Market Overview:

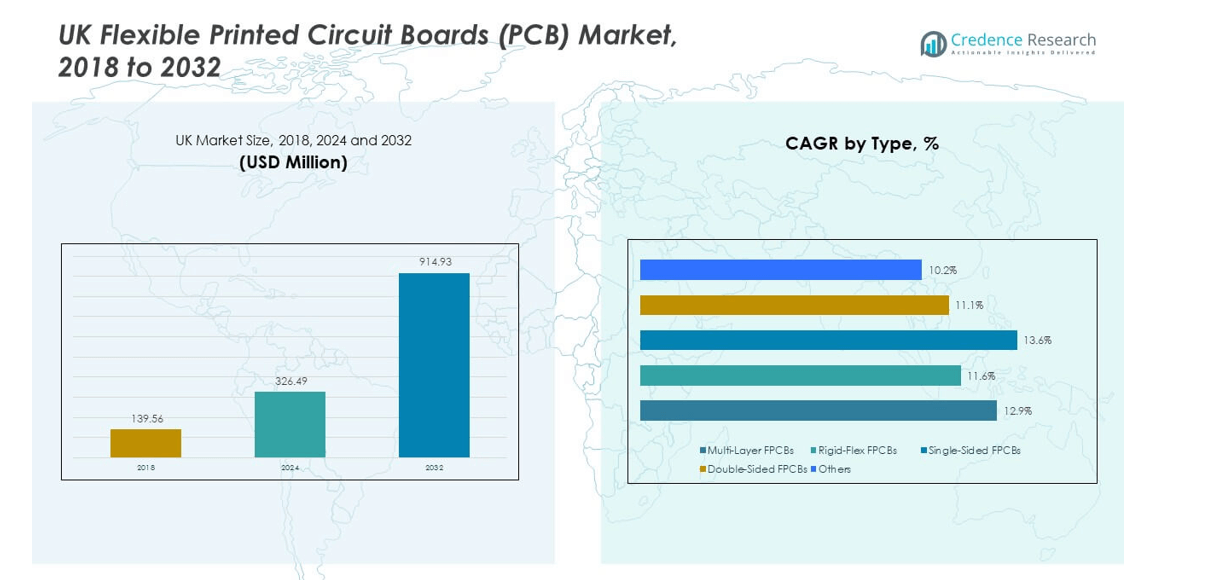

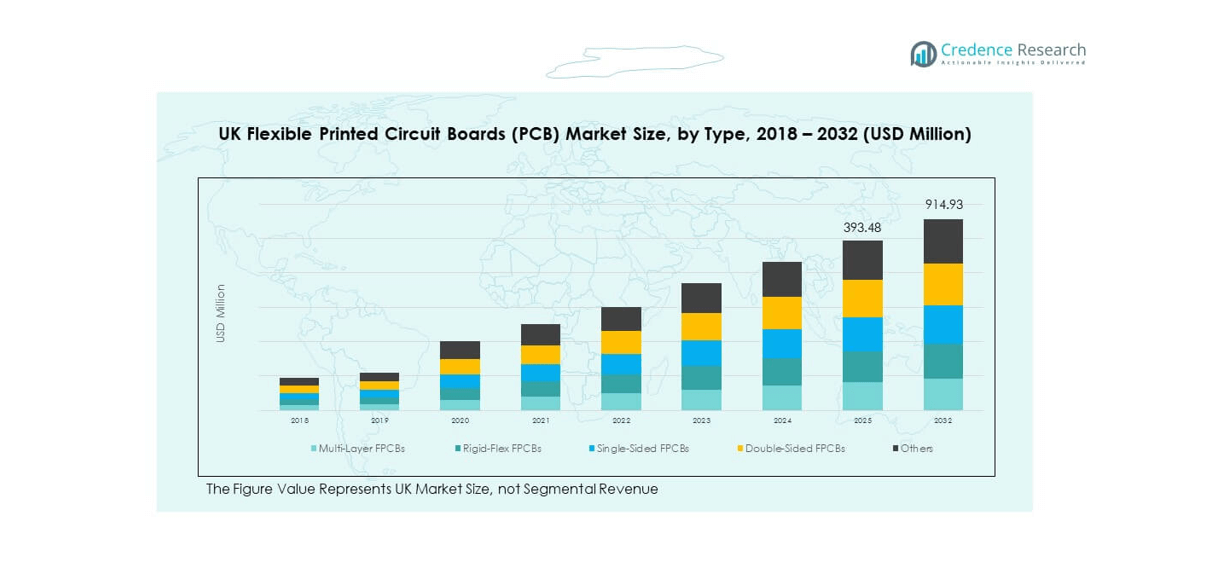

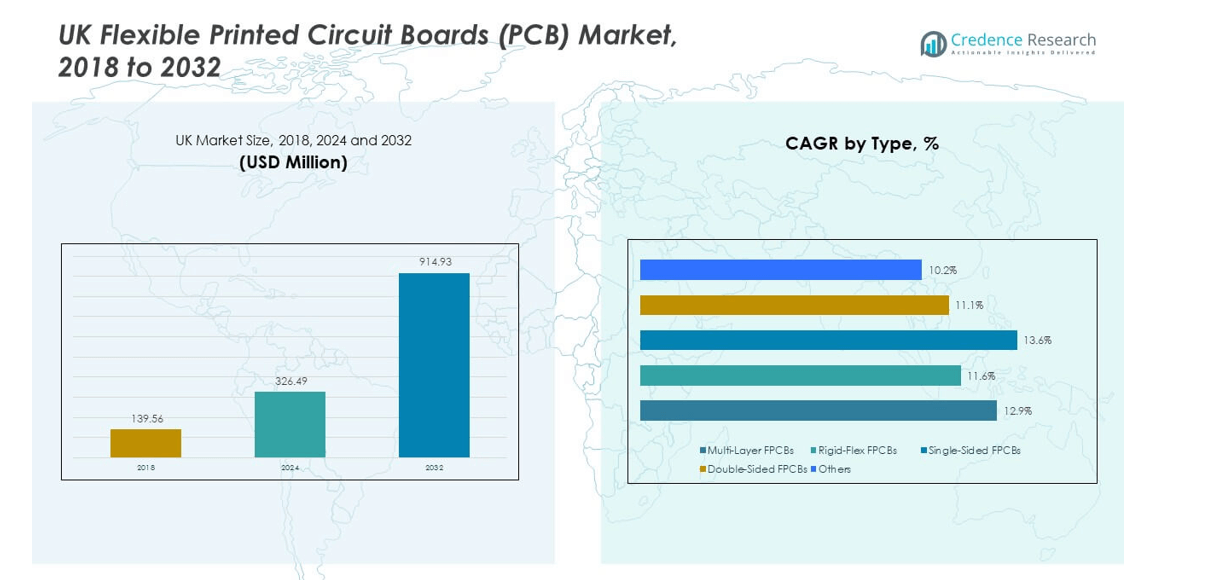

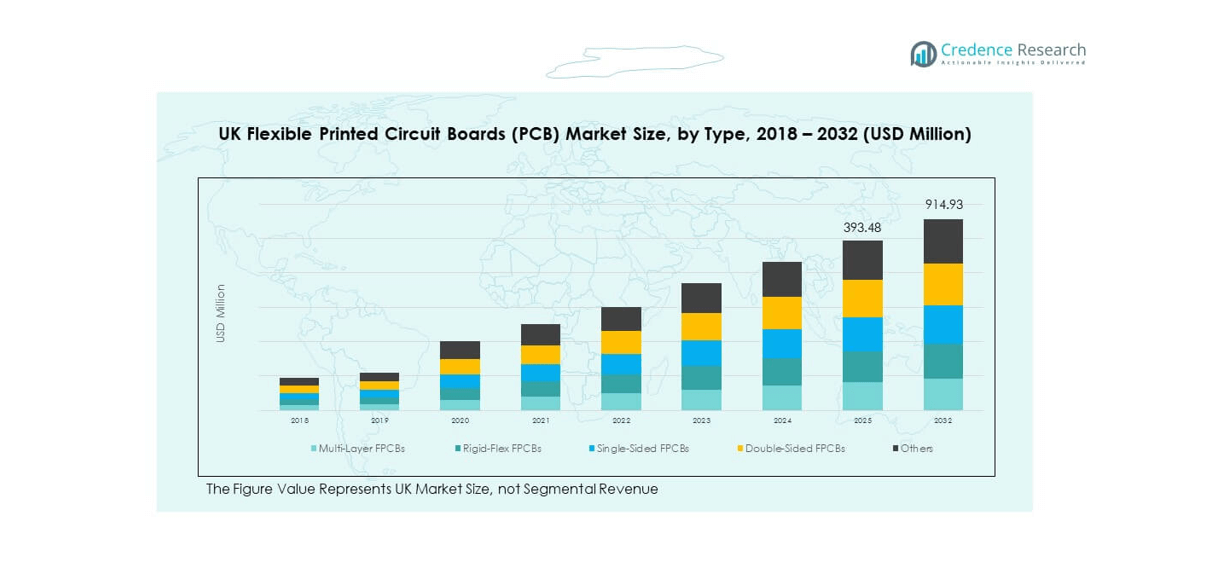

The UK Flexible Printed Circuit Boards (PCB) Market size was valued at USD 139.56 million in 2018, reaching USD 326.49 million in 2024, and is anticipated to attain USD 914.93 million by 2032, growing at a CAGR of 12.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Flexible Printed Circuit Boards (PCB) Market Size 2024 |

USD 326.49 million |

| UK Flexible Printed Circuit Boards (PCB) Market, CAGR |

12.81% |

| UK Flexible Printed Circuit Boards (PCB) Market Size 2032 |

USD 914.93 million |

Rising demand for miniaturized and energy-efficient electronic components drives the UK market. The expansion of automotive electronics, coupled with rapid growth in consumer devices and industrial automation, accelerates flexible PCB adoption. Manufacturers leverage advanced substrate materials and improved circuit density to support higher performance and durability. The shift toward electric vehicles and medical wearables further strengthens demand, as flexible PCBs enable compact layouts, lower weight, and better thermal management for connected devices.

