Market Overview

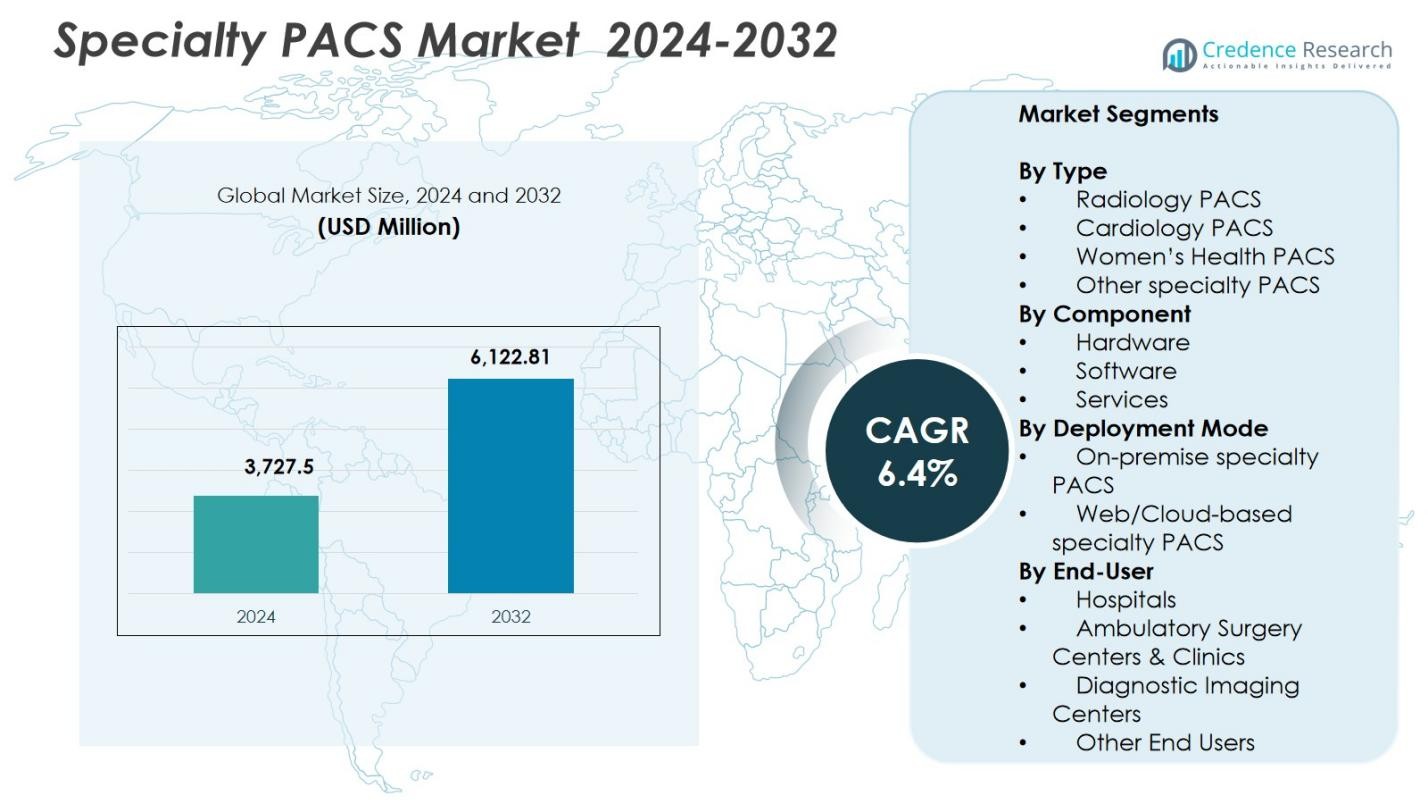

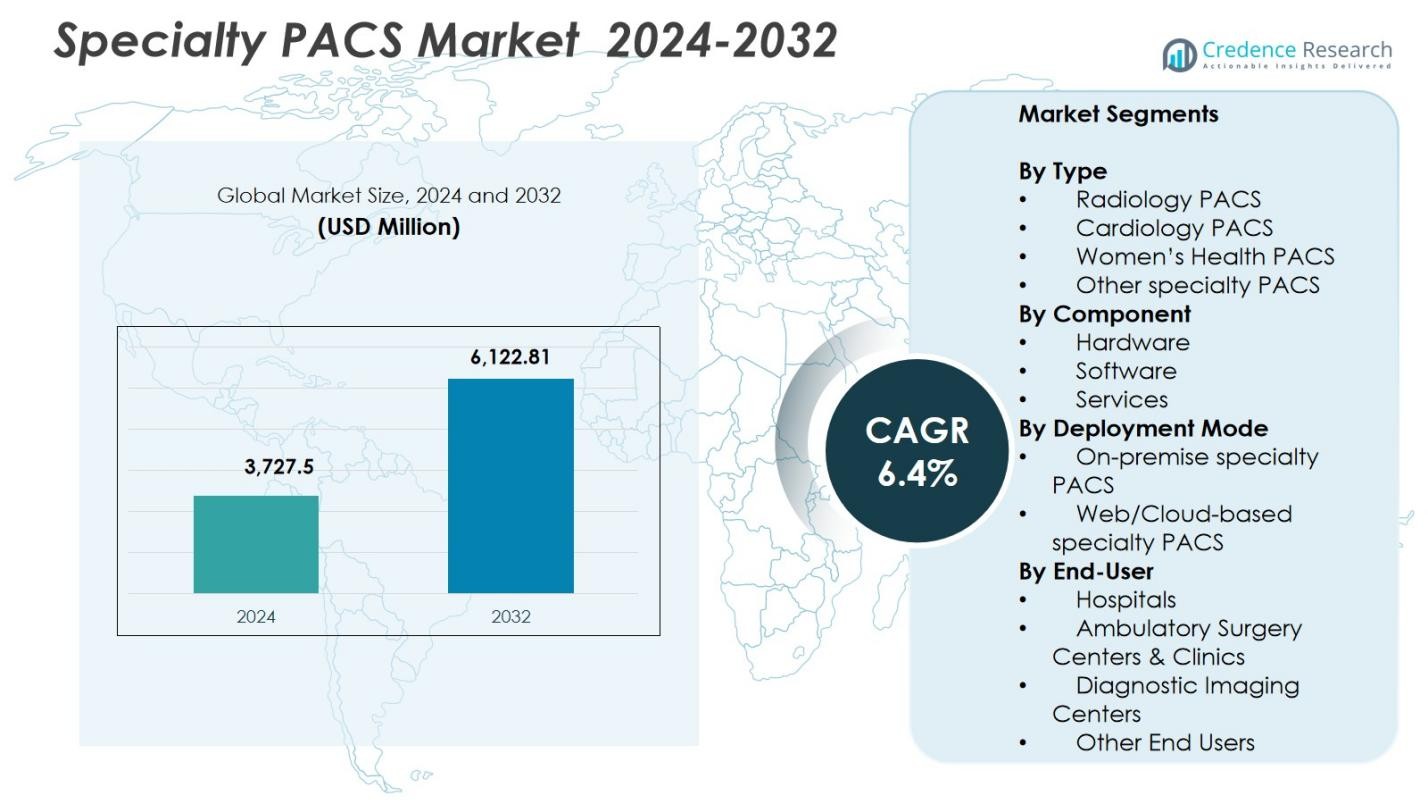

Specialty PACS Market size was valued at USD 3,727.5 Million in 2024 and is anticipated to reach USD 6,122.81 Million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty PACS Market Size 2024 |

USD 3,727.5 Million |

| Specialty PACS Market, CAGR |

6.4% |

| Specialty PACS Market Size 2032 |

USD 6,122.81 Million |

The Specialty PACS Market is shaped by the presence of key players such as GE HealthCare, Koninklijke Philips NV, FUJIFILM Corporation, Siemens AG, Intelerad, Sectra AB, RamSoft, eRAD, Oracle, and McKesson Corporation, each contributing advanced imaging technologies across radiology, cardiology, and specialty diagnostics. These companies focus on AI integration, cloud-based PACS expansion, and enterprise imaging to enhance workflow efficiency and diagnostic accuracy. Regionally, North America leads the market with a 38.2% share, supported by strong healthcare IT infrastructure and widespread adoption of digital imaging solutions, followed by Europe and Asia-Pacific as rapidly expanding regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Specialty PACS Market reached USD 3,727.5 million in 2024 and is expected to hit USD 6,122.81 million by 2032, growing at a 4% CAGR during the forecast period.

- Rising diagnostic imaging volumes, increasing adoption of AI-enabled workflow tools, and strong demand for multi-specialty imaging integration continue to drive growth in the Specialty PACS Market.

- Key trends include rapid migration to cloud-based PACS, expansion of enterprise imaging, and increasing use of advanced analytics to support precision diagnostics and cross-specialty collaboration.

- Leading players such as GE HealthCare, Philips, FUJIFILM, Siemens, Intelerad, and Sectra emphasize innovation in zero-footprint viewers, interoperability, and scalable imaging platforms, while high implementation costs and cybersecurity risks remain key restraints.

