Market Overview

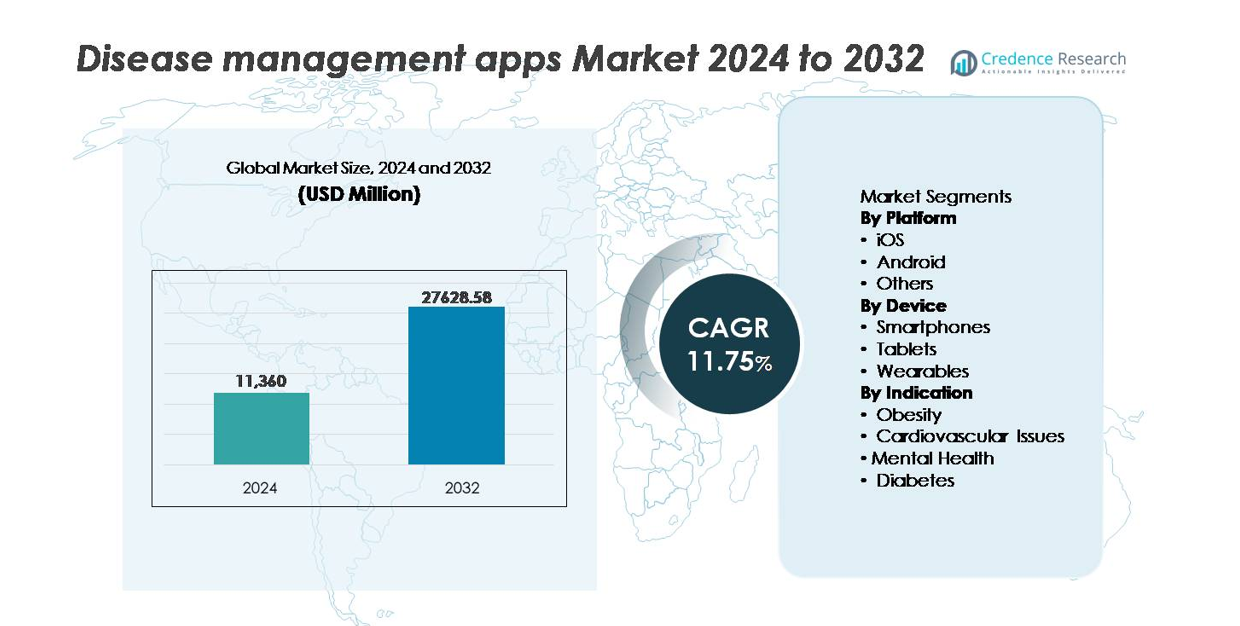

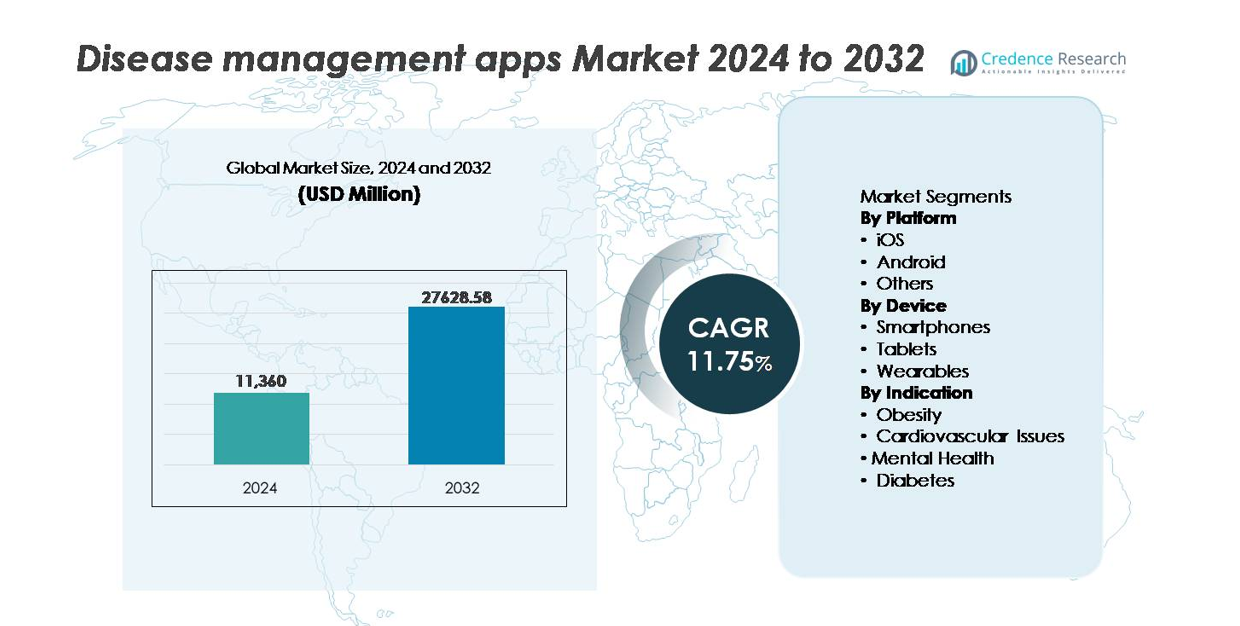

The global Disease Management Apps market was valued at USD 11,360 million in 2024 and is projected to reach USD 27,628.58 million by 2032, expanding at a CAGR of 11.75% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Health Apps Market Size 2024 |

USD 11,360 million |

| Mobile Health Apps Market, CAGR |

11.75% |

| Mobile Health Apps Market Size 2032 |

USD 27,628.58 million |

The competitive landscape of the disease management apps market features established digital health brands and specialized chronic care platforms, including Noom, Inc., Medisafe, Azumio Inc., Curable, Inc., Omada Health Inc., MyFitnessPal, Inc., Sleep Cycle, Bearable Ltd, Fitbit LLC., and Healthy.io Ltd. These companies compete through AI-driven personalization, behavioral coaching modules, and integration with wearable and diagnostic devices to increase user engagement and care compliance. North America remains the leading region, holding approximately 38% of the global market share, supported by strong telehealth adoption, favorable reimbursement policies, and robust investment in digital therapeutics and preventive health technologies.

Market Insights

- The global disease management apps market was valued at USD 11,360 million in 2024 and is projected to reach USD 27,628.58 million by 2032, expanding at a CAGR of 11.75% during the forecast period.

- Rising cases of diabetes, obesity, cardiovascular conditions, and mental health disorders accelerate demand as patients and healthcare providers shift toward digital monitoring, medication tracking, and preventive care engagement.

- Integration of AI, wearables, and remote patient monitoring platforms is emerging as a defining trend, enabling personalized insights and real-time escalation alerts for chronic condition management.

- The market remains competitive with players such as Noom, MyFitnessPal, Omada Health, Medisafe, Fitbit, and Healthy.io, focusing on behavioral therapy modules, smart device connectivity, and subscription-based models to strengthen customer retention.

