Market Overview

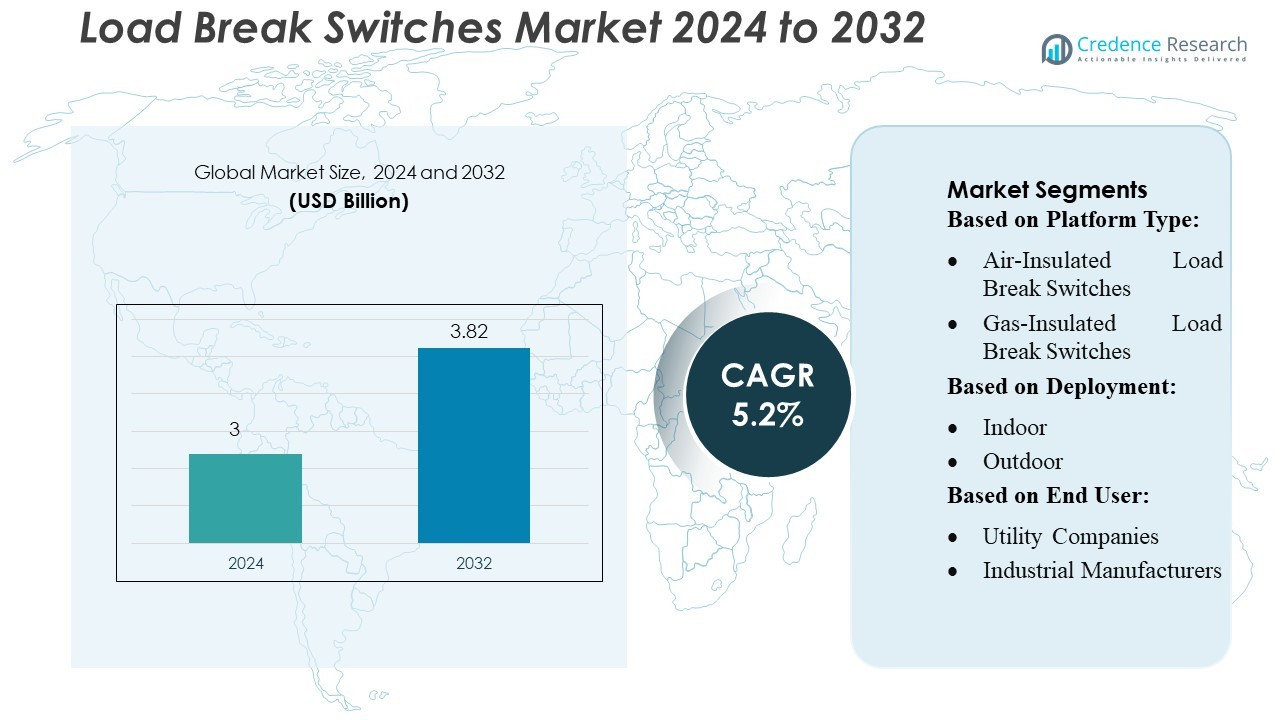

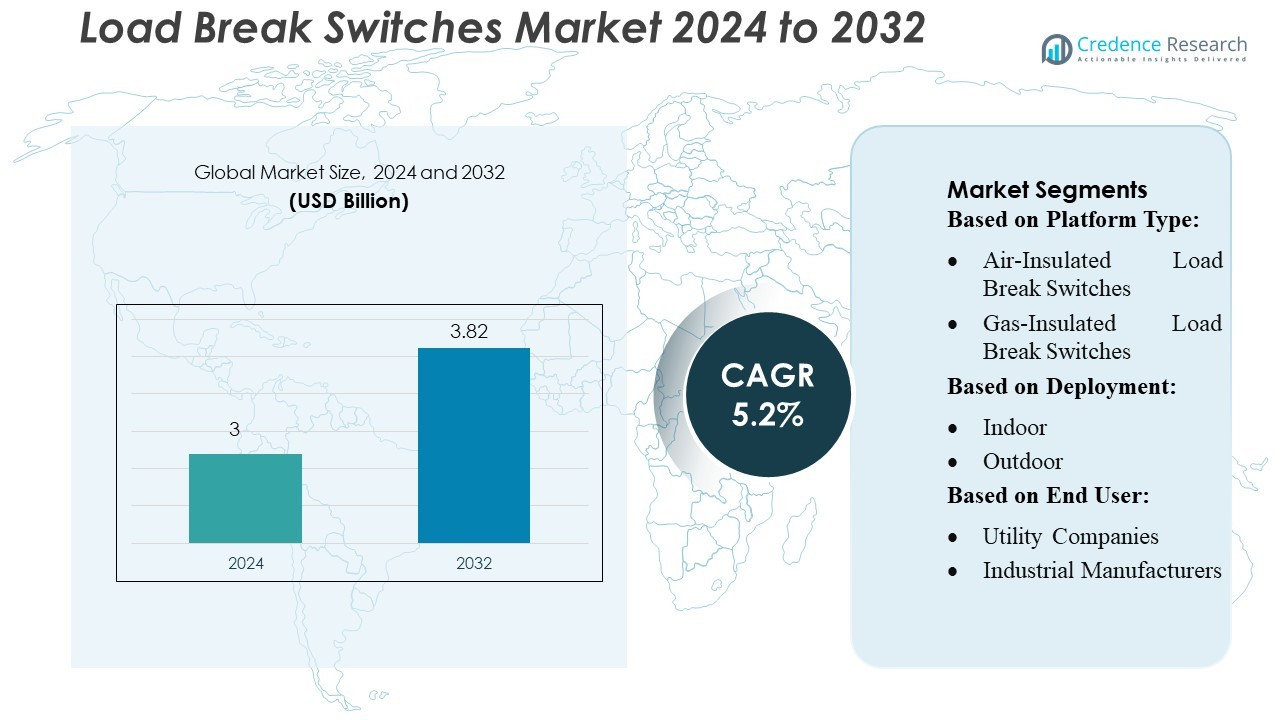

Load Break Switches Market size was valued USD 3 billion in 2024 and is anticipated to reach USD 3.82 billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Load Break Switches Market Size 2024 |

USD 3 Billion |

| Load Break Switches Market, CAGR |

5.2% |

| Load Break Switches Market Size 2032 |

USD 3.82 Billion |

The global load break switches market is led by prominent players such as ABB Ltd., Schneider Electric, Eaton Corporation, Siemens, Fuji Electric, and Legrand, collectively driving innovation in medium-voltage switchgear. These companies leverage strong portfolios in gas-insulated, vacuum, and solid-insulated load break switches to serve utility, industrial, and infrastructure sectors. The Asia-Pacific region is the dominant market, capturing approximately 38.8 % of the global market in 2024, driven by rapid electrification, urbanization, and strong investment in smart grid infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Load Break Switches Market was valued at USD 3 billion in 2024 and is expected to reach USD 3.82 billion by 2032, reflecting a CAGR of 5.2% during the forecast period.

- Growing investments in grid modernization, rising electricity demand, and expansion of distribution networks drive adoption of advanced load break switches across utilities and industrial facilities.

