Market Overview

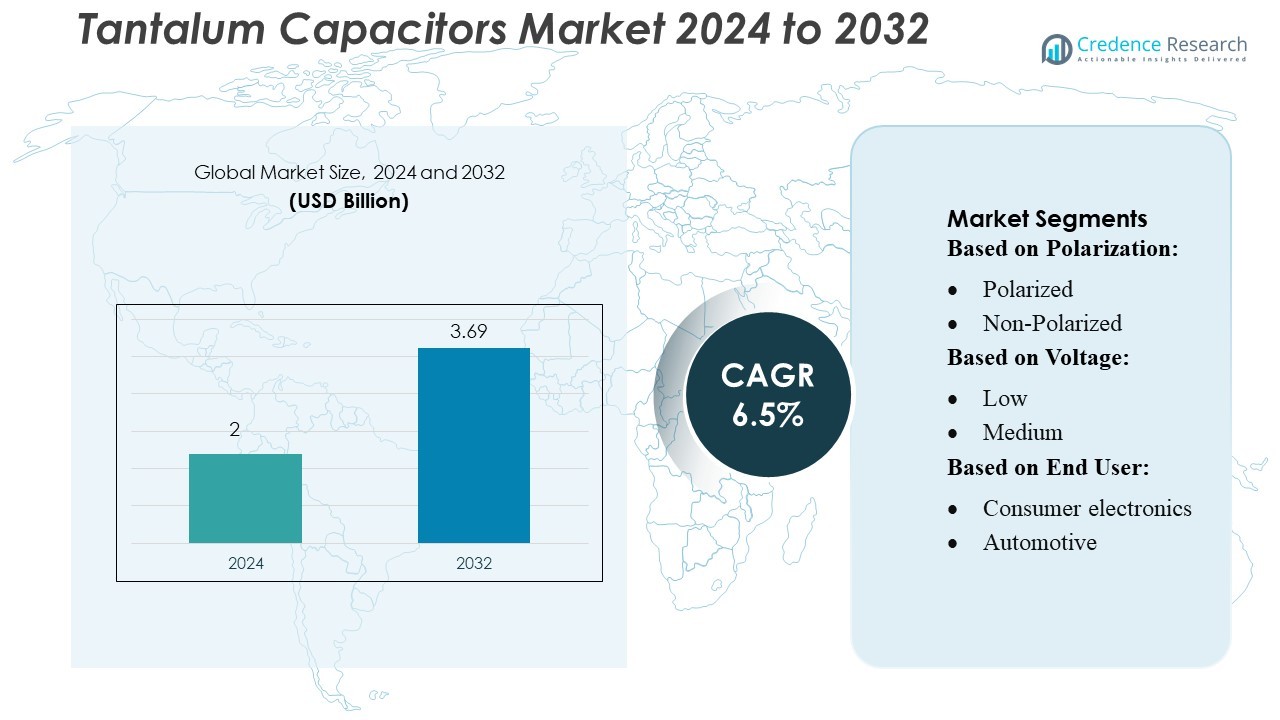

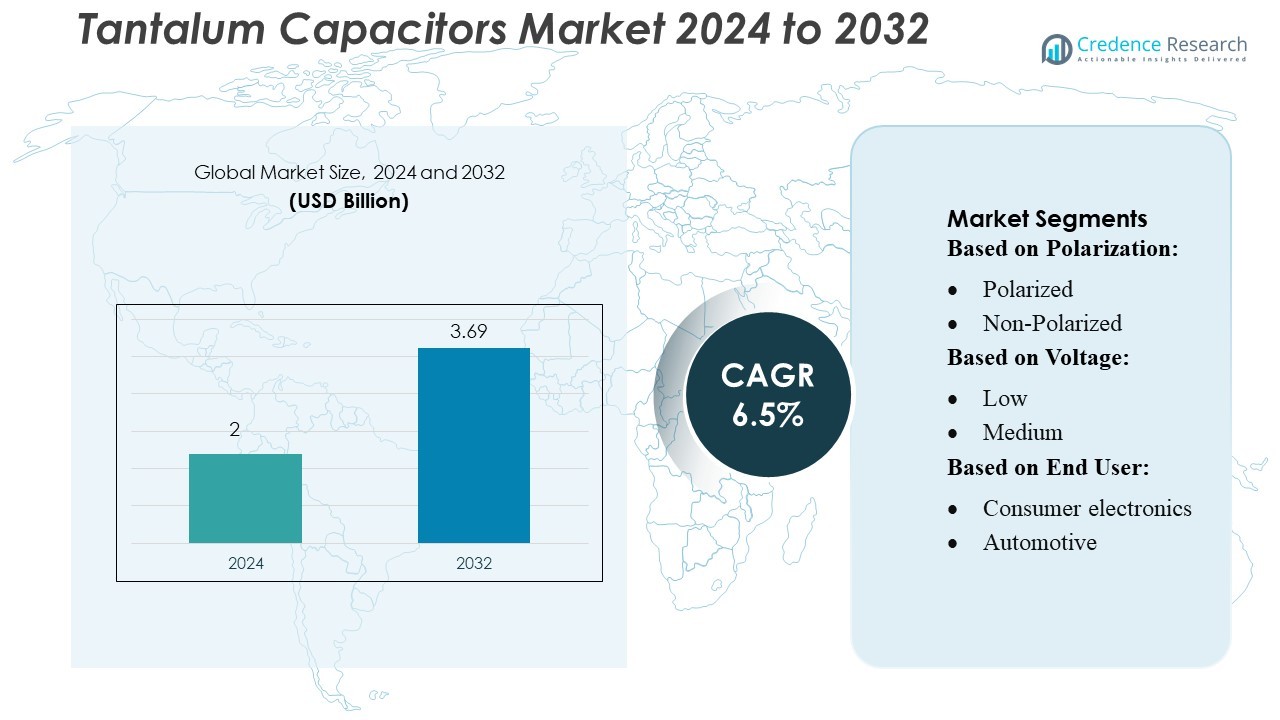

Tantalum Capacitors Market size was valued USD 2 billion in 2024 and is anticipated to reach USD 3.69 billion by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tantalum Capacitors Market Size 2024 |

USD 2 Billion |

| Tantalum Capacitors Market, CAGR |

6.5% |

| Tantalum Capacitors Market Size 2032 |

USD 3.69 Billion |

The tantalum capacitors market features strong competition among major global manufacturers that actively expand product portfolios and invest in polymer technology to meet rising demand for high-capacitance, low-ESR components across automotive, consumer electronics, and communication systems. These players focus on reliability, miniaturization, and supply-chain resilience to strengthen their position in high-growth sectors such as EV powertrains, data centers, and aerospace electronics. Asia-Pacific leads the global market with an estimated 38% share, driven by its dominant electronics manufacturing base, large semiconductor ecosystem, and rapid expansion of 5G and industrial automation infrastructure, making it the most influential region in shaping technological and volume-driven growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Tantalum Capacitors Market was valued at USD 2 billion in 2024 and is projected to reach USD 3.69 billion by 2032, growing at a 6.5% CAGR, driven by rising demand for compact, high-performance components in electronics and automotive systems.

- Growing adoption of polymer tantalum capacitors and miniaturized power-management solutions continues to act as a key market driver, supporting innovation across smartphones, SSDs, EV control units, and 5G hardware.

