Market Overview:

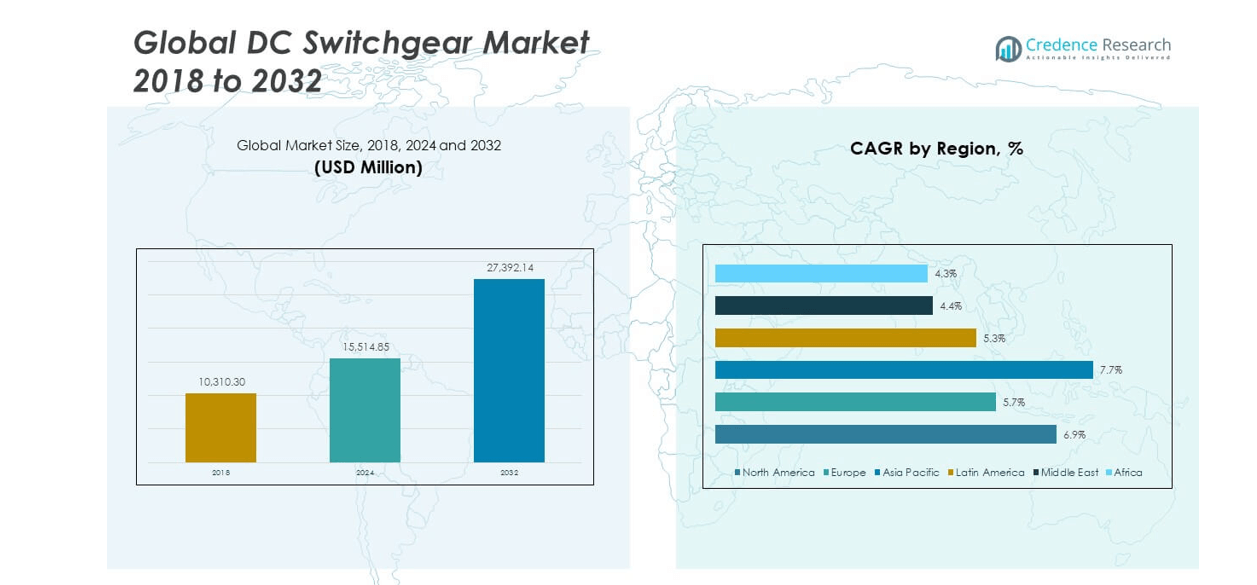

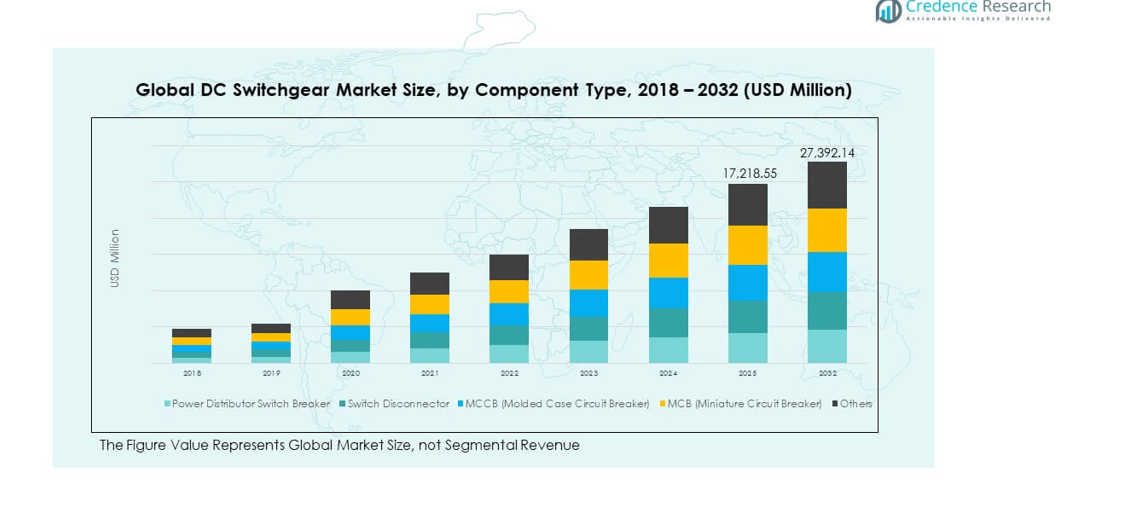

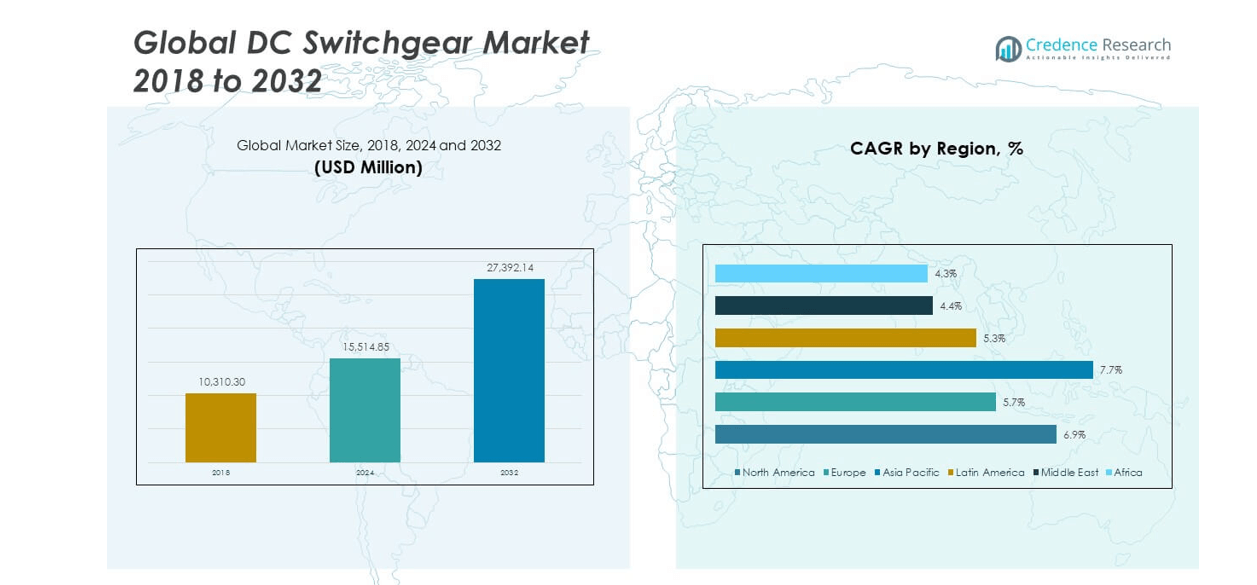

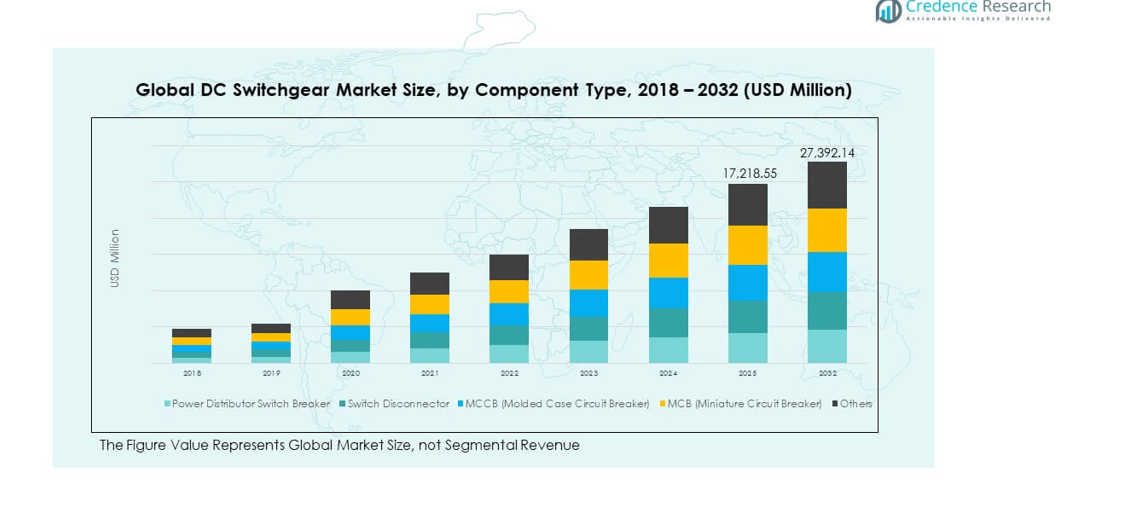

The Global DC Switchgear Market size was valued at USD 10,310.30 million in 2018 to USD 15,514.85 million in 2024 and is anticipated to reach USD 27,392.14 million by 2032, at a CAGR of 6.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Switchgear Market Size 2024 |

USD 15,514.85 million |

| DC Switchgear Market, CAGR |

6.86% |

| DC Switchgear Market Size 2032 |

USD 27,392.14 million |

The market is expanding as demand for renewable energy integration, electrification of transport, and modernization of power infrastructure increases. Rising deployment of solar and wind power projects strengthens the need for reliable DC switchgear. Growing investment in electric vehicle charging networks, battery storage systems, and data centers further supports growth. Governments encourage advanced grid solutions, while manufacturers focus on compact and efficient switchgear designs to ensure higher safety, lower maintenance, and extended operational life.

Asia Pacific leads the market due to rapid industrialization, urban expansion, and heavy investment in renewable energy across China and India. Europe follows with strong grid modernization initiatives and emphasis on sustainable energy transition. North America maintains steady demand driven by