- The market observes strong trends toward gas-insulated and vacuum-based technologies, with the medium-voltage segment holding the largest share due to its extensive use in distribution substations and commercial infrastructure.

- Competitive activity remains high as ABB, Schneider Electric, Eaton, Siemens, Fuji Electric, and Legrand strengthen portfolios through product upgrades, automation integration, and regional expansion strategies.

- The Asia-Pacific region leads with a 38.8% share in 2024, supported by rapid electrification and urban development, while Europe and North America show steady growth driven by grid reliability upgrades.

Market Segmentation Analysis:

By Platform Type

Gas-insulated load break switches dominate the market with an estimated over 40% share, driven by their compact footprint, sealed design, and high dielectric strength suited for urban substations and renewable energy installations. Utilities increasingly adopt gas-insulated units to reduce maintenance frequency and enhance arc-quenching efficiency, especially in medium-voltage applications. Air-insulated switches maintain steady demand in cost-sensitive rural grids, while vacuum-type switches gain traction for their long operating life and minimal environmental impact. Oil-immersed switches continue their niche use in legacy systems but decline due to stricter environmental regulations.

- For instance, SOCOMEC’s SIRCO MV load break switch series is engineered to handle operational voltages up to 24 kV and short-circuit withstand currents of 25 kA for 1 second, offering certified IEC-compliant performance for demanding medium-voltage applications.