- North America leads with around 38% share, followed by Europe at 27% and Asia-Pacific at 24%, while Android dominates platform share due to affordability and broader penetration compared to iOS.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Platform (iOS, Android, Others)

Android represents the dominant platform in the disease management apps market, capturing the largest share due to wider device affordability and penetration across emerging and price-sensitive economies. Open-source flexibility enables developers to deploy faster updates, integrate localized languages, and tailor features for region-specific chronic care protocols. iOS maintains a strong presence in premium markets driven by higher subscription uptake and advanced security features valued in patient data protection. Meanwhile, other platforms remain niche, primarily serving specialized healthcare systems or proprietary monitoring ecosystems.

- For instance, “MyFitnessPal is a market-leading health and fitness app with over 220 million usersworldwide and one of the largest food databases available, containing over 5 million food items. The app’s popular barcode scanner, which is now a premium feature, facilitates high-volume user engagement in diet management workflows across both Android and iOS platforms.

By Device (Smartphones, Tablets, Wearables)

Smartphones lead the device segment, accounting for the highest market share as they serve as the primary interface for patient monitoring, medication reminders, lifestyle tracking, and teleconsultation. The convenience of constant connectivity and high app compatibility drives adoption among both chronic patients and preventive health users. Tablets gain traction in clinical and rehabilitation settings for educational modules and remote assessments, while wearables expand rapidly through integration with glucose monitors, heart rhythm sensors, and fitness trackers, supporting real-time analytics and early risk identification.