EV adoption and smart grid development. Emerging markets in the Middle East, Africa, and Latin America show growth potential as infrastructure projects expand, and governments invest in renewable energy to diversify power supply and reduce dependency on traditional fossil fuels.

Market Insights:

- The Global DC Switchgear Market was USD 10,310.30 million in 2018, grew to USD 15,514.85 million in 2024, and is projected to reach USD 27,392.14 million by 2032, expanding at a CAGR of 6.86%.

- Asia Pacific held 44.4% share in 2024, leading with strong renewable energy projects and industrial growth. North America followed with 27.1%, supported by EV charging expansion, while Europe held 19.1% through grid modernization.

- Asia Pacific is the fastest-growing region with 7.7% CAGR, driven by large-scale renewable deployment, transport electrification, and rapid industrialization.

- Power Distributor Switch Breakers accounted for the largest segment share at 29% in 2024, supported by heavy demand across utilities and industrial systems.

- MCCBs represented 24% of the Global DC Switchgear Market in 2024, driven by widespread use in commercial and medium-scale industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Deployment of Renewable Energy Projects

The Global DC Switchgear Market is experiencing strong growth due to rapid renewable energy adoption. Expansion of solar and wind farms requires advanced DC switchgear to ensure reliability and safety. Governments across regions support green energy with favorable incentives and large-scale investments. It benefits from the rising need to connect renewable energy systems to modern power grids. Grid operators emphasize efficient transmission, which strengthens the adoption of reliable DC switchgear solutions. Large utility-scale projects increase product demand across Asia, Europe, and North America. Manufacturers focus on cost-efficient and compact switchgear designs to address this rising requirement.

Expansion of Electric Vehicle Infrastructure

The growth of electric mobility has created demand for advanced DC switchgear. Charging networks and fast-charging stations depend on high-performance systems for safety and efficiency. It enables smooth energy flow between chargers, storage units, and power grids. Governments provide strong policy support for electric vehicle adoption and infrastructure expansion. Growing installation of battery-based storage solutions also increases reliance on effective DC switchgear. Manufacturers respond with designs that enhance fault protection and improve load management. Rapid expansion of EV fleets across Asia, North America, and Europe fuels consistent demand.

- For instance, ABB, a major manufacturer of EV charging technology, has sold over 30,000 DC fast chargers and offers high-power units, such as the Terra 360, which deliver charge rates of up to 360 kW.