Regionally, England leads the UK Flexible PCB market, supported by strong manufacturing and R&D activity in automotive and electronics sectors. Scotland follows, with increasing investments in semiconductor and sensor production. Wales and Northern Ireland are emerging hubs, driven by government incentives and growing contract manufacturing in electronics assembly. Collaboration between domestic firms and global suppliers continues to enhance technological capacity and export potential within the region.

Market Insights:

- The UK Flexible Printed Circuit Boards (PCB) Market was valued at USD 139.56 million in 2018, reached USD 326.49 million in 2024, and is projected to attain USD 914.93 million by 2032, registering a CAGR of 12.81% during 2024–2032.

- England leads with 58% share, driven by strong automotive, electronics, and defense production bases. Scotland follows with 23%, supported by semiconductor and aerospace innovation, while Wales and Northern Ireland collectively hold 19%, supported by industrial automation and contract manufacturing.

- Scotland represents the fastest-growing region with 23% share, fueled by R&D investments, aerospace expansion, and clean energy initiatives driving flexible PCB demand.

- By type, Multi-Layer FPCBs account for 38%, leading the market due to superior signal integrity and suitability for compact, high-performance devices.

- Rigid-Flex FPCBs hold 26%, expanding in medical, defense, and EV applications where design reliability and vibration resistance are critical.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Penetration of Compact Electronics Across Consumer and Industrial Applications

The UK Flexible Printed Circuit Boards (PCB) Market grows due to the expanding use of compact electronic assemblies in smartphones, tablets, medical devices, and wearables. Increasing preference for miniaturized designs in industrial sensors and automotive control systems strengthens demand. Manufacturers focus on enhancing circuit density and flexibility to meet evolving performance standards. The market benefits from growing replacement cycles in personal electronics. Continuous innovation in thinner substrates and high-frequency laminates supports new applications. Companies invest in roll-to-roll fabrication to scale production. It helps address design constraints in next-generation electronics. Government support for electronic manufacturing further accelerates growth.

