Market Overview

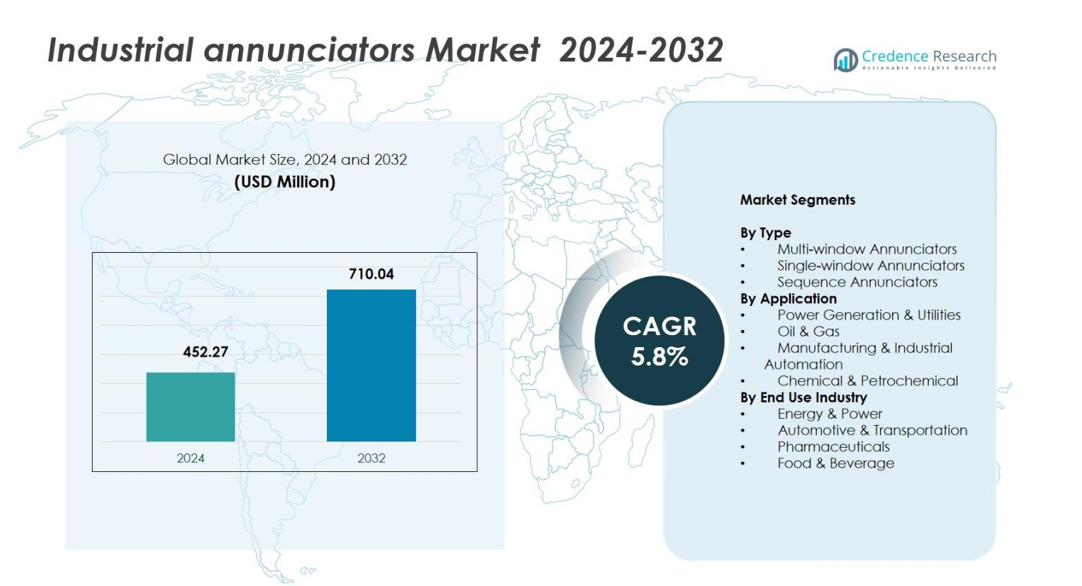

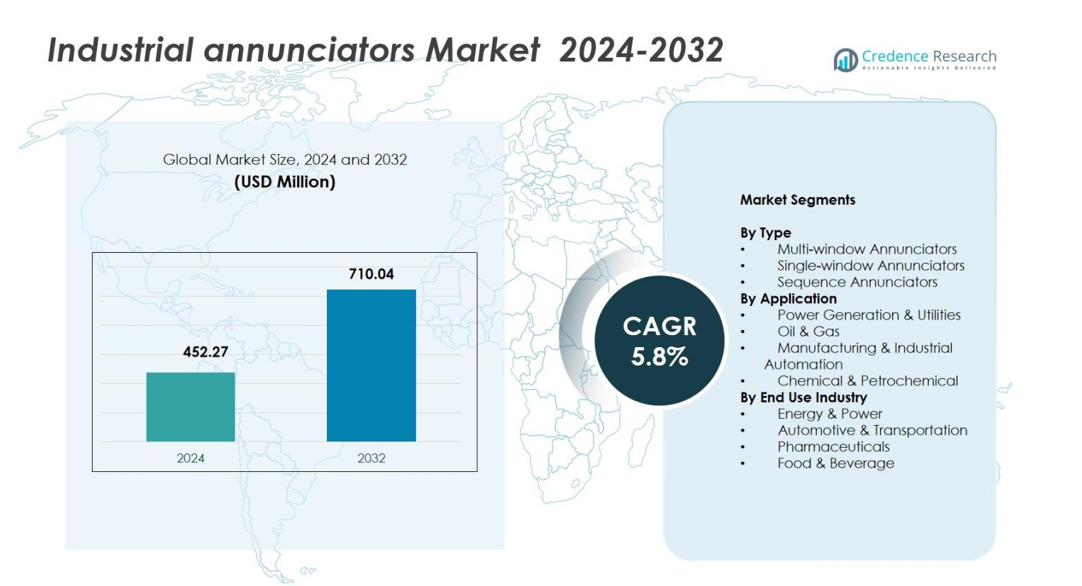

Industrial Annunciators Market size was valued at USD 452.27 Million in 2024 and is anticipated to reach USD 710.04 Million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Annunciators Market Size 2024 |

USD 452.27 Million |

| Industrial Annunciators Market, CAGR |

5.8% |

| Industrial Annunciators Market Size 2032 |

USD 710.04 Million |

Industrial Annunciators Market features prominent players such as Notifier, Honeywell International (Fire-Lite), ABB, Eaton Corporation, AMETEK, Inc., Automation Displays, Inc., OMEGA Engineering, Inc., Hirsch Electronics Corp., Linde North America, Inc., and Century Control Systems, Inc. These companies strengthen their presence through advanced alarm solutions, networked annunciator systems, and expanded industrial safety offerings. North America led the market with a 34.7% share in 2024, driven by strong automation adoption and strict safety regulations, followed by Europe with 27.9% and Asia-Pacific with 28.6%, supported by rapid industrial expansion and modernization across utilities, manufacturing, and energy sectors.