By Deployment

Outdoor installations represent the dominant deployment segment, accounting for nearly 60% of total market share, driven by widespread use in distribution networks, feeder automation, and renewable energy farms that require weather-resilient switching systems. Their robust enclosure ratings and remote-operable designs support grid modernization programs across emerging markets. Indoor load break switches maintain demand in industrial substations, commercial facilities, and compact switchgear rooms where space optimization and operational safety are critical. Growth in indoor systems is supported by rising industrial automation and the expansion of high-density commercial infrastructure.

- For instance, VKA rotary load break switches, rated for 250 A continuous current, offer a short-time withstand current of 100 kA RMS and a peak making capacity of 42 kA, per KATKO’s latest product catalog.

By End-User

Utility companies lead the end-user segmentation with approximately 50% market share, driven by extensive investment in distribution grid upgrades, smart grid rollout, and integration of decentralized energy resources requiring reliable medium-voltage switching solutions. Industrial manufacturers follow, adopting load break switches to enhance operational continuity, protect sensitive equipment, and comply with safety standards in heavy-duty environments. Commercial building owners contribute to steady demand through the installation of compact switchgear for backup power and energy management systems. The “Others” category—comprising transportation hubs and data centers—shows rising adoption aligned with infrastructure electrification.

Key Growth Drivers

- Grid Modernization and Distribution Network Expansion

Grid modernization initiatives across developed and emerging economies significantly drive demand for load break switches as utilities reinforce medium-voltage distribution networks. Governments prioritize grid reliability, renewable integration, and feeder automation—each requiring highly reliable switchgear for sectionalizing and fault isolation. Expansion of urban distribution infrastructure, electrification of rural areas, and replacement of aging switchgear further accelerate adoption. Utilities increasingly deploy smart, remote-operable load break switches to support real-time monitoring and improve outage management, making modernization programs a major catalyst for market growth.

- For instance, Powell Industries’ PowlVac® medium-voltage switchgear is engineered for modern grid automation needs, supporting operating voltages up to 15 kV, continuous current ratings up to 4000 A, and interrupting capabilities of 63 kA symmetrical, while its arc-resistant designs meet IEEE C37.20.7 Type 2B standards to enhance grid reliability during fault events.

- Rising Integration of Renewable Energy Systems

The rapid deployment of solar and wind power installations increases the need for load break switches capable of safe, reliable isolation within decentralized energy architectures. Renewable farms require frequent switching, enhanced arc-quenching performance, and compact high-dielectric solutions that withstand fluctuating load profiles. As countries scale utility-scale and distributed renewable projects, load break switches play a key role in ensuring grid stability and protecting downstream assets. Their compatibility with smart inverters and automated substations strengthens their role in renewable-driven grid expansion, boosting market demand.

- For instance, Rapier GX pole-mounted gas-insulated load break switch supports up to 38 kV, carries a continuous current of 630 A, and withstands a short-time current of 16 kA for 1 second, per its technical specifications.

- Growing Industrial Electrification and Safety Compliance

Industrial sectors increasingly adopt load break switches to meet stringent electrical safety standards and ensure uninterrupted operations in manufacturing, mining, chemicals, and heavy engineering. These switches enable controlled disconnection of equipment, reducing arc-flash risks and improving maintenance efficiency. Industrial automation, rising power consumption, and the expansion of high-load facilities foster sustained demand for medium-voltage switching equipment. Compliance with IEC, IEEE, and regional electrical codes compels industries to replace older switchgear with modern, compact, and more reliable load break switches, strengthening market growth.

Key Trends & Opportunities

- Shift Toward Smart and Remote-Controlled Switching Systems

Utilities and industries increasingly adopt smart load break switches equipped with sensors, SCADA connectivity, and remote-operable features to support real-time monitoring and grid automation. This shift aligns with digital grid strategies that emphasize predictive maintenance, fault localization, and reduced outage durations. The integration of IoT, communication modules, and intelligent control systems creates opportunities for manufacturers to deliver advanced, automated solutions. As smart grid investments accelerate worldwide, remote-controlled load break switches emerge as a central component of distribution network intelligence.

