Market Overviews

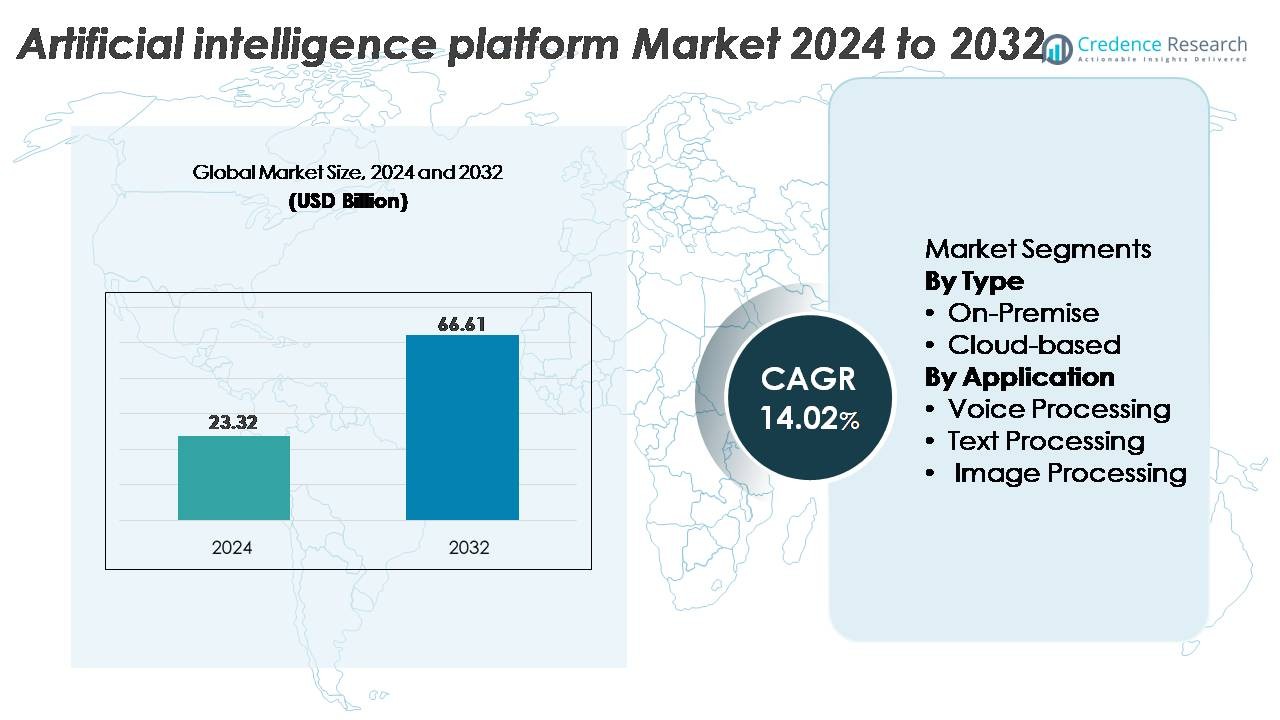

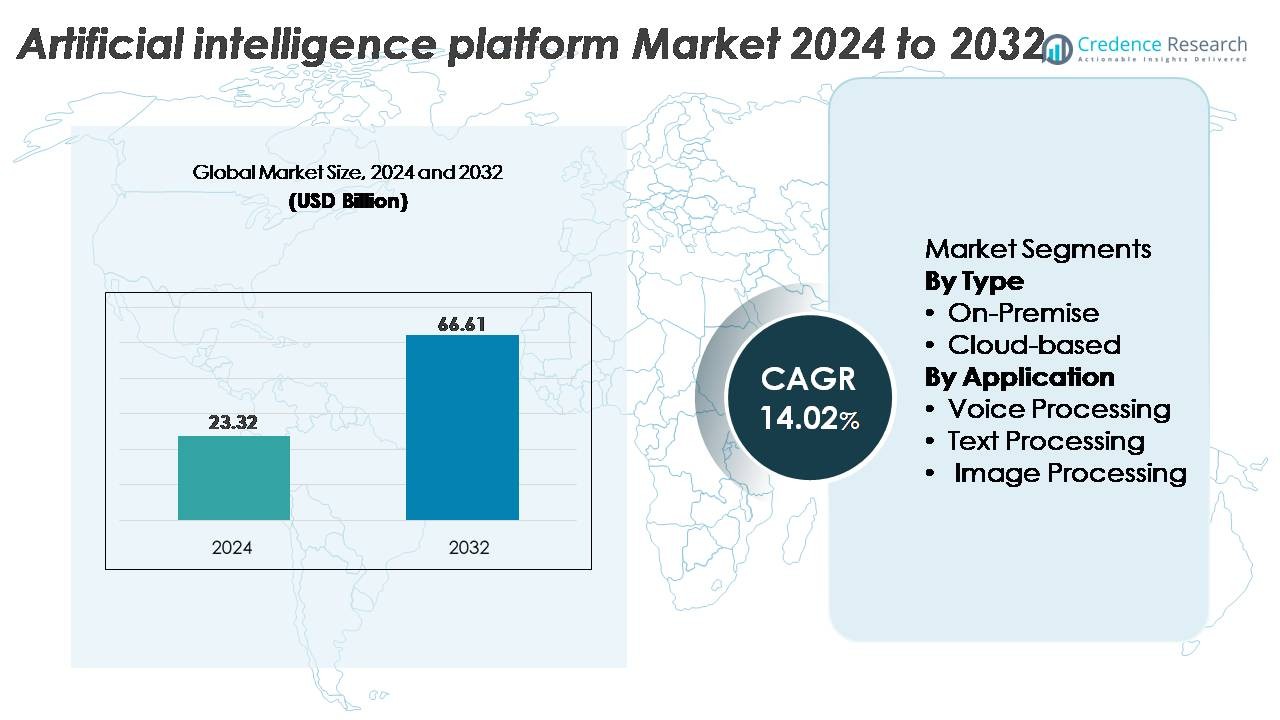

The global Artificial Intelligence (AI) Platform Market was valued at USD 23.32 billion in 2024 and is projected to reach USD 66.61 billion by 2032, expanding at a CAGR of 14.02% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Artificial Intelligence (AI) Platform Market Size 2024 |

USD 23.32 Billion |

| Artificial Intelligence (AI) Platform Market, CAGR |

14.02% |

| Artificial Intelligence (AI) Platform Market Size 2032 |

USD 66.61 Billion |

Leading players in the artificial intelligence platform market include global technology leaders and specialized AI innovators such as Google, Microsoft, IBM, SAP, Intel, Salesforce, Brighterion, Baidu, IFlyTek, and Megvii Technology. These companies compete through advancements in cloud-native AI infrastructure, generative model deployment, industry-specific AI frameworks, and integrated governance capabilities. North America remains the dominant region with approximately 38% market share, supported by strong cloud adoption and enterprise investments in multimodal AI. Asia Pacific follows with around 29%, driven by China’s rapid AI commercialization and expanding digital ecosystems. Europe holds about 24%, anchored by regulated, high-value enterprise AI deployments across industrial and service sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The artificial intelligence platform market was valued at USD 23.32 billion in 2024 and is projected to reach USD 66.61 billion by 2032, advancing at a CAGR of 14.02%, supported by rapid enterprise digitalization and expanding generative AI adoption.

- Market growth is driven by strong demand for automation, cloud-native AI deployment, multimodal analytics, and industry-specific AI models enabling enhanced decision intelligence, productivity gains, and operational efficiency across BFSI, healthcare, retail, and manufacturing.

- Key trends include accelerated adoption of large language models, expansion of multimodal AI combining text–voice–image capabilities, rising demand for domain-tuned AI frameworks, and increased integration of edge AI in autonomous systems and IoT devices.

