Market Overview:

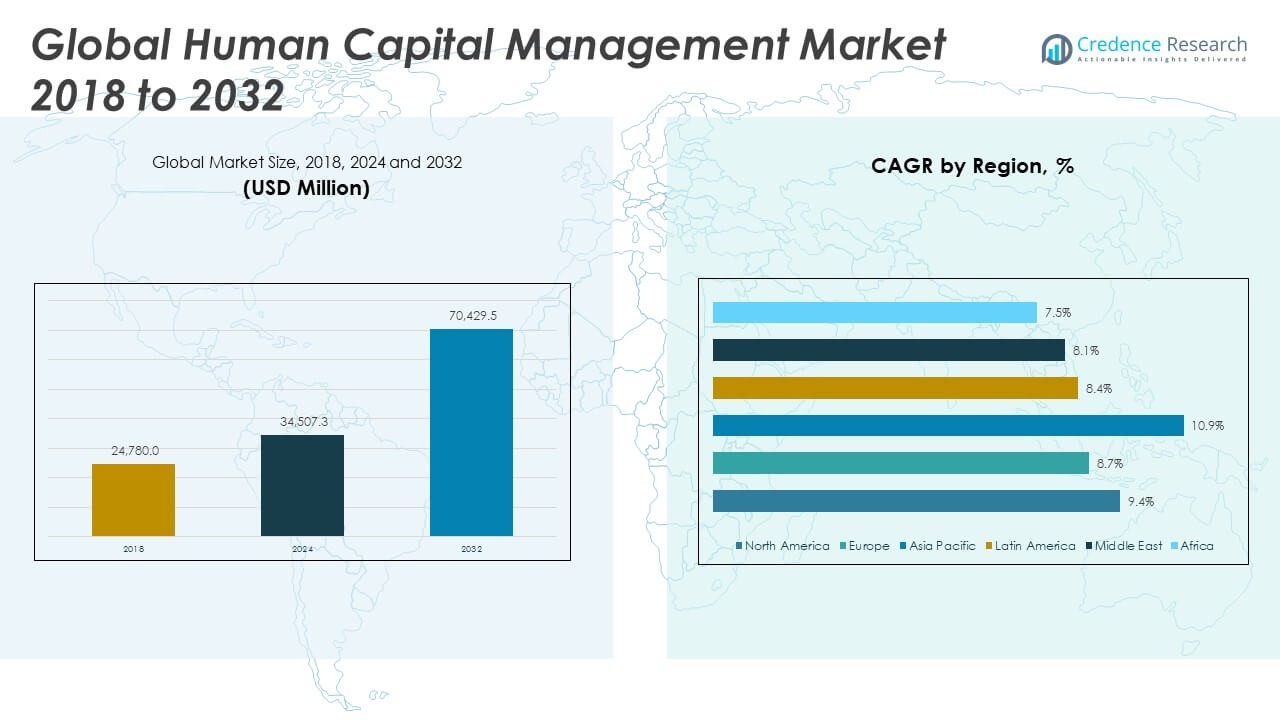

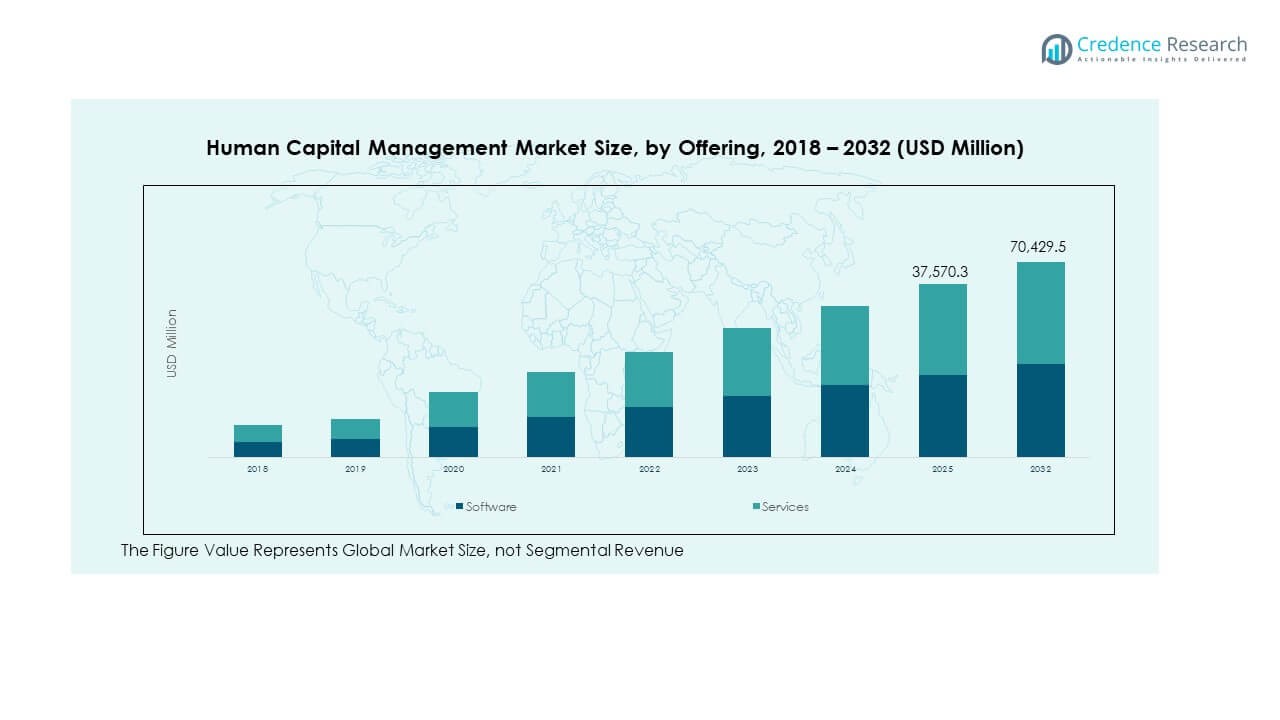

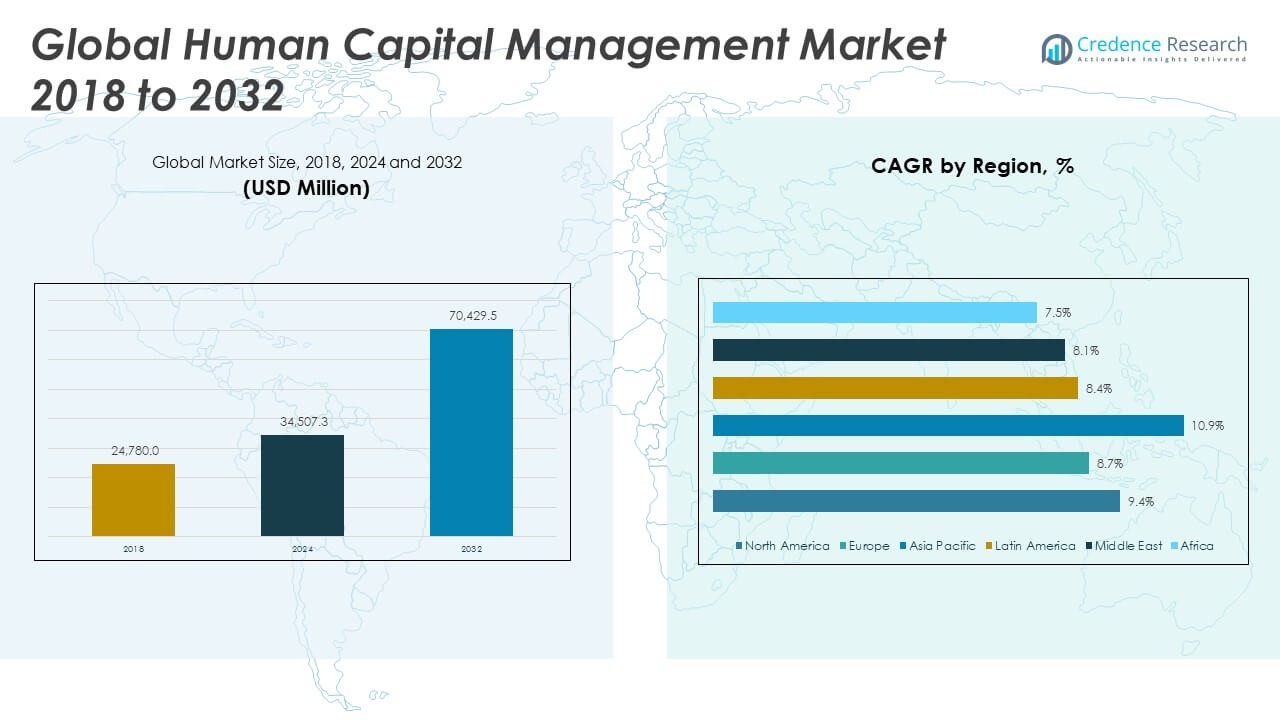

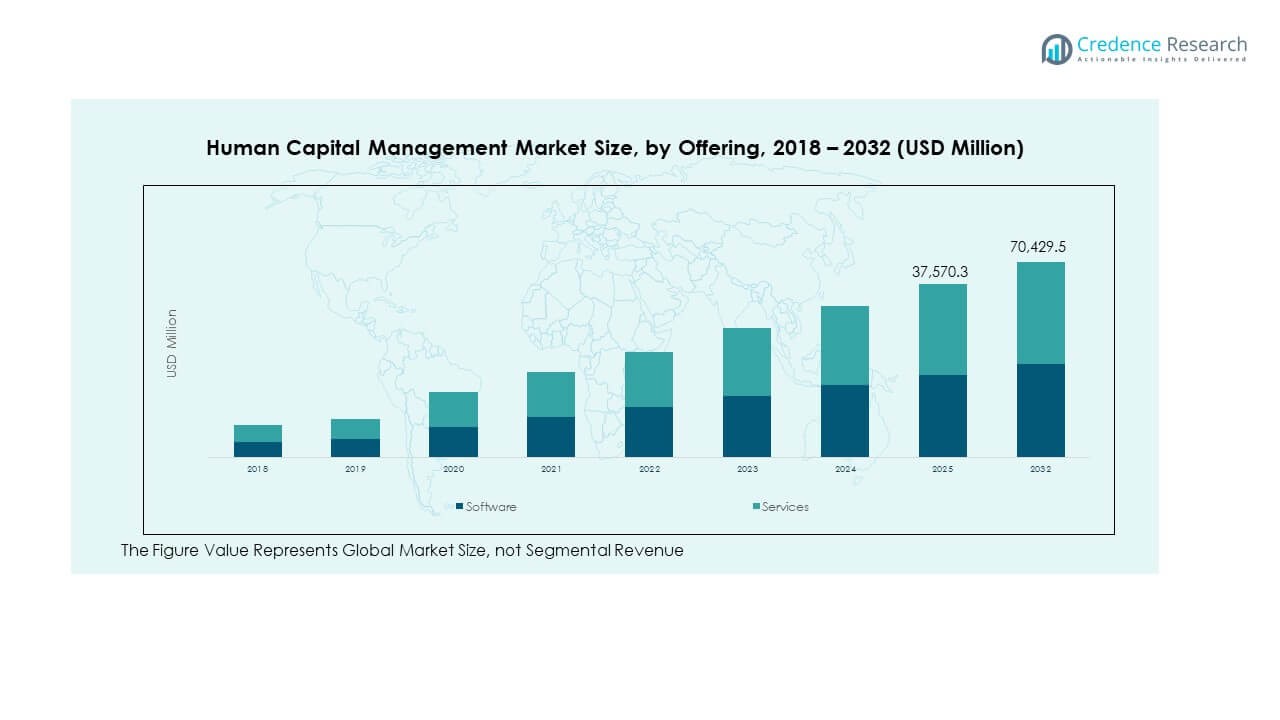

The Human Capital Management Market size was valued at USD 24,780.0 million in 2018 to USD 34,507.3 million in 2024 and is anticipated to reach USD 70,429.5 million by 2032, at a CAGR of 9.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Human Capital Management Market Size 2024 |

USD 34,507.3 Million |

| Human Capital Management Market, CAGR |

9.39% |

| Human Capital Management Market Size 2032 |

USD 70,429.5Million |

The market is driven by the growing adoption of cloud-based solutions, the rising need for workforce analytics, and the increasing demand for automation in HR processes. Organizations are focusing on enhancing employee experience, improving talent acquisition, and streamlining payroll and compliance management. The shift towards remote and hybrid work models further accelerates the need for integrated human capital management platforms that offer scalability, real-time data insights, and advanced analytics capabilities.

