Market Overview

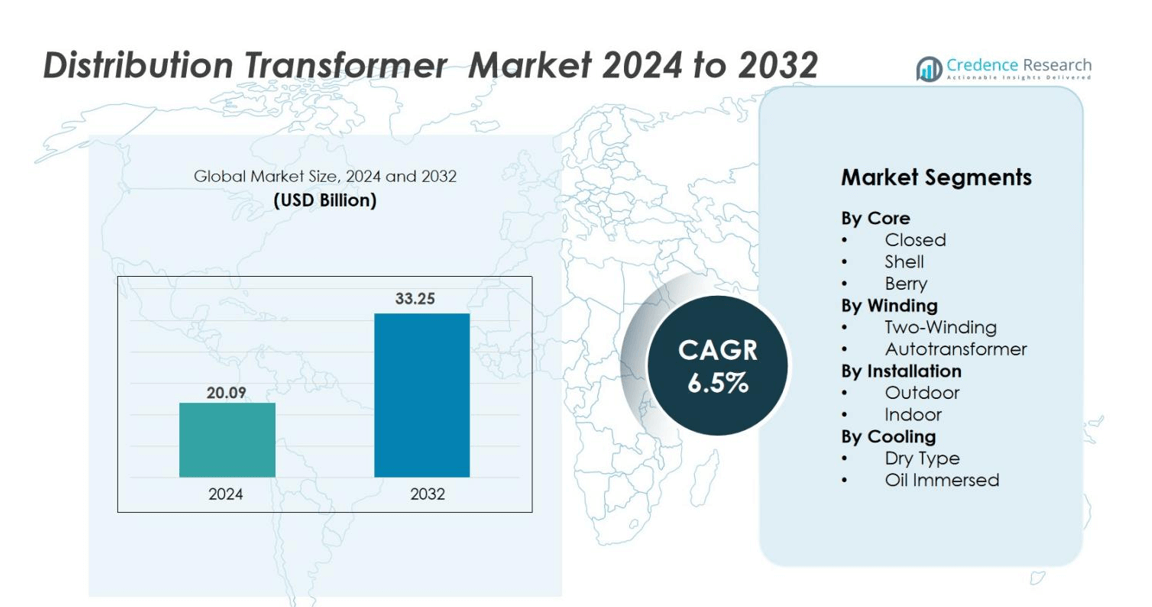

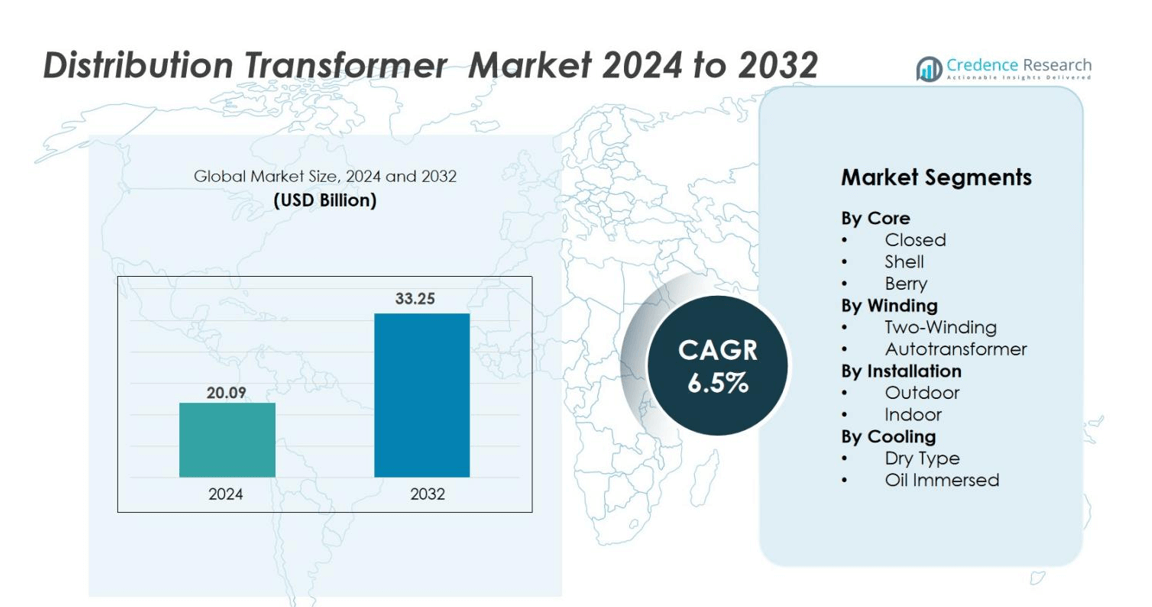

Distribution Transformer market size was valued USD 20.09 Billion in 2024 and is anticipated to reach USD 33.25 Billion by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Transformer Market Size 2024 |