- For instance, Medisafe reports that its smartphone-based digital companion supports over 10 million medication reminders triggered daily, demonstrating the volume of adherence-driven engagement through mobile devices.

By Indication (Obesity, Cardiovascular Issues, Mental Health, Diabetes)

Diabetes management apps dominate the indication segment, holding the largest share driven by rising global prevalence and increased adoption of digital tools for blood glucose tracking, insulin dosage guidance, and nutrition planning. Cardiovascular issue apps follow closely, supported by demand for blood pressure monitoring and arrhythmia alerts. Mental health solutions accelerate with the growth of cognitive behavioral therapy-based interventions and stress tracking modules. Obesity-focused applications benefit from personalized weight-loss programs and AI-guided nutrition analytics, contributing to preventive care engagement.

Key Growth Drivers

Rising Burden of Chronic Diseases and Preventive Digital Care Adoption

The increasing prevalence of diabetes, obesity, cardiovascular disorders, and mental health conditions is driving demand for digitally enabled disease management solutions. Healthcare systems with limited specialist access are adopting remote monitoring and AI-assisted risk prediction to reduce hospital admissions and improve continuity of care. Users increasingly rely on mobile-based medication reminders, diet and activity tracking, and personalized behavioral interventions that align with self-management goals. Integration with electronic health records supports care coordination, while expansion of home healthcare and telemedicine services enables seamless care pathways. As governments promote digital therapeutics reimbursement and remote patient management, disease management apps play a critical role in long-term condition tracking, early escalation prevention, and value-based care delivery, strengthening their penetration across both developed and emerging markets.

- For instance, Omada Health has enrolled more than 550,000 participants across its digital chronic care programs, supporting diabetes, hypertension, and behavioral health management through remote coaching and analytics-driven interventions.

Advancements in AI, Predictive Analytics, and Personalization Engines

Rapid progress in artificial intelligence and predictive analytics is reshaping disease management apps by enabling real-time symptom forecasting, personalized treatment pathways, and automated data interpretation for physicians and patients. Machine learning models can analyze user vitals, lifestyle patterns, and medication adherence to generate risk alerts and intervention prompts. Personalized coaching modules enhance patient engagement and outcomes through tailored behavioral nudges delivered at optimal timing. Integration with wearables and sensors creates continuous data streams, expanding accuracy and clinical relevance. For providers, data dashboards improve decision-making and support remote consultations. As regulatory frameworks evolve to recognize software-as-a-medical-device classifications, AI-enabled disease management platforms are gaining greater clinical credibility, accelerating adoption among payers and health systems focused on proactive care rather than reactive treatment.

- For instance, Lark Health reports that its conversational-AI platform delivers more than 2 million automated coaching messages each day. This high message volume shows strong engagement and reflects how AI-driven tools scale chronic-care support across large patient populations.

Telehealth Ecosystem Expansion and Emergence of Remote Care Models

The widespread adoption of telehealth is significantly accelerating the use of disease management apps as part of remote care workflows. Virtual consultations combined with app-based symptom tracking reduce physical visits, enable post-discharge monitoring, and support timely intervention for chronic patients. Remote patient monitoring programs offered by insurers and healthcare providers incentivize app usage to reduce emergency visits and readmission rates. Digital disease management also strengthens clinician productivity by automating scheduling, reporting, and communication, while enabling scalable patient panel management. Employers and corporate health programs are incorporating these apps into wellness initiatives, contributing to preventive healthcare engagement. As digital reimbursement codes expand and hybrid care becomes standard practice, disease management apps are positioned as essential tools that complement virtual clinics and decentralized care delivery models.

Key Trends & Opportunities

Integration with Wearables, IoT Devices, and Sensor-Based Diagnostics

The integration of disease management apps with wearables, connected medical devices, and IoT-based diagnostics presents one of the most significant growth opportunities. Continuous glucose monitors, cardiac patches, fitness bands, smart scales, and sleep trackers enable real-time data capture, allowing apps to generate instant feedback and escalation alerts. Cloud-based connectivity supports longitudinal health insights for clinicians and caregivers. Device interoperability opens new opportunities for multi-condition platforms tailored to aging populations and lifestyle-related disorders. Partnerships between app developers, consumer electronics firms, and medical device companies are accelerating ecosystem growth. As sensor technology becomes more affordable, data-rich disease management platforms will expand into early screening, relapse prevention, and population-level health management.

