| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Mining Simulation Software Market Size 2023 |

USD 303.65 Million |

| China Mining Simulation Software Market, CAGR |

10.6% |

| China Mining Simulation Software Market Size 2032 |

USD 752.83 Million |

Market Overview:

China Mining Simulation Software Market size was valued at USD 303.65 million in 2023 and is anticipated to reach USD 752.83 million by 2032, at a CAGR of 10.6% during the forecast period (2023-2032).

Several factors are propelling the growth of the mining simulation software market in China. The increasing demand for minerals and resources globally has led mining companies to seek effective solutions to streamline operations and reduce risks. Mining simulation software offers lifelike virtual environments to improve safety procedures, evaluate strategies, and train employees, thereby reducing operational errors and enhancing productivity. This capability allows businesses to test scenarios in a risk-free setting before implementation, minimizing costly mistakes and improving decision-making outcomes. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) into simulation tools enhances predictive capabilities, enabling real-time data analysis and informed decision-making. The AI and ML-driven insights help predict equipment failures, optimize resource allocation, and enhance overall operational efficiency. Additionally, the rise of cloud-based solutions provides scalability, cost-effectiveness, and ease of access, further driving the adoption of simulation software in the mining industry. This transition to cloud-based systems enables greater flexibility and collaboration, further accelerating the digitalization of mining operations.

China stands as a dominant player in the Asia-Pacific region’s simulation software market. In 2023, the country accounted for 9.7% of the global simulation software market revenue and is projected to lead the regional market in terms of revenue by 2030. The nation’s vast mineral resources, coupled with its commitment to technological advancement, make it a fertile ground for the growth of mining simulation software. The government’s emphasis on digital transformation and Industry 4.0 initiatives further supports the adoption of advanced simulation technologies in the mining sector. As mining operations become more complex, the demand for sophisticated simulation tools to optimize processes and ensure safety is expected to rise, solidifying China’s position as a key market for mining simulation software.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The China Mining Simulation Software Market was valued at USD 303.65 million in 2023 and is projected to reach USD 752.83 million by 2032, growing at a CAGR of 10.6%.

- The global mining simulation software market was valued at approximately USD 2.5 billion in 2023 and is projected to reach over USD 5.25 billion by 2032, reflecting a compound annual growth rate (CAGR) of 8.6% during the forecast period.

- The demand for minerals and natural resources is driving the need for efficient mining operations, increasing the adoption of simulation software for process optimization and safety.

- The integration of AI and machine learning into simulation tools enhances real-time predictive capabilities, improving resource allocation and operational efficiency in mining operations.

- Government initiatives supporting digital transformation and Industry 4.0 are accelerating the adoption of advanced simulation technologies in China’s mining sector.

- Mining simulation software helps mitigate safety risks by enabling virtual training and scenario-based risk assessments, improving worker safety and minimizing accidents.

- The rise of cloud-based solutions offers scalability and cost-effectiveness, enhancing accessibility and flexibility in adopting mining simulation tools.

- Despite its growth, the market faces challenges such as high initial investment costs, integration with legacy systems, and the shortage of skilled professionals in simulation software.

Market Drivers:

Increased Demand for Minerals and Resources

The growing global demand for minerals and natural resources is one of the primary drivers of the China mining simulation software market. China remains one of the largest consumers and producers of minerals, which drives the need for efficient and cost-effective mining operations. For instance, mining companies are leveraging simulation platforms to optimize workflows, analyze equipment usage, and improve production schedules. The rapid industrialization of emerging economies and technological advancements across industries have significantly increased the need for raw materials. As the demand for these resources continues to rise, mining companies in China are under pressure to enhance operational efficiency, safety, and productivity. Mining simulation software provides an effective way to address these challenges, allowing companies to simulate real-world mining environments and optimize their operations. By utilizing these tools, mining companies can plan and execute their operations with greater precision, reducing costs and maximizing resource extraction.