- North America leads with a 2% share, followed by Europe at 29.4% and Asia-Pacific at 22.1%, while Radiology PACS dominates segment performance with a 41.6% share in 2024.

Market Segmentation Analysis:

By Type:

Radiology PACS dominated the Specialty PACS Market in 2024 with a 41.6% share, driven by its essential role in high-volume diagnostic workflows across hospitals, imaging centers, and tele-radiology networks. Its leadership is reinforced by rapid adoption of advanced visualization tools, AI-supported diagnostic capabilities, and interoperability with RIS and EMR platforms. Cardiology PACS accounted for a strong share supported by rising cardiovascular imaging volumes, while Women’s Health PACS continued expanding through demand for breast imaging, ultrasound, and OB/GYN diagnostics. Other specialty PACS segments gained traction through niche clinical requirements and subspecialty workflow optimization.

- For instance, GE Healthcare’s Centricity PACS supports various imaging modalities while integrating with RIS and enterprise tools to streamline workflows and boost radiologist productivity.

By Component:

Software emerged as the dominant component with a 47.3% share in 2024, supported by increasing deployment of advanced diagnostic applications, zero-footprint viewers, and enterprise imaging platforms that streamline multi-modality workflows. Demand for AI-powered analytics, automated reporting tools, and cloud-integrated image management further reinforced software adoption. Hardware maintained steady relevance due to ongoing investments in secure storage infrastructure and high-performance servers, while Services expanded through rising needs for system integration, cybersecurity, remote support, and lifecycle management across large healthcare networks.

- For instance, SARC MedIQ’s AI-driven PACS platform automates reporting to cut diagnostic turnaround from 30-45 minutes to under 2 minutes per case. This enables radiologists to prioritize patient care over manual tasks.

By Deployment Model:

Web/Cloud-based Specialty PACS led the market with a 52.8% share in 2024, driven by accelerated digital transformation, remote diagnostic workflows, and the shift toward subscription-based imaging platforms. Scalability, lower upfront costs, and seamless multi-site access strengthened cloud adoption, especially among outpatient imaging centers and telehealth providers. On-premise Specialty PACS retained a significant role in organizations prioritizing data sovereignty, internal infrastructure control, and stringent regulatory compliance. Hybrid deployments also gained momentum as healthcare providers balanced performance, security, and cost efficiency while modernizing imaging ecosystems.

Key Growth Drivers

Increasing Demand for Advanced Diagnostic Imaging

The Specialty PACS Market continues to grow as healthcare providers adopt advanced imaging systems that support faster diagnostics, higher image fidelity, and multi-specialty workflows. Rising imaging volumes in radiology, cardiology, oncology, and women’s health accelerate the need for enterprise-level PACS platforms capable of managing large datasets efficiently. Integration with AI-driven tools enhances clinical decision-making and reduces reporting time, while expanding telehealth models drive remote image access. These factors collectively strengthen investments in modern Specialty PACS solutions across hospitals and diagnostic networks.

- For instance, Siemens Healthineers’ syngo.via provides multimodality reading for oncology with tools to compare PET/CT and SPECT/CT scans from different time points, enabling change-detection in fused images for treatment monitoring.

Expansion of Cloud and Web-Based Imaging Platforms

Cloud-based Specialty PACS solutions serve as a major growth catalyst, enabling scalable storage, multi-site accessibility, and lower capital expenditure. Healthcare organizations increasingly migrate to cloud architectures to streamline collaboration between clinicians, support remote diagnostics, and ensure continuous workflow availability. Vendors offering secure, HIPAA-compliant, zero-footprint viewers and enterprise imaging suites experience rapid adoption. The shift toward subscription-based models and reduced maintenance burdens further encourages hospitals and imaging centers to accelerate cloud transformation initiatives across their imaging infrastructure.

- For instance, Fujifilm’s Synapse Enterprise PACS uses cloud hosting to unify imaging from radiology, cardiology, and pathology in one viewer, automating workflows and enabling customizable protocols for multi-site collaboration.

Growing Emphasis on Workflow Optimization and Interoperability

Demand for seamless interoperability with EHRs, RIS platforms, and third-party imaging applications significantly drives Specialty PACS adoption. Healthcare providers prioritize solutions that consolidate multi-modality imaging, automate repetitive tasks, and improve clinical throughput. Interoperable PACS systems enhance care coordination, minimize administrative delays, and support value-based care initiatives. Increased focus on standardized data exchange, vendor-neutral archives, and automated quality control strengthens market growth as organizations seek integrated imaging ecosystems that improve accuracy, efficiency, and patient outcomes.