- Market trends highlight increasing investments in advanced materials, improved ESR performance, and supply-chain localization strategies as manufacturers strengthen competitive positioning in high-reliability applications.

- Supply constraints related to tantalum sourcing and competition from MLCC alternatives remain major restraints, influencing pricing dynamics and design preferences in cost-sensitive segments.

- Asia-Pacific holds 38% of the market, leading global demand, while the polarized segment accounts for the largest share among product categories, supported by strong deployment in consumer electronics and automotive electronics across the region.

Market Segmentation Analysis:

By Polarization

Polarized tantalum capacitors dominate the market with an estimated over 70% share due to their high capacitance density, stability, and suitability for compact circuit designs. They remain the preferred choice in consumer electronics, automotive ECUs, and telecommunications modules where low leakage current and long-term reliability are essential. Their strong adoption is further driven by the growth of miniaturized devices requiring consistent performance under variable temperature and voltage. Non-polarized variants hold a smaller share because they are used primarily in niche AC applications, limiting overall volume growth.

- For instance, Panasonic’s POSCAP™ TPF series includes a model rated at 6.3 V and 470 µF with an ESR of 10 mΩ and an endurance of 2,000 hours. The part number for a similar, actual component is 2R5TPE470M7, which is a TPE series capacitor with a rating of 2.5 V, 470 µF, an ESR of 7 mΩ, and an endurance of 2,000 hours.