Advancements in Technology: AI and Machine Learning Integration

Advancements in artificial intelligence (AI) and machine learning (ML) have played a significant role in driving the adoption of mining simulation software in China. The integration of AI and ML technologies into simulation platforms allows for real-time predictive analytics, improved decision-making, and enhanced resource optimization. For example, mining firms are using AI-powered algorithms to forecast equipment failures and optimize maintenance schedules, resulting in significant reductions in downtime and maintenance costs. The ability to analyze vast amounts of data from various mining activities allows companies to predict potential bottlenecks, adjust workflows, and streamline operations, all of which contribute to cost reduction and increased productivity. As AI and ML capabilities continue to improve, the reliance on simulation software to automate and optimize mining operations will grow, making these technologies essential to the future of the mining sector in China.

Government Initiatives and Industry 4.0 Adoption

The Chinese government’s strong focus on digital transformation and Industry 4.0 is another key driver of the mining simulation software market. The government has been pushing for the modernization of industries through the adoption of advanced technologies, including automation, robotics, and digital simulation tools. Mining is a critical sector in China’s economy, and the government’s initiatives aim to increase the sector’s competitiveness, sustainability, and safety standards. As part of its broader push for smart mining, the government has encouraged the adoption of simulation software as part of a digital ecosystem that integrates operational technologies and information systems. The adoption of Industry 4.0 solutions in mining, such as cloud-based simulation software, will continue to accelerate as China seeks to enhance its mining capabilities while minimizing environmental and safety risks. This regulatory support helps drive the continued integration of advanced simulation software within China’s mining sector.

Focus on Safety and Risk Mitigation

Safety concerns in the mining industry, particularly in China, have significantly contributed to the growing adoption of mining simulation software. The mining industry is inherently hazardous, with risks such as equipment malfunctions, hazardous material exposure, and environmental impacts being major concerns. Simulation software provides an effective way to address these challenges by allowing companies to conduct virtual risk assessments and safety training in a controlled environment. By simulating dangerous scenarios and operational hazards, mining companies can better prepare their workers for real-life situations, reducing accidents and injuries. Additionally, mining simulation software can be used to evaluate the environmental impacts of mining operations and optimize resource extraction methods to minimize damage to ecosystems. As safety regulations become stricter and the demand for environmentally responsible mining practices increases, the role of simulation software in improving safety standards will become increasingly important.

Market Trends:

Rising Adoption of Cloud-Based Solutions

A notable trend in the China mining simulation software market is the growing shift towards cloud-based solutions. Cloud computing offers several advantages, such as reduced upfront infrastructure costs, scalability, and enhanced collaboration capabilities. Mining companies are increasingly adopting cloud-based simulation tools due to their ability to store vast amounts of data and run complex simulations without the need for on-premises servers. This trend aligns with China’s broader technological shift toward cloud services in multiple industries. The ability to access simulation software remotely allows for more flexible, efficient, and cost-effective operations, enabling mining companies to stay agile in a rapidly evolving market. As more organizations embrace cloud computing, the demand for cloud-compatible mining simulation software is expected to rise steadily.

Integration of Real-Time Data and IoT Technologies

Another key trend driving the mining simulation software market in China is the integration of real-time data and the Internet of Things (IoT). The IoT allows mining companies to connect their equipment, sensors, and devices to a central network, enabling the continuous collection and analysis of operational data. This trend enhances the effectiveness of simulation software by providing real-time inputs, making simulations more accurate and reflective of actual mining conditions. For example, Yangquan Coal Industry (Group) Co in Shanxi province deployed 5G networks inside a 534-meter-deep mine, enabling real-time monitoring of gas density, temperature, and humidity, and facilitating instant communication between surface and underground teams. By integrating IoT technologies into simulation platforms, mining companies can optimize equipment usage, predict failures, and make better operational decisions. This integration is helping to move the mining industry closer to “smart mining,” where real-time data drives decision-making and operational efficiency. With the rapid expansion of IoT in China, this trend is likely to accelerate over the coming years.