- The competitive landscape features global leaders such as Google, Microsoft, IBM, SAP, Intel, Baidu, Salesforce, IFlyTek, Brighterion, and Megvii Technology, competing on cloud capabilities, generative AI, AutoML, and governance-ready platform architectures.

- Regionally, North America leads with ~38%, followed by Asia Pacific at ~29% and Europe at ~24%, while segment-wise, cloud-based platforms dominate with the largest share due to scalable compute availability and faster AI deployment cycles.

Market Segmentation Analysis:

By Type (On-Premise, Cloud-based)

By type, cloud-based AI platforms hold the dominant share, driven by scalable compute resources, rapid model deployment cycles, and seamless integration with enterprise cloud ecosystems. Organizations prefer cloud-native training pipelines and GPU clusters that accelerate experimentation and inferencing workloads while minimizing infrastructure overhead. In contrast, on-premise platforms remain relevant for sectors requiring strict data residency and latency control, such as defense and regulated BFSI environments. Their adoption is supported by high-performance edge servers and dedicated AI accelerators, but the broader market momentum continues to favor cloud delivery models.

- For instance, Microsoft’s Azure ND H100 v5 instances use 8 NVIDIA H100 GPUs delivering a combined 32 petaFLOPs of FP8 compute, while Google’s TPU v5p pods scale up to 8,960 chips for large-model training and high-throughput inference.

By Application (Voice, Text, Image Processing)

By application, text processing leads the segment due to widespread adoption of NLP engines, large language models, and document automation systems across customer service, finance, and enterprise analytics. Its dominance is driven by high-volume unstructured data requiring sentiment analysis, summarization, and conversational AI capabilities. Voice processing advances through speech-to-text and virtual assistant deployments, while image processing grows in healthcare diagnostics, industrial inspection, and security analytics. However, these categories trail text processing because enterprise adoption of multimodal and conversational AI continues to expand faster than audio or vision-specific deployments.

- For instance, the latest models within OpenAI’s GPT-4 architecture, such as GPT-4 Turbo and GPT-4o, support an extensive context window of 128,000 tokens, enabling enterprises to process vast documents and entire knowledge bases in a single pass.

Key Growth Drivers:

Rapid Enterprise Adoption of AI for Automation and Decision Intelligence

Enterprises increasingly deploy AI platforms to automate operational workflows, optimize cost structures, and accelerate decision-making. AI-driven automation supports large-scale data processing, predictive analytics, demand forecasting, anomaly detection, and workflow orchestration across finance, manufacturing, retail, and logistics. Companies use AI platforms to integrate structured and unstructured data into unified intelligence layers, enabling real-time insights and continuous business optimization. The rise of enterprise-grade foundation models and domain-specific LLMs further expands adoption by improving accuracy in text, voice, and vision tasks. Organizations also leverage AI platforms for operational risk assessment, fraud detection, supply chain resilience, and workforce productivity enhancement. As digital transformation accelerates globally, enterprises prioritize platforms that offer model lifecycle management, scalable compute, API-based interoperability, and cloud-deployed AI services. These capabilities reinforce AI platforms as essential infrastructure for modern business operations.

- For instance, Amazon Web Services’ Trainium accelerators deliver up to 2.1 petaFLOPs of mixed-precision compute per device for model training, and Microsoft’s Azure AI infrastructure supports clustering of more than 20,000 NVIDIA H100 GPUs within a single region to train frontier-scale enterprise models.

Expansion of Cloud-Native AI Infrastructure and High-Performance Compute Availability

The availability of advanced cloud-native GPUs, AI accelerators, and distributed training environments significantly drives market adoption. Hyperscalers provide elastic compute clusters optimized for training deep neural networks, enabling faster experimentation cycles and reducing time-to-market for AI-driven applications. Cloud AI platforms offer managed pipelines that support data ingestion, automated labeling, model training, hyperparameter tuning, deployment, and monitoring—reducing complexity for enterprises with limited in-house expertise. As businesses migrate workloads to cloud and hybrid environments, AI platforms become central to enterprise architecture modernization. Cloud providers continue to enhance performance through optimized LLM serving stacks, multi-node training systems, vector databases, and serverless inference endpoints. The scalability and cost-efficiency of cloud infrastructure allow organizations to run larger models, process higher data volumes, and implement continuous learning frameworks, strengthening demand across industries.