By Voltage

Low-voltage tantalum capacitors account for the largest share, approximately 55–60%, as they are widely deployed in smartphones, wearables, IoT nodes, and power management circuits. Their advantage in achieving high capacitance within small surface-mount packages supports ongoing device miniaturization trends. Medium-voltage segments grow steadily with increased usage in industrial control systems and automotive electronics. High-voltage tantalum capacitors capture a niche portion of the market due to higher cost and limited design compatibility, though demand rises in defense and aerospace systems requiring enhanced stability.

- For instance, KEMET’s T525 Series KO-CAP low-ESR polymer tantalum capacitors are rated from 2.5 V to 16 V, and their capacitance range extends up to 680 µF. A specific part number for a 470 µF, 4 V capacitor is the T525D477M004ATE025, which has a maximum ESR of 25 mΩ at 100 kHz.

By End User

Consumer electronics lead the market with over 40% share, driven by strong deployment in smartphones, tablets, solid-state drives, and compact chargers that benefit from high energy density and stable ESR performance. Automotive is the second-largest segment as electrification accelerates ECU, ADAS, and powertrain electronics adoption. Communications and technology applications expand due to demand for high-reliability components in servers, 5G infrastructure, and networking hardware. Transmission & distribution and other industrial users adopt tantalum capacitors for power conditioning and monitoring systems where long lifecycle performance is essential.

Key Growth Drivers

1. Rising Demand for High-Reliability Components in Miniaturized Electronics

The market grows strongly as OEMs increasingly adopt tantalum capacitors for miniaturized devices requiring stable performance, high volumetric efficiency, and long operational life. Smartphones, wearables, SSDs, and IoT modules rely heavily on tantalum due to its low ESR and superior temperature stability compared to aluminum or ceramic alternatives. As consumer devices integrate more power-dense circuits, demand accelerates for compact capacitors that support efficient power management. This shift positions tantalum as a critical component for next-generation portable electronics and high-density computing hardware.

- For instance, Samsung Electro-Mechanics offers its TCPCF0J476MNAR201T polymer tantalum capacitor in a 2012 (0805) package (2.00 × 1.25 mm), delivering 47 µF at 3 V with an ESR of 200 mΩ.

2. Expansion of Automotive Electronics and Electrified Powertrains

Automotive OEMs drive significant demand as electrification expands across EVs, hybrids, and advanced driver-assistance systems. Tantalum capacitors support powertrain control modules, battery management systems, inverters, and radar units that require stable capacitance under thermal stress. Their long lifecycle reliability, vibration resistance, and tolerance to voltage derating make them preferred over MLCCs in safety-critical circuits. Growing semiconductor content per vehicle and rising adoption of distributed power architectures continue strengthening their penetration across propulsion, infotainment, and chassis systems.

- For instance, Elna’s SK-series molded chip tantalum capacitors are available in various ratings, such as a 4.7 µF at 2.5 V model (e.g., SYF-0E475M-RA2), with a leakage current specification of 0.50 µA or less.

3. Growing Deployment in Defense, Aerospace, and Industrial Equipment

Defense and aerospace systems increasingly utilize tantalum capacitors for their exceptional reliability, radiation tolerance, and stable performance under extreme environmental conditions. Applications such as avionics, radar systems, guidance modules, and rugged industrial controls rely on tantalum-based designs to ensure consistent power delivery. As governments increase spending on communication satellites, surveillance systems, and secure electronics, the need for high-grade capacitors expands. Their strong performance in high-temperature, high-vibration, and high-voltage environments reinforces their role in mission-critical power electronics.

Key Trends & Opportunities

1. Rising Adoption of Polymer Tantalum Capacitors

Polymer tantalum capacitors gain significant market traction as manufacturers shift toward solutions offering lower ESR, enhanced frequency characteristics, and improved safety through reduced ignition risk. These devices support higher ripple currents and enable compact, thermally efficient designs ideal for advanced computing, SSDs, and 5G communication hardware. Their performance advantages over conventional MnO₂ variants create opportunities for OEMs seeking higher power density and improved reliability. As polymer formulations continue improving, adoption rises across automotive and industrial power designs.

- For instance, Schneider Electric’s Modicon M241 PLC platform incorporates board-level capacitors in its high-density power stage rated up to 60 V surge tolerance and designed to withstand 1,500 V isolation and shock levels up to 15 g—a reliability envelope aligned with the stability requirements met by polymer tantalum capacitors in automotive-grade control electronics.