Market Insights

- Industrial Annunciators Market reached USD 452.27 Million in 2024 and will grow to USD 710.04 Million by 2032 at a 5.8% CAGR, supported by rising automation and safety compliance needs.

- Strong market drivers include increasing regulatory focus on real-time fault detection and high adoption of multi-window annunciators, which accounted for a 48.6% segment share in 2024.

- Key trends reflect rapid integration of smart, Ethernet-enabled annunciators and expanding deployment in hazardous sectors such as oil & gas, which captured a 27.5% application share.

- Leading players enhance technologically advanced offerings to strengthen market presence, while restraints include integration issues with legacy systems and high maintenance demands in harsh operating environments.

- Regional analysis shows North America leading with a 34.7% share, followed by Europe at 27.9% and Asia-Pacific at 28.6%, driven by industrial modernization, utility upgrades, and growing manufacturing activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Industrial Annunciators Market by type is dominated by multi-window annunciators, holding a 48.6% share in 2024 due to their ability to monitor multiple process parameters simultaneously in complex industrial environments. Their widespread adoption in power plants, refineries, and high-risk facilities is driven by strong demand for real-time fault visualization and enhanced operator safety. Single-window annunciators captured 32.4%, serving smaller installations requiring basic alerting functions, while sequence annunciators held 19%, supported by their role in event sequencing and root-cause diagnostics for advanced automation systems.

- For instance, Seekirk’s A1600 series provides customizable window configurations for visual alarm patterning in electrical power plants and substations.

By Application

Within applications, power generation & utilities led the Industrial Annunciators Market with a 41.2% share in 2024, driven by stringent safety mandates, rising electrical infrastructure upgrades, and the need for continuous equipment monitoring to prevent grid failures. Oil & gas accounted for 27.5%, supported by hazardous-area safety requirements and pipeline monitoring. Manufacturing & industrial automation held 21.3%, fueled by Industry 4.0 adoption, while chemical & petrochemical contributed 10%, relying on annunciators for explosion-proof signaling and strict process-safety compliance.

- For instance, American Electric Power upgraded the annunciator system at its Donald C. Cook Nuclear Plant by installing digital displays with 50 to 100 alarms each, replacing obsolete analog panels to enhance reliability and eliminate single points of failure.

By End Use Industry

The energy & power sector dominated the end-use segmentation with a 44.1% share in 2024, driven by frequent demand for system protection, fault alarms, and critical substation monitoring. Automotive & transportation captured 23.6%, supported by expanding manufacturing automation and quality assurance systems. Pharmaceuticals held 18.2%, where annunciators ensure environmental control, equipment validation, and regulatory compliance in sterile production zones. Food & beverage represented 14.1%, driven by increased automation, hygiene monitoring, and machine-safety requirements across modern processing facilities.

Key Growth Drivers

Rising Focus on Industrial Safety and Compliance

The Industrial Annunciators Market experiences strong growth as industries intensify their focus on operational safety and regulatory compliance. Power plants, chemical facilities, and oil & gas operations increasingly adopt annunciators to ensure instant fault detection and reduce downtime risks. Strict global safety standards, including OSHA and IEC guidelines, propel demand for advanced alarm management systems. Organizations prioritize systems that deliver real-time alerts and multi-window visibility, driving broader adoption across critical infrastructure and industrial automation environments.

- For instance, Curtiss-Wright upgraded annunciator systems at American Electric Power’s Donald C. Cook Nuclear Plant, replacing legacy equipment in both nuclear units to provide immediate visual and audio indications of plant systems.

Expansion of Automation and Industry 4.0 Integration

Rapid industrial automation significantly boosts market growth as manufacturing, energy, and utility sectors integrate smart monitoring solutions. Annunciators support automated workflows by delivering precise fault signaling, event sequencing, and remote supervisory control. Industry 4.0 encourages adoption of intelligent annunciators that interface with PLCs, SCADA, and distributed control systems. As factories shift toward connected operations, demand rises for annunciators that enhance process transparency, accelerate root-cause diagnostics, and optimize overall equipment reliability in high-throughput production environments.

- For instance, Minilec’s microprocessor-based alarm annunciators integrate with SCADA systems via RS485 Modbus RTU protocol, enabling centralized monitoring of alarm events with time-stamped data logging and HMI display for improved operator response in industrial plants.