Increased Focus on Sustainability and Environmental Impact

Sustainability is becoming an increasingly important focus in China’s mining sector, influencing the adoption of mining simulation software. Environmental regulations in China are becoming stricter, and mining companies are under growing pressure to reduce their environmental footprint. Simulation software plays a critical role in assessing and minimizing environmental impacts by simulating various extraction processes and evaluating their potential environmental consequences. Companies are using simulation tools to identify more sustainable mining methods, optimize resource extraction, and reduce waste. For example, intelligent models such as support vector machines (SVM) and classification and regression trees (CART) have been applied to environmental assessment in mining areas, achieving classification accuracies of 94.8% and 89.36%, respectively, for evaluating eco-environmental quality. This trend towards environmentally responsible mining practices is expected to continue, with simulation software playing a crucial role in ensuring compliance with evolving environmental standards and regulations in China.

Emerging Use of Artificial Intelligence for Optimization

The integration of artificial intelligence (AI) into mining simulation software is an emerging trend in China. AI is being used to enhance the optimization of mining processes by analyzing historical data, identifying patterns, and recommending improvements. Machine learning algorithms enable the software to become more effective over time, learning from past simulations and predicting future outcomes with increasing accuracy. This trend is contributing to greater efficiency and cost-effectiveness in mining operations, allowing companies to optimize workflows, improve resource allocation, and reduce energy consumption. As AI technologies continue to evolve, their integration into mining simulation software will become more sophisticated, enabling further advancements in the sector’s digital transformation.

Market Challenges Analysis:

High Initial Investment and Implementation Costs

One of the key challenges faced by mining companies in China when adopting simulation software is the high initial investment and implementation costs. For instance, mining companies adopting simulation software in China face significant upfront expenditures for infrastructure, software licenses, and training. These costs can be particularly burdensome for small to medium-sized mining companies with limited financial resources. Additionally, the software may require ongoing maintenance and updates, adding to the overall cost of ownership. While these solutions offer long-term benefits, such as improved operational efficiency and reduced risks, the high initial financial commitment can delay or prevent adoption, especially for companies hesitant to invest in new technologies without immediate returns.

Integration with Legacy Systems

Another challenge is the complexity of integrating modern mining simulation software with existing legacy systems. Many mining companies in China still rely on outdated equipment and software that are not fully compatible with newer simulation technologies. This integration process can be time-consuming, expensive, and technically challenging, requiring specialized expertise. Moreover, transitioning from traditional methods to digital simulation systems involves retraining staff and altering established workflows, which can lead to temporary disruptions in operations. These integration hurdles can slow down the adoption of mining simulation software, particularly for companies that have entrenched legacy systems.

Data Security and Privacy Concerns

As mining simulation software increasingly relies on cloud-based platforms, concerns about data security and privacy have emerged as a significant challenge. Sensitive operational data, including proprietary mining processes and resource allocation strategies, is often stored in the cloud, making it vulnerable to cyberattacks and unauthorized access. Mining companies in China must ensure that they implement robust cybersecurity measures to protect their data and comply with local data protection regulations. The growing sophistication of cyber threats poses a continual risk to companies that fail to adequately safeguard their systems, creating hesitation among potential users.

Lack of Skilled Workforce

A shortage of skilled professionals with expertise in mining simulation software is another challenge in the market. Although the technology is advancing rapidly, many mining companies face difficulties in hiring or training employees who are proficient in using these complex systems. The need for specialized knowledge in data analysis, AI, and simulation modeling adds to the skill gap in the industry. This shortage of qualified personnel can limit the ability of mining companies to fully leverage the benefits of simulation software, impacting overall productivity and efficiency.