USD 20.09 Billion |

| Power Transformer Market, CAGR |

6.5% |

| Power Transformer Market Size 2032 |

USD 33.25 Billion |

Global players in the distribution transformer market include Siemens, ABB, Schneider Electric, Toshiba Corporation, Eaton, General Electric Company, HD Hyundai Electric, Fuji Electric, Padmavahini Transformers, and Lemi Trafo. These companies compete through high-efficiency cores, smart monitoring systems, and customized voltage designs for utility, industrial, and commercial networks. Asia-Pacific remains the leading region with 35% market share, driven by large-scale electrification, renewable installations, and industrial expansion. North America and Europe follow with strong replacement demand for energy-efficient and digital transformers. Strategic partnerships, after-sales service networks, and smart grid integration keep top manufacturers strong in global utility and industrial contracts.

Market Insights

- Distribution Transformer market size was valued at USD 20.09 Billion in 2024 and will reach USD 33.25 Billion by 2032 with a CAGR of 6.5%.

- Growing electrification, renewable integration, and industrial expansion drive demand for two-winding units, which hold the largest segment share in medium-voltage distribution.

- Smart and energy-efficient transformers gain traction as utilities adopt IoT-based monitoring, predictive maintenance, and low-loss core technologies to improve grid reliability.

- Competition involves Siemens, ABB, Schneider Electric, Toshiba, Eaton, GE, HD Hyundai Electric, Fuji Electric, and Padmavahini Transformers, focusing on product efficiency, digital features, and service networks.

- Asia-Pacific leads with 35% share, followed by North America at 28% and Europe at 24%, supported by replacement demand and grid modernization, while outdoor installations dominate due to wider use in substations and utility feeders.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Core

The closed core segment dominates the distribution transformer market with a 47% share in 2024. Its strong performance is driven by reduced magnetic flux leakage and improved energy efficiency. Closed cores are widely used in residential and commercial networks due to their high mechanical strength and cost-effectiveness. The shell core segment follows, preferred for heavy industrial operations requiring compact size and high fault tolerance. The berry core segment holds a smaller share, primarily used in specialized applications like low-capacity rural power distribution and laboratory transformers.

- For instance, ABB offers closed core transformers engineered for renewable energy integration, providing stable and efficient electricity supply to modern grid systems.

By Winding

The two-winding segment leads the market with a 63% share in 2024, owing to its reliability and efficiency in medium-voltage distribution. It is widely used in urban and industrial grids for clear electrical isolation between primary and secondary circuits. Autotransformers, although smaller in share, are gaining traction for applications needing voltage regulation and compact designs. Their lower material use and high energy transfer efficiency make them ideal for power-intensive utilities and renewable integration systems.

- For instance, Daelim Transformer supplied custom 2600 kVA pad-mounted two-winding transformers to power a blockchain facility in Texas, ensuring seamless and stable power distribution for intensive industrial operations.

By Installation

The outdoor installation segment holds the largest market share of 71% in 2024, supported by widespread utility and industrial use. Outdoor transformers are designed for harsh weather, featuring corrosion-resistant enclosures and advanced cooling systems. They serve distribution lines, substations, and renewable power plants where space and ventilation are crucial. Indoor transformers occupy the remaining share, mostly deployed in commercial buildings, manufacturing units, and data centers where compact designs and fire-resistant insulation are essential for reliable indoor power distribution.

Key Growth Drivers

Rising Electrification in Developing Economies

Growing electrification across Asia-Pacific, Africa, and Latin America drives strong demand for distribution transformers. Governments expand rural grids, execute village electrification programs, and upgrade feeder lines to support industrialization and commercial growth. Utilities install pole-mounted and ground-mounted units to stabilize voltage and reduce transmission losses in long-distance networks. Expansion of residential townships, commercial complexes, and smart industrial zones increases the need for medium-voltage distribution. Supportive policies, subsidies, and public–private partnerships strengthen grid infrastructure investments. As electricity consumption rises across manufacturing, healthcare, retail, and commercial services, utilities deploy large fleets of distribution transformers to ensure reliable last-mile power delivery.

- For instance, ABB leads Asia-Pacific with smart distribution transformers equipped with IoT sensors and real-time analytics that enhance grid reliability and enable predictive maintenance, supporting countries like Japan and South Korea in their electrification and grid modernization efforts.

