Market Overview:

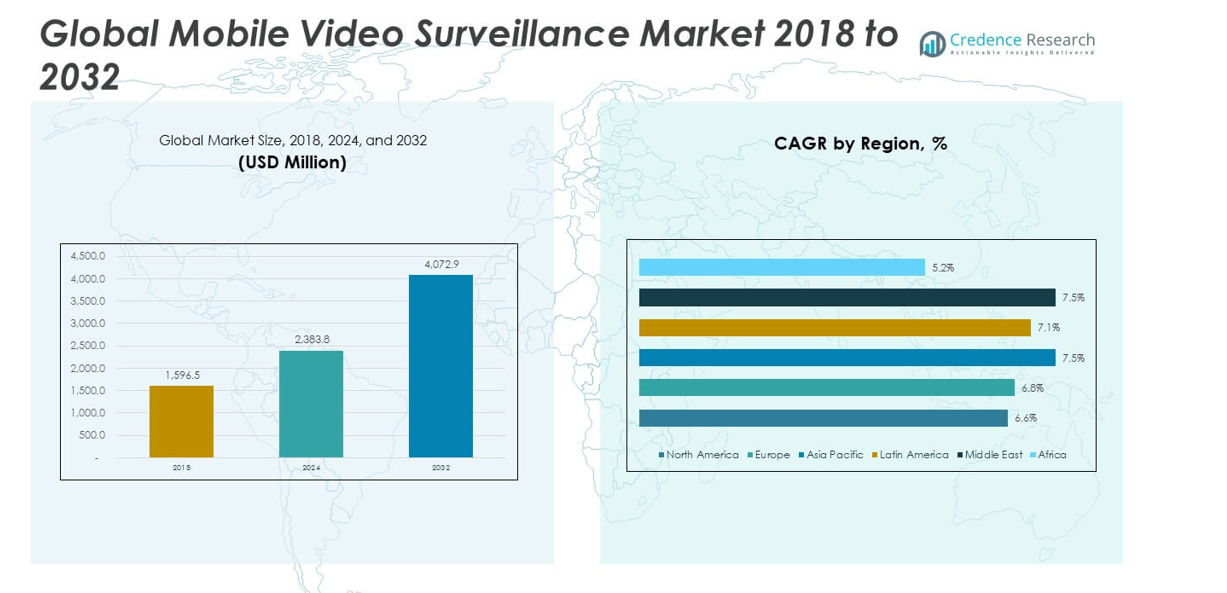

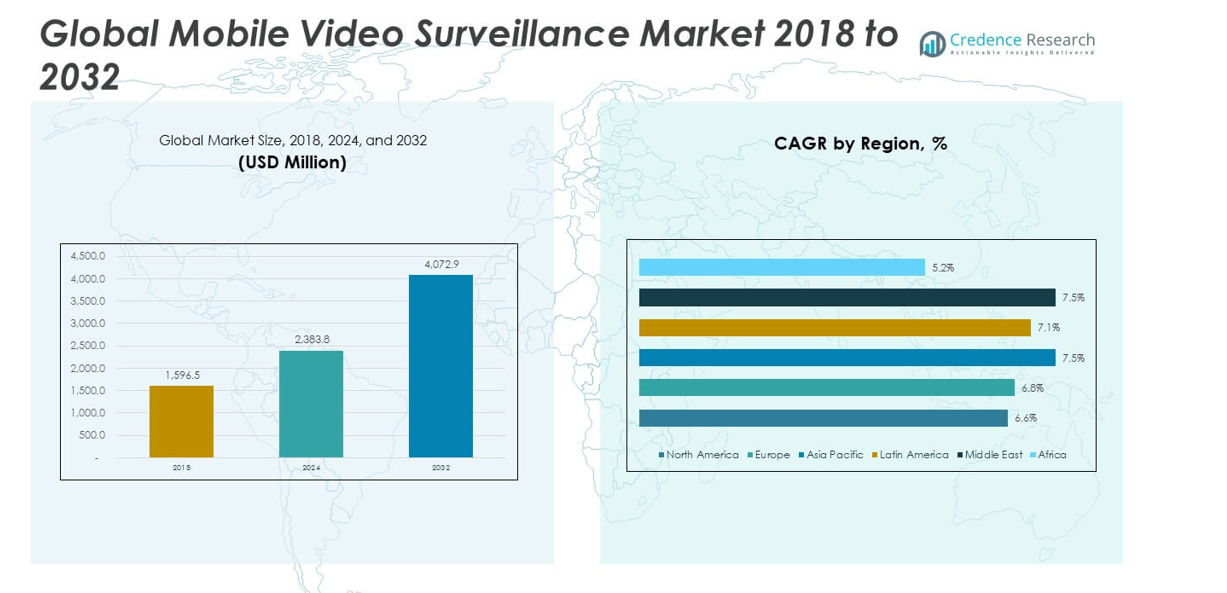

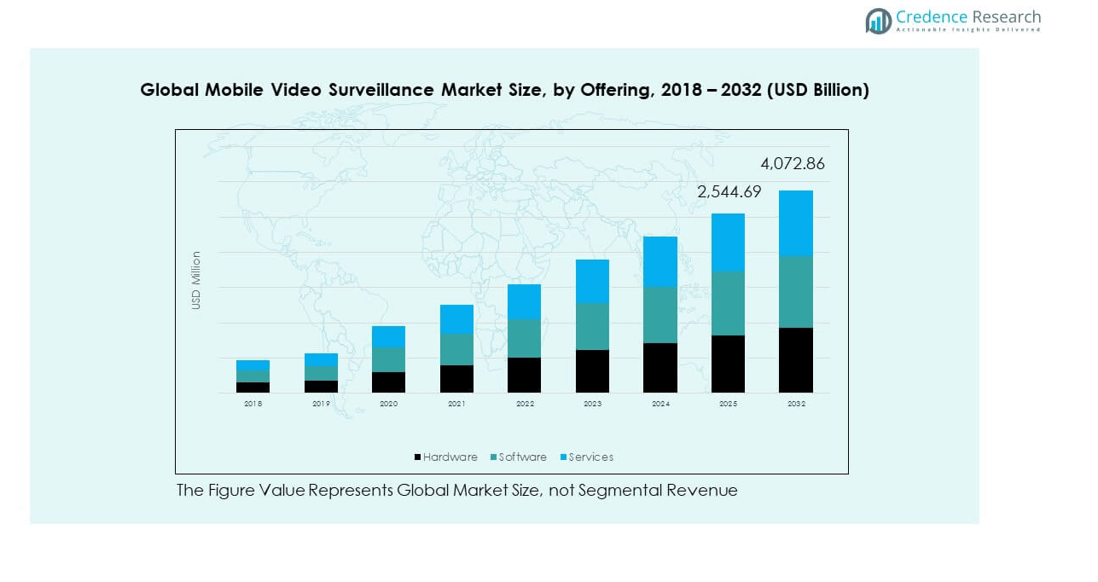

The Global Mobile Video Surveillance Market size was valued at USD 1,596.5 million in 2018, increased to USD 2,383.8 million in 2024, and is anticipated to reach USD 4,072.9 million by 2032, growing at a CAGR of 6.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Video Surveillance Market Size 2024 |

USD 2,383.8 million |

| Mobile Video Surveillance Market, CAGR |

6.95% |

| Mobile Video Surveillance Market Size 2032 |

USD 4,072.9 million |

Growth in the Global Mobile Video Surveillance Market is driven by rising demand for security solutions in public transport, law enforcement, and fleet management. Governments and private operators are adopting mobile surveillance for enhanced safety, real-time monitoring, and evidence collection. Advancements in AI analytics, wireless connectivity, and cloud storage are improving data processing, reducing downtime, and increasing operational efficiency.

Regionally, North America leads the market due to strong adoption in transportation and defense sectors, supported by advanced infrastructure. Europe follows, driven by smart city initiatives and strict safety regulations. The Asia-Pacific region is emerging rapidly, supported by expanding public transport networks, growing urbanization, and rising investments in mobile security systems in countries such as China, Japan, and India.

Market Insights:

- The Global Mobile Video Surveillance Market size was valued at USD 1,596.5 million in 2018, increased to USD 2,383.8 million in 2024, and is projected to reach USD 4,072.9 million by 2032, expanding at a CAGR of 6.95% during the forecast period.