Key Trends & Opportunities

Integration of AI and Advanced Analytics

AI-powered imaging analytics present major opportunities by enhancing diagnostic accuracy, automating anomaly detection, and reducing radiologists’ workload. PACS vendors increasingly embed AI tools for triage, workflow prioritization, 3D reconstruction, and automated reporting. These capabilities improve clinical productivity and accelerate time-sensitive diagnoses. As precision medicine expands, AI-enabled Specialty PACS platforms gain traction for personalized treatment planning and predictive insights. The synergy between PACS, machine learning, and cloud computing creates a strong pipeline for future innovation and cross-specialty imaging enhancement.

- For instance, Aidoc’s aiOS platform integrates AI algorithms into PACS for triage, prioritizing urgent cases like pulmonary embolisms as they enter the system, which flags subtle findings for radiologists and streamlines workflow from scan to diagnosis.

Rising Adoption of Enterprise Imaging and Vendor-Neutral Architectures

Enterprise imaging platforms and vendor-neutral archives (VNA) create significant opportunities for healthcare systems seeking unified data management across radiology, cardiology, pathology, ophthalmology, and other specialties. These architectures offer centralized access, improved security, and standardized workflows suitable for large multi-site networks. Adoption increases as organizations pursue digital transformation, reduce data silos, and enhance long-term archival capabilities. As imaging needs grow more complex, VNAs and enterprise imaging solutions position providers to scale efficiently while ensuring clinical consistency and operational visibility.

- For instance, UNC Health implemented Hyland Acuo VNA as a single clinical image repository across 15 hospitals, 19 campuses, and 900 clinics, integrating with NilRead viewer and PACSgear to eliminate silos for 26,000 users.

Key Challenges

High Implementation Costs and Budget Constraints

Despite strong demand, high investment requirements for PACS deployment including software licensing, hardware infrastructure, cybersecurity enhancements, and staff training remain a major challenge. Smaller hospitals and diagnostic centers often struggle with limited budgets, slowing adoption of advanced Specialty PACS solutions. Ongoing maintenance expenses and periodic upgrades further increase total cost of ownership. These financial pressures push providers toward phased implementations or lower-cost cloud models, but affordability concerns continue to limit market penetration in resource-constrained healthcare environments.

Data Security Risks and Compliance Complexities

As imaging increasingly shifts to web-based and cloud-hosted platforms, ensuring data security and regulatory compliance becomes a critical challenge. Providers must address growing threats related to ransomware, unauthorized access, and cross-platform vulnerabilities. Compliance with HIPAA, GDPR, and regional data protection rules requires continuous monitoring and robust identity management. Integrating legacy systems with modern PACS solutions adds further complexity. These security and compliance burdens require significant investment in encryption, audit trails, and secure access frameworks, influencing adoption decisions for many healthcare organizations.

Regional Analysis

North America

North America led the Specialty PACS Market in 2024 with a 38.2% share, driven by rapid adoption of advanced imaging technologies and strong integration of AI-enabled diagnostic platforms across hospitals and outpatient centers. The region benefits from well-established healthcare IT infrastructure, high imaging volumes in radiology and cardiology, and strong regulatory support for digital health transformation. Growing investments in enterprise imaging, cloud-based PACS, and interoperability solutions strengthen market expansion. Continued demand for workflow automation and rising emphasis on early disease detection further reinforce the region’s leadership in specialty imaging modernization.

Europe

Europe accounted for a 29.4% share of the Specialty PACS Market in 2024, supported by expanding digitization initiatives and strong government-backed healthcare modernization programs across major countries. The region demonstrates growing adoption of enterprise imaging platforms, vendor-neutral archives, and cloud-enabled PACS systems that enhance clinical collaboration. Increased focus on breast imaging, cardiovascular diagnostics, and precision medicine strengthens specialty PACS demand. Regulatory frameworks encouraging data security, structured reporting, and cross-border image exchange further drive investments. Rising healthcare expenditure and hospital system consolidation continue to accelerate market penetration across Western and Northern Europe.

Asia-Pacific

Asia-Pacific captured a 22.1% share of the Specialty PACS Market in 2024, fueled by rapid healthcare infrastructure development, increasing imaging volumes, and widespread deployment of digital radiology systems. Countries such as China, India, Japan, and South Korea significantly invest in cloud imaging platforms, AI-driven diagnostics, and scalable PACS solutions to manage growing patient loads. Expanding private hospital networks, rising chronic disease prevalence, and government-led digital health programs accelerate adoption. The shift toward cost-efficient cloud PACS models and tele-imaging services positions Asia-Pacific as the fastest-expanding region in specialty imaging technology.