- For instance, Google’s TPU v5p pods scale up to 8,960 chips in a single cluster, enabling multi-exaflop training workloads, while AWS Trainium2 delivers up to 4 times the training performance of the previous generation, supporting large-model training with over 700 billion parameters.

Rising Integration of Generative AI Across Consumer and Industrial Use Cases

The rapid adoption of generative AI drives substantial market expansion as industries integrate text, voice, and image-generation models into product ecosystems. Enterprises deploy generative AI for automated content creation, conversational agents, customer support, code generation, synthetic data generation, and R&D simulation. In industrial sectors, generative AI enhances design optimization, predictive maintenance, quality analysis, and autonomous decision-making. Healthcare organizations adopt AI platforms for diagnostic reasoning, clinical documentation, and personalized treatment recommendations. These cross-sector applications require robust AI platforms capable of model fine-tuning, secure deployment, and low-latency inference. The shift toward multimodal AI further strengthens demand as platforms integrate capabilities spanning speech, vision, and text processing. Combined with emerging enterprise governance tools for safety, compliance, and monitoring, generative AI adoption fuels continuous expansion of platform-level investments.

Key Trends and Opportunities:

Growing Demand for Domain-Specific and Industry-Tuned AI Models

Organizations increasingly shift from general-purpose models to domain-adapted AI tuned for specific industries such as healthcare diagnostics, financial risk modeling, legal document analysis, industrial automation, and cybersecurity. This trend creates opportunities for AI platform vendors offering sector-specific datasets, foundation model fine-tuning frameworks, and prebuilt industry agents. Enterprises seek models capable of handling regulated workflows, context-sensitive reasoning, and high-accuracy decision-making. Vendors also invest in automated RLHF pipelines, retrieval-augmented generation (RAG), and secure enterprise data connectors to enhance model reliability. As industries prioritize compliance, explainability, and data governance, platforms providing transparent and auditable AI operations gain a competitive edge. This shift toward specialization unlocks opportunities for verticalized AI marketplaces and modular model services.

- For instance, Bloomberg developed BloombergGPT a 50-billion-parameter financial language model trained on over 363 billion tokens of finance-specific text to support risk analytics, regulatory reporting, and market intelligence

Rising Adoption of Multimodal AI Supporting Text, Voice, Image, and Sensor Fusion

Multimodal AI represents a significant opportunity as enterprises integrate cross-modality intelligence into applications requiring contextual understanding. Industries adopt multimodal models for digital twins, autonomous systems, medical imaging analysis, retail product recognition, and real-time customer interaction management. AI platforms that support combined text–image–video processing enable more sophisticated automation, from inspection systems in manufacturing to AI-powered retail analytics. The surge in multimodal LLMs encourages enterprises to adopt platforms offering unified vector databases, streaming data pipelines, multimodal inference engines, and advanced orchestration layers. As user expectations shift toward natural, human-like interactions, multimodal capabilities become a key differentiator for AI platform providers.

· For instance, Google’s Gemini 1.5 Pro publicly supports a 1,000,000-token context window. A 2,000,000-token context window is available in certain access tiers. It processes synchronized text, image, video, and audio inputs in a single model pass. OpenAI’s Whisper-based multimodal pipelines handle high-fidelity audio inputs. These are internally resampled to 16 kHz. The largest models exceed 1.5 billion parameters.