- For instance, FlexEnable developed organic thin-film transistor substrates that run at <100 °C processing temperatures and enable ultra-thin, ultra-light flexible modules for mobile consumer electronics. Increasing preference for miniaturised designs in industrial sensors and automotive control systems strengthens demand. The market benefits from growing replacement cycles in personal electronics. Continuous innovation in thinner substrates and high-frequency laminates supports new applications.

Expansion of Electric Vehicle Manufacturing and Automotive Electronics Integration

Wider adoption of electric vehicles (EVs) across the UK stimulates demand for lightweight and reliable PCB systems. Flexible PCBs are essential in battery management, infotainment, and advanced driver-assistance systems. The push toward smart mobility and connected vehicle platforms fuels innovation in flexible circuitry. Automotive OEMs emphasize design integration and thermal resistance to improve operational reliability. Partnerships between local suppliers and global technology firms improve material efficiency. The market witnesses growing utilization of polyimide-based boards for temperature tolerance. It supports safety-critical systems and ensures durability under vibration and heat. Automotive electrification continues to shape industry priorities and product specifications.

- For instance, Flexible PCBs are essential in battery management, infotainment, and advanced driver-assistance systems, a case study by Capel FPC demonstrated manufacture of 2-layer flexible PCBs for EV battery protection boards meeting line width/spacing of 0.2 mm/0.25 mm and plate thickness of 0.25 mm ± 0.03 mm. Automotive OEMs emphasise design integration and thermal resistance to improve operational reliability.

Strong Growth in Medical Electronics and Diagnostic Device Adoption

Rising demand for portable and wearable medical equipment drives PCB consumption in healthcare applications. Flexible PCBs provide durability, patient comfort, and high data transmission capacity for advanced diagnostic devices. The market benefits from increased R&D investment in biosensors and imaging technologies. Healthcare equipment manufacturers deploy flexible circuits in ECG monitors, insulin pumps, and hearing aids. The shift toward telehealth and home-based care boosts demand for compact electronics. It supports reliable signal processing and miniaturization. Strategic collaborations with medical device firms enhance innovation capacity. UK’s healthcare infrastructure modernization reinforces long-term market growth.

Integration of Advanced Manufacturing and Smart Production Systems

Automation and digitalization in production facilities strengthen PCB design efficiency. The UK Flexible Printed Circuit Boards (PCB) Market leverages Industry 4.0 technologies to optimize process control. Laser direct imaging and precision etching improve yield and pattern accuracy. The use of AI-driven inspection reduces production errors and waste. Manufacturing firms integrate flexible boards into robotics, drones, and industrial IoT systems. It boosts operational reliability and data transmission capability. Investments in material innovation, such as copper-clad laminates, improve thermal and electrical properties. Increased collaboration between electronics producers and automation integrators advances industrial capability.

Market Trends:

Shift Toward Flexible Hybrid Electronics for Multifunctional Integration

The UK Flexible Printed Circuit Boards (PCB) Market experiences a strong trend toward flexible hybrid electronics combining printed circuits with embedded sensors and chips. These systems enable smart wearables, adaptive surfaces, and responsive medical patches. Manufacturers develop stretchable and transparent substrates to expand design flexibility. Integration with soft materials allows better ergonomics and device comfort. R&D centers invest in conductive inks and thin-film transistors. It supports advanced signal processing in flexible devices. Collaboration between technology firms and research institutes accelerates commercialization. Consumer adoption of smart textiles and fitness monitoring devices propels the trend forward.

- For instance, a study showed stretchable circuits based on elastomer substrates achieved ~30% elongation while maintaining conductive stability. R&D centres invest in conductive inks and thin-film transistors.

Emergence of High-Density Interconnects for Miniaturized Assemblies

Rising preference for high-density interconnect (HDI) FPCBs enhances circuit functionality in limited space. It addresses the demand for compact yet high-performance boards in communication and computing devices. The transition toward fine-line circuitry improves electrical performance and signal speed. Manufacturers employ laser drilling and precision alignment to achieve multi-layer compactness. The trend supports the development of thinner and more complex electronic devices. It promotes design flexibility across IoT modules and aerospace systems. Increased R&D funding improves HDI substrate capability. Local production facilities upgrade to meet the rising standardization requirements across export markets.