Modernization of Aging Power Infrastructure

Modern power systems require efficient switchgear to replace outdated networks. The Global DC Switchgear Market gains momentum from rising investments in grid modernization. It supports digital monitoring and automated controls, improving grid resilience. Utilities upgrade systems to handle distributed energy generation, smart grids, and high-voltage DC networks. The rising frequency of outages and equipment failures accelerates modernization. Governments fund large-scale upgrades to improve safety, reliability, and sustainability of power supply. Advanced DC switchgear plays a critical role in reducing losses and enhancing operational performance.

- For example, Habersham EMC in Georgia modernized its grid with S&C Electric’s IntelliRupter® PulseCloser® and TripSaver® II reclosers, supported by remote monitoring and analytics. The upgrades achieved a 14.6% reduction in outage duration and a 38% decrease in minutes without power for members.

Strong Adoption in Data Centers and Industrial Applications

Growth in data centers and industrial automation is driving high demand. Large-scale data centers rely on reliable DC distribution, increasing switchgear installations. The Global DC Switchgear Market benefits from demand across telecom, IT, and financial services industries. It enhances power quality, minimizes downtime, and supports critical workloads. Industrial automation, smart factories, and robotics require advanced protection systems. Expansion of manufacturing hubs across Asia Pacific boosts adoption further. Reliable switchgear solutions reduce risks of failure and enable industries to achieve energy efficiency targets.

Market Trends

Shift Toward Smart and Digital Switchgear

The market is shifting toward smart switchgear with monitoring and automation features. The Global DC Switchgear Market records demand for systems that integrate IoT and AI. It helps utilities predict failures, monitor performance, and reduce downtime. Sensors and analytics support predictive maintenance, cutting operational costs. Digitalization ensures better visibility of power distribution across networks. Remote access features provide operators with improved control and efficiency. Companies are investing heavily in intelligent switchgear to align with smart grid advancements.

Growing Demand for Compact and Modular Systems

Compact and modular switchgear designs are gaining significant preference globally. The Global DC Switchgear Market benefits from rising urbanization and space constraints in power projects. It enables flexible installations in metro networks, renewable plants, and industrial hubs. Modular systems simplify maintenance, reduce installation time, and lower overall project costs. They are designed for scalability, supporting both small and large applications. Compact units also enhance safety and minimize operational footprint. Rising adoption across transport and commercial facilities drives steady demand for modular solutions.

- For instance, ABB SafePlusis a metal-enclosed compact switchgear system, officially certified for up to 24 kV with functional units as narrow as 16.5 inches (420 mm) wide.

Emphasis on Energy Efficiency and Sustainability

Energy-efficient systems are becoming central to power infrastructure upgrades. The Global DC Switchgear Market is witnessing rising preference for sustainable and eco-friendly solutions. It contributes to reduced energy losses and improved system performance. Manufacturers emphasize the use of recyclable materials and low-emission production methods. Demand for low-maintenance, energy-saving designs is increasing among utilities and industries. International regulations encourage the use of sustainable power systems. This trend strengthens innovation in green switchgear technologies to support long-term energy transition.

- For instance, Schneider Electric EvoPacT circuit breakersare verified Green Premium™ certified, meeting RoHS, REACH, and California Prop 65 standards.

Rising Application in Transportation and Infrastructure Projects

Transportation electrification drives increasing use of advanced switchgear. The Global DC Switchgear Market benefits from deployment in railways, metros, and airports. It ensures efficient power distribution and safety across transportation networks. Large infrastructure projects worldwide integrate DC switchgear into energy systems. Governments emphasize reliable transit systems to meet sustainability goals. Smart city initiatives also expand adoption across urban power distribution. It reflects a broader trend of integrating DC systems into critical infrastructure to meet modern energy requirements.

Market Challenges Analysis

High Installation Costs and Complex Integration

The Global DC Switchgear Market faces cost challenges due to high installation expenses. It involves complex integration with existing AC-based infrastructure. Many utilities hesitate to adopt due to budget limitations. Customization requirements increase costs, especially for renewable and EV applications. The need for skilled labor to manage installation adds to expenses. Limited awareness in emerging markets restricts adoption pace. This slows down penetration across price-sensitive economies where capital investment remains a barrier.