North America leads the Human Capital Management Market due to strong technology adoption, a mature enterprise ecosystem, and the presence of key solution providers. Europe follows, supported by stringent labor regulations and digital transformation initiatives. The Asia-Pacific region is emerging rapidly, driven by the expanding workforce, rising investments in HR tech, and the growing emphasis on talent management in countries like India, China, and Japan. Latin America and the Middle East & Africa show increasing adoption as organizations modernize HR operations to enhance competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Human Capital Management Market was valued at USD 34,507.3 million in 2024 and is projected to reach USD 70,429.5 million by 2032, growing at a CAGR of 9.39%.

- Rising adoption of cloud-based platforms is enabling organizations to streamline HR processes and improve scalability.

- Increasing demand for workforce analytics is driving data-driven decision-making and enhancing talent management strategies.

- High implementation costs and integration complexities remain key barriers to wider adoption among smaller enterprises.

- North America leads the market with 36.26% share in 2024, supported by strong technology infrastructure and early adoption rates.

- Asia Pacific is the fastest-growing region, driven by expanding workforce size and rapid enterprise digitalization.

- Compliance with evolving labor laws is influencing the adoption of advanced HCM solutions across multiple industries.

Market Drivers:

Rapid Adoption of Cloud-Based Human Capital Management Solutions

The Human Capital Management Market is benefiting from a rapid shift toward cloud-based platforms that offer scalability, flexibility, and cost efficiency. Organizations seek solutions that allow seamless integration of multiple HR functions, from recruitment to payroll, under a unified system. Cloud platforms reduce infrastructure costs and ensure accessibility for remote and hybrid teams. It also enhances data security with advanced encryption and compliance features. The growing need for real-time analytics and workforce insights strengthens the preference for cloud models. Companies leverage these tools to optimize decision-making and improve operational efficiency. The ability to deploy updates remotely improves user experience. Increasing vendor innovation ensures continuous enhancements in functionality.