- For instance, state-of-the-art flex circuits now use laser-drilled vias and fine trace widths of ≤0.1 mm to achieve multi-layer stacking in compact modules. It addresses the demand for compact yet high-performance boards in communication and computing devices. The transition toward fine-line circuitry improves electrical performance and signal speed.

Adoption of Sustainable Materials and Eco-Efficient Production Techniques

Sustainability shapes product design and material sourcing strategies within the PCB sector. The market shifts toward halogen-free laminates and recyclable polyimide substrates. Manufacturers implement low-carbon fabrication methods and waste-reduction processes. It aligns with UK environmental compliance frameworks. Circular production principles influence raw material procurement and lifecycle design. The emphasis on renewable inputs and green chemistry grows across large facilities. R&D activities explore bio-based films and water-soluble conductive polymers. Industry players adopt lifecycle assessment tools to evaluate performance and environmental impact, improving long-term competitiveness and compliance.

Technological Transition Toward AI-Enabled Quality Control and Design Automation

Manufacturers deploy AI algorithms to enhance accuracy in inspection, defect detection, and layout optimization. It reduces material waste and improves throughput. AI integration in design platforms accelerates prototyping and testing processes. The UK Flexible Printed Circuit Boards (PCB) Market benefits from predictive analytics that improve reliability forecasting. Cloud-based software supports simulation and performance evaluation. The industry moves toward data-driven decision systems for supply chain control. It promotes precision manufacturing and adaptive workflow management. Adoption of AI-enabled automation shortens product cycles and boosts overall production efficiency.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Instability Affecting Production Costs

The UK Flexible Printed Circuit Boards (PCB) Market faces continuous challenges from copper foil and polyimide price volatility. Dependence on global suppliers exposes manufacturers to fluctuations in import costs. Limited domestic production capacity intensifies reliance on overseas sources. Logistics delays and geopolitical tensions disrupt steady material availability. It increases operational expenditure and inventory risk. Manufacturers face difficulty in maintaining profit margins under volatile cost conditions. The shortage of high-quality laminates affects consistency and delivery timelines. Industry participants invest in local sourcing and recycling to mitigate procurement disruptions.

High Production Complexity and Technological Barriers to Miniaturization

Complex manufacturing processes increase operational cost and technical challenges. Miniaturization requires precision layering, advanced imaging, and tight tolerance control. Small-scale producers struggle to match the technological depth of global competitors. It limits entry of new firms and reduces competitiveness in export markets. High initial investment in automation equipment creates financial strain. Maintaining quality under reduced thickness parameters demands skilled labor and process control. Manufacturers must comply with stringent performance standards set by automotive and aerospace sectors. Sustaining high precision while reducing cost remains a central challenge for the industry.

Market Opportunities:

Growing Investment in Electric Mobility and IoT-Driven Infrastructure

The rapid electrification of transportation presents a major growth avenue. The UK Flexible Printed Circuit Boards (PCB) Market benefits from rising investment in electric vehicles and charging networks. Demand increases for flexible boards in sensors, controllers, and power distribution units. Smart city and IoT infrastructure projects boost the use of advanced circuit systems. It supports real-time data exchange and efficient monitoring across sectors. Domestic manufacturers explore co-development partnerships with EV suppliers to improve integration. Expansion of connected mobility ecosystems ensures steady long-term growth opportunities.

Advancement in Wearable and Biomedical Electronics Supporting Healthcare Innovation

The medical electronics sector presents attractive growth potential through wearable sensors and diagnostics. Flexible PCBs enable lightweight, skin-friendly designs for patient monitoring devices. Growing healthcare digitization in the UK supports innovation in biosensing and data transmission. The shift toward remote diagnostics encourages OEMs to adopt flexible circuit technologies. It improves performance and comfort across long-use medical equipment. Collaborations between universities, healthcare providers, and technology developers accelerate commercialization. Expansion in medical R&D funding strengthens the future market landscape.

