Market Overview

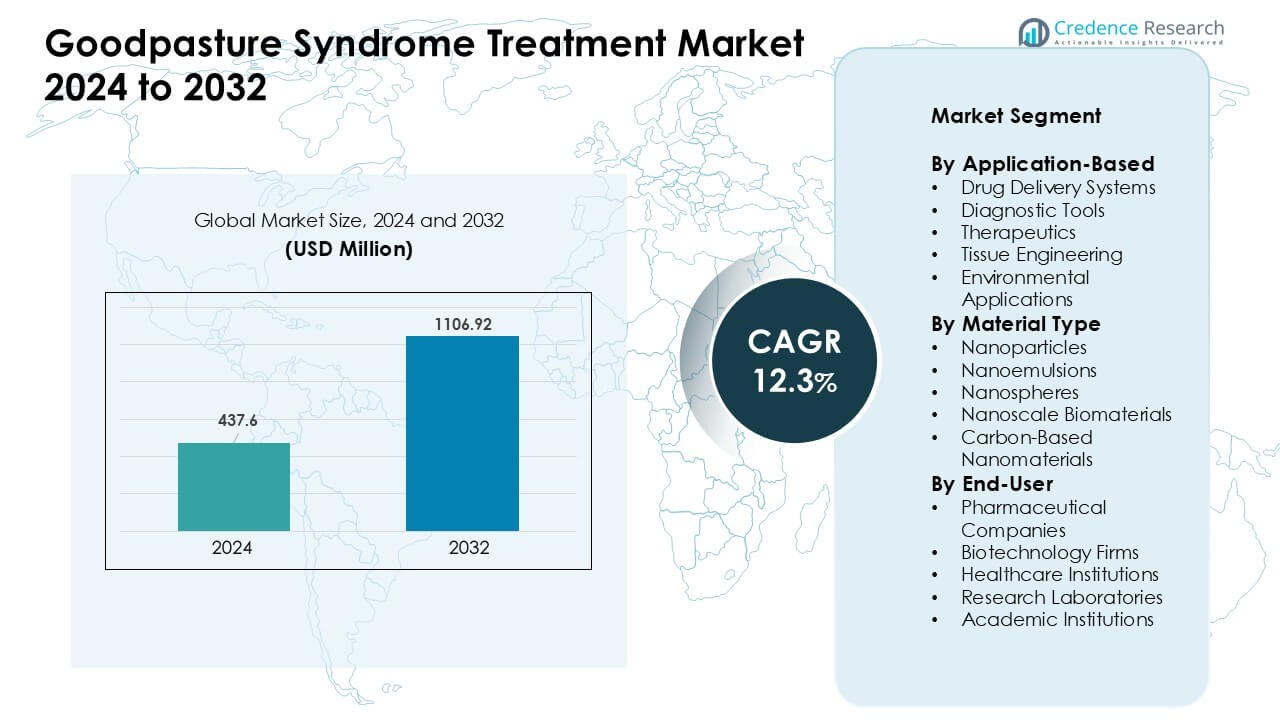

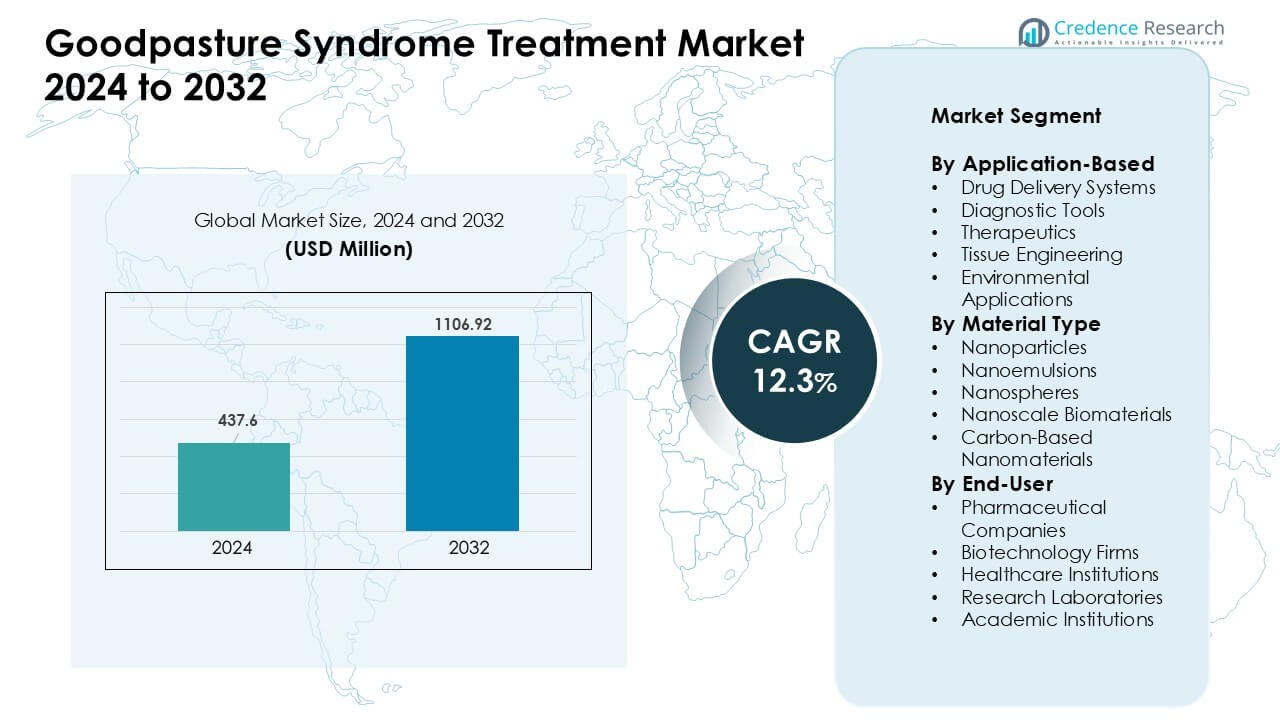

Goodpasture Syndrome Treatment Market was valued at USD 437.6 million in 2024 and is anticipated to reach USD 1106.92 million by 2032, growing at a CAGR of 12.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Goodpasture Syndrome Treatment Market Size 2024 |

USD 437.6 Million |

| Goodpasture Syndrome Treatment Market, CAGR |

12.3% |

| Goodpasture Syndrome Treatment Market Size 2032 |

USD 1106.92 Million |

The Goodpasture Syndrome Treatment Market is shaped by leading healthcare and biopharma companies such as Pfizer Inc., Roche Holding AG, Bristol-Myers Squibb Company, Merck & Co., Inc., AbbVie Inc., GlaxoSmithKline plc, Johnson & Johnson, and Novartis AG. These players focused on improved immunotherapies, biologics, and precision immunosuppressive plans designed to lower toxicity and support faster antibody control. Strong investment in diagnostic innovation and rare disease research also strengthened competition. North America remained the leading region in 2024 with a 38% market share, supported by advanced clinical infrastructure, early diagnosis capabilities, and wide access to specialty care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Goodpasture Syndrome Treatment Market reached notable value USD 437.6 million in 2024 and is projected to grow steadily by USD 1106.92 million 2032 at a strong CAGR of 12.3%, driven by rising diagnosis and better access to advanced therapies.

- Growth increased as improved immunotherapies and targeted biologics supported faster antibody control and reduced organ damage, lifting treatment adoption across major care centers.

- Trends showed rising use of rapid diagnostic tools, expanding nanomedicine research, and broader interest in personalized treatment plans that align with patient-level risk profiles.

- Competition stayed strong among Amgen, Sanofi, Pfizer, Roche, Bristol-Myers Squibb, Merck, AbbVie, GSK, Johnson & Johnson, and Novartis as firms pushed biologic pipelines and safety-focused innovations while managing challenges linked to small patient pools.