- North America (31%), Europe (25%), and Asia Pacific (24%) dominate the market due to large-scale adoption in transportation, defense, and smart city infrastructure, supported by advanced connectivity and regulatory frameworks.

- Asia Pacific is the fastest-growing region, accounting for 24% share, driven by smart urbanization, AI-integrated public transport surveillance, and growing government investments in digital safety.

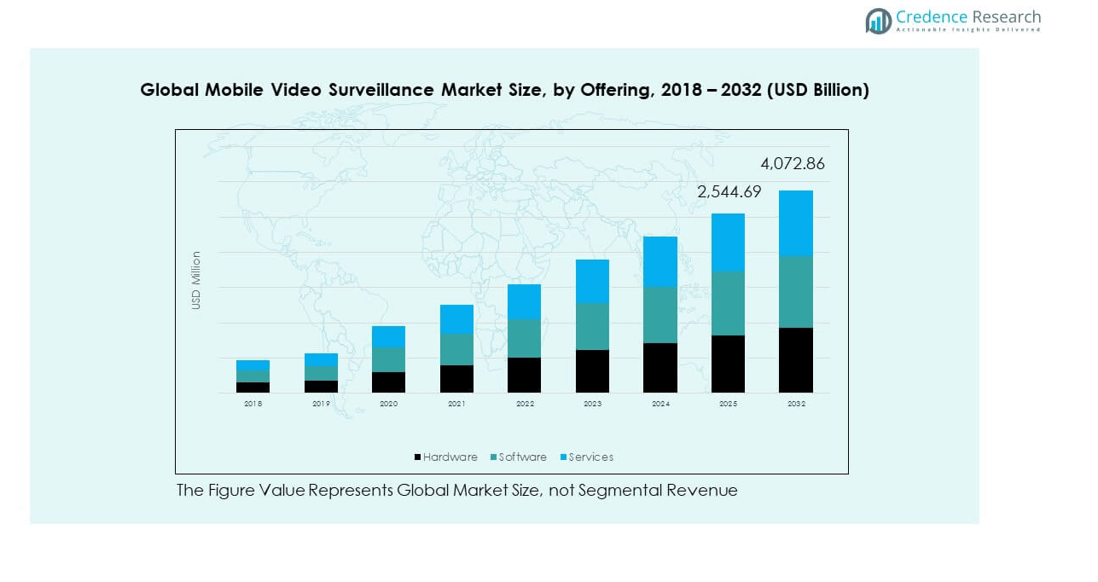

- Based on offering, hardware holds the largest segment share, supported by demand for high-definition cameras, DVRs, and vehicle-mounted devices ensuring real-time monitoring.

- Software and services collectively represent a growing share, driven by the expansion of AI analytics, cloud-based platforms, and maintenance solutions that enhance operational reliability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Adoption of Intelligent Surveillance for Public Transport and Law Enforcement

The Global Mobile Video Surveillance Market benefits from increasing deployment of advanced monitoring systems in buses, trains, and police vehicles. These systems enhance passenger safety and operational visibility, supporting real-time response to incidents. Governments are implementing mandatory surveillance laws in public transport to prevent vandalism and ensure compliance. Rising incidents of theft and accidents drive authorities to adopt intelligent video analytics for proactive monitoring. Cloud-based storage and mobile access improve coordination between field operators and command centers. The integration of 4G and 5G networks strengthens video transmission reliability in motion. Mobile surveillance provides visual evidence for investigations, improving accountability. Continuous upgrades in AI-enabled detection enhance accuracy and reduce false alerts.

- For instance, In September 2025, Dahua Technology officially launched its Xinghan Large-Scale AI Models. The company has promoted the models for use in various applications, including smart transportation, and has stated that the visual intelligence models (V-Series) and multimodal models (M-Series) reduce false alarms and enhance detection range. One example mentioned in company press is its use in perimeter protection, where the models can accurately identify small targets. The company has also noted its intention to expand the application of the models in “smart transportation” and “other real-world scenarios”.