Market Segmentation Analysis:

By Type

The UK Flexible Printed Circuit Boards (PCB) Market features a broad type segmentation, addressing performance needs across multiple industries. Multi-Layer FPCBs dominate due to their high wiring density, signal integrity, and suitability for compact electronics. They are essential in automotive systems, industrial robots, and high-speed communication devices. Rigid-Flex FPCBs follow closely, favored for durability and design flexibility in aerospace, medical, and defense applications. Single-Sided FPCBs remain relevant in cost-sensitive consumer electronics and small appliances. Double-Sided variants offer improved connection density for mid-range devices such as routers and control modules. The “Others” segment includes hybrid and stretchable circuits used in wearable sensors and advanced healthcare systems. It supports innovation through material and fabrication advancements that improve product reliability and flexibility.

- For instance, the NCAB Group UK lists multilayer flex constructions with up to 12 layers and minimum track / gap of 0.075 mm. They are essential in automotive systems, industrial robots, and high-speed communication devices. Rigid-Flex FPCBs follow closely, favored for durability and design flexibility in aerospace, medical, and defense applications.

By End Use

End-use segmentation highlights diverse adoption across critical sectors. Consumer Electronics lead demand, supported by strong sales of smartphones, tablets, and wearable devices. Automotive applications expand rapidly with increasing use in EV control units, infotainment, and ADAS systems. Industrial Electronics use flexible PCBs for automation, monitoring, and high-temperature environments. The IT & Telecom sector benefits from miniaturized circuits used in communication modules and network hardware. Aerospace & Defense rely on rigid-flex structures that withstand vibration and heat, ensuring reliability in mission-critical operations. The “Others” category includes healthcare and instrumentation systems that demand precise, lightweight circuit configurations. It reflects ongoing technology adaptation to sector-specific performance and regulatory standards.

- For instance, Molex documents flexible printed circuits used in smartphones, in-cab infotainment and wearable fitness gear with high signal integrity. Automotive applications expand rapidly with increasing use in EV control units, infotainment, and ADAS systems.

Segmentation:

By Type

- Multi-Layer FPCBs

- Rigid-Flex FPCBs

- Single-Sided FPCBs

- Double-Sided FPCBs

- Others

By End Use

- Industrial Electronics

- Aerospace & Defense

- IT & Telecom

- Automotive

- Consumer Electronics

- Others

By Country (within the UK)

- England

- Scotland

- Wales

- Northern Ireland

Regional Analysis:

England – Leading Regional Hub for Electronics Manufacturing

England accounts for 58% share of the UK Flexible Printed Circuit Boards (PCB) Market, driven by its strong electronics, automotive, and defense manufacturing base. The region houses major production facilities, R&D centers, and design firms that emphasize high-performance and miniaturized PCB solutions. It benefits from government-backed innovation programs supporting electric mobility and industrial automation. Demand remains strong in automotive electronics, medical devices, and telecom infrastructure. Manufacturers in England focus on integrating automation, AI, and advanced substrate technology to enhance production precision and yield. It maintains leadership through continuous investment in design capabilities, skilled workforce, and export-oriented manufacturing clusters.

Scotland – Rapid Expansion in Semiconductor and Aerospace Applications

Scotland holds 23% market share, supported by its growing semiconductor and aerospace industries. The region’s innovation-driven environment encourages PCB development for sensor, radar, and communication systems. Universities and technology institutes play a central role in advancing flexible electronics and hybrid integration. The aerospace sector drives adoption of Rigid-Flex FPCBs that meet high reliability and performance standards under extreme conditions. It gains competitive strength from strong research collaboration and high-value design partnerships with global OEMs. The government’s focus on clean energy and precision manufacturing creates favorable conditions for local PCB suppliers. Scotland’s ecosystem supports niche manufacturing for high-reliability electronics and defense technology applications.