Growing Investments in Power Infrastructure Modernization

Increasing investments in grid modernization and power reliability strengthen market expansion. Utilities upgrade legacy equipment with digital annunciators to improve fault isolation, protect substations, and enhance emergency response. Rising electricity demand, renewable energy integration, and aging transmission infrastructure further accelerate replacement cycles. Modern annunciators offer robust monitoring for transformers, switchgear, and distribution systems, supporting preventive maintenance and reducing blackout risks. This infrastructure push creates sustained demand across energy-intensive economies undergoing rapid industrial and urban development.

Key Trends & Opportunities

Adoption of Smart and Networked Annunciator Systems

A major trend reshaping the market is the shift toward smart annunciator systems equipped with Ethernet connectivity, event logging, and integration with cloud-based platforms. These advanced systems enable centralized monitoring, remote diagnostics, and predictive alerting. Industries increasingly seek annunciators that communicate seamlessly with SCADA and IoT architectures, creating opportunities for manufacturers offering customizable digital interfaces. As industrial operations evolve toward real-time data ecosystems, intelligent annunciators position themselves as critical components for improving operational efficiency and predictive maintenance outcomes.

- For instance, Omniflex alarm annunciators include RS232/485 Modbus and Ethernet interfaces for connection to top-end SCADA systems, supporting event logging in safety-certified designs compliant with IEC61508. These enable total alarm management across distributed nodes via local area networks.

Increasing Use of Annunciators in Hazardous and High-Risk Facilities

Growing industrial activity in hazardous environments creates significant opportunities for explosion-proof and high-integrity annunciator systems. Oil refineries, chemical plants, and LNG terminals demand high-reliability alerting solutions capable of functioning under thermal, corrosive, and mechanical stress. Enhanced design features such as rugged enclosures, fire-resistant materials, and redundant signaling systems expand application potential. This trend aligns with the global shift toward risk mitigation and operational resilience, increasing demand for annunciators engineered to meet stringent safety and environmental conditions.

- For instance, at the Sullom Voe oil terminal, Enquest replaced legacy alarm annunciators with IEC61508 SIL-1 certified units from Omniflex, ensuring compliance and reliability in a high-risk environment.

Key Challenges

Integration Complexity with Legacy Industrial Systems

A major challenge arises from the difficulty of integrating modern annunciators with aging equipment still widely used across industrial facilities. Many legacy systems lack compatible communication protocols, increasing installation time and costs. Organizations often face operational disruptions during system retrofitting or upgrades. This integration barrier slows digital transformation initiatives and forces industries to rely on hybrid configurations. Manufacturers must address compatibility gaps by developing flexible, backward-compatible annunciators to broaden adoption and minimize transition challenges.

High Maintenance Requirements and Reliability Concerns

Annunciators deployed in harsh operating conditions face accelerated wear, leading to higher maintenance needs and potential reliability issues. Dust, vibration, extreme temperatures, and corrosive environments can impair system longevity and signaling accuracy. Frequent calibration, component replacement, and inspection increase operational costs for industries operating continuous processes. Failure or delayed alerts can cause safety incidents, equipment damage, and unplanned downtime. These reliability concerns push manufacturers to innovate with durable materials, self-diagnostics, and low-maintenance designs to remain competitive.

Regional Analysis

North America

North America dominated the Industrial Annunciators Market with a 34.7% share in 2024, driven by advanced industrial automation, stringent safety regulations, and extensive modernization across power generation and oil & gas facilities. The U.S. leads regional demand due to strong investments in grid reliability, refinery expansions, and smart manufacturing adoption. Rising focus on minimizing operational downtime enhances the need for multi-window and networked annunciator systems. Canada contributes further growth through increased mining and energy infrastructure upgrades. Continuous regulatory enforcement and high digital adoption sustain North America’s leadership in the global market.

Europe

Europe held a 27.9% share of the Industrial Annunciators Market in 2024, supported by strong regulatory frameworks, widespread industrial digitalization, and investments in sustainable energy infrastructure. Germany, the U.K., and France are leading markets, driven by automation in manufacturing, chemical processing, and advanced transportation industries. The region’s push toward decarbonization and renewable power integration increases demand for annunciators in substations and grid monitoring systems. Stringent compliance requirements across pharmaceuticals and food processing also expand application potential. Europe’s focus on safety, energy efficiency, and smart industry initiatives continues to reinforce steady market growth.