Market Opportunities:

The China mining simulation software market presents significant opportunities, particularly driven by the nation’s large-scale mining operations and the increasing push toward technological advancement. As China continues to modernize its mining industry, there is a growing demand for innovative solutions that enhance operational efficiency, safety, and environmental sustainability. Mining simulation software provides companies with the ability to optimize operations, reduce operational risks, and improve safety protocols. With the Chinese government’s emphasis on digital transformation and Industry 4.0, there is a clear opportunity for mining companies to adopt advanced simulation tools to streamline processes, automate systems, and improve decision-making. As mining companies look to reduce operational costs while maintaining high standards of safety and productivity, the role of simulation software in achieving these objectives becomes more critical.

Additionally, China’s focus on sustainable mining practices opens up further opportunities for simulation software adoption. Environmental regulations are becoming increasingly stringent, and mining companies are under pressure to adopt more sustainable methods. Simulation software can assist in optimizing resource extraction techniques, minimizing waste, and evaluating the environmental impact of various mining operations. By leveraging these tools, companies can not only ensure compliance with regulatory standards but also enhance their reputation as environmentally responsible players in the global market. Furthermore, the growing trend of integrating artificial intelligence (AI) and machine learning (ML) into simulation platforms presents opportunities for even more advanced predictive analytics and optimization, providing mining companies with cutting-edge solutions for improving operational efficiency and reducing environmental footprints.