Stringent Safety Regulations and Technological Risks

The market is also challenged by strict safety and compliance requirements. The Global DC Switchgear Market must adhere to evolving standards that increase manufacturing costs. It requires constant updates to meet voltage, reliability, and safety certifications. Failure to comply can restrict entry in regulated markets. Technological risks, including overheating and arc faults, create operational challenges. Utilities remain cautious due to high downtime risks in case of failures. Intense competition pressures manufacturers to balance costs with compliance and innovation.

Market Opportunities

Rising Demand Across Emerging Economies

Emerging regions are creating new opportunities for adoption. The Global DC Switchgear Market gains momentum from infrastructure projects in Asia, Africa, and Latin America. It benefits from investments in renewable energy, smart cities, and industrial hubs. Governments support electrification to expand access to reliable power. Growing urban populations drive demand for transport, commercial facilities, and manufacturing power needs. Adoption of DC-based microgrids in rural areas further expands opportunities. Market players explore partnerships to deliver cost-efficient solutions.

Innovation and Integration with Advanced Technologies

Integration of DC switchgear with IoT, AI, and automation tools creates strong opportunities. The Global DC Switchgear Market is advancing with digital twins, remote monitoring, and predictive maintenance. It offers utilities enhanced control, reliability, and cost reduction. Manufacturers innovate compact, eco-friendly, and flexible designs to meet diverse needs. Integration with energy storage and EV charging networks adds revenue potential. Governments promote digital and green technology adoption, supporting industry innovation. These developments open pathways for long-term expansion.