Opportunity for Edge AI and On-Device Intelligence Across Smart Devices

AI computation is increasingly shifting toward the edge as organizations adopt low-latency, privacy-preserving, and real-time decision systems. AI platforms with edge deployment capabilities benefit from demand in autonomous vehicles, robotics, industrial IoT sensors, smart retail, mobile devices, and medical wearables. Improvements in compact AI accelerators, model quantization, and efficient inference architectures enable advanced intelligence at lower power consumption. This trend opens new revenue streams for platforms offering model compression, distributed training, federated learning, and device-side inference optimization. As industries prioritize resilience and local data processing, edge AI emerges as a high-growth opportunity.

Key Challenges:

Data Privacy, Governance, and Regulatory Compliance Constraints

Data privacy regulations create significant challenges for AI platform adoption, as enterprises must manage sensitive information across jurisdictions. Strict compliance requirements covering data residency, auditability, explainability, and algorithmic fairness require robust governance frameworks. Many organizations struggle to balance innovation with regulatory obligations involving personal data, intellectual property, health records, and financial information. AI platforms must incorporate granular access controls, encryption, differential privacy, model interpretability tools, and continuous risk monitoring. Compliance burdens increase for multinational firms operating under varying regulatory regimes, slowing deployment cycles and increasing operational costs. Ensuring secure and compliant AI development remains a core challenge for enterprises adopting platform-based AI systems.

High Computational Costs and Infrastructure Limitations for Large-Scale AI

Training and deploying large AI models requires substantial compute resources, resulting in high operational expenses for enterprises. GPU shortages, rising cloud compute costs, and energy-intensive training workloads pose adoption barriers for smaller organizations. Scaling AI workflows demands specialized infrastructure high-bandwidth memory GPUs, distributed compute clusters, optimized storage systems which many enterprises lack. Long training times, inference bottlenecks, and performance variability further complicate deployment. While model compression, quantization, and serverless inference help reduce costs, the financial burden of running large-scale AI remains a critical challenge. Organizations must carefully evaluate cost-performance trade-offs when adopting AI platforms.

Regional Analysis:

North America

North America holds the largest share of the AI platform market at approximately 38%, driven by strong adoption of enterprise AI, advanced cloud infrastructure, and significant investments from hyperscalers such as AWS, Microsoft Azure, and Google Cloud. The region benefits from mature digital transformation strategies and rapid integration of generative AI across financial services, healthcare, retail, and manufacturing. Government initiatives supporting AI innovation and ethical governance accelerate deployment across public systems. High research activity, strong venture capital funding, and early adoption of multimodal AI reinforce North America’s leadership in platform innovation and commercialization.

Europe

Europe accounts for around 24% of the global AI platform market, supported by strong regulatory frameworks, growing enterprise digitalization, and investments in AI sovereignty initiatives. Industries such as automotive, BFSI, precision manufacturing, and healthcare increasingly deploy AI platforms for predictive maintenance, automation, and customer analytics. The EU’s emphasis on explainable, transparent, and compliant AI encourages adoption of governance-enabled platform architectures. Countries like Germany, France, the U.K., and the Nordics lead in cloud-native AI deployments, while generative AI accelerates adoption in corporate services and industrial engineering. Collaboration between academia and technology providers further strengthens Europe’s position.

Asia Pacific

Asia Pacific captures approximately 29% of the AI platform market, supported by rapid cloud adoption, expanding digital ecosystems, and strong government-led AI initiatives across China, Japan, South Korea, India, and Southeast Asia. Large enterprises and digital-native companies invest heavily in AI-driven automation, voice assistants, image analytics, and multimodal customer interfaces. China’s large-scale AI innovation programs and India’s fast-growing enterprise AI market significantly contribute to regional growth. Manufacturing, e-commerce, telecom, and financial services lead demand for cloud-based platforms. Strong investment in AI R&D, edge intelligence, and 5G integration positions Asia Pacific as the fastest-growing regional market.

