis or delayed referral for pharmacotherapy. However, rising government healthcare outreach programs and digital consultation adoption are beginning to shift awareness. Over-the-counter cognitive supplements observe higher demand than prescription medications. Long-term market opportunity lies in targeted education initiatives and expansion of psychiatric services across provincial cities.

Red Sea & Suez Canal Cities

The Red Sea and Suez Canal Cities collectively represent about 5% of the market, influenced by smaller population density and concentration of private clinics serving working professionals and expatriate communities. Awareness levels and willingness to adopt pharmacological treatment are improving, supported by employer-backed health insurance programs. Seasonal population shifts create inconsistent demand patterns, but private hospitals and pharmacies maintain steady supply of common ADHD medications. As digital healthcare platforms expand, remote assessment and continuous monitoring create an opportunity to expand prescription therapy adoption in these coastal regions.

Market Segmentations:

By Medication Type

- Stimulant Medications

- Non-Stimulant Medications

- Combination Therapies

By Age Group

- Pediatric Patients

- Adult Patients

By Prescription Status

- Prescription Medications

- Over-the-Counter (OTC) Supplements

By Geography

- Greater Cairo

- Alexandria

- Nile Delta Region

- Upper Egypt

- Red Sea & Suez Canal Cities

Competitive Landscape

The competitive landscape of the Egypt ADHD drug market is shaped by a mix of multinational pharmaceutical companies, regional distributors, and emerging local manufacturers specializing in generics and neuropsychiatric formulations. Leading global brands offering stimulant and non-stimulant medications maintain a strong foothold due to clinical credibility, long-standing physician trust, and proven treatment outcomes. Import-based supply remains central to the market, with international companies partnering with local distributors to navigate regulatory frameworks and ensure product availability. Meanwhile, domestic pharmaceutical firms are expanding their portfolios through generic versions that improve affordability and appeal to cost-sensitive patient groups. Growing demand for non-stimulant therapies and extended-release formulations is creating room for product differentiation, while digital patient support programs and compliance-tracking platforms are emerging as value-added competitive levers. The landscape continues to evolve as stakeholders adopt hybrid models linking medication with behavioral therapy, digital monitoring, and telepsychiatric follow-up to strengthen patient retention and market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, RespireRx announced an NIH/NINDS grant and related financing to advance its AMPAkine compounds (CX717, CX1739), positioned as novel, fast-onset non-stimulant ADHD treatments alongside other indications, supported partly by a U.S. Department of Defense award.

- In November 2025, Otsuka submitted a New Drug Application (NDA) for its investigational ADHD therapy Centanafadine, a first-in-class norepinephrine/dopamine/serotonin reuptake inhibitor (NDSRI) designed for children, adolescents, and adults.

Report Coverage

The research report offers an in-depth analysis based on Medication Type, Age Group, Prescription Status and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ADHD medications is expected to rise as early childhood screening becomes more widely adopted across schools and pediatric clinics.

- Digital therapeutics and AI-based monitoring tools will increasingly support medication adherence and remote behavioral management.

- Non-stimulant therapies are likely to gain stronger market traction due to improved safety profiles and suitability for diverse patient groups.

- Extended-release and once-daily formulations will see greater adoption to enhance compliance and reduce side-effect variability.

- Public and private mental health infrastructure expansion will improve treatment accessibility beyond major metropolitan areas.

- Adult ADHD diagnosis will continue to grow, driven by workplace performance challenges and reduced social stigma.

- Pharmaceutical companies may explore co-therapy models linking medication with behavioral therapy subscription services.

- Telepsychiatry and e-prescription platforms will facilitate consistent treatment follow-up and clinical supervision.

- Generic medication production will intensify price competition and broaden affordability for long-term therapy.

- Policy evolution and insurance participation in mental health coverage will support higher treatment penetration.