Market Overview

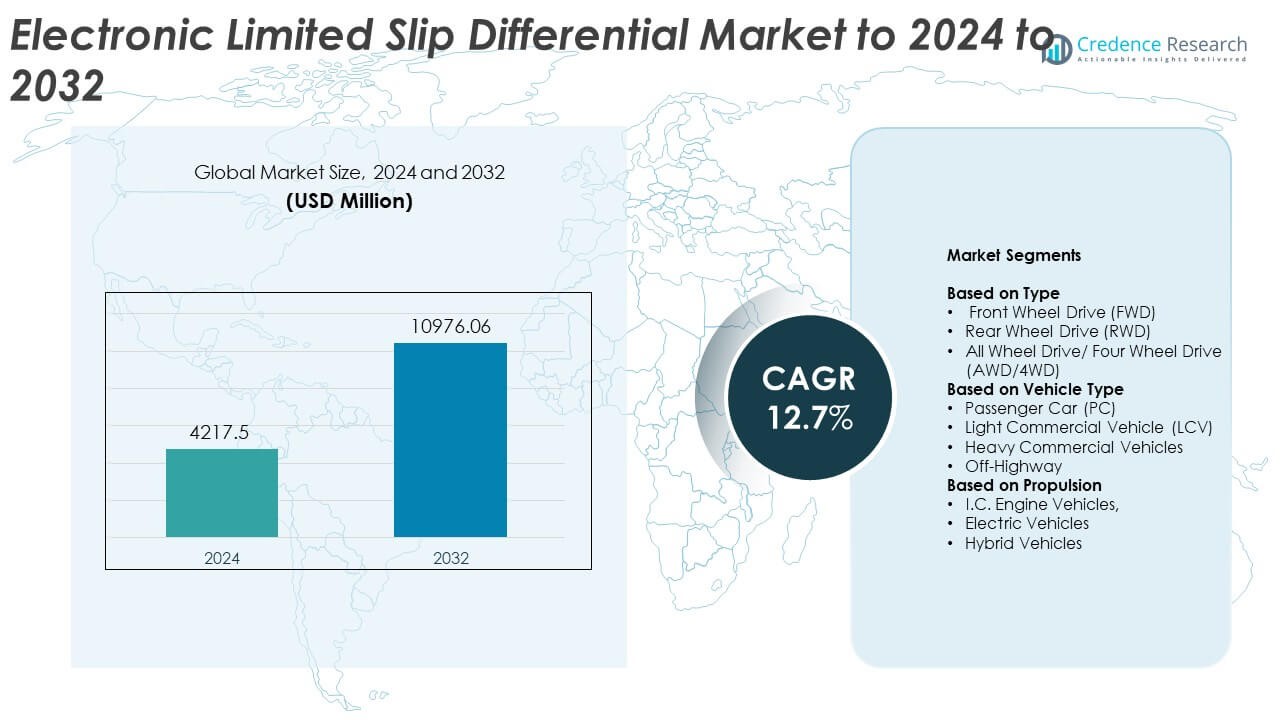

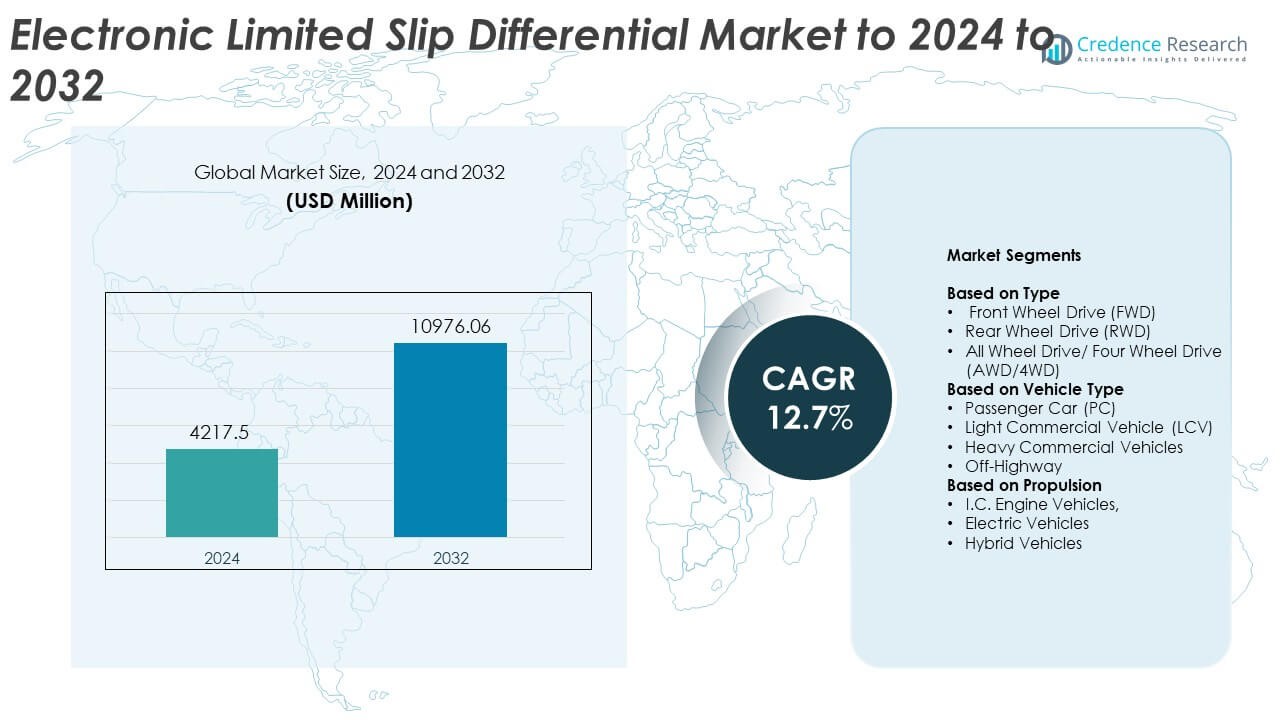

Electronic Limited Slip Differential Market size was valued at USD 4217.5 million in 2024 and is anticipated to reach USD 10976.06 million by 2032, at a CAGR of 12.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Limited Slip Differential Market Size 2024 |

USD 4217.5 Million |

| Electronic Limited Slip Differential Market, CAGR |

12.7% |

| Electronic Limited Slip Differential Market Size 2032 |

USD 10976.06 Million |

The Electronic Limited Slip Differential Market is shaped by major companies such as ZF Friedrichshafen AG, Linamar, JTEKT Corporation, Continental AG, American Axle & Manufacturing, GKN Automotive, BorgWarner Inc., Schaeffler India Limited, Eaton, and Dana Limited. These players compete through advancements in electronic control units, compact actuator systems, and software-driven torque management. North America leads the global market with about 37% share in 2024, supported by strong production of SUVs, pickups, and performance vehicles. Europe follows with nearly 32% share due to high adoption in premium sedans and sports cars, while Asia Pacific accounts for about 26%, driven by rising vehicle manufacturing and expanding AWD usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Electronic Limited Slip Differential Market was valued at USD 4217.5 million in 2024 and is projected to reach USD 10976.06 million by 2032, growing at a CAGR of 12.7%.

• Growth is driven by rising production of performance vehicles, expanding SUV demand, and increasing adoption of AWD systems, with AWD holding about 49% share and passenger cars leading with roughly 58% share in 2024.

• Key trends include deeper integration of software-controlled driveline systems, rising EV and hybrid adoption, and growing use of lightweight differential designs in next-generation platforms.

• Competition strengthens as major suppliers expand electronics, actuators, and torque-vectoring technologies to support premium and high-torque vehicle programs across global OEMs.

• North America leads with around 37% share in 2024, followed by Europe at 32% and Asia Pacific at 26%, while Latin America and Middle East & Africa hold smaller shares but show steady adoption in SUV and LCV segments.