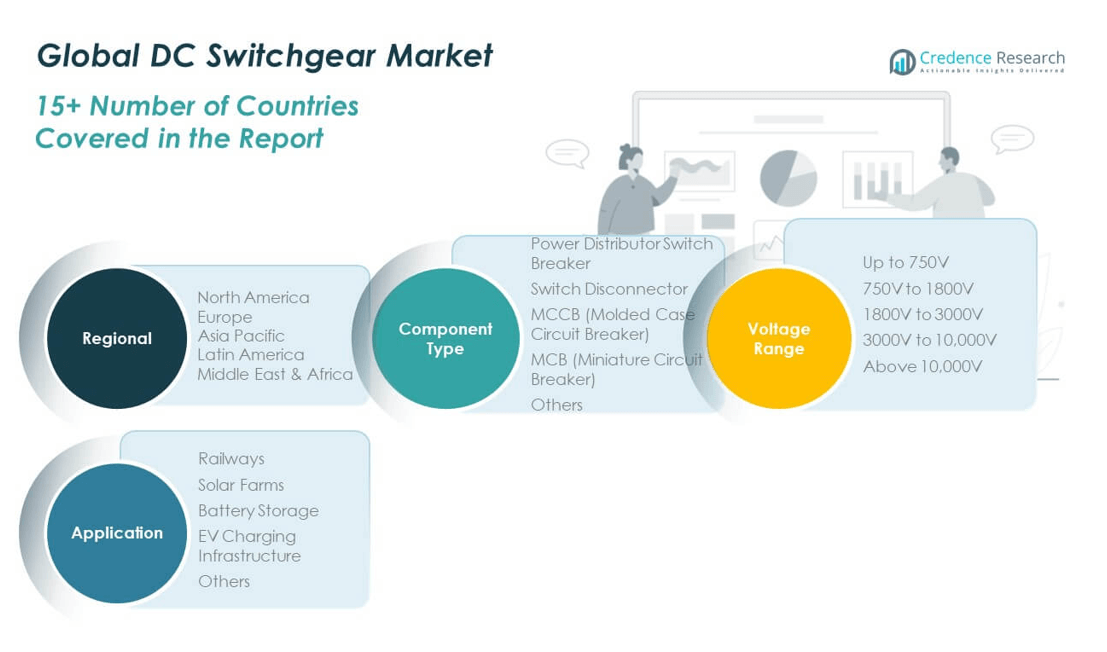

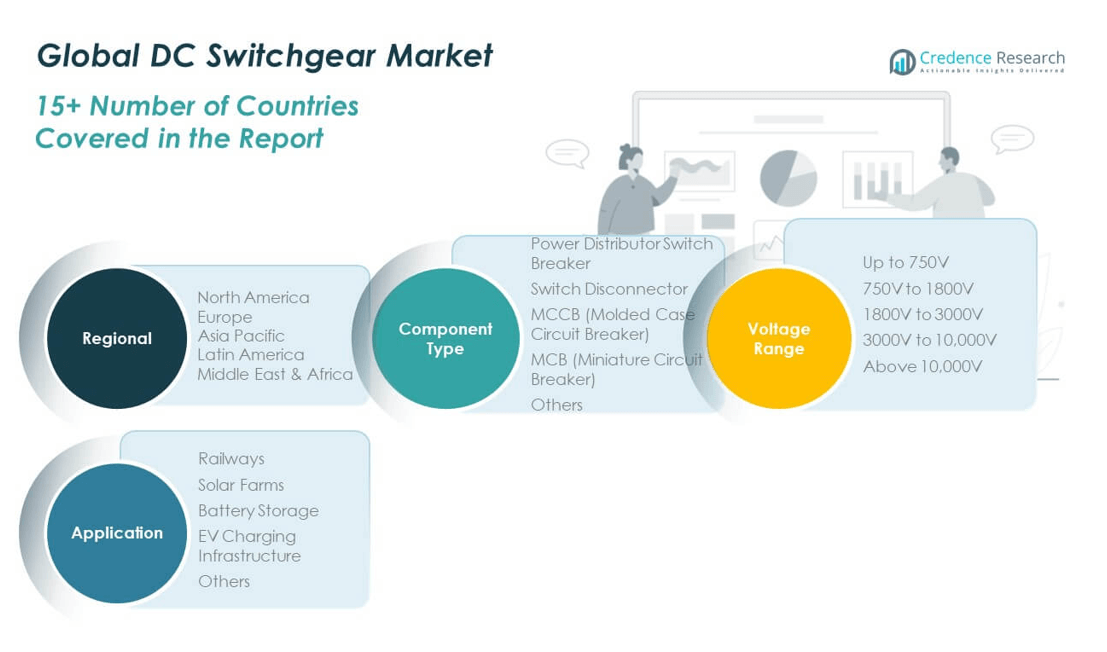

Market Segmentation Analysis:

By component type, the Global DC Switchgear Market is driven by strong demand for power distributor switch breakers and switch disconnectors due to their reliability in industrial and utility applications. MCCBs and MCBs remain essential for residential, commercial, and medium-scale industrial use, offering enhanced protection against overloads and short circuits. It also includes other components that support specialized installations across transport, renewable energy, and storage sectors.

- For example, GE Vernova and ABB supply DC switch-disconnectors and high-speed circuit breakers for utilities, mass transit, and industry. These products are integrated into type-tested panels that meet both AC and DC standards, ensuring reliability and personnel safety.

By voltage range, up to 750V dominates small-scale and residential systems, while 750V to 1800V and 1800V to 3000V categories hold a steady role in solar farms, EV charging stations, and industrial setups. The 3000V to 10,000V and above 10,000V segments serve heavy industrial projects, large utilities, and transportation infrastructure. It demonstrates versatility across multiple voltage needs, ensuring safety and operational efficiency in diverse environments.

- For example, Myers Power Products manufactures DC switchgear systems ranging from 300 V to 1,600 V, with current ratings up to 15 kA. These solutions are designed for applications in battery storage, solar arrays, and industrial power systems.

By application, railways lead the demand with growing electrification projects, followed by solar farms that integrate DC systems for renewable power distribution. Battery storage facilities create opportunities for reliable switchgear installations, ensuring stable energy supply. EV charging infrastructure is rapidly emerging as a key growth driver, supported by global investment in clean transport. Others include niche industrial and commercial uses where advanced switchgear ensures long-term reliability. It highlights the market’s critical role across power generation, transmission, and end-user applications.