Increasing Demand for Workforce Analytics and Talent Intelligence

Workforce analytics has become a priority for enterprises aiming to make data-driven HR decisions. The Human Capital Management Market is witnessing strong growth from solutions that provide predictive insights into employee performance, attrition risks, and skill gaps. It enables HR teams to design effective training, career development, and retention strategies. Advanced analytics tools help organizations forecast staffing needs accurately and reduce hiring cycles. Businesses are investing in AI-powered analytics to improve recruitment quality and reduce turnover. Real-time dashboards assist in tracking productivity across departments. It also ensures alignment between workforce strategies and business goals. The trend supports improved employee satisfaction and organizational competitiveness.

- For example, Aura’s AI-powered workforce analytics platform processes over 1 billion employee profiles and 500 million job postings, delivering predictive attrition, skill gap, and retention insights for more than 500 Bain & Company clients in 2023.

Growing Emphasis on Employee Experience and Engagement

Employee engagement directly impacts productivity, retention, and profitability. The Human Capital Management Market is influenced by the increasing focus on enhancing the employee experience across all stages of the lifecycle. It offers self-service portals, mobile access, and AI-powered chatbots to simplify HR interactions. Personalized learning programs encourage skill enhancement and career growth. Modern systems incorporate feedback tools for continuous improvement. HR platforms integrate wellness and mental health modules to support workforce well-being. Recognition and reward systems motivate employees and boost morale. The shift toward people-centric strategies positions engagement as a core business priority. Enhanced experiences lead to stronger employer branding.

Regulatory Compliance and Evolving Labor Laws Driving Digital Transformation

Regulatory compliance requirements are prompting organizations to adopt advanced HCM solutions. The Human Capital Management Market benefits from platforms that automate compliance tracking and reporting. It minimizes the risk of penalties by ensuring adherence to local, national, and international labor laws. Businesses can easily update policies in response to regulatory changes. The system streamlines documentation, audit trails, and secure data management. Industries with complex compliance needs, such as finance and healthcare, find these solutions particularly valuable. Multinational companies rely on HCM platforms to manage cross-border workforce compliance efficiently. Automated compliance reduces manual errors and improves governance. The emphasis on legal adherence is driving adoption in diverse sectors.

- For example, Secureframe’s compliance automation platform connects with over 100 external systems including cloud services, HR platforms, and developer tools to automate evidence collection and enable continuous monitoring for frameworks like SOC 2, ISO 27001, and HIPAA compliance.

Market Trends

Integration of Artificial Intelligence and Machine Learning in HR Processes

The Human Capital Management Market is embracing AI and ML to optimize recruitment, workforce planning, and talent development. It enables automated candidate screening, predictive attrition analysis, and personalized learning paths. AI-driven chatbots provide instant HR support and reduce response times. Machine learning models enhance skills matching between job roles and candidates. Intelligent scheduling tools improve resource allocation efficiency. Businesses use AI to identify leadership potential within existing teams. Data-driven algorithms ensure more accurate performance evaluations. The trend enhances decision-making while reducing operational costs.

Rise of Mobile-First HCM Platforms for Workforce Accessibility

Mobile-first solutions are gaining traction due to the increasing need for anytime, anywhere workforce management. The Human Capital Management Market benefits from apps that provide instant access to payroll data, leave applications, and performance feedback. It supports field workers, remote employees, and global teams. Mobile platforms integrate push notifications for important updates. Organizations use mobile tools to improve employee engagement through gamification and quick surveys. Digital signatures and document sharing streamline HR workflows. The shift ensures higher adoption rates among younger, tech-savvy employees. It strengthens overall workforce connectivity and collaboration.

Expansion of HCM into Comprehensive Employee Wellness Programs

Employee well-being has become a strategic priority for many organizations. The Human Capital Management Market is seeing greater integration of wellness tools, including fitness tracking, stress management resources, and mental health support. It aligns well-being initiatives with productivity improvement strategies. Platforms offer confidential counseling access and health risk assessments. Businesses link wellness participation to performance incentives. Data from wellness programs helps HR teams address absenteeism and burnout issues. Corporate social responsibility goals increasingly include employee well-being. Wellness-focused HCM solutions improve workforce loyalty and retention.

- For example, Virgin Pulse’s wellness platform offers organizations on-demand analytics and richly detailed reports on employee well-being covering key biometric indicators like BMI, blood pressure, cholesterol, glucose, and waist circumference. The platform also enables insights across 21 wellness topics ranging from nutrition and sleep to mental and financial well-being and productivity.

Adoption of Unified Platforms Combining HR, Payroll, and ERP Systems

Organizations prefer unified systems that eliminate the inefficiencies of disconnected HR tools. The Human Capital Management Market benefits from platforms that merge HR functions with payroll and enterprise resource planning modules. It reduces data duplication and improves information accuracy. Integrated solutions simplify reporting for both HR and finance teams. Cross-functional visibility supports better workforce budgeting and forecasting. Companies save on IT maintenance costs with a single platform. The approach improves interdepartmental collaboration. It positions HCM systems as central hubs for organizational data management.