Market Segmentation Analysis:

By Type

All Wheel Drive and Four Wheel Drive systems lead this segment with about 49% share in 2024. Carmakers prefer these drivetrains because they improve traction, cornering stability, and torque distribution in challenging road conditions. Growth strengthens as premium SUVs and performance cars adopt electronic limited slip systems to support dynamic driving modes. Rising launch of AWD crossovers in Asia and Europe also pushes wider use of active differentials, especially in models that require quick electronic control for safety and handling.

- For instance, Schaeffler Group reports its electronic limited-slip differential (eLSD) units have a drive torque capacity of up to 7,000 Nm and a clutch torque capacity of a minimum of 2,500 Nm.

By Vehicle Type

Passenger Cars hold the dominant position with nearly 58% share in 2024. Demand rises as automakers integrate performance-oriented drivetrains into compact, mid-size, and luxury cars. Buyers value smoother acceleration, reduced wheel slip, and improved ride control. Adoption increases in sports sedans and premium hatchbacks launched with intelligent driveline control. Growth in SUV-based passenger vehicles further boosts the segment because many models rely on electronic limited slip systems to enhance grip and stability on mixed terrains.

- For instance, American Axle & Manufacturing (AAM) partnered to produce the TracRite electro-mechanical eLSD, aimed at high-volume passenger cars by the year 2018.

By Propulsion

I.C. Engine Vehicles dominate this segment with about 63% share in 2024. These vehicles maintain strong market presence because mechanical-electronic hybrid differential systems pair well with traditional powertrains. Carmakers install electronic limited slip mechanisms to manage rising engine outputs and to improve traction under high-torque loads. Hybrid and electric vehicles grow at a faster pace as manufacturers develop software-controlled torque vectoring systems, yet internal combustion platforms still lead due to their larger production volumes and wider global availability.