Asia-Pacific

Asia-Pacific accounted for a 28.6% share in 2024, emerging as the fastest-growing region due to rapid industrial expansion, increasing power consumption, and widespread adoption of automation technologies. China, India, Japan, and South Korea lead demand, supported by strong manufacturing ecosystems, energy sector upgrades, and large-scale investments in petrochemicals. Growing emphasis on operational safety and process optimization drives extensive use of multi-window annunciators in high-volume industries. Urbanization and infrastructure modernization further accelerate deployments across utilities and transportation. Government-led industrial digitalization programs position Asia-Pacific as a major growth engine for the global market.

Latin America

Latin America captured a 5.2% share of the Industrial Annunciators Market in 2024, driven by rising investment in oil & gas exploration, mining operations, and power distribution upgrades. Brazil and Mexico lead the region with expanding industrial automation initiatives and increased adoption of alarm monitoring systems for safety compliance. Petrochemical manufacturing growth supports demand for rugged annunciators capable of withstanding harsh operating environments. Infrastructure development and regulatory improvements are gradually strengthening market penetration. Despite economic fluctuations, the region’s industrial modernization efforts continue to create new opportunities for annunciator suppliers.

Middle East & Africa

The Middle East & Africa region held a 3.6% share in 2024, shaped by significant activity in oil & gas, power generation, and large-scale industrial projects. Countries such as Saudi Arabia, UAE, and South Africa drive adoption through investments in refineries, utilities, and petrochemical facilities requiring advanced fault detection systems. Harsh environmental conditions increase the need for robust, corrosion-resistant annunciators. Growing emphasis on operational safety, coupled with expanding industrial infrastructure, supports long-term demand. While market penetration remains developing, strategic initiatives across energy diversification and industrial growth enhance future market potential.

Market Segmentations

By Type

- Multi-window Annunciators

- Single-window Annunciators

- Sequence Annunciators

By Application

- Power Generation & Utilities

- Oil & Gas

- Manufacturing & Industrial Automation

- Chemical & Petrochemical

By End Use Industry

- Energy & Power

- Automotive & Transportation

- Pharmaceuticals

- Food & Beverage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Industrial Annunciators Market features key players such as Notifier, Honeywell International (Fire-Lite), ABB, Eaton Corporation, AMETEK, Inc., Automation Displays, Inc., OMEGA Engineering, Inc., Hirsch Electronics Corp., Linde North America, Inc., and Century Control Systems, Inc. These companies strengthen their market positions through product innovation, expanded distribution networks, and integration of digital technologies. Manufacturers increasingly focus on advanced annunciator designs with Ethernet connectivity, multi-window configurations, and enhanced diagnostic capabilities to support Industry 4.0 environments. Strategic partnerships with automation solution providers and investments in R&D accelerate the development of intelligent alarm management systems. Leading players emphasize reliability, durability, and compliance with global safety standards to meet diverse industrial requirements. Additionally, expansion into high-growth sectors such as power distribution, petrochemicals, and manufacturing enables vendors to capture rising demand for monitoring and safety systems worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Notifier

- Linde North America, Inc.

- Automation Displays, Inc.

- Honeywell International (Fire-Lite)

- Century Control Systems, Inc.

- OMEGA Engineering, Inc.

- Hirsch Electronics Corp.

- ABB

- Eaton Corporation

- AMETEK, Inc.

Recent Developments

- In October 2025, Honeywell launched NOTIFIER INSPIRE in Canada, a new fire-alarm control panel that integrates with its Connected Life Safety Services for remote monitoring and maintenance.

- In August 2025, Eaton Corporation introduced a range of hazardous-area products including the “CEAG VLL Series Ex Lights” and “MTL Zone Guardian” systems -at the Automation Expo 2025 in Mumbai, aimed at harsh industrial and hazardous environments.

- In July 2025, Honeywell completed a strategic acquisition of the “Li-ion Tamer” business from Nexceris, expanding its portfolio of gas detection and related safety solutions

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Industrial Annunciators Market will experience strong growth as industries intensify adoption of automation and real-time monitoring systems.

- Demand will rise for intelligent annunciators that integrate with SCADA, PLCs, and cloud-based platforms.

- Multi-window annunciators will continue leading due to expanding use in complex, high-risk industrial environments.

- Digital transformation initiatives will accelerate replacement of legacy alarm systems with advanced networked annunciators.

- Utilities and power generation facilities will increase investments in annunciators to support grid modernization and reliability.

- Oil & gas and chemical sectors will adopt rugged annunciators designed for hazardous and corrosive environments.

- Predictive maintenance capabilities will become essential as industries prioritize proactive operational safety.

- Manufacturers will focus on energy-efficient, low-maintenance annunciators to reduce lifecycle costs.

- Asia-Pacific will remain a significant growth engine driven by rapid industrial expansion and infrastructure upgrades.

- Vendors will strengthen portfolios through innovation, partnerships, and technology integration to meet evolving industrial safety needs.