- For instance, Oracle Payroll fully unified with Oracle Fusion Cloud HCM streamlines payroll operations with automated calculations and reduced manual errors. While Oracle delivers native payroll capabilities in 14 countries, it extends processing to over 160 countries through its global payroll partner network.

Market Challenges Analysis

High Implementation Costs and Complexity in System Integration

The Human Capital Management Market faces challenges from the significant costs of deploying advanced platforms. It requires substantial investment in software, customization, and training. Smaller businesses may struggle to justify the expense without immediate ROI. Integration with existing IT infrastructure can be complex and time-consuming. Incompatibility with legacy systems creates additional expenses. Vendor selection and migration planning demand careful strategy. Resistance from internal teams slows adoption in some organizations. Implementation delays can disrupt HR operations and reduce system effectiveness.

Data Privacy Concerns and Compliance Risks in Global Operations

Data privacy remains a major barrier to adoption. The Human Capital Management Market must address stringent global regulations on employee data storage and processing. It faces the challenge of ensuring secure access while maintaining usability. Multinational companies manage diverse compliance rules across regions. Breaches or non-compliance can lead to reputational and financial damage. Cybersecurity investments are essential to protect sensitive workforce data. Employees may hesitate to use platforms if trust is lacking. Ensuring consistent compliance across different jurisdictions requires continuous system updates.

Market Opportunities

Rising Demand for AI-Driven Talent Management and Predictive Insights

The Human Capital Management Market is poised to benefit from the growing interest in AI-based recruitment, workforce planning, and retention strategies. It enables organizations to forecast talent needs, reduce attrition, and enhance productivity. Predictive analytics improves hiring accuracy and workforce deployment. Companies can identify future skills requirements proactively. Integration with learning systems supports rapid skill development. AI tools provide actionable insights that enhance HR decision-making.

Growing Adoption in Emerging Economies with Expanding Workforce Needs

Emerging economies present strong potential for HCM adoption due to rapid urbanization, industrial growth, and workforce expansion. The Human Capital Management Market can tap into sectors modernizing HR operations to meet competitive pressures. It supports digital transformation in small and medium enterprises. Affordable cloud-based models appeal to budget-conscious firms. Localization features address regional workforce requirements effectively. Increasing internet penetration and smartphone usage accelerate adoption.

Market Segmentation Analysis:

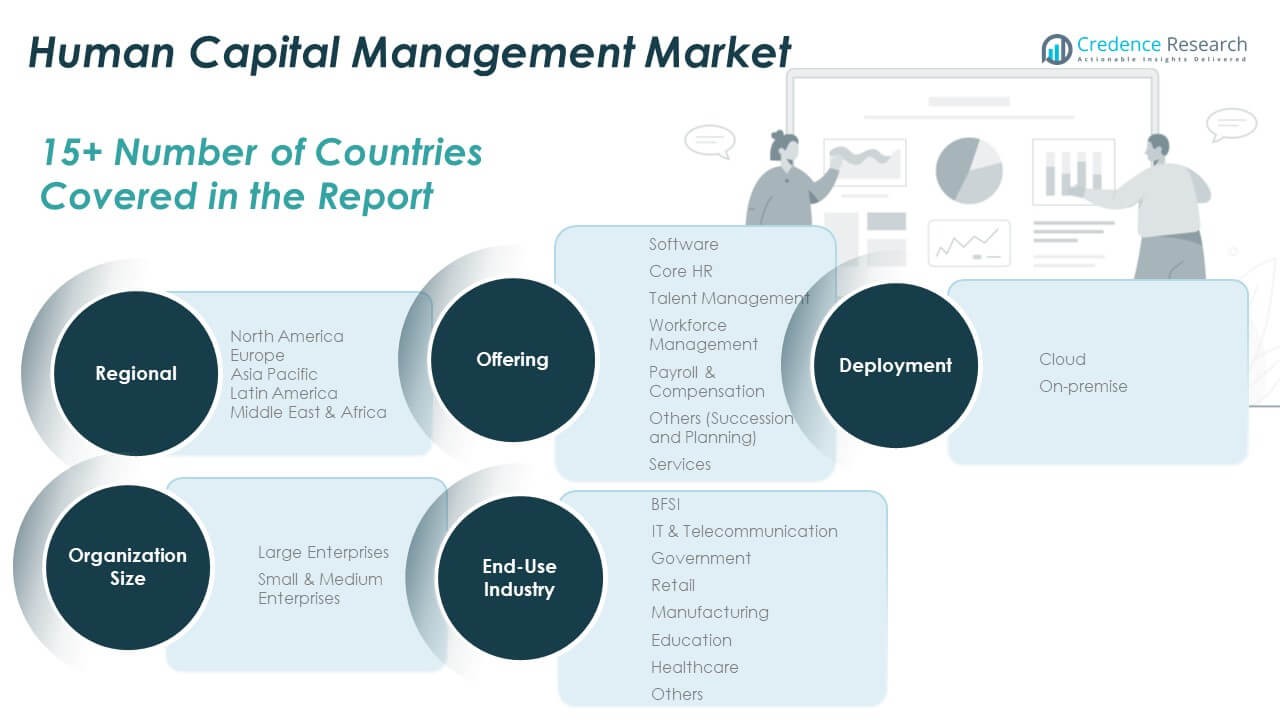

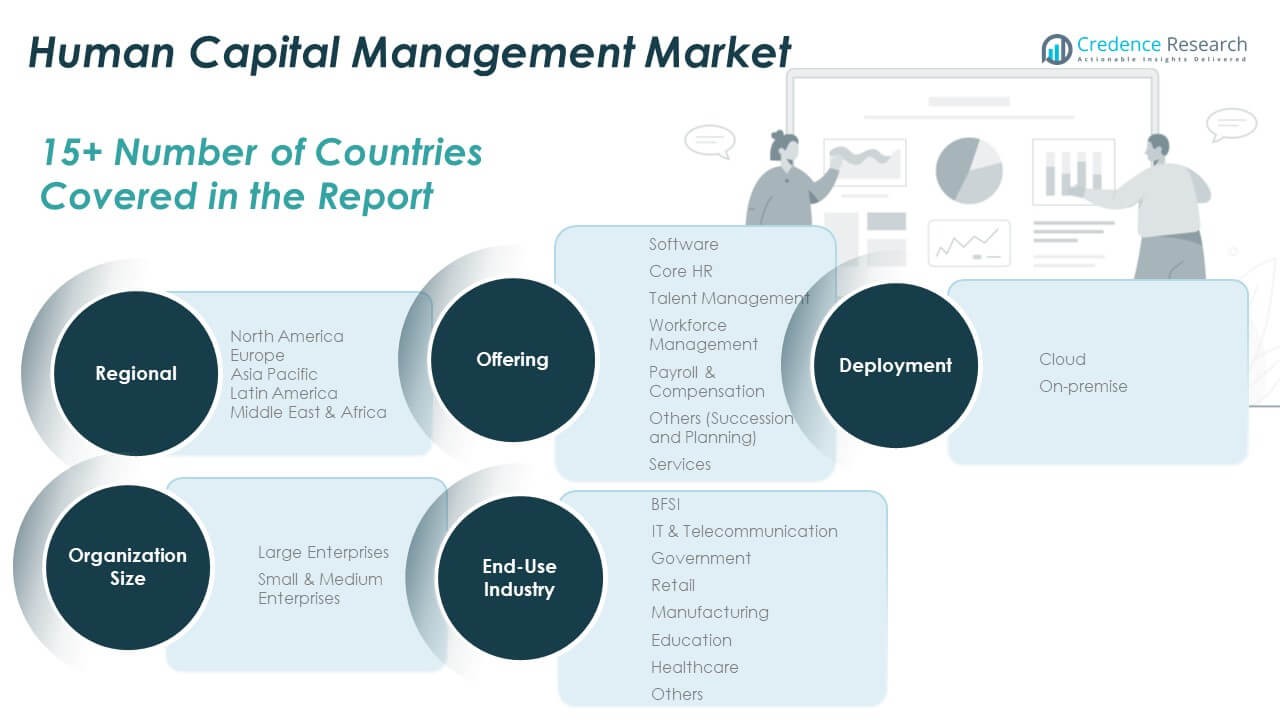

The Human Capital Management Market is segmented

By offering into software and services. The software segment includes core HR, talent management, workforce management, payroll and compensation, and others such as succession and planning. Core HR systems manage employee data, compliance, and benefits, while talent management tools support recruitment, onboarding, and career development. Workforce management solutions optimize scheduling, attendance, and productivity tracking. Payroll and compensation systems ensure accurate salary processing and compliance with tax regulations. Services include consulting, implementation, and maintenance, enabling organizations to maximize platform efficiency.

By deployment, the market is classified into cloud and on-premise models. Cloud deployment holds a strong share due to scalability, remote accessibility, and reduced infrastructure costs. On-premise deployment remains relevant for organizations requiring higher data control and customization.

By end-use industry, the market serves BFSI, IT & telecommunication, government, retail, manufacturing, education, healthcare, and others. BFSI and IT sectors lead adoption, driven by large workforce bases and complex compliance needs. Government agencies focus on digitizing HR processes, while retail and manufacturing emphasize workforce optimization. Education and healthcare sectors value integrated platforms for managing diverse employee categories.

- For example, Akrivia HCM’s unified platform enables organizations such as those in the BFSI sector to manage personalized learning programs, performance reviews, and regulatory compliance within a single system, reducing manual workload through streamlined reporting.