Integration of Renewable Energy and Smart Grids

Solar and wind capacity additions require efficient power evacuation and stable low-voltage distribution. Distribution transformers provide safe voltage adjustment between renewable plants, substations, and consumer load centers. Governments enforce green-energy mandates, net-metering policies, and rooftop solar programs, leading to increased integration of grid-tied and off-grid systems. Smart grids boost adoption of digitally monitored transformers equipped with IoT sensors, SCADA connectivity, and predictive maintenance capabilities. Utilities replace aging assets with energy-efficient transformers to support fluctuating loads from renewable inputs.

- For instance, Genus Power Innovations leads in advancing distribution transformer metering with IoT-enabled solutions, improving monitoring of electricity flow and supporting renewable integration.

Urbanization and Industrial Expansion

Large construction activity, industrial automation, and commercial development expand load demand in metropolitan regions. Data centers, hospitals, manufacturing parks, airports, and metro rail networks require stable power at medium-voltage levels. Governments invest in underground distribution systems and compact indoor transformers for urban planning. Rising EV charging infrastructure and cold-chain logistics facilities further push demand for higher-capacity distribution transformers. Industrial policies, foreign direct investment, and infrastructure programs accelerate substation upgrades and new distribution lines. These factors drive continuous procurement of two-winding and outdoor transformer units in utilities and private industries.

Key Trends & Opportunities

Adoption of Energy-Efficient and Eco-Design Transformers

Utilities and industries shift toward low-loss transformers with amorphous metal cores, advanced insulation systems, and improved cooling technologies. Regulations on energy efficiency and carbon reduction create a strong replacement market for older units. Eco-design products reduce no-load losses, enhance durability, and minimize operating costs over long service life. Growing interest in biodegradable ester fluids and fire-safe transformer oils offers opportunities for environmentally friendly designs in densely populated or environmentally sensitive zones. Manufacturers focus on compact designs and higher overload handling, offering strong opportunities in renewable and commercial sectors.

- For instance, Fuji Electric launched a transformer using natural ester oil (FR3®Fluid), a plant-derived, biodegradable insulating oil that reduces CO2 emissions across its lifecycle and offers higher fire safety compared to mineral oils.

Expansion of Digital and IoT-Enabled Transformers

Smart monitoring becomes a major trend as utilities adopt connected transformers with embedded sensors, thermal monitoring, remote diagnostics, and fault-prediction analytics. Digital models reduce downtime, extend life, and support predictive maintenance under fluctuating load conditions. SCADA-supported transformers improve real-time visibility of grid performance and power quality. Increasing cyber-secure control systems and cloud-enabled analytics create opportunities for technology partnerships between transformer manufacturers and software providers. This trend strengthens smart grid rollouts, especially in North America, Europe, and emerging smart city projects.

- For instance, Siemens has developed transformer stations with integrated IoT connectivity that enable real-time asset management, energy quality monitoring, and predictive maintenance, which has resulted in increased grid reliability and reduced operational costs.

Key Challenges

High Installation and Upgrade Costs

Distribution transformers require heavy capital spending for purchase, installation, testing, civil works, and maintenance. Utilities face financial strain when replacing aging fleets or deploying high-efficiency models in large numbers. Budget limitations delay modernization in developing regions, leading to slow replacement cycles. Import dependency on core materials, copper windings, and advanced electrical steels increases cost volatility. This makes adoption of premium energy-efficient and smart-enabled models slower for cost-sensitive regions and small industries.

Electrical Failures and Operational Risks

Grid overloads, weather events, thermal stress, and poor maintenance increase transformer failure risk. Voltage fluctuations, harmonics, and short circuits cause insulation damage and reduced life expectancy. Frequent power outages and delayed repairs affect reliability for utilities and end users. Lack of skilled technicians and slow spare-part availability extend downtime in remote locations. As grids integrate renewable sources and fluctuating loads, transformers face higher stress, raising the need for advanced protection systems and predictive monitoring.

Regional Analysis

North America

North America holds 28% market share in the distribution transformer market, supported by grid modernization and renewable integration. Utilities continue replacing aging oil-filled units with energy-efficient and digital transformers equipped with remote monitoring and fault prediction. Strong investments in underground distribution for urban areas and expansion of EV charging corridors boost demand for medium-voltage units. The United States leads the region, driven by federal infrastructure spending, smart grid programs, and storm-resilient grid upgrades. Canada follows with replacement demand in industrial zones, data centers, and commercial buildings focused on improved power reliability and reduced transmission losses.

Europe

Europe accounts for 24% market share, backed by strict energy-efficiency standards and the rapid shift toward carbon-neutral power networks. Countries expand renewable capacity from wind and solar, pushing utilities to adopt low-loss, eco-design, and digital distribution transformers. Underground cabling in urban cities, electric mobility infrastructure, and industrial automation support strong replacement demand across Germany, the UK, France, and Italy. Manufacturers focus on biodegradable ester fluids and advanced insulation to meet fire-safety and environmental norms. Eastern Europe sees rising installation of outdoor units due to rural grid upgrades and cross-border power transfer projects.