Wales and Northern Ireland – Emerging Centers for Industrial and Consumer Electronics

Wales and Northern Ireland collectively contribute 19% share of the market, supported by growing investments in contract manufacturing and electronics assembly. Wales focuses on industrial automation, renewable energy systems, and electronic control applications, while Northern Ireland sees expansion in consumer and communication electronics. Both regions attract mid-scale enterprises seeking cost-efficient production environments. It benefits from regional funding and technology transfer programs designed to build advanced material processing capabilities. The presence of specialized SMEs in printed circuit design and component integration enhances local competitiveness. Strong infrastructure development and government-backed initiatives continue to transform these regions into strategic contributors to the national flexible PCB supply chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- NCAB Group UK

- Eurocircuits UK

- PCB Technologies

- Eltek Ltd. UK

- Corsair Components

- MCL Electronic Products

- Pragmatic Technologies

- Cambridge Electronics

- Clarke Rogers Technical Solutions

- The Signet Group

Competitive Analysis:

The UK Flexible Printed Circuit Boards (PCB) Market features a competitive landscape led by domestic and global manufacturers focusing on innovation, material efficiency, and customization. Companies invest in advanced manufacturing, automation, and R&D to meet evolving industry standards. It emphasizes design precision, durability, and flexible performance for high-demand applications in automotive, consumer electronics, and aerospace. Key players such as NCAB Group UK, Eurocircuits UK, Pragmatic Technologies, and Eltek Ltd. UK strengthen their market presence through strategic collaborations and product diversification. Continuous innovation, cost optimization, and local production capacity define the competitive advantage across the market.

Recent Developments:

- In August 2025, Eltek Ltd. (NASDAQ: ELTK) received purchase orders totaling $2.4 million from a leading Israeli defense company. The products are to be delivered mainly throughout 2026 and 2027. The PCBs being delivered are critical components in the customer’s systems, requiring advanced technological capabilities. Eltek specializes in the manufacture and supply of complex and high-quality PCBs, including HDI, multilayered, and flex-rigid boards for the high-end market.

- In March 2025, MCL (Millennium Circuits Limited) announced a new scholarship partnership with Harrisburg University of Science and Technology. MCL’s $30,000 gift establishes two brand-new, four-year scholarships for two Advanced Manufacturing students. This partnership highlights MCL’s focus on building Pennsylvania’s manufacturing capacity and retaining local talent in the circuit board industry, aligning with the company’s 20th anniversary of incorporation. The check-signing ceremony was held on March 19, 2025.

- In March 2025, Pragmatic Semiconductor launched the Pragmatic FlexIC Platform Gen 3, offering a 10x digital power and 3x digital area improvement over the previous generation. The platform was announced on March 4, 2025, and enables innovators to swiftly design and manufacture custom FlexICs, which are ultra-thin, physically flexible application-specific integrated circuits (ASICs) with a low carbon footprint. The platform provides manufacturing capabilities via the Pragmatic FlexIC Foundry at Pragmatic Park in County Durham, England.

- In August 2025, Wright Industries acquired Exception PCB Ltd, returning the printed circuit board manufacturer to UK ownership. The acquisition was announced on August 3-4, 2025. Exception PCB joined Wright Industries’ other investments as part of the Connexion Technologies group. This strategic acquisition underscores both companies’ shared commitment to building advanced manufacturing capability in the UK.

- In January 2025, UK-based contract electronics manufacturer Active-PCB Solutions Ltd was acquired by Agile Circuit Technologies Group Ltd (ACT Group). Active-PCB, based in Reading and founded 28 years ago, provides flexible, high-quality solutions in electronic and mechanical assembly to customers from early design and prototyping through to peak volume production. This was the second acquisition by Dean Curran, forming a new group of side-by-side businesses.

Report Coverage:

The research report offers an in-depth analysis based on Type and End Use segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Integration of AI-based quality control will improve production accuracy and defect detection.

- Demand for Rigid-Flex FPCBs will rise in aerospace, defense, and electric vehicle applications.

- Miniaturization and high-density interconnect adoption will strengthen product design flexibility.

- Growing healthcare digitization will expand use in wearable and diagnostic medical devices.

- Sustainable and recyclable materials will become a key focus across manufacturing facilities.

- Domestic production will gain traction through government-led electronics industry incentives.

- Technological innovation in conductive inks will enhance hybrid and stretchable circuit designs.

- Collaboration between OEMs and research institutes will drive advanced substrate development.

- Automation and smart manufacturing will increase throughput and supply reliability.

- The evolving 5G and IoT ecosystem will sustain long-term growth for flexible PCB adoption.