- North America led the market with a 38% share, while therapeutics dominated the application segment with about 42% share in 2024, supported by early intervention practices and advanced specialty care infrastructure.

Market Segmentation Analysis:

By Application-Based

Therapeutics held the dominant share in 2024 with about 42%. Demand stayed high because clinicians need fast-acting options to control anti-GBM antibody activity. Many hospitals used targeted biologics and immunosuppressive plans to reduce kidney and lung damage in early stages. Diagnostic tools grew as labs adopted faster assays to support quick case detection. Drug delivery systems and tissue engineering advanced through research focused on improved precision and reduced toxicity. Environmental applications stayed limited, but niche studies continued in exposure-linked risk assessment.

- For instance, Roche’s rituximab (anti-CD20 monoclonal antibody) is documented to cause near-complete depletion of circulating CD20+ B cells within weeks, with B-cell recovery typically taking 6–9 months in autoimmune kidney disorders, supporting its reported off-label use in refractory anti-GBM disease.

By Material Type

Nanoparticles led the material segment in 2024 with nearly 45% share. Researchers favored nanoparticles due to strong drug-loading capacity and controlled release profiles. Hospitals and biotech teams used these materials in trials aimed at lowering treatment toxicity and improving antibody suppression. Nanoemulsions and nanospheres gained steady traction because they support stable formulations for sensitive biologics. Nanoscale biomaterials advanced through regenerative studies, while carbon-based nanomaterials saw niche use in next-stage diagnostic platforms.

By End-User

Pharmaceutical companies dominated the end-user segment in 2024 with about 39% share. Large firms invested in next-gen immunotherapies and plasmapheresis adjuncts to address limited treatment choices. Biotechnology firms grew fast as they focused on novel antibody-targeting platforms and nanomedicine pipelines. Healthcare institutions drove steady demand through rising case detection and adoption of updated clinical protocols. Research laboratories and academic institutions expanded trials on biomarkers, rapid diagnostics, and engineered delivery systems that support future therapeutic progress.

- For instance, Mayo Clinic Laboratories offers CLIA-validated anti-GBM antibody testing using standardized immunoassays, supporting confirmed diagnosis and longitudinal antibody monitoring during treatment.

Key Growth Drivers

Rising Early Diagnosis and Clinical Awareness

Growing awareness among clinicians drove faster diagnosis of Goodpasture syndrome and supported wider use of structured treatment plans. Hospitals strengthened screening practices for anti-GBM antibodies, which helped reduce delays linked to kidney and lung damage. Higher adoption of rapid immunoassays also improved case detection in emergency settings. Many countries trained physicians to identify early symptoms, which raised demand for targeted therapies and advanced immunosuppressive plans. Greater clinical focus on rare autoimmune disorders supported more referrals to specialist centers, which boosted treatment uptake across key regions.

- For instance, Thermo Fisher Scientific’s EliA™ anti-GBM assay provides quantitative results in under 2 hours and shows clinical sensitivity above 94%, supporting rapid emergency diagnosis.

Advances in Immunotherapy and Targeted Biologics

New biologic therapies shaped strong growth as companies worked on safer and more focused immune-modulating drugs. Many pipelines explored antibody-neutralizing agents that reduced treatment toxicity compared with older immunosuppressants. Research groups pushed for precision dosing tools that limited kidney stress in severe cases. Several biotech firms invested in engineered molecules designed to block autoantibody binding. These advances helped raise confidence among clinicians who wanted long-term gains with fewer side effects. Better trial designs also attracted funding toward next-stage biologic platforms.

- For instance, Alexion (AstraZeneca) developed monoclonal antibodies with picomolar-range binding affinity in complement-driven autoimmune research, demonstrating high targeting precision relevant to severe renal immune injury.

Expansion of Nanomedicine and Regenerative Research

Nanomedicine gained speed as researchers studied nanoparticles and biomaterials that improved drug delivery in Goodpasture therapy. Many studies aimed to raise treatment efficiency by delivering active molecules to kidney tissue with better control and reduced toxicity. Research teams also explored regenerative biomaterials to support tissue repair in advanced renal injury. Collaboration between academic labs and biotech firms helped push trials forward. Increased interest in engineered nanoscale tools created fresh pathways for future combination therapies.