By organization size, the market caters to large enterprises and small & medium enterprises (SMEs). Large enterprises dominate adoption due to higher budgets and advanced integration needs across global operations. SMEs increasingly adopt cost-effective, cloud-based solutions to streamline HR functions and improve talent retention. It continues to witness demand growth across all segments, driven by the need for automation, analytics, and improved employee experiences.

- For example, Square Payroll is a cloud-based payroll and HR solution built for small U.S. businesses (typically under 100 employees). It automates payroll calculations, tax withholdings, filings, and integrates with Square POS for seamless time-entry.

Segmentation:

By Offering

- Software

- Core HR

- Talent Management

- Workforce Management

- Payroll & Compensation

- Others (Succession and Planning)

- Services

By Deployment

By End-use Industry

- BFSI

- IT & Telecommunication

- Government

- Retail

- Manufacturing

- Education

- Healthcare

- Others

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Region

-

- North America

- Europe

- Asia Pacific

- Latin America

Regional Analysis:

North America

The North America Human Capital Management Market size was valued at USD 9,094.26 million in 2018 to USD 12,512.13 million in 2024 and is anticipated to reach USD 25,502.66 million by 2032, at a CAGR of 9.4% during the forecast period. The region accounts for 36.26% of the global market share in 2024. The Human Capital Management Market in North America benefits from strong technological infrastructure, early adoption of advanced HR solutions, and the presence of leading vendors. It supports diverse industries such as BFSI, IT, and healthcare in streamlining workforce management. Cloud-based adoption is high due to the emphasis on scalability and integration. Large enterprises drive market demand, but SMEs are increasingly investing in AI-driven HR systems. Data analytics, automation, and compliance management remain key adoption factors. Strategic partnerships between software providers and enterprises boost innovation and deployment rates. Regulatory complexity across states further enhances demand for robust HCM platforms.

Europe

The Europe Human Capital Management Market size was valued at USD 6,851.67 million in 2018 to USD 9,188.34 million in 2024 and is anticipated to reach USD 17,766.04 million by 2032, at a CAGR of 8.7% during the forecast period. The region holds 26.64% of the global market share in 2024. The Human Capital Management Market in Europe is driven by strict labor laws, GDPR compliance requirements, and widespread digital transformation initiatives. Industries focus on centralizing HR functions to improve efficiency and meet regulatory demands. Talent acquisition platforms and workforce analytics tools are in high demand. The region shows strong adoption in manufacturing, retail, and public sector organizations. Cloud deployment is increasing, although on-premise systems still serve data-sensitive sectors. Multilingual capabilities and regional customization are critical for vendor competitiveness. Cross-border workforce management remains a strategic priority for multinational companies. Investments in employee wellness and engagement platforms are also rising.

Asia Pacific

The Asia Pacific Human Capital Management Market size was valued at USD 5,476.38 million in 2018 to USD 8,000.36 million in 2024 and is anticipated to reach USD 18,192.00 million by 2032, at a CAGR of 10.9% during the forecast period. The region captures 23.18% of the global market share in 2024. The Human Capital Management Market in Asia Pacific is expanding rapidly due to economic growth, increasing workforce size, and enterprise digitalization. It supports industries across IT, BFSI, and manufacturing with cloud-first adoption strategies. Small and medium enterprises are driving demand for affordable, scalable solutions. The region’s diverse labor regulations create a need for adaptable compliance tools. Talent management is a top priority, particularly in high-growth economies like India, China, and Southeast Asia. Mobile-enabled HCM platforms are gaining popularity for field and remote workforce management. Vendors are investing in localization to address language, cultural, and regulatory variations. The market benefits from strong government initiatives promoting digital transformation.

Latin America

The Latin America Human Capital Management Market size was valued at USD 1,620.61 million in 2018 to USD 2,235.73 million in 2024 and is anticipated to reach USD 4,244.79 million by 2032, at a CAGR of 8.4% during the forecast period. The region represents 6.48% of the global market share in 2024. The Human Capital Management Market in Latin America is supported by increasing HR automation adoption and a growing shift towards cloud-based systems. Businesses are focusing on improving workforce productivity and reducing administrative burdens. Economic modernization and expanding service industries are accelerating demand. Talent retention and recruitment platforms are key growth areas. Multinational companies drive adoption through regional expansions. Compliance with evolving labor regulations motivates investment in advanced HCM solutions. Vendors offering localized support and Spanish/Portuguese language integration gain competitive advantage. Cost-effective subscription models are favored by small and medium enterprises.

Middle East

The Middle East Human Capital Management Market size was valued at USD 1,015.98 million in 2018 to USD 1,331.76 million in 2024 and is anticipated to reach USD 2,472.46 million by 2032, at a CAGR of 8.1% during the forecast period. The region accounts for 3.86% of the global market share in 2024. The Human Capital Management Market in the Middle East benefits from government-led digital transformation programs and growing private sector modernization. Adoption is rising in oil and gas, construction, and public administration sectors. Cloud deployment is gaining preference for scalability and accessibility. Talent localization and workforce nationalization policies are shaping HR strategies. Large-scale infrastructure projects drive workforce management system needs. The market sees strong demand for payroll and compliance modules to manage diverse expatriate workforces. Regional tech investments and partnerships with global vendors support solution expansion.