2. Expansion of 5G, Cloud Data Centers, and AI Hardware

Massive growth in 5G deployments, hyperscale data centers, and AI acceleration hardware drives higher demand for stable, high-capacitance components. Tantalum capacitors suit voltage-regulated modules, baseband units, edge servers, and high-speed storage arrays where low ESR and predictable derating are essential. Their reliability under continuous operation aligns well with data center uptime requirements. With AI servers incorporating more power-hungry GPUs and high-bandwidth memory, tantalum components see expanding opportunities in power integrity, signal conditioning, and energy buffering roles.

- For instance, Murata’s ECAS series polymer aluminum capacitors (used alongside tantalum in many of its power module designs) offer capacitance up to 470 µF at 25 V, with ESR as low as 4.5 mΩ and operating temperature from –40 °C to +105 °C, according to the company’s datasheet.

3. Increasing Focus on Supply Chain Localization & Recycling

Manufacturers explore new opportunities in vertically integrated production and recycling programs to mitigate concerns around tantalum sourcing. Investments in traceable, ethically mined tantalum and recovery from electronic waste strengthen supply reliability for capacitor makers. Governments and industry bodies promoting conflict-free minerals create further incentives for supply chain transparency. As OEMs emphasize ESG-aligned procurement, suppliers adopting sustainable refining and closed-loop recycling processes gain competitive advantage, opening long-term market expansion potential.

Key Challenges

1. Supply Constraints and Geopolitical Risks in Tantalum Sourcing

Tantalum availability remains vulnerable to geopolitical instability, mining concentration in a few regions, and regulatory pressures related to conflict minerals. Fluctuating ore prices and export restrictions complicate long-term procurement planning for capacitor manufacturers. Dependence on a limited number of smelters increases supply chain concentration risk, potentially causing component shortages and price volatility. These factors challenge OEMs seeking stable supply, particularly in high-volume electronics and automotive programs requiring predictable component quality and delivery timelines.

2. Competition from MLCCs and Advanced Aluminum Capacitors

The market faces competitive pressure from multilayer ceramic capacitors and electrolytic aluminum capacitors that continue improving in volumetric efficiency, voltage range, and cost structure. MLCC vendors increasingly target applications traditionally served by tantalum, especially in mobile devices where cost optimization is critical. As ceramic technologies advance in reliability and temperature stability, some use cases shift away from tantalum solutions. This competition forces tantalum suppliers to innovate in polymer technologies, derating improvements, and cost-effective manufacturing to maintain market share.

Regional Analysis

North America

North America holds around 28% of the global tantalum capacitors market, driven by strong demand from aerospace, defense, data centers, and advanced semiconductor manufacturing. The region benefits from high adoption of polymer tantalum capacitors in server hardware, AI accelerators, and high-reliability military electronics. OEMs in the U.S. increasingly prioritize components with proven long-term stability and low ESR for mission-critical systems. Growth is further supported by expanding EV production and investments in 5G and cloud infrastructure, which create sustained demand for high-density, thermally stable power-management components.

Europe

Europe accounts for approximately 22% of the market, driven by robust automotive production, industrial automation, and aerospace system upgrades. Germany, France, and the UK lead adoption as OEMs demand high-reliability capacitors for EV control units, ADAS, and aviation electronics requiring consistent performance under thermal and vibration stress. Increasing investments in renewable energy systems and power conversion technologies also boost demand for stable, long-life capacitors. The region’s emphasis on stringent safety and quality standards supports the transition toward polymer tantalum variants with enhanced electrical characteristics and improved derating performance.

Asia-Pacific

Asia-Pacific is the largest regional market with about 38% share, driven by large-scale consumer electronics manufacturing in China, South Korea, Japan, and Taiwan. High-volume production of smartphones, SSDs, wearables, and IoT devices accelerates demand for compact, high-capacitance tantalum capacitors. The region’s semiconductor fabrication expansion and rapid adoption of 5G network equipment further strengthen growth. Automotive electrification across China and Japan adds demand for reliable capacitors used in powertrains and ECU modules. Competitive manufacturing costs and strong supply chain integration position Asia-Pacific as the core hub for tantalum capacitor deployment and innovation.