Key Trends & Opportunities

Growth of Rapid Diagnostic Platforms

Faster testing tools created new opportunities as labs shifted toward high-sensitivity assays. Companies built automated platforms that shortened detection time for anti-GBM antibodies. Hospitals used these tools to guide early treatment and improve patient outcomes. Research groups developed microfluidic systems that allowed real-time monitoring of immune activity. These advances opened room for point-of-care devices that may reshape emergency diagnosis. Growing adoption of precision diagnostics supported long-term market expansion.

- For instance, a recently developed chemiluminescence immunoassay (ChLIA) for anti-GBM IgG by EUROIMMUN Medizinische Labordiagnostika AG was evaluated on sera from 67 confirmed anti-GBM patients and 221 disease controls. In that evaluation, the ChLIA achieved 100.0% clinical sensitivity and 98.6% specificity significantly outperforming conventional ELISA (which showed 89.6% sensitivity) in that cohort.

Increasing Use of Personalized Treatment Approaches

Personalized care gained traction as clinicians aimed to match therapy plans with patient risk levels. Many centers started using biomarker profiles to pick optimal immunosuppressants or biologics. Data-driven tools supported dose adjustments that lowered adverse effects. Researchers used genomic and proteomic insights to study why some patients respond better to certain therapies. These efforts opened new paths for targeted drug development and supported broader investment in customized treatment platforms.

- For instance, EUROIMMUN’s anti-GBM chemiluminescence immunoassay achieved 100.0% clinical sensitivity and 98.6% specificity in evaluated cohorts, enabling patient-specific monitoring during therapy.

Key Challenges

Limited Patient Pool and High Research Costs

Goodpasture syndrome remains rare, which restricts the patient base for large clinical trials. Companies face higher costs due to the need for long-term immune monitoring and specialized study designs. Small sample sizes also slow approval timelines and create uncertainty for investors. Many firms struggle to justify high spending on development when commercial returns remain narrow. These constraints often delay innovation and keep treatment options limited.

Side Effects Linked to Current Immunosuppressive Therapies

Standard immunosuppressive plans bring risks such as infection, metabolic stress, and reduced organ resilience. Clinicians handle these effects with careful monitoring, but many patients still struggle with long recovery periods. The need to balance fast antibody suppression with safety challenges treatment planning. These limitations increase demand for safer biologics, but delays in approval slow adoption. Managing side effects remains a major barrier to wider acceptance of advanced therapies.

Regional Analysis

North America

North America held the leading share of about 38% in 2024 due to strong diagnostic capacity, early treatment adoption, and broad access to specialty care. Hospitals used advanced immunoassays and biologic therapies at a faster pace than other regions, which improved clinical outcomes and supported steady market growth. Research funding remained high, and many biotech firms advanced trials in targeted immunotherapy. The U.S. also saw higher disease recognition, which increased referrals to nephrology and pulmonology centers. Robust insurance coverage further strengthened treatment uptake.

Europe

Europe accounted for nearly 30% share in 2024, driven by strong public healthcare systems and structured rare disease programs supporting Goodpasture syndrome management. Countries like Germany, the U.K., and France adopted updated diagnostic guidelines that raised early detection rates. Many research institutions worked on biomarker studies and improved immunosuppressive protocols. Access to trained specialists and standardized treatment pathways helped maintain stable demand. Collaboration between academic hospitals and biotech players supported trials in biologics and regenerative approaches, reinforcing the region’s role in innovation.

Asia-Pacific

Asia-Pacific captured around 24% share in 2024 and grew quickly due to improving diagnostic infrastructure and wider awareness of autoimmune kidney disorders. Countries such as Japan, South Korea, and Australia advanced early testing capabilities, while China increased investments in immunology research. Rising adoption of biologics in tertiary hospitals supported steady growth. Many healthcare systems expanded nephrology units to manage severe cases. Regional biotech activity also increased, driving interest in nanomedicine and engineered delivery systems for complex autoimmune conditions.