Latin America

Latin America held a 6.7% share of the Specialty PACS Market in 2024, driven by growing investments in diagnostic imaging equipment and modernization of healthcare IT systems across Brazil, Mexico, Argentina, and Chile. Adoption expands as hospitals migrate from legacy systems to cloud-based PACS solutions that improve accessibility and reduce operational costs. Increasing radiology and cardiology imaging volumes, coupled with rising demand for integrated workflows, support regional growth. Despite budget limitations in public healthcare, private sector investments and tele-radiology partnerships continue to enhance PACS penetration across emerging Latin American markets.

Middle East & Africa

The Middle East & Africa region accounted for a 3.6% share of the Specialty PACS Market in 2024, supported by increasing adoption of digital imaging systems in the Gulf Cooperation Council (GCC) countries and growing investments in hospital infrastructure. Expansion of specialty diagnostic services, particularly in women’s health and cardiology, drives demand for modern PACS platforms. Healthcare digitization strategies and rising partnerships with global technology vendors further strengthen uptake. While limited IT budgets in parts of Africa pose challenges, ongoing telehealth initiatives and cloud-based imaging deployments contribute to steady market growth across the region.

Market Segmentations:

By Type

- Radiology PACS

- Cardiology PACS

- Women’s Health PACS

- Other specialty PACS

By Component

- Hardware

- Software

- Services

By Deployment Mode

- On-premise specialty PACS

- Web/Cloud-based specialty PACS

By End-User

- Hospitals

- Ambulatory Surgery Centers & Clinics

- Diagnostic Imaging Centers

- Other End Users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Specialty PACS Market features a strong competitive environment led by GE HealthCare, Koninklijke Philips NV, FUJIFILM Corporation, Siemens AG, Intelerad, Sectra AB, RamSoft, eRAD, Oracle, and McKesson Corporation, each offering advanced imaging solutions tailored to radiology, cardiology, and specialty diagnostics. Vendors compete by enhancing AI-driven image analysis, expanding cloud-based PACS platforms, and delivering enterprise imaging systems that support multi-modality workflows. Continuous innovation in zero-footprint viewers, advanced visualization, and interoperability tools strengthens market differentiation. Strategic partnerships, product upgrades, and regional expansion remain core competitive strategies as companies aim to improve clinical efficiency, accelerate diagnostic accuracy, and support healthcare providers transitioning to integrated, scalable imaging ecosystems. As demand for workflow automation, remote diagnostics, and secure cloud architectures grows, leading players focus on enhancing cybersecurity, data governance, and seamless EHR integration to maintain market leadership and address evolving clinical and operational requirements across diverse healthcare settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sectra AB

- eRAD

- GE HealthCare

- Intelerad

- RamSoft

- Oracle

- FUJIFILM Corporation

- McKesson Corporation

- Siemens AG

- Koninklijke Philips NV

Recent Developments

- In November 2025, Avatar Medical and Barco launched Eonis Vision, providing advanced 3D imaging capabilities through their collaboration.

- In December 2025, Koninklijke Philips NV showcased its new Advanced Visualization Workspace (AVW 16) with AI-powered multi-modality support at RSNA.

- In December 2025, Sectra expanded its enterprise imaging solution with a digital pathology module for Region Halland in Sweden, enabling instant remote access to images and enhanced cancer diagnostics.

- In October 2024, GE HealthCare launched an advanced Radiology PACS system featuring AI-driven imaging analysis capabilities.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Deployment Mode, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong adoption of cloud-based PACS as healthcare providers prioritize scalability and remote diagnostic capabilities.

- AI-driven workflow automation and decision-support tools will increasingly integrate into specialty imaging platforms.

- Enterprise imaging strategies will expand as organizations shift toward unified data management across multiple specialties.

- Demand for vendor-neutral archives will rise to support long-term storage, interoperability, and multi-site accessibility.

- Precision medicine initiatives will accelerate adoption of advanced visualization and analytics tools within PACS ecosystems.

- Tele-radiology and tele-cardiology services will expand, driving the need for high-speed image exchange and secure cloud infrastructure.

- Regulatory emphasis on data security and compliance will shape PACS development and deployment models.

- Hybrid deployment models will gain traction as providers balance cloud flexibility with on-premise data control.

- Growth in specialty diagnostics, including women’s health and oncology imaging, will expand PACS utilization.

- Emerging markets will invest more in digital imaging infrastructure, boosting global Specialty PACS adoption.