Latin America

Latin America contributes around 6% of the global market, with growth led by expanding telecommunications infrastructure, consumer electronics imports, and increasing investments in industrial automation. Brazil and Mexico remain the main demand centers, supported by rising automotive assembly activities requiring reliable capacitors for control units and infotainment modules. Although regional production remains limited, the adoption of tantalum capacitors grows steadily as enterprises modernize data centers and telecom networks. Gradual expansion in renewable energy projects and utility monitoring systems also contributes to moderate but consistent market development.

Middle East & Africa

The Middle East & Africa region holds roughly 6% market share, driven by investments in defense electronics, communications systems, and industrial modernization. Countries in the Gulf region increasingly adopt tantalum capacitors for secure communications, aviation upgrades, and oil-and-gas monitoring equipment where durability and temperature stability are essential. Growing smart city initiatives and data center expansions in the UAE and Saudi Arabia support demand for polymer tantalum components used in power regulation circuits. Africa sees rising adoption through telecom expansion and infrastructure digitization, though market growth remains gradual due to cost-sensitive procurement trends.

Market Segmentations:

By Polarization:

By Voltage:

By End User:

- Consumer electronics

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The tantalum capacitors market features a competitive landscape led by Panasonic, Kemet, Havells India, Samsung Electro-Mechanics, Elna, Schneider Electric, Murata Manufacturing, Cornell Dubilier, Kyocera AVX Components, and ABB. The tantalum capacitors market remains moderately consolidated, with competition shaped by advancements in polymer technology, tighter supply-chain strategies, and increasing specialization across high-reliability applications. Manufacturers focus heavily on enhancing volumetric efficiency, lowering ESR, and improving thermal stability to meet the demands of miniaturized electronics, EV powertrains, and high-performance computing systems. The shift toward 5G infrastructure, AI servers, and advanced industrial automation accelerates the need for capacitors with consistent derating behavior and long-term reliability. Companies increasingly invest in conflict-free tantalum sourcing, recycling programs, and localized production to reduce supply volatility. Market differentiation is driven by innovation in compact, high-capacitance designs and strategic partnerships with OEMs in automotive, aerospace, and telecommunications sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panasonic

- Kemet

- Havells India

- Samsung Electro-Mechanics

- Elna

- Schneider Electric

- Murata Manufacturing

- Cornell Dubilier

- Kyocera AVX Components

- ABB

Recent Developments

- In October 2025, Murata Manufacturing and QuantumScape entered a collaboration to mass-produce ceramic films for solid-state batteries, widening Murata’s revenue streams beyond traditional MLCCs.

- In December 2024, Starck Group includes the tungsten producer H.C. Starck Tungsten GmbH with production sites in Germany, Canada and China as well as sales. H.C. Starck Tungsten GmbH was acquired by one of the world’s experts in tungsten and sophisticated ceramic powders, Mitsubishi Materials Corporation.

- In June 2024, Quantic Electronics partnered with Powell Electronics to expand the global availability of its advanced electronic components. The agreement specifically focused on Quantic’s US-based capacitor businesses, including Quantic Evans, Quantic Eulex, Quantic Paktron, and Quantic UTC, to accelerate the delivery of mission-critical solutions worldwide.

- In March 2024, KEMET Launches First T581 Polymer Tantalum Surface Mount Capacitors Qualified to Military Performance Specification. These capacitors are designed to provide a reliable solution for high-performance military applications, offering full compliance with MIL-PRF qualifications.

Report Coverage

The research report offers an in-depth analysis based on Polarization, Voltage, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as miniaturized consumer electronics require higher-capacitance, high-reliability components.

- Polymer tantalum capacitors will gain wider adoption due to superior ESR performance and improved safety characteristics.

- Automotive electrification will accelerate demand for stable, long-life capacitors used in EV powertrains, ADAS, and battery management systems.

- Data centers, AI servers, and 5G infrastructure will increasingly rely on tantalum capacitors for power integrity and thermal stability.

- Defense and aerospace sectors will strengthen usage due to stringent reliability and radiation-tolerance requirements.

- Supply chain localization initiatives will grow as manufacturers reduce reliance on geographically concentrated tantalum sources.

- Recycling and conflict-free sourcing programs will expand, supporting sustainability-focused procurement across industries.

- Advancements in compact high-capacitance designs will enhance adoption in next-generation storage devices and computing hardware.

- Industrial automation and IIoT deployments will drive demand for robust capacitors capable of operating under harsh conditions.

- Competition from MLCCs will encourage continuous innovation in cost efficiency, derating performance, and energy density within tantalum technology.