Latin America

Latin America held roughly 5% share in 2024, supported by gradual improvements in specialty care and better recognition of autoimmune diseases. Brazil and Mexico led adoption of updated diagnostic tools, though access varied across public and private facilities. Clinical guidelines advanced slowly, but key hospitals increased use of combination immunosuppressive therapies. Funding constraints limited large-scale trials, yet partnerships with global pharma firms helped introduce newer treatment options. Awareness campaigns also encouraged earlier referrals, improving treatment timelines.

Middle East & Africa

Middle East & Africa accounted for about 3% share in 2024, reflecting limited diagnostic coverage and smaller specialist networks. Countries like UAE and Saudi Arabia expanded advanced nephrology and immunology services, supporting better disease management. However, many regions still relied on basic immunosuppressive plans due to cost barriers. Investment in rare disease programs grew slowly but showed promise with new laboratory upgrades. Partnerships with global research groups helped introduce modern testing methods and supported gradual improvement in treatment accessibility.

Market Segmentations:

By Application-Based

- Drug Delivery Systems

- Diagnostic Tools

- Therapeutics

- Tissue Engineering

- Environmental Applications

By Material Type

- Nanoparticles

- Nanoemulsions

- Nanospheres

- Nanoscale Biomaterials

- Carbon-Based Nanomaterials

By End-User

- Pharmaceutical Companies

- Biotechnology Firms

- Healthcare Institutions

- Research Laboratories

- Academic Institutions

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Goodpasture Syndrome Treatment Market features active participation from major healthcare and biopharmaceutical leaders such as S.A., Pfizer Inc., Roche Holding AG, Bristol-Myers Squibb Company, Merck & Co., Inc., AbbVie Inc., GlaxoSmithKline plc, Johnson & Johnson, and Novartis AG. These companies invested in advanced immunotherapies, biologics, and improved immunosuppressive protocols aimed at reducing treatment toxicity and enhancing long-term patient outcomes. Many firms expanded research collaborations with academic hospitals to study biomarkers and refine early diagnostic tools. Several players also strengthened nanomedicine pipelines to explore targeted delivery systems for kidney and lung protection. Rising interest in rare autoimmune disorders encouraged broader clinical trial activity and strategic partnerships. Companies focused on safety, precision dosing, and faster antibody suppression to secure competitive advantage in this specialized treatment space.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pfizer Inc.

- Roche Holding AG

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- AbbVie Inc.

- GlaxoSmithKline plc

- Johnson & Johnson

- Novartis AG

Recent Developments

- In December 4, 2024, Hansa Biopharma completed enrollment for its global pivotal Phase 3 trial of imlifidase in anti-GBM disease (Goodpasture syndrome). The study enrolled 50 patients across the U.S., U.K., and EU, evaluating imlifidase combined with standard immunosuppressive therapy, glucocorticoids, and plasma exchange versus standard care alone. The trial assesses renal function outcomes, highlighting imlifidase’s role in rapidly removing pathogenic IgG antibodies in this rare autoimmune condition.

Report Coverage

The research report offers an in-depth analysis based on Application-Based, Material type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance as early diagnosis tools become faster and more accessible.

- Biologic therapies will gain wider use due to better safety and targeted action.

- Nanomedicine platforms will shape new delivery options for kidney and lung protection.

- Precision treatment plans will expand as biomarker research improves patient profiling.

- Clinical trials for rare autoimmune disorders will increase with broader funding support.

- Partnerships between pharma firms and research institutions will accelerate therapeutic innovation.

- Hospitals will adopt standardized care pathways that improve treatment outcomes.

- Digital monitoring tools will support real-time assessment of immune activity.

- Greater awareness among clinicians will raise early referral rates and support timely care.

- Regulatory focus on safer immunotherapies will encourage new product approvals.