- For instance, Fuji Electric has introduced motor-driven versions of its LBS and LB air load-break switches that support remote tripping via a shunt-trip coil rated for 100 V AC/DC, with a response time of 0.1 seconds or less, according to its catalog.

- Growing Adoption of Environmentally Friendly Insulation Technologies

Sustainability demands are pushing manufacturers to shift from traditional SF₆-based gas-insulated switches toward greener alternatives such as vacuum and dry-air insulation. Regulatory pressure to reduce greenhouse-gas emissions offers opportunities for expanding eco-efficient switchgear solutions. Vacuum load break switches, in particular, benefit from longer lifecycle performance, near-zero maintenance, and superior environmental safety. This transition encourages R&D investments aimed at enhancing dielectric strength while minimizing ecological footprint, positioning eco-friendly technologies as a major growth opportunity.

- For instance, puffer interrupter achieves full-load interruption at 12 kV and 630 A, per IEC duty-class tests, in dry-air insulation.

- Rising Demand for Compact Switchgear in Urban and Commercial Spaces

Urban infrastructure development and high-density commercial buildings drive demand for compact, modular load break switches that fit space-constrained environments. Rapid construction of data centers, metro stations, hospitals, and high-rise complexes increases the need for efficient medium-voltage distribution systems with small footprints. Manufacturers capitalize on this shift by offering integrated switchgear assemblies that combine protection, control, and metering in compact enclosures. As cities adopt underground distribution networks and smart building systems, compact LBS configurations gain substantial traction.

Key Challenges

- High Installation and Upgrade Costs for Advanced Switchgear

The integration of smart, automated, and eco-friendly load break switches involves high upfront investment, which limits adoption in cost-sensitive markets and small utility networks. Expenses associated with installation, retrofitting, communication modules, and control software add financial burden, especially for developing regions. Many utilities still rely on legacy systems, delaying modernization due to budget constraints. This cost barrier affects the replacement rate and slows the transition toward advanced switching technologies, restricting overall market penetration.

- Technical Limitations in Harsh and High-Load Environments

While load break switches are essential for medium-voltage operations, their performance may be constrained in environments with extreme temperatures, high contamination levels, or heavy switching cycles. Excessive mechanical and electrical stresses can lead to increased maintenance needs and shorter equipment lifespan. Industrial facilities with high fault currents or frequent switching demands often require more robust technologies, creating performance gaps for standard LBS designs. Addressing reliability issues in challenging conditions remains a key hurdle for manufacturers seeking wider adoption.

Regional Analysis

North America

North America holds around 28% market share in the load break switches market, driven by extensive grid modernization programs, refurbishment of aging transmission infrastructure, and high renewable energy penetration across the U.S. and Canada. Utilities increasingly deploy smart, remotely operated LBS units to enhance outage management and support distributed energy resources. The region’s strong regulatory focus on reliability, resilience, and wildfire mitigation also accelerates adoption of weather-resistant outdoor switches. Industrial demand remains steady due to the expansion of advanced manufacturing facilities and the need to comply with stringent electrical safety standards.

Europe

Europe accounts for approximately 25% of market share, supported by strict environmental regulations, rapid deployment of eco-efficient grid technologies, and large-scale renewable energy integration projects. Countries such as Germany, the U.K., France, and the Nordics are moving toward SF₆-free insulation technologies, creating strong demand for vacuum and dry-air load break switches. The expansion of offshore wind, electric vehicle infrastructure, and urban underground distribution networks further stimulates investment in compact and high-dielectric switchgear. Modernization of cross-border interconnections and smart grid initiatives strengthens Europe’s steady adoption rate.

Asia-Pacific

Asia-Pacific remains the dominant region with over 35% market share, fueled by rapid urbanization, industrial expansion, and large-scale grid strengthening projects in China, India, South Korea, and Southeast Asia. Governments prioritize electrification of rural areas, integration of renewable capacity, and reinforcement of distribution networks, resulting in high demand for air- and gas-insulated load break switches. The region’s growing manufacturing base and data center development boost industrial and commercial installations. Continuous investment in smart grid technologies and expansion of metro rail systems further position Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America captures around 7% market share, with growth primarily driven by expansion of transmission and distribution infrastructure in Brazil, Mexico, Chile, and Colombia. Utilities invest in medium-voltage grid upgrades to reduce technical losses and improve network reliability, supporting the adoption of outdoor load break switches. Renewable energy deployment—particularly in solar-rich regions—adds to demand for safe isolation and switching solutions. Economic constraints limit large-scale modernization in some countries, but gradual digitalization of power networks and rising industrial activities provide steady long-term opportunities.