- For instance, Fitbit reports that its wearables have captured more than 150 billion hours of heart-rate data. This large dataset supports development of arrhythmia-sensing algorithms and improved sleep-stage analytics. These insights help strengthen digital health and chronic-disease monitoring platforms.

Rise of Digital Therapeutics and Prescription-Based App Models

The emergence of evidence-backed digital therapeutics (DTx) offers new revenue opportunities for disease management app developers seeking clinical validation and regulatory approval. Prescription-based platforms deliver structured therapeutic programs for conditions such as diabetes, addiction, mental health disorders, and hypertension with measurable clinical outcomes. Increasing involvement of insurers and payers recognizing DTx as reimbursable interventions strengthens market traction. Pharmaceutical companies are integrating digital solutions with medication adherence programs to improve treatment effectiveness. As healthcare transitions toward precision and outcome-based models, prescription-linked disease management apps create a pathway for formal clinical integration, stronger patient retention, and long-term recurring revenue models.

- For instance, Omada Health has reported clinical results showing an average HbA1c reduction of about 0.8 percentage points among users of its digital diabetes management program. This outcome highlights meaningful improvements in glycemic control. The data supports the value of structured digital coaching for chronic-disease care.

Key Challenges

Data Security, Privacy Concerns, and Regulatory Compliance Barriers

Healthcare data protection remains a critical challenge for disease management apps as they handle sensitive medical information. Variations in global privacy regulations, patient consent protocols, data residency requirements, and cybersecurity standards complicate cross-border scalability. The increasing use of AI-driven models raises concerns over algorithm transparency, potential bias, and data ownership. Trust remains a barrier for users concerned about third-party data sharing, insurance profiling, and commercial reuse of personal health analytics. Companies must invest heavily in encryption, certification, privacy-by-design frameworks, and clinical-grade security protocols to meet stakeholder expectations and regulatory scrutiny.

Limited Adoption Among Technologically Disconnected and Elderly Populations

Digital literacy gaps, inconsistent internet access, and technology hesitancy among elderly and rural populations limit disease management app adoption. Many chronic patients who most benefit from monitoring tools may struggle with app navigation, sensor setup, or troubleshooting. Language limitations, complex interfaces, and limited customer support further reduce usability across diverse population groups. Additionally, healthcare providers face integration challenges, workflow disruption concerns, and reluctance toward new data platforms that increase administrative load. To overcome this challenge, developers must optimize accessibility features, simplify UI design, support multilingual interfaces, and ensure caregiver-assisted onboarding to broaden adoption and improve patient engagement.

Regional Analysis

North America

North America commands the largest market share of approximately 38%, driven by high adoption of digital therapeutics, advanced telehealth infrastructure, and strong investment from healthcare payers and technology companies. The United States leads regional contribution, supported by reimbursement pathways for app-based chronic disease management and integration with remote patient monitoring programs. A high chronic disease burden, particularly diabetes and cardiovascular issues, accelerates engagement with personalized AI-based care plans and medication adherence tools. Strategic partnerships between hospitals, insurers, and app developers further strengthen market dominance, fostering scalable patient management models across preventive and long-term care settings.

Europe

Europe accounts for around 27% of the global market, supported by established regulatory frameworks for software-as-a-medical-device and government-funded digital health adoption programs. Germany, through its DiGA reimbursement model, and the U.K., via NHS digital care pathways, remain key contributors to app-driven chronic care management. The region benefits from strong public health monitoring initiatives and a coordinated regional focus on reducing hospital readmission rates. Stringent data protection regulations increase patient confidence and adoption rates, while chronic lifestyle disease prevalence continues to rise, creating sustained demand for clinically validated digital disease management platforms.

Asia-Pacific

Asia-Pacific represents approximately 24% market share and is the fastest-growing region, driven by rapid digitalization, growing smartphone penetration, and expanding access to teleconsultation services. China and India lead adoption due to large chronic patient populations and government-supported digital health infrastructure expansion. Regional technology startups are creating localized solutions with multilingual interfaces and AI-enabled monitoring for diabetes and cardiovascular conditions. Wearable adoption and mobile-first healthcare services are rising across Southeast Asia, addressing specialist shortages. The region’s price-sensitive population fuels demand for cost-efficient app-based disease management, positioning Asia-Pacific for increasing future share.