Integration of Artificial Intelligence and Analytics to Enhance Operational Efficiency

AI-driven analytics are transforming mobile surveillance systems by enabling real-time event detection and predictive security. Automated facial recognition, license plate tracking, and behavioral analysis support law enforcement and fleet operations. The technology reduces dependency on manual monitoring, increasing speed and accuracy in decision-making. Integration of AI allows dynamic data insights, enhancing situational awareness in crowded or mobile environments. Businesses and municipalities are adopting these tools to optimize route safety and resource allocation. It helps in detecting irregular movements or unauthorized entries, reducing potential losses. Continuous software updates improve recognition capabilities in low-light or high-motion conditions. The Global Mobile Video Surveillance Market is gaining traction with demand for efficient, automated, and intelligent security solutions.

- For instance, Hanwha Vision’s Wisenet 9 SoC AI-powered cameras, which were showcased at the Global Security Exchange (GSX) in September 2025, offer advanced object detection and AI analytics for vehicles.

Expansion of Connected Infrastructure and IoT-Based Surveillance Ecosystems

The proliferation of IoT and connected devices accelerates the growth of mobile video surveillance networks. IoT integration enables seamless data flow between vehicles, monitoring stations, and control centers. The ecosystem supports large-scale fleet tracking and unified security management. It ensures minimal downtime and fast incident reporting, improving public safety outcomes. Cloud-enabled IoT devices enhance scalability and simplify video data retrieval. Cities and enterprises adopt integrated platforms for synchronized camera control and network health management. This approach lowers operational costs and improves surveillance continuity. The Global Mobile Video Surveillance Market is strengthening with investments in connected vehicle safety and IoT-based security infrastructure.

Rising Security Requirements in Industrial and Commercial Fleet Operations

Industrial and commercial fleets use mobile surveillance to protect assets and monitor logistics. The systems record driver behavior, cargo status, and route adherence to improve efficiency. Insurance companies support video-based evidence collection for claim validation, driving adoption across industries. Advanced DVR and NVR systems provide multi-channel recording and high-definition footage for analysis. It enhances accountability among drivers and contractors, reducing operational disputes. Energy and construction sectors deploy these systems to secure high-value machinery. Increasing digitalization of fleet management platforms enables better system integration. The Global Mobile Video Surveillance Market grows with expanding safety regulations and focus on operational transparency.

Market Trends:

Shift Toward Cloud-Based Video Surveillance and Remote Accessibility

Cloud technology is redefining the structure of mobile surveillance systems by offering flexible data storage and management. Remote access through smartphones and web portals improves decision-making and response times. Service providers offer subscription-based models for cost efficiency and scalability. Enterprises prefer cloud surveillance for minimal hardware investment and secure access control. Hybrid cloud solutions provide redundancy and data protection for critical operations. It enhances surveillance coverage in transport fleets and law enforcement units. Real-time sharing of evidence with authorities becomes faster and more reliable. The Global Mobile Video Surveillance Market is evolving toward a connected, cloud-supported surveillance ecosystem.

Integration of Advanced Connectivity Standards Such as 5G and Edge Computing

5G networks and edge computing technologies are transforming surveillance performance with ultra-low latency and high bandwidth. These systems process video data closer to the source, improving real-time analytics. It enhances image clarity, motion detection, and rapid event alerts without network overload. Mobile surveillance vehicles use 5G connectivity for live feeds during field operations. Edge devices ensure secure data filtering before cloud transmission, strengthening cybersecurity. Manufacturers develop hardware optimized for high-speed communication and AI inference. Integration with smart city grids improves emergency response coordination. The Global Mobile Video Surveillance Market benefits from the expanding deployment of 5G and edge intelligence.

- For instance, Hikvision signed a Memorandum of Understanding (MOU) with InfraX in October 2025 at GITEX Global to collaborate on developing innovative AI and machine learning camera solutions for enterprises and critical infrastructure in the UAE, according to official event announcements.

Adoption of AI-Powered Analytics for Proactive and Predictive Security Measures

AI analytics enables surveillance systems to predict unusual activities and automate alerts before incidents occur. Behavioral algorithms detect motion anomalies, helping reduce human errors. Security operators use data-driven insights to plan patrol routes and resource deployment. Predictive analytics improve law enforcement readiness and reduce emergency response times. Deep learning enhances recognition capabilities under varied environmental conditions. It allows continuous learning from real-world footage, improving overall accuracy. Integration with vehicle telematics provides detailed operational insights. The Global Mobile Video Surveillance Market advances through innovation in AI-assisted decision systems.