Asia-Pacific

Asia-Pacific leads the global market with 35% share, driven by rapid urbanization, industrial expansion, and large-scale electrification. China and India account for major installations in manufacturing hubs, metro networks, industrial clusters, and renewable energy parks. Governments focus on stabilizing overloaded distribution lines and reducing technical losses through high-efficiency transformers. Southeast Asian nations expand commercial and residential infrastructure, fueling demand for pole-mounted units and smart grid-ready models. Growing investments in data centers, EV charging stations, industrial automation, and rural electricity access continue to reinforce regional dominance.

Latin America

Latin America holds 7% market share, driven by grid expansion, industrial growth, and electrification of remote regions. Brazil and Mexico invest in utility upgrades, solar farms, and infrastructure modernization. Rising commercial construction and manufacturing activity increase demand for medium-voltage distribution transformers. Rural electrification programs and energy access projects support deployment of outdoor and pole-mounted units. However, slow replacement cycles and budget limitations impact adoption of premium energy-efficient models. Partnerships with global transformer manufacturers help local utilities deploy durable products suited for hot climates and load fluctuation.

Middle East & Africa

The Middle East & Africa region captures 6% market share, supported by expanding power generation, industrial facilities, and smart city projects. Gulf countries install advanced distribution transformers in grid modernization and large commercial developments. Africa focuses on electrification of villages, renewable integration, and substation upgrades. Harsh weather conditions and wide geographic coverage raise demand for outdoor transformers with corrosion-resistant designs. Investments from international development banks and public–private partnerships support expansion of reliable power distribution. Data centers, mining operations, and water desalination plants further create demand for high-capacity units.

Market Segmentations:

By Core

By Winding

- Two-Winding

- Autotransformer

By Installation

By Cooling

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the distribution transformer market features a mix of global manufacturers and regional specialists competing through product efficiency, digital monitoring, and customized voltage designs. Leading companies such as Siemens, Schneider Electric, ABB, Toshiba Corporation, Eaton, HD Hyundai Electric, and General Electric focus on smart-enabled transformers with IoT sensors, SCADA connectivity, and predictive maintenance functions to support modern grid operations. Manufacturers invest in amorphous metal cores, advanced insulation, and flame-resistant ester oils to meet stringent efficiency and safety standards. Regional players like Padmavahini Transformers and Lemi Trafo serve utility and industrial clients with cost-effective models tailored to local network configurations. Strategic partnerships with utilities, EPC contractors, and renewable developers help expand installation bases. Companies also strengthen after-sales services, remote diagnostics, and rental fleets to improve customer retention. As countries push toward renewable integration and reduction of no-load losses, competition increases around energy-efficient and eco-design transformer portfolios.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens

- Eaton

- Fuji Electric Co., Ltd.

- Padmavahini Transformers Private Limited

- General Electric Company

- Schneider Electric

- ABB

- TOSHIBA CORPORATION

- HD HYUNDAI ELECTRIC CO., LTD.

- Lemi Trafo Jsc

Recent Developments

- In March 2025, Hitachi Energy announced an additional USD 250 million commitment to transformer component capacity, hiring over 100 staff across its European sites.

- In March 2025, Schneider Electric revealed plans to invest over USD 700 million in its U.S. operations through 2027 to upgrade three plants and meet growing demand for data centers and AI infrastructure.

- In March 2025, Hyosung Heavy Industries began expanding its transformer production facility in Memphis, Tennessee, aiming to raise annual output to over 250 units by 2027.

- In February 2025, the CIRCUIT Act, co-sponsored by Senators Jerry Moran and Catherine Cortez Masto, was introduced to extend production tax credits to electric distribution transformers.

Report Coverage

The research report offers an in-depth analysis based on Core, Winding, Installation, Cooling and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as countries expand power distribution networks in urban and rural areas.

- Renewable energy integration will boost installations of smart and energy-efficient transformers.

- Utilities will adopt IoT-enabled monitoring to reduce failures and improve grid uptime.

- Replacement of aging infrastructure will create strong opportunities in developed regions.

- Underground cabling in cities will increase the need for compact indoor transformers.

- Growth in EV charging infrastructure will push higher-capacity distribution units near public and fleet stations.

- Eco-friendly insulation fluids and low-loss cores will gain wider acceptance due to energy regulations.

- Data centers and industrial automation will drive demand for stable medium-voltage distribution.

- Manufacturers will expand service networks to support predictive maintenance and remote diagnostics.

- Smart grid investment will strengthen partnerships between transformer OEMs and utility companies.