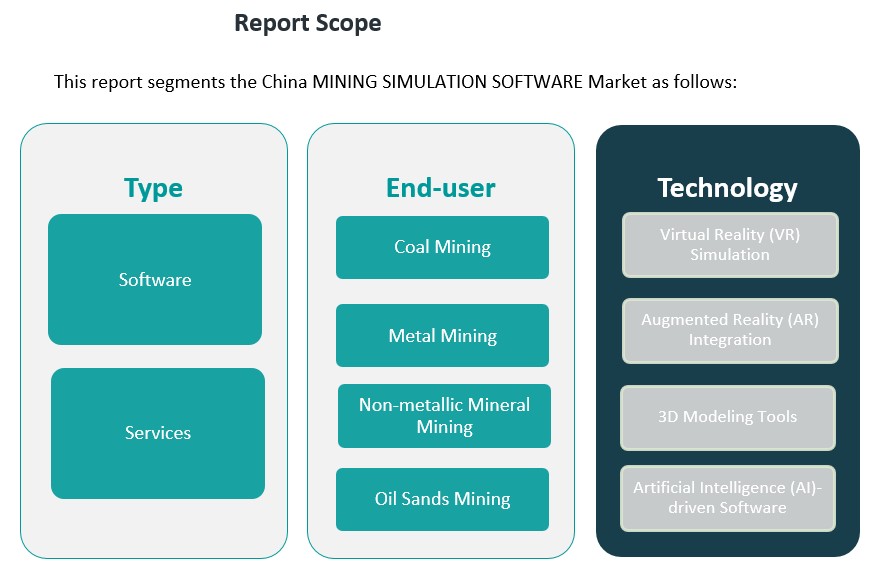

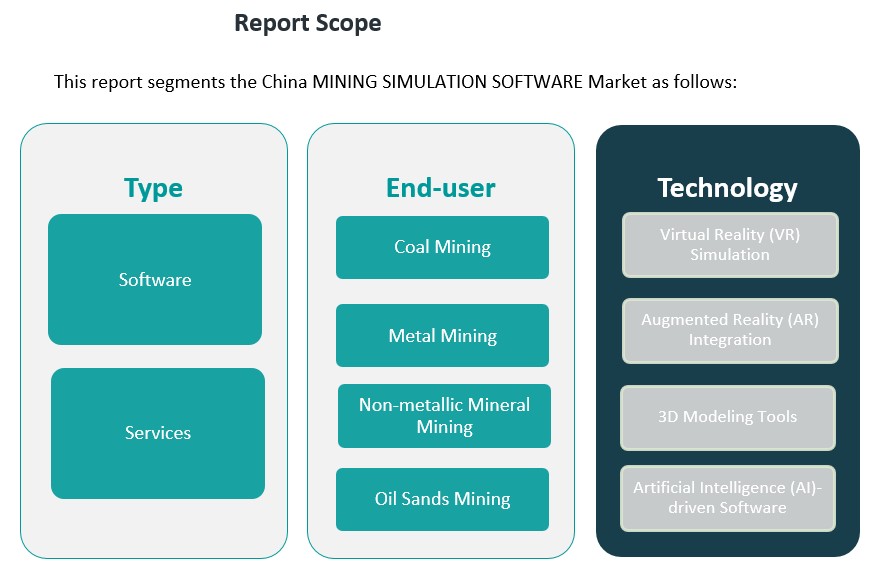

Market Segmentation Analysis:

The China mining simulation software market is segmented across various dimensions, including type, end-user, and technology, which enables tailored solutions for the diverse needs of the mining industry.

By Type Segment

The market is divided into two primary categories: software and services. Software solutions dominate the market, offering tools for modeling, simulation, and optimization of mining operations. These software platforms help companies improve efficiency, predict outcomes, and enhance safety. Services, on the other hand, include system integration, support, and customization, which are critical to implementing and maintaining mining simulation systems.

By End-User Segment

The market’s end-users are categorized into coal mining, metal mining, non-metallic mineral mining, and oil sands mining. Coal mining remains a major contributor to the demand for simulation software due to its large-scale operations. Metal mining, including precious and base metals, is also a significant segment, with simulation software used for mine planning, ore extraction, and environmental management. Non-metallic mineral mining, such as limestone and gypsum, and oil sands mining, are gradually adopting simulation software to improve operational efficiency and sustainability.

By Technology Segment

The technology segment includes virtual reality (VR) simulation, augmented reality (AR) integration, 3D modeling tools, and AI-driven software. VR and AR technologies are gaining traction in training and operational planning, providing immersive, real-time simulations. AI-driven software enhances predictive analytics and optimization, while 3D modeling tools remain essential for mine design and operational modeling. These technological advancements help improve the accuracy and efficiency of mining simulations, addressing the growing complexity of modern mining operations.

Segmentation:

By Type Segment:

By End-User Segment:

- Coal Mining

- Metal Mining

- Non-metallic Mineral Mining

- Oil Sands Mining

By Technology Segment:

- Virtual Reality (VR) Simulation

- Augmented Reality (AR) Integration

- 3D Modeling Tools

- Artificial Intelligence (AI)-driven Software

Regional Analysis:

China stands as a dominant player in the Asia-Pacific region’s mining simulation software market, primarily due to its expansive mining industry and technological advancements. The country’s mining sector remains one of the largest in the world, making it a key area for the adoption of simulation software. As China continues to focus on modernizing its mining industry, there is an increasing demand for advanced digital solutions, including mining simulation software. This technology helps mining companies optimize their operations, enhance safety protocols, and improve overall decision-making processes. With the government’s emphasis on technological innovation and digital transformation across all sectors, mining simulation software has become an essential tool for mining companies aiming to stay competitive in a rapidly changing industry.

The Chinese government’s support for Industry 4.0, which includes the integration of automation, data analytics, and digital simulation, plays a crucial role in the widespread adoption of these technologies. As part of its broader digital transformation agenda, China is encouraging mining companies to invest in advanced solutions that optimize processes, reduce operational risks, and improve resource management. Mining simulation software allows companies to simulate real-world mining conditions, enabling them to predict potential risks, test different operational scenarios, and streamline workflows. This level of simulation and optimization enhances the operational efficiency of mining companies and helps them remain competitive in the global market.

China’s mining sector is also witnessing a shift toward more sustainable and environmentally friendly mining practices, which further boosts the adoption of simulation software. As environmental regulations become stricter, mining companies are increasingly using simulation tools to assess the environmental impact of their operations and find more sustainable extraction methods. This trend, alongside the growing need for operational optimization, positions China as a leading market for mining simulation software in the Asia-Pacific region. The country’s large-scale mining operations and commitment to modernization ensure that mining simulation software will continue to play a crucial role in shaping the future of the industry.