Emergence of Mobile Surveillance-as-a-Service (MSaaS) Models

The market witnesses growing interest in subscription-based mobile surveillance offerings. These models lower upfront costs for small and medium operators. MSaaS combines equipment, installation, cloud storage, and maintenance under one contract. Clients gain flexibility to scale services with fleet expansion. Continuous monitoring and software updates ensure uninterrupted performance. Providers deliver analytics dashboards for operational visibility and compliance tracking. It helps organizations adopt advanced surveillance without technical expertise. The Global Mobile Video Surveillance Market is shifting toward service-oriented and subscription-based models for sustainable growth.

Market Challenges Analysis:

Data Privacy, Bandwidth Limitations, and Integration Complexity Across Networks

Data privacy remains a critical challenge for the Global Mobile Video Surveillance Market due to large-scale video collection from public areas. Compliance with regional data protection laws complicates storage and transmission frameworks. Limited bandwidth in remote or rural zones restricts video quality and continuity. Network congestion during high traffic periods affects real-time streaming performance. Integrating heterogeneous systems from multiple vendors often causes compatibility issues. Maintenance costs rise due to frequent updates and connectivity requirements. Managing video retention policies and encryption standards adds technical overhead. It requires significant investment in cybersecurity and network optimization to ensure data integrity and operational reliability.

High Installation Costs and Limited Awareness in Developing Markets

The cost of deploying high-resolution cameras, recording systems, and mobile network support restricts market penetration in low-income regions. Developing economies often lack trained personnel and supporting infrastructure for surveillance deployment. Public awareness about advanced monitoring systems remains low, reducing adoption in small enterprises and municipalities. Budget constraints in government transport departments delay modernization projects. Integration with legacy systems further increases setup time and expenses. It affects the pace of deployment in emerging cities with growing safety needs. Vendors face challenges in offering affordable yet high-performing systems. The Global Mobile Video Surveillance Market must address these cost and awareness barriers to sustain long-term expansion.

Market Opportunities:

Expansion of Smart City Initiatives and Demand for Public Safety Infrastructure

Global investments in smart city projects are creating strong opportunities for mobile surveillance adoption. Governments aim to enhance public safety, transport management, and emergency response using AI-integrated cameras. Smart transportation systems depend on real-time video for traffic optimization and incident prevention. It supports centralized control and analytics for large-scale surveillance networks. Vendors offering IoT-enabled systems gain contracts for city-wide monitoring. Public-private partnerships boost deployment in developing urban areas. The Global Mobile Video Surveillance Market is set to benefit from expanding city infrastructure modernization.

Rising Adoption Across Commercial and Industrial Mobility Applications

Commercial logistics, construction, and energy sectors present new growth avenues for mobile surveillance providers. Businesses use onboard cameras to monitor goods, employees, and compliance activities. Integration with telematics systems supports detailed reporting and asset protection. AI-powered analytics help detect unsafe driving patterns, minimizing risks. It assists organizations in meeting insurance and regulatory requirements. Expansion of electric and autonomous vehicles drives demand for advanced video monitoring. The Global Mobile Video Surveillance Market will expand with industrial digitalization and fleet safety advancements.

Market Segmentation Analysis:

By Offering

The Global Mobile Video Surveillance Market is segmented into hardware, software, and service. Hardware holds the dominant share, driven by rising demand for high-definition cameras, storage units, and mobile DVRs that deliver real-time recording and playback. Software solutions are gaining traction due to advancements in AI analytics, motion detection, and video management systems. Cloud-based platforms and integrated monitoring tools enhance scalability and simplify remote access. Service offerings, including installation, maintenance, and system integration, continue to grow as end users seek turnkey surveillance solutions. It strengthens the ecosystem by supporting long-term performance, updates, and security management.

- For instance, at GSX 2025 (Global Security Exchange), Bosch Security and Safety Systems showcased new AI-enabled solutions, including the updated AUTODOME 7100i cameras. These cameras feature enhanced video analytics and deep-learning technology designed to improve situational awareness and reduce false alarms by filtering out irrelevant environmental factors, allowing security personnel to focus on genuine threats.