Latin America

Latin America holds a developing market share of nearly 7%, supported by expanding telemedicine frameworks and insurer-led chronic care engagement programs. Brazil and Mexico dominate adoption through digital health initiatives focused on managing diabetes and hypertension at population levels. Mobile-based disease tracking helps bridge traditional care access disparities, especially in urban centers. However, infrastructure gaps and inconsistent digital literacy restrain uniform penetration across the region. Increasing partnerships between app developers, telecom providers, and private healthcare networks are improving accessibility and strengthening the business case for scalable chronic disease management solutions.

Middle East & Africa

The Middle East & Africa region accounts for roughly 4% of the market, with the Middle East contributing the majority share due to national digital health transformation strategies and investments in AI-enabled preventive care. GCC countries are adopting chronic disease management platforms to address diabetes and obesity prevalence. In Africa, mobile-first health apps are gaining traction to supplement limited clinical resources and improve remote patient support. Despite growth potential, affordability and limited internet connectivity pose challenges. Government-backed eHealth initiatives and public-private collaborations are set to improve adoption over the forecast period.

Market Segmentations:

By Platform

By Device

- Smartphones

- Tablets

- Wearables

By Indication

- Obesity

- Cardiovascular Issues

- Mental Health

- Diabetes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the disease management apps market is characterized by a mix of global digital health companies, emerging regional developers, and enterprise healthcare platforms integrating chronic care management into broader virtual care ecosystems. Competition is intensifying as players focus on AI-enabled personalization, data analytics, wearable integration, and regulatory compliance to differentiate offerings. Companies are leveraging subscription-based models, payer partnerships, and employer wellness programs to secure recurring revenue streams. Collaboration with pharmaceutical manufacturers to enhance medication adherence and companion digital therapeutics is expanding as clinical validation becomes essential for market credibility. Startups continue to disrupt with specialized solutions targeting diabetes, mental health, and cardiovascular care, while larger telehealth providers strengthen their presence through acquisitions and platform consolidation. Growing demand for multilingual support, privacy assurance, and interoperability with electronic health records is reshaping product roadmaps, driving continuous innovation to meet evolving regulatory and user expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Noom, Inc.

- Medisafe

- Azumio Inc.

- Curable, Inc

- Omada Health Inc.

- MyFitnessPal, Inc.

- Sleep Cycle

- Bearable Ltd

- Fitbit LLC.

- io Ltd

Recent Developments

- In October 2025 Noom launched new AI-powered features called “Face Scan” and “Future Me,” enabling users to get personalized health screening (e.g. metabolic and cardiovascular risk indicators) from a simple smartphone selfie.

- In April 2025, Medisafe introduced “VIA,” a voice-intelligent agent designed to simplify patient engagement and reduce friction in treatment adherence workflows.

- In February 2025, MyFitnessPal released its “2025 Winter Release,” which added a Voice Log feature (allowing users to log meals via voice-to-text) and a new Weekly Habits module to help users build consistent nutrition and diet habits.

Report Coverage

The research report offers an in-depth analysis based on Platform, Device, Indication and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Disease management apps will increasingly serve as core tools in remote patient monitoring and decentralized care delivery.

- AI-driven predictive analytics will enhance early risk detection and treatment adherence support.

- Integration with wearables, biosensors, and IoT medical devices will strengthen real-time insights and continuous tracking capabilities.

- Digital therapeutics approvals will expand, positioning apps as clinically recognized interventions.

- Data interoperability with electronic health records will accelerate coordinated care.

- Payer and employer-based wellness programs will broaden user adoption through incentivized engagement.

- Personalized behavior modification models will evolve through machine learning and emotional analytics.

- Virtual coaching and automated counseling will support mental health and chronic lifestyle disease management.

- Multilingual and accessibility-first platforms will increase penetration into non-urban and underserved populations.

- Stronger cybersecurity frameworks will shape user trust and regulatory compliance for long-term digital health adoption