Latin America

Latin America holds about 5% of the AI platform market, with adoption accelerating as enterprises modernize digital infrastructures and integrate AI into banking, retail, telecom, and public services. Countries such as Brazil, Mexico, Chile, and Colombia drive most deployments, leveraging cloud-based AI platforms for fraud detection, customer analytics, logistics optimization, and conversational automation. Growing investments in fintech, e-commerce, and smart city initiatives stimulate demand for scalable AI capabilities. Although infrastructure constraints and lower digital maturity limit adoption in some economies, increased cloud penetration and government digitalization programs continue supporting steady market growth.

Middle East & Africa

The Middle East & Africa region accounts for roughly 4% of the AI platform market, with adoption strengthened by national AI strategies, smart city investments, and expanding cloud availability. The UAE, Saudi Arabia, Qatar, and South Africa lead deployments across government services, energy, BFSI, and healthcare. Large-scale digital transformation programs—such as Saudi Vision 2030 and UAE’s National AI Strategy—stimulate demand for intelligent automation, predictive analytics, and multimodal AI solutions. While adoption varies across countries, increasing enterprise cloud migration, AI training initiatives, and growing startup ecosystems continue to enhance regional platform utilization.

Market Segmentations:

By Type

By Application

- Voice Processing

- Text Processing

- Image Processing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the artificial intelligence platform market features a mix of global cloud hyperscalers, specialized AI platform providers, and enterprise software vendors accelerating innovation across model development, deployment, and governance. Major players such as Microsoft Azure, Google Cloud, and Amazon Web Services dominate through expansive cloud-native AI stacks, integrated LLM services, and scalable GPU clusters supporting enterprise-grade training and inference. IBM, Oracle, and SAP strengthen competitiveness by embedding AI automation, predictive analytics, and industry-specific model frameworks into their software ecosystems. Emerging leaders such as NVIDIA, DataRobot, H2O.ai, and C3.ai differentiate through optimized model-building pipelines, AutoML capabilities, vector databases, and multimodal AI orchestration tools. Competitive intensity increases as vendors integrate generative AI, retrieval-augmented generation (RAG), agent-based automation, and governance features for responsible AI adoption. Continuous investments in edge AI, high-performance compute, and model fine-tuning ecosystems further shape vendor strategies as enterprises demand secure, scalable, and customizable AI platform solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Megvii Technology

- Salesforce

- Google

- Brighterion

- Microsoft

- Baidu

- IFlyTek

- Intel

- SAP

- IBM

Recent Developments:

- In May 2025, during its Build 2025 event, Microsoft emphasized the shift toward “AI agents” and expanded its platform capabilities to support agentic workflows and deeper reasoning and memory functions.

- In 2025, Intel and Microsoft deepened their collaboration: Intel’s foundry secured a contract to build Microsoft’s next-generation AI processor “Maia 2” using its 18A/18A-P process node, marking a move toward co-optimized hardware for AI workloads.

- In December 2024, Google pushed major advances in its AI platform lineup, formally unveiling Gemini 2.0 and a new custom AI accelerator chip named Trillium, aiming to challenge incumbent hardware providers and underpin next-gen AI workloads.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Enterprises will integrate larger multimodal models, enabling unified text, voice, and image intelligence across workflows.

- Cloud-based AI platforms will scale further as organizations shift training, fine-tuning, and inference workloads to elastic compute environments.

- Generative AI adoption will accelerate, driving demand for secure deployment, governance frameworks, and responsible AI controls.

- Industry-specific AI agents will expand across healthcare, finance, manufacturing, and retail, enhancing domain-level automation.

- Edge AI will grow rapidly as real-time processing becomes essential for robotics, autonomous systems, and IoT devices.

- AI platforms will increasingly support federated learning to enable privacy-preserving model development across distributed datasets.

- Vector databases and retrieval-augmented generation will become core to enterprise AI architectures.

- Organizations will prioritize cost-efficient model optimization using quantization, pruning, and serverless inference.

- Regional AI policies and regulatory frameworks will influence platform design, compliance, and adoption strategies.

- Competition will intensify as cloud hyperscalers, chipmakers, and AI-native companies expand vertically integrated AI ecosystems.