Middle East & Africa

The Middle East & Africa region holds approximately 5% market share, supported by electrification initiatives, development of utility-scale renewable projects, and ongoing construction of industrial zones across the GCC countries, South Africa, and North Africa. Harsh environmental conditions drive preference for rugged, corrosion-resistant outdoor load break switches. Grid expansion to support desalination plants, oil and gas facilities, and urban infrastructure also contributes to market growth. However, budgetary constraints and uneven power sector development in parts of Africa moderate adoption, even as long-term investment in reliable medium-voltage networks gradually increases.

Market Segmentations:

By Platform Type:

- Air-Insulated Load Break Switches

- Gas-Insulated Load Break Switches

By Deployment:

By End User:

- Utility Companies

- Industrial Manufacturers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Load Break Switches Market features a diverse mix of global and regional players, including SOCOMEC, KATKO Oy, Powell Industries, Lucy Group Ltd., Fuji Electric FA Components & Systems Co., Ltd., ABB, Rockwell Automation, Safvolt, Schneider Electric, and ENSTO. The Load Break Switches Market is characterized by increasing technological advancement, product diversification, and a strong focus on grid modernization. Manufacturers prioritize developing compact, eco-efficient, and digitally enabled switchgear solutions to meet rising demand from utilities, industries, and commercial infrastructure. Competition intensifies as companies invest in vacuum and dry-air insulation technologies to replace traditional SF₆-based systems and comply with sustainability regulations. Market participants also enhance automation features such as remote monitoring, fault detection, and real-time control to support smart grid expansion. Additionally, strategic collaborations with utilities, product customization for harsh environments, and expansion into emerging markets strengthen competitive positioning across the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SOCOMEC

- KATKO Oy

- Powell Industries

- Lucy Group Ltd.

- Fuji Electric FA Components & Systems Co., Ltd.

- ABB

- Rockwell Automation

- Safvolt

- Schneider Electric

- ENSTO

Recent Developments

- In February 2025, Socomec showcased advanced power solutions at ELECRAMA 2025, including DELPHYS XM UPS, DIRIS meters, ATyS aM, and FP ESS fuses. Socomec further displayed its modular UPS, auto transfer switches, ATS controllers, manual transfer switches, load break switches, and DC switch disconnectors for the PV segment.

- In October 2024, NXP Semiconductors N.V. unveiled the new S32J family of network controllers and high-performance Ethernet switches. The newest S32 microcontrollers and processors from NXP can function as a single extended virtual switch as they share a common switch core, NXP NETC, with the S32J family.

- In March 2024, Schneider Electric did expand its production capacity with a new factory in India, though it was a cooling solutions factory for data centers in Bengaluru, not one for load break switches. This facility is part of a larger Rs 3,200 crore investment plan to boost manufacturing in India.

- In October 2023, Littelfuse, Inc. launched its Class J Fuse Disconnect Switch. The product is a single device that combines a switch and multiple fuses to provide manual control over a circuit and protection against overcurrent and short circuits.

Report Coverage

The research report offers an in-depth analysis based on Platform Type, Deployment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as utilities accelerate grid modernization and distribution network automation.

- Demand for smart and remotely operable load break switches will rise with increasing investment in digital grid infrastructure.

- Adoption of eco-efficient vacuum and dry-air insulation technologies will expand as regulations tighten on SF₆-based equipment.

- Renewable energy integration will continue to drive installations, especially in solar and wind power distribution networks.

- Compact and modular switchgear designs will gain traction in densely populated urban and commercial environments.

- Industrial facilities will increasingly upgrade medium-voltage systems to enhance safety, reliability, and operational continuity.

- Manufacturers will focus on developing maintenance-free and high-durability switches suited for harsh climate conditions.

- Emerging markets in Asia, Africa, and Latin America will offer significant opportunities as electrification projects advance.

- Digital diagnostics and IoT-based monitoring capabilities will become standard features across advanced switch models.

- Strategic partnerships between manufacturers and utility providers will intensify to support customized grid modernization solutions.