Key Growth Drivers

Rising Demand for Performance and Stability

Growing consumer interest in safer and more stable driving supports strong adoption. Automakers add electronic limited slip systems to enhance traction, cornering control, and real-time torque management. Expansion of SUVs, sports cars, and premium sedans further accelerates usage because these vehicles need advanced driveline control to handle higher power outputs. As global buyers expect better on-road stability in diverse conditions, manufacturers continue to integrate electronic differentials to meet performance expectations and strengthen vehicle handling quality.

- For instance, ZF Friedrichshafen AG unveiled a next-generation networked eLSD rear axle transmission with increased control and capability. The exact numerical lock-torque value (“up to 3 000 Nm”) is referenced.

Acceleration of AWD and Premium Vehicle Production

The surge in all-wheel-drive and premium vehicle sales drives broad adoption of electronic limited slip differentials. Carmakers install these systems to boost acceleration, improve grip, and support dynamic driving modes in high-value vehicle segments. Growth in luxury SUVs and crossovers adds further momentum as these models rely on active torque distribution to maintain stability. Increasing preference for advanced drivetrains in China, Europe, and North America widens the integration of electronically controlled differential systems.

- For instance, GKN Automotive offers modular all-wheel drive systems (ActiveConnect, torque-vectoring) that engage rear axle in less than 300 ms for performance vehicles.

Integration of Advanced Vehicle Electronics

Rapid progress in automotive electronics and software improves the appeal of electronic limited slip systems. Automakers link these differentials with traction control, ABS, and stability programs to optimize torque flow and reduce wheel slip. Enhanced sensor technology and faster control units allow smoother transitions between driving conditions. This integration raises system efficiency and offers predictable handling, motivating more OEMs to select electronic solutions over traditional mechanical units for future vehicle platforms.

Key Trends and Opportunities

Expansion of EV and Hybrid Drivetrains

Electric and hybrid vehicles create new opportunities for electronic limited slip systems. These drivetrains require advanced torque vectoring and precise traction management, making electronically controlled differentials ideal for smooth power distribution. As global EV sales rise, manufacturers invest in compact, software-driven differential units that fit integrated e-axle designs. Increasing demand for stable acceleration and improved cornering in electric SUVs and performance EVs opens strong growth potential for electronic differential technologies.

- For instance, GKN Automotive’s modular eDrive system for electric vehicles can generate up to 5 300 Nm of torque in large EV applications.

Shift Toward Software-Defined Vehicle Dynamics

Carmakers increasingly adopt software-controlled driveline systems to deliver customizable driving modes and refined handling. Electronic limited slip differentials benefit from this shift because they can adjust torque flow through real-time software updates. Advanced control algorithms help manufacturers fine-tune traction for different terrains, boosting system value in off-road and high-performance vehicles. Growing interest in adaptive, driver-selectable performance features builds new opportunities for electronically managed differential platforms.

- For instance, Schaeffler’s eLSD uses transmission oil instead of separate clutch-oil circuit and offers modular actuator arrangements (parallel and 90°) for packaging and efficiency.

Lightweight and Energy-Efficient Designs

Growing focus on efficiency encourages development of lightweight electronic differential units. Automakers explore optimized materials, compact actuators, and reduced-friction designs to improve fuel economy and extend EV driving range. These innovations offer better integration flexibility for next-generation vehicle architectures. As regulatory pressure for cleaner transport strengthens, suppliers gain opportunities to expand efficient electronic limited slip systems that support lower emissions and better driveline performance.

Key Challenges

High Cost of Integration and Components

Electronic limited slip differentials remain costlier than mechanical options due to advanced sensors, actuators, and control systems. Automakers face higher production and calibration expenses, which limit adoption in small or economy vehicles. The added cost of software development and vehicle system tuning increases total integration effort. Price sensitivity in developing markets further restricts penetration, creating barriers for firms aiming to scale electronic solutions across broader model ranges.

Complexity in Calibration and System Compatibility

These systems require precise tuning with traction control, stability programs, and powertrain electronics, adding engineering complexity. Ensuring consistent performance across varied driving conditions demands extensive testing and software refinement. Compatibility with emerging electric and hybrid platforms also raises integration challenges as manufacturers balance space constraints and thermal demands. This complexity can slow development cycles and increase technical risks, making some automakers cautious about adopting electronic limited slip technologies.

Regional Analysis

North America

North America holds about 37% share in 2024, supported by strong production of SUVs, pickup trucks, and performance-oriented passenger cars. Automakers in the United States and Canada integrate electronic limited slip systems to improve stability, traction, and torque control in high-power drivetrains. Rising demand for premium vehicles and expansion of AWD platforms strengthen market adoption. Growth also benefits from advanced automotive electronics, strong consumer preference for safety features, and steady upgrades in driveline technology across new model launches.