By Vertical

The market spans law enforcement, industrial, commercial, military and defense, first responders, and transportation sectors. Law enforcement remains a primary adopter due to the need for mobile patrol monitoring, evidence collection, and live incident management. Industrial and commercial sectors invest in mobile surveillance to ensure worker safety and asset protection. Military and defense applications focus on vehicle-mounted surveillance for tactical operations and situational awareness. First responders use these systems for rapid deployment during emergencies. The transportation segment expands rapidly with fleet safety requirements and smart mobility projects. It benefits from continuous infrastructure upgrades and increasing emphasis on public safety.

- For instance, Axis Communications offers a suite of products for law enforcement operations centers, including cameras, audio equipment, and intelligent analytics to provide real-time situational awareness. This technology helps officers gather intelligence, investigate efficiently, and respond decisively to protect the community.

Segmentation:

By Offering:

- Hardware

- Software

- Service

By Vertical:

- Law Enforcement

- Industrial

- Commercial

- Military & Defense

- First Responders

- Transportation

By Region:

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Regional Analysis:

North America

The North America Mobile Video Surveillance Market size was valued at USD 544.71 million in 2018, reached USD 799.66 million in 2024, and is anticipated to attain USD 1,335.08 million by 2032, growing at a CAGR of 6.6% during the forecast period. North America holds around 31% share of the Global Mobile Video Surveillance Market, driven by strong adoption in transportation, defense, and public safety. High investments in smart city infrastructure and government surveillance programs enhance market growth. The U.S. leads due to widespread use of body-worn and vehicle-mounted cameras by law enforcement agencies. Canada supports growth with expanding public transit monitoring systems. It benefits from robust technological infrastructure and advanced network connectivity. Integration of AI and 5G improves analytics efficiency across surveillance fleets. Continuous upgrades to fleet management and security policies sustain regional dominance.

Europe

The Europe Mobile Video Surveillance Market size was valued at USD 426.74 million in 2018, reached USD 630.75 million in 2024, and is projected to reach USD 1,063.02 million by 2032, at a CAGR of 6.8%. Europe accounts for approximately 25% of the Global Mobile Video Surveillance Market share. The region’s growth is influenced by stringent data protection laws and advanced security standards in transportation and logistics. The U.K., Germany, and France lead in adoption due to active law enforcement modernization and urban safety initiatives. EU-backed funding supports deployment in smart mobility and railway projects. It gains momentum from cross-border logistics surveillance and emergency response vehicles. Industrial and commercial fleet operators increasingly deploy mobile video systems to ensure compliance and safety. Rising incidents of vandalism and vehicle theft strengthen market penetration.

Asia Pacific

The Asia Pacific Mobile Video Surveillance Market size was valued at USD 370.70 million in 2018, increased to USD 571.70 million in 2024, and is estimated to reach USD 1,018.21 million by 2032, at a CAGR of 7.5%. Asia Pacific contributes about 24% of the Global Mobile Video Surveillance Market. China, Japan, and India drive adoption through expanding transport infrastructure, smart city programs, and defense upgrades. Rapid urbanization and growing crime rates push demand for AI-enabled surveillance vehicles. Governments promote digital security and real-time monitoring in metro systems and highways. Local manufacturers provide cost-effective solutions, improving affordability. It benefits from strong manufacturing capabilities and AI integration in surveillance hardware. The region witnesses increasing use in public transport, logistics, and police vehicles. Investments in 5G connectivity further accelerate market expansion.

Latin America

The Latin America Mobile Video Surveillance Market size was valued at USD 162.84 million in 2018, grew to USD 244.58 million in 2024, and is forecast to reach USD 421.13 million by 2032, at a CAGR of 7.1%. Latin America represents about 10% of the Global Mobile Video Surveillance Market. The region experiences steady growth driven by modernization of public transport systems and rising safety needs. Brazil and Mexico dominate due to large fleets and public safety programs. Governments invest in vehicle surveillance for crime prevention and traffic control. It faces challenges from limited digital infrastructure and high equipment costs but shows improvement through regional partnerships. Mobile video surveillance adoption in logistics and law enforcement is expanding. Increasing cloud-based surveillance deployments strengthen regional adoption.