Key Player Analysis:

- Dassault Systèmes

- Bentley Systems

- RPMGlobal

- Hexagon Mining

- Maptek

- Siemens AG

- VIST Group

- Autodesk

- Caterpillar

- BMT Group

- Centling Technologies

- China Coal Research Institute (CCRI)

Competitive Analysis:

The China mining simulation software market is highly competitive, with both international and domestic players vying for market share. Leading global companies such as CAE Mining, Dassault Systèmes, and Ansys offer comprehensive simulation solutions that support various stages of the mining process, including planning, design, and optimization. These companies are known for their robust software that integrates advanced technologies like artificial intelligence, machine learning, and cloud computing to enhance operational efficiency and safety. On the domestic front, Chinese firms like 3DMine Software Ltd. and WAYTOUS are making significant strides. These companies provide tailored solutions that cater to the unique needs of the Chinese mining industry, with a focus on safety, resource optimization, and automation. The integration of cutting-edge technologies such as virtual reality (VR), augmented reality (AR), and AI is increasingly prevalent across both global and local players. This competitive landscape is spurring continuous innovation, making the market dynamic and growth-oriented.

Recent Developments:

- In February 2025, Dassault Systèmes’ subsidiary Centric Software announced the acquisition of Contentserv, an AI-powered Product Experience Management (PXM) solution provider, for €220 million. This move enhances Dassault Systèmes’ capabilities in product information management and digital transformation, directly supporting industries including mining in their digitalization journeys.

- On April 2, 2025, Hexagon completed the acquisition of the Geomagic software business from 3D Systems Corporation. This acquisition brings advanced 3D measurement, modeling, and reverse engineering capabilities to Hexagon’s portfolio, strengthening its offering across manufacturing, mining, and construction sectors. The Geomagic suite will now be integrated into Hexagon’s Manufacturing Intelligence division and supported for all existing hardware and software partners.

Market Concentration & Characteristics:

The China mining simulation software market exhibits a moderate concentration, with a mix of global leaders and emerging domestic players. International companies such as CAE Mining, Dassault Systèmes, and Ansys dominate the high-end segment, offering advanced, integrated solutions that cater to large-scale mining operations. These players leverage established brand recognition, global experience, and cutting-edge technologies, positioning them as key competitors in the market. However, the market also includes a growing number of domestic companies like 3DMine Software Ltd. and WAYTOUS, which are focusing on providing localized solutions tailored to China’s specific mining needs. These players are gaining traction by offering cost-effective, customized software and services that address local regulatory requirements and operational challenges. The market is characterized by rapid technological innovation, particularly in the integration of AI, virtual reality (VR), and augmented reality (AR). Companies are continuously evolving their product offerings to meet the growing demand for automation, efficiency, and sustainability in mining operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for mining simulation software in China is expected to grow as mining companies increasingly adopt digital transformation strategies.

- Integration of AI, machine learning, and real-time data analytics will continue to drive software innovation and improve operational efficiency.

- The rise of cloud-based solutions will offer cost-effective, scalable, and flexible options for mining companies.

- Virtual reality (VR) and augmented reality (AR) technologies will play a larger role in training, safety, and operational planning.

- China’s regulatory push for environmental sustainability will drive the adoption of simulation tools that optimize resource extraction and reduce waste.

- Domestic software developers will gain more market share by offering localized, cost-efficient solutions tailored to Chinese mining operations.

- Increasing automation and Industry 4.0 initiatives will require advanced simulation systems to support smart mining technologies.

- Growing competition will spur continuous innovation, enhancing software capabilities and expanding the range of features offered.

- The shift towards non-metallic mineral and oil sands mining will create new opportunities for simulation software providers.

- As the mining industry embraces more complex operations, the need for sophisticated simulation solutions will continue to rise, ensuring steady market growth.