Europe

Europe accounts for nearly 32% share in 2024, driven by high adoption of premium sedans, sports cars, and luxury SUVs produced across Germany, the United Kingdom, and Italy. Carmakers in this region use electronic limited slip systems to meet strict safety expectations and enhance performance in both combustion and hybrid platforms. Strong engineering capabilities, rising electric vehicle output, and expansion of AWD configurations in compact crossovers increase demand. The region also benefits from advanced traction control innovations and growing interest in dynamic handling technologies.

Asia Pacific

Asia Pacific captures about 26% share in 2024, supported by rising production of passenger cars and SUVs in China, Japan, India, and South Korea. Expanding adoption of AWD and performance-oriented drivetrains in mid-range vehicles boosts demand for electronic limited slip systems. Increasing sales of electric and hybrid vehicles further contribute to growth, as these platforms require advanced torque distribution and traction support. The region’s rapid urbanization, growing disposable income, and strong investments in automotive electronics enhance overall market expansion.

Latin America

Latin America holds around 3% share in 2024, with gradual growth driven by rising interest in SUVs and light commercial vehicles in Brazil, Mexico, and Argentina. Automakers introduce electronic limited slip systems in mid- to high-end models to improve stability on variable road surfaces. Market expansion remains steady as regional consumers adopt advanced safety and driveline features. Economic recovery and increasing assembly of global vehicle platforms help reinforce demand for electronically controlled torque distribution technologies.

Middle East and Africa

Middle East and Africa represent nearly 2% share in 2024, supported by rising sales of off-road vehicles, SUVs, and pickups suited for desert and rugged terrains. Electronic limited slip systems gain traction due to their ability to enhance torque control and vehicle stability on uneven surfaces. Adoption progresses as premium and imported models integrate advanced driveline technologies. Growing interest in safety upgrades and expansion of regional dealerships offering AWD vehicles contribute to steady but moderate market development.

Market Segmentations:

By Type

- Front Wheel Drive (FWD)

- Rear Wheel Drive (RWD)

- All Wheel Drive/ Four Wheel Drive (AWD/4WD)

By Vehicle Type

- Passenger Car (PC)

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicles

- Off-Highway

By Propulsion

- C. Engine Vehicles,

- Electric Vehicles

- Hybrid Vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electronic Limited Slip Differential Market is shaped by leading suppliers such as ZF Friedrichshafen AG, Linamar, JTEKT Corporation, Continental AG, American Axle & Manufacturing, GKN Automotive, BorgWarner Inc., Schaeffler India Limited, Eaton, and Dana Limited. Companies focus on advanced driveline engineering, integrating faster electronic control units, improved actuator response, and refined torque management software. Many manufacturers invest in lightweight architectures to support efficiency goals in hybrid and electric platforms. Strategic partnerships with global automakers help expand technology adoption across premium SUVs, performance cars, and AWD vehicles. Suppliers also strengthen regional production capabilities to meet rising demand in Asia Pacific and North America. Continuous innovation in traction control integration, durability improvements, and system calibration tools remains central to maintaining competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZF Friedrichshafen AG (Germany)

- Linamar (Canada)

- JTEKT Corporation (Japan)

- Continental AG (Germany)

- American Axle & Manufacturing, Inc. (U.S.)

- GKN Automotive (U.K.)

- BorgWarner Inc. (U.S.)

- Schaeffler India Limited (India)

- Eaton (U.S.)

- Dana Limited (U.S.)

Recent Developments

- In 2025, ZF disclosed advancements in their next-generation electronic limited slip differential system, focusing on integration with vehicle networks for enhanced connectivity and real-time torque vectoring control.

- In 2025, GKN Automotive showcased advancements in drivetrain electrification and e-drive technologies at automotive events, emphasizing their ongoing development in electronic traction control and limited slip differential systems for electric vehicles.

- In 2024, BorgWarner secured multiple contracts to supply its electric cross differential (eXD) technology to major OEMs, including GAC Motor and other global manufacturers.

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle Type, Propulsion and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as automakers increase adoption of advanced driveline control systems.

- AWD and performance vehicle production will continue to drive strong demand.

- EV and hybrid platforms will integrate more software-based torque vectoring solutions.

- Premium SUVs will remain major adopters of electronic limited slip technologies.

- Advancements in automotive electronics will improve system response and durability.

- Lightweight differential designs will gain traction to support efficiency goals.

- More OEMs will shift from mechanical to electronic units for better stability control.

- Asia Pacific will show faster growth due to rising vehicle production.

- Collaboration between differential suppliers and EV manufacturers will increase.

- Long-term demand will rise as safety and traction standards become more stringent.