Middle East

The Middle East Mobile Video Surveillance Market size was valued at USD 69.29 million in 2018, rose to USD 106.83 million in 2024, and is projected to reach USD 190.20 million by 2032, with a CAGR of 7.5%. The Middle East holds nearly 7% share of the Global Mobile Video Surveillance Market. Regional growth is led by the GCC countries, where governments invest heavily in smart cities, airport surveillance, and defense mobility. Security demands around public events and border control boost adoption. It benefits from integration of AI analytics and networked video systems across law enforcement fleets. Saudi Arabia and the UAE lead with advanced digital transformation projects. Oil and gas transport sectors use mobile surveillance for asset tracking. Continued investment in infrastructure modernization supports long-term growth.

Africa

The Africa Mobile Video Surveillance Market size was valued at USD 22.19 million in 2018, reached USD 30.27 million in 2024, and is anticipated to hit USD 45.21 million by 2032, growing at a CAGR of 5.2%. Africa contributes about 3% to the Global Mobile Video Surveillance Market. Growth is emerging in urban security, mining operations, and public transport monitoring. South Africa leads adoption due to high crime rates and active security reforms. Other countries follow with projects aimed at improving city safety and transportation efficiency. It faces obstacles such as weak infrastructure and low digital literacy. Partnerships with global technology firms improve system accessibility. Increasing public awareness of safety and government-led modernization efforts are boosting gradual adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Mobile Video Surveillance Market features strong competition among global and regional players focusing on product innovation, AI integration, and connectivity advancements. It is characterized by the presence of major companies such as Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, and Hanwha Techwin. These firms compete through technological differentiation, strategic collaborations, and large-scale deployments across transport and law enforcement sectors. The market is witnessing increased investment in cloud-based solutions, edge analytics, and high-definition imaging systems. It emphasizes strong aftersales service, customization, and interoperability to meet end-user demands. Competitive intensity remains high due to fast-evolving technology cycles and regional partnerships for infrastructure projects.

Recent Developments:

- In October 2025, Dahua Technology significantly advanced its mobile video surveillance capabilities by introducing an upgraded version of its Xinghan Large-Scale AI Models. These models leverage multimodal AI and domain expertise to make video surveillance smarter by overcoming common challenges like detecting small targets at long distances and reducing false alarms caused by environmental interference. The new generation of Xinghan models highlights Dahua’s leadership in integrating advanced AI into intelligent IoT video solutions, streamlining deployment for diverse and complex scenarios.

- In October 2025, Hikvision signed a strategic Memorandum of Understanding (MoU) with InfraX, a Dubai-based digital solutions provider, to co-develop innovative AI and machine learning-powered camera solutions. This partnership is focused on delivering next-generation intelligent video management systems aimed at enhancing situational awareness for critical infrastructure and large-scale enterprises. The collaboration also supports the UAE’s vision for advanced, AI-driven smart infrastructure and data analytics in security applications.

- At the 2025 Global Security Exchange (GSX) held from September 29 to October 1, 2025, Axis Communications launched a suite of advanced products, including a new bispectral PTZ camera combining thermal and visual imaging, AI-powered bullet cameras, multilayer radars with wide-angle detection capabilities, and a standalone air quality sensor with two-way audio. Powered by the ARTPEC-9 system-on-chip, these innovations enable sophisticated edge analytics, real-time data processing, and expanded environmental monitoring—meeting the rising demand for integrated, multisensory video surveillance systems in complex environments.

Report Coverage:

The research report offers an in-depth analysis based on offering (hardware, software, and service) and vertical (law enforcement, industrial, commercial, military and defense, first responders, and transportation) segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Integration of AI and IoT will drive predictive surveillance capabilities.

- 5G adoption will enhance data transmission speed and reliability.

- Demand for cloud-based video management will expand across fleets.

- Public safety initiatives will accelerate system deployments globally.

- Growing use of smart transportation will increase camera installations.

- Edge computing will enable real-time analytics at the vehicle level.

- Defense and law enforcement will remain key demand sectors.

- Software-based analytics will outpace hardware growth in long term.

- Partnerships between OEMs and telecom providers will intensify.

- Sustainability and energy-efficient designs will shape future systems.