Africa

The Africa Human Capital Management Market size was valued at USD 721.10 million in 2018 to USD 1,238.95 million in 2024 and is anticipated to reach USD 2,251.58 million by 2032, at a CAGR of 7.5% during the forecast period. The region holds 3.58% of the global market share in 2024. The Human Capital Management Market in Africa is emerging, supported by growing adoption of cloud-based HR platforms in banking, telecom, and public sectors. Businesses aim to modernize workforce processes and align with global operational standards. SMEs are increasingly adopting subscription-based systems for affordability and flexibility. Limited IT infrastructure in some areas creates opportunities for mobile-enabled solutions. Talent management and payroll automation remain the most in-demand modules. Government initiatives in digital transformation and labor compliance encourage adoption. Localized, multilingual solutions are key for penetrating diverse markets across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- Cornerstone OnDemand, Inc.

- Ceridian HCM, Inc.

- Infor, Inc.

- Ramco Systems Ltd.

- Workday, Inc.

- Paycom Software, Inc.

- UKG Inc.

- Cegid

- BambooHR LLC

- Sumtotal Systems, LLC

Competitive Analysis:

The Human Capital Management Market is highly competitive, with global and regional players offering comprehensive software and service portfolios. Leading companies such as SAP SE, Oracle Corporation, Microsoft Corporation, Workday Inc., and UKG Inc. focus on innovation, cloud integration, and AI-driven capabilities to strengthen market presence. It is shaped by strategic mergers, acquisitions, and partnerships that expand geographic reach and product functionality. Vendors compete on scalability, customization, and compliance features. Emerging players target niche markets with cost-effective, industry-specific solutions. Continuous investment in mobile accessibility, analytics, and employee experience platforms remains a key differentiator. Strategic alliances with payroll providers and workforce analytics specialists are enhancing product ecosystems. Growing emphasis on ESG compliance and sustainability reporting is also influencing product development strategies.

Recent Developments:

- In July 2025, SAP SE announced significant enhancements to its Business AI portfolio, aiming to deliver high-impact artificial intelligence innovations to its human capital management (HCM) customers. These enhancements include updates to SAP Build and new intelligent applications within the SAP Business Data Cloud, with a continued focus on boosting business productivity and process automation for large enterprises.

- In June 2025, Oracle Corporation unveiled a landmark $30 billion cloud deal, marking one of the largest agreements in the company’s history. While the customer’s name remains confidential, industry speculation points to G42, a UAE-based firm prioritizing AI-optimized data centers.

- In February 2025, Workday launched its new Agent System of Record, a platform that centralizes management of AI agents for organizational HR functions. The system provides businesses with tools for onboarding, defining roles, real-time monitoring, and compliance for AI agents, aiming to streamline integration between human and AI workflows and optimize both performance and costs.

- In January 2025, Microsoft Corporation extended its partnership with OpenAI, deepening collaboration on enterprise-scale artificial intelligence. The agreement secures Microsoft’s exclusive access to OpenAI’s APIs through Azure and supports new innovations in AI-driven business solutions.

Market Concentration & Characteristics:

The Human Capital Management Market demonstrates moderate to high concentration, with a few dominant vendors holding substantial global market share. It features a mix of established technology providers and specialized HR solution firms. The market is characterized by rapid technological adoption, strong demand for cloud-based platforms, and integration of AI and analytics. It favors providers capable of delivering secure, scalable, and localized solutions across multiple industries and geographies. Competitive intensity drives constant innovation, while long-term contracts with enterprise clients enhance vendor stability. Expanding service portfolios through modular offerings is helping vendors address diverse organizational needs. Growing demand for vertical-specific solutions is encouraging providers to tailor features for industry-focused deployments.

Report Coverage:

The research report offers an in-depth analysis based on Offering, Deployment, End-use Industry and Organization Size. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing integration of AI and machine learning will enhance predictive analytics and talent management capabilities.

- Cloud-based adoption will accelerate as organizations seek scalable, cost-efficient HR solutions.

- Mobile-first platforms will gain prominence to support remote and hybrid workforce management.

- Data security and compliance features will evolve to address stricter global labor regulations.

- Demand for unified platforms combining HR, payroll, and ERP functions will expand across industries.

- Employee wellness and engagement modules will see greater adoption as part of holistic workforce strategies.

- SMEs will emerge as a significant growth segment through affordable, subscription-based models.

- Industry-specific customization will rise, with tailored solutions for healthcare, manufacturing, and public sectors.

- Partnerships between HCM vendors and technology providers will drive innovation and ecosystem expansion.

- Advanced analytics for diversity, equity, and inclusion will become a strategic priority in workforce planning.