Segmentation:

By Component Type

- Power Distributor Switch Breaker

- Switch Disconnector

- MCCB (Molded Case Circuit Breaker)

- MCB (Miniature Circuit Breaker)

- Others

By Voltage Range

- Up to 750V

- 750V to 1800V

- 1800V to 3000V

- 3000V to 10,000V

- Above 10,000V

By Application

- Railways

- Solar Farms

- Battery Storage

- EV Charging Infrastructure

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global DC Switchgear Market size was valued at USD 2,849.20 million in 2018 to USD 4,217.09 million in 2024 and is anticipated to reach USD 7,478.33 million by 2032, at a CAGR of 6.9% during the forecast period. North America holds 27.1% of the global market share in 2024, reflecting strong adoption across power infrastructure. The market benefits from rapid expansion of EV charging networks and grid modernization initiatives. It supports high demand in the U.S. where federal policies encourage renewable integration. Canada and Mexico contribute steadily with investments in industrial automation and transport electrification. It also gains traction from strong data center expansion across the region. Smart grid adoption, digital solutions, and automation tools further enhance demand for advanced switchgear. Industrial safety regulations strengthen the preference for reliable and high-performance systems.

Europe

The Europe Global DC Switchgear Market size was valued at USD 2,075.87 million in 2018 to USD 2,965.08 million in 2024 and is anticipated to reach USD 4,796.71 million by 2032, at a CAGR of 5.7% during the forecast period. Europe accounts for 19.1% of the global market share in 2024, led by Germany, the UK, and France. Growth is fueled by renewable energy integration, particularly offshore wind and solar farms. The EU energy transition roadmap creates strong incentives for advanced switchgear solutions. It gains further momentum from railway electrification projects and sustainable transport infrastructure. Regional policies focused on carbon neutrality support adoption of green and compact switchgear. It also benefits from strong presence of global manufacturers headquartered in the region. Growing industrial modernization and steady demand across utilities drive long-term growth.

Asia Pacific

The Asia Pacific Global DC Switchgear Market size was valued at USD 4,417.51 million in 2018 to USD 6,897.76 million in 2024 and is anticipated to reach USD 12,935.42 million by 2032, at a CAGR of 7.7% during the forecast period. Asia Pacific dominates with 44.4% of the global market share in 2024, led by China, India, and Japan. The region experiences high demand from large-scale renewable energy projects, metro systems, and industrial hubs. It benefits from government-backed investments in EV infrastructure and grid upgrades. Rapid urbanization and expanding power demand drive large-scale deployments of DC systems. It remains a hub for manufacturing and exports, supporting cost-competitive supply chains. Data center expansion in countries such as Singapore and India strengthens product penetration. It also records rising adoption in transport, commercial, and residential sectors, ensuring strong growth momentum.

Latin America

The Latin America Global DC Switchgear Market size was valued at USD 506.47 million in 2018 to USD 753.03 million in 2024 and is anticipated to reach USD 1,182.68 million by 2032, at a CAGR of 5.3% during the forecast period. Latin America holds 4.8% of the global market share in 2024, with Brazil leading adoption. The market benefits from increasing renewable energy investments, particularly solar projects. It gains steady demand from industrial automation and electrification initiatives. Railways and transport electrification projects also create niche opportunities for advanced switchgear. It supports power reliability in commercial facilities and growing urban centers. Limited infrastructure modernization challenges adoption but targeted investments improve regional presence. Countries such as Mexico and Argentina contribute moderately with expanding renewable power capacity.

Middle East

The Middle East Global DC Switchgear Market size was valued at USD 271.57 million in 2018 to USD 371.32 million in 2024 and is anticipated to reach USD 546.02 million by 2032, at a CAGR of 4.4% during the forecast period. The region represents 2.4% of the global market share in 2024, driven by GCC countries. Strong investments in infrastructure, airports, and metro systems create steady demand. It benefits from renewable energy expansion, particularly solar projects in the UAE and Saudi Arabia. Growing electrification in industrial facilities also supports adoption. However, reliance on oil and gas limits broader energy diversification. Governments aim to modernize power grids with digital and efficient systems. It records increasing adoption in transport, commercial infrastructure, and smart city initiatives.

Africa

The Africa Global DC Switchgear Market size was valued at USD 189.67 million in 2018 to USD 310.56 million in 2024 and is anticipated to reach USD 452.99 million by 2032, at a CAGR of 4.3% during the forecast period. Africa accounts for 2.0% of the global market share in 2024, led by South Africa and Egypt. The region experiences demand growth from renewable energy projects and rural electrification. It gains importance in supporting microgrids and decentralized power systems. Expansion of solar power in off-grid areas increases adoption of DC switchgear. Limited investment capacity remains a challenge, slowing down infrastructure upgrades. Governments and global agencies support renewable projects to expand access to electricity. It holds long-term opportunities through smart city projects and industrial zone development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Eaton Corporation

- Mitsubishi Electric Corporation

- General Electric (GE)

- Hitachi Ltd.

- Fuji Electric Co., Ltd.

- Toshiba Corporation

- Larsen & Toubro Limited

Competitive Analysis:

The Global DC Switchgear Market is highly competitive with a mix of global leaders and regional players. Siemens, ABB, Schneider Electric, Eaton, Mitsubishi Electric, and General Electric dominate with broad product portfolios and strong distribution networks. It benefits from continuous innovation, where leading companies focus on compact, energy-efficient, and digital switchgear solutions. Hitachi, Fuji Electric, Toshiba, and Larsen & Toubro strengthen competition through regional expertise and project-based solutions. Market players pursue mergers, acquisitions, and partnerships to expand geographic presence and customer reach. New product launches target renewable energy, EV charging, and industrial automation sectors. It also records competition in price-sensitive regions, where smaller manufacturers provide cost-effective alternatives. Strategic differentiation lies in integrating smart technologies, meeting regulatory standards, and supporting sustainable power infrastructure.

Recent Developments:

- In August 2025, ABB Ltd. partnered with E.ON, Germany’s largest distribution system operator, to supply its next-generation SF6-free gas-insulated switchgear (GIS), signaling a major shift towards more sustainable and greenhouse gas-free switchgear for DC and medium-voltage grids.

- In July 2025, Siemens AG entered into a strategic partnership with Q-Tec Switchgear, aiming to manufacture and distribute the Simoprime World brand of switchgear within Qatar, significantly enhancing local access to advanced medium-voltage DC switchgear solutions.

- In February 2025, Schneider Electric SE acquired a controlling stake in Motivair Corporation, strengthening its service offering for cooling and power infrastructure relevant to DC switchgear, particularly in advanced data center environments.

- In August 2024, Mitsubishi Electric Corporation signed a co-development agreement with Siemens Energy Global for multi-terminal HVDC systems and DC Circuit Breaker requirement specifications aimed at large-scale renewable energy resource integration, underscoring joint advancement in global DC switching technology.

Report Coverage:

The research report offers an in-depth analysis based on Component Type, Voltage Range and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global DC Switchgear Market will expand steadily, supported by renewable energy growth and grid upgrades.

- Rising deployment of solar and wind projects will strengthen demand for advanced DC switchgear solutions.

- Expansion of electric vehicle charging networks will create sustained need for compact and efficient systems.

- Grid modernization initiatives across developed economies will drive adoption of smart and digital switchgear.

- It will benefit from predictive monitoring, remote control, and improved system resilience in power distribution.

- Growth in global data centers will increase reliance on reliable DC distribution and protection systems.

- Industrial automation and robotics adoption will fuel demand for advanced circuit protection solutions.

- Electrification of railways, metros, and smart infrastructure projects will boost regional installations.

- Emerging economies in Asia, Africa, and Latin America will create opportunities through electrification and urbanization.

- Sustainability goals will push manufacturers to design eco-friendly and energy-efficient products for utilities.

- Partnerships, acquisitions, and mergers will help companies expand presence and diversify portfolios.

- IoT-enabled monitoring, predictive maintenance, and digital innovations will shape future competitiveness and reliability.